Professional Documents

Culture Documents

Caps Floors Collars

Caps Floors Collars

Uploaded by

Naga Mani MeruguOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caps Floors Collars

Caps Floors Collars

Uploaded by

Naga Mani MeruguCopyright:

Available Formats

Interest Rate Caps / Floors / Collars

Rate Limiting Tools: Interest Rate Caps, Floors and Collars Caps and Floors are essential tools in managing floating rate liabilities while minimizing hedging and opportunity costs. They protect against adverse rates risk, while allowing gains from favourable rate movements. Caps and floors are forms of option contracts, conferring potential benefits to the purchaser and potential obligations on the seller. When purchasing a cap or floor, the buyer pays a premiumtypically up-front. The premium amount depends on the specified cap or floor rate and time period covered, which may range from a few months to several years. Benefits of Caps, Floors and Collars Caps and Floors greatly enhance a treasurer's flexibility in managing financial assets and liabilities. Used together or in combination with other hedging instruments, Caps and Floors are efficient tools for reconfiguring a company's financial risk profile. Caps and Floors are used to: Hedge floating-rate liabilities Reduce borrowing costs Increase investment returns Create synthetic investments Neutralize options embedded in assets or liabilities Interest Rate Caps A cap creates a ceiling on floating rate interest costs. When market rates move above the cap rate, the seller pays the purchaser the difference. A company borrowing on a floating rate basis when 3 month LIBOR (London Interbank Offered Rate) is 6% might purchase a 7% cap, for example, to protect against a rate rise above that level. If rates subsequently rise to 9%, the company receives a 2% cap payment to compensate for the rise in market rates. The cap ensures that the borrower's interest rate costs will never exceed the cap rate. Interest Rate Floors A floor is the mirror image of a cap. When market rates fall below the floor rate, the seller pays the difference. A 6% floor triggers a payment to the purchaser whenever market rates drop below 6%. Asset managers buy floors to guarantee a minimum return on floating rate assets. They sell floors to generate incrementally higher returns. Debt managers buy floors to protect against opportunity losses on fixed rate debt when rates fall. They may sell floors as a component of a hedge strategy involving other derivative instruments. Combining Caps and Floors to Create Collars A Collar is created by purchasing a cap or floor and selling the other. The premium due for the cap (floor) is partially offset by the premium received for the floor (cap), making the collar an effective way to hedge rate risk at low cost. In return the hedger gives up the potential benefit of favourable rate movements outside the band defined by the collar. A borrower who purchases an 8% cap and sells a 6% floor guarantees a 6-8% base rate on a floating rate loan. An investor in floating rate CD's might do exactly the opposite, buying a 6% floor and financing it with the sale of an 8% cap. A costless collar is created when the cap and floor levels are set so that the premiums exactly offset each other. Caps and Floors are a simple but very effective way to control risk and manage hedge costs. The option characteristics of caps and floors offer unique opportunities to minimize borrowing costs or achieve higher investment returns.

INTEREST RATE OPTIONS Cap: a call option on an interest rate At each settlement date, check whether index rate is greater than strike rate If not, cap purchaser does not receive cash flows If so, purchaser receives from seller: [ (index rate - strike rate) x (days in settlement period / 360) x [notional amount ]

Example: $20,000,000 two-year quarterly interest rate cap on 3-month LIBOR with a strike rate of 8% Cost: 150 basis points. Up-front premium = 0.015 x $20M = $300,000 If 3-month LIBOR = 9%, seller pays (.09-.08) x 90/360 x $20M = $50,000 (for that quarter)

Floor: a put option on an interest rate At each settlement date, check whether index rate is greater than strike rate If so, floor purchaser does not receive cash flows If not, purchaser receives from seller: [ (strike rate - index rate) x (days in settlement period / 360) x notional amount ]

Collar: simultaneously buying a cap and selling a floor Purchase a cap to hedge floating-rate liabilities Sell a floor at a lower strike rate Sale of floor helps finance purchase of cap Net result: Interest expense will be limited on both ends -- will float between the cap and floor strike rates Can achieve zero-premium collar

