Professional Documents

Culture Documents

Mca Ratios

Mca Ratios

Uploaded by

Gambhir Commerce ClassesCopyright:

Available Formats

You might also like

- Walmart's Financial Reporting AnalysisDocument30 pagesWalmart's Financial Reporting AnalysisRabab BI0% (1)

- Tally Prime Essential NotesDocument199 pagesTally Prime Essential Noteshg100% (3)

- Comprehensive Problem On Intercompany TransactionsDocument9 pagesComprehensive Problem On Intercompany TransactionsasdasdaNo ratings yet

- Financial Numericals RatiosDocument27 pagesFinancial Numericals Ratiosanks0909100% (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Liz Claiborne Incorporated Case StudyDocument16 pagesLiz Claiborne Incorporated Case Studykhedaywi100% (10)

- Accounting Ratios - Ii: Module - 6ADocument20 pagesAccounting Ratios - Ii: Module - 6AFareehaAkbarNo ratings yet

- Accounting RatiosDocument14 pagesAccounting RatiosnadishNo ratings yet

- RATIO Practice QuestionsDocument14 pagesRATIO Practice Questionspranay raj rathoreNo ratings yet

- Analytical Techniques Used Horizontal Analysis Trend Analysis Common Size Statement RatiosDocument35 pagesAnalytical Techniques Used Horizontal Analysis Trend Analysis Common Size Statement RatiosAparna PandeyNo ratings yet

- Ratio: AnalysisDocument51 pagesRatio: AnalysisSatwik100% (1)

- Analysis of The Financial Statements Excellent ToysDocument6 pagesAnalysis of The Financial Statements Excellent ToysBryann MonesNo ratings yet

- Accounts Assignment - Accounting RatiosDocument12 pagesAccounts Assignment - Accounting RatiosnovairafNo ratings yet

- Ratio AnalysisDocument9 pagesRatio AnalysisCrazy electroNo ratings yet

- 04 Evaluating Operating and Financial Performance PDFDocument31 pages04 Evaluating Operating and Financial Performance PDFMiguel Gonzalez LondoñoNo ratings yet

- Accounting Ratios PDFDocument22 pagesAccounting Ratios PDFumerceoNo ratings yet

- Understanding Financial Statements - 2024Document108 pagesUnderstanding Financial Statements - 2024sogutuNo ratings yet

- Financial Statement AnalysisDocument55 pagesFinancial Statement Analysismukul3087_305865623No ratings yet

- Chapter 06 PDFDocument21 pagesChapter 06 PDFnsfaheemNo ratings yet

- Assignment 1 FMDocument4 pagesAssignment 1 FMgobiNo ratings yet

- Notes For MBA 3Document213 pagesNotes For MBA 3Pramod VasudevNo ratings yet

- MobDocument4 pagesMobJun TdhNo ratings yet

- Financial Analysis Through RatiosDocument8 pagesFinancial Analysis Through RatiosChandramouli KolavasiNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- Ratio Analysis SRKDocument61 pagesRatio Analysis SRKsrkwin6No ratings yet

- Chapter 5Document42 pagesChapter 5Aamrh AmrnNo ratings yet

- Longenecker-Materi KomplemenDocument13 pagesLongenecker-Materi KomplemenAtyaFitriaRiefantsyahNo ratings yet

- 17 Raatio Analysis PresentationDocument64 pages17 Raatio Analysis Presentationsrkwin6No ratings yet

- XII-ACCOUNT L DeshettyDocument5 pagesXII-ACCOUNT L DeshettyL DeshettyNo ratings yet

- Mba Assignment SolutionDocument5 pagesMba Assignment SolutionDuke GlobalNo ratings yet

- CH - 05 Accounting RatiosDocument8 pagesCH - 05 Accounting RatiosMahathi AmudhanNo ratings yet

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- Working Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Document6 pagesWorking Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Marc WrightNo ratings yet

- Chapter Five - Financial RatiosDocument33 pagesChapter Five - Financial RatiosbavanthinilNo ratings yet

- General Accounting PrinciplesDocument20 pagesGeneral Accounting PrinciplesUmaNo ratings yet

- Group ProjectDocument7 pagesGroup ProjectMohammed ademNo ratings yet

- Ratio Analysis: Palisades Furniture, Inc. Comparative Income Statement Year Ended December 31, 20X3 and 20X2Document6 pagesRatio Analysis: Palisades Furniture, Inc. Comparative Income Statement Year Ended December 31, 20X3 and 20X2ashishdbg2008No ratings yet

- Analysis of Financial Statements in Relation To SalesDocument13 pagesAnalysis of Financial Statements in Relation To SalesNishi YadavNo ratings yet

- Unit 3 LeveragesDocument25 pagesUnit 3 LeveragesKhushi DNo ratings yet

- An Assignment On Ratio Analysis AutoDocument20 pagesAn Assignment On Ratio Analysis AutoMehedi HasanNo ratings yet

- Ratio Analysis and Example PDFDocument9 pagesRatio Analysis and Example PDFthexplorer008No ratings yet

- 277f2790 1641961800019Document35 pages277f2790 1641961800019Pankaj MahantaNo ratings yet

- BusinessReview24 3 Ratio AnalysisDocument15 pagesBusinessReview24 3 Ratio AnalysisJahanzaib MalikNo ratings yet

- Basic Note About Ratio AnalysisDocument7 pagesBasic Note About Ratio AnalysisbeteNo ratings yet

- Solvency Ratio AnalysisDocument20 pagesSolvency Ratio AnalysispappunaagraajNo ratings yet

- CH 5 - Fin RatiosDocument18 pagesCH 5 - Fin RatiosbavanthinilNo ratings yet

- Fsa Solved ProblemsDocument27 pagesFsa Solved ProblemsKumarVelivela100% (1)

- Turnover RatiosDocument10 pagesTurnover RatiosBOSENo ratings yet

- Income StatementDocument6 pagesIncome Statementkyrian chimaNo ratings yet

- 05 - Working Capital Management (Notes)Document8 pages05 - Working Capital Management (Notes)Cheezuu DyNo ratings yet

- Chapter 5 ExercisesDocument7 pagesChapter 5 ExercisesTrang TranNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- Debtors / Receivables ManagementDocument28 pagesDebtors / Receivables ManagementTuki DasNo ratings yet

- Ratio Analysis Is A Form of FinancialDocument18 pagesRatio Analysis Is A Form of FinancialAmrutha AyinavoluNo ratings yet

- Economics and Financial Accounting Module: By: Mrs - Shubhangi DixitDocument56 pagesEconomics and Financial Accounting Module: By: Mrs - Shubhangi DixitGladwin JosephNo ratings yet

- Sit Dolor AmetDocument14 pagesSit Dolor AmetpriyanshiNo ratings yet

- Chap2+3 1Document36 pagesChap2+3 1Tarif IslamNo ratings yet

- Financial AnalysisDocument7 pagesFinancial AnalysisReyza Mikaela AngloNo ratings yet

- Liquidity:-: (Working Capital) Current RatioDocument7 pagesLiquidity:-: (Working Capital) Current RatiojackmaloufNo ratings yet

- Dey's Additional Accounting Ratios Class-XII 2022-23Document3 pagesDey's Additional Accounting Ratios Class-XII 2022-23Tûshar ThakúrNo ratings yet

- Financial: AnalysisDocument55 pagesFinancial: AnalysisJennelyn MercadoNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Sum On House PropertyDocument9 pagesSum On House PropertyVaishnaviNo ratings yet

- Biogen Valuation TemplateDocument44 pagesBiogen Valuation TemplateYin LukNo ratings yet

- Lana Taher (Second Stage) - Profit and Loss AccountDocument8 pagesLana Taher (Second Stage) - Profit and Loss AccountTana AzeezNo ratings yet

