Professional Documents

Culture Documents

Government of Maharashtra Directorate of Industries: District Industries Centre, Akola

Government of Maharashtra Directorate of Industries: District Industries Centre, Akola

Uploaded by

Sachin IngoleCopyright:

Available Formats

You might also like

- PDF Esther Vilar The Manipulated Man PDF CompressDocument69 pagesPDF Esther Vilar The Manipulated Man PDF CompressnichiooharaNo ratings yet

- Sidbi Pro Msme PDFDocument7 pagesSidbi Pro Msme PDFSonamNo ratings yet

- MSME PresentationDocument37 pagesMSME PresentationMass Nelson100% (1)

- Day 5 Task (Bop Cad FD)Document11 pagesDay 5 Task (Bop Cad FD)ashish sunnyNo ratings yet

- Investment in Entrepreneurial Ability SchultzDocument12 pagesInvestment in Entrepreneurial Ability SchultzRafael LemusNo ratings yet

- EU: Articles of Stationery - Market Report. Analysis and Forecast To 2020Document9 pagesEU: Articles of Stationery - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Aug Pay SlipDocument1 pageAug Pay SlipDAYA SHANKARNo ratings yet

- Unemployed Youth Employment Generation Programme 45Document8 pagesUnemployed Youth Employment Generation Programme 45gs_sankarNo ratings yet

- Micro Small IndustriesDocument43 pagesMicro Small IndustriesManoj Kumar VNo ratings yet

- Taxation Benefits To Ssi, Various IncentivesDocument31 pagesTaxation Benefits To Ssi, Various IncentivesThasni MK33% (3)

- Msme PDFDocument41 pagesMsme PDFs_bharathkumarNo ratings yet

- 7 Via PSI Presentation 08.11.2019 PDFDocument47 pages7 Via PSI Presentation 08.11.2019 PDFsplhuf19No ratings yet

- MSME (Micro, Small and Medium Enterprises)Document6 pagesMSME (Micro, Small and Medium Enterprises)ISU MITTALNo ratings yet

- E-Book For MSMEsNFNFDocument61 pagesE-Book For MSMEsNFNFvikas24202No ratings yet

- StateGovernmentSchemes 30 11 2018Document10 pagesStateGovernmentSchemes 30 11 2018Ravi KumarNo ratings yet

- Small Scal Industry PolicyDocument6 pagesSmall Scal Industry PolicysweetuhemuNo ratings yet

- Ministry of MSME, Govt. of IndiaDocument37 pagesMinistry of MSME, Govt. of IndiaKannan GopalakrishnanNo ratings yet

- Eco Ap 21-22Document17 pagesEco Ap 21-22Sai AnuthNo ratings yet

- Asignment 2 Yasir SirDocument5 pagesAsignment 2 Yasir Sirosama samiNo ratings yet

- Psi 2007Document56 pagesPsi 2007splhuf19No ratings yet

- Astorianz Industries PVT LTD.: Schemes at Central IndiaDocument3 pagesAstorianz Industries PVT LTD.: Schemes at Central IndiavedantNo ratings yet

- GO - Ms - No - 14Document192 pagesGO - Ms - No - 14Adhavan M AnnathuraiNo ratings yet

- IIT D MSME FocusDocument8 pagesIIT D MSME FocusSreemanti DeyNo ratings yet

- Industrial Policy APDocument6 pagesIndustrial Policy APapi-3711789No ratings yet

- Startup India: Budget AnnouncementsDocument4 pagesStartup India: Budget AnnouncementsYash MaheshwariNo ratings yet

- Psi 2019Document19 pagesPsi 2019splhuf19No ratings yet

- MsmeDocument42 pagesMsmeRajesh KumarNo ratings yet

- MSME Schemes For Small Entrepreneurs or Startup Entrepreneurs Founders - Women EntrepreneursDocument31 pagesMSME Schemes For Small Entrepreneurs or Startup Entrepreneurs Founders - Women EntrepreneursAnil GuptaNo ratings yet

- Mrunal 4.45Document8 pagesMrunal 4.45regecartNo ratings yet

- MSME PresentationDocument37 pagesMSME PresentationMass NelsonNo ratings yet

- (Economic Survey) Ch9 Micro Small & Medium Enterprises (MSME), Definitions, SSI Reserved Items, SIDBI, SIDF, Sick Industries, Budget 2014Document8 pages(Economic Survey) Ch9 Micro Small & Medium Enterprises (MSME), Definitions, SSI Reserved Items, SIDBI, SIDF, Sick Industries, Budget 2014vijayNo ratings yet

