Professional Documents

Culture Documents

CEO Confidence Low 08

CEO Confidence Low 08

Uploaded by

Nicolet BankCopyright:

Available Formats

You might also like

- UITF Exam ReviewerDocument8 pagesUITF Exam ReviewerArianne Garcia75% (4)

- ACC 307 Final Project Part IIDocument4 pagesACC 307 Final Project Part IISalman Khalid100% (4)

- Treasury Management Sample Questions Dec 18 ExamsDocument114 pagesTreasury Management Sample Questions Dec 18 ExamsajithaNo ratings yet

- Comparative Study of BSE AND NSEDocument66 pagesComparative Study of BSE AND NSEAnonymous w7l74n067% (3)

- 2007 Business Pulse©: CEO Confidence Continues To CascadeDocument2 pages2007 Business Pulse©: CEO Confidence Continues To CascadeNicolet Bank100% (2)

- 2007 Business Pulse©: CEO Confidence: A Slippery SlopeDocument2 pages2007 Business Pulse©: CEO Confidence: A Slippery SlopeNicolet BankNo ratings yet

- CEOs Challenges 2009Document2 pagesCEOs Challenges 2009Nicolet Bank100% (1)

- Revised GDP FY21Document2 pagesRevised GDP FY21YogeshNo ratings yet

- Accenture Beyond 2021Document39 pagesAccenture Beyond 2021Muhammad SabirNo ratings yet

- Stimulus Receives Little SupportDocument2 pagesStimulus Receives Little SupportNicolet BankNo ratings yet

- NFIB ReportDocument23 pagesNFIB ReportsrdielNo ratings yet

- Mni Chicago Press Release 2019 03Document2 pagesMni Chicago Press Release 2019 03Valter SilveiraNo ratings yet

- Tonys View 12 January 2023 PDFDocument5 pagesTonys View 12 January 2023 PDFAndreas KleberNo ratings yet

- 5 Challenges CFOs Must Navigate To Grow Earnings Amid Economic HeadwindsDocument17 pages5 Challenges CFOs Must Navigate To Grow Earnings Amid Economic HeadwindsElles RomaniaNo ratings yet

- Eco Case StudyDocument17 pagesEco Case StudyGs AbhilashNo ratings yet

- CFIBBusinessBarometerNationalAugustReport September2012Document4 pagesCFIBBusinessBarometerNationalAugustReport September2012Tessa VanderhartNo ratings yet

- Sector Business Cycle AnalysisDocument12 pagesSector Business Cycle AnalysisesgurazovNo ratings yet

- Compass Financial - Weekly Market Commentary June 16, 2008Document2 pagesCompass Financial - Weekly Market Commentary June 16, 2008compassfinancialNo ratings yet

- 10-Rules of Thumb - Morgan Stanley PDFDocument8 pages10-Rules of Thumb - Morgan Stanley PDFParas BholaNo ratings yet

- BCI Report QI 2014 - 3 - OPTIMIZEDDocument11 pagesBCI Report QI 2014 - 3 - OPTIMIZEDRiannaNo ratings yet

- TD Bank-Aug-04-Cfib Sme Business Outlook SurveyDocument1 pageTD Bank-Aug-04-Cfib Sme Business Outlook SurveyMiir ViirNo ratings yet

- CEO Macro BriefingDocument72 pagesCEO Macro BriefingNagesh ShettyNo ratings yet

- Qualitative Models of Corporate FailureDocument4 pagesQualitative Models of Corporate FailureHillary TukahirwaNo ratings yet

- Economic Measures Continue To SlowDocument6 pagesEconomic Measures Continue To Slowsamp123No ratings yet

- Grow Beyond The BasicsDocument23 pagesGrow Beyond The BasicsKarolNo ratings yet

- Paylocity FY21 Q3 Earnings AnalysisDocument8 pagesPaylocity FY21 Q3 Earnings AnalysisjamesNo ratings yet

- Year End Review TemplateDocument16 pagesYear End Review TemplatekassongoNo ratings yet

- Us 3Q22 Cfo Signals Report Part1Document24 pagesUs 3Q22 Cfo Signals Report Part1X alterNo ratings yet

- Emerging Companies 2009 Survey Results Report FINALDocument27 pagesEmerging Companies 2009 Survey Results Report FINALdebgageNo ratings yet

- KICTalking Points 080608Document6 pagesKICTalking Points 080608russ8609No ratings yet

- GECS-Q2-2023 v9Document18 pagesGECS-Q2-2023 v9anastasov.plamenNo ratings yet

- Economy Outlook 2009-10: Dun & BradstreetDocument18 pagesEconomy Outlook 2009-10: Dun & BradstreetFaria HasanNo ratings yet

- India Needs Intelligent Lockdown Exit Strategy - SBI Report - The Economic TimesDocument2 pagesIndia Needs Intelligent Lockdown Exit Strategy - SBI Report - The Economic TimesSumant AlagawadiNo ratings yet

- FSN E-Commerce Ventures Limited: August 05Document36 pagesFSN E-Commerce Ventures Limited: August 05Chandresh SinghNo ratings yet

