Professional Documents

Culture Documents

Conflict Between Stockholders & Bondholders: High-Risk Projects

Conflict Between Stockholders & Bondholders: High-Risk Projects

Uploaded by

Mujahid AbbasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Conflict Between Stockholders & Bondholders: High-Risk Projects

Conflict Between Stockholders & Bondholders: High-Risk Projects

Uploaded by

Mujahid AbbasCopyright:

Available Formats

Conflict Between Stockholders & Bondholders

High-risk Projects

Shareholders promote those projects that offer higher incentives and thus are accompanied by high risks. The higher risk values increase the needed return on the company's debt. As a result, the value of outstanding bonds is affected. If the outcome of a project is positive, shareholders earn the extra profits while bondholders get their fixed returns. However, in an eventuality of losses, both shareholders and bondholders must contribute. Consequently, to secure their investment, bondholders favor projects involving limited risk. Project selection thus leads to disagreement between both parties.

Low-risk Projects

A low-risk project is accompanied by lower return on investment. Bondholders are in favor of such investments with positive net present value. From a shareholder's perspective, the proportionate gains accruing to bondholders are high, and thus it is not a lucrative opportunity. Companies are often tempted to forgo such projects and thus win shareholder's trust. Underinvestment problems thus are another critical cause of conflict between shareholders and bondholders.

1.

o

Spin-off

Corporate divestiture for creation of a new entity via the issue of new shares is another situation leading to conflict between stockholders and bondholders. Management can transfer wealth to existent or new shareholders by issuing fresh debt. The firm's financial risk increases, and the bond value gets reduced. In fact, to tempt shareholders, companies explain wealth transfer gains during the spin-off announcements. Typically during the announcement months, bondholders receive negative returns on their investment. The bondholder's claim to wealth gets diluted in favor of a shareholder.

High Dividend Payments

o

A firm has the option of paying high dividends to shareholders. However, while shareholders would be in favor of such a situation, the resultant reduced cash flows are not a healthy sign for a bondholder. An extreme situation is where the company pays all of its assets as dividends. In this case it avoids paying debts.

Sponsored Links

Agency cost refers to the cost incurred by a firm because of the problems associated with the different interests of management and shareholder and the information asymmetry that exists between the principal (shareholders) and the agent (management). Agency Cost of Equity The agency cost of equity arises because of the difference in interests between the shareholders and the management. As long as the managements interests diverge from that of the shareholders, the shareholders will have to bear this cost. Management may be tempted to take suboptimal decisions that may not work towards maximizing the value for the firm. Any measures implemented to oversee and prevent this will have a cost associated with it. So, the agency costs will include both, the cost due to the suboptimal decision, and the cost incurred in monitoring the management to prevent them from taking these decisions. Agency Cost of Debt The agency cost of debt arises because of different interests of shareholders and debt-holders. Assume that the management is in favour of the shareholders. If so, the management can in many ways transfer the wealth to the shareholders and leaving debt-holders empty handed. Anticipating such activities, the debt-holders will take various preventive measures to disallow management from doing so. The debt holders may do so in the form of higher interest rates to protect themselves from the losses. Alternatively they may impose restrictive covenants. One example of such behaviour is seen in the priority given to dividends. In their pursuit to please the shareholders, the management may give cash dividends to the shareholders, leaving very less to pay to the debt holders. To avoid this situation, there is this requirement that the interest must be paid before dividends. Similarly there are other situations where such covenants are placed, for example, debts with different seniority. Information Asymmetry In general, we can say that the management is more information about the prospects of the business compared to shareholders, debt-holders and other parties. This is called information asymmetry.

The information asymmetry directly affects the agency costs: the higher the information asymmetry, the greater will be the agency costs.

You might also like

- Financial Management - Mba Question AnswersDocument40 pagesFinancial Management - Mba Question AnswersVenkata Narayanarao Kavikondala93% (28)

- Development Studies-Notes & Revision Questions Module 1-4Document164 pagesDevelopment Studies-Notes & Revision Questions Module 1-4laone sephiri100% (2)

- Chap 015Document17 pagesChap 015Kuthubudeen T MNo ratings yet

- FruitomansDocument56 pagesFruitomansSHERIN1239No ratings yet

- Debt&eqiutyDocument5 pagesDebt&eqiutyRafidul IslamNo ratings yet

- To A Lender.: Debt Contract Is An Agreement in Which Borrower Agrees To Repay FundsDocument4 pagesTo A Lender.: Debt Contract Is An Agreement in Which Borrower Agrees To Repay Fundsapple0608No ratings yet

- Optimizing The Capital Structure Finding The Right Balance Between Debt and EquityDocument4 pagesOptimizing The Capital Structure Finding The Right Balance Between Debt and EquityUmar ShafiqueNo ratings yet

- Cycle 4: Intermediate Corporate FinanceDocument15 pagesCycle 4: Intermediate Corporate FinanceAnna LelorieuxNo ratings yet

- 7.1. Source of Project FinanceDocument7 pages7.1. Source of Project FinanceTemesgenNo ratings yet

- Assignment 1 - Project FinanceDocument2 pagesAssignment 1 - Project FinancevasanthaNo ratings yet

- Practices-Financial Leverage ROA and SpreadDocument4 pagesPractices-Financial Leverage ROA and SpreadAli NasarNo ratings yet

- Chapter 14 Agency Theory SolutionDocument7 pagesChapter 14 Agency Theory SolutionariestbtNo ratings yet

- Agency TheoryDocument27 pagesAgency TheoryWilsonNo ratings yet

- Financial Management: Assignment: 1Document8 pagesFinancial Management: Assignment: 1Shashank SinghNo ratings yet

- Assignment 3.editedDocument4 pagesAssignment 3.editedDAVID WASWANo ratings yet

- Selecting Sources of Finance For Business: Can The Necessary Finance Be Provided From Internal Sources?Document6 pagesSelecting Sources of Finance For Business: Can The Necessary Finance Be Provided From Internal Sources?Pawan_Vaswani_9863No ratings yet

- What Is Debt Equity Ratio & Its Significance?Document2 pagesWhat Is Debt Equity Ratio & Its Significance?bibhav poudelNo ratings yet

- Agency Problems and Their ConsequencesDocument4 pagesAgency Problems and Their ConsequencesGreat ButaliNo ratings yet

- ch05 SM RankinDocument17 pagesch05 SM Rankinhasan jabrNo ratings yet

- Individuals AssignmentDocument7 pagesIndividuals AssignmentQuỳnh NhưNo ratings yet

- Manajemen Keuangan Lanjutan - Tugas Minggu 1Document7 pagesManajemen Keuangan Lanjutan - Tugas Minggu 1NadiaNo ratings yet

- Assignment No 1Document9 pagesAssignment No 1Fahad AhmedNo ratings yet

- BFIN300 Full Hands OutDocument46 pagesBFIN300 Full Hands OutGauray LionNo ratings yet

- There Are Many Different Motivations To Source MoneyDocument7 pagesThere Are Many Different Motivations To Source MoneyJamaica RamosNo ratings yet

- Assignment: Strategic Financial ManagementDocument7 pagesAssignment: Strategic Financial ManagementVinod BhaskarNo ratings yet

- A Survey at Corporate GovernanceDocument4 pagesA Survey at Corporate GovernancemahsanmukhtarNo ratings yet

- Business Finance TADocument9 pagesBusiness Finance TAOlivier MNo ratings yet

- Untitled DocumentDocument5 pagesUntitled DocumentTrần Thị Phương LinhNo ratings yet

- Every Company Is Required To Take Three Main Financial Decisions, They AreDocument5 pagesEvery Company Is Required To Take Three Main Financial Decisions, They Areroyette ladicaNo ratings yet

- E8 Business FinanceDocument8 pagesE8 Business FinanceTENGKU ANIS TENGKU YUSMANo ratings yet

- CF AGE SM Ch17Document10 pagesCF AGE SM Ch17SK (아얀)No ratings yet

- Positive Theory of Accounting Policy and DisclosureDocument6 pagesPositive Theory of Accounting Policy and DisclosureMirnah AmirNo ratings yet

- Wealth MaximizationDocument9 pagesWealth MaximizationApplopediaNo ratings yet

- Debt Vs EquityDocument3 pagesDebt Vs EquityPriyanka KulshresthaNo ratings yet

- FM Module 4 Capital Structure of A CompanyDocument6 pagesFM Module 4 Capital Structure of A CompanyJeevan RobinNo ratings yet

- UNIT 2 Cost of CapitalDocument11 pagesUNIT 2 Cost of Capitalshreya.fruity23No ratings yet

- Chapter 16Document2 pagesChapter 16canadian_ehNo ratings yet

- Financial Technologies TheoriesDocument10 pagesFinancial Technologies Theoriesfirst breakNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- Capital Structure: Limits To The: Use of DebtDocument9 pagesCapital Structure: Limits To The: Use of DebtLâm Thanh Huyền NguyễnNo ratings yet

- PMF Unit 5Document10 pagesPMF Unit 5dummy manNo ratings yet

- Fnancial Management ReportDocument5 pagesFnancial Management ReportPearl RagasajoNo ratings yet

- Inve, T and Portfolio Management Assin 1Document11 pagesInve, T and Portfolio Management Assin 1Filmona YonasNo ratings yet

- Kelompok 4 - Chapter 11Document9 pagesKelompok 4 - Chapter 11Hanbin KimNo ratings yet

- Sources of Long Term FinanceDocument30 pagesSources of Long Term FinanceManu Mallikarjun NelagaliNo ratings yet

- Chapter 18 SummaryDocument8 pagesChapter 18 SummaryCyrilla NaznineNo ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementShibu ShashankNo ratings yet

- IntermediaryDocument5 pagesIntermediarybtsvt1307 phNo ratings yet

- Capital Structure DefinitionDocument15 pagesCapital Structure DefinitionVan MateoNo ratings yet

- Long-Term CapitalDocument13 pagesLong-Term Capitalafoninadin81No ratings yet

- Ge Entrep Activity 2 (Sayre)Document4 pagesGe Entrep Activity 2 (Sayre)Cyrell Malmis SayreNo ratings yet

- FM Module 6Document6 pagesFM Module 6James Levi Tan QuintanaNo ratings yet

- FM ExamDocument13 pagesFM Examtigist abebeNo ratings yet

- Opportunity Cost of CapitalDocument2 pagesOpportunity Cost of CapitalNayana PremchandNo ratings yet

- AF301 Unit 7 Positive Accounting TheoryDocument41 pagesAF301 Unit 7 Positive Accounting TheoryNarayan DiviyaNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- CH 14 - Mini Case - 23845Document11 pagesCH 14 - Mini Case - 23845Aamir KhanNo ratings yet

- DividendsDocument8 pagesDividendsNtege SimonNo ratings yet

- Corporate FinanceDocument17 pagesCorporate FinanceSarah VUNo ratings yet

- Public FinanceDocument26 pagesPublic FinanceVarshini NagarajuNo ratings yet

- Top Two Ways Corporations Raise CapitalDocument4 pagesTop Two Ways Corporations Raise CapitalSam vermNo ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Hots International ProposalDocument8 pagesHots International ProposalNidhish DevadigaNo ratings yet

- 10180405206.sample DPR - Manufacturing of Palm Leaf PlateDocument23 pages10180405206.sample DPR - Manufacturing of Palm Leaf PlateFrtyuNo ratings yet

- Abc - VedDocument23 pagesAbc - VedVamsi krishnaNo ratings yet

- Format For Project Profile - Cum - Claim Form For Claiming 50% Advance Subsidy/RefinanceDocument14 pagesFormat For Project Profile - Cum - Claim Form For Claiming 50% Advance Subsidy/RefinancePankaj GoyenkaNo ratings yet

- Chapter 6 MoodleDocument36 pagesChapter 6 MoodleMichael TheodricNo ratings yet

- Landbank V OnateDocument4 pagesLandbank V OnateMacky CaballesNo ratings yet

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Lecturer 2: Introduction To Transaction ProcessingDocument110 pagesLecturer 2: Introduction To Transaction ProcessingontykerlsNo ratings yet

- Scientific Management TheoryDocument3 pagesScientific Management Theoryhash05100% (3)

- HAY - Building Successful Leaders by Effectively Aligning People and RolesDocument22 pagesHAY - Building Successful Leaders by Effectively Aligning People and Rolesjlg-jlgNo ratings yet

- Problem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Document2 pagesProblem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Rizky Wahyu FebriyantoNo ratings yet

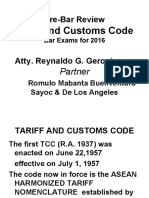

- Reviewer Tariff CustomsDocument49 pagesReviewer Tariff CustomsNoel IV T. Borromeo100% (3)

- Srija ReportDocument22 pagesSrija ReportNATHANNo ratings yet

- Sales Quota and Sales Budget, Notes For Distance MBA - Management ParadiseDocument4 pagesSales Quota and Sales Budget, Notes For Distance MBA - Management Paradisehermandeep5No ratings yet

- Accounting For InventoriesDocument65 pagesAccounting For InventoriesRalph Ernest HulguinNo ratings yet

- Business Combination 9Document2 pagesBusiness Combination 9Paulo VictoriousNo ratings yet

- The 6 Stages of The Employee Life CycleDocument3 pagesThe 6 Stages of The Employee Life CyclenerenNo ratings yet

- Guideline StarbucksDocument2 pagesGuideline StarbucksMinh ThangNo ratings yet

- Foreign Trade Policy (2015-2020)Document17 pagesForeign Trade Policy (2015-2020)Neha RawalNo ratings yet

- ISEA Community Solar Proposal Development Presentation 7-7-17Document33 pagesISEA Community Solar Proposal Development Presentation 7-7-17Levi MuromboNo ratings yet

- 2022 Budget StatementDocument348 pages2022 Budget StatementFuaad DodooNo ratings yet

- Ashley Evans James Jordan Sierra Law Chris Wiebe Jasmine KurywczakDocument31 pagesAshley Evans James Jordan Sierra Law Chris Wiebe Jasmine KurywczakSierra LawNo ratings yet

- OneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporeDocument11 pagesOneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporejaitleyarushiNo ratings yet

- Reflection PaperDocument4 pagesReflection PaperDanica SolisNo ratings yet

- United Airlines V CIRDocument1 pageUnited Airlines V CIRiciamadarangNo ratings yet

- Gössling Et Al. (2019)Document24 pagesGössling Et Al. (2019)Maximiliano Karl OrtegaNo ratings yet

- Example Financial Statements Risk AnalysisDocument7 pagesExample Financial Statements Risk AnalysisGabriel EmordiNo ratings yet