Professional Documents

Culture Documents

Pages From Bsa

Pages From Bsa

Uploaded by

Syed Abdul QadirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pages From Bsa

Pages From Bsa

Uploaded by

Syed Abdul QadirCopyright:

Available Formats

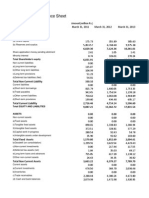

Financial Statement Analysis of Non Financial Sector 2010

Azgard Nine Ltd.(Legler-Nafees Denim Mills Ltd.)

Items

A.Non-Current Assets (A1+A3+A5+A6+A7)

1.Capital work in progress

2.Operating fixed assets at cost

3.Operating fixed assets after deducting accumulated depreciation

4.Depreciation for the year

5.Intangible assets

6.Long term investments

7.Other non-current assets

B.Current Assets (B1+B2+B3+B4+B5)

1.Cash & bank balance

2.Inventories

3.Trade Debt

4.Short term investments

5.Other current assets

C.Current Liabilities (C1+C2)

1.Short term Secured loans

2.Other current liabilities

D.Non-Current Liabilities (D1+D2+D3+D4+D5)

1.Long term secured loans

2.Long term unsecured loans

3.Debentures/TFCs

4.Employees benefit obligations

5.Other non-current liabilities

E.Shareholders Equity (E1+E2+E3)

1.Issued, Subscribed & Paid up capital

i).Ordinary Shares

ii).Preference shares

2.Reserves

i).Capital Reserve

ii).Revenue Reserve

3.Surplus on revaluation of fixed assets

(Thousand Rupees)

2009

2010

2005

2006

2007

2008

5,668,395

23,784,946

24,244,939

8,687,158

42,857,047

42,857,047

6,913,340

26,418,548

27,786,186

11,275,747

7,380,422

39,901,859

7,380,422

39,901,859

5,594,458

264,284

20,013,878

535,228

20,482,735

729,590

8,653,622

538,506

29,696,709

18,408

29,696,709

18,408

73,937

3,771,068

3,762,204

33,536

5,645,096

37

5,645,096

37

4,915,508

7,062,660

9,451,173

18,684,515

134,783

15,638,041

134,783

15,638,041

46,283

1,132,967

630,082

82,074

437,814

437,814

2,123,665

1,034,669

2,903,999

1,520,389

2,532,100

2,366,279

4,034,103

0

5,985,036

4,586,931

5,985,036

4,586,931

760,796

950,095

49

1,505,256

882,995

3,039,717

11,540,498

3,027,840

0

4,628,260

0

4,628,260

4,491,017

3,532,298

9,935,874

7,877,741

10,686,285

5,429,188

10,353,720

7,302,259

24,459,435

16,402,024

24,459,435

16,402,024

958,719

2,718,407

2,058,133

11,249,254

5,257,097

13,441,452

3,051,461

6,674,514

8,057,411

18,224,297

8,057,411

18,224,297

15,684,724

15,684,724

2,393,670

7,712,953

10,404,259

3,962,461

392,185

0

392,185

0

324,737

3,536,301

3,037,193

2,712,053

0

2,147,388

0

2,147,388

3,374,479

1,737,308

9,662,478

3,788,839

9,568,375

3,788,823

10,343,439

3,827,119

15,811,356

4,879,344

15,811,356

4,879,344

868,654

868,654

1,637,171

3,127,101

661,738

5,873,639

3,127,135

661,688

5,779,552

3,827,119

0

6,516,320

4,548,719

330,625

6,962,860

3,152,134

3,810,726

4,548,719

330,625

6,962,860

3,152,134

3,810,726

3,969,152

3,969,152

4,662,202

791,645

3,870,557

3,523,721

6,624,764

2,492,848

4,131,916

4,731,960

12,936,942

7,504,488

5,432,454

8,362,558

11,827,025

11,724,806

102,219

8,238,448

1,138,481

363,755

1,892,804

563,152

4,574,384

841,802

3,588,577

1,089,025

26,276,262

14,524,421

11,751,841

17,982,858

6,401,919

11,580,939

8,293,405

2,141,365

782,580

1,358,784

26,276,262

14,524,421

11,751,841

17,982,858

6,401,919

11,580,939

8,293,405

2,141,365

782,580

1,358,784

2,693,503

4,791,419

4,917,049

1,363,061

157,119

29,591

0

1,292,451

F.Operation:

1.Sales

i).Local sales (Net)

ii).Export Sales (Net)

2.Cost of sales

i).Cost of material

ii).Other input cost

3.Gross Profit

4.General, administrative and other expenses

i).Selling & distribution expenses

ii).Administrative and other expenses

5.Salaries, wages and employee benefits

6.Financial expenses

of which: (i) Interest expenses

7.Net profit before tax

8.Tax provision (current year)

9.Total amount of dividend

10.Total value of bonus shares issued

11.Cash flows from operations

363,755

563,152

841,802

1,089,025

790,070

47,858

164,610

0

213,982

123,640

210,493

0

1,916,324

100,401

343,981

0

(1,457,675)

13,287,571

0

0

2,693,503

4,791,419

4,917,049

1,363,061

157,119

29,591

0

1,292,451

6,092,886

2,393,670

577,602

5,925,968

20,911,732

7,712,953

(120,151)

15,590,694

23,009,827

10,404,259

1,471,942

15,833,447

17,017,953

3,962,461

(14,745,246)

11,264,720

34,035,653

15,684,724

1,176,351

32,086,748

34,035,653

15,684,724

1,176,351

32,086,748

0.41

6.23

22.19

0.44

1.09

75.58

2.14

9.36

25.52

16.16

4.51

2.20

0.27

17.92

22.95

0.21

0.71

71.43

2.19

1.03

3.28

1.58

0.43

2.28

0.36

16.64

18.29

0.38

0.88

64.64

2.52

5.94

19.93

8.73

5.28

5.11

1.12

39.04

0.00

0.43

1.80

69.66

1.65

-4.77

-14.64

-7.28

0.21

18.23

17.46

0.45

0.64

68.44

2.70

3.17

10.42

5.34

40.75

4.39

1.28

5.19

0.03

2.65

34.76

0.21

18.23

17.46

0.45

0.64

68.44

2.70

2.33

8.62

4.00

40.75

4.39

1.28

5.19

0.03

2.65

34.76

290,509

1,187,224

2,152,438

4,617,259

G.Miscellaneous

1.Total capital employed (E+D)

2.Total fixed liabilities (D1+D3)

3.Retention in business (F7-F8-F9)

4.Contractual Liabilities (G2+C1)

H.Key Performance Indicators

1.Acid test or quick ratio[(B1+B3+B4) to C]

2.Financial expenses as % of sales (F6 as % of F1)

3.Trade Debt as % of sales (B3 as % of F1)

4.Assets turnover ratio [F1 to (A+B)]

5.Current ratio (B to C)

6.Cost of goods sold to sales (F2 as % of F1)

7.Debt equity ratio [(C+D) to E]

8.Return on assets [F7 as % of avg.(A+B)]

9.Return of equity (F7 as % of avg. E)

10.Return on capital employed ( F7 as % of avg. G1)

11.Dividend cover ratio [(F7-F8) to F9]

12.Inventory Turnover Ratio (F1 to B2)

13.Interest cover ratio [(F7+ F6(i)) to F6(i)]

14.Net profit margin (F7 as % of F1)

15.Operating cash flow to debt ratio [F11 to (C+D)]

16.Earning per share after tax (Rs./share) [(F7-F8)/No. of Ord. shares]

17.Break-up value shares (Rs./share) (E/No. of Ord. shares)