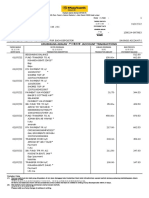

Q. As the assistant treasurer of a large corporation, your job is to look for ways your company can lock in its cost of borrowing in the financial markets. The date is January 2. Your firm is taking out a loan of $25,000,000, with interest to be paid on January 2, April 2, July 2 and October 2. Your will pay the LIBOR in effect at the beginning of the interest payment period. The current LIBOR is 10 percent. You recommend that the firm buy an interest rate cap with a strike of 10 percent and a cap for an up-front payment of $70,000. Determine the cash flows with and without over the life of this loan if LIBOR turns out to be 9.75 percent on April 2, 12.375 percent on July 2, and 11.50 percent on October 2. The payoff is based on the exact number o days and a 360-day year Solution: Calculation of Net Cash Flow with and without Cap Date Days in period 90 91 92 92 LIBOR (%) Interest Due Cap Payment Principal Repayment Net Cash Flow with Cap $24,930,000 -$625,000 -$616,146 -$638,889 -$25,638,889 Net Cash Flow without Cap $25,000,000 -$625,000 -$616,146 -$790,625 -$25,734,722

January 2 April 2 July 2 October 2 January 2

10.000 9.750 12.375 11.500

$625,000 $616,146 $790,625 $734,722

-$70,000 $151,736 $95,833 $25,000,000

Q. You are a funds manager for a large bank. On December 16, your bank lends a corporation $ 15,000,000, with interest payments to be made on March 16, June 16, and September 15. The amount of interest will be determined by LIBOR at the beginning of the interest payment period. On December LIBOR is 8 percent. Your forecast is for declining interest rates, so you anticipate lower loan interest revenues. You decide to buy an interest rate floor with a strike set an 8 percent and a floor for an upfront payment of $30,000. Determine the cash flows with and without over the life of this loan if LIBOR turns out to be 8.25 percent on March 16, 7.125 percent on June 16, and 6.00 percent on September 16. The payoff is based on the exact number of days and a 360-day year.

Solution: Calculation of Net Cash Flow with and without Floor Date Days in period 90 92 91 92 LIBOR (%) Interest Due Floor Payment $30,000 $33,177 $76,667 Principal Repayment $15,000,000 Net Cash Flow with Floor $15,030,000 $300,000 $316,250 $303,333 $15,306,667 Net Cash Flow without Floor $15,000,000 $300,000 $316,250 $270,156 $15,230,000

December 16 March 16 June 16 September 15 December 16

8.000 8.250 7.125 6.000

$300,000 $316,250 $270,156 $230,000

You might also like

- Asset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionFrom EverandAsset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionRating: 4 out of 5 stars4/5 (13)

- BFC5935 - Tutorial 10 SolutionsDocument8 pagesBFC5935 - Tutorial 10 SolutionsAlex YisnNo ratings yet

- Chapter 3Document8 pagesChapter 3Siful Islam Anik100% (1)

- Hedging BasicsDocument5 pagesHedging Basicsrksp99999No ratings yet

- Chapter 6 Bond - Assignment AnswerDocument6 pagesChapter 6 Bond - Assignment AnswerRoger RogerNo ratings yet

- BFC5935 - Tutorial 1 Solutions PDFDocument7 pagesBFC5935 - Tutorial 1 Solutions PDFXue Xu100% (1)

- Sources of Short-Term Financing: Discussion QuestionsDocument28 pagesSources of Short-Term Financing: Discussion QuestionsДр. ЦчатерйееNo ratings yet

- Local Voice - Winter 2019Document32 pagesLocal Voice - Winter 2019MoveUP, the Movement of United ProfessionalsNo ratings yet

- Interest Rate CollarDocument3 pagesInterest Rate Collarinaam mahmoodNo ratings yet

- Ch8 Practice ProblemsDocument5 pagesCh8 Practice Problemsvandung19No ratings yet

