Professional Documents

Culture Documents

Accounting For Labour

Accounting For Labour

Uploaded by

Taleem TableegOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Labour

Accounting For Labour

Uploaded by

Taleem TableegCopyright:

Available Formats

5/9/12 Accounting for labour accastart.com/acca-start-paperf-2-list-chapter-6.

html 1/5 Paper F2 - Management accounting chapter 6 - Accounting for labour 1 Direct and indirect labour Labour is often one of the major expenses of a business. One of the most important distinctions of labour is between direct and indirect costs. Direct labour costs make up part of the prime cost of a product and include the basic pay of direct workers. Direct workers are those employees who are directly involved in making an organisations products. Indirect labour costs make up part of the overheads (indirect costs) and include the basic pay of indirect workers. Indirect workers are those employees who are not directly involved in making products, (for example, maintenance staff, factory supervisors and canteen staff. Indirect labour costs also include the following. Bonus payments. Employers NationalInsurance Contributions. Idle time (when workers are paid but are not making any products, for example when a machine breaks down). Sick pay. Time spent by direct workers doing indirect jobs for example, cleaning or repairing machines. Overtime and overtime premiums When employees work overtime, they receive a basic pay element and an overtime premium. For example, if Fred is paid $8 per hour and overtime is paid at time and a half, when Fred works overtime, he willreceive $12 per hour ($8 + $4 (50% x $8)). It is important that his pay is analysed into direct and indirect labour costs.

Overtime premiums are treated as direct labour costs, if at the specific request of a customer because they want a job to be finished as soon as possible. Employees who work night shifts, or other antisocial hours may be entitled to a shift allowance or shift premium. Shift premiums are similar to overtime premiums where the extra amount paid above the basic rate is treated as an indirect labour cost. Vienna is a direct labour employee who works a standard 35 hours per week and is paid a basic rate of $12 per hour. Overtime is paid at time and a third. In week 8 she worked 42 hours and received a $50 bonus. A company operates a factory which employed 40 direct workers throughout the fourweek period just ended. Direct employees were paid at a basic rate of $4.00 per hour for a 38hour week. Total hours of the direct workers in the fourweek period were 6,528. Overtime, which is paid at a premium of 35%, is worked in order to meet general production requirements. Employee deductions total 30% of gross wages. 188 hours of direct workers time were registered as idle. Calculate the following for the fourweek period just ended. Gross wages (earnings) $ Deductions $ Net wages $ Direct labour cost $ Indirect labour cost $ 2 Calculating labour in products and services Determining time spent doing jobs Methods can include: time sheets Get Your ACCA in London Fully Funded MBA for ACCA Students. Study ACCA with LSBF London. Enrol! www.LSBF.org.uk/ACCA

Ads by Google Payroll Accounting Accounting Accounting Services Tax Accounting << >>5/9/12 Accounting for labour accastart.com/acca-start-paperf-2-list-chapter-6.html 2/5 time cards job sheets. Payroll department The payroll department is involved in carrying out functions that relate input labour costs to the work done. Preparation of the payroll involves calculating gross wages from time and activity records. The payroll department also calculates net wages after deductions from payroll (PAYE, Employers National Insurance Contributions and Employees National Insurance Contributions). The payroll department also carries out an analysis of direct wages, indirect wages, and cash required for payment. 3 Accounting for labour costs Labour costs are an expense and are recorded in an organisations income statement. Accounting transactions relating to labour are recorded in the labour account. The labour account is debited with the labour costs incurred by an organisation. The total labour costs are then analysed into direct and indirect labour costs. Direct labour costs are credited from the labour account and debited in the workinprogress (WIP) account. Remember, direct labour costs are directly involved in production and are therefore transferred to WIP before being transferred to finished goods and then cost of sales. Indirect labour costs are also credited out of the labour account and debited to the production overheads account. It is important that total labour costs are analysed into their direct and indirect elements.

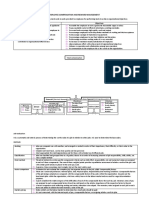

(1) Labour costs incurred are paid out of the bank before they are analysed further in the labour account. (2) The majority of the labour costs incurred by a manufacturing organisation are in respect of direct labour costs. Direct labour costs are directly involved in production and are transferred out of the labour account via a credit entry to the WIP account as shown above. (3) Indirect labour costs include indirect labour (costs of indirect labour workers), overtime premium (unless overtime is worked at the specific request of a customer), shift premium, sick pay and idle time. All of these indirect labour costs are collected in the production overheads account. They are transferred there via a credit entry out of the labour account and then debited in the production overheads account. Accounting for labour Direct workers Indirect workers Total $$$ Basic pay for basic hours 43,000 17,000 60,000 Overtime basic pay 10,000 4,500 14,500 Overtime premium 5,000 2,250 7,250 Training 2,500 1,250 3,750 Sick pay 750 250 1,000 Idle time 1,200 1,200 The following information is taken from the payroll records of a company. Required: Using the information given, complete the labour account shown below. Labour account 4 Remuneration methods There are two basic approaches to remuneration, timerelated or outputrelated.

The two basic methods are timebased and piecework systems. Timebased systems We looked at timebased systems, the most common remuneration method, at the beginning of this chapter. Employees are paid a basic rate per hour, day, week or month. Piecework systems A piecework system pays a fixed amount per unit produced. The basic formula for a piecework system is as follows. Basic timebased systems do not provide any incentive for employees to improve productivity and close supervision is often necessary. The basic formula for a timebased system is as follows. Total wages = (hours worked x basic rate of pay per hour) + (overtime hours worked x overtime premium per hour) Total wages = (units produced x rate of pay per unit) A company operates a differential piecework system and the following weekly rates have been set: How much would be paid to the following employees for the week?5/9/12 Accounting for labour accastart.com/acca-start-paperf-2-list-chapter-6.html 3/5 Employee A output achieved = 800 units Employee B output achieved = 570 units Weekly production Rate of pay per unit in this band $ 1 to 500 units 0.20 501 to 600 units 0.25 601 units and above 0.55 Employee A = $ Employee A = $ A Differential piecework B A flat rate per hour with a premium for overtime working

C Straight piecework D Piecework with a guaranteed minimum daily wage Incentive schemes Incentive schemes can be aimed at individuals and/or groups. Many different systems exist in practice for calculating bonus schemes. General rules are as follows: They should be closely related to the effort expended by employees. They should be agreed by employers/employees before being implemented. They should be easy to understand and simple to operate. They must be beneficial to all of those employees taking part in the scheme. Most bonus schemes pay a basic time rate, plus a portion of the time saved as compared to some agreed allowed time. These bonus schemes are known premium bonus plans. Examples of such schemes are Halsey and Rowan. Halsey the employee receives 50% of the time saved. Time allowed Time taken Bonus = Time rate 2 Rowan the proportion paid to the employee is based on the ratio of time taken to time allowed. Time taken Bonus = Time rate Time saved Time allowed Measured day work the concept of this approach is to pay a high time rate, but this rate is based on an analysis of past performance. Initially, work measurement is used to calculate the allowed time per unit. This allowed time is compared to the time actually taken in the past by the employee, and if this is better than the allowed time an incentive is agreed, e.g. suppose the allowed time is 1 hour per unit and that the average time taken by an employee over the last three

months is 50 minutes. If the normal rate is $12/hour, then an agreed incentive rate of (say) $14/hour could be used. Share of production share of production plans are based on acceptance by both management and labour representatives of a constant share of value added for payroll. Thus, any gains in value added whether by improved production performance or cost savings are shared by employees in this ratio. Ten employees work as a group. When production of the group exceeds the standard 200 pieces per hour each employee in the group is paid a bonus for the excess production in addition to wages at hourly rates. The bonus is computed thus: the percentage of production in excess of the standard quantity is found, and one half of the percentage is regarded as the employees share. Each employee in the group is paid as a bonus this percentage of a wage rate of $5.20 per hour. There is no relationship between the individual workers hourly rate and the bonus rate. The following is one weeks record: During this week, Jones worked 42 hours and was paid $3 per hour basic. Complete the following. Hours worked Production Monday 90 24, 500 Tuesday 88 20, 600 Wednesday 90 24, 200 Thursday 84 20, 100 Friday 88 20, 400 Saturday 40 10, 200 480 120,000

(1) The bonus rate for the week was $ (2) The total bonus for the week was $ (3) The total pay for Jones for the week was $ 5 Labour turnover In an examination you will be given clear instructions on any bonus scheme in operation. You should follow the instructions given carefully in order to calculate the bonus payable from the data supplied.5/9/12 Accounting for labour accastart.com/acca-start-paperf-2-list-chapter-6.html 4/5 Labour turnover is a measure of the proportion of people leaving relative to the average number of people employed. Management might wish to monitor labour turnover, so that control measures might be considered if the rate of turnover seems too high, and the business is losing experienced and valuable staff at too fast a rate. Labour turnover is calculated for any given period of time using the following formula: Number of leavers who require replacement 100 Average number of employees At 1 January a company employed 3,641 employees and at 31 December employee numbers were 3,735. During the year 624 employees chose to leave the company. What was the labour turnover rate for the year? A company had 4,000 staff at the beginning of 20X8. During the year, there was a major restructuring of the company and 1,500 staff were made redundant and 400 staff left the company to work for one of the companys main competitors. 400 new staff joined the company in the year to replace those who went to work for the competitor. Required: Calculate the labour turnover rate for 20X8.

6 Labour efficiency, capacity and production volume ratios Labour efficiency ratio Labour is a significant cost in many organisations and it is important to continually measure the efficiency of labour against preset targets. Labour capacity ratio Sometimes the workforce is idle through no fault of its own, and cannot get on with productive work. This sometimes happens if machines break down or need to be reset for a new production run. Labour production volume ratio The labour efficiency ratio measures the performance of the workforce by comparing the actual time taken to do a job with the expected time. The labour efficiency ratio is calculated using the following formula: Expected hours to produce output 100% Actual hours to produce output (1) The labour capacity ratio measures the number of hours spent actively working as a percentage of the total hours available for work (full capacity or budgeted hours). (2) The labour capacity ratio is calculated using the following formula: Number of hours spent working (active production) 100% Total hours available The labour production volume ratio compares the number of hours expected to be worked to produce actual output with the total hours available for work (full capacity or budgeted hours).

The labour production volume ratio is calculated using the following formula: Expected hours to produce actual output 100% Total hours available (budgeted) A company budgets to make 40,000 units of Product DOY in 4,000 hours (each unit is budgeted to take 0.1 hours each) in a year. Actual output during the year was 38,000 units which took 4,180 hours to make. Required: Calculate the labour efficiency, capacity and production volume ratios . Number of hours spent working (active production) x 100% Total hours available (budgeted)5/9/12 Accounting for labour accastart.com/acca-start-paperf-2-list-chapter-6.html 5/5 << >>

You might also like

- CXC Csec Pob p2 Jan 2022 (1064)Document16 pagesCXC Csec Pob p2 Jan 2022 (1064)Shaquille William83% (6)

- Carib Studies Past Papers AnswersDocument47 pagesCarib Studies Past Papers AnswersStephen Pommells71% (17)

- Chapter 3 - Accumulating Costs For Products and Services (1-20)Document24 pagesChapter 3 - Accumulating Costs For Products and Services (1-20)JAY AUBREY PINEDA100% (1)

- Break Even Practice Class QuestionsDocument7 pagesBreak Even Practice Class QuestionsÃhmed AliNo ratings yet

- Master in Business Administration: Managerial Economics (MPME 7113) Assignment 1Document5 pagesMaster in Business Administration: Managerial Economics (MPME 7113) Assignment 1Mohamad Nazrin Shah Mohd ZulkifliNo ratings yet

- Chapter 3 SolutionsDocument72 pagesChapter 3 SolutionsAshishpal SinghNo ratings yet

- Chap 017 AccDocument47 pagesChap 017 Acckaren_park1No ratings yet

- The Correct Answer For Each Question Is Indicated by ADocument19 pagesThe Correct Answer For Each Question Is Indicated by Aakash deepNo ratings yet

- Chapter 16 Safety, Health, and Risk Management: Human Resource Management, 15e (Dessler)Document45 pagesChapter 16 Safety, Health, and Risk Management: Human Resource Management, 15e (Dessler)moganraj8munusamyNo ratings yet

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- IBA Suggested Solution First MidTerm Taxation 12072016Document9 pagesIBA Suggested Solution First MidTerm Taxation 12072016Syed Azfar HassanNo ratings yet

- A Milk Producers Union Wishes To Test Whether The Preference Pattern of Consumers For Its Products Is Dependent On Income LevelsDocument2 pagesA Milk Producers Union Wishes To Test Whether The Preference Pattern of Consumers For Its Products Is Dependent On Income Levelsaruna270750% (2)

- VanDerbeck14e SM Ch03Document32 pagesVanDerbeck14e SM Ch03Mahnoor MaalikNo ratings yet

- Labour Tutorial QuestionsDocument4 pagesLabour Tutorial QuestionsCristian Renatus100% (1)

- Summer Training Report of Ucal Private LimitedDocument11 pagesSummer Training Report of Ucal Private LimitedPawan KumarNo ratings yet

- Chapter No. 3 Marketing Cost and Profitability AnalysisDocument12 pagesChapter No. 3 Marketing Cost and Profitability AnalysisBabarNo ratings yet

- Basel AccordDocument11 pagesBasel AccordleojosephkiNo ratings yet

- API Final RiceDocument74 pagesAPI Final RiceAaqib ChaturbhaiNo ratings yet

- Decisions Involving Alternative ChoicesDocument3 pagesDecisions Involving Alternative ChoicesHimani Meet JadavNo ratings yet

- Nestle-Organizational Behaviour With Refrence To 17 PointsDocument9 pagesNestle-Organizational Behaviour With Refrence To 17 PointsKhaWaja HamMadNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: By:-Yohannes NegatuDocument52 pagesProvisions, Contingent Liabilities and Contingent Assets: By:-Yohannes NegatuEshetie Mekonene AmareNo ratings yet

- 1321612987financial AnalysisDocument15 pages1321612987financial AnalysisMuhammad Arslan UsmanNo ratings yet

- Principle of Auditing AssignmentDocument6 pagesPrinciple of Auditing AssignmentranjinikpNo ratings yet

- Taxation Management Notes Tax Year 2020Document61 pagesTaxation Management Notes Tax Year 2020Ramsha ZahidNo ratings yet

- Marginal Costing - Brief Cases and Solutions PDFDocument7 pagesMarginal Costing - Brief Cases and Solutions PDFKaranSinghNo ratings yet

- ALl Questions According To TopicsDocument11 pagesALl Questions According To TopicsHassan KhanNo ratings yet

- "An Individual Assesse Is Allowed To Get Tax Rebate On Certain Investment"-Explain. 4Document3 pages"An Individual Assesse Is Allowed To Get Tax Rebate On Certain Investment"-Explain. 4Shawon SarkerNo ratings yet

- A Company Operates A Number of Hairdressing Establishments Which AreDocument1 pageA Company Operates A Number of Hairdressing Establishments Which AreAmit PandeyNo ratings yet

- Xerox Case StudyDocument2 pagesXerox Case StudyRaafay GulNo ratings yet

- FFCDocument17 pagesFFCAmna KhanNo ratings yet

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocument17 pagesACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNo ratings yet

- Organizaltional Chart of OGDCLDocument1 pageOrganizaltional Chart of OGDCLFarrukh Zaman BhuttoNo ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- Chapter 1-5 PDFDocument180 pagesChapter 1-5 PDFdcold6100% (1)

- Performance 6.10Document2 pagesPerformance 6.10George BulikiNo ratings yet

- Accounting Textbook Solutions - 48Document19 pagesAccounting Textbook Solutions - 48acc-expertNo ratings yet

- Cost & Management Accounting - Acc 416Document60 pagesCost & Management Accounting - Acc 416Noorfatihah ZaidiNo ratings yet

- Compensation Management: Components of Compensation SystemDocument9 pagesCompensation Management: Components of Compensation SystemgopareddykarriNo ratings yet

- Cost Accounting BookDocument148 pagesCost Accounting BookSharma Vishnu100% (2)

- Flexible Budget Examples Chapter 18Document9 pagesFlexible Budget Examples Chapter 18Surbhi JainNo ratings yet

- Budgets and Budgetary ControlDocument56 pagesBudgets and Budgetary ControlKartik JunejaNo ratings yet

- Chapter 5 Marginal CostingDocument36 pagesChapter 5 Marginal CostingSuku Thomas SamuelNo ratings yet

- MBA 515 FinalDocument25 pagesMBA 515 FinalKazi Anisul IslamNo ratings yet

- 02 MavisDocument41 pages02 MavisSantosh TalariNo ratings yet

- Mbo HerohondaDocument22 pagesMbo HerohondavithanibharatNo ratings yet

- Assignment: Inter-Organizational LinkagesDocument3 pagesAssignment: Inter-Organizational LinkagesRahim BachaNo ratings yet

- Public Sector Accounting & FinanceDocument21 pagesPublic Sector Accounting & Financeappiah ernestNo ratings yet

- 4 - Estimating The Hurdle RateDocument61 pages4 - Estimating The Hurdle RateDharmesh Goyal100% (1)

- Act202 Project Final Tea Stall Docx Determine Cost BudgetDocument17 pagesAct202 Project Final Tea Stall Docx Determine Cost BudgetFahad ChowdhuryNo ratings yet

- Conceptual FrameworksDocument17 pagesConceptual FrameworksShah KamalNo ratings yet

- Pre Finals Quiz 2 - Accounting For Government & Non-Profit OrganizationsDocument2 pagesPre Finals Quiz 2 - Accounting For Government & Non-Profit OrganizationsHelen Fiedalan Falcutila MondiaNo ratings yet

- Project One PSODocument25 pagesProject One PSOUr OojNo ratings yet

- Primary Data and Secondary Data: Reliability Test?Document15 pagesPrimary Data and Secondary Data: Reliability Test?saeed meo100% (3)