- Introduction To Msme SectorDocument32 pagesIntroduction To Msme Sectorashimathakur50% (2)

- PMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Document43 pagesPMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Naresh KadyanNo ratings yet

- Unit-1 The Micro-Small and Medium Enterprises (Msmes) Are Small Sized Entities, Defined inDocument36 pagesUnit-1 The Micro-Small and Medium Enterprises (Msmes) Are Small Sized Entities, Defined inBhaskaran BalamuraliNo ratings yet

- Jharkhand Draft Industrial Policy 2010Document22 pagesJharkhand Draft Industrial Policy 2010IndustrialpropertyinNo ratings yet

- Need of Small-Scale Industries For The General Prosperity of The CountryDocument4 pagesNeed of Small-Scale Industries For The General Prosperity of The CountryashutoshNo ratings yet

- Msme SchemesDocument60 pagesMsme SchemesSathyanandam SathyanandamNo ratings yet

- Assignment - 1 Subject - Business Plan, Strategy & Project ReportDocument14 pagesAssignment - 1 Subject - Business Plan, Strategy & Project ReportAkarshaNo ratings yet

- 6 IndustriesDocument19 pages6 IndustriesRavee GillalaNo ratings yet

- Accounts-Small Scale IndustriesDocument7 pagesAccounts-Small Scale IndustriesdevugoriyaNo ratings yet

- Prime Minister Employment Generation Programme (PMEGP) : ObjectivesDocument16 pagesPrime Minister Employment Generation Programme (PMEGP) : ObjectivesPandhari SanapNo ratings yet

- 0711120857ECO14306EA16Unit3, Topic Industrial Sector and PSUs in J&K Stateu3t2Document11 pages0711120857ECO14306EA16Unit3, Topic Industrial Sector and PSUs in J&K Stateu3t2adil sheikhNo ratings yet

- Packaging Scheme Incentives 2013Document40 pagesPackaging Scheme Incentives 2013Piyush KulkarniNo ratings yet

- Small Scale Industry 08Document16 pagesSmall Scale Industry 08ajabrao80% (5)

- Highlights of Budget 2018-19Document3 pagesHighlights of Budget 2018-19anon_430308539No ratings yet

- Economical Weaker Sections of Upper Caste: Discrimination Under PMEGPDocument27 pagesEconomical Weaker Sections of Upper Caste: Discrimination Under PMEGPNaresh KadyanNo ratings yet

- Benefits of Msme Registration in IndiaDocument2 pagesBenefits of Msme Registration in Indiaankit ayashkNo ratings yet

- MSC Malaysia Bill of Guarantees - Ihl Booklet v.1Document14 pagesMSC Malaysia Bill of Guarantees - Ihl Booklet v.1ARVIN ARSENALNo ratings yet

- Prime Minister's Employment Generation Programme (PMEGP)Document2 pagesPrime Minister's Employment Generation Programme (PMEGP)nagesh raoNo ratings yet

- On Schemes & Policies For MSMEs - Final-14.12.2022Document36 pagesOn Schemes & Policies For MSMEs - Final-14.12.2022shreenathjiagriexport1No ratings yet

- Ts2015ind MS78Document90 pagesTs2015ind MS78itzprasuNo ratings yet

- MSME Ch-2Document31 pagesMSME Ch-2aishuphotos01No ratings yet

- Unit - 5 Taxation Benefits To Ssi, Various Incentives &subsidiesDocument16 pagesUnit - 5 Taxation Benefits To Ssi, Various Incentives &subsidiesaparna kallaNo ratings yet

- Government Initiative WB Msme Policy 2013-18Document7 pagesGovernment Initiative WB Msme Policy 2013-18Vikash AgarwalNo ratings yet

- MSMED Act, 2006 Short FeaturesDocument7 pagesMSMED Act, 2006 Short FeaturesHexaNotesNo ratings yet

- Disaster TrendsDocument5 pagesDisaster TrendsABHISHEK SINGHNo ratings yet

- Presentation On: Presentation On: Features of and Benefits To Msmes Features of and Benefits To MsmesDocument41 pagesPresentation On: Presentation On: Features of and Benefits To Msmes Features of and Benefits To MsmesRajeevChandNo ratings yet

- ENTREPRENEURSHIPpDocument13 pagesENTREPRENEURSHIPpRaj K GahlotNo ratings yet

- Policy Governing MSMEDocument16 pagesPolicy Governing MSMEarupkumaradhikaryNo ratings yet