- Cadila Health (Version 1)Document12 pagesCadila Health (Version 1)Sahitya sinhaNo ratings yet

- Awami Supermarkets LTDDocument16 pagesAwami Supermarkets LTDdeepakjontyNo ratings yet

- Finance Group AssignmentDocument7 pagesFinance Group AssignmentAreej AJNo ratings yet

- FSA Assignment 2 - Muhammad Rakan - 1402224203Document6 pagesFSA Assignment 2 - Muhammad Rakan - 1402224203Rakan AdhitamaNo ratings yet

- Darshana Shiporkar 030008Document34 pagesDarshana Shiporkar 030008sheetalrai200105No ratings yet

- Financial Ratios PLDT and GlobeDocument3 pagesFinancial Ratios PLDT and GlobeRosejane EMNo ratings yet

- Tutorial Questions On Financial Ratio AnalysisDocument9 pagesTutorial Questions On Financial Ratio AnalysisSyazliana Kasim100% (9)

- Санхүүгийн Тайлангийн МАЯГТ Англи Хэл ДээрDocument13 pagesСанхүүгийн Тайлангийн МАЯГТ Англи Хэл Дээрmunkhtsetseg.tsogooNo ratings yet

- Multiplan DF 3T07 EngDocument43 pagesMultiplan DF 3T07 EngMultiplan RINo ratings yet

- Receivables TheoriesDocument8 pagesReceivables TheoriesIris MnemosyneNo ratings yet

- Entrep12 Q2 Mod8 Computation-Of-Gross-Profit v2Document16 pagesEntrep12 Q2 Mod8 Computation-Of-Gross-Profit v2Bianca Christine AgustinNo ratings yet

- 598481Document10 pages598481btstanNo ratings yet

- Economic 2Document13 pagesEconomic 2Ahmed JassimNo ratings yet

- Analysis of FSDocument28 pagesAnalysis of FSHaseeb TariqNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument52 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsMicha MaaloulyNo ratings yet

- Module 1 - PGBP Handout PDF - 240124 - 204954Document42 pagesModule 1 - PGBP Handout PDF - 240124 - 204954jabeanonionNo ratings yet

- David - sm15 - Inppt - 08Document48 pagesDavid - sm15 - Inppt - 08hero alomNo ratings yet

- Xlookup ExercisesDocument59 pagesXlookup ExercisesSamNo ratings yet

- Financial Analysis - Planning NotesDocument49 pagesFinancial Analysis - Planning NotesMadhan Kumar BobbalaNo ratings yet

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22No ratings yet

- DCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021Document7 pagesDCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021anandNo ratings yet

- Cost and Management Accounting Chapter 06Document10 pagesCost and Management Accounting Chapter 06Muhammad SohailNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

Mca Ratios

Mca Ratios

Uploaded by

Gambhir Commerce ClassesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mca Ratios

Mca Ratios

Uploaded by

Gambhir Commerce ClassesCopyright:

Available Formats

Chapter 2 Ratios Liquidity Ratios Liquidity Ratios measure the firms ability to pay off current dues i.e.

, repayable within a year. Liquidity ratios are otherwise called as short term solvency ratios. 1. Current Ratio 2. Liquid Ratio 3. Absolute Liquid Ratio 1. Current Ratio : This ratio is used to assess the firms ability to meet its current liabilities. The relationship of current assets to current liabilities is known as current ratio. The ratio is calculated as: Current Assets Current Ratio = Current Liabilities Current Assets are those assets, which are easily convertible into cash within one year. This includes cash in hand, cash at bank, sundry debtors, bills receivable, short term investment or marketable securities, stock and prepaid expenses. Current Liabilities are those liabilities which are payable within one year. This includes bank overdraft, sundry creditors, bills payable and outstanding expenses. Illustration : 1 From the following compute current ratio: Rs. Rs. Stock 36,500 Prepaid expenses 1,000 Sundry Debtors 63,500 Bank overdraft 20,000 Cash in hand & bank 10,000 Sundry creditors 25,000 Bills receivable 9,000 Bills payable 16,000 Short term investments 30,000 Outstanding expenses 14,000 Solution: Current Assets Current Ratio = Current Liabilities Current Assets = Stock + Sundry debtors + Cash in hand and bank + Bills receivable + Short term investments + Prepaid expenses = 36,500 + 63,500 + 10,000 + 9,000 + 30,000 + 1,000 = Rs. 1,50,000 Current Liabilities = Bank overdraft + Sundry creditors+ Bills payable + Outstanding expenses = 20,000 + 25,000 + 16,000 + 14,000= Rs. 75,000. 1,50,000 Current Ratio = 75,000 =2:1 2. Liquid Ratio This ratio is used to assess the firms short term liquidity. The relationship of liquid assets to current liabilities is known as liquid ratio. It is otherwise called as Quick ratio or Acid Test ratio. The ratio is calculated as:

Liquid Assets Liquid Ratio = Current Liabilities Liquid assets means current assets less stock and prepaid expenses. Illustration : 2 Taking the figures from the above illustration liquid ratio is calculated as follows: Solution: Liquid Assets Liquid Ratio = Current liabilities Liquid Assets = Current Assets (Stock + Prepaid expenses) = 1,50,000 (36,500 + 1,000) = 1,50,000 37,500= Rs. 1,12,500 1,12,500 Liquid Ratio = 75,000 = 1.5 : 1 II. Solvency Ratios Solvency refers to the firms ability to meet its long term indebtedness. Solvency ratio studies the firms ability to meet its long term obligations. The following are the important solvency ratios: 1. Debt-Equity Ratio 2. Proprietory Ratio 1. Debt Equity Ratio This ratio helps to ascertain the soundness of the long term financial position of the concern. It indicates the proportion between total long term debt and shareholders funds. This also indicates the extent to which the firm depends upon outsiders for its existence. The ratio is calculated as: Total long term Debt Debt-Equity Ratio = Shareholders funds Total long term debt includes Debentures, long term loans from banks and financial institutions Shareholders funds includes Equity share capital, Preference share capital, Reserves and surplus. Illustration : 3 Calculate Debt Equity Ratio from the following information. Debentures 2,00,000 Loan from Banks 1,00,000 Equity share capital 1,25,000 Reserves 25,000 Solution: Total Long Term Debt Debt - Equity Ratio = Shareholders funds

Total long term debt = Debentures + Loans from Bank = 2,00,000 + 1,00,000 = Rs. 3,00,000 Shareholders funds = Equity Share Capital + Reserves = 1,25,000 + 25,000 = Rs. 1,50,000 3,00,000 Debt-Equity Ratio = = 2:1 1,50,000 2. Proprietory Ratio This ratio shows the relationship between proprietors or shareholders funds and total tangible assets. The ratio is calculated as: Share holders funds (Proprietors funds) Proprietory Ratio = Total tangible assets Tangible assets will include all assets except goodwill, preliminary expenses etc. Illustration : 4 From the following calculate Proprietory Ratio: Equity share capital 1,00,000 Furniture 10,000 Preference share capital 75,000 Bank 20,000 Reserves & surplus 25,000 Cash 25,000 Machinery 30,000 Stock 15,000 Goodwill 5,000 Solution : Shareholders funds Proprietory Ratio = Total tangible assets Shareholders fund = Equity capital + Preference Share Capital + Reserve & Surplus = 1,00,000 + 75,000 + 25,000 = Rs. 2,00,000 Total tangible assets= Machinery + Furniture + Bank + Cash + Stock = 30,000 + 10,000 + 20,000 + 25,000+ 15,000 = Rs. 1,00,000 2,00,000 = = 2:1 1,00,000 (Note : All solvency ratios are expressed as a proportion.) III. Profitability Ratios Efficiency of a business is measured by profitability. Profitability ratio measures the profit earning capacity of the business concern. The important profitability ratios are discussed below: 1. Gross Profit Ratio 2. Net Profit Ratio 3. Operating Profit Ratio 4. Operating Ratio

