Professional Documents

Culture Documents

Where - Money - Goes in Court Fines

Where - Money - Goes in Court Fines

Uploaded by

Les HawthorneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Where - Money - Goes in Court Fines

Where - Money - Goes in Court Fines

Uploaded by

Les HawthorneCopyright:

Available Formats

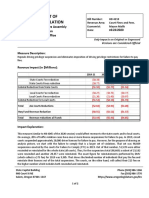

WHERE THE MONEY GOES Who gets the money Superior Court collects on fines and forfeitures?

What happens to money received by a California court for traffic tickets? Three factors decide the ultimate distribution and destination of money collected by courts on fines and bail forfeitures: 1. 2. 3. the law enforcement agency issuing the citation: the location of the violation, and: the nature of the violation, such as Vehicle Code, Health and Safety Code, Penal Code, or Fish and Game Code.

While outside the scope of this article, some violations have special distributions. The intent here is to discuss only the most common distribution for most Kern County fines. This discussion is focused on County distributions only. The law enforcement agency City or County Arrest The first determining factor when distributing a fine is whether the arrest is a city or county arrest. Generally if a county officer issues the citation, the fine is paid to the county. Likewise, if a city officer issues the citation, the fine is paid to the city employing the officer. If a California Highway Patrol (CHP) officer issues the citation, the location of the violation determines the distribution of the fine. City/County Arrest Defined If an officer who makes the arrest is employed by the city, it is a city arrest. It is also a city arrest if a CHP officer makes an arrest in a city, or when the sheriff makes an arrest in a city which contracts with the county for police services. Arrests made by deputy sheriffs in non-contract cities, or in the unincorporated parts of Kern County, are considered county arrests. Violation Code The nature of the violation is another factor that determines the destination of the part of the payment that is the fine. Generally, fines for violations of the Vehicle Code go to motor vehicle/safety related accounts. Money collected for fines and forfeitures for other violations go mostly to general funds. Revenues deposited in motor vehicle accounts can be spent for traffic safety efforts. Penalty Assessments and 20% State Surcharge A penalty assessment and 20% state surcharge is added to each fine. By statute, California created the first penalty assessment in the late 1960s. Over the years, the penalty assessment has increased to the point that it is now larger than the fine. Today,

the penalty assessment in Kern County averages more than 260% of the base fine. The penalty assessment is $26 for each $10 (or portion of $10) fine. Therefore, for example, when a judge imposes a fine of $100, the court must collect $100 plus ten increments of the $26 penalty assessment ($260) and a 20% state surcharge ($20) for a total of $380. In Kern County, the $26 penalty assessment is made up of five main sections, the $10 state penalty (Penal Code 1464), the $7 county penalty (Government Code 76000), the $5 state court facilities penalty (Government Code 70372(a)), and the $4 penalty levied by the DNA Fingerprint, Unsolved Crime and Innocence Protection Act (GC 76104.6 and GC 76104.7).

Other Fees/Assessments Special fees are assessed in Vehicle Code violations as follows: Courts that conduct night court sessions collect an additional $1 fee to Vehicle Code violations to help defray the added cost of providing night court sessions (Vehicle Code 42006). A $10 drivers license priors fee (Vehicle Code 40508.6A) is collected on all vehicle code violations when there are prior vehicle code violations, to help defray the cost of recording and maintaining a record of the defendants prior convictions. A $40 court security fee is imposed on every conviction for a criminal offense, including traffic offenses (Penal Code 1465.8). A $35 criminal conviction assessment is also added for every infraction and a $30 criminal conviction assessment is added for every misdemeanor and felony (GC 70373). An additional penalty of $4 is imposed on every vehicle code conviction for the Emergency Medical Air Transport Fund (GC 76000.10). All combined, Kern County Courts collect $460 for a $100 base fine on a vehicle code infraction with no prior convictions. In Summary: When the court imposes a $100 base fine for a city arrest of a violation in the vehicle code, the court is required by statute to collect a total of $460: $100 is allocated between the city and the county in accordance with Section 1463.002 of the Penal Code; $280 to the various penalty assessments and 20% state surcharge as described above, $40 to the state court security fund, $35 to the criminal conviction assessment for infractions, a $4 penalty to the Emergency Medical Air Transport Fund, and the final $1 goes to the night court assessment. If there is a prior vehicle code violation, an additional $10 penalty assessable base fine is added, as well as a $10 administrative fee . The minimum base fine per statute for a driving under the influence (DUI) conviction in California is $390. After adding the penalty and special assessments (alcohol abuse program fee (Penal Code 1463.25), the 20% state surcharge (PC 1465.7), a restitution fee (Penal Code 1202.4), a court security fee (Penal Code 1465.8), a criminal conviction assessment (GC 70373), and a $4 penalty for the Emergency Medical Air Transportation Fund (GC 76000.10, a person must pay $1,726. The total is calculated as follows: Since

