Professional Documents

Culture Documents

Tata Steel (TISCO) : Inventory Write-Down Impacts Performance

Tata Steel (TISCO) : Inventory Write-Down Impacts Performance

Uploaded by

Sajith PratapOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Steel (TISCO) : Inventory Write-Down Impacts Performance

Tata Steel (TISCO) : Inventory Write-Down Impacts Performance

Uploaded by

Sajith PratapCopyright:

Available Formats

Result Update

February 13, 2012

Rating matrix

Rating Target Target Period Potential Upside : : : : Hold | 442 12-15 months -7%

Tata Steel (TISCO)

| 475

WHATS CHANGED

FY12E 130936.6 12914.9 2222.7 FY13E 137024.2 16042.2 4943.1

Key Financials

(| Crore) Net Sales EBITDA Adj Net Profit FY10 101757.8 8042.7 -325.5 FY11 117149.8 15995.6 6672.5

PRICE TARGET....................................................................... Changed from | 447 to | 442 EPS (FY12E)......................................................................... Changed from | 46.6 to | 22.9 EPS (FY13E)......................................................................... Changed from | 69.4 to | 50.9 RATING.....................................................................................Changed from BUY to HOLD

Valuation summary

EPS (|) PE (x) Target PE (x) EV/EBITDA(x) P/BV (x) RoNW (%) RoCE (%) FY10 NA NA NA 11.0 1.8 -8.8 4.7 FY11 69.6 6.8 6.4 5.9 1.2 18.0 11.9 FY12E 22.9 20.6 19.3 7.4 1.1 5.3 8.0 FY13E 50.9 9.3 8.7 5.8 1.0 10.9 9.7

Inventory write-down impacts performance

Tata Steels Q3FY12 numbers were broadly below our expectations, primarily due to the inventory write-down. During the quarter under review, the total operating income stood at | 33103.1 crore (our estimate: | 28194.5 crore) higher by 13.8% YoY and 1.8% QoQ. The EBITDA margin during the quarter under review stood at 5.2% (our estimate 7.5%), which was lower by 660 bps YoY and 330 bps QoQ. There was inventory write-down to the tune of | 741.7 crore, which led to muted margins during the quarter under review. Consequently, the Tata Steel group registered a net loss of | 603 crore in Q3FY12 compared to a net profit of | 1003 crore in Q3FY11 (our estimate: | 133 crore). Operational performance The results of domestic operations broadly came in line with our expectation. For domestic operations, the company posted an underlying EBITDA/tonne of | 16218/tonne against our estimate of | 15592/tonne (Q2FY12 EBITDA/tonne for domestic operations was | 16786/tonne). Tata Steel Europe reported an EBITDA loss of | 781 crore (US$147 million) in Q3FY12. The Q3FY12 loss was mainly due to mark-to-market provisions on stock. The reported EBITDA/tonne was US$ -43.9/tonne. However, adjusting for the inventory write down, the adjusted EBITDA/tonne came in at US$ -1.2/tonne.

Stock data

Market Capitalisation Debt (FY11) Cash (FY11) EV 52 week H/L Equity capital Face value DII Holding (%) FII Holding (%) | 45253 Crore | 60684 Crore | 10893 Crore | 95044 Crore 661/332 | 958.7 Crore | 10 27.7 14.7

Price movement

6,500 6,000 5,500 5,000 4,500 4,000 3,500 3,000 2,500 2,000 Feb-11 May-11 Aug-11 Nov-11 Nifty (L.H.S) Price (R.H.S) 750 650 550 450 350 250 150 50 Feb-12

Valuation

At the CMP of | 472, the stock is discounting its FY13E EPS by 9.3x and EV/EBITDA by 5.8x. We have a cautious view on overseas operations on account of global macro headwinds. However, on the back of the improvement seen in the domestic demand scenario, we have valued the Indian operations at 6.0x its FY13E EV/EBITDA (from 5.5x earlier) and European and Asian subsidiaries at 4x its FY13E EV/EBITDA and arrived at a target price of | 442 assigning a HOLD rating to the stock.