1. Gross Profit Ratio This ratio indicates the efficiency of trading activities. The relationship of Gross profit to Sales is known as gross profit ratio. The ratio is calculated as: Gross Profit Gross Profit Ratio = x 100 Sales Gross profit is taken from the Trading Account of a business concern. Otherwise Gross profit can be calculated by deducting cost of goods sold from sales. Sales means Net sales. Gross Profit = Sales Cost of goods sold Cost of goods sold = Opening Stock + Purchases+direct expenses Closing Stock (or)Sales Gross Profit Illustration : 5 From the following particulars ascertain gross profit ratio Cash sales 40,000 Sales return 5,000 Credit sales 65,000 Gross profit 40,000 Solution: Gross Profit Gross Profit Ratio = x 100 Sales Sales = Total Sales Sales Returns = 40,000 + 65,000 5,000 = Rs. 1,00,000 40,000 = x 100 = 40% 1,00,000 2. Net Profit Ratio: This ratio determines the overall efficiency of the business. The relationship of Net profit to Sales is known as net profit ratio. The ratio is calculated as: Net Profit Net Profit Ratio = x 100 Sales Net profit is taken from the Profit and Loss account of the business concern or the gross profit of the concern less administration expenses, selling and distribution expenses and financial expenses. Illustration : 6 Calculate net profit ratio from the following: Net Profit 60,000 Sales 3,00,000 Solution: Net Profit Net Profit Ratio = x 100 Sales 60,000 = x 100=20% 3,00,000

3. Operating Profit Ratio This ratio is an indicator of the operational efficiency of the management. It establishes the relationship between Operating profit and Sales. The ratio is calculated as: Operating Profit Operating Profit Ratio = x 100 Sales Where operating profit is Net profit + Non-operating expenses Non-operating income. Where, Non-operating expenses are interest on loan and loss on sale of assets. Non-operating income are dividend, interest received and profit on sale of asset. (or) Operating profit = Gross profit Operating expenses. Operating expenses include administration, selling and distribution expenses. Financial expenses like interest on loan are excluded for this purpose. Illustration : 7 Calculate the operating profit ratio from the following: Net Profit 3,00,000 Loss on Sale of Furniture 10,000 Profit on sale of investments 30,000 Interest paid on loan 30,000 Interest from investments 20,000 Sales 5,80,000 Solution: Operating Profit Operating Profit Ratio = x 100 Sales Operating profit = Net profit + Non-operating expenses Non-operating income. Non-operating expenses = Interest on loan + Loss on sale of furniture. = 30,000 + 10,000 = Rs. 40,000 Non-operating income = Interest received from investments + Profit on sale of investment = 20,000 + 30,000= Rs.50,000 Operating profit = 3,00,000 + 40,000 50,000 = Rs. 2,90,000 2,90,000 Operating Profit Ratio = x 100 5,80,000 = 50% 4. Operating Ratio This ratio determines the operating efficiency of the business concern. Operating ratio measures the amount of expenditure inurred in production, sales and distribution of output. The relationship between Operating cost to Sales is known as Operating Ratio. The ratio is calculated as:

Cost of goods sold +Operating expenses Operating Ratio = x 100 Sales Illustration : 9 From the following details, calculate the operating ratio. Cost of goods sold 6,00,000 Operating expenses 40,000 Sales 8,20,000 Sales returns 20,000 Solution: Cost of goods sold + Operating expenses Operating Ratio = x 100 Sales 6,00,000 + 40,000 = x 100 8,20,000 - 20,000 6,40,000 Operating Ratio = x 100 = 80% 8,00,000 (Note: All profitability ratios will be expressed in terms of percentage.) IV. Activity Ratios Activity ratios indicate the performance of the business. The performance of a business is judged with its sales (turnover) or cost of goods sold. These ratios are thus referred to as turnover ratios. 1. Capital turnover ratio 2. Fixed assets turnover ratio 3. Stock turnover ratio 4. Debtors turnover ratio 5. Creditors turnover ratio 1. Capital Turnover Ratio This shows the number of times the capital has been rotated in the process of carrying on business. Efficient utilisation of capital would lead to higher profitability. The relationship between Sales and Capital employed is known as Capital Turnover Ratio. The ratio is calculated as: Sales Capital Turnover Ratio = Capital Employed Where Sales means Sales less sales returns and Capital employed refers to total long term funds of the business concern i.e.,Equity share capital, Preference share capital, Reserves and surplus and Long term borrowed funds.

Illustration : 10 Calculate capital turnover ratio from the following information. Cash sales 2,00,000 Credit sales 1,75,000 Sales return 25,000 Equity Share Capital 1,00,000 Long term loan 50,000 Reserves 25,000 Solution: Sales Capital Turnover Ratio = Capital Employed Net Sales = Cash sales + Credit sales Sales returns = 2,00,000 + 1,75,000 - 25,000 = Rs. 3,50,000 Capital Employed = Share capital + Long term loan + Reserves = 1,00,000 + 50,000 + 25,000 = Rs. 1,75,000 3,50,000 Capital Turnover Ratio = = 2 times 1,75,000

2. Fixed Assets Turnover Ratio: This shows how best the fixed assets are being utilised in the business concern. The relationship between Sales and Fixed assets is known as Fixed assets turnover ratio. The ratio is calculated as: Sales Fixed assets turnover Ratio = Fixed assets Fixed assets means Fixed assets less depreciation. Illustration : 11 Calculate the fixed asset turnover ratio from the following figures. Sales 6,15,000 Sales Return 15,000 Fixed assets 1,50,000 Solution: Sales Fixed assets turnover ratio = Fixed assets Sales = Sales - Sales return = 6,15,000 - 15,000 = Rs. 6,00,000 6,00,000 Fixed assets turnover ratio = = 4 Times 1,50,000 3. Stock Turnover Ratio This ratio is otherwise called as inventory turnover ratio. It indicates whether stock has been efficiently used or not. It establishes a relationship between the cost of goods sold during a particular period and the average amount of stock in the concern. The ratio is calculated as:

Cost of goods sold Stock turnover ratio = Average stock Opening stock + closing stock Average stock = 2 If information to calculate average stock is not given then closing stock may be taken as average stock. Illustration : 12 Calculate stock turnover ratio from the following: Cost of goods sold 6,75,000 Stock at the beginning of the year 1,00,000 Stock at the end of the year 1,25,000 Solution: Cost of goods sold Stock turnover ratio = Average stock Opening Stock + Closing Stock Average stock = 2 1,00,000 + 1,25,000 = 2 2,25,000 = 2 = Rs. 1,12,500 6,75,000 Stock turnover ratio = = 6 Times 1,12,500 Illustration : 13 Calculate stock turnover ratio from the following information. Sales 2,00,000 Gross profit 50,000 Stock 30,000 Solution: Cost of goods sold Stock turnover ratio = Average Stock Cost of goods sold = Sales Gross profit = 2,00,000 50,000 = Rs. 1,50,000 1,50,000 Stock turnover ratio = = 5 Times 30,000

4. Debtors Turnover Ratio This establishes the relationship between credit sales and average accounts receivable. Debtors turnover ratio indicates the efficiency of the business concern towards the collection of amount due from debtors. The ratio is calculated as: Credit Sales Debtors turnover Ratio = Average Accounts Receivable Accounts receivable includes sundry debtors and bills receivable. Opening (debtors + bills receivable) + Closing (debtors + bills receivable) Average accounts receivable = 2 In case credit sales is not given, total sales can be taken as credit sales.