- Futures and ForwardsDocument39 pagesFutures and Forwardskamdica100% (1)

- Chap18 (1) The Statement of CashflowsDocument77 pagesChap18 (1) The Statement of Cashflowsgsagar879No ratings yet

- Forward ContractsDocument29 pagesForward ContractsAjay shahNo ratings yet

- DerivativesDocument125 pagesDerivativesLouella Liparanon100% (1)

- Capital Market AnalysisDocument86 pagesCapital Market AnalysisalenagroupNo ratings yet

- Chapter 7 Accounting For Foreign Currency TransactionsDocument5 pagesChapter 7 Accounting For Foreign Currency TransactionsMixx MineNo ratings yet

- Chapter 2-Determinants of Interest RatesDocument2 pagesChapter 2-Determinants of Interest RatesClaire VensueloNo ratings yet

- Foreign Currency Transactions and TranslationsDocument5 pagesForeign Currency Transactions and TranslationsKenneth PimentelNo ratings yet

- CH 23Document16 pagesCH 23Madiyar Mambetov100% (1)

- Risk and Rate of Returns in Financial ManagementDocument50 pagesRisk and Rate of Returns in Financial ManagementReaderNo ratings yet

- TB 12Document47 pagesTB 12Asiong SalongaNo ratings yet

- Fundamentals of Microfinance BankingDocument5 pagesFundamentals of Microfinance BankingMoses ElijahNo ratings yet

- Problems & SolutionsDocument436 pagesProblems & Solutionsmelissa100% (1)

- Financial Markets and Institutions: Abridged 10 EditionDocument31 pagesFinancial Markets and Institutions: Abridged 10 EditionrynajaeNo ratings yet

- IAS21Document3 pagesIAS21Mohammad Faisal SaleemNo ratings yet

- Interest Rate SwapsDocument29 pagesInterest Rate SwapsSAKINAMANDSAURWALANo ratings yet

- DerivativesDocument53 pagesDerivativesnikitsharmaNo ratings yet

- 04 Working Capital Management and Corporate GovernanceDocument26 pages04 Working Capital Management and Corporate GovernanceKrutika NandanNo ratings yet

- Chapter 11 Derivatives Hedging - ReportingDocument9 pagesChapter 11 Derivatives Hedging - ReportingEricka AlimNo ratings yet

- Unit III TOPIC: - Forward and Futures Contracts: Meaning, Difference Between Forward and FuturesDocument12 pagesUnit III TOPIC: - Forward and Futures Contracts: Meaning, Difference Between Forward and FuturescammyNo ratings yet

- Ifrs 7Document5 pagesIfrs 7alkhaqiNo ratings yet

- Corporate Finance Chapter6Document20 pagesCorporate Finance Chapter6Dan688No ratings yet

- FIN220 - Time Value of Money Practice QuestionsDocument2 pagesFIN220 - Time Value of Money Practice QuestionsMatt ZaheadNo ratings yet

- Ch02 Questions and Problems AnswersDocument2 pagesCh02 Questions and Problems AnswersjwbkunNo ratings yet

- Asset Backed SecuritiesDocument179 pagesAsset Backed SecuritiesShivani NidhiNo ratings yet

- Fin 444 Midterm Total Points 45 MZFDocument5 pagesFin 444 Midterm Total Points 45 MZFTãjriñ Biñte Ãlãm100% (1)

- Preparation of A Cash Flow Statement FromDocument22 pagesPreparation of A Cash Flow Statement FromUddish BagriNo ratings yet

- Chap 008Document6 pagesChap 008Haris JavedNo ratings yet

- Chapter 19 Foreign Exchange Risk: 1. ObjectivesDocument31 pagesChapter 19 Foreign Exchange Risk: 1. ObjectivesDerickBrownThe-Gentleman100% (1)

- Cost of CapitalDocument37 pagesCost of Capitalrajthakre81No ratings yet

- The Foreign Exchange MarketDocument16 pagesThe Foreign Exchange Marketmanojpatel5167% (3)