- Msme-A Tool For Inclusive Growth of IndiaDocument25 pagesMsme-A Tool For Inclusive Growth of Indiaprashantt22No ratings yet

- Software Industry Detail AnalysisDocument66 pagesSoftware Industry Detail Analysisamit.c.parekh1317100% (7)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Op Ed Final WordDocument3 pagesOp Ed Final Wordapi-254578671No ratings yet

- REply FN - SVDocument62 pagesREply FN - SVNhung NguyễnNo ratings yet

- I II III IV V VI VII Viii IX X XI XII XiiiDocument1 pageI II III IV V VI VII Viii IX X XI XII XiiiAWOR GraceNo ratings yet

- Important Facts of Census 2011 - Paper TyariDocument2 pagesImportant Facts of Census 2011 - Paper Tyarisunil kumar routNo ratings yet

- BOP and XMasTreeDocument1 pageBOP and XMasTreeo_tostaNo ratings yet

- Severely UW Underweight: NewbornDocument4 pagesSeverely UW Underweight: NewbornRoanne LaguaNo ratings yet

- Chapter 8: BibliographyDocument13 pagesChapter 8: BibliographyRavi GuptaNo ratings yet

- Application For Provident LoanDocument3 pagesApplication For Provident LoanJerexNo ratings yet

- Knowing The Contribution of Agriculture To The Nigerian GDPDocument52 pagesKnowing The Contribution of Agriculture To The Nigerian GDPmarkchima8No ratings yet

- TSF External Apr 2022 Junior Engineer TSF ENGDocument2 pagesTSF External Apr 2022 Junior Engineer TSF ENGMuhammad DandyNo ratings yet

- TreesDocument6 pagesTreesrajeshsupremNo ratings yet

- Regional Integration (Caricom)Document8 pagesRegional Integration (Caricom)Mat Bernz100% (1)

- Demand Analysis - IIDocument25 pagesDemand Analysis - IIlalith vamsiNo ratings yet

- ES2011Document309 pagesES2011adityaverma7No ratings yet

- Continous Compounded Interest Pert CCIHWDocument4 pagesContinous Compounded Interest Pert CCIHWH2wo FansNo ratings yet

- 080920-Hyderabad Circle and Its BranchesDocument189 pages080920-Hyderabad Circle and Its BranchesSudhir DehariyaNo ratings yet

- Money Supply and Inflationary Trend in Nigeria 1Document31 pagesMoney Supply and Inflationary Trend in Nigeria 1CEO DimejiNo ratings yet

- Invites: For Pre-Booking of Industrial PlotsDocument1 pageInvites: For Pre-Booking of Industrial PlotsRakesh ShahNo ratings yet

- Subject: Applied Economics: Subject Teacher: Ms. Jane M. CaranguianDocument23 pagesSubject: Applied Economics: Subject Teacher: Ms. Jane M. CaranguianJane CaranguianNo ratings yet

- Poverty and UnemploymentDocument10 pagesPoverty and UnemploymentJOSEPH HERBERT MABELNo ratings yet

- Nuclear & Thermal Power Plants (Top MCQ)Document27 pagesNuclear & Thermal Power Plants (Top MCQ)mat kumarNo ratings yet

- IFPRI Research PaperDocument36 pagesIFPRI Research Paperrajaji63No ratings yet

- Sample Exam 3Document8 pagesSample Exam 3Luu Nguyen Quyet ThangNo ratings yet

- Hearing Committee On The Budget House of Representatives: Members' DayDocument170 pagesHearing Committee On The Budget House of Representatives: Members' DayScribd Government DocsNo ratings yet

- Notice: Sub: Fsa Status of Existing Linked Consumers of SeclDocument32 pagesNotice: Sub: Fsa Status of Existing Linked Consumers of SeclShabbir MoizbhaiNo ratings yet

Government of Maharashtra Directorate of Industries: District Industries Centre, Akola

Government of Maharashtra Directorate of Industries: District Industries Centre, Akola

Uploaded by

Sachin IngoleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government of Maharashtra Directorate of Industries: District Industries Centre, Akola

Government of Maharashtra Directorate of Industries: District Industries Centre, Akola

Uploaded by

Sachin IngoleCopyright:

Available Formats

1

GOVERNMENT OF MAHARASHTRA DIRECTORATE OF INDUSTRIES

DISTRICT INDUSTRIES CENTRE, AKOLA

OLD COTTON MARKET,NEAR ,BSNL OFFICE,AKOLA

E mail- didicakola@maharashtra .gov.in Phone - 0724- 2430880 Fax0724- 2442490 Development commissioner (Industries ), Directorate of Industries, Govt.of Maharashtra is to monitors ,& implementation for promotion & Development of MSME sector at State level (Micro, Small & Medium enterprise ) through District Industries Centre in each district. Directorate of Industries also implements Self Employment Scheme through MSME for Educated Unemployed Youths. DIC also organised Enterpreneurship Development Programme. Small Industries Guidance & Monitoring Assistance (SIGMA COUNTER) is at

1

the enterance of DIC provides all kind of information regarding project report and financial assistance to Entrepreneurs.

(A) SCHEME FOR PROMOTION OF MSME SECTOR 01) 02) 03) 04) 05) MSME Registration IT & BT Registration Registration under CSPO. District Award Scheme. Pakage Scheme of Incentives-2007

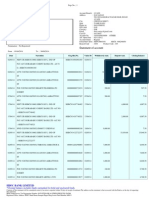

(B) SCHEME FOR SELF EMPLOYMENT 01) PMEGP 02) RSMS 03) DIC Margin Money Scheme. 04) Enterpreneurship Development Programme. Defination as per MSMED Act- 2006 Sr. No. 1 2 Enterpri Manufacturing ses enterprises Micro Fix Investment in P& M up to 25 Lakhs. Small Fix Investment in P&M above 25 Lakhs & up to 5 Crore Medium Fix investment in P&M above 5 Crore & up to 10 Crore. Service enterprises Fix Investment in P&M up to 10 Lakhs. Fix Investment in P&M abve 10 Lakhs up to 2 Crore. Fix investment in P&M above 2 Crore up to 5 crore.

INFORMATION TECHNOLOGY

& BIO TECHNOLOGY (IT &BT)

Maharashtra is a knowledge State, and passing through Century of Knowledge. IT & BT units reflects in Indian economy and increase the growth in Rural as well as Urban areas. Government is encouraging to setting up IT & BT units . Offered various incentives like land in concessional rates Exemption in Electricity duty for a period of 10 Years., waiver of stamp duty exemption etc. DIC provides Provisional/Permanent MSMEs Memorandum to Micro & Small Enterprises to filling morundum of scheduled I / Scheduled II respectively by entrepreneur who desire. Registration Under Central Stores Purchase Oganisation Any enterprises desire to have a registration with CSPO as a manufactruring /Stockist may to submit following documents to Directorate of Industries through DIC. (01) (02) (03) (04) (05) (06) (07) Application from in prescribed formate MSME's Memorandum scheduled-II. Income Tax Clerance. Balance Sheets for last 3 Years. Document related to constitution of firm. Document related to provision of land . Statement of order executed from Gov Dep.

District Award scheme. District award is granted to deserving MSME's those are are permanently registered with Directorate of Industries and is continuous production at least last three years & Repayment of laon regular. Those units who fulfilled the above criteria is eligible for award selected through district level committee. Award Ist prise Prize Rs 15000/-, Mometo, etc.

II nd prise Rs 10000/- Mometo, etc. PAKAGE SCHEME OF INCENTIVE - 2007 In order to encourage the dispersal of Indusries to the less developed areas of the state, Government has been giving a package of incentive to new/expantion units set up in the developing region. Under a scheme popularly known as the package scheme of incentives -2007. Coverage under the 2007 Scheme:1. Mfg .enterprises as defined in the MSMED Act, 2006. 2. Information Technology,Bio Technology (IT & BT) units registered with Directorate of Industries. Poultry . 3. Cold storage and Agro Industries. Period of operation:1st April. 2007 to 31st March, 2011. Industrial Promitional Subsidy:( IPS) New Micro and Small manufacturing Enterprises, Medium Enterprises/ LSI (Including IT/BT units):- New project, whch are set up in these category in different parts of the state, will be eligible for industrial promotion subsidy. Akola district cover under D+ area classification.