30

2.93

16.95

0.00

8.54

38.85

3.23

0.00

0.29

30.90

14.81

0.00

5.81

30.60

-12.32

0.00

-38.53

27.03

You might also like

- 3 - Sbi FFR I & II FormatDocument3 pages3 - Sbi FFR I & II FormatCA Shailendra Singh78% (9)

- Bond Portfolio ManagementDocument90 pagesBond Portfolio ManagementAbhishek DuaNo ratings yet

- Fisher Separation TheoremDocument31 pagesFisher Separation TheoremArdi Gunardi0% (3)

- Factors Determining The Performance of Early Stage High-Technology Venture Capital Funds - A Review of The Academic LiteratureDocument67 pagesFactors Determining The Performance of Early Stage High-Technology Venture Capital Funds - A Review of The Academic LiteraturedmaproiectNo ratings yet

- Pakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)Document16 pagesPakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)0300MalikamirNo ratings yet

- Petroleum BSA 06 10Document44 pagesPetroleum BSA 06 10Haji Suleman AliNo ratings yet

- Cement2001 2006Document1 pageCement2001 2006Mahnoor KhanNo ratings yet

- Financial Statement Analysis of Non Financial SectorDocument6 pagesFinancial Statement Analysis of Non Financial SectorTayyaub khalidNo ratings yet

- Bawany Air Products LTDDocument1 pageBawany Air Products LTDDostmuhammad01No ratings yet

- Year Ended/Ending On March 31 No - of Months: ActualDocument14 pagesYear Ended/Ending On March 31 No - of Months: ActualVinod JainNo ratings yet

- Barwa Real Estate Balance Sheet Particulars Note NoDocument28 pagesBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarNo ratings yet

- CMA FinalDocument62 pagesCMA FinalKartik DoshiNo ratings yet

- 16 Format of Financial Follow Up Report SbiDocument4 pages16 Format of Financial Follow Up Report SbiSandeep PahwaNo ratings yet

- IBF QuestionDocument13 pagesIBF QuestionSaqib JawedNo ratings yet

- Cma AFSDocument14 pagesCma AFSvijayNo ratings yet

- Accounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Document1 pageAccounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Jatin GuptaNo ratings yet

- Financial Follow Up Report (FFR-II)Document3 pagesFinancial Follow Up Report (FFR-II)Kiran ThakkerNo ratings yet

- Ref: Code No. 530427: Encl: As AboveDocument3 pagesRef: Code No. 530427: Encl: As AboveShyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- SEBI Apr 25 2011Document2 pagesSEBI Apr 25 2011reachsubbusNo ratings yet

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocument7 pagesSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirNo ratings yet

- Year 1 Year 2 Year 3 Year 4: Finance Formulas Financial Ratio AnalysisDocument3 pagesYear 1 Year 2 Year 3 Year 4: Finance Formulas Financial Ratio Analysisalsaban_7No ratings yet

- 5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)Document9 pages5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)herenasir4uNo ratings yet

- Balance Sheet With Ratios1Document1 pageBalance Sheet With Ratios1RioChristianGultomNo ratings yet

- Format of The Revised Schedule VIDocument2 pagesFormat of The Revised Schedule VIJoydip DasNo ratings yet

- Last Years Actuals As Per The Audited Accounts Current Years Estimates Following Years ProjectionsDocument22 pagesLast Years Actuals As Per The Audited Accounts Current Years Estimates Following Years ProjectionsAnupam BaliNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Business Plan Format - Part 04Document6 pagesBusiness Plan Format - Part 04kalana heshanNo ratings yet

- Business FinanceDocument4 pagesBusiness FinanceJinkee F. Sta MariaNo ratings yet

- Financial Results Sep 2011Document1 pageFinancial Results Sep 2011Shankar GargNo ratings yet

- 3 - Sbi FFR I & II FormatDocument3 pages3 - Sbi FFR I & II FormatArti BalujaNo ratings yet

- 42 FFR 1 2 FormatDocument3 pages42 FFR 1 2 FormatpraveenNo ratings yet

- 3 - Sbi FFR I & II FormatDocument3 pages3 - Sbi FFR I & II FormatArti BalujaNo ratings yet

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- 0452 s13 Ms 11Document8 pages0452 s13 Ms 11Naðooshii AbdallahNo ratings yet

- FORMAT P&L and BSDocument8 pagesFORMAT P&L and BSPrachi MurarkaNo ratings yet

- Exhibit 6.3 Margin Money For Working CapitalDocument12 pagesExhibit 6.3 Margin Money For Working Capitalanon_285857320No ratings yet

- Sebi Million Q3 1213 PDFDocument2 pagesSebi Million Q3 1213 PDFGino SunnyNo ratings yet

- Particulars Equity and Liabilities Shareholders' FundsDocument6 pagesParticulars Equity and Liabilities Shareholders' FundsAnonymous MIMwLdPNo ratings yet

- Financial Accounting Chapter 12 - Business Decisions and Financial Accounting Solutions Answers To Mini-Exercises M1-1 Abbreviation Full DesignationDocument31 pagesFinancial Accounting Chapter 12 - Business Decisions and Financial Accounting Solutions Answers To Mini-Exercises M1-1 Abbreviation Full DesignationChiến Cao DuyNo ratings yet

- Financial Statements & Analysis 2024 SPCCDocument29 pagesFinancial Statements & Analysis 2024 SPCCSaturo GojoNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document1 pageStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Mamta Fasshion Balnc SheetDocument7 pagesMamta Fasshion Balnc SheetSusruth DamodaranNo ratings yet

- Highlights Dec 11Document2 pagesHighlights Dec 11ashokchhotuNo ratings yet

- Theory For Financial Statements of A Company 2nd Puc AccountancyDocument5 pagesTheory For Financial Statements of A Company 2nd Puc Accountancykakashihatake371No ratings yet

- Format of Revised Schedule VI To The Companies Act 1956 in ExcelDocument2 pagesFormat of Revised Schedule VI To The Companies Act 1956 in ExcelAman ThindNo ratings yet

- Ceres Gardening Company Submission TemplateDocument7 pagesCeres Gardening Company Submission TemplateAnkur PansaraNo ratings yet

- Scribd: Solutions. ThanksDocument6 pagesScribd: Solutions. ThanksAnees ChampNo ratings yet

- Analysis of Apollo TiresDocument12 pagesAnalysis of Apollo TiresTathagat ChatterjeeNo ratings yet

- Particulars: Form II Operating StatementDocument26 pagesParticulars: Form II Operating StatementvineshjainNo ratings yet

- 0452 s11 Ms 22Document9 pages0452 s11 Ms 22Athul TomyNo ratings yet

- of Revised Schdule Vi1Document43 pagesof Revised Schdule Vi1Jay RoyNo ratings yet

- Table 4.1-Overall Balance of PaymentsDocument4 pagesTable 4.1-Overall Balance of PaymentsPrasanth BalantrapuNo ratings yet

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDocument16 pagesICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementbalajeenarendraNo ratings yet

- Fundamentals of Finance: Ignacio Lezaun English Edition 2021Document13 pagesFundamentals of Finance: Ignacio Lezaun English Edition 2021Elias Macher CarpenaNo ratings yet

- 7110 w11 Ms 21Document10 pages7110 w11 Ms 21mstudy123456No ratings yet

- Audited Financial 2011Document1 pageAudited Financial 2011gayatri9324814475No ratings yet

- Financial Results, Auditors Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Auditors Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Statement Analysis & Reporting Assignment IV: (C) Balance SheetDocument3 pagesFinancial Statement Analysis & Reporting Assignment IV: (C) Balance SheetmariyaNo ratings yet