Exhibit 1: Financial Performance

(| Crore) Net Sales EBITDA EBITDA Margin (%) Depreciation Interest Reported PAT Q3FY12 33103.1 1717.3 5.2 1164.0 706.9 -602.7 Q3FY12E 28194.5 2111.2 7.5 1185.2 750.5 133.1 Q3FY11 29089.5 3424.6 11.8 1126.4 743.2 1003.0 Q2FY12 32507.5 2750.0 8.5 1108.8 716.1 212.4 YoY (Chg %) 13.8 -49.9 (660) bps 3.3 -4.9 PL QoQ (Chg %) 1.8 -37.6 (330) bps 5.0 -1.3 PL

Analysts name

Dewang Sanghavi dewang.sanghavi@icicisecurities.com

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Results Analysis

Group performance

The group consolidated turnover at | 33,103 crore (US$6.24 billion) in Q3FY12 improved by 13.8%, compared to Q3FY12. Group deliveries of 5.84 million tonne (MT) in Q3FY12 were marginally lower YoY (5.9 MT in Q3FY11). During the quarter under review, deliveries from Tata Steel India were 1.62 MT (1.64 MT in Q3FY11 and 1.65 MT in Q2FY12) while that from Tata Steel Europe were 3.35 MT (3.39 MT in Q3FY11 and 3.57 MT in Q2FY12). Deliveries from South East Asia operations during the quarter under review stood at 0.66 MT (0.78 MT in Q3FY11 and 0.78 MT in Q2FY12). The reported group EBITDA in Q3FY12 stood at | 1717.3 crore, lower by 49.9% YoY and 37.6% QoQ (our estimate: | 2111.2 crore). The performance during the quarter under review was impacted by inventory write-down. Value of inventories of raw materials and finished goods at some of the subsidiary companies, especially in Tata Steel Europe, has been written down to recognise the fall in market price of these products. The write-down for the quarter ended December 31, 2011 amounts to | 741.7 crore. Consequently, the Tata Steel group registered a net loss of | 603 crore (US$114 million) in Q3FY12 compared to a net profit of | 1,003 crore (US$189 million) in Q3FY11.

Indian operations

During the quarter under review, the turnover of Tata Steels Indian operations was | 8382 crore (US$1.58 billion), which was higher by 13.3% YoY and 2.1% QoQ. In Q3FY12, deliveries from Tata Steels Indian operations were 1.62 MT, which was slightly below our estimate of 1.65 MT. The EBITDA for Q3FY12 was | 2630.6, down ~5% QoQ. The PAT during the quarter under review stood at | 1421.3 crore, which was lower by 4.9% QoQ and 6.1% YoY.

European operations

During the quarter under review, the turnover of Tata Steels European operations was | 20535 crore (US$3.87 billion), which was higher by 17.2% YoY but lower by 3.0% QoQ. In Q3FY12, deliveries from Tata Steels European operations were 3.35 MT, which was marginally higher than our estimate of 3.3 MT. There was an EBITDA loss of | 781 crore (US$147 million) in Q3FY12 compared to positive EBITDA of | 392 crore (US$74 million) in Q3FY11 and | 505 crore (US$95 million) in Q2FY12. The Q3FY12 loss was mainly due to mark-to-market provisions on stock.

Exhibit 2: Tata Steel Groups performance Q3FY12

Particulars Deliveries (MT) Turnover (US$ Mn) Reported EBITDA (US$ Mn) Add: NRV* provisions (US$ Mn) Adjusted EBITDA (US$ Mn) Adjusted EBITDA Margin (in %) Adjuted EBITDA/tonne (in US$) Tata Steel-India 1.62 1580.0 491.0 0.0 491.0 31.1 303 Tata Steel-Europe 3.35 3870.0 -147.0 143.0 -4.0 -0.1 -1 SE Asia 0.66 586.0 -2.0 0.0 -2.0 -0.3 -3 Tata Steel Group 5.84 6239.0 366.0 0.0 366.0 5.9 63