Illustration : 14 Calculate Debtors turnover ratio from the following: Total sales 2,00,000 Cash sales 40,000 Opening debtors 35,000 Closing debtors 45,000 Solution: Credit sales Debtors Turnover Ratio = Average debtors Credit Sales = Total sales - Cash sales = 2,00,000 - 40,000 = Rs.1,60,000 Opening Debtors + Closing Debtors Average Debtors = 2 35,000 + 45,000 = 2 80,000 = 2 = Rs. 40,000 1,60,000 Debtors Turnover Ratio = = 4 Times 40,000 5. Creditors Turnover Ratio: This establishes the relationship between credit purchases and average accounts payable. Creditors turnover ratio indicates the period in which the payments are made to creditors. The ratio is calculated as: Credit Purchases Creditors turnover ratio = Average Accounts payable

Accounts payable include sundry creditors and bills payable. Opening (creditors + bills payable) + Closing (creditors + bills payable) Average accounts payable = 2 In case credit purchases is not given total purchases can be taken as credit purchases. Illustration : 15 Calculate creditors turnover ratio from the following: Credit purchases 1,50,000 Opening creditors 36,000 Closing creditors 24,000 Solution: Credit Purchases Creditors Turnover Ratio = Average accounts payable 36,000 + 24,000 Average Creditors = 2 60,000 = = Rs. 30,000 2 1,50,000 = = 5 Times 30,000 (Note: All turnover ratios will be expressed in terms of times.) Other Illustrations: Illustration : 16 From the following calculate current ratio Share capital 21,000 Fixed Assets 17,000 Reserves 4,000 Stock 6,000 Bank Overdraft 2,000 Debtors 3,200 Creditors 6,000 Cash 6,800 Solution: Current Assets Current Ratio = Current Liabilities Current Assets = Stock + Debtors + Cash = 6,000 + 3,200 + 6,800 = Rs. 16,000 Current Liabilities = Bank overdraft + Creditors = 2,000 + 6,000 = Rs. 8,000 16,000 = = 2:1 8,000

Illustration : 17 Calculate Current Ratio And Liquid Ratio Equity share capital 40,000 Machinery 45,000 Profit & Loss A/c 4,000 Stock 22,000 Debentures 25,000 Debtors 19,000 Creditors 24,000 Cash 5,000 Prepaid expenses 2,000 93,000 93,000 Solution: Current Assets Current Ratio = Current Liabilities Current Assets = Stock + Debtors + Cash + Prepaid expenses = 22,000 + 19,000 + 15,000 + 20,000 = Rs. 48,000 Current liabilities = Creditors = Rs. 24,000 48,000 Current Ratio = = 2:1 24,000 Liquid Assets Liquid Ratio = Current Liabilities Liquid Assets = Current Asset (Stock + Prepaid expenses) = 48,000 (22,000 + 2,000) = 48,000 24,000 = Rs. 24,000 24,000 Liquid Ratio = = 1:1 24,000 Illustration : 18 From the following, calculate Debt-Equity Ratio. Equity shares 1,00,000 General reserves 75,000 Debentures 75,000 Sundry creditors 40,000 Outstanding expenses 10,000 Solution: Long term Debt Debt-Equity ratio = Shareholders funds Long term Debt = Debentures = Rs. 75,000 Shareholders funds = Equity shares + General Reserves = 1,00,000 + 75,000= Rs. 1,75,000 75,000 Debt-Equity ratio = = 0.42 : 1 1,75,000

Illustration : 19 Calculate Gross Profit Ratio from the following: Rs. Purchases 2,65,000 Opening stock 10,000 Closing stock 20,000 Sales 3,00,000 Solution: Gross Profit Gross Profit Ratio = x 100 Sales Gross Profit = Sales Cost of Goods Sold Cost of goods sold = Opening stock + Purchases Closing stock = 10,000 + 2,65,000 20,000 = Rs. 2,55,000 Gross Profit = 3,00,000 2,55,000 = Rs. 45,000 45,000 Gross Profit Ratio = x 100=15% 3,00,000 Illustration : 20 From the following data, calculate the fixed asset turnover ratio. Rs. Cash sales 1,00,000 Credit sales 1,20,000 Sales Returns 20,000 Fixed assets 45,000 Depreciation 5,000 Solution: Sales Fixed Asset Turnover Ratio = Fixed Assets Sales = Cash sales + Credit sales Sales Returns = 1,00,000 + 1,20,000 20,000 = 2,20,000 20,000 = Rs. 2,00,000 Fixed Assets = Fixed Assets Depreciation = 45,000 5,000 = Rs. 40,000 2,00,000 Fixed Asset Turnover Ratio = = 5 Times 40,000 Illustration : 21 From the following figures calculate creditors turnover ratio Rs. Credit purchases 1,80,000 Bills payable 50,000 Creditors 40,000 Solution:

Credit Purchases Creditors Turnover Ratio = Average Accounts Payable Average accounts payable= Bills payable + Creditors = 50,000 + 40,000 = Rs. 90,000 1,80,000 Creditors Turnover Ratio = = 2 Times 90,000 Illustration : From the given data, calculate 1. Gross Profit Ratio 2. Net Profit Ratio and 3. Current Ratio Sales 3,00,000 Cost of goods sold 2,00,000 Net Profit 30,000 Current Assets 60,000 Current liabilities 30,000 Illustration 22 From the following details calculate 1. Gross Profit Ratio 2. Net Profit Ratio 3. Stock Turnover Ratio 4. Debtors Turnover Ratio Rs. Sales 1,50,000 Cost of Goods Sold 1,20,000 Opening Stock 29,000 Closing Stock 31,000 Debtors 15,000 Administration Expenses 15,000 Solution: Gross Profit 1) Gross Profit Ratio = x 100 Sales Gross Profit = Sales Cost of goods sold = 1,50,000 1,20,000 = Rs. 30,000 30,000 Gross Profit Ratio = x 100 = 20% 1,50,000 Net Profit 2) Net Profit Ratio = x 100 Sales Net Profit = Gross Profit Administration Expenses = 30,000 15,000 = Rs. 15,000

15,000 = x 100=10% 1,50,000 Cost of Goods Sold 3) Stock Turnover Ratio = Average Stock Opening Stock + Closing Stock Average Stock = 2 29,000 + 31,000 = 2 = Rs. 30,000 1,20,000 = = 4 Times 30,000 Credit Sales 4) Debtors Turnover Ratio = Average Accounts Receivable 1,50,000 = = 10 Times 15,000 Illustration 23 Calculate Operating profit ratio and Operating ratio.. Sales 2,00,000 Gross Profit 80,000 Office Expenses 6,000 Selling Expenses 4,000 Finance expenses 3,000 Loss on sale of plant 400 Interest received 500 Net Profit 67,100 Solution: Operating Profit 1) Operating Profit Ratio = Sales Operating profit = Net Profit + Non-operating expenses Non-operating Income = Net Profit + Loss on sale of plant + Financial expenses Interest received = 67,100 + 400 + 3,000 500 = Rs. 70,000 70,000 = x 100 2,00,000 = 35% Cost of goods sold + Operating expenses 4) Operating Ratio = Sales Cost of goods sold = Sales Gross Profit = 2,00,000 80000 = Rs.1,20,000 Operating expenses = Office expenses + Selling expenses