- MICRO ASS 1 Eco 401Document3 pagesMICRO ASS 1 Eco 401Uroona MalikNo ratings yet

- 5401Document6 pages5401ArumNo ratings yet

- ACG2071 Managerial AccountingDocument12 pagesACG2071 Managerial AccountingKavita SinghNo ratings yet

- Chapter 18 OverheadsDocument23 pagesChapter 18 OverheadsAkash PatilNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Inventory valuation Complete Self-Assessment GuideFrom EverandInventory valuation Complete Self-Assessment GuideRating: 4 out of 5 stars4/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Recruitment Process Outsourcing A Complete Guide - 2020 EditionFrom EverandRecruitment Process Outsourcing A Complete Guide - 2020 EditionNo ratings yet

- The Truth About Material Wealth: Is It God’S Blessing in Disguise?From EverandThe Truth About Material Wealth: Is It God’S Blessing in Disguise?No ratings yet

- Chapter 7 Unemployment and The Labor MarketDocument8 pagesChapter 7 Unemployment and The Labor MarketMD. ABDULLAH KHANNo ratings yet

- Career Assign Edited by Jany Deng Jeny BA in Psychology (Hawassa University)Document21 pagesCareer Assign Edited by Jany Deng Jeny BA in Psychology (Hawassa University)Jany JenyNo ratings yet

- EconomicsDocument833 pagesEconomicsluiso petronellaNo ratings yet

- An Analysis of The Link of Philippine Fertility Rate To Economic GrowthDocument51 pagesAn Analysis of The Link of Philippine Fertility Rate To Economic GrowthEzekiel FernandezNo ratings yet

- Manpower Utilization and TechniquesDocument10 pagesManpower Utilization and TechniquesMahaboob BashaNo ratings yet

- Employee Compensation and Reward ManagementDocument4 pagesEmployee Compensation and Reward ManagementPrabhat AcharyaNo ratings yet

- An Introduction To Cost Terms and Purposes 2-1Document33 pagesAn Introduction To Cost Terms and Purposes 2-1Moayad TeimatNo ratings yet

- Economics - Chapter 1 - Chapter 11Document122 pagesEconomics - Chapter 1 - Chapter 11Urish PreethlallNo ratings yet

- OperationsManagement Part1Document121 pagesOperationsManagement Part1nethaji_pNo ratings yet

- Machine Building For Profit and The Flat Turret LatheDocument262 pagesMachine Building For Profit and The Flat Turret LatheMike67% (3)

- What Is Economics?: Professor Mikal Skuterud ECON 101 - FALL 2019 University of WaterlooDocument23 pagesWhat Is Economics?: Professor Mikal Skuterud ECON 101 - FALL 2019 University of Waterlooiliyan nuruddinNo ratings yet

- EconomicsDocument19 pagesEconomicssam713No ratings yet

- Endogenous Growth Kaldor PDFDocument41 pagesEndogenous Growth Kaldor PDFJavier SolanoNo ratings yet

- Law of Comparative AdvantageDocument11 pagesLaw of Comparative Advantage12jaya21No ratings yet

- Saudi Real Estate SectorDocument14 pagesSaudi Real Estate SectorJitendra Garg100% (4)

- 5Document22 pages5Max33% (3)

- Assessing The Opportunities Available To Banks in Financing Horticulture Sub-Sector in EthiopiaDocument12 pagesAssessing The Opportunities Available To Banks in Financing Horticulture Sub-Sector in Ethiopiamoroda keneaNo ratings yet

- 413 Ib GC NotesDocument28 pages413 Ib GC NotesDr. Rakesh BhatiNo ratings yet

- 3 Sem EcoDocument10 pages3 Sem EcoKushagra SrivastavaNo ratings yet

- AKK PipelineDocument14 pagesAKK PipelinePalak LimbachiyaNo ratings yet

- Global Capitalism Post-PandemicDocument11 pagesGlobal Capitalism Post-PandemicJimmy SmythNo ratings yet

- Becker LaborDocument16 pagesBecker Labor_Insani_siiper_6040No ratings yet

- Krajewski TIF Chapter 14Document63 pagesKrajewski TIF Chapter 14Saja BassamNo ratings yet

- Globalization and Social TheoryDocument44 pagesGlobalization and Social TheoryMohd ZulhilmiNo ratings yet

- SVKM'S Nmims School of Law, Mumbai: Havells India - Recruitment and SelectionDocument43 pagesSVKM'S Nmims School of Law, Mumbai: Havells India - Recruitment and SelectionArnav DasNo ratings yet

- Methods ManufacturingDocument22 pagesMethods Manufacturingchetanpatil24No ratings yet