Professional Documents

Culture Documents

Cadila Healthcare Result Updated

Cadila Healthcare Result Updated

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cadila Healthcare Result Updated

Cadila Healthcare Result Updated

Uploaded by

Angel BrokingCopyright:

Available Formats

4QFY2012 Result Update | Pharmaceutical

May 11, 2012

Cadila Healthcare

Performance Highlights

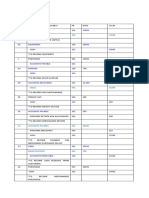

Y/E March (` cr) Net sales Other income Gross profit Operating profit Reported net profit 4QFY2012 1,344 71 870 229 171 3QFY2012 1352 49 900 231 149 % chg (qoq) (0.6) 45.4 (3.4) (0.7) 14.5 4QFY2011 1169 48 731 184 179 % chg (yoy) 15.0 49.5 19.0 24.8 (4.6)

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Pharmaceutical 14,805 0.4 984 / 629 12,597 5 16,293 4,929 CADI.BO CDH@IN

`767 `953

12 months

Source: Company, Angel Research

Cadila Healthcare (Cadila) reported lower-than-expected numbers for 4QFY2012, except on the sales front. The companys sales for the quarter were mostly in-line at `1,344cr. On the operating front, gross and operating margins reported an improvement. However, a higher interest and tax expense during the quarter resulted in net profit coming in lower than expectations. Overall, net profit came in at `171cr, registering a dip of 4.6% yoy. Management expects the company to be a US$3bn company by 2015. We recommend Buy on the stock. Sales just in-line with expectations: For 4QFY2012, Cadila reported net sales of `1,344cr, up 15.0% yoy and higher than our estimate of `1,415cr, driven by domestic markets. On the domestic front, net sales grew by 32.5% yoy to `644.3cr. The companys gross margin expanded to 64.7% during the quarter. The companys OPM also expanded to 17.1%, majorly due to improvement in gross margin. Net profit for the quarter, however, declined by 4.6% yoy to `171cr (`179cr), on account of higher interest and tax expense during the quarter. Outlook and valuation: We expect Cadilas net sales to post a 17.3% CAGR to `7,386cr and EPS to report a 22.3% CAGR to `47.7 over FY201214E. We recommend Buy on the stock with a revised target price of `953.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 74.8 16.0 4.2 5.0

Abs.(%) Sensex Cadila

3m (8.2) 10.2

1yr (12.3)

3yr 39.5

(15.7) 251.4

Key financials (Consolidated)

Y E March (` cr) Net sales % chg Net profit % chg EPS EBITDA margin (%) P/E (x) RoE (%) RoCE (%) P/BV (x) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2011 4,465 24.9 711 39.6 34.7 19.3 22.1 37.4 23.2 7.2 3.7 19.1

FY2012 5,090 14.0 653 (8.2) 31.9 17.9 24.0 27.5 20.3 6.1 3.2 18.0

FY2013E 6,148 20.8 769 17.9 37.6 18.6 20.4 26.8 20.9 5.0 2.6 14.1

FY2014E 7,386 20.1 976 26.9 47.7 19.6 16.1 27.5 23.1 4.0 2.1 10.9

Sarabjit Kour Nangra

+91 22 39357600 Ext: 6806 sarabjit@angelbroking.com

Please refer to important disclosures at the end of this report

Cadila Healthcare | 4QFY2012 Result Update

Exhibit 1: 4QFY2012 performance (Consolidated)

Y/E March (` cr) Net Sales Other Income Total Income Gross profit Gross margin (%) Operating profit Operating Margin (%) Financial Cost Depreciation PBT Provision for taxation PAT before Extra-ordinary item Exceptional Minority PAT before Extra-ordinary item & MI EPS (`)

Source: Company, Angel Research

4QFY2012 1,344 71 1,416 870 64.7 229 17.0 38 39 224 44 180 0 9 171 8.3

3QFY2012 1,352 49 1,313 900 66.6 231 21.3 59 47 174 17 157 0 7 149 7.3

% chg (qoq) (0.6) 45.4 7.8 (3.4) (0.7) (36.7) (16.0) 28.6 151.3 15.0 26.0 14.5

4QFY2011 1,169 48 1,216 731 62.5 184 15.7 3 32 197 10 186 0 7 179 7.4

% chg (yoy) 15.0 49.5 16.4 19.0 24.8 1164.0 23.1 13.8 319.5 (3.3) 28.8 (4.6)