= 6,000 + 4,000 = Rs.10,000 10,000 + 1,20,000 = x 100 2,00,000 = 65% Ques for Practice) 1. From the following, calculate the current ratio. Cash in hand 2,00,000 Sundry debtors 80,000 Stock 1,20,000 Sundry creditors 1,50,000 Bills payable 50,000 (Answer: 2:1) 2. Calculate liquid ratio Current assets 20,000 Stock 3,000 Prepaid expenses 1,000 Current liabilities 8,000 (Answer: 2:1) 3. From the following information, calculate current ratio and liquid ratio Cash 5,000 Debtors 29,000 Bills receivable 5,000 Short term investment 15,000 Stock 52,000 Prepaid expenses 2,000 Creditors 36,000 Bills payable 10,000 Outstanding expenses 8,000 (Answer: Current ratio 2:1; Liquid ratio 1:1) 4. From the following, calculate Current ratio & Liquid ratio Share Capital 6,300 Fixed Assets 5,100 Reserves 1,200 Stock 2,100 Bank overdraft 600 Debtors 960 Creditors 1,800 Cash 1,740 9,900 9,900 (Answer: Current ratio 2:1; Liquid ratio 1.13:1) 5. From the following, you are required to calculate liquidity ratios. Debtors 5,000 Creditors 4,000 Cash in hand 4,000 Bills payable 3,000 Cash at Bank 6,000 Outstanding expenses 250 Short Term Investments 2,000 Bills receivable 3,000 Prepaid expenses 1,000 Closing stock 8,000 (Answer : Current Ratio 4:1; Liquid Ratio 2.76:1) 6. From the following information, calculate current ratio, liquid ratio Cash 1,800 Creditors 5,000 Debtors 14,200 Outstanding expenses 1,500

Stock 18,000 Bank overdraft 7,500 Bills Payable 2,700 (Answer: Current ratio 2.04:1; Liquid ratio 0.96:1; Absolute liquid ratio 0.196:1) 7. Calculate Debt - Equity ratio. Equity share capital 2,00,000 General Reserve 1,50,000 Long term loan 50,000 Debentures 1,00,000 (Answer: 0.43:1) 8. From the following, Calculate Gross Profit Ratio Gross Profit 50,000 Sales 5,50,000 Sales Return 50,000 (Answer: 10%) 9. Calculate Gross Profit ratio Sales 6,50,000 Cost of Goods sold 4,80,000 Sales Return 50,000 (Answer: 20%) 10. Calculate Capital turnover ratio Sales 10,20,000 Sales Returns 20,000 Equity Share Capital 1,00,000 Loans 25,000 Preference Share Capital 50,000 Reserves 25,000 (Answer: 5 Times) 11. From the following data, calculate the Fixed Asset Turnover ratio Fixed Assets 3,00,000 Depreciation 1,00,000 Total Sales 8,50,000 Sales Returns 50,000 (Answer : 4 times) 12. Calculate Net Profit Ratio Net Profit 4,000 Sales 44,000 Sales Return 4,000 (Answer: 10%) 13. Calculate Operating profit ratio Gross profit 1,00,000 Operating expenses 40,000 Sales 6,02,000 Sales return 2,000 (Answer: 10%) 14. Calculate Fixed Assets Turnover Ratio Fixed asset 1,00,000

Depreciation 25,000 Sales 3,00,000 (Answer: 4 times) 15. Calculate Fixed Assets Turnover Ratio Fixed Assets 1,50,000 Sales 4,50,000 (Answer: 3 times) 16. From the following, determine the stock turnover ratio Opening Stock 40,000 Closing stock 30,000 Purchases 95,000 (Answer: 3 times) 17. Calculate Stock turnover ratio Opening Stock 15,000 Closing Stock 25,000 Purchases 60,000 (Answer: 2.5 times) 18. Compute Debtors turnover ratio Total Sales 7,50,000 Sales Return 50,000 Opening Debtors 1,17,000 Closing Debtors 83,000 (Answer: 7 times) 19. From the following, determine Debtors Turnover ratio. Total Sales 1,75,000 Cash Sales 35,000 Sales Return 10,000 Opening Debtors 8,000 Closing Debtors 12,000 (Answer: 13 times) 20. Calculate creditors turnover from the following information Total Purchases 85,000 Cash Purchases 20,000 Purchases Return 5,000 Opening Creditors 25,000 Closing Creditors 15,000 (Answer: 3 times) 21.Calculate Debtors turnover ratio from the following. Total Sales 10,000 Cash Sales 2,000 Opening Debtors 1,000 Closing Debtors 1,500 Opening Bills Receivable 750 Closing Bills Receivable 1,250

24.

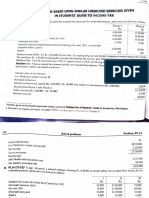

25.Calculate Profitability Ratios:

26.Calculate creditors turnover ratio from the following: Credit purchases 1,50,000 Opening creditors 36,000 Closing creditors 24,000 27.From the following calculate current ratio Share capital 21,000 Fixed Assets 17,000 Reserves 4,000 Stock 6,000 Bank Overdraft 2,000 Debtors 3,200 Creditors 6,000 Cash 6,800

Chapter 3 Marginal costing

Marginal cost=direct material cost +direct labor cost+other variable cost Or Total cost-fixed cost Ques for Practice)Variable cost Rs.50000 Fixed cost Rs.20000 Selling price Rs.80000 Cslculate Contribution ,profit

Profit volume ratio(p/v ratio)= Contribution / sales Variable cost=sales(1-p/v ratio) Break even point(output or units)=fixed cost / contribution per unit Break even point(in Rupees or sales)=fixed cost / contribution per unit X selling price per unit Or Fixed cost / pv ratio Output(units) for a desired profit = fixed cost + desired profit contribution per unit Output(sales) for a desired profit = fixed cost + desired profit contribution per unit x selling price per unit

Or output(sales) for a desired profit = fixed cost + desired profit p/v ratio Margin of safety =totsl sales break even sales Ques for Practice) A factory manufactures sewing machines has the capacity to produce 500 machines per annum.The marginal(variable) cost is Rs.200 and each machine is sold for Rs.250.Fixed overheads are Rs.12000 per annum.Calculate the break even point for output and sales and price volume ratio? Ques for Practice)Calculate P/V ratio Profit when sales are Rs.20000 New break even point if selling price is reduced by 20% Fixed expenses Rs 4000 Break even point Rs10000 Ques for Practice) Calculate break even point(sales) Fixed cost Rs.20000 Contribution per unit Rs0.5 per unit Ques for Practice)Sales Rs20000 Variable cost Rs10000 Fixed cost Rs.6000 Calculate P/v ratio,break even point and margin of safety Ques for Practice)Calculate break even point,P/V ratio Sales Rs.40000 Variable cost Rs20000 Fixed cost Rs.10000

Ques for Practice)From the following data compute the profit under Marginal costing Selling price per unit: Rs.8 Variable cost per unit: Rs.4 Fixed cost per unit: Rs.2 Normal volume of production is 26 000 units per quarter. The opening and closing stocks consisting of both finished goods and equivalent units of work in progress are as follows:

Ques for Practice)A Company budgets for a production of 150000 units. The variable cost per unit is Rs.14 and fixed cost per unit is Rs.2 per unit. The company fixes the selling price to fetch a profi t of 15% on cost. Required, A. What is the break- even point? B] What is the profi t/volume ratio? C] If the selling price is reduced by 5%, how does the revised selling price affects the Break Even Point and the Profi t/Volume Ratio? D] If profi t increase of 10% is desired more than the budget, what should be the sales at the reduced price? Solution: A] Break Even Point = Fixed Cost /Contribution Per unit Fixed cost= Rs.2 X1 50 000 units = Rs.3, 00, 000 /Rs.18.40 Rs.14.00 = Rs.3, 00, 000 / Rs.4.40 = 68, 182 units. Note: Contribution per unit is computed as shown below. Selling Price per unit = Total Cost + 15% Profi t on cost = Rs.16 [Rs.14 variable cost + Rs.2 fixed cost] + Rs.2.40 [15% of Rs.16] = Rs.18.40 Contribution = Selling Price Variable Cost = Rs.18.40 Rs.14 = Rs.4.40 B] Profi t/Volume Ratio: Contribution Per Unit/Selling Price Per Unit X100 Rs.4.40 /Rs.18.40 X100 = 23.9 C] Reduction in selling price by 5%: Reduced selling price = Rs.18.40 5% of Rs.18.40 = Rs.17.48, Revised contribution = Rs.17.48 Rs.14.00 = Rs.3.48 Break Even Point = Fixed Cost /Contribution Per Unit = Rs.3, 00, 000 /Rs.3.48 = 86, 207 units D] Desired profi t = Rs.2.40 + 10% of Rs.2.40 = Rs.2.64 per unit Total Profi ts = Rs.2.64 _ 1 50 000 units = Rs.3, 96, 000 + Total Fixed Costs = Rs.3, 00, 000 Total Contribution = Rs.6, 96, 000