* - Net Realizable Value

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 2

Conference Call highlights & other key developments

Indian operations During the quarter under review, the overall net realisations were higher due to increased retail sales and favorable sales mix in longs. The long products sales dropped in Q3FY12 due to lower availability of semis on account of planned shutdowns. Flat products volume increased 3% YoY, which was in line with the increase in production volume. The 2.9 MTPA brownfield expansion in Jamshedpur is expected to be commissioned in Q4FY12. For FY13, the management expects incremental volumes of ~1 MT from the new capacity. With respect to the ferro alloys and mineral division, increased domestic market focus led to improved realisation in Q3FY12. Furthermore, during the quarter under review, higher production in ferro chrome conversion units resulted in higher ferro alloy sales. NatSteel holdings Singapore performed better on account of better scrap-rebar gap management and its conversion cost reduction programme. Furthermore, downstream sales were the best ever. Furnace upgrade by December 2012 is expected to result in both productivity enhancement and power cost savings. Tata Steel Thailand The construction industry contracted 10.4% QoQ in Q3FY12 due to severe floods. Continued focus on mix enrichment led to higher sales of special wire rods in Q3FY12. Net debt at the end of September 2011 was | 45,056 crore (US$9.2 billion) compared to | 46,627 crore (US$9.5 billion) at the end of March 2011. Capex for FY12E and FY13E is expected to be in the range of ~ US$2 billion each. European operations For the European operations, the management expects steel deliveries to remain broadly at the same level as FY12. The write-down of high cost inventory is expected have a positive impact on the Q4FY12 margins. Capex guidance Tata Steel plans to incur a capex of US$2.5 billion every year for the next two years. Out of this, US$600 million would be for European operations, US$400 million for the Jamshedpur expansion (residual payments), US$ 800 million for its expansion in Odisha, US$150 million for its JV with Nippon Steel, US$100 million for its raw material projects and a sustenance capex of US$300 million.

ICICI Securities Ltd | Retail Equity Research

Page 3

Valuation

At the CMP of | 472, the stock is discounting its FY13E EPS by 9.3x and EV/EBITDA by 5.8x. We have a cautious view on overseas operations on account of global macro headwinds. However, on the back of an improvement seen in the domestic demand scenario we have valued the Indian operations at 6.0x its FY13E EV/EBITDA (from 5.5x earlier) and European and Asian subsidiaries at 4x its FY13E EV/EBITDA. We have arrived at a target price of | 442 assigning a HOLD rating to the stock.

Exhibit 3: Valuation matrix

FY10 FY11 FY12E FY13E Sales (| Crore) 101757.8 117149.8 130936.6 137024.2 EPS (|) NA 69.6 22.9 50.9 PE (x) NA 6.8 20.6 9.3 EV/EBIDTA (x) 11.0 5.9 7.4 5.8 P/ BV (x) 1.8 1.2 1.1 1.0 RoNW (%) -8.8 18.0 5.3 10.9 RoCE (%) 4.7 11.9 8.0 9.7

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 4

Financial summary (Consolidated)

Profit and loss statement

(Year-end March) Net Sales Other Operating Income Total Operating Income Growth (%) Raw Material Expenses Employee Expenses Purchase of Power Other expenses Total Operating Expenditure EBITDA Growth (%) Depreciation Interest Other Income PBT Exceptional Item Total Tax PAT Growth (%) Minorities, Associates etc Rep PAT after Assoc., MI Adj PAT after Assoc, MI Growth (%) Adj EPS (|) FY10 101757.8 635.4 102393.1 -30.2 31664.5 16463.0 4051.7 42171.2 94350.5 8042.7 -55.6 4491.7 3022.1 1185.9 1714.7 -1683.7 2151.8 -2120.8 59.9 111.6 -2009.2 -325.5 PL NA FY11 117149.8 1603.3 118753.1 16.0 36688.1 15288.4 4014.8 46766.2 102757.5 15995.6 98.9 4414.8 2770.0 981.0 9791.7 2310.2 3245.9 8856.0 LP 126.6 8982.7 6672.5 LP 69.6 FY12E 130936.6 800.0 131736.6 10.9 44628.4 16897.0 4844.9 52451.4 118821.7 12914.9 -19.3 4639.6 3112.3 430.5 5593.4 3919.5 3650.7 5862.2 -33.8 280.0 6142.2 2222.7 -66.7 22.9

(| crore)

FY13E 137024.2 850.0 137874.2 4.7 45508.8 17524.8 5078.0 53720.4 121832.0 16042.2 24.2 5655.1 3272.2 600.0 7714.9 0.0 2936.8 4778.1 -18.5 165.0 4943.1 4943.1 122.4 50.9