FY2012 5,090 226 5,316 3410 67.0 910 17.9 185 158 794 113 681 0 29 653 31.9

FY2011 4,465 179 4,643 2989 67.0 861 19.3 70 127 842 106 736 0 25 711 34.7

% chg 14.0 26.8 14.5 14.1 5.7 164.4 24.4 (5.8) 6.3 (7.5)

(8.2)

Exhibit 2: 4QFY2012 Actual vs. Angel estimates

(` cr) Net sales Operating profit Tax Net profit

Source: Company, Angel Research

Actual 1,344 229 44 171

Estimates 1,415 264 51 200

Variance (%) (5.0) (13.2) (14.5) (14.6)

Revenue up 15.0% yoy, just in-line with estimates

For 4QFY2012, Cadila reported net sales of `1,344cr, up 15.0% yoy and higher than our estimate of `1,415cr, driven by domestic markets, which grew by 32.5% yoy. Exports, on the other hand, grew by mere 5.3% yoy during the period. The low growth in exports was mainly on account of the dip in the CRAMS business. Overall, the U.S. business reported double-digit growth of 26.1% to `353.3cr. Europe and Japan, the other key geographies, posted yoy growth of 7.7% and 5.0%, respectively. Brazil and other emerging markets grew by 5.9% yoy and 5.2% yoy, respectively.

May 11, 2012

Cadila Healthcare | 4QFY2012 Result Update

Exhibit 3: Sales trend in the U.S. and Europe

400 360 320 280 240 200 160 120 80 40 0 4QFY2011 1QFY2012 US

Source: Company, Angel Research

344 280 239 307

353

(` cr)

66

77

62

89

71

2QFY2012 Europe

3QFY2012

4QFY2012

For 4QFY2012, the domestic segment reported 32.5% yoy growth, with the formulations segment registering 38.2% yoy growth. In the consumer healthcare division, Cadila continued to post growth of 10.6% in 4QFY2012. Animal healthcare, on the other hand, grew by 25.8% yoy. During the quarter, Cadila launched 19 new products, including line extensions in domestic markets, of which seven were for the first time.

Exhibit 4: Sales trend in domestic formulation and consumer divisions

600 500 400 361 457 470 469 499

(` cr)

300 200 100 0 4QFY2011 1QFY2012 2QFY2012 3QFY2012 4QFY2012 Domestic Formulation Consumer division 77 91 88 80 86

Source: Company, Angel Research

On the CRAMS front, the company generated sales of `114.1cr (`168.9cr), reporting a dip of 32.4% yoy. For FY2012, the CRAMS segment grew by 16.0% yoy. OPM expands by 133bp yoy During the quarter, the companys gross margin expanded to 64.7%, registering an expansion of 217bp yoy. However, OPM came in at 17.0% (15.7%), expanding by 133bp yoy. This was on the back of 27.7% and 25.3% rise in R&D and other expenses, respectively. With this, R&D expenditure stood at ~6.6% of net sales in 4QFY2012 vs. 6.0% of net sales during 4QFY2011.

May 11, 2012

Cadila Healthcare | 4QFY2012 Result Update

Exhibit 5: OPM trend

25.0 20.0 19.6 15.0 15.7 18.1

21.3 17.0

(%)

10.0 5.0 0.0

4QFY2011

1QFY2012

2QFY2012

3QFY2012

4QFY2012

Source: Company, Angel Research

Reported net profit declined by 4.6% yoy: Reported net profit declined by 4.6% yoy to `171cr (`179cr), lower than our estimate of `200cr. This was on account of higher interest and tax expense during the quarter. Interest and tax expenses during the quarter stood at `37.5cr (`3.0cr) and `43.6cr(`10.4cr), respectively.

Exhibit 6: Net profit trend

250 200 150 230

179 149 103

171

(` cr)

100 50 0 4QFY2011 1QFY2012

2QFY2012

3QFY2012

4QFY2012

Source: Company, Angel Research

Concall takeaways

The company aims to become a US$3bn company by 2015. The key growth drivers for the same would be the U.S. and Indian markets. Management has guided for 15-18% growth in the domestic business in FY2013 on the back of Biochems acquisition and new product launches. The U.S. business is expected to grow by 20%+ in FY2013 and FY2014 on the back of 10-15 new launches every year. Management plans to file 25 ANDAs in the U.S. in FY2013.