Quantity to be sold = Total Contribution + Revised Contribution Per Unit Rs.6, 96, 000 / Rs.3.48 = 2, 00, 000 units Sales Value = 2 00 000 units _ Rs.17.48 = Rs.34, 96, 000 Ques for Practice) From the following figures, find the Break Even Volume Selling price per ton Rs.69.50 Variable cost per ton Rs.35.50 Fixed Cost Rs.18.02 lakhs If this volume represents 40% capacity, what is the additional profi t for an added production of 40%capacity, the selling price of which is 10% lower for 20% production and 15% lower than the existing price, for the other 20% capacity? Solution: Existing Break Even Sales = Fixed Cost/Contribution per unit Rs.18.02 lakhs/Rs.69.50 Rs.35.50 Rs.18.02 lakhs/Rs.34 = 53 000 units Sales Value = 53, 000 XRs.69.50 = Rs.36, 83, 500 It is given in the problem that 40% capacity represents 53, 000 units Hence 80% capacity will represent 1 06 000 units For additional 20% capacity, selling price falls by 10% Revised Selling Price = Rs.69.50 Rs.6.95 = Rs.62.55 Less: Variable Cost = Rs.35.50 Contribution = Rs.27.05 20% capacity = 53, 000 units/2 = 26, 500 units Profi t if sale price is Rs.62.55 = Contribution per unit X Sales units Rs.27.05 X26, 500 units = Rs.7, 16, 825 Contribution by 20% capacity for which selling price falls by 15% Revised Selling Price = Rs.69.50 Rs.10.425 = Rs.59.075 Less: Variable Cost = Rs.35.50 Contribution = Rs.23.575 Profit is sale price is Rs.59.075 = Contribution per unit X Sales units Rs.23.575 X26, 500 units = Rs.6, 24, 737 Additional profit by 40% sales = Rs.7,16, 825 + Rs.6,24,737 = Rs.13, 41, 562 Ques for Practice). A retail dealer in garments is currently selling 24 000 shirts annually. He supplies the following details for the year ended 31st March 2007. Selling price per shirt: Rs.800 Variable cost per shirt: Rs.600 Fixed Cost: Staff salaries: Rs.24, 00, 000 General Office Cost: Rs.8, 00,000 Advertising Cost: Rs.8, 00 000 As a Cost Accountant, you are required to answer the following each part independently: 1. Calculate Break Even Point and margin of safety in sales revenue and number of shirts sold. 2. Assume that 30000 shirts were sold during the year, fi nd out the net profit of the fi rm.

Solution: 1. Break Even Point: [units] = Fixed Cost / Contribution Per Unit = Rs.40, 00, 000/Rs.200 = 20 000 number of shirts Note: Contribution per units is selling price variable cost per unit Rs.800 Rs.600 = Rs.200 Break Even Point [sales value] = 20000 units _ Rs.800 = Rs.1, 60, 00, 000 Margin of safety = Actual Sales Break Even Sales 24, 000 shirts _ Rs.800 = Rs.1, 92, 00, 000 Rs.1, 60, 00, 000 = Rs.32, 00, 000 Margin of safety [units] = 24, 000 shirts 20, 000 shirts = 4000 shirts 2. Amount of profi t if 30, 000 shirts are sold: Sales [units] = Fixed Cost + Profi t / Contribution Per Unit 30, 000 = Rs.40, 00, 000 + Profit /Rs.200 = Profit = Rs.20, 00, 000 Ques for Practice)The following figures are available from the records of Venus Traders as on 31st March Figures: In Lakhs of Rs. Particulars 2006 2007 Sales 150 200 Profits 30 50 Calculate: a) Profi t/Volume ratio and total fi xed expenses b) Break Even Sales c) Sales required to earn a profi t of Rs.90 lakhs d) Profi t/Loss that would arise if the sales were Rs.280 lakhs Solution: The first step in the problem is to work out the profi t/volume ratio a) Profit / Volume Ratio = Change in profit/Change in sales X 100 Rs.20/Rs.50 X 100 = 40% Fixed Expenses: We can take the sales of any one year, suppose we take the sales of the year ended on 31st March 2006, the amount is Rs.150 lakhs The profi t/volume ratio is 40% which means that contribution is 40% of sales i.e. 40% of Rs.150 lakhs which comes to Rs.60 lakhs. The amount of profi t is Rs.30 lakhs. Contribution Fixed Cost = Profi t, i.e. Rs.60 lakhs Fixed Cost = Rs.30 lakhs, therefore fi xed cost is Rs.30 lakhs b) Break Even Sales = Fixed Cost / Profi t/Volume Ratio = Rs.30 lakhs/40% = Rs.75 lakhs c) Sales required to earn a profi t of Rs.90 lakhs: Sales = Fixed Cost + Profi t /P/V Ratio = Sales = Rs.30 lakhs + Rs.90 lakhs /40% Sales = Rs.120 lakhs/40% = Rs.3, 00, 00, 000 i.e. Rs.300 lakhs d) Profit / loss if sales are Rs.280 lakhs, Sales = Fixed Cost + Profit /P/V Ratio Rs.280 lakhs = Rs.30 lakhs + Profi t /40% = Rs.82 lakhs

Ques for Practice). ABC Ltd. maintains a margin of safety of 37.5% with an overall contribution to sales ratio of 40%. Its fi xed costs amount to Rs.5, 00,000. Calculate the following: 1. Break Even Sales 2. Total Sales 3. Total Variable Sales 4. Current Profits 5. New Margin of Safety if the sales volume is increased by 7.5% Solution: 1. Break Even Sales = Fixed Cost / Profi t/Volume Ratio = Rs.5, 00,000/40% = Rs.12, 50, 000 2. Total Sales = Break Even Sales + Margin of Safety Margin of Safety = Actual Sales Break-Even Sales Let the actual sales be 100, Margin of Safety is 37.5% Hence Break even sales will be Rs.62.5 Now, if the Break even sales are Rs.62.5, actual sales are Rs.100, hence if Break even sales are Rs.12.5 lakhs, actual sales will be 100/62.5 X 12.5 = Rs.20 lakhs 3. Contribution = Sales Variable Cost. As the contribution is 40% of sales, the variable cost is 60% of sales and so variable cost will be 60% of Rs.20 lakhs, i.e. Rs.12 lakhs. 4. Current Profi ts = Sales [Fixed Cost + Variable Cost] = Rs.20, 00,000 [Rs.12, 00,000 + Rs.5, 00, 000] = Rs.3. 00.000 5. New Margin of Safety is the sales volume is increased by 7.5% New Sales Volume = Rs.20, 00,000 + 7.5% of Rs.20, 00,000 = Rs.21, 50,000 Hence, New Margin of Safety = Rs.21, 00,000 BEP Sales Rs.12, 50,000 = Rs.9, 00,000

Chapter 4

Budgets

Cash Budget: Cash budget is one of the most important budgets prepared by a business concern as every transaction directly or indirectly deals with cash. Cash budget shows the estimate of cash receipts and cash payments from all sources over a specific period. This is also called as Finance Budget.