Cash flow statement

(Year-end March) Profit after Tax Add: Depreciation (Inc)/dec in Current Assets Inc/(dec) in CL and Prov. Others CF from operating activities (Inc)/dec in Investments (Inc)/dec in Fixed Assets Others CF from investing activities Issue/(Buy back) of Equity Inc/(dec) in loan funds Dividend paid & dividend tax Inc/(dec) in Share Cap Others CF from financing activities Net Cash flow Opening Cash Closing Cash FY10 -2009.2 4491.7 10649.0 -247.4 722.7 13606.9 993.3 -4981.7 -10.8 -3999.2 -5316.0 -6800.1 -909.4 3334.3 750.4 -8940.9 666.8 6148.4 6815.1 FY11 8982.7 4414.8 -11819.4 3774.3 94.0 5446.4 -2429.6 -11012.4 4.8 -13437.1 1750.2 7584.0 -1313.5 4830.6 -783.1 12068.2 4077.5 6815.1 10892.6 FY12E 6142.2 4639.6 -7058.6 348.1 0.0 4071.2 1650.0 -4800.0 165.0 -2985.0 12.0 1000.0 -1362.9 0.0 0.0 -350.9 735.3 10892.6 11627.9

(| crore)

FY13E 4943.1 5655.1 -740.5 8386.5 0.0 18244.3 -500.0 -13800.0 80.0 -14220.0 0.0 500.0 -1362.9 0.0 0.0 -862.9 3161.4 11627.9 14789.3

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

Balance sheet

(Year-end March) Liabilities Equity Share Capital Reserve and Surplus Total Shareholders funds Total Debt Deferred Tax Liability Minority Interest & Others Total Liabilities Assets Gross Block Less: Impairment Less: Acc Depreciation Net Block CWIP Investments Goodwill on Consolidation Inventory Debtors Loans and Advances Other Current Assets Cash Total Current Assets Current Liabilities Provisions Current Liabilities & Prov Net Current Assets Misc Expenditure Application of Funds FY10 886.7 21944.6 22831.4 53100.4 1802.9 2054.7 79789.3 97289.0 2909.8 57902.9 36476.4 9319.4 5417.8 14541.8 16971.5 11512.4 6849.9 1722.7 6815.1 43871.7 23392.5 6594.2 29986.7 13885.1 148.8 79789.3 FY11 958.7 36122.6 37081.4 60684.3 2188.2 1768.3 101722.2 98101.4 3180.3 58411.8 36509.3 15884.2 7847.3 15298.2 22213.7 14816.3 9994.7 1851.4 10892.6 59768.6 26671.1 7089.9 33761.0 26007.7 175.6 101722.2 FY12E 970.7 40901.9 41872.6 61684.3 2188.2 1933.3 107678.4 108101.4 3380.3 63051.4 41669.7 10884.2 6197.3 15298.2 21902.1 17936.5 14244.7 1851.4 11627.9 67562.6 26769.2 7339.9 34109.1 33453.5 175.6 107678.4

(| crore)

FY13E 970.7 44482.1 45452.9 62184.3 2188.2 2013.3 111838.7 118101.4 3580.3 68706.5 45814.6 14884.2 6697.3 15298.2 30032.7 15016.3 9774.7 1851.4 14789.3 71464.5 34905.7 7589.9 42495.7 28968.8 175.6 111838.7

Key ratios

(Year-end March) Per share data (|) Adj EPS Cash EPS BV DPS Cash Per Share Operating Ratios (%) EBITDA Margin PBT / Total Operating income PAT Margin Inventory days Debtor days Creditor days Return Ratios (%) RoE RoCE RoIC Valuation Ratios (x) P/E EV / EBITDA EV / Net Sales Market Cap / Sales Price to Book Value Solvency Ratios Debt/EBITDA Debt / Equity Current Ratio Quick Ratio FY10 NA 28.0 257.5 8.0 76.9 7.9 1.7 -2.0 80.2 41.3 110.6 -8.8 4.7 5.1 NA 11.0 0.9 0.4 1.8 6.6 2.3 1.5 0.9 FY11 69.6 139.7 386.8 12.0 113.6 13.5 8.2 7.6 91.3 46.2 109.6 18.0 11.9 13.3 6.8 5.9 0.8 0.4 1.2 3.8 1.6 1.8 1.1 FY12E 22.9 111.1 431.3 12.0 119.8 9.8 4.2 4.7 90.0 50.0 110.0 5.3 8.0 9.0 20.6 7.4 0.7 0.3 1.1 4.8 1.5 2.0 1.3 FY13E 50.9 109.2 468.2 12.0 152.4 11.6 5.6 3.6 80.0 40.0 125.0 10.9 9.7 11.2 9.3 5.8 0.7 0.3 1.0 3.9 1.4 1.7 1.0

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 5

ICICIdirect.com coverage universe (Metals & Mining)

Adhunik Metaliks Idirect Code ADHMET CMP (|) Target (|) Upside (%) MCap (| Cr) JSW Steel Idirect Code JINVIJ CMP (|) Target (|) Upside (%) MCap (| Cr) Usha Martin Idirect Code USHBEL CMP (|) Target (|) Upside (%) MCap (| Cr) Visa Steel Idirect Code VISST CMP (|) Target (|) Upside (%) MCap (| Cr) Idirect Code 636.9 TISCO CMP (|) Target (|) Upside (%) MCap (| Cr) SAIL Idirect Code SAIL CMP (|) Target (|) Upside (%) MCap (| Cr) Sesa Goa Idirect Code 46757.5 SESGOA CMP (|) Target (|) Upside (%) MCap (| Cr) Hindustan Zinc Idirect Code HINZIN CMP (|) Target (|) Upside (%) MCap (| Cr) Idirect Code 61393.9 STEIND CMP (|) Target (|) Upside (%) MCap (| Cr) 43443.6 127.6 125.0 -2.0 Sterlite Indsutries FY10 FY11 FY12E FY13E 24410.3 30248.1 40401.1 44537.2 11.1 15.0 14.1 17.6 10.0 7.4 7.9 6.3 6.7 4.9 5.1 4.3 10.1 12.2 9.7 10.3 8.7 10.8 9.4 9.8 143.0 142.0 -0.7 FY10 FY11 FY12E FY13E 8017.0 9912.1 11586.0 12543.2 9.6 11.6 13.6 15.1 14.9 12.3 10.5 9.5 10.0 8.0 6.4 5.0 22.3 21.7 20.7 18.9 24.5 22.8 20.4 18.9 20415.2 231.0 198.0 -14.3 111.0 120.0 8.1 FY10 FY11 FY12E FY13E FY10 FY11 FY12E FY13E 41307.2 43432.8 45141.9 49726.4 5858.3 9205.1 8007.5 8183.5 16.4 11.9 9.6 10.4 31.6 48.6 29.8 39.0 6.8 9.3 11.6 10.7 6.8 4.4 7.2 5.5 3.9 6.2 8.3 8.6 5.8 3.6 6.4 7.3 20.4 13.3 9.8 9.9 33.2 33.0 17.2 18.8 20.2 13.4 8.0 8.0 31.1 37.0 17.4 12.4 46137.5 475.0 442.0 -6.9 Tata Steel - Cons FY10 FY11 FY12E FY13E 101757.8 117149.8 130936.6 137024.2 NA 69.6 22.9 50.9 NA 6.8 20.6 9.3 11.0 5.9 7.4 5.8 -8.8 18.0 5.3 10.9 4.7 11.9 8.0 9.7 57.6 53.0 -7.9 FY10 FY11 FY12E FY13E 1156.9 1305.9 1449.4 1788.5 4.5 4.7 2.6 7.3 12.9 12.3 22.0 7.9 8.4 10.7 10.3 5.2 15.4 14.4 7.5 17.2 10.0 8.5 5.2 13.8 1063.5 35.7 29.0 -18.8 FY10 FY11 FY12E FY13E 2514.4 3046.6 3379.1 3792.0 5.5 4.5 1.3 3.5 5.6 6.9 23.7 8.8 4.0 4.4 6.1 5.1 10.0 7.7 2.2 5.8 12.7 10.7 6.9 8.9 18223.1 810.0 595.0 -26.5 FY10 FY11 FY12E FY13E 18780.4 23900.2 28630.9 32448.5 85.4 78.6 53.8 70.7 9.5 10.3 15.1 11.5 6.8 6.1 6.0 5.6 17.3 10.6 7.2 8.8 11.0 9.5 10.1 9.6 657.0 54.6 37.0 -32.2 FY10 FY11 FY12E FY13E Sales (| Cr) 1449.7 1793.4 2074.9 2528.3 EPS (|) 11.1 14.8 4.9 12.5 PE (x) 4.9 3.7 11.0 3.0 EV/EBITDA (x) 5.3 5.9 6.6 4.9 RoNW(%) 19.0 21.0 6.8 15.4 RoCE(%) 12.5 10.7 9.1 11.9

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 6

Exhibit 4: Recommendation History

800 700 600 500 400 300 200 100 0 Feb-11 Mar-11 May-11 Jun-11 Price Aug-11 Sep-11 Target Price Nov-11 Dec-11 Feb-12

Source: Company, ICICIdirect.com Research

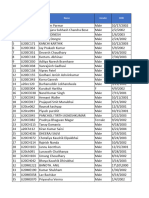

Exhibit 5: Recent Releases

Date 17-Feb-11 8-Apr-11 30-May-11 5-Jul-11 17-Aug-11 5-Oct-11 11-Nov-11 6-Jan-12 10-Feb-12 Event Q3FY11 Result Update Q4FY11 Preview Q4FY11 Result Update Q1FY12 Preview Q1FY12 Result Update Q2FY12 Result Preview Q2FY12 Result Update Q3FY12 Result Preview Q3FY12 Result Update CMP 655 630 579 597 473 401 430 364 475 Target Price 700 700 639 632 506 506 447 448 442 Rating HOLD HOLD HOLD HOLD HOLD HOLD HOLD BUY HOLD

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 7

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction; Buy: >10%/15% for large caps/midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Pankaj Pandey Head Research pankaj.pandey@icicisecurities.com ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No. 7, MIDC, Andheri (East) Mumbai 400 093 research@icicidirect.com ANALYST CERTIFICATION

We /I, Dewang Sanghavi MBA (FIN) research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.

Disclosures:

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and employees (ICICI Securities and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. It is confirmed that Dewang Sanghavi MBA (FIN) research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business. ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. It is confirmed that Dewang Sanghavi MBA (FIN) research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use of information contained in the report prior to the publication thereof. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities Ltd | Retail Equity Research

Page 8

You might also like

- INSIDE THE CRIMINAL MIND, REVISED AND UPDATED EDITION (PAPERBACK) by STANTON SAMENOW - ExcerptDocument24 pagesINSIDE THE CRIMINAL MIND, REVISED AND UPDATED EDITION (PAPERBACK) by STANTON SAMENOW - ExcerptCrown Publishing Group65% (17)

- Admissions Offer LetterDocument4 pagesAdmissions Offer LetterMohammed Abraruddin100% (1)

- Sail 1Q FY 2014Document11 pagesSail 1Q FY 2014Angel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument19 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Steel: Performance HighlightsDocument13 pagesTata Steel: Performance HighlightsAngel BrokingNo ratings yet

- J. P Morgan - Tata Steel LTDDocument15 pagesJ. P Morgan - Tata Steel LTDvicky168No ratings yet

- Steel Authority of India Result UpdatedDocument13 pagesSteel Authority of India Result UpdatedAngel BrokingNo ratings yet

- Tata Steel: Performance HighlightsDocument13 pagesTata Steel: Performance HighlightsAngel BrokingNo ratings yet

- Tata Motors: Performance HighlightsDocument15 pagesTata Motors: Performance HighlightsAngel BrokingNo ratings yet

- Tata Motors: AccumulateDocument5 pagesTata Motors: AccumulatepaanksNo ratings yet

- Market Outlook 12th August 2011Document6 pagesMarket Outlook 12th August 2011Angel BrokingNo ratings yet

- Vesuvius India: Performance HighlightsDocument12 pagesVesuvius India: Performance HighlightsAngel BrokingNo ratings yet

- IVRCL Infrastructure: Performance HighlightsDocument12 pagesIVRCL Infrastructure: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook 24th October 2011Document14 pagesMarket Outlook 24th October 2011Angel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- Ceat Result UpdatedDocument11 pagesCeat Result UpdatedAngel BrokingNo ratings yet

- Market Outlook 9th August 2011Document6 pagesMarket Outlook 9th August 2011Angel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Steel Authority of India: Performance HighlightsDocument12 pagesSteel Authority of India: Performance HighlightsAngel BrokingNo ratings yet

- Asian Paints 4Q FY 2013Document10 pagesAsian Paints 4Q FY 2013Angel BrokingNo ratings yet

- Jyoti Structures: Performance HighlightsDocument10 pagesJyoti Structures: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook 31st October 2011Document12 pagesMarket Outlook 31st October 2011Angel BrokingNo ratings yet

- Performance Highlights: Company Update - AutomobileDocument13 pagesPerformance Highlights: Company Update - AutomobileZacharia VincentNo ratings yet

- Amara Raja Batteries: Performance HighlightsDocument11 pagesAmara Raja Batteries: Performance HighlightsAngel BrokingNo ratings yet

- TTMT, 15th February 2013Document16 pagesTTMT, 15th February 2013Angel BrokingNo ratings yet

- JSW Steel: CMP: INR1,176 TP: INR1,678 BuyDocument8 pagesJSW Steel: CMP: INR1,176 TP: INR1,678 BuySUKHSAGAR1969No ratings yet

- Market Outlook 13th February 2012Document9 pagesMarket Outlook 13th February 2012Angel BrokingNo ratings yet

- Jyoti Structures 4Q FY 2013Document10 pagesJyoti Structures 4Q FY 2013Angel BrokingNo ratings yet

- Market Outlook 11th November 2011Document13 pagesMarket Outlook 11th November 2011Angel BrokingNo ratings yet

- Tata Steel 3rd QTR Fy22-23Document3 pagesTata Steel 3rd QTR Fy22-23Akshat Sharma Roll no 21No ratings yet

- Tata Steel, 1Q FY 2014Document13 pagesTata Steel, 1Q FY 2014Angel BrokingNo ratings yet

- 2qfy24 Press ReleaseDocument3 pages2qfy24 Press ReleaseAnkit jhaNo ratings yet

- Moil 1qfy2013ruDocument10 pagesMoil 1qfy2013ruAngel BrokingNo ratings yet

- Jyoti Structures (JYOSTR) : When Interest Burden Outweighs AllDocument10 pagesJyoti Structures (JYOSTR) : When Interest Burden Outweighs Allnit111100% (1)

- Market Outlook 18th January 2012Document7 pagesMarket Outlook 18th January 2012Angel BrokingNo ratings yet

- Coal India, 1Q FY 2014Document10 pagesCoal India, 1Q FY 2014Angel BrokingNo ratings yet

- Hindalco, 1Q FY 2014Document12 pagesHindalco, 1Q FY 2014Angel BrokingNo ratings yet

- Graphite India Result UpdatedDocument10 pagesGraphite India Result UpdatedAngel BrokingNo ratings yet

- Steel Authority of IndiaDocument13 pagesSteel Authority of IndiaAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Moil 2qfy2013Document10 pagesMoil 2qfy2013Angel BrokingNo ratings yet

- Sterlite Industries: Performance HighlightsDocument13 pagesSterlite Industries: Performance HighlightsAngel BrokingNo ratings yet

- Crompton Greaves: Performance HighlightsDocument12 pagesCrompton Greaves: Performance HighlightsAngel BrokingNo ratings yet

- Thermax: Performance HighlightsDocument10 pagesThermax: Performance HighlightsAngel BrokingNo ratings yet

- Acc 1Q CY 2013Document10 pagesAcc 1Q CY 2013Angel BrokingNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- Sterlite Industries: Performance HighlightsDocument13 pagesSterlite Industries: Performance HighlightsAngel BrokingNo ratings yet

- Acc 2Q Cy 2013Document10 pagesAcc 2Q Cy 2013Angel BrokingNo ratings yet

- Sembawang Marine 3 August 2012Document6 pagesSembawang Marine 3 August 2012tansillyNo ratings yet

- Hindalco: Performance HighlightsDocument15 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- IVRCL, 18th February, 2013Document11 pagesIVRCL, 18th February, 2013Angel BrokingNo ratings yet

- JP Associates: Performance HighlightsDocument12 pagesJP Associates: Performance HighlightsAngel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument11 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook 7th February 2012Document10 pagesMarket Outlook 7th February 2012Angel BrokingNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- Sterlite, 1Q FY 2014Document13 pagesSterlite, 1Q FY 2014Angel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- NMDC 1qfy2013ruDocument12 pagesNMDC 1qfy2013ruAngel BrokingNo ratings yet

- Coal India, 15th February 2013Document10 pagesCoal India, 15th February 2013Angel BrokingNo ratings yet