4

The quantum of benefit and period will be as follows:Taluka & Area clacification Celling as % of fixed capital investment Micro & Small Medium Manufacturing Manufacturing Enterprises/LSI A B C D D+ No.Industries District -20 30 40 50 60 --20 25 30 35 No.of years

Micro & Medium Small Manufacturing Manufacturin Enterprises/LSI g --6 -7 5 8 6 9 7 10 8

INTEREST SUBSIDY : All new eligible Micro & Small Manufacturing Enterprises in Textile, Hosiery, knitwear and Readymade Garment sector in the will be eligible for interest Subsidy in addition to Industrial Promotion Subsidy as under. Taluka & Area classification A B C D D+ No.Industries District Monetary ceiling limit (Rs. Lakhs) -20 30 40 50 60 Maximum period in year --20 25 30 35

Exemption of Electricity Duty Eligible new units in C , D, & D + areas and No Industries District (S) will be exempted from payment of Electricity Duty for aperod of 15 years. In other parts of the State, 100% Export Oriented Units (EOUs), Information Technology (IT) and BioTechnology (BT) units will also be exempted from payment of Electricity Duty for a period of 10 years. Waiver of Stamp Duty: New as well as unit undertaking Expansion/Diversification will be exempted from payment of Stamp duty up to 31st 2011 C,D,D, D+ Taluka and No Industry District Districts. However, in A and B areas, stamp duty exemption would be available as given below: BT and IT units in public : : 100% BT and IT unit in private Parks : 75% Royalty Refund: All eligible units, new as well as units undertaking expansion in Vidarbha region will be eligible for refund of royalty paid on purchase of materials from mine owners within the State of Maharashtra for a period of five years from the date of commencement of commercial production. Refund of Octroi/Entry Tax in lieu of Octroi: An eligible unit, after it goes into commercial production, will be entitled to refund of Octroi duty/Entry Tax (in lieu of Octroi), account based cess or other way charged instead of or in lieu of Octroi payable and paid to the local authority on Imports of all items required by the eligible units this incentive will be admissible in the form of a grant restricted to 100% of the admissible fixed capital investment of the ellibible unit for a period of 5/7/9/12 yeas respectively in the B/C/D/ D + areas in recpect of no industries area, However, the period of 15 Years.

6

(B) SCHEME FOR SELF EMPLOYMENT PRIME MINISTER EMPLOYMENT GENERATION PROGRAMME.(PMEGP) Govt. of India, introduced a new credit linked subsidy programme called as PMEGP (Merging of PMRY & REGP Scheme), the main objective of the scheme generation of employment through Micro enterprises through rural as well as urban area. Nature of the Financial Assistance. Categories of beneficiariesunder Area General Special (Including SC/ST/OBCs/Minories/women, Physically Handicapped.) Own contribution 10% 05% Rate of Subsidy Urban Rural 15% 25% 25% 35% Banks

90% 95%

Maximam project admissible under manufacturing is Rs. 25lakh. Maximum project admissible under B & S is . Rs. 10 Lakhs. Eligibility criteria of beneficiaries. 1. Any individual above 18 years of Age. 2. There is no income ceilling for enterprises 3. The units have already avail Government Subsidy under PMRY/ REGP or other scheme are not eligible. 4. only new project sanctioned under PMEGP. 5. only one person family.

Document required in two copies. 1. Application in prescribed formate with photo's 2. Education qualification certificate T.C. & Marklist. 3. Employment card. 4. Rent Argement ,Tax receipt. 5. Quotation. 6. Project Report. 7. Cast certificate 8. Experience certificate. 9. Affidevit on 20% stamp paper in prescribed formats 10. Ration card. 11.Training certificate.( if already undergone) Negative List. 1 .Industry concerned. with meat i.e processing, canning And/serving items made of it.,intoxicant item like Bidi/Pan//Cigar/ cigarate. 2) Dhaba serving liquir, preparation/producing & Tobaco as a raw material. 3) Harvester machine, manufacturing of polythene bags of 20 micron thickness . 4) Processing of Pashmina wool and other products like hand spinning and hand weaving , Khadi programme availing sales rebate . 5) Rurtal transports etc.

DIC, Loan Scheme.(It is a oldest Scheme) Micro Industries and service Industries unit with investment in P&M up to two lakhs & unit located in rural areas with population below 1,00,000 as per 1971 census. no condition of education. Above 18 years age. No. income criteria Coverage of Extent of assistance Margin Money loan assistance is available for fixed capital as well as working capital limit to 20% of total investment maximum Rs, 40,000/- for general category. However 30% of SC/ST category maximum 60,000/- at the rate of interest 4% penal interest 1%. Repayment scheduled up to 10 Years & for 5 Years respectively. 02) REVISED SEED MONEY SCHEME.. Educated unemployed youth who desire to state business Enterprises or MSME's for self employments up to project cost of 25 lakhs. Eligibility cretiria Maximum VII std Passed Age Limit 18 to 50 Year. No. defaulter with financial institution. Coverage & extent of assistance. 15% seed money of total cost of project @ 6/- P.A.. with 1% penal interest. Maximum seed money limit is 3.75 lakhs . For a project below 10 lakhs. 20% -- Seed Money given to SC/ST OBC /VJ/NT. 15% General candidates.