Advantages :

1. It helps in maintaining an adequate cash balance. 2. It provides the following useful information to the management a. to determine the future cash needs of a business concern b. to plan for financing those needs and c. to have control over cash balance of the business concern. Thus, in short cash budget is an useful tool for financial planning. Methods of cash budget

Receipts and Payments Method

Under this method Cash budget projects the concerns cash receipts and payments for a certain period (budget period). It has two basic components: 1. Estimate of cash receipts and 2. Estimate of cash payments Cash Receipts include: . Cash sales . Cash receivable from customers . Business receipts like interest, commission, dividend etc . Sale of assets . Proceeds from issue of shares/debentures . Loans borrowed Cash Payments include: . Cash purchases . Cash payable to suppliers . Business expenses like wages, office expenses, selling expenses, etc. . Payment of interest, income tax, dividend etc. . Purchase of assets . Redemption of shares/debentures . Repayment of loans

Steps in the preparation of cash budget

Step 1 Take opening cash balance Step 2 Add the estimated total cash receipts for the month Step 3 Calculate the total cash available for the month Step 4 Less the estimated total cash payments during the month Step 5 Calculate the closing cash balance

Ques for practice)

Ques for practice)

Ques for practice) From the following prepare Cash budget for the month of August and September 2004:

Ques for practice)

Production Budget: Estimated sales Add: Desired closing stock Less: Desired opening stock Ques for Practice)Prepare a production budget for 3 months ending March 31,1995 for a factory producing 4 products on the basis of following information: Type of product Estimated stock on jan 1 1995 2000 3000 4000 3000 Estimated sales during january march 10000 15000 13000 12000 Desired closing stock on march 31 1995 3000 5000 3000 2000

A B C D

Sales budget for the year Product Budget for future period Qty Total Ques for Practice)Prepare sales budget for xyz ltd Budgeted sales for the current year Product East west 600 at Rs.9 500 at Rs.21 Price Value Budget for current period Qty Price Value Actual sales for current period Qty Price

Value

X 400 at Rs.9 Y 300 at Rs.21 Actual sales for the current year

X 500 at Rs,9 700 at Rs.9 Y 200 at Rs.21 400 at Rs.21 It is observed that to succeed in the market the price of X is increased by 1% and product Y is reduced by 1%. Percentage increase in sales over budget X Y 10% 20% 5% 10%

With the help of intensive advertisement the following additional sales above estimated sales are possible: X Y 60 40 70 50

Chapter 5 Capital Budgeting

Ques for practice) The expected cash flows of a project are as follows Year Cash flows 0 -100000 1 20000 2 30000 3 40000 4 50000 5 30000 The cost of capital is 12%.calculate the following :net present value ,IRR and payback period Ques for practice)Jitin ltd is considering the purchase of a machine costing Rs.500000 that has the following expected cash flows Year Expected cash flows 1 200000 2 250000 3 150000 4 100000 5 75000 Calculate the discounted payback period if the discount rate is 13 %. Ques for practice) Gambhir ltd is evaluating a project whose expected cash flows are as follows Year Cash flows 0 -1000000 1 100000 2 200000 3 300000 4 600000 5 300000 what is the NPV of the project if the discount rate is 14%. Ques for practice)the cash flows for the two projects are as follows Year Project a Project b 0 -100000 -150000 1 30000 50000 2 40000 50000 3 50000 50000 4 30000 50000 5 20000 50000 Calculate the discounted payback period.assume a discount rate of 14%. Ques for practice)The cash flows associated with a project are as follows

Year Cash flows 0 -100000 1 25000 2 40000 3 50000 4 40000 5 30000 Calculate the payback period and npv and profitability index of the project Ques for practice)What is the present value of the following cash stream if the discount rate is 14% Year 0 1 2 3 4 Cash flow 5000 6000 8000 9000 8000

Ques for practice) The investment data for Ashok ltd are as follows Capital oulayRs.200000 Year Cash flows 1 100000 2 100000 3 80000 4 80000 5 40000 On the basis of available data calculate payback period,average rate of return,net present value and profitability index. Ques for practice)XYZ ltd whose cost of capital is 10% is considering two mutually exclusive projects x and y the details of which are as follows: Project x Project y 0 -70000 -70000 1 10000 50000 2 20000 40000 3 30000 20000 4 45000 10000 5 60000 10000 Compute the npv ,profitability index and IRR of the two projects. Ques for practice)calculate WACC from the following capital structure Equity share capital 12%preference share capital 10%debentures 100000 200000 100000

Retained earnings 200000 Total 500000 The cost of equity is 15% and retained earnings is 12% Ques for practice)Calculate the cost of capital for the following capital structure: Equity share capital 12% preference share capital 8% debentures Total The cost of equity is 15% and tax rate is 50%. Ques for practice)Calculate the cost of capital: Equity share capital 200000 14%prefernce share capital 300000 10%debentures 400000 Reserve and surplus 100000 Total 1000000 Cost of retained earnings is 12%,tax rate is 50% and cost of equity is 18%. 100000 200000 300000 600000

You might also like

- Walmart's Financial Reporting AnalysisDocument30 pagesWalmart's Financial Reporting AnalysisRabab BI0% (1)

- Tally Prime Essential NotesDocument199 pagesTally Prime Essential Noteshg100% (3)

- Comprehensive Problem On Intercompany TransactionsDocument9 pagesComprehensive Problem On Intercompany TransactionsasdasdaNo ratings yet

- Financial Numericals RatiosDocument27 pagesFinancial Numericals Ratiosanks0909100% (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Liz Claiborne Incorporated Case StudyDocument16 pagesLiz Claiborne Incorporated Case Studykhedaywi100% (10)

- Accounting Ratios - Ii: Module - 6ADocument20 pagesAccounting Ratios - Ii: Module - 6AFareehaAkbarNo ratings yet

- Accounting RatiosDocument14 pagesAccounting RatiosnadishNo ratings yet

- RATIO Practice QuestionsDocument14 pagesRATIO Practice Questionspranay raj rathoreNo ratings yet

- Analytical Techniques Used Horizontal Analysis Trend Analysis Common Size Statement RatiosDocument35 pagesAnalytical Techniques Used Horizontal Analysis Trend Analysis Common Size Statement RatiosAparna PandeyNo ratings yet

- Ratio: AnalysisDocument51 pagesRatio: AnalysisSatwik100% (1)

- Analysis of The Financial Statements Excellent ToysDocument6 pagesAnalysis of The Financial Statements Excellent ToysBryann MonesNo ratings yet

- Accounts Assignment - Accounting RatiosDocument12 pagesAccounts Assignment - Accounting RatiosnovairafNo ratings yet

- Ratio AnalysisDocument9 pagesRatio AnalysisCrazy electroNo ratings yet

- 04 Evaluating Operating and Financial Performance PDFDocument31 pages04 Evaluating Operating and Financial Performance PDFMiguel Gonzalez LondoñoNo ratings yet

- Accounting Ratios PDFDocument22 pagesAccounting Ratios PDFumerceoNo ratings yet

- Understanding Financial Statements - 2024Document108 pagesUnderstanding Financial Statements - 2024sogutuNo ratings yet

- Financial Statement AnalysisDocument55 pagesFinancial Statement Analysismukul3087_305865623No ratings yet

- Chapter 06 PDFDocument21 pagesChapter 06 PDFnsfaheemNo ratings yet

- Assignment 1 FMDocument4 pagesAssignment 1 FMgobiNo ratings yet

- Notes For MBA 3Document213 pagesNotes For MBA 3Pramod VasudevNo ratings yet

- MobDocument4 pagesMobJun TdhNo ratings yet

- Financial Analysis Through RatiosDocument8 pagesFinancial Analysis Through RatiosChandramouli KolavasiNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- Ratio Analysis SRKDocument61 pagesRatio Analysis SRKsrkwin6No ratings yet