- IIIrd Sem 2012 All Questionpapers in This Word FileDocument16 pagesIIIrd Sem 2012 All Questionpapers in This Word FileAkhil RupaniNo ratings yet

- Tax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleDocument30 pagesTax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleSiddharth SharmaNo ratings yet

- Lecture 5: Interest Rate Risk (Part I) : DR Lixiong Guo Semester 2, 2015Document31 pagesLecture 5: Interest Rate Risk (Part I) : DR Lixiong Guo Semester 2, 2015studentNo ratings yet

- Derivative MarketsDocument31 pagesDerivative MarketsShinam BansalNo ratings yet

- Chapter 7 CPA FAR NotesDocument5 pagesChapter 7 CPA FAR Notesjklein2588No ratings yet

- Money Banking Practice Questions and AnswersDocument3 pagesMoney Banking Practice Questions and AnswersNihad RüstəmsoyNo ratings yet

- Preguntas 5 y 6Document4 pagesPreguntas 5 y 6juan planas rivarolaNo ratings yet

- Ias 21Document25 pagesIas 21shakilNo ratings yet

- LBP UITF FAQs - As of October 2020 FINALDocument10 pagesLBP UITF FAQs - As of October 2020 FINALMardezz AcordaNo ratings yet

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesDivine CuasayNo ratings yet

- Accounting For InventoriesDocument9 pagesAccounting For InventoriesPrince AngelNo ratings yet

- Refinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenDocument6 pagesRefinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenJeffNo ratings yet

- Chapter 03Document97 pagesChapter 03HaNo ratings yet

- What Is Duration?: Bond Debt Instrument Interest Rates Time To Maturity PrincipalDocument4 pagesWhat Is Duration?: Bond Debt Instrument Interest Rates Time To Maturity PrincipalBhowmik DipNo ratings yet

- 2 Forward Rate AgreementDocument8 pages2 Forward Rate AgreementRicha Gupta100% (1)

- Module 2 Getting Ready To BuyDocument13 pagesModule 2 Getting Ready To BuysukhveerNo ratings yet

- InvestmentsDocument4 pagesInvestmentsIevaNo ratings yet

- Lecture Notes For FSA (Credit Analysis)Document43 pagesLecture Notes For FSA (Credit Analysis)durga03100% (1)

- Margin Handbook: Page 1 of 17Document17 pagesMargin Handbook: Page 1 of 17satishleoNo ratings yet

- Iv-Semester Online Examinations MBA405F-Financial ServicesDocument5 pagesIv-Semester Online Examinations MBA405F-Financial ServicesNaga Mani MeruguNo ratings yet

- Mba 201Document16 pagesMba 201Naga Mani MeruguNo ratings yet

- Mba 402Document5 pagesMba 402Naga Mani MeruguNo ratings yet

- Mba 205Document23 pagesMba 205Naga Mani MeruguNo ratings yet

- Mba 202Document13 pagesMba 202Naga Mani MeruguNo ratings yet

- Depository ServicesDocument15 pagesDepository ServicesNaga Mani MeruguNo ratings yet

- Lending Policies: Click To Edit Master Subtitle StyleDocument8 pagesLending Policies: Click To Edit Master Subtitle StyleNaga Mani MeruguNo ratings yet

- Verma Panel FindingsDocument17 pagesVerma Panel FindingsNaga Mani MeruguNo ratings yet

- Branch BankingDocument5 pagesBranch BankingNaga Mani MeruguNo ratings yet

- Safety:: General Principles of Sound LendingDocument3 pagesSafety:: General Principles of Sound LendingNaga Mani MeruguNo ratings yet

- Structure of Indian Banking SystemDocument5 pagesStructure of Indian Banking SystemNaga Mani MeruguNo ratings yet

- Jagadish S: Best Answers In: Event Marketing and Promotions (1) ..Document3 pagesJagadish S: Best Answers In: Event Marketing and Promotions (1) ..Naga Mani MeruguNo ratings yet