10

ENTERPRENEUARSHIP DEVELOPMENT PROGRAMM. Enterpreneuraship Dvelopment Programmes are orgnise for self-employment of various category like educated unemployed youth, minority community and weaker section of the society. The duration of EDPs are 10 days. Skill development programme are organised for improving skill in the entrepreneurs the duration of progammes are 30 days and These programme are conducted by MCED & MITCON. residential programme 15 days also organise this organisation paid Rs. 1000/- to the participant .

For further information and details contact General manager DIC, Akola. *****

10

You might also like

- PDF Esther Vilar The Manipulated Man PDF CompressDocument69 pagesPDF Esther Vilar The Manipulated Man PDF CompressnichiooharaNo ratings yet

- Sidbi Pro Msme PDFDocument7 pagesSidbi Pro Msme PDFSonamNo ratings yet

- MSME PresentationDocument37 pagesMSME PresentationMass Nelson100% (1)

- Day 5 Task (Bop Cad FD)Document11 pagesDay 5 Task (Bop Cad FD)ashish sunnyNo ratings yet

- Investment in Entrepreneurial Ability SchultzDocument12 pagesInvestment in Entrepreneurial Ability SchultzRafael LemusNo ratings yet

- EU: Articles of Stationery - Market Report. Analysis and Forecast To 2020Document9 pagesEU: Articles of Stationery - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Aug Pay SlipDocument1 pageAug Pay SlipDAYA SHANKARNo ratings yet

- Unemployed Youth Employment Generation Programme 45Document8 pagesUnemployed Youth Employment Generation Programme 45gs_sankarNo ratings yet

- Micro Small IndustriesDocument43 pagesMicro Small IndustriesManoj Kumar VNo ratings yet

- Taxation Benefits To Ssi, Various IncentivesDocument31 pagesTaxation Benefits To Ssi, Various IncentivesThasni MK33% (3)

- Msme PDFDocument41 pagesMsme PDFs_bharathkumarNo ratings yet

- 7 Via PSI Presentation 08.11.2019 PDFDocument47 pages7 Via PSI Presentation 08.11.2019 PDFsplhuf19No ratings yet

- MSME (Micro, Small and Medium Enterprises)Document6 pagesMSME (Micro, Small and Medium Enterprises)ISU MITTALNo ratings yet

- E-Book For MSMEsNFNFDocument61 pagesE-Book For MSMEsNFNFvikas24202No ratings yet

- StateGovernmentSchemes 30 11 2018Document10 pagesStateGovernmentSchemes 30 11 2018Ravi KumarNo ratings yet

- Small Scal Industry PolicyDocument6 pagesSmall Scal Industry PolicysweetuhemuNo ratings yet

- Ministry of MSME, Govt. of IndiaDocument37 pagesMinistry of MSME, Govt. of IndiaKannan GopalakrishnanNo ratings yet

- Eco Ap 21-22Document17 pagesEco Ap 21-22Sai AnuthNo ratings yet

- Asignment 2 Yasir SirDocument5 pagesAsignment 2 Yasir Sirosama samiNo ratings yet

- Psi 2007Document56 pagesPsi 2007splhuf19No ratings yet

- Astorianz Industries PVT LTD.: Schemes at Central IndiaDocument3 pagesAstorianz Industries PVT LTD.: Schemes at Central IndiavedantNo ratings yet

- GO - Ms - No - 14Document192 pagesGO - Ms - No - 14Adhavan M AnnathuraiNo ratings yet

- IIT D MSME FocusDocument8 pagesIIT D MSME FocusSreemanti DeyNo ratings yet

- Industrial Policy APDocument6 pagesIndustrial Policy APapi-3711789No ratings yet

- Startup India: Budget AnnouncementsDocument4 pagesStartup India: Budget AnnouncementsYash MaheshwariNo ratings yet

- Psi 2019Document19 pagesPsi 2019splhuf19No ratings yet

- MsmeDocument42 pagesMsmeRajesh KumarNo ratings yet

- MSME Schemes For Small Entrepreneurs or Startup Entrepreneurs Founders - Women EntrepreneursDocument31 pagesMSME Schemes For Small Entrepreneurs or Startup Entrepreneurs Founders - Women EntrepreneursAnil GuptaNo ratings yet

- Mrunal 4.45Document8 pagesMrunal 4.45regecartNo ratings yet

- MSME PresentationDocument37 pagesMSME PresentationMass NelsonNo ratings yet

- (Economic Survey) Ch9 Micro Small & Medium Enterprises (MSME), Definitions, SSI Reserved Items, SIDBI, SIDF, Sick Industries, Budget 2014Document8 pages(Economic Survey) Ch9 Micro Small & Medium Enterprises (MSME), Definitions, SSI Reserved Items, SIDBI, SIDF, Sick Industries, Budget 2014vijayNo ratings yet

- Introduction To Msme SectorDocument32 pagesIntroduction To Msme Sectorashimathakur50% (2)

- PMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Document43 pagesPMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Naresh KadyanNo ratings yet

- Unit-1 The Micro-Small and Medium Enterprises (Msmes) Are Small Sized Entities, Defined inDocument36 pagesUnit-1 The Micro-Small and Medium Enterprises (Msmes) Are Small Sized Entities, Defined inBhaskaran BalamuraliNo ratings yet

- Jharkhand Draft Industrial Policy 2010Document22 pagesJharkhand Draft Industrial Policy 2010IndustrialpropertyinNo ratings yet

- Need of Small-Scale Industries For The General Prosperity of The CountryDocument4 pagesNeed of Small-Scale Industries For The General Prosperity of The CountryashutoshNo ratings yet

- Msme SchemesDocument60 pagesMsme SchemesSathyanandam SathyanandamNo ratings yet

- Assignment - 1 Subject - Business Plan, Strategy & Project ReportDocument14 pagesAssignment - 1 Subject - Business Plan, Strategy & Project ReportAkarshaNo ratings yet

- 6 IndustriesDocument19 pages6 IndustriesRavee GillalaNo ratings yet

- Accounts-Small Scale IndustriesDocument7 pagesAccounts-Small Scale IndustriesdevugoriyaNo ratings yet

- Prime Minister Employment Generation Programme (PMEGP) : ObjectivesDocument16 pagesPrime Minister Employment Generation Programme (PMEGP) : ObjectivesPandhari SanapNo ratings yet

- 0711120857ECO14306EA16Unit3, Topic Industrial Sector and PSUs in J&K Stateu3t2Document11 pages0711120857ECO14306EA16Unit3, Topic Industrial Sector and PSUs in J&K Stateu3t2adil sheikhNo ratings yet

- Packaging Scheme Incentives 2013Document40 pagesPackaging Scheme Incentives 2013Piyush KulkarniNo ratings yet

- Small Scale Industry 08Document16 pagesSmall Scale Industry 08ajabrao80% (5)

- Highlights of Budget 2018-19Document3 pagesHighlights of Budget 2018-19anon_430308539No ratings yet

- Economical Weaker Sections of Upper Caste: Discrimination Under PMEGPDocument27 pagesEconomical Weaker Sections of Upper Caste: Discrimination Under PMEGPNaresh KadyanNo ratings yet

- Benefits of Msme Registration in IndiaDocument2 pagesBenefits of Msme Registration in Indiaankit ayashkNo ratings yet

- MSC Malaysia Bill of Guarantees - Ihl Booklet v.1Document14 pagesMSC Malaysia Bill of Guarantees - Ihl Booklet v.1ARVIN ARSENALNo ratings yet

- Prime Minister's Employment Generation Programme (PMEGP)Document2 pagesPrime Minister's Employment Generation Programme (PMEGP)nagesh raoNo ratings yet

- On Schemes & Policies For MSMEs - Final-14.12.2022Document36 pagesOn Schemes & Policies For MSMEs - Final-14.12.2022shreenathjiagriexport1No ratings yet

- Ts2015ind MS78Document90 pagesTs2015ind MS78itzprasuNo ratings yet

- MSME Ch-2Document31 pagesMSME Ch-2aishuphotos01No ratings yet

- Unit - 5 Taxation Benefits To Ssi, Various Incentives &subsidiesDocument16 pagesUnit - 5 Taxation Benefits To Ssi, Various Incentives &subsidiesaparna kallaNo ratings yet

- Government Initiative WB Msme Policy 2013-18Document7 pagesGovernment Initiative WB Msme Policy 2013-18Vikash AgarwalNo ratings yet

- MSMED Act, 2006 Short FeaturesDocument7 pagesMSMED Act, 2006 Short FeaturesHexaNotesNo ratings yet

- Disaster TrendsDocument5 pagesDisaster TrendsABHISHEK SINGHNo ratings yet

- Presentation On: Presentation On: Features of and Benefits To Msmes Features of and Benefits To MsmesDocument41 pagesPresentation On: Presentation On: Features of and Benefits To Msmes Features of and Benefits To MsmesRajeevChandNo ratings yet

- ENTREPRENEURSHIPpDocument13 pagesENTREPRENEURSHIPpRaj K GahlotNo ratings yet

- Policy Governing MSMEDocument16 pagesPolicy Governing MSMEarupkumaradhikaryNo ratings yet

- Msme-A Tool For Inclusive Growth of IndiaDocument25 pagesMsme-A Tool For Inclusive Growth of Indiaprashantt22No ratings yet

- Software Industry Detail AnalysisDocument66 pagesSoftware Industry Detail Analysisamit.c.parekh1317100% (7)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Op Ed Final WordDocument3 pagesOp Ed Final Wordapi-254578671No ratings yet

- REply FN - SVDocument62 pagesREply FN - SVNhung NguyễnNo ratings yet

- I II III IV V VI VII Viii IX X XI XII XiiiDocument1 pageI II III IV V VI VII Viii IX X XI XII XiiiAWOR GraceNo ratings yet

- Important Facts of Census 2011 - Paper TyariDocument2 pagesImportant Facts of Census 2011 - Paper Tyarisunil kumar routNo ratings yet

- BOP and XMasTreeDocument1 pageBOP and XMasTreeo_tostaNo ratings yet

- Severely UW Underweight: NewbornDocument4 pagesSeverely UW Underweight: NewbornRoanne LaguaNo ratings yet

- Chapter 8: BibliographyDocument13 pagesChapter 8: BibliographyRavi GuptaNo ratings yet

- Application For Provident LoanDocument3 pagesApplication For Provident LoanJerexNo ratings yet

- Knowing The Contribution of Agriculture To The Nigerian GDPDocument52 pagesKnowing The Contribution of Agriculture To The Nigerian GDPmarkchima8No ratings yet

- TSF External Apr 2022 Junior Engineer TSF ENGDocument2 pagesTSF External Apr 2022 Junior Engineer TSF ENGMuhammad DandyNo ratings yet

- TreesDocument6 pagesTreesrajeshsupremNo ratings yet

- Regional Integration (Caricom)Document8 pagesRegional Integration (Caricom)Mat Bernz100% (1)

- Demand Analysis - IIDocument25 pagesDemand Analysis - IIlalith vamsiNo ratings yet

- ES2011Document309 pagesES2011adityaverma7No ratings yet

- Continous Compounded Interest Pert CCIHWDocument4 pagesContinous Compounded Interest Pert CCIHWH2wo FansNo ratings yet

- 080920-Hyderabad Circle and Its BranchesDocument189 pages080920-Hyderabad Circle and Its BranchesSudhir DehariyaNo ratings yet

- Money Supply and Inflationary Trend in Nigeria 1Document31 pagesMoney Supply and Inflationary Trend in Nigeria 1CEO DimejiNo ratings yet

- Invites: For Pre-Booking of Industrial PlotsDocument1 pageInvites: For Pre-Booking of Industrial PlotsRakesh ShahNo ratings yet

- Subject: Applied Economics: Subject Teacher: Ms. Jane M. CaranguianDocument23 pagesSubject: Applied Economics: Subject Teacher: Ms. Jane M. CaranguianJane CaranguianNo ratings yet

- Poverty and UnemploymentDocument10 pagesPoverty and UnemploymentJOSEPH HERBERT MABELNo ratings yet

- Nuclear & Thermal Power Plants (Top MCQ)Document27 pagesNuclear & Thermal Power Plants (Top MCQ)mat kumarNo ratings yet

- IFPRI Research PaperDocument36 pagesIFPRI Research Paperrajaji63No ratings yet

- Sample Exam 3Document8 pagesSample Exam 3Luu Nguyen Quyet ThangNo ratings yet

- Hearing Committee On The Budget House of Representatives: Members' DayDocument170 pagesHearing Committee On The Budget House of Representatives: Members' DayScribd Government DocsNo ratings yet

- Notice: Sub: Fsa Status of Existing Linked Consumers of SeclDocument32 pagesNotice: Sub: Fsa Status of Existing Linked Consumers of SeclShabbir MoizbhaiNo ratings yet