May 11, 2012

Cadila Healthcare | 4QFY2012 Result Update

The company expects double-digit growth in its consumer healthcare business in FY2013. The company expects Nesher to achieve US$100mn in revenue from six launches over the next three years. In FY2013, the company plans to launch two products by Nesher. The companys gross margin is expected to improve by 100bp in FY2013. Tax rate is expected to be around 20% of PBT for FY2013. Management has guided for capex of `500cr-650cr for FY2013. USFDA inspected its Moriya injectable facility in March 2012 and management expects to hear back from the FDA in the coming weeks and expects to get 10-15 ANDA approvals within six months of resolution of the manufacturing issues.

Recommendation rationale

Strong domestic portfolio: Cadila is the fifth largest player in the domestic market, with sales of about `2,454cr in FY2012, contributing 47% to its top line. The company enjoys a leadership position in the CVS, GI, women healthcare and respiratory segments, with sales force of 4,500. The company, on an aggressive front, launched more than 40 new products in FY2012, including line extensions, of which 10 were for the first time. During FY200812, the company reported a ~13% CAGR in its top line in the domestic formulation business. Going forward, the company expects the segment to grow at above-industry average of 1518% on the back of new product launches and field force expansion. Further, the company has a strong consumer division through its stake in Zydus Wellness, which has premium brands, such as Sugarfree, Everyuth and Nutralite, under its umbrella. This segment, which contributes ~7% to the companys sales, posted a dip in sales in FY2012 and is expected to bounce back and post double-digit growth in FY2013. Exports on a strong footing: Cadila has a two-fold focus on exports, wherein it is targeting developed as well as emerging markets, which contributed around 53% to its FY2012 top line. The company has developed a formidable presence in the developed markets of U.S., Europe (France and Spain) and Japan. In the U.S., the company achieved critical scale of US$241mn on the sales front in FY2012, primarily driven by market share gains in the U.S., as some key competitors had manufacturing constraints due to the USFDA issue. In Europe, the companys growth going forward would be driven by new product launches and margin improvement by product transfer to Indian facilities. In emerging markets, Cadila is aggressively targeting Brazil and the CIS region. One of the most profitable CRAMS players: Cadilas CRAMS JV with Nycomed and Hospira is one of the most profitable in the industry. With Abbott, the company has guided for launches in Eastern EU market, which would begin from October 2012.

May 11, 2012

Cadila Healthcare | 4QFY2012 Result Update

Outlook and valuation

We expect Cadilas net sales to post a 17.3% CAGR to `7,386cr and EPS to report a 22.3% CAGR to `47.7 over FY201214E. We recommend Buy on the stock with a revised target price of `953.

Exhibit 7: Key assumptions

Key assumptions Sales growth (%) Growth in employee expenses (%) Operating margin (excl. tech. know-how fees) (%) Capex (` cr)

Source: Company, Angel Research

FY2013E 20.8 20.7 18.6 650

FY2014E 20.1 20.1 19.6 650

Exhibit 8: One-year forward PE band

1,200 1,000 800 600 400 200 -

Dec-06

Dec-08

Aug-07

Aug-09

Dec-10

Aug-11

28x

Apr-06

Apr-08

Apr-10

Price

Source: Company, Angel Research

7x

14x

21x

May 11, 2012

Apr-12

Cadila Healthcare | 4QFY2012 Result Update

Exhibit 9: Recommendation summary

Company Alembic Pharmaceuticals Aurobindo Pharma Aventis* Cadila Healthcare Cipla Dr Reddy's Dishman Pharma GSK Pharma* Indoco Remedies Ipca labs Lupin Orchid Chemicals Ranbaxy* Sun Pharma Reco Buy Buy Reduce Buy Buy Accumulate Buy Neutral Buy Buy Buy Buy Neutral Accumulate CMP Tgt. price Upside (`) 52 109 2,083 766 319 1,662 42 2,049 460 358 517 161 479 570 (`) 91 175 1,937 953 379 1,798 92 665 443 646 270 635 76.0 60.3 (7.0) 24.4 18.8 8.2 119.0 44.5 23.8 25.1 68.2 11.5 5.7 6.2 20.0 16.1 16.8 18.5 3.2 24.9 6.9 8.8 16.0 4.2 16.1 20.9 FY2014E 0.7 0.5 2.6 2.1 2.9 2.7 0.7 5.1 0.9 1.4 2.1 0.9 1.8 5.7 4.7 3.7 16.6 10.9 13.5 11.3 4.1 16.4 6.0 6.4 10.8 4.6 11.1 12.6 FY12-14E 14.6 4.7 5.6 22.3 13.5 (4.5) 38.9 8.7 25.1 23.5 29.1 50.0 44.8 8.3 FY2014E 29.4 10.1 16.1 23.0 15.2 29.5 8.9 38.9 13.8 27.3 28.0 10.7 15.6 24.0 29.2 14.0 17.0 27.5 16.8 19.5 10.1 29.0 16.9 27.7 25.2 18.0 28.1 20.8 % PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Source: Company, Angel Research; Note: *December year ending

May 11, 2012

Cadila Healthcare | 4QFY2012 Result Update

Profit & Loss statement (Consolidated)

Y/E March (` cr) Gross sales Less: Excise duty Net sales Other operating income Total operating income % chg Total expenditure Net raw materials Other mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation& amortisation EBIT % chg (% of Net Sales) Interest & other charges Other income (% of PBT) Recurring PBT % chg Extraordinary expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Less: Minority interest (MI) PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E 2,917 55 2,862 65 2,928 26.0 2,322 957 122 311 933 541 34.7 18.9 112 429 40.9 15.0 121 20 5 394 19.3 24 370 66.6 18.0 303 (0.1) 303 327 23.8 10.6 14.8 14.8 17.5 3,614 40 3,574 113 3,687 25.9 2,881 1,178 150 393 1,159 694 28.3 19.4 134 560 30.5 15.7 82 16 3 606 53.9 5 602 74.1 12.3 527 22.9 505 509 55.5 14.1 24.7 24.7 66.8 4,521 56 4,465 166 4,630 25.6 3,604 1,475 162 549 1,417 861 24.1 19.3 127 734 31.1 16.4 70 13 2 842 39.0 842 106.4 12.6 736 25.1 711 711 39.6 15.9 33.8 33.8 36.8 5,181 91 5,090 173 5,263 13.7 4,179 1,679 320 751 1,429 911 5.8 17.9 158 753 2.6 14.8 185 53 7 794 -5.7 794 113.0 14.2 681 28.6 653 653 -8.2 12.8 31.9 31.9 (5.4) 6,217 69 6,148 144 6,292 19.5 5,005 2,090 386 907 1,621 1,143 25.5 18.6 250 892 18.6 14.5 82 43 4 997 25.6 997 199.5 20.0 798 28.6 769 769 17.9 12.5 37.6 37.6 17.9 7,460 75 7,386 144 7,530 19.7 5,939 2,437 464 1,090 1,948 1,447 26.6 19.6 296 1,151 29.0 15.6 82 43 3 1,256 25.9 1,256 251.2 20.0 1,005 28.6 976 976 26.9 13.2 47.7 47.7 26.9

May 11, 2012

Cadila Healthcare | 4QFY2012 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity share capital Reserves & Surplus Shareholders funds Minority interest Total loans Deferred tax liability Total liabilities APPLICATION OF FUNDS Gross block Less: Acc. depreciation Net block Capital Work-in-Progress Goodwill Investments Current assets Cash Loans & advances Other Current liabilities Net Current assets Mis. Exp. not written off Total assets 1,809 757 1,052 189 478 25 1,605 252 297 1,056 692 913 2,657 2,074 873 1,201 248 484 21 1,775 251 307 1,217 866 909 10 2,872 2,348 999 1,348 431 484 21 2,283 295 411 1,577 1,119 1,164 3,448 3,253 1,157 2,096 248 988 24 2,760 467 275 2,019 2,153 607 3,963 3,903 1,408 2,495 248 988 24 3,475 705 332 2,438 2,661 814 4,569 4,553 1,704 2,849 248 988 24 4,458 1,130 398 2,929 3,185 1,273 5,382 68 1,167 1,235 23 1,267 132 2,657 68 1,560 1,629 39 1,091 114 2,872 102 2,069 2,171 67 1,097 113 3,448 102 2,474 2,577 90 1,177 118 3,963 102 3,052 3,155 119 1,177 117 4,569 102 3,836 3,941 148 1,177 116 5,382 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

May 11, 2012

Cadila Healthcare | 4QFY2012 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr) Profit before tax Depreciation (Inc)/Dec in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec.in Fixed Assets (Inc.)/Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E 370 112 (137) 20 49 275 (388) (1) 20 (368) 421 (71) (142) 208 115 93 252 602 134 3 16 77 646 (299) (84) 16 (368) (177) 75 (177) (279) (1) 252 251 842 127 (211) 13 106 639 (291) (0) 13 (278) 7 (176) (147) (317) 45 251 295 794 158 729 53 113 1,514 (723) (3) 53 (673) 226 (192) (704) (670) 171 295 467 997 250 32 43 199 1,037 (650) 43 (607) (192) (192) 238 467 705 1,256 296 (34) 43 251 1,223 (650) 43 (607) (192) (192) 425 705 1,130

May 11, 2012

10

Cadila Healthcare | 4QFY2012 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) 0.8 1.9 3.6 0.5 1.2 6.8 0.4 0.9 10.5 0.3 0.8 4.1 0.1 0.4 10.8 0.0 0.0 14.0 1.7 67 52 70 74 1.9 67 47 72 65 2.1 62 49 80 60 1.9 66 57 136 35 1.8 69 60 141 7 1.8 73 65 142 6 18.3 26.3 28.5 20.2 30.9 35.6 23.2 35.6 37.4 20.3 33.5 27.5 20.9 36.5 26.8 23.1 40.8 27.5 15.0 82.0 1.3 16.5 9.4 0.8 21.9 15.7 87.7 1.5 20.1 6.1 0.7 29.5 16.4 87.4 1.6 23.0 5.6 0.4 30.7 14.8 85.8 1.6 20.1 13.9 0.3 22.1 14.5 80.0 1.7 19.9 5.6 0.2 22.9 15.6 80.0 1.9 23.1 5.6 0.1 24.5 14.8 14.8 20.3 3.0 60.4 24.7 24.7 31.2 5.0 79.7 33.8 33.8 40.9 6.0 106.1 31.9 31.9 39.6 8.0 125.9 37.6 37.6 49.8 8.0 154.1 47.7 47.7 62.1 8.0 192.5 51.7 37.7 12.7 0.4 5.8 30.8 6.3 31.0 24.5 9.6 0.7 4.6 23.8 5.7 22.6 18.7 7.2 0.8 3.7 19.1 4.8 24.0 19.3 6.1 1.0 3.2 18.0 4.1 20.4 15.4 5.0 1.0 2.6 14.1 3.5 16.1 12.3 4.0 1.0 2.1 10.9 2.9 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

May 11, 2012

11

Cadila Healthcare | 4QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Cadila No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

May 11, 2012

12

You might also like

- Fa - End TermDocument21 pagesFa - End Termmadhurialamuri100% (3)

- Activity No 1Document2 pagesActivity No 1Makeyc Stis100% (1)

- Msq01 Overview of The Ms Practice by The CpaDocument9 pagesMsq01 Overview of The Ms Practice by The CpaAnna Marie75% (8)

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- Cadila Healthcare, 12th February 2013Document12 pagesCadila Healthcare, 12th February 2013Angel BrokingNo ratings yet

- Cadila Healthcare: Performance HighlightsDocument12 pagesCadila Healthcare: Performance HighlightsAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories: Performance HighlightsDocument10 pagesDr. Reddy's Laboratories: Performance HighlightsAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories: Performance HighlightsDocument11 pagesDr. Reddy's Laboratories: Performance HighlightsAngel BrokingNo ratings yet

- DRL, 22nd February, 2013Document11 pagesDRL, 22nd February, 2013Angel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument11 pagesAlembic Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Cadila, 1Q FY 2014Document12 pagesCadila, 1Q FY 2014Angel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Cadila 4Q FY 2013Document12 pagesCadila 4Q FY 2013Angel BrokingNo ratings yet

- Cipla 4Q FY 2013Document11 pagesCipla 4Q FY 2013Angel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument11 pagesAlembic Pharma: Performance Highlightsvicky168No ratings yet

- Dishman 4Q FY 2013Document10 pagesDishman 4Q FY 2013Angel BrokingNo ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo-1QFY2013RU 10th AugDocument11 pagesAurobindo-1QFY2013RU 10th AugAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies, 30th January 2013Document11 pagesIndoco Remedies, 30th January 2013Angel BrokingNo ratings yet

- Alembic Pharma Result UpdatedDocument9 pagesAlembic Pharma Result UpdatedAngel BrokingNo ratings yet

- Aurobindo 4Q FY 2013Document10 pagesAurobindo 4Q FY 2013Angel BrokingNo ratings yet

- Ipca Labs Result UpdatedDocument10 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Ipca Labs Result UpdatedDocument12 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Hul 2qfy2013ruDocument12 pagesHul 2qfy2013ruAngel BrokingNo ratings yet

- Sun Pharma 1QFY2013Document11 pagesSun Pharma 1QFY2013Angel BrokingNo ratings yet

- Indoco Remedies 4Q FY 2013Document11 pagesIndoco Remedies 4Q FY 2013Angel BrokingNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Aurobindo Pharma: Performance HighlightsDocument11 pagesAurobindo Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies Result UpdatedDocument11 pagesIndoco Remedies Result UpdatedAngel BrokingNo ratings yet

- Aurobindo, 12th February 2013Document11 pagesAurobindo, 12th February 2013Angel BrokingNo ratings yet

- Alembic Pharma, 1Q FY 2014Document10 pagesAlembic Pharma, 1Q FY 2014Angel BrokingNo ratings yet

- AngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216Document11 pagesAngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216HitechSoft HitsoftNo ratings yet

- Ranbaxy, 1st March, 2013Document11 pagesRanbaxy, 1st March, 2013Angel BrokingNo ratings yet

- DR Reddys Laboratories Limited 4 QuarterUpdateDocument11 pagesDR Reddys Laboratories Limited 4 QuarterUpdateparry0843No ratings yet

- Lupin Result UpdatedDocument11 pagesLupin Result UpdatedAngel BrokingNo ratings yet

- Aurobindo Pharma: Performance HighlightsDocument10 pagesAurobindo Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- GSK, 20th February, 2013Document11 pagesGSK, 20th February, 2013Angel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo Pharma Result UpdatedDocument10 pagesAurobindo Pharma Result UpdatedAngel BrokingNo ratings yet

- Orchid Chemicals Result UpdatedDocument11 pagesOrchid Chemicals Result UpdatedAngel BrokingNo ratings yet

- Orchid Chemicals Result UpdatedDocument11 pagesOrchid Chemicals Result UpdatedAngel BrokingNo ratings yet

- Ipca Labs: Performance HighlightsDocument11 pagesIpca Labs: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo, 1Q FY 2014Document11 pagesAurobindo, 1Q FY 2014Angel BrokingNo ratings yet

- UPL, 30th January 2013Document11 pagesUPL, 30th January 2013Angel BrokingNo ratings yet

- Lupin Result UpdatedDocument11 pagesLupin Result UpdatedAngel BrokingNo ratings yet

- Colgate: Performance HighlightsDocument9 pagesColgate: Performance HighlightsAngel BrokingNo ratings yet

- Sun Pharma: Performance HighlightsDocument12 pagesSun Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Ranbaxy: Performance HighlightsDocument11 pagesRanbaxy: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument10 pagesAlembic Pharma: Performance HighlightsTirthajit SinhaNo ratings yet

- Aurobindo PharmaDocument11 pagesAurobindo PharmaAngel BrokingNo ratings yet

- Sun Pharma 4Q FY 2013Document11 pagesSun Pharma 4Q FY 2013Angel BrokingNo ratings yet

- Cravatex: Strategic Partnerships To Be Key DriverDocument14 pagesCravatex: Strategic Partnerships To Be Key DriverAngel BrokingNo ratings yet

- Sanofi India, 28th February, 2013Document10 pagesSanofi India, 28th February, 2013Angel BrokingNo ratings yet

- United Phosphorus Result UpdatedDocument11 pagesUnited Phosphorus Result UpdatedAngel BrokingNo ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Accountancy Class XII Holidays Homework AssignmentDocument15 pagesAccountancy Class XII Holidays Homework AssignmentSiddharth GoelNo ratings yet

- Chapter 5Document48 pagesChapter 5HelloWorldNowNo ratings yet

- Practical Accounting IIDocument19 pagesPractical Accounting IIChristine Nicole BacoNo ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFDocument43 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFWilliamCartersafg100% (14)

- ENTREP10 MODULES-Quarter2-Week5-9Document16 pagesENTREP10 MODULES-Quarter2-Week5-9Kristel AcordonNo ratings yet

- Part 2 Financial Statement in General FS Analysis - Qs 04 Sept 2021Document21 pagesPart 2 Financial Statement in General FS Analysis - Qs 04 Sept 2021Alyssa PilapilNo ratings yet

- Cash FlowDocument23 pagesCash FlowSundara BalamuruganNo ratings yet

- Intangible Investments, Scaling, and The Trend in The Accrual-Cash Flow AssociationDocument69 pagesIntangible Investments, Scaling, and The Trend in The Accrual-Cash Flow AssociationKári FinnssonNo ratings yet

- Simulated Qualifying Exam ReviewerDocument10 pagesSimulated Qualifying Exam ReviewerJanina Frances Ruidera100% (1)

- Pas 20 Government Grants: Nature: Government Grant Government AssistanceDocument2 pagesPas 20 Government Grants: Nature: Government Grant Government AssistanceKristalen ArmandoNo ratings yet

- Session 1: Overview of Financial Accounting and ControlDocument10 pagesSession 1: Overview of Financial Accounting and ControlYamu HiadeenNo ratings yet

- PWC Ifrs Illustrative Ifrs Consolidated Financial Statements 2015Document204 pagesPWC Ifrs Illustrative Ifrs Consolidated Financial Statements 2015AliNo ratings yet

- Answer Template For Financial Statement Analysis Exercises JanuaryDocument4 pagesAnswer Template For Financial Statement Analysis Exercises JanuaryFiqNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- General JournalDocument14 pagesGeneral JournalHana SantiagoNo ratings yet

- Quiz 8 - Chapter 14Document3 pagesQuiz 8 - Chapter 14Sherri BonquinNo ratings yet

- Prepaid Insurance 115 Insurance Expense 510Document13 pagesPrepaid Insurance 115 Insurance Expense 510klm klmNo ratings yet

- Test Bank For Financial Reporting 3rd Edition Janice Loftus Ken Leo Sorin Daniliuc Noel Boys Belinda Luke Hong Nee Ang Karyn Byrnes DownloadDocument12 pagesTest Bank For Financial Reporting 3rd Edition Janice Loftus Ken Leo Sorin Daniliuc Noel Boys Belinda Luke Hong Nee Ang Karyn Byrnes Downloadtonyafosternmzdfpwtgb100% (29)

- 02 Questions F3 INT LRPDocument54 pages02 Questions F3 INT LRPshabiumer100% (1)

- Introduction To CSEC POADocument13 pagesIntroduction To CSEC POAItz Mi AriNo ratings yet

- Strictly No Cheating. Those Who Will Be Caught Cheating Will Automatically Be Given A Grade of 5.0 in The ExamDocument4 pagesStrictly No Cheating. Those Who Will Be Caught Cheating Will Automatically Be Given A Grade of 5.0 in The Examjapvivi ceceNo ratings yet

- Mock Test Qe1 1Document31 pagesMock Test Qe1 1Ma. Fatima H. FabayNo ratings yet

- Igcse Accounting Essential 2e Answers 7 PDFDocument12 pagesIgcse Accounting Essential 2e Answers 7 PDFluyawinNo ratings yet

- Company Analysis - Renault Trucks Defense Valued at 772 Million Euros ?Document12 pagesCompany Analysis - Renault Trucks Defense Valued at 772 Million Euros ?David Misovsky100% (1)

- Qtkd-704015-Qtccu CH2Document78 pagesQtkd-704015-Qtccu CH2Na NguyễnNo ratings yet

- AE211 Final ExamDocument10 pagesAE211 Final ExamMariette Alex AgbanlogNo ratings yet

- Dr. CA Ravi Agarwal FR CompilerDocument1,468 pagesDr. CA Ravi Agarwal FR Compiler6dzk78g2vyNo ratings yet