- Chapter 5Document42 pagesChapter 5Aamrh AmrnNo ratings yet

- Longenecker-Materi KomplemenDocument13 pagesLongenecker-Materi KomplemenAtyaFitriaRiefantsyahNo ratings yet

- 17 Raatio Analysis PresentationDocument64 pages17 Raatio Analysis Presentationsrkwin6No ratings yet

- XII-ACCOUNT L DeshettyDocument5 pagesXII-ACCOUNT L DeshettyL DeshettyNo ratings yet

- Mba Assignment SolutionDocument5 pagesMba Assignment SolutionDuke GlobalNo ratings yet

- CH - 05 Accounting RatiosDocument8 pagesCH - 05 Accounting RatiosMahathi AmudhanNo ratings yet

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- Working Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Document6 pagesWorking Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Marc WrightNo ratings yet

- Chapter Five - Financial RatiosDocument33 pagesChapter Five - Financial RatiosbavanthinilNo ratings yet

- General Accounting PrinciplesDocument20 pagesGeneral Accounting PrinciplesUmaNo ratings yet

- Group ProjectDocument7 pagesGroup ProjectMohammed ademNo ratings yet

- Ratio Analysis: Palisades Furniture, Inc. Comparative Income Statement Year Ended December 31, 20X3 and 20X2Document6 pagesRatio Analysis: Palisades Furniture, Inc. Comparative Income Statement Year Ended December 31, 20X3 and 20X2ashishdbg2008No ratings yet

- Analysis of Financial Statements in Relation To SalesDocument13 pagesAnalysis of Financial Statements in Relation To SalesNishi YadavNo ratings yet

- Unit 3 LeveragesDocument25 pagesUnit 3 LeveragesKhushi DNo ratings yet

- An Assignment On Ratio Analysis AutoDocument20 pagesAn Assignment On Ratio Analysis AutoMehedi HasanNo ratings yet

- Ratio Analysis and Example PDFDocument9 pagesRatio Analysis and Example PDFthexplorer008No ratings yet

- 277f2790 1641961800019Document35 pages277f2790 1641961800019Pankaj MahantaNo ratings yet

- BusinessReview24 3 Ratio AnalysisDocument15 pagesBusinessReview24 3 Ratio AnalysisJahanzaib MalikNo ratings yet

- Basic Note About Ratio AnalysisDocument7 pagesBasic Note About Ratio AnalysisbeteNo ratings yet

- Solvency Ratio AnalysisDocument20 pagesSolvency Ratio AnalysispappunaagraajNo ratings yet

- CH 5 - Fin RatiosDocument18 pagesCH 5 - Fin RatiosbavanthinilNo ratings yet

- Fsa Solved ProblemsDocument27 pagesFsa Solved ProblemsKumarVelivela100% (1)

- Turnover RatiosDocument10 pagesTurnover RatiosBOSENo ratings yet

- Income StatementDocument6 pagesIncome Statementkyrian chimaNo ratings yet

- 05 - Working Capital Management (Notes)Document8 pages05 - Working Capital Management (Notes)Cheezuu DyNo ratings yet

- Chapter 5 ExercisesDocument7 pagesChapter 5 ExercisesTrang TranNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- Debtors / Receivables ManagementDocument28 pagesDebtors / Receivables ManagementTuki DasNo ratings yet

- Ratio Analysis Is A Form of FinancialDocument18 pagesRatio Analysis Is A Form of FinancialAmrutha AyinavoluNo ratings yet

- Economics and Financial Accounting Module: By: Mrs - Shubhangi DixitDocument56 pagesEconomics and Financial Accounting Module: By: Mrs - Shubhangi DixitGladwin JosephNo ratings yet

- Sit Dolor AmetDocument14 pagesSit Dolor AmetpriyanshiNo ratings yet

- Chap2+3 1Document36 pagesChap2+3 1Tarif IslamNo ratings yet

- Financial AnalysisDocument7 pagesFinancial AnalysisReyza Mikaela AngloNo ratings yet

- Liquidity:-: (Working Capital) Current RatioDocument7 pagesLiquidity:-: (Working Capital) Current RatiojackmaloufNo ratings yet

- Dey's Additional Accounting Ratios Class-XII 2022-23Document3 pagesDey's Additional Accounting Ratios Class-XII 2022-23Tûshar ThakúrNo ratings yet

- Financial: AnalysisDocument55 pagesFinancial: AnalysisJennelyn MercadoNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Sum On House PropertyDocument9 pagesSum On House PropertyVaishnaviNo ratings yet

- Biogen Valuation TemplateDocument44 pagesBiogen Valuation TemplateYin LukNo ratings yet

- Lana Taher (Second Stage) - Profit and Loss AccountDocument8 pagesLana Taher (Second Stage) - Profit and Loss AccountTana AzeezNo ratings yet

- Cadila Health (Version 1)Document12 pagesCadila Health (Version 1)Sahitya sinhaNo ratings yet

- Awami Supermarkets LTDDocument16 pagesAwami Supermarkets LTDdeepakjontyNo ratings yet

- Finance Group AssignmentDocument7 pagesFinance Group AssignmentAreej AJNo ratings yet

- FSA Assignment 2 - Muhammad Rakan - 1402224203Document6 pagesFSA Assignment 2 - Muhammad Rakan - 1402224203Rakan AdhitamaNo ratings yet

- Darshana Shiporkar 030008Document34 pagesDarshana Shiporkar 030008sheetalrai200105No ratings yet

- Financial Ratios PLDT and GlobeDocument3 pagesFinancial Ratios PLDT and GlobeRosejane EMNo ratings yet

- Tutorial Questions On Financial Ratio AnalysisDocument9 pagesTutorial Questions On Financial Ratio AnalysisSyazliana Kasim100% (9)

- Санхүүгийн Тайлангийн МАЯГТ Англи Хэл ДээрDocument13 pagesСанхүүгийн Тайлангийн МАЯГТ Англи Хэл Дээрmunkhtsetseg.tsogooNo ratings yet

- Multiplan DF 3T07 EngDocument43 pagesMultiplan DF 3T07 EngMultiplan RINo ratings yet

- Receivables TheoriesDocument8 pagesReceivables TheoriesIris MnemosyneNo ratings yet

- Entrep12 Q2 Mod8 Computation-Of-Gross-Profit v2Document16 pagesEntrep12 Q2 Mod8 Computation-Of-Gross-Profit v2Bianca Christine AgustinNo ratings yet

- 598481Document10 pages598481btstanNo ratings yet

- Economic 2Document13 pagesEconomic 2Ahmed JassimNo ratings yet

- Analysis of FSDocument28 pagesAnalysis of FSHaseeb TariqNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument52 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsMicha MaaloulyNo ratings yet

- Module 1 - PGBP Handout PDF - 240124 - 204954Document42 pagesModule 1 - PGBP Handout PDF - 240124 - 204954jabeanonionNo ratings yet

- David - sm15 - Inppt - 08Document48 pagesDavid - sm15 - Inppt - 08hero alomNo ratings yet

- Xlookup ExercisesDocument59 pagesXlookup ExercisesSamNo ratings yet

- Financial Analysis - Planning NotesDocument49 pagesFinancial Analysis - Planning NotesMadhan Kumar BobbalaNo ratings yet

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22No ratings yet

- DCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021Document7 pagesDCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021anandNo ratings yet

- Cost and Management Accounting Chapter 06Document10 pagesCost and Management Accounting Chapter 06Muhammad SohailNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet