Professional Documents

Culture Documents

Informs: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations Research

Informs: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations Research

Uploaded by

hessamhoorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Informs: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations Research

Informs: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations Research

Uploaded by

hessamhoorCopyright:

Available Formats

Planning Horizons for the Dynamic Lot Size Model: Zabel vs.

Protective Procedures and Computational Results Author(s): Rolf A. Lundin and Thomas E. Morton Reviewed work(s): Source: Operations Research, Vol. 23, No. 4 (Jul. - Aug., 1975), pp. 711-734 Published by: INFORMS Stable URL: http://www.jstor.org/stable/169852 . Accessed: 14/05/2012 01:00

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

INFORMS is collaborating with JSTOR to digitize, preserve and extend access to Operations Research.

http://www.jstor.org

OPERATIONS RESEARCH, Vol. 23, No. 4, July-August 1975

Planning Horizonsfor the Dynamic Lot Size Model: Zabel vs. Protective Proceduresand ComputationalResults

ROLF LUNDIN A.

University of Gothenburg, Sweden Gothenburg,

E. THOMAS MORTON

Carnegie-MellonUniversity, Pittsburgh, Pennsylvania (Received original July 24, 1974;final, December 4, 1974)

Forwardalgorithms that solve successivelylonger finitehorizonproblems and that possess good stopping rules (suchas a planninghorizon) seem better suited to the needs of a manager facing a partial than the more commonprocedureof selectinformation environment ing a horizon [0, TI in advance. In this light, the Wagner and Whitin forward algorithm with a planning horizon procedure for the dynamic lot size model goes far beyond computationalsavings. on Building additional resultsdue to Zabel, we develop new planning horizonproceduresand near planninghorizonprocedures. (A brief sketch of how to develop similarresultsfor the production smoothing problem suggests that the basic methodology developed possesses some generality.) We present an extensive empirical study that reports that Wagner-Whitin planning horizons were found for a reasonably small subset of problems within 500 periods, while planning horizons, or at least near planning horizons,were found universallyby the modified procedure. (TheZabel procedure was intermediatein power.) The numberof periods untila 'near' horizon seems to be given empiricallyby t = /2K/hD for the linear stationarycase, where K is the setup cost, h the holding cost, and D the average demand rate. Extensions useful for a broad subset of the general concave cost case are also given.

W HILE IT is common practice to solve infinite horizon nonstationary

optimization problems by restricting attention to a finite horizon [0, TI, this heuristic selection of T in effect presupposes a great deal of knowledge about the convergence rate of the solution in T, which is usually not available. (Customarily, 'solution' means a complete set of decision rules or policies for every point in time between 0 and T, for every possible state of the problem. Here we are really only interested in finding an initial

711

712

Rolf A. Lundinand Thomas E. Morton

portion of the policy, since the problem is typically resolved periodically to incorporate improved forecast data. For the discrete problems considered here, this initial portion might be the decision rule for the current period.) One approach to this problem is to provide analytic or computational insight into the convergence rate. Another is to provide a forward algorithm that can efficiently solve longer and longer finite horizon problems. In the latter case, one also needs a good stopping rule. Possibilities include: (a) apparent initial policy convergence; (b) a planninghorizon; (c) computationalbounds on the opportunitycost of using a currentestimate of the solution; (d) computationalbounds on the optimal initial policy. In this light, the importance of the Wagner-Whitin"7'forward algorithm with its associated planning horizon procedure far exceeds simple computational savings in solving a T period problem. Unfortunately, however, their procedure can find planning horizons only for a reasonably small subset of problems likely to be encountered, as will be seen in the empirical study discussed in Section 3. Building on results due to Zabelt81 have we produced planning horizon procedures that are seen empirically for the linear stationary case universally to supply planning horizons, or 'near) horizons in a sense to be developed below. The unmodified Zabel procedure is seen to be intermediate in power. Conditions are developed under which the procedures given are 'protective'; that is, the procedures will eventually find any horizon that could conceivably be found by a 'perfect' procedure. In Section 1 previous planning horizon results for dynamic lot size models are briefly summarized. In Section 2 the main ideas developed in this paper are introduced in a rather general context. The development is rather abstract, because we feel that the machinery will be useful in providing forward algorithms and protective planning horizon procedures for a much broader class of problems than dynamic lot size models. (To give substance to this hope, we sketch an application of the machinery that finds protective planning horizon procedures for the deterministic production smoothing problem.) For infinite horizon decision problems we suggest an optimality criterion that leads to the concept of E planning and forecast horizons. The key concept of a regeneration set is introduced and related to obtaining planning and forecast horizons. Section 3 points out, for the dynamic lot size model, that under conditions leading to Zabel's theorem, such regeneration sets are automatically available. For the stationary cost case, mild conditions are given for such sets to lead to a protective

PlanningHorizons: Dynamic Size Model The Lot

713

procedure. The remainder of Section 3 is devoted to describing the results of a large empirical study investigating the frequency of planning horizons of various types under broad ranges of costs and demand patterns. An important empirical discovery is that the number of periods required to guarantee an initial decision no more than 1 percent from optimal in average cost seems to be about t = 5V2K/hD, where K is the setup cost, h the holding cost, and D the average demand. This result should be useful to managers not wishing to implement a more complicated procedure. Section 4 develops extensions and generalizations to some previous planning horizon results. Emphasis is placed on the derivation of regeneration sets, but results pertaining to computational efficiency are also given. Finally, Section 5 develops procedures for a fairly broad subclass of concave production costs that will provide an alternative methodology for obtaining regeneration sets and protective forecast horizons. The two procedures are quite different; neither dominates the other. The procedure of Section 4 handles more general cost structures, while that of Section 5 is more amenable to such model extensions as backlogging. An algorithm is specified, and a numerical example is presented. 1. PREVIOUS PLANNING FOR MODELS HORIZON RESULTS DYNAMIC SIZE LOT The principal previous results developing forward planning horizons for the dynamic lot size model are found in five studies: Wagner and Whitin,17' Zabelt8 Eppen, Gould, and Pashigianj2' Blackburn and Kunreuther,111 and Thomas." We initially consider the first two papers. l and Assumptions Definitions Let

, T. do= demand in period t (d 0), t=1, 2, ct(xt)=Kt+cxt if x,>O, else 0 (Kt, xt>0). This is the cost of producing xt units in period t. This is the cost of holding inventory It It>0). h(It)=htl(htO, from period t to period t+1. It is assumed that lo = 0. If in fact Io>0, the problem can be redefined as indicated by Zabel,81p. 468. The problem is solved with IT 0 O. The optimal t-period solution is defined to be the least cost solution for the first t periods with I = 0. If xt >0, we say that period t is a setup period and if It=0, we say that t is a regenerationpoint. Because of concavity one characteristic of the optimal solution is xtIt = 0. Omitting other results following from concavity concerning the form of the optimal solution, we have THE PLANNING HORIZON THEOREM (Wagner and Whiting7' p. 92). If an optimal t-periodsolution has a last setup in period 1(t), then at least one optimal solution to any t*-periodproblem(whereto > t) will neverhave a last setup prior

714

RolfA. Lundin Thomas Morton and E.

to period 1(t). Furthermore,if l(t) = t, then periods 1 through t- 1 constitute planning horizon; that is, an optimal solution to the t*-period problem has It-1= O. The second part of the theorem is the planning horizon result offered by Wagner and Whitin. The first part of the theorem was later strengthened to the following FORWARD PLANNING HORIZON THEOREM (Zabel,f8 p. 467): 1. If the optimal t-period solution has a last setup in period 1(t), then at least one optimal solution to any t*-period problem (where t*>t) will have a setup in period - such that l(t) ? 1? t. 2. Furthermore,as in 1, if the optimal (t - 1)-period solution for all t such that 1(t)?- < t has a last setup in period ![t< 1(t)], then periods 1 through t-1 constitute a planning horizon. (It should be noted that the first part of the theorem contains the Wagner and Whitin planning horizon result as a special case.) We now consider the study by Eppen, et al.121 In this study the authors allow the marginal production cost (ct) to vary with time (but not with quantity). One important notion in reference 2 is the idea of a forward extrapolation from period t1 to period t2 (t1? t2) defined as atl=t2ctl+ E-=t hi. The forward extrapolation idea is used to define a violator set m (to, t2) = I tr:1, 2, .., t2l I att2 < at, tt2 I Define 1(t) to be the last setup period in the optimal solution to a tperiod problem. Note that 1(t)-1 is the corresponding last regeneration point in the previous terminology [if 1(t) > 1]. E THEOREM (Eppen et al., 21 p. 274). Given the optimal t-period solution and 1(t), and if m[l(t), t]=p, then periods 1 through l(t)-1 constitute a planning horizon [if 1(t) > 1]. Blackburn and Kunreuthertll have recently extended the above analysis to cover the backlogging case and concave holding and penalty costs. First they transform the inventory related cost function Wt (It) by Wt (It) = Wt (It) + (ct- ct+i) It to obtain an equivalent problem (see Veinott[61) in which the total cost in a period is K ti (Xt ) + Wt (I t) They also define W, and Wt as the lower bounds on transformed marginal holding cost and backlogging cost per unit, respectively. A period t is called a planning period if there is no speculative motive for producing in another period j to satisfy demand in period t; that is,

I .

Wt

van,

j <t;

j_1 Wi0,

j>t.

Now let k (t) denote the next-to-last regeneration point and 1(t) the last production point. THEOREM B (Blackburn and KunreutherIl1). If 1(t) is a planning period, then given any t*> tj

Planning Horizons. The Dynamic Lot Size Model

715

(a) k (t*) > k (t), (b) I (t*) > l (0), (c) the t* solution has a regenerationpoint t, k (t) <t (t- 1), (d) k (t) =t-1, l (t) = t implies a planning horizon. Blackburn and Kunreuther also give a generalization of Eppen, Gould, and Pashigian for the general speculative case. Thomas[51 works with the same system as Eppen et al., but he includes prices so that dt = kt (pt) =demand in period t when the decision variable price is pt(dt ?O). Thomas gets the same planning horizon results as Eppen et al. for this generalization. PLANNING HORIZON PROCEDURES 2. PROTECTIVE Although the planning horizon methodology developed in this section is applied here for the simple version of the dynamic lot size model reviewed in the last section, the principles are quite general. There may be multiple products, demand classes, production modes; demands or production may be positive or negative; costs may be more general; various constraints and bounds may be added. Costs are assumed known and separable by period; demands are assumed known. (Of course, the primary purpose of the procedures to be developed is to indicate how much demand information is really needed for a current decision.) Periods are linked by a state variable that we will call the inventory level. For the procedures to have much content there must be a marked state to which the system tends to return; we shall say 'ending inventory is zero.' A period known to be in this state is called a regeneration period or point. Solving a t period subproblem means finding the least cost solution for the first t periods with same initial state as the full problem and with period t constrained to be a regeneration point. For such a problem, a forward algorithm that solves successively longer t-period subproblems may be defined in standard fashion. 16] Note that this section gives no constructive procedures for finding the 'regeneration sets' defined below. Thus this claim for generality is not a claim for the existence of easy procedures to find regeneration sets in more complicated problems, but rather a claim that the quest for planning horizons and other related procedures may be reduced to the quest for regeneration sets. A necessarily very brief sketch of how regeneration sets may be found in a rather different problem may lend some substance to this discussion. Recently Kunreuther and Mortont3l developed some planning horizon results for the deterministic production smoothing problem. These results were not protective in the sense developed in this section, nor was a forward algorithm given.

716

E. and Rolf A. Lundin Thomas Morton

For definiteness, consider the linear stationary version of their problem with overtime, but no undertime or backlogging. The state variable in this case is (Pt, I,), the production level and ending inventory level. One of the K - M results is that for every 2n* (a constant calculated from the cost parameters) periods, it may be assumed that at least one period will have ending inventory equal to zero in any longer problem. Also, in a period with ending inventory equal to zero, the optimal production level is known to be between two bounds D** > Pt* > Dt*. (The bounds are calculated from the demand data, 2n** being known.) Thus, although not finite, the sets Rt= { (Pk, O)It<kt+2n**, D*>P?>&Dv*} are regeneration sets in the sense developed in this section and form a protective regeneration sequence. The regeneration set may actually be considered finite, since in varying the ending condition Pk in a k period problem only the extreme values or values involving a change of the basis need be considered because of linearity. Thus, given a forward algorithm that would require only some modification of a standard programming package together with a link that constructs a feasible solution to a t+ 1 period problem from the optimal solution to a t period problem, the full machinery developed in this section is available for this problem. It is customary to define multiperiod models on a finite set of periods 1, , T. However, heuristic selection of such a T in effect presupposes a great deal of knowledge about sensitivity of the initial part of the solution to T, which should preferably be supplied by the solution procedure Thus we consider the infinite horizon problem with the following optimality criterion. Let artrepresent a policy defined on the first t periods, C (7rt) its cost, C*(t) the least cost for a t period subproblem, and C*(tl7ru) the optimum cost when the policy is constrained to be iri- for the first u periods. Definition. A policy art is called (e, t, n ) optimal if for all N > n, C* (N|7rt) . We call e the C* (N) <t, irrespective of demands in periods n+, 1, tolerance, t the E-planninghorizon, and n the e-forecast horizon. Zero planning and forecast horizons will be called planning and forecast horizons. Definition. The minimum n for which there exists a policy rt that is (E, t, n) optimal is denoted n* (E, t) and is called the defacto forecast horizon for t. (n* may be infinite.) Definition. Let Z be any finite set of periods, and denote its maximum and minimum element by zu and z4, respectively. If for every t ? zu there is at least one optimal solution to the t period subproblem with a regeneration point belonging to Z, then Z is termed a regenerationset for the full problem. No general procedure seems to be available for finding regeneration sets.

Planning Horizons. The Dynamic Lot Size Model

717

In later sections, we shall develop procedures for specific dynamic lot size models. Here we content ourselves with developing the importance of regeneration sets for finding planning horizons. Definition. Z' is called a derived regeneration set if Z' contains at least one regeneration point for at least one optimal plan for a z period problem for every zEZ. In particular, F (Z) is any derived regeneration set of Z consisting of the first regeneration point for one optimum plan for each

zeZ.

Note that a derived regeneration set has essentially all the properties of the original set but may be much smaller.

1. PROPOSITION Let Z be a regeneration set.

(a) For every N ? z' there is an optimal N period policy with a regeneration point belonging to Y (Z) (or any Z'). (b) In particular, if F (Z) is the single period f, then any optimal f plan lrf is (0, f, zu) optimal; that is, z' is a forecast horizon for the first f periods. Although obvious, Proposition 1 is shown in the next section to be comnputationally powerful in providing planning horizons at little extra cost in the linear case. If the first regeneration point for every z is unique, we call such a planning horizon simple. To illustrate Proposition 1, suppose in a dynamic lot size model it is known for some reason that in any longer horizon problem one of periods 17, 18, 19, or 20 is a regeneration point. Suppose the finite horizon problems of length 17, 18, 19, or 20 all have a first regeneration point in period 4. This means that for all these finite horizon problems it was optimal to produce for four periods in period 1. Since one of the finite horizon problems is known to be part of any longer problem, any longer problem must also produce for four periods in period 1, giving a planning horizon. The following extension is computationally more demanding but is guaranteed to give horizons of some tolerance.

PROPOSITION2.

for any

t?Zd.

Let Z be a regeneration set, and consider any policy Then 7rtis (e, t, zu) optimal, where e--maxzf z 1/t {C* (Zj7rt )-C*

(Z ) }.

(l

lrt,

Proof. For any N> z, let z (N) EZ be a regeneration point of the N period problem, and define F[z (N), N] =C* (N) - C*[z(N)] (that is, the cost- of the final segment). Then C* (NlIrt) < C*[z(N) Irt]+F[z (N), N];

718 also

RolfA. Lundin Thomas Morton and E.

C* (N)=C*[z (N)]+F[z (N), N]. Thus, C*(NIst)-C*(N)<C*[z(N)i

rt]-C*[z(N)] _max{

C*(zIst)-C*(z)

}.

To illustrate Proposition 2, modify the example just given so that the finite horizon subproblem of length 19 has a first regeneration point in period 5 while the others remain at 4. Suppose that a 20 cost penalty is incurred if the 19-period subproblem is instead constrained to have a first regeneration at four periods. Proposition 2 then states that the opportunity cost of producing for four periods in period 1 and behaving optimally from period 5 on cannot exceed 20?, or 50 for each of the first four periods. We are interested in incorporating Proposition 1 and/or Proposition 2 into an efficient forward algorithm and also in some sense in specifying how close to 'perfect' the procedure is. Definition. A forward procedure that requires only n* (e, t) periods of demand, for fixed e and t to discover at least one plan irt that is (e, t, n) optimal is called perfect. Perfect procedures do not seem easily obtainable. A lesser goal is to specify conditions allowing 'near-perfect' procedures. Definition. If n *(e, t) is finite, a forward procedure guaranteed to find a plan irt that is (e, t, n) optimal for some n is called protective. Definition. A sequence of regeneration sets Z(t) defined on an infinite subsequence of periods, such that z' (t) = t and lim suptw, Zd (t) = is called a protectiveregenerationsequence.

PROPOSITION

3. Given a protective regeneration sequence, a protective forward algorithm can be constructed to find either simple planning horizons or e-horizons. Proof. Choose, for example, to such that zd (to) n* (E, t), If the algorithm is designed to implement Proposition 2 on each successive Z(t), the horizon will be discovered when z (to) is investigated. Turning briefly to computational considerations, we can see that given a protective regeneration sequence, implementing a protective procedure for finding simple planning horizons requires little extra calculations-one simply finds and saves the first regeneration point as well as the next to the last one (the last one being the final period) for the optimal solution to the t-period subproblem. If the next to the last is period 0, the first is period t. If the next to the last is 1(t) - 1, the first is the same as the first for that problem, which has been previously saved. The procedure terminates when, for a given t, F[Z (t)] reduces to a single period.

Lot Planning Horizons: Dynamic Size Model The

719

Full implementation of Proposition 2 seems less attractive, since to calculate C* (zl7rt) over incremental values of z, one would seem to require a separate run of the forward algorithm for each constrained lrt investigated. Two compromise procedures seem viable:

PROCEDURE 1.

(a) Run an algorithmbased on Proposition1 until either a simple planning horizonis discoveredor a cutoff (say t, = 50) is reached. (b) Even if F[Z(t,)]has morethan one element,it is likely to have only a small number. (c) Run the forwardalgorithmsimultaneouslyfor each such value of the first regeneration point, and implementProposition2 on successiveZ(t). The advantages of Procedure 1 include complete safety and speed if a simple horizon is found. The disadvantages include the difficult choice of a cutoff value and departure from a unified forward algorithm.

PROCEDURE

2.

(a) Save for each value of t not only the best first regeneration point and its optimal cost, but also the second, third, *.., Mth best regenerationpoints and associatedoptimalcost. (b) To find the mth best for t +1, only the m best finalregeneration points need be considered for each finalregeneration and point, one of its m best plans;that is, choose the minimumover m2choicesof final regeneration point for that subproblem. (c) For any first regeneration point candidatethat is representedon the Mth best list for every zEZ(t), Proposition2 can be implemented. The main advantage of Procedure 2 is that it is a true forward algorithm and is very conservative in the use of demand information. The disadvantage is in the choice of M. Too large an M is expensive computationally; to small an M risks a good policy's not being represented on the list for every zEZ(t), especially where there are near multiple optima. In the empirical results, to be discussed below, we actually implemented Procedure 2 with M=4 with excellent results over an extremely wide selection of cost parameters and demand patterns. 3. EMPIRICAL RESULTS THELINEAR FOR STATIONARY COSTCASE Implementation of the procedures developed in the last section requires only a method for generating a regeneration sequence within the forward algorithm. Showing that the procedure is 'good' in the sense of eventually finding any de facto planning horizon also requires obtaining conditions under which the left endpoint of the regeneration sets can be made as large as desired.

720

E. and RolfA. Lundin Thomas Morton

Observation1. Whenever the first half of Zabel's forward planning horizon theorem holds, the sets [k(t), - , (t- 1)], for all t are, regeneration sets providing a regeneration sequence. For example, the Blackburn and Kunreuther1' backlogging planning horizon results follow directly after Zabel's theorem is proved for that case. This fact was clearly recognized by Zabel, who used it directly to construct his planning horizon result. Unfortunately, he required that the last regenerationpoint, rather than the first (or Nth), agree for all the problems in the regeneration set. Observation2. For the stationary cost case, any interval [(t- k), * , (t-1 )] must contain at least one regeneration point, as long as k >K/hDt. The proof is trivial. It is cheaper to setup in period t and incur K than to carry inventory from period t- k or earlier. Observation3. For the stationary cost case, the Zabel regeneration sequence is protective as long as lim supkO Dt+k> K/hk. Again the proof is trivial. Note that the condition is not restrictive. If demand were to remain less than E, say, one should terminate business! Analogues of Observations 1-3 for more general structures will occupy Section 5. We turn now to the empirical study. Two substudies were conducted, part 1 being an implementation of Procedure 1, part 2 of Procedure 2. The first part of the study used a standard forward algorithm for the dynamic lot size model, saving the first regeneration point f (t) for each subproblem as well as the next to the last regeneration point k (t). [In the standard fashion, the monotonicity of k (t) was also used to reduce storage and computation.] As a tie-breaking mechanism, when there were multiple choices for a new k (t), Dt was perturbed slightly to 1.0001DA,making the largest tying value of k be chosen. For each run, for each successive value of t, the program checked whether or not a Wagner-Whitin planning horizon, a Zabel planning horizon, or a simple protective planning horizon had yet occurred and saved the period of first occurrence, if any. These criteria were: [k(t))#O] (a) k (t) = t-1 (Wagner-Whitin), (b) k[k(t)]=k[k(t)+1] ... =k(t-1) (c) f[k (t)]-=f[k (t )+ 1]... =f(t-1) (Zabel), (simple protective).

The run terminated with a cutoff t = 500. The demand generating mechanism employed was Dt+1- {DoTt[L.O+A cos [(Bt+C)2ir]]+SDot} + (2)

Planning Horizons: The Dynamic Lot Size Model

721

where Do is the base demand rate, T the geometric trend factor, A the 'seasonal factor' magnitude, 1/B the length of the 'season,' C a phase shift for position in the season, S the demand spread, SDo the standard deviation of demand, t an approximate normal deviate (generated by normalizing the sum of four random numbers drawn from the unit interval) and D,+1?0. In all runs, without loss of generality, Do was set=10, and a single normalized cost parameter

J K/ (Doh)

(3)

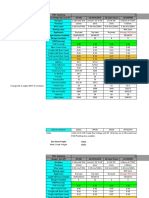

(called the normalized setup cost) was varied. The first group of runs consisted of all combinations of: (a) six basic demand patterns, (b) four demand standard deviation levels, (c) 15 J values, and, (d) 10 replications each, resulting in a total of 3,600 runs. The demand patterns were: constant, 1.005 trend, 0.995 trend, 50 percent seasonal variation and 0.12 cycles per period, 50 percent and 0.04, and 50 percent and 0.01 (starting at peak demand). The standard deviations were 0.5 percent, 5 percent, 15 percent, and 50 percent of the base demand, respectively. The J values were 1, 1.5, 2, 3, 4, 6, 8, 10, 15, 20, 30, 50, 75, 100, and 150, giving roughly a logarithmic coverage. Notice that for constant demand, J = 1 is a reasonable lower bound since it implies production in every period. For large J, VYJ is the standard EOQ in units of periods, giving a value of 17.3 at the upper bound. (It was felt that for computational reasons a manager in practice would be unlikely to choose a period length giving larger values of the EOQ.) As an illustrative example, the results for the constant demand pattern with a 15 percent standard deviation are presented in Fig. 1. The period in which the first forecast horizon is achieved for each of the three techniques is plotted as a function of J, the normalized setup cost. We plotted only the median value of the 10 replications, except in the protective case, where the range is also shown with vertical bars. All three techniques coincide for J's of 1 and 1.5. After that the Wagner-Whitin technique deteriorates very quickly, finding no horizons within 500 periods for 3?<J ?150. The Zabel technique continues to coincide with the protective technique up to about J = 4, at which point it begins to deteriorate more moderately, finding no horizons within 500 periods for 20? J ?150. Ranges for both the Zabel and Wagner-Whitin techniques (not shown) grow extremely large as the maximum effective J is neared. By contrast, the protective technique always found horizons for every J with a maximum median at J = 100 of 112 periods. Note that 112 periods may or may not be of practical interest, depending on the problem. In cash management problems, the decision period would probably be daily with a data horizon of 200 to 500 periods. In inventory-distribution problems the decision period is often weekly with

722

Rolf A. Lundinand Thomas E. Morton

._~~~

CN

S _0~~~~~

a)~~~~~~~

Q

~ ~~~~~O~ 2

F I

co

0e Q)~~~~~~~~~~~~~~~~~~~~~~~~~~

*

I I

a)

IL

* \

Co

0) C+

.

'I

W~~~~

1!

R

N

~~

H- -H_

d~~~~~~~~~~~~~~~~~~~~

h=

o~~~~~~~~~~.,

-o

0

0

_

~~~~~~~~~

-1~~~~~~~~~~~~Cu

~~~~~~~~~

CF2

Q~~~~~

LO0

0 lseuOaJOd PO'J~d

W~~~0

p9AaILq0V UOZIJOH

PlanningHorizons: Dynamic Size Model The Lot

723

a data horizon of 50 to 150 periods. In capacity expansion problems the decision period might be monthly with a data horizon of 120 to 240 periods. A line of informal fit to the function would seem to have a slope of about 1.0 for small values of J and about 0.5 for large J. Since the scale is log-log, this result implies that the median time to forecast horizon, normalized as a multiple of V\2J, is roughly asymptotically constant for large J. For the graph, i_ t/A/Y2J7 or 8. (This is quite satisfying intuitively, since if a given continuous problem were to be discretized with successively smaller period length, \"2J would increase as the inverse of the period length, so that t/x/2J = constant would imply the existence of forecast horizons for a continuous time problem. Of course, this is simply speculation based on empirical results. However, we will discuss similar results with respect to 1 percent forecast horizons.) Because of space limitations, presentation of all 24 sets of runs corresponding to Fig. 1 is not possible. However, a reasonable summary of these results has been presented in Tables I and II. In Table I, for each standard deviation, technique, and J value, a grand median was formed of the six medians for each demand type, giving roughly an 'average' picture over demand types. All techniques improve as the standard deviation increases. The Wagner-Whitin technique is effective only for J values up to 2.0 or 3.0 except for the extreme 50-percent standard deviation case, for which its range increases to about 8 to 10. At the other extreme, the protective technique is effective throughout the full range for all standard deviations, although it begins to deteriorate badly at very low standard deviations. The Zabel technique is intermediate, behaving like the Wagner-Whitin technique at low standard deviations and the protective technique at very high standard deviations. Table II presents a different kind of summary, looking at the full distribution of time to forecast horizon, but averaging over J values. (In essence a uniform distribution is being assumed over log J for 1 ? J ? 150 and over the 6 demand types.) The protective technique achieves a horizon within 500 periods 92 percent of the time even in the worst case with standard deviation of 0.5 percent, while these figures are only 25 percent and 39 percent for the Wagner-Whitin and Zabel techniques, respectively. For the rather representative 15 percent standard deviation case, the protective technique has an 87 percent probability of achieving a horizon within 100 periods, while these figures are 24 percent and 54 percent for the other two. The situation most favorable to obtaining Wagner-Whitin horizons is either one of very large demand de, or a sequence of small demands followed by a large one. These situations explain why changing the standard deviation from 0.5 percent to 15 percent has little effect on the technique. The

724

and E. RolfA. Lundin Thomas Morton

?n

Ia cq

]C

I Cb111 I

t d

u7

f I 1s

l~~~~~~~~t I 1olC0,2

r-r--

I t

4

-1 1 1 1c 1? ~~~~~~~~~~~~~~~~~~10

C)

cl

....

._.

; .r *we ;

0+ C4

1 s

0D

1Lo

C1

ba

t~~~~t

m

w)

X0

'Tt

ca

"O

Ca.

.=

c3

Cd

Ca

E

5 3!

d~~~~~~~~~~~~~~~~. ...

nq

nq W v~~~C s

v cq00

s0 0

Planning Horizons: Dynamic Size Model The Lot

> 000

It O 000

725

0o

8 8

......

x C- cy I- C-D C

Ci cycy CtCt 9

c o 0 0

~~

If)

C~

3

06

0 o

00 0o

C;

000000

- I

W 4

oo

o oo

M~~~~~

Eo-

-I3to CT

CZo

co to-

C> C

o o

0000 00 0

0 E-

o-

;-f

>

Ca

3

N 3

t (-C4-

o

o

I

kc

:z; m

:4

g

o0o00 00

Y -4c

-ho c3

e

d~~~~~C

>.S

o

Icd

cl

mm

/

.$

r

;o

Vil4"- Vll4VllllVl Vll4

726

and RolfA. Lundin Thomas Morton E.

50 percent pattern, however, allows the possibility of such demand sequences and thus is very helpful to the technique. Similarly, although not presented, positive trends were very helpful for the W-W technique, negative trends unhelpful, and seasonal patterns moderately helpful. These effects also operate for protective horizons. In addition the latter horizons are sensitive to the fact that repetitive deterministic patterns have multiple optima for certain values of J. Thus, in comparing the 0.5 percent vs. the 5 percent case, the protective horizon range is much larger for the former. Also, the median itself fluctuates wildly for slight changes in J for the near repetitive case. The Zabel technique forms a truly intermediate case. On every dimension discussed, it is somewhere between the Wagner-Whitin and the protective results. Although the degeneracy question just alluded to may be seldom met in practice since the standard deviation is likely to be at least 5 percent, a second set of runs (not presented here) was made for periodic patterns with a 0-percent standard deviation. Since no replications were necessary and wild fluctuation in performance for similar J values was expected, the range was divided into 70 values of J instead of 15. A total of 12 demand patterns was run, the 6 new patterns investigating briefly the effects of shifts in the season, larger or smaller seasonal patterns, combined pattern and trend. These results hold no new surprises, giving results very similar to the 0.5 percent case (after smoothing by taking the median of five observations surrounding each nominal J by about plus or minus 20 percent). Part 2 of the empirical study used a computationally more demanding version of the algorithm that saved the first, second, third, and fourth best first regeneration point for each t period subproblem with associated last regeneration point and total subproblem cost. Define these as f (t, 1 ), ***,

f(t, 4); k(t, 1), *..., k(t, 4); C(t, 1), ... , C(t, 4), respectively, and define k4 (t) = minik (t, i). A set of periods always containing at least one regen-

eration point for a fourth best problem might be called a four-regeneration set. Observation4. (a) k4(t) is nondecreasing in t, (b) {k4(t), ***, (t-1 )} is a four-regeneration set. (Although Observation 4 is very useful computationally, we shall not prove it. The proof is similar to Zabel's.) Once the same first regeneration point appears as one of the best four solutions for every period in the fourregeneration set, an e-forecast horizon can be obtained by subtracting the optimal cost from that cost in each case and taking the maximum over the four-regeneration set. Finally, it is desirable to normalize the excess cost bound as a percentage. The relevant costs are the costs until the first regeneration point, since in

Planning The Lot Horizons. Dynamic Size Model

727

practice at that point the problem will be re-solved. The cost for the first production block includes K and associated holding costs on the same order of magnitude (by analogy with the stationary continuous solution, where they are exactly equal). Thus, the program divided the excess cost by 2K (even a conservative division by K would not change the results much). Table III presents a summary of the results for the same 12 demand patterns and 0-percent standard deviation, for forecast horizons giving decisions guaranteed within 1 percent of optimal. Note that the results are very good, giving forecast horizons roughly comparable to that for a 50-percent standard deviation of demand for simple protective forecast horizons. There also was a remarkable consistency across demand patterns and little noise as J was varied. For this reason, a grand set of medians was calculated and translated into a multiple of t = t/V\2J as before. Here again, t seems to increase asymptotically to a constant value, which in this case is about 5.0, implying the existence of 1-percent forecast horizons for a continuous version of the problem. A brief investigation of 1-percent vs. 5-percent forecast horizons was undertaken. (A positive standard deviation of demand was added to investigate that effect as well.) Rather surprisingly, settling for a 5-percent cutoff seems to save relatively little, indicating that 1 percent might as well be used. Finally, while the Part 2 algorithm may well be thought too computationally demanding for practical use, the procedure of Part 1 requires little extra storage or computation over the usual algorithm. In addition, we suggest the following heuristic procedure if it is simply desired to choose problem cutoff period T in advance. Average forecast demand over the next year. Calculate the classical EOQ, translate into time, and multiply by 5.0, giving a practical estimate of the decision horizon. 4. EXTENSIONS AND GENERALIZATIONSPREVIOUS OF PLANNING HORIZON RESULTS In this section we extend and generalize some of the planning horizon results alluded to in Section 1. Emphasis is placed on the derivation of regeneration sets. Here the production and holding cost functions have a general concave form over the domain [0, + oo). The right-hand derivatives of the costs are denoted by ct'(xt) and ht'(It) and defined in the customary way. The least marginal production and holding costs in period t are it = limt 0 Ct (xt) and ht = limInt. ht'(It). Since negative marginal costs are allowed, it is assumed that the nature of the problem precludes the possibility of infinite production quantity in a period. One simple sufficient condition is it+ east hi> 0 for all t and for all t*> T(t).

728

Rolf A. Lundinand Thomas E. Morton

0

1?

X-

H-4

c3 m

4-H o=

o 0

(M

0* 00

NO4

0~~~~~X

b o

Z %

U2

_U

11 ?

Planning Horizons: Dynamic Size Model The Lot

729

Some further definitions are needed. Let Da,b = E-b dj, ha,b= Zia hi, F (t) =the least cost solution to a t-period subproblem (with

It =?0),

F (1, t) = the least cost solution to a t-period subproblem when the last setup is restricted to period 1(with It= 0). F[l(t), fl=F(t)l and S (1, th, t2) = sum of marginal holding costs attributable to demands in periods (t1+ 1) through t2 for a plan with a last setup in period 1. We assume that Io = 0 so that we can use all the elementary implications that our concave cost structure has on the form of the optimal solution (refer to the developments of Zangwill91 ). Definition. Say that condition A is satisfied if F (li, ti) > F (12,ti) while ti t1) Cll +hi,, 12-1 > Cl2 (Dl2,tl ) and that condition B is satisfied if F (11, ) < F (12, while c', (D11, t)?+ EZ2 hi' (Di+1,t) =cz2 (11<lt1).

PROPOSITION 4:

(a) If condition A holds for the optimal ti-period solution, then we can disregard 11as a last setup in any problem longer than ti. (b) If condition B holds for the optimal ti-period solution, then we can disregard 12as a last setup in any problem longer than tj. Proof. First observe that by definition

F(1, t2)=F(l,

tl)+c,(DI, t2)-cl(Dl tl)+S(1, t1, t2).

(a) Given condition A, and that t2> t1, then

F(11,t2)-F (12, t2)= {F (11,ti) -F(12) ti) I+ Icil (DI,)t2)- Cll (Dil tl) I } -{c12 (D12t2)-c12 (D12, )}+ I S (11,t, t2)-S (12,tl,t2) t

> {F~l,tl-F(12

tl)}{[cllC'2(

12,tl )+hll,12-1]1

l~~2

> 0 by hypothesis. (b) Given condition B and that t2>-t1,then by reversal of arguments we get

F (l11t2)- F (12

t2)<:!

IF (l11ti) -F(12)

tl)

+ {[c l (D11 ) _ cl2+ ZS 17 hj (Dj+i,,l)] *Dtl+j,2 } <0 by hypothesis.

The usefulness of the proposition in terms of computational savings is evident, but the conditions are somewhat cumbersome to check. To get a simplification in that respect, one can substitute 1(t1) for 12 in condition A, in and 1(t1) for 11 condition B. In this way we get a special case of Proposition 4, the Corollary. In a forward-oriented algorithm, Proposition 4 is of course applied sequentially. Let E (t1) be the set of periods not after t1that have to be con-

730

Rolf A. Lundinand Thomas E. Morton

sidered as possible last setup periods for a problem longer than t1, and let -1 L (t1) be the subset of periods in E (t1 ) U {t1} that can be eliminated from consideration as a last setup period in a problem longer than t1by the application of Proposition 4. Then E(tj) =E(tj-1 )U{t1 }-L(t1). E(O )=_. Observe that 1(ti) EE(t1). The following proposition has important planning horizon implications. 5. PROPOSITION Given E (t), the optimal solution to a t*-period subproblem where t*> t will have one setup in period tofor some toEE(t). Proof. We make a Zabel[81-type argument. By Proposition 4, the optimal t*-period solution will have a last setup period toEE(t) U {t+ 1, , t'} t*}. If toEE(t) then the proposition holds trivially. If toE{t+ 1, , t*}. By Proposition 4 the then there is a first setup period t'E {t+ 1, (t'-1 )-period subproblem will have a last setup period in the set E (t).

...

Define Z (t) = {i-1 jiEE (t) }.

It should be obvious that Z (t) is a re-

generation set as defined in Section 2. In particular, Propositions 1 and 2 hold for the set Z(t). Observe that one can define a set similar to E (t) by using the Corollary. E' (t1) = E' (t1-1 ) U {t1} - L' (t1), where L' (t, ) is defined by using the Corollary rather than Proposition 4. But E (t) cE' (t), and this implies that the results of Section 2 are also applicable to Z' (t) = {i-1 liEE'(t) }. However, an algorithm based on Z (t) will be at least as efficient as one using Z' (t) in terms of forecast horizon lengths. We can now see how theorems of previous work are special cases of these results. First, considering the Wagner and Whitin model, we see that for 1< 1(t), we have lfEE(t), since marginal holding costs are nonnegative and marginal production costs constant for that model. This result gives the first part of the planning horizon theorem (Wagner and Whitin,171 p. 92). The second part follows from the fact that for 1(t) = t, we have Z' (t) = {t-1} and periods 1 through t- 1 constitute a planning horizon. The first part of Zabel's forward planning horizon theorem, [8] p. 467, is evident by the fact that for 1< 1(t), we have lfE' (t) and by the application of Proposition 5. The second part of Zabel's theorem is a weaker version of Proposition 1 (part b). Next consider the Eppen, et al. model. Note that for their system the right-hand derivatives of costs are constant for positive arguments, but this result implies that the right-hand derivatives equal their respective greatest lower bounds. But then m[l (t), t] in Theorem E,[21 p. 274 is equivalent to E' (t) -I1(t). Now include pricing into the model, i.e., dt=4t (pt), where pt possibly is a vector of decision variables available for period t. Let D*,b denote the sum of demands from period a to period b in the optimal b-period solution. Definition. Say that condition C holds if Jz+hztllc(t1)(Dl'c,),t1)+ Litl (t1). 1(tj) hj'(D* +11t), where I< t1and ll

PlanningHorizons: Dynamic Size Model The Lot

731

PROPOSITION 6. If condition C holds for the optimal t-period solution, then we can disregard 1 as a last setup in any problem longer than tj. Proof. Similar to Proposition 4. It is interesting to see how the pricing decision affects Proposition 6. In a sense Proposition 6, where pricing is included is more restrictive than Proposition 4, where demand quantities are fixed.

1. In Proposition6 all comparisons made against the least cost solutionfor are the ti-period problem,but in Proposition4 any two solutionscan be compared. 2. In Proposition6 all forwardextrapolations to periodti, but in Proposition go 4 only to period12?tl. In accordance with the previous developments in this section, sets like E (t) and Z (t) can be derived for the pricing case, preserving the properties of these sets. It is easy to see that the pricing equivalents of these results contain the planning horizon theorem by Thomas, p. 748.

15

5. PROTECTIVE PROCEDURES CONCAVE FOR COSTS In this section we develop procedures for obtaining regeneration sets for the backlogging problem with concave production costs and concave holding and backlogging costs that in a large number of cases may be shown to be protective. The procedure is quite different from that of the last section; neither is a special case of the other. In particular, for the no-backlogging case without speculative motives in production, the two procedures will lead to different regeneration sets. We use the Blackburn and Kunreuther (see Section 1) cost transformation and notation, with the addition that the original cost function c, (xt) is also assumed concave with limit of the right-hand derivative it. We also define IC (possibly infinite) as the smallest number such that for all xt, 0 <?x,!c6(x,)<K,+itxt. Thus in the transformed problem 0< Ct(xt) ? Kt. We proceed to define a procedure that, when well defined, leads to protective regeneration sequences. Define a holding horizon for period t by

H (t) =inf {t, sit~s:! t, Ej~jj==dj8=' Wj:i!K,} E

A computationally simpler but weaker concept would be

(4) (5)

= H(t) inf {tide1:1-l

Wji>

KI }.

H (t) is allowed to be infinite. We define the inverse holding horizon for period t by H (O) =)0 slt<s<t,

Eat

H-'(t)=sup{t,

djEi--

Wj>

K4}.

(6) is not gen-

The composition may not be the identity function since H(.) erally one-to-one.

732

RolfA. Lundin Thomas Morton and E.

Define a holding regenerationset to be one on which inventory can always be guaranteed <0 in at least one period, and backloggingregenerationset for ?0. The proofs of the propositions in this section are omitted since they follow directly from the definitions, propositions, and previous observations in Sections 2 and 3. PROPOSITION 7. [t, H (t) -1] is a holding regeneration set.

PROPOSITION

8. H (t) and H' (t) are nondecreasing functions of t.

We define a backlogging horizon and an inverse backlogging horizon similarly by B (t) =infj1, slt<s<!, Eji=8 djE'W> 8} (7) = 0, B-'(0) B-'(t)=sup{t,sft<s<t,

PROPOSITION PROPOSITION

j-tdjEZ~lWj>Kgj.

(8)

9.

[t, B(t)-1]

is a backlogging regeneration set.

10. B (t) and B-' (t) are nondecreasing functions of t. Note that if H (t) = t or B (t) = t, the propositions should read simply It< 0 or It 0, respectively. In particular, if backlogging is not allowed, we may consider Wi = oo so that B (t) = t. We now define a regenerationhorizon for period t by R (t) =H[B (t)-1]. (9)

One condition for R (t) to be finite is that H (. ) and B (*) are finite for all positive integers. We define the inverseregenerationhorizon for period t by R-1 (t) = B-'[H-' (t ) + 1]. (10) It should be noted that R'[R (t)] is not necessarily t, but t < R-'[R (t)], since different periods might have the same regeneration horizon. 11. Given conditions ensuring finiteness of an infinite subsequence of the sets [R- (t), t- 1], these sets form a protective regeneration sequence.

PROPOSITION PROPOSITION

12. One set of conditions under which the sets [R- (t), t-1] can be guaranteed finite is: (a) 0<Kt<K<oo, (b) 0 < W all t, (11 ) Wt, all t, < WTt, all t,

(c) 0 < (d) lim supt-. dt>d>0.

Lot PlanningHorizons: Dynamic Size Model The

733

Proofs of Propositions 11 and 12 are fairly obvious. Conditions for 12 would usually be satisfied, for example, for the stationary cost case or discounted stationary cost case. For completeness, we give a detailed forward algorithmic procedure. Define F (t) = the optimal solution to the t-period problem (with I, = 0), F (r, t) = minimum costs for satisfying demands in period r through period t when Ir1 = It =0, and we have one setup period s such that r < <t where F (0) _0. and F (t) =min,>R-1(t) IF (r-1 )+F (r. t)1 With these definitions, we can now describe our general procedure. 1. Set t = 1. 2. Determine numerical values for Kt, Wt and Wt. 3. Determine H- (t) and B-' (t). 4. Determine R-1 (t). 5. [R-'(t), t- 1] is a regeneration set. Investigate for simple horizons, e forecast horizons, or production bounds. Terminate on satisfaction or cutoff value for t. 6. Determine F (r, t) using the known facts that r> R' (t), and for the setup periods r<s<t, r>H-1(t) and r<B-'(s). 7. Solve the t period problem. 8. Increase t by 1 and go to 2. This procedure simplifies in the obvious way for the no backlogging case by using B (t) = t, and s = r, for determining F (r, t). We conclude the section with a numerical example. Let x=O, Ct (Xt)= c(x) =0, lOx, 50+5x, Wt(It) = W(I) =2I, 2(-I), Demands are given by t 1 1 5 2 10 3 15 4 10 5 5 6 5 7 10 8 20 9 25 _10 Unknown O<x<10O x> 10, I>O0 I<O.

dt

Omitting details of the solution, in period 9 we find a forecast horizon giving periods 1 to 5 as a planning horizon.

REFERENCES 1. J.

BLACKBURN AND H. KUNREUTHER, "Planning and Forecast Horizons for the Dynamic Lot Size Model with Backlogging," Management Sci. 21, 251-255 (1974).

734

E. and RolfA. Lundin Thomas Morton

2. G. D. EPPEN, F. J. GOULD, AND B. P. PASHIGIAN, "Extensions of the Planning Horizon Theorem in the Dynamic Lot Size Model," Management Sci. 15, 268-277 (1969). 3. H. KUNREUTHER AND T. E. MORTON, "Planning Horizons for Production Smoothing with Deterministic Demands: 1, 11," ManagementSci. 20, 110-125, 1037-1046 (1973, 1974). 4. R. A. LUNDIN, "Planning Horizon Procedures for Production-Inventory Systems with Concave Costs," Ph.D. Dissertation, University of Chicago, Chicago, Illinois, 1973. 5. J. Thomas, "Price-Production Decisions with Deterministic Demand," Management Sci. 16, 747-750 (1970). 6. A. VEINOTT, JR., "The Status of Mathematical Inventory Theory," Management Sci. 12, 9, 745a-777 (1966). 7. H. M. WAGNER AND T. M. WHITIN, "Dynamic Version of the Economic Lot Size Model," Management Sci. 5, 89-96 (1958). 8. E. ZABEL, "Some Generalizations of an Inventory Planning Horizon Theorem," Management Sci. 10, 465-471 (1964). 9. W. I. ZANGWILL,"A Backlogging Model and a Multi-Echelon Model of a DyNetwork Approach." namic Economic Lot Size Production System-A Management Sci. 15, 506-527 (1969).

You might also like

- Content ServerDocument18 pagesContent ServerHitlermannNo ratings yet

- Dynamic Version of The Economic Lot Size ModelDocument9 pagesDynamic Version of The Economic Lot Size ModelMuhammed LeeNo ratings yet

- Informs: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations ResearchDocument26 pagesInforms: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations ResearchStephen TesterovNo ratings yet

- Optimizing Time Cost Trade Off Scheduling by Genetic AlgorithmDocument9 pagesOptimizing Time Cost Trade Off Scheduling by Genetic AlgorithmInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Optimal Lot SizingDocument17 pagesOptimal Lot SizingHansenNo ratings yet

- Articulo SeleccionDocument15 pagesArticulo Seleccionandresp1000No ratings yet

- CFM Mat FiltDocument13 pagesCFM Mat Filtgregu4No ratings yet

- A Linear Programming Approach To Solving Stochastic Dynamic ProgramsDocument39 pagesA Linear Programming Approach To Solving Stochastic Dynamic ProgramskcvaraNo ratings yet

- 1 s2.0 S0377221705008416 MainDocument21 pages1 s2.0 S0377221705008416 MainAyesha Maher khanNo ratings yet

- A Simple Inventory Replenishment PDFDocument6 pagesA Simple Inventory Replenishment PDFStevens Mulford CarvajalNo ratings yet

- Literature Review On Inventory Lot SizingProblemsDocument16 pagesLiterature Review On Inventory Lot SizingProblemsElvira TollaNo ratings yet

- Satisfiability Modulo Theories: Introduction and ApplicationsDocument9 pagesSatisfiability Modulo Theories: Introduction and ApplicationsshastryNo ratings yet

- A Survey of Lot Sizing and Scheduling ModelsDocument10 pagesA Survey of Lot Sizing and Scheduling ModelsClebson CardosoNo ratings yet

- Constraints and AI PlanningDocument29 pagesConstraints and AI PlanningMahmoud NabilNo ratings yet

- Practical Optimization Using Evolutionary MethodsDocument20 pagesPractical Optimization Using Evolutionary MethodsGerhard HerresNo ratings yet

- Convex Duality in Stochastic Programming and Mathematical FinanceDocument32 pagesConvex Duality in Stochastic Programming and Mathematical FinanceVinay KhaddaNo ratings yet

- Vanhoucke HPMS2015Document20 pagesVanhoucke HPMS2015rorrito33No ratings yet

- Computers & Industrial Engineering: Dorit S. HochbaumDocument8 pagesComputers & Industrial Engineering: Dorit S. HochbaumYANUAR YUDHA ADI PUTRANo ratings yet

- Mixed Integer ImpDocument23 pagesMixed Integer ImpLavi SahuNo ratings yet

- Multi-Objective Compared To Single-Objective Optimization With Application To Model Validation and Uncertainty QuantificationDocument10 pagesMulti-Objective Compared To Single-Objective Optimization With Application To Model Validation and Uncertainty QuantificationHeni AgustianiNo ratings yet

- Review of Optimization TechniquesDocument13 pagesReview of Optimization TechniquesFrederic NietzcheNo ratings yet

- Short Tutorial IpoptDocument17 pagesShort Tutorial IpoptCarloyos HoyosNo ratings yet

- Parametric Analysis of Setup Cost in The Economic Lot-Sizing Model Without Speculative MotivesDocument10 pagesParametric Analysis of Setup Cost in The Economic Lot-Sizing Model Without Speculative MotivesLivia MarsaNo ratings yet

- Aksen 2003Document9 pagesAksen 2003Yusuf Ali DanışNo ratings yet

- Fast Technique For Unit Commitment by Genetic Algorithm Based On Unit ClusteringDocument9 pagesFast Technique For Unit Commitment by Genetic Algorithm Based On Unit ClusteringAn Nguyễn KhánhNo ratings yet

- A Genetic Algorithm Approach For The Time-Cost Trade-Off in PERT NetworksDocument23 pagesA Genetic Algorithm Approach For The Time-Cost Trade-Off in PERT NetworksLeonardo BaganhaNo ratings yet

- Review of Optimization Techniques PDFDocument13 pagesReview of Optimization Techniques PDFshripathy1-1No ratings yet

- Review of Optimization TechniquesDocument13 pagesReview of Optimization Techniquesshripathy1-1No ratings yet

- CILAMCE2015 Renatha PDFDocument15 pagesCILAMCE2015 Renatha PDFMarcos Huber MendesNo ratings yet

- 12278-Article (PDF) - 25733-1-10-20210113Document36 pages12278-Article (PDF) - 25733-1-10-20210113Florin MunteanNo ratings yet

- A New Hybrid Genetic Algorithm For Global Optimization PDFDocument10 pagesA New Hybrid Genetic Algorithm For Global Optimization PDFhidou2013No ratings yet

- Long Horizon Versus Short Horizon Planning in Dynamic Optimization Problems With Incomplete InformationDocument39 pagesLong Horizon Versus Short Horizon Planning in Dynamic Optimization Problems With Incomplete InformationrerereNo ratings yet

- Stope Boundary Optimization Using A 3D Approximate Hybrid AlgorithmDocument14 pagesStope Boundary Optimization Using A 3D Approximate Hybrid AlgorithmKENNY BRANDON MAWODZWANo ratings yet

- EJOR 2007 FinalDocument15 pagesEJOR 2007 FinalSantiago CabreraNo ratings yet

- Composite Stock CuttingDocument18 pagesComposite Stock CuttingJefferson SantanaNo ratings yet

- Castro Povoa Matos 2001Document10 pagesCastro Povoa Matos 2001Sergio NeiroNo ratings yet

- Planning Electric Power Systems Under Demand Uncertainty With Different Technology Lead TimesDocument18 pagesPlanning Electric Power Systems Under Demand Uncertainty With Different Technology Lead TimesGermán Arias FernándezNo ratings yet

- JQT - Planned Replacement - Some Theory and Its ApplicationDocument10 pagesJQT - Planned Replacement - Some Theory and Its ApplicationbriandpcNo ratings yet

- A 0-1 Model For Fire and Emergency Service Facility Location Selection:A Case Study in NigeriaDocument10 pagesA 0-1 Model For Fire and Emergency Service Facility Location Selection:A Case Study in Nigeriacsrajmohan2924No ratings yet

- Stochastic Lot-Sizing: Maximising Probability of Meeting Target ProfitDocument8 pagesStochastic Lot-Sizing: Maximising Probability of Meeting Target Profitrizki setiawanNo ratings yet

- Explanation-Based Repair Techniques For Solving Dynamic Scheduling ProblemsDocument2 pagesExplanation-Based Repair Techniques For Solving Dynamic Scheduling Problemsppkppk7890No ratings yet

- Xfem Dyn Part1Document43 pagesXfem Dyn Part1kiet.phamk20bkNo ratings yet

- Variants of Resource Allocation Problem: Vijaya GoelDocument7 pagesVariants of Resource Allocation Problem: Vijaya GoelVijaya GoelNo ratings yet

- A Branch-And-Bound Algorithm For The Quadratic Assignment Problem Based On The Hungarian MethodDocument12 pagesA Branch-And-Bound Algorithm For The Quadratic Assignment Problem Based On The Hungarian MethoddesiNo ratings yet

- Amulti Phasecoveringpareto OptimalfrontmethodDocument28 pagesAmulti Phasecoveringpareto OptimalfrontmethodarpitdagreatNo ratings yet

- Differential Equation Project Group 3Document7 pagesDifferential Equation Project Group 3Uzair NadeemNo ratings yet

- Multi-Item EOQ Calculation in Presence of Warehouse Constraints: A Simulative AnalysisDocument10 pagesMulti-Item EOQ Calculation in Presence of Warehouse Constraints: A Simulative AnalysisAgung WicaksonoNo ratings yet

- Ainassaari Kallio RanneDocument17 pagesAinassaari Kallio RanneŠejla HadžićNo ratings yet

- 15.7.2 Tolerance DesignDocument8 pages15.7.2 Tolerance DesignRupak SapkotaNo ratings yet

- Yaacoub 2018Document12 pagesYaacoub 2018peppas4643No ratings yet

- Dissertation Wolfgang StilleDocument167 pagesDissertation Wolfgang StilleYouth ZoomNo ratings yet

- Monte Carlo Simulation and QueuingDocument11 pagesMonte Carlo Simulation and QueuingNeel ShethNo ratings yet

- Modelos de Degradação 3Document8 pagesModelos de Degradação 3ambrosio85No ratings yet

- TanakaDocument35 pagesTanakaAndrey DubanNo ratings yet

- Research ArticleDocument8 pagesResearch ArticleAseef EmonNo ratings yet

- AJournal 03 30abr18Document12 pagesAJournal 03 30abr18VANENo ratings yet

- MSC Thesis DissertationDocument8 pagesMSC Thesis DissertationHelpWithWritingAPaperCanada100% (1)

- Mathematical and Computer Modelling: Minjae Park, Hoang PhamDocument16 pagesMathematical and Computer Modelling: Minjae Park, Hoang PhamMubashir UnnissaNo ratings yet

- Real-Time Optimization and Nonlinear Model Predictive Control of Processes Governed by Differential-Algebraic EquationsDocument9 pagesReal-Time Optimization and Nonlinear Model Predictive Control of Processes Governed by Differential-Algebraic EquationsIngole DeepakNo ratings yet

- Lab Project Report Template - CSEDocument13 pagesLab Project Report Template - CSESadikul IslamadilNo ratings yet

- Genetic Mutation LAB SHEET REVISEDDocument2 pagesGenetic Mutation LAB SHEET REVISEDyusufoyololaNo ratings yet

- TBG Catalog Vol 6Document64 pagesTBG Catalog Vol 6GeorgeNo ratings yet

- Types of Variables (In Statistical Studies) - Definitions and Easy ExamplesDocument9 pagesTypes of Variables (In Statistical Studies) - Definitions and Easy ExamplesAntonioNo ratings yet

- Questão 20: Língua Inglesa 11 A 20Document3 pagesQuestão 20: Língua Inglesa 11 A 20Gabriel TeodoroNo ratings yet

- Terraformer D TsDocument7 pagesTerraformer D TsprogramhNo ratings yet

- Quizapp: 15It324E Mini Project ReportDocument24 pagesQuizapp: 15It324E Mini Project ReportSubroto DasNo ratings yet

- CA Level 1Document43 pagesCA Level 1Cikya ComelNo ratings yet

- Personal Workbook For Breaking The Chain of Low Self EsteemDocument308 pagesPersonal Workbook For Breaking The Chain of Low Self EsteemPragyan Nanda100% (1)

- 1385 PDFDocument70 pages1385 PDFEdmund ZinNo ratings yet

- Vietnam SPC - Vinyl Price ListDocument9 pagesVietnam SPC - Vinyl Price ListThe Cultural CommitteeNo ratings yet

- Colah Github Io Posts 2015 08 Understanding LSTMsDocument16 pagesColah Github Io Posts 2015 08 Understanding LSTMsMithun PantNo ratings yet

- Business Plan-HCB MFGDocument18 pagesBusiness Plan-HCB MFGGenene asefa Debele75% (4)

- DM Assignment 1Document5 pagesDM Assignment 1Mai Anh TrầnNo ratings yet

- Bundle Bundle Js LICENSEDocument11 pagesBundle Bundle Js LICENSE333surimaNo ratings yet

- Capstone Project Proposal: My Inquiry Question IsDocument7 pagesCapstone Project Proposal: My Inquiry Question Isapi-491542571No ratings yet

- Swati Bajaj ProjDocument88 pagesSwati Bajaj ProjSwati SoodNo ratings yet

- Moxon Sat AntDocument4 pagesMoxon Sat AntMaureen PegusNo ratings yet

- 1 s2.0 S0920586123000196 MainDocument13 pages1 s2.0 S0920586123000196 Mainsofch2011No ratings yet

- PreloadDocument21 pagesPreloadjainshani2No ratings yet

- CtsDocument2 pagesCtsRadhika ChaudharyNo ratings yet

- Milling MachinesDocument39 pagesMilling MachinesSahil Sheth0% (1)

- ADT Service ManualDocument152 pagesADT Service ManualZakhele MpofuNo ratings yet

- Advt 2013 Ver 3Document6 pagesAdvt 2013 Ver 3mukesh_mlbNo ratings yet

- Nursing School Study Checklist PDFDocument8 pagesNursing School Study Checklist PDFDeannaNo ratings yet

- FormDocument83 pagesFormAnimesh SinghNo ratings yet

- Gosat Gs 7055 Hdi FirmwareDocument3 pagesGosat Gs 7055 Hdi FirmwareAntoinetteNo ratings yet

- Bovaird Loeffler 2016Document13 pagesBovaird Loeffler 2016coolchannel26No ratings yet

- Chapter 2 - Equivalence Above Word LevelDocument23 pagesChapter 2 - Equivalence Above Word LevelNoo NooNo ratings yet

- Am at Photogr 21 February 2015Document92 pagesAm at Photogr 21 February 2015TraficantdePufarineNo ratings yet