Professional Documents

Culture Documents

Market Commentary 5/2/2012

Market Commentary 5/2/2012

Uploaded by

CJ MendesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Commentary 5/2/2012

Market Commentary 5/2/2012

Uploaded by

CJ MendesCopyright:

Available Formats

C.J. Mendes Trading Options For Income 8770 Sunset Drive 201 Miami Florida 33143 305-631-2239 www.tradingoptionsforincome.

com

Wednesday, May 02, 2012

So after a string of clearly weak economic data, yesterday we get a very strong ISM manufacturing report showing a big jump in domestic manufacturing activity. This is in contrast to the recent regional data and it did catch the market leaning bearish. Today in turn we get some indications that the jobs picture is weakening globally and some very weak PMI data from across Europe suggest a deeper recession ahead. This caught the market leaning a bit bullish even though yesterdays did suggest some skepticism of the strong ISM data. Mixed signals from the economy is par for the course these days! So can the U.S. economy decouple from Europe? From a general market fundamental point of view, this has to be the most important question for traders and investors. Last year the answer from most was that decoupling was not likely and what ailed Europe would affect the U.S. and would therefore be reflected in equity markets. This year following the actions of the ECB, the market seems to believe that they have done enough to contain any fallout and avert contagion to the broad Global economy. I dont believe that the 2 largest economies in the world can decouple to this extent. I would agree that the central banks have perhaps taken the worst case scenarios off the immediate horizon, but not that the U.S. economy can completely shed the effects of a worsening economic downturn in Europe. This disparity between European and American equity market performance will eventually narrow. Those who believe the decoupling theory will state that emerging markets will make up for the weaker demand from established markets. While I agree this makes for a compelling long term argument for equities, I dont see the BRICs being able to provide sufficient near term growth to dampen the short term effects of the slowdown in Europe and the U.S. China seems to be slowing down with its own issues and so is Brazil. The debate most short term participants are having today is whether or not the correction is completed. From a true broad market overbought/oversold point of view which, in my estimation, is the percentage of NYSE stocks above or below 2 standard deviations from their 40 day moving averages respectively, we are about at the middle of the range. At the moment we are at about 15% of NYSE stocks trading two standard deviation or more above their 40 day MA. Historically, figures above 35% are considered overbought and extremely overbought conditions at levels above 40%. As a point of reference in late October of last year the NYSE had 50% of its stocks trading at or above 2 standard deviations from their 40 day moving averages! Strong bottoms usually come in when these same indicators show readings below 3%. So from this perspective, markets seem to be fairly balanced, not really overbought or oversold. These are very important indicators for index/sector traders as it gives us a indication of true overbought/oversold conditions from the perspective of the actual components of an index, the meat and potatos, rather than just a perspective from the day to day price action of the ETF. Again these are not necessarily to be used for entry and exit signals but they do make a world of difference when trying to make sense of stochastic readings. Looking at the stochastic chart to the right, we can see the differences in overbought readings from both late October 11 and from the recent peaks. Note that the peak in late March into overbought has come with a substantially lower number of stocks trading 2 standard deviations above their 40 day MAs. The most recent peak which we are seeing at the moment to the far right of the chart is even narrower with yet a lower number of stocks trading 2 standard deviations above their 40 day MAs. So bottomline is that we should be seeing around twice the number of stocks trading stocks trading 2 standard deviations above their 40 day MAs at this point. The fact that it is contracting instead is a strong indication that the most probable direction for the near term is lower. Obviously these are fluid readings and a spike in the breadth charts could quickly take this from a bad over bought to a good overbought, but as of now, that is not the case.

No statement in this web site is to be construed as a recommendation by Madeira Investments LLC. , Madeira Trading Newsletter and/or Trading Options For Income to purchase or sell a security, or to provide investment advice. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options . Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, One North Wacker Dr., Suite 500 Chicago, IL 60606 (1-800-678-4667).

Page 1

You might also like

- Chapter 1: Base Knowledge Worksheet: Name: - DateDocument370 pagesChapter 1: Base Knowledge Worksheet: Name: - DateMartim Coutinho100% (2)

- TAVISTOCK Psychialry MK-ULTRA EIR PDFDocument8 pagesTAVISTOCK Psychialry MK-ULTRA EIR PDFHANKMAMZERNo ratings yet

- Euro Experiment: Test Results Are In: October 2011 EditionDocument27 pagesEuro Experiment: Test Results Are In: October 2011 EditionnicknyseNo ratings yet

- The Feds Invisible Moving TargetDocument12 pagesThe Feds Invisible Moving TargetJose Fernando PereiraNo ratings yet

- Ulman Financial Fourth Quarter Newsletter - 2018-10Document8 pagesUlman Financial Fourth Quarter Newsletter - 2018-10Clay Ulman, CFP®No ratings yet

- Real Investment ReportDocument24 pagesReal Investment ReportGediminas VedrickasNo ratings yet

- X-Factor Report 1/28/13 - Will The Market Ever Correct?Document10 pagesX-Factor Report 1/28/13 - Will The Market Ever Correct?streettalk700No ratings yet

- Consulting Our Technical Playbook: MarketDocument5 pagesConsulting Our Technical Playbook: MarketdpbasicNo ratings yet

- X-Factor091214 - As The Fed Leaves Markets StagnateDocument17 pagesX-Factor091214 - As The Fed Leaves Markets StagnateJamesNo ratings yet

- 2013 09sep015 Update and CommentaryDocument5 pages2013 09sep015 Update and CommentaryRoger StephensNo ratings yet

- The Pensford Letter - 10.24.11Document7 pagesThe Pensford Letter - 10.24.11Pensford FinancialNo ratings yet

- FX 20140626Document2 pagesFX 20140626eliforuNo ratings yet

- Recap of Last Week's Watchlist:: Weekly Watchlist For Free MembersDocument7 pagesRecap of Last Week's Watchlist:: Weekly Watchlist For Free MembersSebastian NilssonNo ratings yet

- Market Haven Monthly Newsletter - July 2011Document11 pagesMarket Haven Monthly Newsletter - July 2011MarketHavenNo ratings yet

- RD 110601Document2 pagesRD 110601Minh NguyenNo ratings yet

- Cloud Alpha Newsletter Sept629Document11 pagesCloud Alpha Newsletter Sept629Pui SanNo ratings yet

- Bill Miller 2010 01 CommentaryDocument3 pagesBill Miller 2010 01 CommentarytekesburNo ratings yet

- Black Swan Capital July 10Document5 pagesBlack Swan Capital July 10ZerohedgeNo ratings yet

- Managed Futures and A Bond Bubble: September 13, 2010Document6 pagesManaged Futures and A Bond Bubble: September 13, 2010intercontiNo ratings yet

- T MKC G R: HE Loba L EportDocument3 pagesT MKC G R: HE Loba L EportMKC GlobalNo ratings yet

- TomT Stock Market Model 2012-05-20Document20 pagesTomT Stock Market Model 2012-05-20Tom TiedemanNo ratings yet

- Hither and WhenceDocument13 pagesHither and WhenceHmt NmslNo ratings yet

- Vital Signs: Death Cross-Dow Theory Warns?Document4 pagesVital Signs: Death Cross-Dow Theory Warns?GauriGanNo ratings yet

- 2019-8-05 Inaugural EditionDocument5 pages2019-8-05 Inaugural Editionsvejed123No ratings yet

- Securities Offered Through LPL Financial, Member FINRA/SIPC. LPL Compliance Tracking #1-264181Document7 pagesSecurities Offered Through LPL Financial, Member FINRA/SIPC. LPL Compliance Tracking #1-264181Clay Ulman, CFP®No ratings yet

- Signs of Risk Aversion ReturnsDocument5 pagesSigns of Risk Aversion ReturnsValuEngine.comNo ratings yet

- 7-24-12 How Bad Can It Get?Document3 pages7-24-12 How Bad Can It Get?The Gold SpeculatorNo ratings yet

- The Pensford Letter - 5.18.15Document6 pagesThe Pensford Letter - 5.18.15Pensford FinancialNo ratings yet

- Market Commentary 04/23/2012Document1 pageMarket Commentary 04/23/2012CJ MendesNo ratings yet

- Coronavirus and Its Impact On Global Financial MarketsDocument3 pagesCoronavirus and Its Impact On Global Financial MarketsAnkur ShardaNo ratings yet

- Thursday 1 October 2009Document6 pagesThursday 1 October 2009ZerohedgeNo ratings yet

