Professional Documents

Culture Documents

Chapter II

Chapter II

Uploaded by

Nde AnCopyright:

Available Formats

You might also like

- Cash and Bank Disbursement - SOP ExampleDocument5 pagesCash and Bank Disbursement - SOP ExampleMochammad IqbalNo ratings yet

- Manh Supply Chain Solutions enDocument32 pagesManh Supply Chain Solutions enPrasanna VenkatesanNo ratings yet

- Internship Report On MCB Bank LimitedDocument40 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- CBI Holding Company, Inc. / Case 2.6Document3 pagesCBI Holding Company, Inc. / Case 2.6octaevia50% (4)

- Bank Sulselbar: Business English Faculty of Language and Literature Universitas Negeri Makassar 2020Document4 pagesBank Sulselbar: Business English Faculty of Language and Literature Universitas Negeri Makassar 2020AfifahNo ratings yet

- Report LI at BSNDocument8 pagesReport LI at BSNSitie Fatima ElaniNo ratings yet

- RTIAct 2005 Nov 2013Document50 pagesRTIAct 2005 Nov 2013Stalin JoseNo ratings yet

- Chapter-2 Overview of OrganisationDocument13 pagesChapter-2 Overview of OrganisationRahul ThakurNo ratings yet

- Financial Policies: Sources of CapitalDocument4 pagesFinancial Policies: Sources of CapitalGhulam AbbasNo ratings yet

- Askari Report 2Document19 pagesAskari Report 2Faeza NaveedNo ratings yet

- Internship Report SilkbankDocument80 pagesInternship Report SilkbankKomal Shujaat67% (6)

- Bank of Maharashtra ProjectDocument39 pagesBank of Maharashtra Projectchakshyutgupta76% (21)

- Askari Bank Limited-ReportDocument22 pagesAskari Bank Limited-ReportNaeem AsifNo ratings yet

- Financial Statment Analysis of SiblDocument30 pagesFinancial Statment Analysis of SiblShafiur Ratul100% (1)

- Corporation BankDocument31 pagesCorporation BankShruti Das50% (2)

- Management Information System at Commercial BankDocument13 pagesManagement Information System at Commercial BankdianaNo ratings yet

- Rekha Jatev 6thDocument63 pagesRekha Jatev 6thMayank Jain NeerNo ratings yet

- Body of The ReportDocument33 pagesBody of The ReportJehan MahmudNo ratings yet

- About UsDocument16 pagesAbout UsbudakhensemNo ratings yet

- 1.1 AbstractDocument62 pages1.1 AbstractAhsan NasidNo ratings yet

- Welcome To My Presentation: Submitted To Submitted byDocument15 pagesWelcome To My Presentation: Submitted To Submitted byjenefar lollyNo ratings yet

- Internal Monitoring Unit (IMU)Document35 pagesInternal Monitoring Unit (IMU)salman saeedNo ratings yet

- Sapana Int Part2Document25 pagesSapana Int Part2Mùkésh RôyNo ratings yet

- Soneri Bank PresentationDocument9 pagesSoneri Bank PresentationAsadNo ratings yet

- Web - Based Spot CashDocument4 pagesWeb - Based Spot CashMark HenryNo ratings yet

- Fin 219Document3 pagesFin 219Dipayan_luNo ratings yet

- Origin of SbiDocument10 pagesOrigin of SbiIkbal ZkNo ratings yet

- Internship-Report-on-General-Banking-of-Janata-Bank-Limited 2Document35 pagesInternship-Report-on-General-Banking-of-Janata-Bank-Limited 2Bronson CastroNo ratings yet

- Chapter # 1 1.1 Industory: 1.2.1 HistoryDocument38 pagesChapter # 1 1.1 Industory: 1.2.1 HistoryHassanNo ratings yet

- General Banking Southeast BankDocument40 pagesGeneral Banking Southeast BankRasadul Hasan RaselNo ratings yet

- Profile: Name: Veena H Pillai STD: Tybcom. Div: B Roll No: 192Document6 pagesProfile: Name: Veena H Pillai STD: Tybcom. Div: B Roll No: 192hemantswapnaliNo ratings yet

- Overview of The Sonali BankDocument18 pagesOverview of The Sonali BankMoumita Rahman100% (1)