- DCF Method of ValuationDocument45 pagesDCF Method of Valuationnotes 1No ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Final Annual Report 2019Document174 pagesFinal Annual Report 2019Wajeeha IftikharNo ratings yet

- Afm Unit 1 Total NotesDocument26 pagesAfm Unit 1 Total NotesanglrNo ratings yet

- DOSRI AccountsDocument3 pagesDOSRI AccountsJanna Robles SantosNo ratings yet

- ch11 Doc PDF - 2 PDFDocument39 pagesch11 Doc PDF - 2 PDFRenzo RamosNo ratings yet

- Polytechnic University of The PhilippinesDocument88 pagesPolytechnic University of The PhilippinesZejkeara ImperialNo ratings yet

- KCL 4Q 2017 Results Transcript PDFDocument9 pagesKCL 4Q 2017 Results Transcript PDFSoftPaperNo ratings yet

- Quantitative Analysis PDFDocument303 pagesQuantitative Analysis PDFamiller1987No ratings yet

- Free Mock Test For Jaiib & CaiibDocument5 pagesFree Mock Test For Jaiib & CaiibBiswajit DasNo ratings yet

- Annual Report 2005Document132 pagesAnnual Report 2005zackypragmaNo ratings yet

- Accounting Standard-18: Related Party DisclosureDocument26 pagesAccounting Standard-18: Related Party DisclosurelulughoshNo ratings yet

- Advanced Cost Accounting: Marginal CostingDocument41 pagesAdvanced Cost Accounting: Marginal CostingManaliNo ratings yet

- Opportunity CostDocument12 pagesOpportunity Costsowmya100% (2)

- Session 3 - ACLO - Lecture PDFDocument9 pagesSession 3 - ACLO - Lecture PDFQamber AliNo ratings yet

- Ekta Kapoor BiographyDocument18 pagesEkta Kapoor BiographyRahul JaiswarNo ratings yet

- Indiareit Domestic Fund IV PresentationDocument28 pagesIndiareit Domestic Fund IV PresentationChetan Mukhija100% (1)

- Chapter Three How Financial Statements Are Used in ValuationDocument35 pagesChapter Three How Financial Statements Are Used in ValuationSilvia WongNo ratings yet

- HSBC Amanah Homeowner Takaful Certificate Jan2012Document33 pagesHSBC Amanah Homeowner Takaful Certificate Jan2012Monica HenryNo ratings yet

- AB Bank Final ReportDocument72 pagesAB Bank Final ReportShahjalal Sumon100% (1)

- Connecticut Foreclosure EventDocument2 pagesConnecticut Foreclosure EventHelen BennettNo ratings yet

- Ratio Analysis in Business Decisions@ Bec DomsDocument85 pagesRatio Analysis in Business Decisions@ Bec DomsBabasab Patil (Karrisatte)No ratings yet

- Welding Electrode Manufacturing Plant. Production of Stick Electrodes, Welding Rods, Weld Rods.-77816 PDFDocument65 pagesWelding Electrode Manufacturing Plant. Production of Stick Electrodes, Welding Rods, Weld Rods.-77816 PDFJatin Shandilya50% (2)

- Filipino Sa Piling LaranganDocument6 pagesFilipino Sa Piling LaranganIvy Joy AutorNo ratings yet

- Fraud Risk FactorsDocument7 pagesFraud Risk FactorsFrancis Azul SimalongNo ratings yet

- Accounting QuizDocument25 pagesAccounting QuizabhishekNo ratings yet

- Macquarie - India Consumer Sector - Shifting To Higher Orbit of Growth - Aug 2018Document37 pagesMacquarie - India Consumer Sector - Shifting To Higher Orbit of Growth - Aug 2018Raghav BhatnagarNo ratings yet

- Australian Visa NotesDocument37 pagesAustralian Visa NotesBitu Thomas100% (2)

- Ong Yong vs. TiuDocument29 pagesOng Yong vs. TiuXtine CampuPotNo ratings yet