- The Year Ahead - Financial TimesDocument6 pagesThe Year Ahead - Financial TimesLow chee weiNo ratings yet

- Global Macro Commentary Nov 12Document2 pagesGlobal Macro Commentary Nov 12dpbasicNo ratings yet

- Tear Sheet July 2016Document26 pagesTear Sheet July 2016Dr Bugs TanNo ratings yet

- Market Analysis November 2020Document21 pagesMarket Analysis November 2020Lau Wai KentNo ratings yet

- When Bubble Meets TroubleDocument21 pagesWhen Bubble Meets TroubleViswanathan SundaresanNo ratings yet

- March 292010 PostsDocument12 pagesMarch 292010 PostsAlbert L. PeiaNo ratings yet

- Summary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterFrom EverandSummary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterNo ratings yet

- Send An Email To Eirik - Moe@gmail - Com If You Would Like To Be Added To The Distribution ListDocument6 pagesSend An Email To Eirik - Moe@gmail - Com If You Would Like To Be Added To The Distribution ListEirik W. MoeNo ratings yet

- Article 2014 06 Analytic Insights Mispriced RiskDocument12 pagesArticle 2014 06 Analytic Insights Mispriced RisklcmgroupeNo ratings yet

- TRIGGER$ - May 2011Document37 pagesTRIGGER$ - May 2011goldenphiNo ratings yet

- Course Handouts For March 20 STDocument6 pagesCourse Handouts For March 20 STherojit ngangbamNo ratings yet

- The Pensford Letter - 6.3.13Document7 pagesThe Pensford Letter - 6.3.13Pensford FinancialNo ratings yet

- FPA Crescent Qtrly Commentary 0911Document4 pagesFPA Crescent Qtrly Commentary 0911James HouNo ratings yet

- The Monarch Report 6-18-2012Document4 pagesThe Monarch Report 6-18-2012monarchadvisorygroupNo ratings yet

- March 112010 PostsDocument10 pagesMarch 112010 PostsAlbert L. PeiaNo ratings yet

- Why Prices Really Move in A MarketDocument4 pagesWhy Prices Really Move in A MarketMichael MarioNo ratings yet

- Day Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)From EverandDay Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)No ratings yet

- Alpha Fractal ReportDocument7 pagesAlpha Fractal Reportapi-213311303No ratings yet

- August 182010 PostsDocument273 pagesAugust 182010 PostsAlbert L. PeiaNo ratings yet

- MKT ThoughtsDocument6 pagesMKT ThoughtselmoatazshawkyNo ratings yet

- Victor Niederhoffer On Trend FollowingDocument9 pagesVictor Niederhoffer On Trend FollowingJack JensenNo ratings yet

- August 172010 PostsDocument269 pagesAugust 172010 PostsAlbert L. PeiaNo ratings yet

- Calling All Traders Get Ready To Make Money Shorting The MarketDocument5 pagesCalling All Traders Get Ready To Make Money Shorting The MarketMarci HajduNo ratings yet

- Insider Weekly 20161120Document8 pagesInsider Weekly 20161120alikarimiak1347No ratings yet

- Beware The Dreaded Anchoring BiasDocument2 pagesBeware The Dreaded Anchoring BiasbenclaremonNo ratings yet

- Strategy Zim 0221 CtaDocument63 pagesStrategy Zim 0221 CtaDAVID ISAZA CADAVIDNo ratings yet

- Option Special Report PDFDocument22 pagesOption Special Report PDFbastian_wolf100% (1)

- Gilmo Report Feb 2 2011Document9 pagesGilmo Report Feb 2 2011Alessandro Ortiz FormoloNo ratings yet

- How To Use IG Client SentimentDocument7 pagesHow To Use IG Client SentimentRJ Zeshan AwanNo ratings yet

- Bear Marke - CorrecDocument30 pagesBear Marke - CorrecSoren K. GroupNo ratings yet

- Pay Attention To What The Market Is SayingDocument11 pagesPay Attention To What The Market Is SayingEmmy ChenNo ratings yet

- Focus Group Discussion Questionnaire (24.01.2022)Document4 pagesFocus Group Discussion Questionnaire (24.01.2022)Mohammed EcoNo ratings yet

- Review Paper: (2016) Int. Res. J. Social SciDocument7 pagesReview Paper: (2016) Int. Res. J. Social Scimesut reusNo ratings yet