- Banking & Insurance AssignmentDocument10 pagesBanking & Insurance AssignmentKonok_StyleNo ratings yet

- Ifs Cat 2Document16 pagesIfs Cat 2sureshNo ratings yet

- Internship Report On Kanchepuram Central Cooperative BankDocument28 pagesInternship Report On Kanchepuram Central Cooperative BankSanjay Soupboy50% (2)

- Chapter-1: 1.1 Introduction of The ReportDocument24 pagesChapter-1: 1.1 Introduction of The Reportbany_dhakaNo ratings yet

- JANKIDocument47 pagesJANKIJankiNo ratings yet

- An Internship Report of Mutual Trust Bank Ltd.Document73 pagesAn Internship Report of Mutual Trust Bank Ltd.Nazmul Amin Aqib0% (1)

- Soneri BankDocument28 pagesSoneri Bankfahadali966No ratings yet

- Report Submission Finance (Noboni)Document20 pagesReport Submission Finance (Noboni)Afrid KhanNo ratings yet

- Ali HaiderDocument68 pagesAli HaiderManamNo ratings yet

- Acleda Bank Case StudyDocument15 pagesAcleda Bank Case StudySophie LamNo ratings yet

- Service Marketing (Pubali Bank)Document12 pagesService Marketing (Pubali Bank)leo_monty007No ratings yet

- A Report On Deposit in RBB Bank NepalDocument30 pagesA Report On Deposit in RBB Bank NepalShivam KarnNo ratings yet

- A Report On Deposit in RBB Bank NepalDocument30 pagesA Report On Deposit in RBB Bank NepalShivam Karn0% (1)

- Project Report 5678898798999Document45 pagesProject Report 5678898798999Aman BhatiaNo ratings yet

- Chapter One: 1.1 Type of Business/ OrganizationDocument20 pagesChapter One: 1.1 Type of Business/ OrganizationMndela MadibaNo ratings yet

- College of Business and Economics Department of Management Strategic Management Group AssignmentDocument18 pagesCollege of Business and Economics Department of Management Strategic Management Group AssignmentmengistuNo ratings yet

- Banking REPORT RecoveredDocument37 pagesBanking REPORT RecoveredBiRat Raj JoshiNo ratings yet

- Report - 1862Document23 pagesReport - 1862aqsamumtaz812No ratings yet

- Function of Commercial Banks in IndonesiaDocument4 pagesFunction of Commercial Banks in IndonesiaAbahLatifCanvasmasNo ratings yet

- Branch Banking CompleteDocument195 pagesBranch Banking Completesohail merchantNo ratings yet

- Online Banking ReportDocument11 pagesOnline Banking ReportkawyahvNo ratings yet

- Internship Report On Standard Bank General BankingDocument62 pagesInternship Report On Standard Bank General BankingArifEnamNo ratings yet

- Internship Report On MCB Bank LimitedDocument42 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- Soneri BankDocument42 pagesSoneri BankFahad JavaidNo ratings yet

- DIPAKDocument60 pagesDIPAKVipul KalathiyaNo ratings yet

- Organisational Setup and Management of The State Bank of IndiaDocument6 pagesOrganisational Setup and Management of The State Bank of IndiapandisivaNo ratings yet

- NBL Internship ReportDocument129 pagesNBL Internship ReportMohammad Anamul HoqueNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Alcatel 1660 SMDocument8 pagesAlcatel 1660 SMILiketobWithuNo ratings yet

- Supply Chain in Retail Business - Hidden Factor For SuccessDocument15 pagesSupply Chain in Retail Business - Hidden Factor For SuccesspeanakyNo ratings yet

- Bill GazDocument1 pageBill GazNawfal RakrakiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGirithar M SundaramNo ratings yet

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFDocument21 pagesSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFMOHAMMED KHAYYUMNo ratings yet

- Psysc Form 1Document1 pagePsysc Form 1Shiela Prades SopitaNo ratings yet

- Bank Mellat1Document6 pagesBank Mellat1mantanha066No ratings yet

- Formulir Berlangganan: Subscription FormDocument1 pageFormulir Berlangganan: Subscription FormNino KrishnamurtiNo ratings yet

- Medical Records NYCDocument3 pagesMedical Records NYCgwapingMDNo ratings yet

- AirtelDocument25 pagesAirtelSrabani PalNo ratings yet

- Automated Teller Machine ATMDocument17 pagesAutomated Teller Machine ATMSyed AlimuddinNo ratings yet