- Banks With TaglinesDocument2 pagesBanks With TaglinesNaga Mani MeruguNo ratings yet

- Fin ServicesDocument17 pagesFin ServicesNaga Mani MeruguNo ratings yet

- Dissertation Report On E-BankingDocument8 pagesDissertation Report On E-BankingCustomNotePaperNewYork100% (1)

- Ifrs 1 First Time Adoption of Ifrss: BackgroundDocument3 pagesIfrs 1 First Time Adoption of Ifrss: Backgroundmusic niNo ratings yet

- Example Paper CF Exam 2Document6 pagesExample Paper CF Exam 2Ashton Kyle ClarkeNo ratings yet

- Goldman SachsDocument40 pagesGoldman SachsAurelia AlessiaNo ratings yet

- Verizon Communications Inc.: Horizontal AnalysisDocument42 pagesVerizon Communications Inc.: Horizontal Analysisjm gonzalezNo ratings yet

- FAP Midterm (A)Document3 pagesFAP Midterm (A)musharraf anjumNo ratings yet

- FAR.113 - INVESTMENT PROPERTY With Answer PDFDocument5 pagesFAR.113 - INVESTMENT PROPERTY With Answer PDFMaeNo ratings yet

- Mumbai Attendee ListDocument9 pagesMumbai Attendee ListVikramNo ratings yet

- Solution of Chapter 5Document3 pagesSolution of Chapter 5Minh Do Ky0% (1)

- SOA MailFile 128 181800292Document7 pagesSOA MailFile 128 181800292s.suresh k.swaminathanNo ratings yet

- CH 7 International Bond MarketDocument12 pagesCH 7 International Bond MarketManan SuchakNo ratings yet

- Unit 4 FMISDocument3 pagesUnit 4 FMISmahidpr18No ratings yet

- 179-Article Text-1014-1-10-20210725Document15 pages179-Article Text-1014-1-10-20210725Eka TriwulandariNo ratings yet

- ch2 All HW-PS2Document89 pagesch2 All HW-PS2yu zhangNo ratings yet

- Bsa3b Ia Ipppe BaltazarDocument6 pagesBsa3b Ia Ipppe BaltazarElaine Joyce GarciaNo ratings yet

- Capm-Apt Notes 2021Document4 pagesCapm-Apt Notes 2021hardik jainNo ratings yet

- Latihan Accounts ReceivableDocument2 pagesLatihan Accounts ReceivableAlghifary RamadhanNo ratings yet

- A Dissertation On Mutual Fund and InvestorDocument19 pagesA Dissertation On Mutual Fund and Investormadhu4frends3412No ratings yet

- Format Excel For BS IS and CFSDocument9 pagesFormat Excel For BS IS and CFSNishant WasadNo ratings yet

- BF Assign1Document3 pagesBF Assign1Mian Shawal67% (3)

- FINC 302, Selected Questions For PracticeDocument30 pagesFINC 302, Selected Questions For PracticethomasNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthJayson Deocareza Dela Torre100% (1)

- Fiori ListsDocument1,220 pagesFiori ListsAnonymous idAkaGNo ratings yet

- ARCI - The New PlayerDocument4 pagesARCI - The New PlayerjohnNo ratings yet

- Chapter 20: Managing Credit Risk On The Balance SheetDocument17 pagesChapter 20: Managing Credit Risk On The Balance SheetAmmar Ali AyubNo ratings yet

- Nism Series III A Securities Intermediaries Compliance Non Fund Exam Workbook in PDFDocument416 pagesNism Series III A Securities Intermediaries Compliance Non Fund Exam Workbook in PDFManiesh MahajanNo ratings yet

- Ibs Ipoh Main, Jsis 1 31/07/22Document6 pagesIbs Ipoh Main, Jsis 1 31/07/22azman ab wahabNo ratings yet

- Intermediate Accounting SolmanDocument14 pagesIntermediate Accounting SolmanAlarich CatayocNo ratings yet

- 909Document2 pages909Kashif SiddiquiNo ratings yet