- Reliance Industries: Performance HighlightsDocument14 pagesReliance Industries: Performance HighlightsAngel BrokingNo ratings yet

- High Speed Steel End Mills & Milling Cutters World Summary: Market Sector Values & Financials by CountryFrom EverandHigh Speed Steel End Mills & Milling Cutters World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Northern Valley Regional HS District LawsuitDocument39 pagesNorthern Valley Regional HS District LawsuitDaniel HubbardNo ratings yet

- Aadhar Update CertificateDocument1 pageAadhar Update CertificateMAMATHA XEROX AND RECHARGES 2No ratings yet

- List of 220KV Grid Stations-NTDCDocument7 pagesList of 220KV Grid Stations-NTDCImad Ullah0% (1)

- The Absurd in Endgame and The MetamorphosisDocument7 pagesThe Absurd in Endgame and The MetamorphosisMubashra RehmaniNo ratings yet

- Featured Chaim BloomDocument2 pagesFeatured Chaim Bloomapi-583037485No ratings yet

- Reardon v. DePuy Orthopaedics - ComplaintDocument22 pagesReardon v. DePuy Orthopaedics - ComplaintGeorge ConkNo ratings yet

- Soc Sci Part 4Document4 pagesSoc Sci Part 4Girlie Ann JimenezNo ratings yet

- Training For Hygiene Promotion. Part 3: Additional Training For HP CoordinatorsDocument64 pagesTraining For Hygiene Promotion. Part 3: Additional Training For HP CoordinatorsOswar Mungkasa100% (1)

- 14 Bank of Commerce V San PabloDocument2 pages14 Bank of Commerce V San PabloAleezah Gertrude RaymundoNo ratings yet

- Thesis ProjectDocument81 pagesThesis ProjectAnne Chui Alferez Pacia50% (2)

- Raam Group Data - SVNITDocument22 pagesRaam Group Data - SVNITarjunsharma1530asdfNo ratings yet

- PPP Frame WorkDocument10 pagesPPP Frame WorkchelimilNo ratings yet

- Info Iec60376 (Ed3.0) enDocument6 pagesInfo Iec60376 (Ed3.0) enjycortes0% (1)

- Year 4 Module Sample Essays TextbookDocument42 pagesYear 4 Module Sample Essays TextbookShanthi RamanathanNo ratings yet

- Magna Carta of PWDDocument56 pagesMagna Carta of PWDPatrice De CastroNo ratings yet

- Gmi12 27Document3 pagesGmi12 27ashaik1No ratings yet

- E-Tender Document Tender For Supply of Blood Bags, Test Kits and Reagents For The Year-2018-19Document102 pagesE-Tender Document Tender For Supply of Blood Bags, Test Kits and Reagents For The Year-2018-19Moath AlshabiNo ratings yet

- Creating A Diagram of The Film Company LANDocument3 pagesCreating A Diagram of The Film Company LANonlycisco.tkNo ratings yet

- LGBT FactsDocument43 pagesLGBT Factsjohn kaneNo ratings yet

- Elements of A Negligence Claim: Car Accidents Slip and FallDocument19 pagesElements of A Negligence Claim: Car Accidents Slip and FallOlu FemiNo ratings yet

- The Red Pyramid: By: Rick RiordanDocument4 pagesThe Red Pyramid: By: Rick RiordanTejas KumarNo ratings yet

- System Requirements Specifications SampleDocument12 pagesSystem Requirements Specifications SampleEbbyNo ratings yet

- Batik Fabric Bangkok Thailand With Low PriceDocument3 pagesBatik Fabric Bangkok Thailand With Low PriceAjeng Sito LarasatiNo ratings yet

- MNM Chambal PresentationDocument26 pagesMNM Chambal PresentationMukteshwar MishraNo ratings yet

- One Minute Video GuideDocument49 pagesOne Minute Video GuideRizuan RazifNo ratings yet

- People V MendozaDocument4 pagesPeople V MendozaKrys MartinezNo ratings yet

- Environmental Study Report - Fort York Pedestrian & Cycle BridgeDocument143 pagesEnvironmental Study Report - Fort York Pedestrian & Cycle BridgeReivax50No ratings yet

- The Industrial Revolution Slideshow: Questions/Heading Answers/InformationDocument5 pagesThe Industrial Revolution Slideshow: Questions/Heading Answers/InformationMartin BotrosNo ratings yet