there are 39 $10 increments in $390, penalty assessment is calculated at 39 x $26 = $1,014. The $390 base fine, plus $1,014 penalty assessment, $78 20% state surcharge, $50 alcohol abuse program fee, $120 restitution fee, $40 court security fee, $30 criminal conviction assessment, and $4 penalty for the Emergency Medical Air Transportation Fund, come to a total of $1,726. This $1,726 is the minimum DUI fine including penalty and special assessments for first-time offenders. Allocation (Distribution) of Money Paid Actual distribution is more complicated than described so far. There are several layers of information that have to be considered when deciding who gets what. Determining whether an arrest is a city arrest or a county arrest is only the first step. Section 1463.002 of the California Penal Code sets the base fine distribution for California counties. One looks here to find the share of county or city arrest fines. The county share of city fines in Kern County is an average of approximately 15 percent. Each county has a different percentage for the county share of city fines. The discussion here is limited to Kern County. Details are different for other counties but the general construct is good for all California counties. Many special distributions represent exceptions to standard allocations discussed in this article. For example, there are special allocations for litter violations and drug related violations. For purposes of clarity (and brevity) we will mention exceptions only in passing. Penalty Assessment Distribution The State of California mandates that courts collect penalty assessments in addition to every fine. If the court imposes fines on more than one violation on a case, the penalty assessment is calculated on the total of all fines on the case. The $10 State Penalty Assessment The State of California allocates 70% of the State penalty to the State Penalty Fund. The remaining 30% is deposited in the County General Fund to assist the County in their maintenance of effort contribution to the state for trial court operations. The State of California distributes the 70% allocation to several California programs or agencies. The following chart displays the distribution of the 70% allocated to the State Penalty Fund. FUND 70% of State Penalty Split Percentage Restitution Fund 32.02% Peace Officers Training 23.99% Driver Training Penalty Assessment 25.70% Corrections Training Fund 7.88% Fish & Game Preservation Fund 0.33% Local Public Prosecutors and Public Defenders 0.78% Training Fund Victim Witness Assistance Fund 8.64%

Traumatic Brain Injury Fund Total State Penalty Distribution

0.66% 100.00%

The $7 County Penalty Assessment The $7 County Penalty Assessment is distributed in accordance with Section 76100 of the Government Code and is used to fund the criminal justice automated system, the automated fingerprint fund, and the emergency medical system fund. Conclusions California, as part of its State Funding of trial court efforts, made important changes in January 1, 1998. Seventy-five (75) percent of county revenue, resulting from fines and forfeitures, is retained in the County General Fund to subsidize County obligations for trial court funding as mandated by Assembly Bill 233, the Trial Court Funding Act of 1997. In addition, before any distributions are made, two percent of all monies collected for fines and penalty assessments (including bail forfeitures) is allocated to the States Trial Court Improvement Fund. Kern Countys base fine distribution for a county arrest is as follows: 98% to the county and 2% to the State Trial Court Improvement Fund. Kern Countys city distribution allocates approximately 83.3% to the cities, 14.7% to the county and 2% to the State Trial Court Improvement Fund. California State Courts assess, collect and distribute legislatively mandated fines, fees and assessments for law enforcement and criminal justice related agencies and related programs.

You might also like

- Affidavit of Undertaking - HDMFDocument2 pagesAffidavit of Undertaking - HDMFbw_shop82% (17)

- LOSAP Investigative ReportDocument32 pagesLOSAP Investigative ReportAsbury Park PressNo ratings yet

- Regulatory Guide to Money Transmission & Payment Laws in the U.S.From EverandRegulatory Guide to Money Transmission & Payment Laws in the U.S.No ratings yet

- LA County Minimum Fees ListDocument92 pagesLA County Minimum Fees ListSGVNewsNo ratings yet

- Uniform Fine ScheduleDocument115 pagesUniform Fine ScheduleAMSNo ratings yet

- 2009 Crime Victims Assistance & Prevention Section Annual ReportDocument76 pages2009 Crime Victims Assistance & Prevention Section Annual ReportMike DeWineNo ratings yet

- Clerk of Orphans CourtDocument15 pagesClerk of Orphans CourtROB CARTERNo ratings yet

- Traffic Citations: Information Brief Research Department Minnesota House of RepresentativesDocument10 pagesTraffic Citations: Information Brief Research Department Minnesota House of RepresentativesJohnson SmithNo ratings yet

- Measure 80 Financial ImpactDocument2 pagesMeasure 80 Financial ImpactStatesman JournalNo ratings yet

- California Traffic FinesDocument171 pagesCalifornia Traffic FinesflybullNo ratings yet

- Bou Bou Joint Task ForceDocument6 pagesBou Bou Joint Task ForceWilliam N. GriggNo ratings yet

- Bail Schedule For Infractions and Misdemeanors: Superior Court of California County of Los AngelesDocument94 pagesBail Schedule For Infractions and Misdemeanors: Superior Court of California County of Los AngelesTomas JimenezNo ratings yet

- Why Create A Centralized Court For Cases of Criminal Domestic Violence?Document4 pagesWhy Create A Centralized Court For Cases of Criminal Domestic Violence?Absa AbbyNo ratings yet

- Fiscal Impact Report: Estimated Additional Operating Budget Impact (Dollars in Thousands)Document10 pagesFiscal Impact Report: Estimated Additional Operating Budget Impact (Dollars in Thousands)Justin GarciaNo ratings yet

- Comptroller Audit Albany County Sheriff'sDocument22 pagesComptroller Audit Albany County Sheriff'sBrendan LyonsNo ratings yet

- What Is FraudDocument5 pagesWhat Is Fraudbooolang150No ratings yet

- Safe Driving For DummiesDocument3 pagesSafe Driving For Dummieseyeonwabasha0% (1)

- Ad Valorem Taxes: Notie LansfordDocument8 pagesAd Valorem Taxes: Notie Lansfordwinblacklist1507No ratings yet

- California Government Code 27388 Real Estate Fraud Trust FundDocument6 pagesCalifornia Government Code 27388 Real Estate Fraud Trust Fund83jjmackNo ratings yet

- White House Plebiscite BudgetDocument1 pageWhite House Plebiscite BudgetJohn E. MuddNo ratings yet

- Allegheny County Office of The Public Defender: Expungement Process GuideDocument26 pagesAllegheny County Office of The Public Defender: Expungement Process GuideJesse Scheck100% (1)

- Mount Kisco Audit, Parking Ticket CollectionsDocument12 pagesMount Kisco Audit, Parking Ticket CollectionsCara MatthewsNo ratings yet

- Governor Martin O'Malley's Special Gambling Session FAQDocument3 pagesGovernor Martin O'Malley's Special Gambling Session FAQDavid MoonNo ratings yet

- HB 4210 Revenue ImpactDocument2 pagesHB 4210 Revenue ImpactSinclair Broadcast Group - EugeneNo ratings yet

- Be It Enacted by The People of The State of Illinois, Represented in The General AssemblyDocument321 pagesBe It Enacted by The People of The State of Illinois, Represented in The General AssemblyNgân Hàng Ngô Mạnh TiếnNo ratings yet

- Eastchester Audit, Parking Ticket CollectionsDocument14 pagesEastchester Audit, Parking Ticket CollectionsCara MatthewsNo ratings yet

- Center For Economic Justice - Written Comments To TDIDocument13 pagesCenter For Economic Justice - Written Comments To TDITexas WatchNo ratings yet

- Driving Under The Influence: Non-Moving ViolationDocument5 pagesDriving Under The Influence: Non-Moving ViolationAmanda whiteNo ratings yet

- Vocabulario y Tips LEGALDocument16 pagesVocabulario y Tips LEGALAlvaro AlegreNo ratings yet

- Agriculture Law: RL33730Document16 pagesAgriculture Law: RL33730AgricultureCaseLawNo ratings yet

- Fine (Penalty) - WikipediaDocument26 pagesFine (Penalty) - WikipediaKim Seo-junNo ratings yet

- Analysis - CombinedDocument2 pagesAnalysis - CombineddelegatemikeNo ratings yet

- Traffic Rules of The Road TSDocument43 pagesTraffic Rules of The Road TSSumit KumarNo ratings yet

- A Resource Guide To The U.S. Foreign Corrupt Practices ActDocument130 pagesA Resource Guide To The U.S. Foreign Corrupt Practices ActVanessa SchoenthalerNo ratings yet

- Minnesota State Auditor Asset Forfeiture 2021 ReportDocument223 pagesMinnesota State Auditor Asset Forfeiture 2021 ReportinforumdocsNo ratings yet

- Thomas Frazier Appointed As Compliance Director For The Oakland Police DepartmentDocument7 pagesThomas Frazier Appointed As Compliance Director For The Oakland Police Departmentali_winstonNo ratings yet

- Fsi Senate New & Retrospective British Bank Sentencing Laws From 1 Oct 2014Document7 pagesFsi Senate New & Retrospective British Bank Sentencing Laws From 1 Oct 2014SenateBriberyInquiryNo ratings yet

- IRR Ra 9406Document14 pagesIRR Ra 9406Anonymous 1sztuiWNo ratings yet

- Schwartz 63 5Document155 pagesSchwartz 63 5Anna MNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument28 pagesIn The United States Bankruptcy Court For The District of DelawarePaul MastersNo ratings yet

- Lawsuit Challenges Tennessee Driver's License Revocation LawDocument19 pagesLawsuit Challenges Tennessee Driver's License Revocation LawUSA TODAY Network100% (5)

- Jarvis Et Al. (2015) - Guidance Marijuana Related Business (IncludingDocument11 pagesJarvis Et Al. (2015) - Guidance Marijuana Related Business (IncludingBoyce BrownNo ratings yet

- Drinking and DrivingDocument12 pagesDrinking and Drivingapi-302064810No ratings yet

- Chapter 11 Solutions - Review Questions and ExercisesDocument8 pagesChapter 11 Solutions - Review Questions and Exercisesbip6420No ratings yet

- Analysis of Pretrial & ID System - FINALDocument80 pagesAnalysis of Pretrial & ID System - FINALLydia DePillisNo ratings yet

- JusticeDocument3 pagesJusticeapi-19777944No ratings yet

- Guide To The Dcjs Criminal History ReportDocument14 pagesGuide To The Dcjs Criminal History Reportrodney_torres_10No ratings yet

- BNP Paribas Plea AgreementDocument12 pagesBNP Paribas Plea AgreementManchesterCFNo ratings yet

- Shasta County Grand Jury ReportDocument24 pagesShasta County Grand Jury ReportAnonymous nZBPge5ENo ratings yet

- Ontario Association of Police Services BoardsDocument2 pagesOntario Association of Police Services BoardsPaisley RaeNo ratings yet

- 2011 General Assembly ReportDocument104 pages2011 General Assembly Reportnwg002No ratings yet

- City of Bonney Lake RESOLUTION NO. 959 DEA Task Force AgreementDocument10 pagesCity of Bonney Lake RESOLUTION NO. 959 DEA Task Force Agreement420leaksNo ratings yet

- AB109 ReDocument1 pageAB109 ReAli GuitronNo ratings yet

- Statement For Non-Bank Financial Institutions (June 30, 2021)Document2 pagesStatement For Non-Bank Financial Institutions (June 30, 2021)araspopovicNo ratings yet

- Ab109report 2Document16 pagesAb109report 2Paige OsburnNo ratings yet

- McPier Airport Departure Tax LawsuitDocument64 pagesMcPier Airport Departure Tax Lawsuitdannyecker_crain100% (1)

- Fcpa Guide 2020 FinalDocument133 pagesFcpa Guide 2020 FinalSamuel FLoresNo ratings yet

- Rec Marijuana CostsDocument5 pagesRec Marijuana CostsRob PortNo ratings yet

- Asset Forfeiture Policy Directive 17-1 SignedDocument3 pagesAsset Forfeiture Policy Directive 17-1 SignedIan MasonNo ratings yet

- SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardFrom EverandSEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardNo ratings yet

- United States v. Jay Briley, 4th Cir. (2016)Document3 pagesUnited States v. Jay Briley, 4th Cir. (2016)Scribd Government DocsNo ratings yet

- Part B DocumentsDocument5 pagesPart B DocumentsWinston RuhayanaNo ratings yet

- 2235 FINAL PROJECT CRPCDocument20 pages2235 FINAL PROJECT CRPCJyoti GautamNo ratings yet

- Temporary Mental Health Order of Protection (007924)Document13 pagesTemporary Mental Health Order of Protection (007924)FOX 17 NewsNo ratings yet

- F30 Montemayor v. Araneta University FoundationDocument2 pagesF30 Montemayor v. Araneta University FoundationHanna Mari Carmela FloresNo ratings yet

- Criminal Law. L.b.reyesDocument8 pagesCriminal Law. L.b.reyeserikha_araneta100% (1)

- Borromeo CaseDocument3 pagesBorromeo CaselizleNo ratings yet

- Forensic Psychiatry-3: LT Col Sandeep BansalDocument58 pagesForensic Psychiatry-3: LT Col Sandeep BansalSandeep BansalNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument3 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Complainants Vs Vs Respondent: en BancDocument4 pagesComplainants Vs Vs Respondent: en BancyanaNo ratings yet

- 129 Ramoran V Jardine CMGDocument1 page129 Ramoran V Jardine CMGkim_santos_20No ratings yet

- Attorney's Fees PALEDocument5 pagesAttorney's Fees PALEerlaine_franciscoNo ratings yet

- Criminal Procedure Rules 2020 Part 10 and CPR 10.1A - 5ADocument8 pagesCriminal Procedure Rules 2020 Part 10 and CPR 10.1A - 5AtsmannatNo ratings yet

- D.K Basu Vs State of West Bengal PDFDocument20 pagesD.K Basu Vs State of West Bengal PDFakshay royalNo ratings yet

- Williams v. State of Alabama Et Al (INMATE1) - Document No. 4Document7 pagesWilliams v. State of Alabama Et Al (INMATE1) - Document No. 4Justia.comNo ratings yet

- Felicity Huffman, Lori Loughlin Criminal ComplaintDocument1 pageFelicity Huffman, Lori Loughlin Criminal ComplaintNational Content Desk100% (2)

- History of Steven Seagal En-M-Wikipedia-OrgDocument40 pagesHistory of Steven Seagal En-M-Wikipedia-OrgLionel TaneoNo ratings yet

- Jose Espinelli Vs PPDocument2 pagesJose Espinelli Vs PPEl Sitas100% (1)

- Ethics Digests CompiledDocument47 pagesEthics Digests Compiledandrew estimoNo ratings yet

- Bureau of Printing v. Bureau of Printing Employees Association Case DigestDocument2 pagesBureau of Printing v. Bureau of Printing Employees Association Case DigestYzzabel DangananNo ratings yet

- Midterm Exams Crimlaw QuestionsDocument11 pagesMidterm Exams Crimlaw QuestionsRamon George Atento100% (1)

- Reduction of BailbondDocument2 pagesReduction of BailbondMeng GoblasNo ratings yet

- United States v. Mellon Bank, N. A., Appeal of Milton F. Meissner, Intervenor-Respondent, 521 F.2d 708, 3rd Cir. (1975)Document9 pagesUnited States v. Mellon Bank, N. A., Appeal of Milton F. Meissner, Intervenor-Respondent, 521 F.2d 708, 3rd Cir. (1975)Scribd Government DocsNo ratings yet

- Federal V Air21Document21 pagesFederal V Air21Luigi JaroNo ratings yet

- Foreclosure Settlement Agreement VoidDocument7 pagesForeclosure Settlement Agreement Voidmortgageabuse6970No ratings yet

- United States v. Kevin Small, 3rd Cir. (2015)Document9 pagesUnited States v. Kevin Small, 3rd Cir. (2015)Scribd Government DocsNo ratings yet

- Criminal Law 1 NotesDocument20 pagesCriminal Law 1 NotesJunj Sawadj100% (1)

- The Unionist December 2012Document8 pagesThe Unionist December 2012novvotikNo ratings yet

- Parol Evidence CasesDocument20 pagesParol Evidence CasesChrysta FragataNo ratings yet