- Cadenas Drives USA PDFDocument238 pagesCadenas Drives USA PDFCamilo Araya ArayaNo ratings yet

- McCAMISH HelpDocument39 pagesMcCAMISH HelpSrinivas BalledaNo ratings yet

- Reporting in Seam5 Group 3Document5 pagesReporting in Seam5 Group 3Frednixen GapoyNo ratings yet

- AZIZ Ur RehmanDocument3 pagesAZIZ Ur Rehmantop writerNo ratings yet

- Sefer YetzirahDocument12 pagesSefer YetzirahChild of EnochNo ratings yet

- Royalton Hotel Dubai Hotel VoucherDocument1 pageRoyalton Hotel Dubai Hotel VoucherGabriel OmoluruNo ratings yet

- Gilgit-Baltistan: Administrative TerritoryDocument12 pagesGilgit-Baltistan: Administrative TerritoryRizwan689No ratings yet

- Mrunal Explained: Cheque Truncation System CTS-features, BenefitsDocument3 pagesMrunal Explained: Cheque Truncation System CTS-features, BenefitsPrateek BayalNo ratings yet

- Karunanidhi FamilyDocument6 pagesKarunanidhi FamilyAnonymous 9uu04elNo ratings yet

- Recruitment & Selection PolicyDocument7 pagesRecruitment & Selection PolicyAnonymous CmDManNo ratings yet

- Suplemental Affidavit of MeritDocument21 pagesSuplemental Affidavit of MeritSLAVEFATHERNo ratings yet

- Magic Quadrant For 5G Network Infrastructure For Communications Service ProvidersDocument19 pagesMagic Quadrant For 5G Network Infrastructure For Communications Service ProvidersRazman Rashid100% (1)

- EpicorDocument15 pagesEpicorsalesh100% (1)

- Towards A Sustainable Transportation Environment. The Case of Pedicabs and Cycling in The Philippines Brian GOZUN Marie Danielle GUILLENDocument8 pagesTowards A Sustainable Transportation Environment. The Case of Pedicabs and Cycling in The Philippines Brian GOZUN Marie Danielle GUILLENChristian VenusNo ratings yet

- 81 Department of Commerce PDFDocument17 pages81 Department of Commerce PDFDrAbhishek SarafNo ratings yet

- Understand Arabic in 12 Coloured TablesDocument36 pagesUnderstand Arabic in 12 Coloured Tablesspeed2kx100% (1)

- Booking Report 6-11-2021Document3 pagesBooking Report 6-11-2021WCTV Digital TeamNo ratings yet

- Shouldice Hospital: Libiran. Mindanao. TormoDocument21 pagesShouldice Hospital: Libiran. Mindanao. TormoDavid ManzoNo ratings yet

- PC 1 2022Document92 pagesPC 1 2022Dea Rose Jacinto Amat-MallorcaNo ratings yet

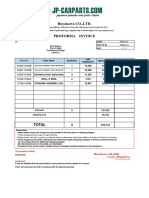

- Hayakawa CO.,LTD.: TO: Dated: 08/01/19 Invoice No.: 190801421 1 / 1Document1 pageHayakawa CO.,LTD.: TO: Dated: 08/01/19 Invoice No.: 190801421 1 / 1Earl CharlesNo ratings yet

- DFW11 014Document4 pagesDFW11 014ntcbffaNo ratings yet

- Impact of Christian Religious Involvement To The Stress Coping Mechanisms of Senior High Learners - Revised PaperDocument16 pagesImpact of Christian Religious Involvement To The Stress Coping Mechanisms of Senior High Learners - Revised PaperShiera Mae PuguonNo ratings yet

- Sept. 5, 1969, Issue of LIFE MagazineDocument7 pagesSept. 5, 1969, Issue of LIFE MagazineDoghouse ReillyNo ratings yet

- Thomas Hobbes: Alarcon, Maria Teresa LDocument3 pagesThomas Hobbes: Alarcon, Maria Teresa LNievesAlarcon100% (1)

- Flight TicketDocument3 pagesFlight TicketAkshay KanyanNo ratings yet

- Einstein God Does Not Play Dice SecDocument11 pagesEinstein God Does Not Play Dice SecyatusacomosaNo ratings yet