- Why Working Capital MattersDocument4 pagesWhy Working Capital MattersMayank PatelNo ratings yet

- 02.08.2012 - EuroCham Business Climate Index Falls Below Mid-PointDocument3 pages02.08.2012 - EuroCham Business Climate Index Falls Below Mid-PointEuropean Chamber of Commerce in VietnamNo ratings yet

- Insights IndiaDocument14 pagesInsights Indiaarryaan001No ratings yet

- Third Quarter 2020 Earnings Results Presentation: October 14, 2020Document16 pagesThird Quarter 2020 Earnings Results Presentation: October 14, 2020Zerohedge100% (1)

- CMI August2015Document7 pagesCMI August2015alphathesisNo ratings yet

- Rashyu GuyinDocument1 pageRashyu GuyinChandra SegarNo ratings yet

- ATTO January Investor Presentation 01.05.2016Document35 pagesATTO January Investor Presentation 01.05.2016gns1234567890No ratings yet

- Business Census 2016Document22 pagesBusiness Census 2016Andrew Richard ThompsonNo ratings yet

- BCG How Private Equity Can Capture The Upside in A Downturn August 2019 - tcm9 225891Document8 pagesBCG How Private Equity Can Capture The Upside in A Downturn August 2019 - tcm9 2258919980139892No ratings yet

- Unit 3Document39 pagesUnit 3sheetal gudseNo ratings yet

- How Transformative Ceos Lead in A Crisis: by Lars Fæste, Christian Gruß, and Jose FloresDocument8 pagesHow Transformative Ceos Lead in A Crisis: by Lars Fæste, Christian Gruß, and Jose FloresAnonymous FaqNSHEtNo ratings yet

- Aec 675 F 4Document14 pagesAec 675 F 4RahulNo ratings yet

- Sector Business Cycle AnalysisDocument9 pagesSector Business Cycle AnalysisGabriela Medrano100% (1)

- Banking Sector Roundup Q1fy24 BCGDocument52 pagesBanking Sector Roundup Q1fy24 BCGSumiran BansalNo ratings yet

- 2013 Mid-Year Economic National Small Business AssociationDocument21 pages2013 Mid-Year Economic National Small Business AssociationBurton Thomas WeaverNo ratings yet

- Business Destination Called "India": White PaperDocument12 pagesBusiness Destination Called "India": White PaperRishi KhuranaNo ratings yet

- Goldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedDocument3 pagesGoldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedZerohedge100% (1)

- Understanding Financial Statement AnalysisDocument7 pagesUnderstanding Financial Statement Analysisaniban.noemiNo ratings yet

- Impact of COVID-19 On The Economy:: Recovery of Aggregate Demand Hinges On Private InvestmentDocument9 pagesImpact of COVID-19 On The Economy:: Recovery of Aggregate Demand Hinges On Private InvestmentTavish SettNo ratings yet

- Article 4Document44 pagesArticle 4Bel Bahadur BoharaNo ratings yet

- Financial Management (1) (8818)Document22 pagesFinancial Management (1) (8818)georgeNo ratings yet

- Month in Macro: For Informational Purposes OnlyDocument46 pagesMonth in Macro: For Informational Purposes OnlyALVARO PALOMINONo ratings yet

- Deloitte 2010 Shift IndexDocument198 pagesDeloitte 2010 Shift IndexCoreyO'NealNo ratings yet

- Corporate Tax Cut To Have 'Minor' Impact On Fiscal Deficit: Niti AayogDocument1 pageCorporate Tax Cut To Have 'Minor' Impact On Fiscal Deficit: Niti AayogAnkit Garg/TCS/GandhinagarNo ratings yet

- Growth, Employment and Labour Through A Budget LensDocument4 pagesGrowth, Employment and Labour Through A Budget LensPratyush BaruaNo ratings yet

- The CEO Macro Briefing BookDocument68 pagesThe CEO Macro Briefing BookRoulettista CoinistaNo ratings yet

- Effect of Liquidity Management, Asset Management, Debt Management Onprofit PDFDocument6 pagesEffect of Liquidity Management, Asset Management, Debt Management Onprofit PDFCoco LumberNo ratings yet

- Ey Impact of The Pandemic On Indian Corporate ResultsDocument37 pagesEy Impact of The Pandemic On Indian Corporate ResultsAbhinav NaiduNo ratings yet

- NB-AR-0610 Anger at GoldmanDocument2 pagesNB-AR-0610 Anger at GoldmanNicolet BankNo ratings yet

- BobAtwell FaceTime July09Document2 pagesBobAtwell FaceTime July09Nicolet BankNo ratings yet

- NB-AR-0310 Stocks Roar BackDocument3 pagesNB-AR-0310 Stocks Roar BackNicolet BankNo ratings yet

- NB AR 0110 Richard RymanDocument1 pageNB AR 0110 Richard RymanNicolet BankNo ratings yet

- NB AR 0209 Treasury InvestmentDocument3 pagesNB AR 0209 Treasury InvestmentNicolet BankNo ratings yet

- NB-AR-0209 State CEOs OpposeDocument1 pageNB-AR-0209 State CEOs OpposeNicolet BankNo ratings yet

- Nicolet Bank Money Into CommunityDocument1 pageNicolet Bank Money Into CommunityNicolet BankNo ratings yet

- NB-AR-0509 Stress Text ResultsDocument2 pagesNB-AR-0509 Stress Text ResultsNicolet BankNo ratings yet

- Rescue Leaves Markets ColdDocument3 pagesRescue Leaves Markets ColdNicolet BankNo ratings yet

- Stimulus Receives Little SupportDocument2 pagesStimulus Receives Little SupportNicolet BankNo ratings yet

- ABCNews NicoletDocument3 pagesABCNews NicoletNicolet BankNo ratings yet

- 2007 Business Pulse©: CEOs: Innovation ImperativeDocument2 pages2007 Business Pulse©: CEOs: Innovation ImperativeNicolet Bank100% (2)

- In The News: Is Time Right For Muni Bonds?Document2 pagesIn The News: Is Time Right For Muni Bonds?Nicolet BankNo ratings yet

- CEOs Challenges 2009Document2 pagesCEOs Challenges 2009Nicolet Bank100% (1)

- Public Trust ErodedDocument2 pagesPublic Trust ErodedNicolet BankNo ratings yet

- In The News: Nicolet Bank Receives $15MDocument1 pageIn The News: Nicolet Bank Receives $15MNicolet Bank100% (1)

- CEOs Face RecessionDocument2 pagesCEOs Face RecessionNicolet BankNo ratings yet

- 2007 Business Pulse©: Who Do You Love? CEOs Turn To Employees Customers For InnovationDocument2 pages2007 Business Pulse©: Who Do You Love? CEOs Turn To Employees Customers For InnovationNicolet Bank100% (3)

- In The News: New Economic Ills Will Force Winner's HandDocument3 pagesIn The News: New Economic Ills Will Force Winner's HandNicolet BankNo ratings yet

- In The News: New North Poised For Global Success in Alternative EnergyDocument2 pagesIn The News: New North Poised For Global Success in Alternative EnergyNicolet BankNo ratings yet

- 2008 Business Pulse©: CEOs See Green Long-Term - No Fad!Document2 pages2008 Business Pulse©: CEOs See Green Long-Term - No Fad!Nicolet BankNo ratings yet

- 2007 Business Pulse©: CEOs: Benefits/ Barriers To InnovationDocument2 pages2007 Business Pulse©: CEOs: Benefits/ Barriers To InnovationNicolet Bank100% (1)

- 2007 Business Pulse©: CEO Cure All For Healthcare?Document2 pages2007 Business Pulse©: CEO Cure All For Healthcare?Nicolet BankNo ratings yet

- CH 14 Var Vs Abs CostingDocument60 pagesCH 14 Var Vs Abs CostingShannon BánañasNo ratings yet

- Faith in Balfour Beatty Bosses at Low Ebb - Online News - BuildingDocument3 pagesFaith in Balfour Beatty Bosses at Low Ebb - Online News - BuildingantonbabogloNo ratings yet

- BSP & Money Notes 9Document16 pagesBSP & Money Notes 9Michael VxchoricNo ratings yet

- Comparing InvestmentsDocument59 pagesComparing InvestmentsKondeti Harsha VardhanNo ratings yet

- Price ActionDocument6 pagesPrice Actionpadrino2244No ratings yet

- AutoCount Accounting Sample Report PDFDocument213 pagesAutoCount Accounting Sample Report PDFindartoimams100% (2)

- Hizar Assignment (4)Document10 pagesHizar Assignment (4)Sohail KhanNo ratings yet

- ESOP PresentationDocument19 pagesESOP Presentationneha_bahadurNo ratings yet

- Strat SheetDocument1 pageStrat Sheetcourier12No ratings yet

- AsdasdasdasdDocument112 pagesAsdasdasdasdTan Wei ShengNo ratings yet

- Financial Accounting - BRS McqsDocument39 pagesFinancial Accounting - BRS McqsDivya SriNo ratings yet

- Synopsis of Indian Derivatives MarketDocument6 pagesSynopsis of Indian Derivatives MarketEhsaan IllahiNo ratings yet

- Navjeet Singh SobtiDocument18 pagesNavjeet Singh SobtiShreyans GirathNo ratings yet

- Free Numerical Reasoning Test QuestionsDocument16 pagesFree Numerical Reasoning Test QuestionsautojunkNo ratings yet

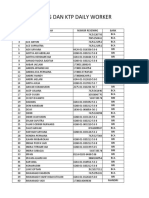

- Data Daily WorkerDocument4 pagesData Daily Workerzulmi07No ratings yet

- STF Pa Pin BarDocument7 pagesSTF Pa Pin BarCandra Yuda100% (2)

- Beta and Its ValuesDocument4 pagesBeta and Its ValuesAshok ChakravarthyNo ratings yet

- To Calculate The Present Value and Ytm of The Bond: Live ProjectDocument17 pagesTo Calculate The Present Value and Ytm of The Bond: Live ProjectMudit AgrawalNo ratings yet

- Fuqua 2014Document248 pagesFuqua 2014Andrew100% (1)

- Investment ManagementDocument19 pagesInvestment ManagementMichael VuhaNo ratings yet

- Required Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate FinanceDocument2 pagesRequired Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate Financegenius_2No ratings yet

- Foundations of Financial Management: Stanley B. BlockDocument9 pagesFoundations of Financial Management: Stanley B. BlockElvis169No ratings yet

- Met Institute of Management Subject: Ebanking By: Suprabha ParabDocument21 pagesMet Institute of Management Subject: Ebanking By: Suprabha ParabsuprabhaparabNo ratings yet

- Capital Budgeting: Mid-Term Exam Guideline (Fall 2012-1213) : (Multiple Choice QuestionsDocument1 pageCapital Budgeting: Mid-Term Exam Guideline (Fall 2012-1213) : (Multiple Choice QuestionssunnyrictoNo ratings yet

- Chapter 3 International Financial MarketsDocument93 pagesChapter 3 International Financial Marketsธชพร พรหมสีดาNo ratings yet

- ACFrOgCeMg EcWjLzT bpaitWYnN0tGMbe0uehIEd667hkf4je4LbJxK3Cfu4Sp6xvpPhA TlriPg5k9RkPpd-AualdglFPTzIJH dv1o10WgAz3FDmQuu-cEED3uqUDocument42 pagesACFrOgCeMg EcWjLzT bpaitWYnN0tGMbe0uehIEd667hkf4je4LbJxK3Cfu4Sp6xvpPhA TlriPg5k9RkPpd-AualdglFPTzIJH dv1o10WgAz3FDmQuu-cEED3uqUrajasekhara babu kolluriNo ratings yet

- Chapter 10 Behavioural FinanceDocument59 pagesChapter 10 Behavioural Financesharktale28280% (1)

CEO Confidence Low 08

CEO Confidence Low 08

Uploaded by

Nicolet BankOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CEO Confidence Low 08

CEO Confidence Low 08

Uploaded by

Nicolet BankCopyright:

Available Formats

B U S I N E S S P U L S E©

These days, sagging Confidence remain far more negative than the

isn’t Big News…and The Nicolet perception of any other aspect

Bank Business Pulse© conducted of the Current Conditions Index.

immediately after Congress passed Eight-of-ten CEOs indicate that

its historic, gigantic, bailout bill general economic conditions have

simply quantified the obvious. worsened in the past three months;

55% say that economic conditions

The Big News is how far

in their industry have worsened.

CEO Confidence has fallen!

Of the economic indicators that

CEO The Nicolet Bank Business Pulse© relate to their company (revenues,

slid to 70.0 – almost 30 points profits, employment and capital

Confidence from 98.7 at the end of last quarter. spending), all turned negative for the

70.0 is the lowest point the index first time since Nicolet Bank began

tracking this data 28 quarters ago.

Reaches has been since the inception of The

Business Pulse© - some 28 Quarters

ago (in 2001). 70.0 is down from PAST 3 Months CEOs say:

Record Low its previous low of 91.7 in the 4th say:

General Economy

Quarter last year. This is the fifth

<1% Better | 84% Worse

consecutive quarter in which the

index has been below 100, indicating Industry Economy

more negative views of the economic 1% Better | 55% Worse

conditions than positive views. Revenues

The Business Pulse measures Current

© 23% Increase | 35% Decrease

Economic Conditions compared to Profits

three months ago - as well as Future 24% Increase | 38% Decrease

Economic Expectations of CEOs and

Capital Spending

Business Owners over the next three 24% Increase | 36% Decrease

months. The Current Economic Index

and The Future Expectations Index Employment

are then combined into the overall 22% Increase | 24% Decrease

Business Pulse Index.

Current Conditions Index and the Future Expectations

Future Expectations Index also

dropped significantly last month. For the first time in 28 quarters,

The Current Condition Index dropped there are more negative than positive

from 87.7 to the current level of 66.8, views regarding the Future as well.

and the Future Expectations Index The Future Expectations Index fell

dropped from 109.7-to-73.1. below the 100 baseline for the

first time - bottoming out at 73.1.

Current Conditions In June, The Future Expectations

Index was at 109.7.

CEO perceptions of the general

condition of the economy, and

the conditions in their own sector

Executive Summary:

End of Q3/08

“I’m not getting information; I'm not managing.”

John Torinus, President & CEO — Serigraph, Inc

On all six indicators, the percent based on interviews of 100 CEOs dropped, The Pulse Index dropped;

giving negative responses is up nationally; a score of 50 on the when the S&P 500 went up, The

from Q2/08. What is particularly Conference Board Measure of Pulse Index tracked right along with

striking is that on the four Business Confidence indicates it.) However, beginning in Q3/05 -

performance indicators (revenues, the same percentage of Positive and especially in Q3/06 - these two

profits, employment and capital and Negative responses. The indicators began to diverge. The

spending), CEO perception of the Conference Board measure is S&P 500 continued to climb while

next three months is substantially similar to The Nicolet Bank the confidence of CEOs trended

more negative than their views of Business Pulse© where a score of downward. The gap remained fairly

the past three months. In other 100 means an equal percentage wide until Q3/08 when both took

words, CEOs sense that the worst of Positives and Negatives. a dramatic downturn.

is not over. It may get worse

The Conference Board’s Measure What explains this divergence

before it gets better.

of Consumer Confidence also over the past few quarters? Is it

NEXT 3 Months CEOs see: dropped - like a rock - to a the exuberance that Wall Street

historical low. In January 2008, had in the market coupled with

General Economy

the Consumer Confidence Index the more pragmatic views of CEOs

17% Better | 49% Worse

stood at 87.9; in July, it dropped on Main Street?

Industry Economy to 51.9; it now stands at 38.0.

14% Better | 50% Worse

The base line for the Consumer Summary

Revenues Confidence Index is 100. The

26% Increase | 41% Decrease

Expectations component of the The confidence of CEOs in

Index found that consumers are northeastern Wisconsin experienced

Profits

21% Increase | 45% Decrease particularly pessimistic about the a free fall at the end of the 3rd

future. The Expectation Index Quarter. CEO confidence reached

Capital Spending its all time low, but even more

14% Increase | 46% Decrease dropped from 61.5 in September

to 35.5 in October. Consumers striking is the low level of optimism

Employment are most concerned about their about the future. In fact, many

14% Increase | 24% Decrease earnings and the possible increase CEOs feel the worst is not over.

in inflation over the next few The economic downturn is also

months. These pessimistic views having substantial effects all

National Comparisons among consumers are of special around the world. It appears we

concern in the retail market as may be in for a global - not just a

Nationally, CEO evaluations in

we enter the holiday shopping national - economic downturn.

Q3/08 stayed about the same

as Q2/08 - according to The period. Since consumer spending And many questions remain: Are

Conference Board Measure of accounts for approximately there more shoes to drop? How

Business Confidence conducted 70% of economic activity, long will this downturn last?

from mid-August to mid-September these pessimistic views among Will the federal bailout legislation

(released October 16, 2008). The consumers are troubling for have a substantial impact? What

Conference Board CEO Confidence many segments of the economy. additional governmental action

Measure is now at 40 - essentially will be necessary? How will the

When The Nicolet Bank Business

unchanged from the 39 in Q2. new administration handle the

Pulse© is compared to the S&P 500,

The Conference Board Measure mess? At this point, CEOs and

some interesting results emerge.

was taken before the full extent of business leaders have far, far

From Q4/01-to-Q2/05, The Business

the Wall Street crisis was known. more questions than answers.

Pulse Index and the S&P 500 follow

The Conference Board Measure is

very similar trends. (When the S&P

How the Survey is Conducted

The Nicolet Bank Business Pulse© is a Quarterly Study of CEOs and business leaders in NE Wisconsin

(Brown, Calumet, Door, Kewaunee, Manitowoc, Marinette, Oconto, Outagamie, Shawano, Winnebago

Counties) and Menominee, Michigan. It is designed and implemented by IntellectualMarketing, LLC.

The survey was conducted between October 13–19, 2008. Participants include: 27% in manufacturing;

24% in services; 14% retail trade; 4% wholesale trade; 5% finance, real estate, insurance; 5% in

transportation, communications, utilities; 6% in construction; 14% in other industries. 22% have fewer

than 6 employees; 30% have 6-25; 15% have 26-50; 7% 51-100; 12% 101-250; 5% 251-500;

6% 501-1,000; 4% have 1,001 or more.

QUESTIONS to Dr. David G. Wegge (920) 217-7738; david@intellectualmarketing.com

You might also like

- UITF Exam ReviewerDocument8 pagesUITF Exam ReviewerArianne Garcia75% (4)

- ACC 307 Final Project Part IIDocument4 pagesACC 307 Final Project Part IISalman Khalid100% (4)

- Treasury Management Sample Questions Dec 18 ExamsDocument114 pagesTreasury Management Sample Questions Dec 18 ExamsajithaNo ratings yet

- Comparative Study of BSE AND NSEDocument66 pagesComparative Study of BSE AND NSEAnonymous w7l74n067% (3)

- 2007 Business Pulse©: CEO Confidence Continues To CascadeDocument2 pages2007 Business Pulse©: CEO Confidence Continues To CascadeNicolet Bank100% (2)

- 2007 Business Pulse©: CEO Confidence: A Slippery SlopeDocument2 pages2007 Business Pulse©: CEO Confidence: A Slippery SlopeNicolet BankNo ratings yet

- CEOs Challenges 2009Document2 pagesCEOs Challenges 2009Nicolet Bank100% (1)

- Revised GDP FY21Document2 pagesRevised GDP FY21YogeshNo ratings yet

- Accenture Beyond 2021Document39 pagesAccenture Beyond 2021Muhammad SabirNo ratings yet

- Stimulus Receives Little SupportDocument2 pagesStimulus Receives Little SupportNicolet BankNo ratings yet

- NFIB ReportDocument23 pagesNFIB ReportsrdielNo ratings yet

- Mni Chicago Press Release 2019 03Document2 pagesMni Chicago Press Release 2019 03Valter SilveiraNo ratings yet

- Tonys View 12 January 2023 PDFDocument5 pagesTonys View 12 January 2023 PDFAndreas KleberNo ratings yet

- 5 Challenges CFOs Must Navigate To Grow Earnings Amid Economic HeadwindsDocument17 pages5 Challenges CFOs Must Navigate To Grow Earnings Amid Economic HeadwindsElles RomaniaNo ratings yet

- Eco Case StudyDocument17 pagesEco Case StudyGs AbhilashNo ratings yet

- CFIBBusinessBarometerNationalAugustReport September2012Document4 pagesCFIBBusinessBarometerNationalAugustReport September2012Tessa VanderhartNo ratings yet

- Sector Business Cycle AnalysisDocument12 pagesSector Business Cycle AnalysisesgurazovNo ratings yet

- Compass Financial - Weekly Market Commentary June 16, 2008Document2 pagesCompass Financial - Weekly Market Commentary June 16, 2008compassfinancialNo ratings yet

- 10-Rules of Thumb - Morgan Stanley PDFDocument8 pages10-Rules of Thumb - Morgan Stanley PDFParas BholaNo ratings yet

- BCI Report QI 2014 - 3 - OPTIMIZEDDocument11 pagesBCI Report QI 2014 - 3 - OPTIMIZEDRiannaNo ratings yet

- TD Bank-Aug-04-Cfib Sme Business Outlook SurveyDocument1 pageTD Bank-Aug-04-Cfib Sme Business Outlook SurveyMiir ViirNo ratings yet

- CEO Macro BriefingDocument72 pagesCEO Macro BriefingNagesh ShettyNo ratings yet

- Qualitative Models of Corporate FailureDocument4 pagesQualitative Models of Corporate FailureHillary TukahirwaNo ratings yet

- Economic Measures Continue To SlowDocument6 pagesEconomic Measures Continue To Slowsamp123No ratings yet

- Grow Beyond The BasicsDocument23 pagesGrow Beyond The BasicsKarolNo ratings yet

- Paylocity FY21 Q3 Earnings AnalysisDocument8 pagesPaylocity FY21 Q3 Earnings AnalysisjamesNo ratings yet

- Year End Review TemplateDocument16 pagesYear End Review TemplatekassongoNo ratings yet

- Us 3Q22 Cfo Signals Report Part1Document24 pagesUs 3Q22 Cfo Signals Report Part1X alterNo ratings yet

- Emerging Companies 2009 Survey Results Report FINALDocument27 pagesEmerging Companies 2009 Survey Results Report FINALdebgageNo ratings yet

- KICTalking Points 080608Document6 pagesKICTalking Points 080608russ8609No ratings yet

- GECS-Q2-2023 v9Document18 pagesGECS-Q2-2023 v9anastasov.plamenNo ratings yet

- Economy Outlook 2009-10: Dun & BradstreetDocument18 pagesEconomy Outlook 2009-10: Dun & BradstreetFaria HasanNo ratings yet

- India Needs Intelligent Lockdown Exit Strategy - SBI Report - The Economic TimesDocument2 pagesIndia Needs Intelligent Lockdown Exit Strategy - SBI Report - The Economic TimesSumant AlagawadiNo ratings yet

- FSN E-Commerce Ventures Limited: August 05Document36 pagesFSN E-Commerce Ventures Limited: August 05Chandresh SinghNo ratings yet

- Why Working Capital MattersDocument4 pagesWhy Working Capital MattersMayank PatelNo ratings yet

- 02.08.2012 - EuroCham Business Climate Index Falls Below Mid-PointDocument3 pages02.08.2012 - EuroCham Business Climate Index Falls Below Mid-PointEuropean Chamber of Commerce in VietnamNo ratings yet

- Insights IndiaDocument14 pagesInsights Indiaarryaan001No ratings yet

- Third Quarter 2020 Earnings Results Presentation: October 14, 2020Document16 pagesThird Quarter 2020 Earnings Results Presentation: October 14, 2020Zerohedge100% (1)

- CMI August2015Document7 pagesCMI August2015alphathesisNo ratings yet

- Rashyu GuyinDocument1 pageRashyu GuyinChandra SegarNo ratings yet

- ATTO January Investor Presentation 01.05.2016Document35 pagesATTO January Investor Presentation 01.05.2016gns1234567890No ratings yet

- Business Census 2016Document22 pagesBusiness Census 2016Andrew Richard ThompsonNo ratings yet

- BCG How Private Equity Can Capture The Upside in A Downturn August 2019 - tcm9 225891Document8 pagesBCG How Private Equity Can Capture The Upside in A Downturn August 2019 - tcm9 2258919980139892No ratings yet

- Unit 3Document39 pagesUnit 3sheetal gudseNo ratings yet

- How Transformative Ceos Lead in A Crisis: by Lars Fæste, Christian Gruß, and Jose FloresDocument8 pagesHow Transformative Ceos Lead in A Crisis: by Lars Fæste, Christian Gruß, and Jose FloresAnonymous FaqNSHEtNo ratings yet

- Aec 675 F 4Document14 pagesAec 675 F 4RahulNo ratings yet

- Sector Business Cycle AnalysisDocument9 pagesSector Business Cycle AnalysisGabriela Medrano100% (1)

- Banking Sector Roundup Q1fy24 BCGDocument52 pagesBanking Sector Roundup Q1fy24 BCGSumiran BansalNo ratings yet

- 2013 Mid-Year Economic National Small Business AssociationDocument21 pages2013 Mid-Year Economic National Small Business AssociationBurton Thomas WeaverNo ratings yet

- Business Destination Called "India": White PaperDocument12 pagesBusiness Destination Called "India": White PaperRishi KhuranaNo ratings yet

- Goldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedDocument3 pagesGoldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedZerohedge100% (1)

- Understanding Financial Statement AnalysisDocument7 pagesUnderstanding Financial Statement Analysisaniban.noemiNo ratings yet

- Impact of COVID-19 On The Economy:: Recovery of Aggregate Demand Hinges On Private InvestmentDocument9 pagesImpact of COVID-19 On The Economy:: Recovery of Aggregate Demand Hinges On Private InvestmentTavish SettNo ratings yet

- Article 4Document44 pagesArticle 4Bel Bahadur BoharaNo ratings yet

- Financial Management (1) (8818)Document22 pagesFinancial Management (1) (8818)georgeNo ratings yet

- Month in Macro: For Informational Purposes OnlyDocument46 pagesMonth in Macro: For Informational Purposes OnlyALVARO PALOMINONo ratings yet

- Deloitte 2010 Shift IndexDocument198 pagesDeloitte 2010 Shift IndexCoreyO'NealNo ratings yet

- Corporate Tax Cut To Have 'Minor' Impact On Fiscal Deficit: Niti AayogDocument1 pageCorporate Tax Cut To Have 'Minor' Impact On Fiscal Deficit: Niti AayogAnkit Garg/TCS/GandhinagarNo ratings yet

- Growth, Employment and Labour Through A Budget LensDocument4 pagesGrowth, Employment and Labour Through A Budget LensPratyush BaruaNo ratings yet

- The CEO Macro Briefing BookDocument68 pagesThe CEO Macro Briefing BookRoulettista CoinistaNo ratings yet

- Effect of Liquidity Management, Asset Management, Debt Management Onprofit PDFDocument6 pagesEffect of Liquidity Management, Asset Management, Debt Management Onprofit PDFCoco LumberNo ratings yet

- Ey Impact of The Pandemic On Indian Corporate ResultsDocument37 pagesEy Impact of The Pandemic On Indian Corporate ResultsAbhinav NaiduNo ratings yet

- NB-AR-0610 Anger at GoldmanDocument2 pagesNB-AR-0610 Anger at GoldmanNicolet BankNo ratings yet

- BobAtwell FaceTime July09Document2 pagesBobAtwell FaceTime July09Nicolet BankNo ratings yet

- NB-AR-0310 Stocks Roar BackDocument3 pagesNB-AR-0310 Stocks Roar BackNicolet BankNo ratings yet

- NB AR 0110 Richard RymanDocument1 pageNB AR 0110 Richard RymanNicolet BankNo ratings yet

- NB AR 0209 Treasury InvestmentDocument3 pagesNB AR 0209 Treasury InvestmentNicolet BankNo ratings yet

- NB-AR-0209 State CEOs OpposeDocument1 pageNB-AR-0209 State CEOs OpposeNicolet BankNo ratings yet

- Nicolet Bank Money Into CommunityDocument1 pageNicolet Bank Money Into CommunityNicolet BankNo ratings yet

- NB-AR-0509 Stress Text ResultsDocument2 pagesNB-AR-0509 Stress Text ResultsNicolet BankNo ratings yet

- Rescue Leaves Markets ColdDocument3 pagesRescue Leaves Markets ColdNicolet BankNo ratings yet

- Stimulus Receives Little SupportDocument2 pagesStimulus Receives Little SupportNicolet BankNo ratings yet

- ABCNews NicoletDocument3 pagesABCNews NicoletNicolet BankNo ratings yet

- 2007 Business Pulse©: CEOs: Innovation ImperativeDocument2 pages2007 Business Pulse©: CEOs: Innovation ImperativeNicolet Bank100% (2)

- In The News: Is Time Right For Muni Bonds?Document2 pagesIn The News: Is Time Right For Muni Bonds?Nicolet BankNo ratings yet

- CEOs Challenges 2009Document2 pagesCEOs Challenges 2009Nicolet Bank100% (1)

- Public Trust ErodedDocument2 pagesPublic Trust ErodedNicolet BankNo ratings yet

- In The News: Nicolet Bank Receives $15MDocument1 pageIn The News: Nicolet Bank Receives $15MNicolet Bank100% (1)

- CEOs Face RecessionDocument2 pagesCEOs Face RecessionNicolet BankNo ratings yet

- 2007 Business Pulse©: Who Do You Love? CEOs Turn To Employees Customers For InnovationDocument2 pages2007 Business Pulse©: Who Do You Love? CEOs Turn To Employees Customers For InnovationNicolet Bank100% (3)

- In The News: New Economic Ills Will Force Winner's HandDocument3 pagesIn The News: New Economic Ills Will Force Winner's HandNicolet BankNo ratings yet

- In The News: New North Poised For Global Success in Alternative EnergyDocument2 pagesIn The News: New North Poised For Global Success in Alternative EnergyNicolet BankNo ratings yet

- 2008 Business Pulse©: CEOs See Green Long-Term - No Fad!Document2 pages2008 Business Pulse©: CEOs See Green Long-Term - No Fad!Nicolet BankNo ratings yet

- 2007 Business Pulse©: CEOs: Benefits/ Barriers To InnovationDocument2 pages2007 Business Pulse©: CEOs: Benefits/ Barriers To InnovationNicolet Bank100% (1)

- 2007 Business Pulse©: CEO Cure All For Healthcare?Document2 pages2007 Business Pulse©: CEO Cure All For Healthcare?Nicolet BankNo ratings yet

- CH 14 Var Vs Abs CostingDocument60 pagesCH 14 Var Vs Abs CostingShannon BánañasNo ratings yet

- Faith in Balfour Beatty Bosses at Low Ebb - Online News - BuildingDocument3 pagesFaith in Balfour Beatty Bosses at Low Ebb - Online News - BuildingantonbabogloNo ratings yet

- BSP & Money Notes 9Document16 pagesBSP & Money Notes 9Michael VxchoricNo ratings yet

- Comparing InvestmentsDocument59 pagesComparing InvestmentsKondeti Harsha VardhanNo ratings yet

- Price ActionDocument6 pagesPrice Actionpadrino2244No ratings yet

- AutoCount Accounting Sample Report PDFDocument213 pagesAutoCount Accounting Sample Report PDFindartoimams100% (2)

- Hizar Assignment (4)Document10 pagesHizar Assignment (4)Sohail KhanNo ratings yet

- ESOP PresentationDocument19 pagesESOP Presentationneha_bahadurNo ratings yet

- Strat SheetDocument1 pageStrat Sheetcourier12No ratings yet

- AsdasdasdasdDocument112 pagesAsdasdasdasdTan Wei ShengNo ratings yet

- Financial Accounting - BRS McqsDocument39 pagesFinancial Accounting - BRS McqsDivya SriNo ratings yet

- Synopsis of Indian Derivatives MarketDocument6 pagesSynopsis of Indian Derivatives MarketEhsaan IllahiNo ratings yet

- Navjeet Singh SobtiDocument18 pagesNavjeet Singh SobtiShreyans GirathNo ratings yet

- Free Numerical Reasoning Test QuestionsDocument16 pagesFree Numerical Reasoning Test QuestionsautojunkNo ratings yet

- Data Daily WorkerDocument4 pagesData Daily Workerzulmi07No ratings yet

- STF Pa Pin BarDocument7 pagesSTF Pa Pin BarCandra Yuda100% (2)

- Beta and Its ValuesDocument4 pagesBeta and Its ValuesAshok ChakravarthyNo ratings yet

- To Calculate The Present Value and Ytm of The Bond: Live ProjectDocument17 pagesTo Calculate The Present Value and Ytm of The Bond: Live ProjectMudit AgrawalNo ratings yet

- Fuqua 2014Document248 pagesFuqua 2014Andrew100% (1)

- Investment ManagementDocument19 pagesInvestment ManagementMichael VuhaNo ratings yet

- Required Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate FinanceDocument2 pagesRequired Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate Financegenius_2No ratings yet

- Foundations of Financial Management: Stanley B. BlockDocument9 pagesFoundations of Financial Management: Stanley B. BlockElvis169No ratings yet

- Met Institute of Management Subject: Ebanking By: Suprabha ParabDocument21 pagesMet Institute of Management Subject: Ebanking By: Suprabha ParabsuprabhaparabNo ratings yet

- Capital Budgeting: Mid-Term Exam Guideline (Fall 2012-1213) : (Multiple Choice QuestionsDocument1 pageCapital Budgeting: Mid-Term Exam Guideline (Fall 2012-1213) : (Multiple Choice QuestionssunnyrictoNo ratings yet

- Chapter 3 International Financial MarketsDocument93 pagesChapter 3 International Financial Marketsธชพร พรหมสีดาNo ratings yet

- ACFrOgCeMg EcWjLzT bpaitWYnN0tGMbe0uehIEd667hkf4je4LbJxK3Cfu4Sp6xvpPhA TlriPg5k9RkPpd-AualdglFPTzIJH dv1o10WgAz3FDmQuu-cEED3uqUDocument42 pagesACFrOgCeMg EcWjLzT bpaitWYnN0tGMbe0uehIEd667hkf4je4LbJxK3Cfu4Sp6xvpPhA TlriPg5k9RkPpd-AualdglFPTzIJH dv1o10WgAz3FDmQuu-cEED3uqUrajasekhara babu kolluriNo ratings yet

- Chapter 10 Behavioural FinanceDocument59 pagesChapter 10 Behavioural Financesharktale28280% (1)