- Comparison Between Retail and CorporateDocument10 pagesComparison Between Retail and CorporateAkshay RathiNo ratings yet

- 5G-NR Frame Structure and NumerologyDocument13 pages5G-NR Frame Structure and Numerologygajendra5No ratings yet

- Bank-In Dawhkan Atrangin Ka Loan An Reject..??: Pu Mapuia Hannah-I PaDocument1 pageBank-In Dawhkan Atrangin Ka Loan An Reject..??: Pu Mapuia Hannah-I PaPascal ChhakchhuakNo ratings yet

- Care Credit AppDocument7 pagesCare Credit AppwvhvetNo ratings yet

- TP Link Hx220Document2 pagesTP Link Hx220armando.corralesNo ratings yet

- 19.5.5 Packet Tracer - Configure and Verify A Site-To-Site IPsec VPN - ITExamAnswersDocument5 pages19.5.5 Packet Tracer - Configure and Verify A Site-To-Site IPsec VPN - ITExamAnswersAna Maria Citlali Diaz HernandezNo ratings yet

- CmaDocument22 pagesCmaAhmed Mostafa ElmowafyNo ratings yet

- Current Location 19Document10 pagesCurrent Location 19watandostNo ratings yet

- Credit Card IssuersDocument36 pagesCredit Card IssuersTedh ShinNo ratings yet

- Panneer Chennai To SalemDocument1 pagePanneer Chennai To SalemDhanusraaj CNo ratings yet

- Banking & Finance Awareness 2016 (Jan-Nov) by AffairsCloud PDFDocument167 pagesBanking & Finance Awareness 2016 (Jan-Nov) by AffairsCloud PDFShivank TripathiNo ratings yet

- Complete List of Banking TermsDocument33 pagesComplete List of Banking TermsTanya Hughes100% (1)

- Quotation #Q1908413 22-06-2023 15-17-58Document1 pageQuotation #Q1908413 22-06-2023 15-17-58nivedNo ratings yet

- Introduction To New Radio (NR) 5gDocument9 pagesIntroduction To New Radio (NR) 5gLokendra RathoreNo ratings yet

- Competitive Analysis: Top 5 CompetitorsDocument5 pagesCompetitive Analysis: Top 5 Competitorssonakshi mathurNo ratings yet

- College Accounting Chapters 1-24-11th Edition Nobles Test BankDocument28 pagesCollege Accounting Chapters 1-24-11th Edition Nobles Test Bankthomasgillespiesbenrgxcow100% (22)

Chapter II

Chapter II

Uploaded by

Nde AnOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter II

Chapter II

Uploaded by

Nde AnCopyright:

Available Formats

CHAPTER II GENERAL DESCRIPTIONS A. Geographical Location PT.

Bank Sulselbar Maros branch office is located is located in strategic area, where most people spend a little time to arrive. It is exactly located in Jl.Jendral Sudirman No.3 Maros, South Sulawesi.

B. Brief History of PT. Bank Sulselbar PT.BPD Sulselbar was established in South Sulawesi, Makassar on January 13, 1961 under the name PT Bank Sulawesi Selatan Tenggara Regional Development in accordance Raden Kadiman Notary in Jakarta No.95 dated January 23, 1961. Then based on Notary Raden Kadiman No.67 dated July 13, 1961 the name of PT BPD Sulawesi Selatan Tenggara was changed to BPD Sulawesi Selatan Tenggara. BPD Sulawesi Selatan Tenggara started operating in 1961 in a building of Bank Indonesia, Jalan Nusantara No. 53 and then moved on to build the Bank Jalan Summa at No.91 Makassar Sulawesi Selatan. The purpose of the establishment of the Bank is to manage the financial area and help boost the local economy. Preparation of the founding of Bank of Sulawesi Selatan is by initiative of Mr Shamsuddin Dg. Mangawing which later became the first Director of the bank.

Under the rules of Provinces of South Sulawesi Southeast No.002 of 1964 dated February 12, 1964, the name of BPD Sulawesi Selatan Tenggara changed with authorized capital of Rp 250,000,000.00. Because of the separation between the Province of South Sulawesi Province of Southeast Sulawesi and the change in the authorized capital regulations No.002 of 1964 has been amended several times and eventually the Bank changed its name to BPD Sulsel. Based on regional regulation No.01 of 1963, the authorized capital to Rp 25 billion and as the Bank is BPD Sulsel with status as a regional company. Based Perda No.08 year 1999 increased the authorized capital of Rp 25 billion to Rp 150 billion. Furthermore, in order to change the status of the Regional Company (PD) to Limited Liability Company (PT), it gives birth to Regulation No. 13 of 2003 about changing the status of Legal Entity form Bank Pembangunan Daerah Sulsel from PD to PT where the capital base was increased to Rp 650 billion, which Deed of Establishment was approved by the Minister of Justice and Human Rights Republic of Indonesia by virtue of Decree No. C-31 541 H7.01.01 Th. December 29, 2004 concerning the ratification of the Limited Liability Company Act

establishing the Regional Development Bank of Sulawesi Selatan (abbreviated as

PT Bank Sulsel), and was published in the State Gazette of the Republic of Indonesia No. 13 dated 15 February 2005, Supplement No. 1655/2005. The operating changeof use of license to PT Bank Pembangunan Daerah Sulawesi Selatan dan Sulawesi Barat abbreviated to PT Bank Sulselbar has obtained approval from Bank Indonesia through the BI Governor Decree No. 13/32/KEP.GBI/2011 on May 10, 2011. C. Vision and Mission Vision To become the best bank in Eastern Indonesia with the support of management and professional human resources and provides added value to local government and community. Mission 1. Mover and driver of regional economic development rate 2. Local Cash Holder and / or perform money storage area 3. One source of revenue Motto MELAYANI SEPENUH HATI D. Products and Services Product development and improvement of banking services cannot be separated from the development of information technology (IT). Almost all

products and Bank services have implemented the use of information technology, among others. Centralized database system with real time network of online services continue to be development, especially in supporting the efficiency and effectiviness of the reconciliation process of bookkeping for millions of accounts they manage. The real time network online services has covered all sub branches and cash offices throughout the south and west sulawesi. Service delivery channel has been also developed in the current bank of South Sulawesi, including: ATM and Phone Banking. In carrying out its vision and mission, the Bank Sulsel conducts union activities and the use of funds as follow: a. The fund which comes from community and goverment deposits in the form:

1. Giro Giro Bank Sulsel is deposit for individual customers that can help business transactions fast, secure and flexible. The benefits and advantages are to transact at all bank sulsel branches in real time on-line system as well as from other banks to transfer facilities, Safe & flexible, simply by using a check to do transactions anytime, Current Account can be requested every time the account owner free to change. 2. Deposit "Investing in a Safe and Reliable" Take advantage of the ease and benefits of investing with the Deposit Bank Sulsel. Deposits of Bank Sulsel are long term deposit for individual customers,

6

companies and government agencies with attractive interst and other benefits. With flexible investment period and in accordance with the needs of the Customer. Bank Sulsel always provides more advantage in every your investment.

3. Savings Savings is deposit in the bank which cash can be done every time during the balance deposit sufficient and the bank still operate. The product saving in PT. Bank Sulselbar consist of: 1. SIMPEDA Deposit Local Development (SIMPEDA) Bank Sulsel is saving that provide benefit, safety, and pleasure of all your financial transactions. Account opening Simpeda Bank Sulselbar all of your financial transactions can be done quickly, and easily wherever you are. 2. TAPEMDA Savings for Regional Development (TAPEMDA) Bank Sulselbar is a deposit facility that provides security and convenience to you with initial deposit from Rp. 50.000,-. We can withdraw and deposit at all branch offices and cash offices of PT. Bank Sulselbar. The benefits of TAPEMDA are can be used as a means of payment of loan installments in Bank Sulselbar, has competitive interest and no administrative cost. 3. TAMPAN

Future savings are savings deposits / installment savings to realize depositors future such as education of the child, marriage, car payment, travel, or investment purposes in Rupiah with the system fixed monthly payments every month, the amount adapted to needs and abilities of depositors.

b. The use of funds disbursed in the form of loans to people with various types, which consist of: 1. KUL (Other Commercial Credit) This credit special for civil servant (PNS) who receives his salary in PT. Bank Sulselbar, with consumptive characteristic in increasing prosperity with requirements Taspen and Karpeg as a guarantee and authorization salary by PT. Bank Sulselbar. 2. KUM (Independent Business Credit) This credit is a special credit of the civil servant (PNS) who receives his salary in PT. Bank Sulselbar Maros branch office. This credit aims to help develop the business of civil servant who want to increase working capital for its business, and as surety is original Taspen, SK first and last original decree, and Karpeg, photos 3 models with business certificate from the village where the opening of business.

c.

Bank service

In addition to the collection and use of funding activities, PT. Bank Sulselbar also provides service other banking service include: 1. Remmitances 2. Inkasso 3. Guarantee Bank (Bank Guarantee) 4. Payments of phone bill, PAM, Electricity, Tax 5. Payment of salaries for retired public servants 6. Deposit for pilgrimage operational cost 7. Foreign exchange trade (Money Changer) 8. Mobile Banking

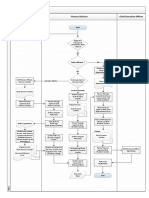

E. Organization Structure Organization structure is an arrangement or sequence order that describes the level of the parts in an organization that is normally presented in the form of chart that can explain the roles and responsibilities of each part and the relationship among them in achieving a goal.

Organization structure of Bank Sulselbar Maros bran ch office as follows:

Pemimpin Cabang

SEKSI PEMASARAN

SEKSI AKUNTANSI & ADMINISTRASI TRANSAKSI Pemimpin Seksi

SEKSI UMUM & SUMBER DAYA MANUSIA Pemimpin Seksi

Pemimpin Seksi

Analis Kredit

FRONT OFFICE

Koord. Kantor Kas Teller Tunai Petugas Transfer & Petugas Pajak

BACK OFFICE

Pramubakti

Account Officer Service Assistant

Head Teller Teller Non Tunai/ Pemindahbukuan Penangg.jawab VBS & ATM

Driver

Security

10

You might also like

- Cash and Bank Disbursement - SOP ExampleDocument5 pagesCash and Bank Disbursement - SOP ExampleMochammad IqbalNo ratings yet

- Manh Supply Chain Solutions enDocument32 pagesManh Supply Chain Solutions enPrasanna VenkatesanNo ratings yet

- Internship Report On MCB Bank LimitedDocument40 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- CBI Holding Company, Inc. / Case 2.6Document3 pagesCBI Holding Company, Inc. / Case 2.6octaevia50% (4)

- Bank Sulselbar: Business English Faculty of Language and Literature Universitas Negeri Makassar 2020Document4 pagesBank Sulselbar: Business English Faculty of Language and Literature Universitas Negeri Makassar 2020AfifahNo ratings yet

- Report LI at BSNDocument8 pagesReport LI at BSNSitie Fatima ElaniNo ratings yet

- RTIAct 2005 Nov 2013Document50 pagesRTIAct 2005 Nov 2013Stalin JoseNo ratings yet

- Chapter-2 Overview of OrganisationDocument13 pagesChapter-2 Overview of OrganisationRahul ThakurNo ratings yet

- Financial Policies: Sources of CapitalDocument4 pagesFinancial Policies: Sources of CapitalGhulam AbbasNo ratings yet

- Askari Report 2Document19 pagesAskari Report 2Faeza NaveedNo ratings yet

- Internship Report SilkbankDocument80 pagesInternship Report SilkbankKomal Shujaat67% (6)

- Bank of Maharashtra ProjectDocument39 pagesBank of Maharashtra Projectchakshyutgupta76% (21)

- Askari Bank Limited-ReportDocument22 pagesAskari Bank Limited-ReportNaeem AsifNo ratings yet

- Financial Statment Analysis of SiblDocument30 pagesFinancial Statment Analysis of SiblShafiur Ratul100% (1)

- Corporation BankDocument31 pagesCorporation BankShruti Das50% (2)

- Management Information System at Commercial BankDocument13 pagesManagement Information System at Commercial BankdianaNo ratings yet

- Rekha Jatev 6thDocument63 pagesRekha Jatev 6thMayank Jain NeerNo ratings yet

- Body of The ReportDocument33 pagesBody of The ReportJehan MahmudNo ratings yet

- About UsDocument16 pagesAbout UsbudakhensemNo ratings yet

- 1.1 AbstractDocument62 pages1.1 AbstractAhsan NasidNo ratings yet

- Welcome To My Presentation: Submitted To Submitted byDocument15 pagesWelcome To My Presentation: Submitted To Submitted byjenefar lollyNo ratings yet

- Internal Monitoring Unit (IMU)Document35 pagesInternal Monitoring Unit (IMU)salman saeedNo ratings yet

- Sapana Int Part2Document25 pagesSapana Int Part2Mùkésh RôyNo ratings yet

- Soneri Bank PresentationDocument9 pagesSoneri Bank PresentationAsadNo ratings yet

- Web - Based Spot CashDocument4 pagesWeb - Based Spot CashMark HenryNo ratings yet

- Fin 219Document3 pagesFin 219Dipayan_luNo ratings yet

- Origin of SbiDocument10 pagesOrigin of SbiIkbal ZkNo ratings yet

- Internship-Report-on-General-Banking-of-Janata-Bank-Limited 2Document35 pagesInternship-Report-on-General-Banking-of-Janata-Bank-Limited 2Bronson CastroNo ratings yet

- Chapter # 1 1.1 Industory: 1.2.1 HistoryDocument38 pagesChapter # 1 1.1 Industory: 1.2.1 HistoryHassanNo ratings yet

- General Banking Southeast BankDocument40 pagesGeneral Banking Southeast BankRasadul Hasan RaselNo ratings yet

- Profile: Name: Veena H Pillai STD: Tybcom. Div: B Roll No: 192Document6 pagesProfile: Name: Veena H Pillai STD: Tybcom. Div: B Roll No: 192hemantswapnaliNo ratings yet

- Overview of The Sonali BankDocument18 pagesOverview of The Sonali BankMoumita Rahman100% (1)

- Banking & Insurance AssignmentDocument10 pagesBanking & Insurance AssignmentKonok_StyleNo ratings yet

- Ifs Cat 2Document16 pagesIfs Cat 2sureshNo ratings yet

- Internship Report On Kanchepuram Central Cooperative BankDocument28 pagesInternship Report On Kanchepuram Central Cooperative BankSanjay Soupboy50% (2)

- Chapter-1: 1.1 Introduction of The ReportDocument24 pagesChapter-1: 1.1 Introduction of The Reportbany_dhakaNo ratings yet

- JANKIDocument47 pagesJANKIJankiNo ratings yet

- An Internship Report of Mutual Trust Bank Ltd.Document73 pagesAn Internship Report of Mutual Trust Bank Ltd.Nazmul Amin Aqib0% (1)

- Soneri BankDocument28 pagesSoneri Bankfahadali966No ratings yet

- Report Submission Finance (Noboni)Document20 pagesReport Submission Finance (Noboni)Afrid KhanNo ratings yet

- Ali HaiderDocument68 pagesAli HaiderManamNo ratings yet

- Acleda Bank Case StudyDocument15 pagesAcleda Bank Case StudySophie LamNo ratings yet

- Service Marketing (Pubali Bank)Document12 pagesService Marketing (Pubali Bank)leo_monty007No ratings yet

- A Report On Deposit in RBB Bank NepalDocument30 pagesA Report On Deposit in RBB Bank NepalShivam KarnNo ratings yet

- A Report On Deposit in RBB Bank NepalDocument30 pagesA Report On Deposit in RBB Bank NepalShivam Karn0% (1)

- Project Report 5678898798999Document45 pagesProject Report 5678898798999Aman BhatiaNo ratings yet

- Chapter One: 1.1 Type of Business/ OrganizationDocument20 pagesChapter One: 1.1 Type of Business/ OrganizationMndela MadibaNo ratings yet

- College of Business and Economics Department of Management Strategic Management Group AssignmentDocument18 pagesCollege of Business and Economics Department of Management Strategic Management Group AssignmentmengistuNo ratings yet

- Banking REPORT RecoveredDocument37 pagesBanking REPORT RecoveredBiRat Raj JoshiNo ratings yet

- Report - 1862Document23 pagesReport - 1862aqsamumtaz812No ratings yet

- Function of Commercial Banks in IndonesiaDocument4 pagesFunction of Commercial Banks in IndonesiaAbahLatifCanvasmasNo ratings yet

- Branch Banking CompleteDocument195 pagesBranch Banking Completesohail merchantNo ratings yet

- Online Banking ReportDocument11 pagesOnline Banking ReportkawyahvNo ratings yet

- Internship Report On Standard Bank General BankingDocument62 pagesInternship Report On Standard Bank General BankingArifEnamNo ratings yet

- Internship Report On MCB Bank LimitedDocument42 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- Soneri BankDocument42 pagesSoneri BankFahad JavaidNo ratings yet

- DIPAKDocument60 pagesDIPAKVipul KalathiyaNo ratings yet

- Organisational Setup and Management of The State Bank of IndiaDocument6 pagesOrganisational Setup and Management of The State Bank of IndiapandisivaNo ratings yet

- NBL Internship ReportDocument129 pagesNBL Internship ReportMohammad Anamul HoqueNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Alcatel 1660 SMDocument8 pagesAlcatel 1660 SMILiketobWithuNo ratings yet

- Supply Chain in Retail Business - Hidden Factor For SuccessDocument15 pagesSupply Chain in Retail Business - Hidden Factor For SuccesspeanakyNo ratings yet

- Bill GazDocument1 pageBill GazNawfal RakrakiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGirithar M SundaramNo ratings yet

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFDocument21 pagesSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFMOHAMMED KHAYYUMNo ratings yet

- Psysc Form 1Document1 pagePsysc Form 1Shiela Prades SopitaNo ratings yet

- Bank Mellat1Document6 pagesBank Mellat1mantanha066No ratings yet

- Formulir Berlangganan: Subscription FormDocument1 pageFormulir Berlangganan: Subscription FormNino KrishnamurtiNo ratings yet

- Medical Records NYCDocument3 pagesMedical Records NYCgwapingMDNo ratings yet

- AirtelDocument25 pagesAirtelSrabani PalNo ratings yet

- Automated Teller Machine ATMDocument17 pagesAutomated Teller Machine ATMSyed AlimuddinNo ratings yet

- Comparison Between Retail and CorporateDocument10 pagesComparison Between Retail and CorporateAkshay RathiNo ratings yet

- 5G-NR Frame Structure and NumerologyDocument13 pages5G-NR Frame Structure and Numerologygajendra5No ratings yet

- Bank-In Dawhkan Atrangin Ka Loan An Reject..??: Pu Mapuia Hannah-I PaDocument1 pageBank-In Dawhkan Atrangin Ka Loan An Reject..??: Pu Mapuia Hannah-I PaPascal ChhakchhuakNo ratings yet

- Care Credit AppDocument7 pagesCare Credit AppwvhvetNo ratings yet

- TP Link Hx220Document2 pagesTP Link Hx220armando.corralesNo ratings yet

- 19.5.5 Packet Tracer - Configure and Verify A Site-To-Site IPsec VPN - ITExamAnswersDocument5 pages19.5.5 Packet Tracer - Configure and Verify A Site-To-Site IPsec VPN - ITExamAnswersAna Maria Citlali Diaz HernandezNo ratings yet

- CmaDocument22 pagesCmaAhmed Mostafa ElmowafyNo ratings yet

- Current Location 19Document10 pagesCurrent Location 19watandostNo ratings yet

- Credit Card IssuersDocument36 pagesCredit Card IssuersTedh ShinNo ratings yet

- Panneer Chennai To SalemDocument1 pagePanneer Chennai To SalemDhanusraaj CNo ratings yet

- Banking & Finance Awareness 2016 (Jan-Nov) by AffairsCloud PDFDocument167 pagesBanking & Finance Awareness 2016 (Jan-Nov) by AffairsCloud PDFShivank TripathiNo ratings yet

- Complete List of Banking TermsDocument33 pagesComplete List of Banking TermsTanya Hughes100% (1)

- Quotation #Q1908413 22-06-2023 15-17-58Document1 pageQuotation #Q1908413 22-06-2023 15-17-58nivedNo ratings yet

- Introduction To New Radio (NR) 5gDocument9 pagesIntroduction To New Radio (NR) 5gLokendra RathoreNo ratings yet

- Competitive Analysis: Top 5 CompetitorsDocument5 pagesCompetitive Analysis: Top 5 Competitorssonakshi mathurNo ratings yet

- College Accounting Chapters 1-24-11th Edition Nobles Test BankDocument28 pagesCollege Accounting Chapters 1-24-11th Edition Nobles Test Bankthomasgillespiesbenrgxcow100% (22)