Professional Documents

Culture Documents

Arena Summary Security

Arena Summary Security

Uploaded by

Matt DriscollCopyright:

Available Formats

You might also like

- Formula 1 Draft ContractDocument33 pagesFormula 1 Draft Contractal_crespoNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Gsa and The OverstandingDocument43 pagesGsa and The OverstandingJoshua Sygnal Gutierrez100% (13)

- BPCA AgreementDocument7 pagesBPCA AgreementEliot Brown / New York Observer100% (1)

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 AnswersAhmed Zeeshan100% (25)

- Lockeed 5 StarDocument6 pagesLockeed 5 StarAjay SinghNo ratings yet

- Chapter 9 Governmental and Non-For-profit Accounting Test BankDocument16 pagesChapter 9 Governmental and Non-For-profit Accounting Test BankAngelo Mendez100% (2)

- Term Sheet: Shinnecock Nation & Gateway Casino ResortsDocument12 pagesTerm Sheet: Shinnecock Nation & Gateway Casino ResortsArchive ItNo ratings yet

- Soccer Development Deal For Council-2Document17 pagesSoccer Development Deal For Council-2petersoe0No ratings yet

- Letter of Intent Relating To Development of WaterWalk Hotel 2010-01-12Document10 pagesLetter of Intent Relating To Development of WaterWalk Hotel 2010-01-12Bob WeeksNo ratings yet

- Doraville MOUDocument39 pagesDoraville MOUZachary HansenNo ratings yet

- Valuing ProjectsDocument5 pagesValuing ProjectsAjay SinghNo ratings yet

- Emil Haag Charging DocumentsDocument1 pageEmil Haag Charging DocumentsMatt DriscollNo ratings yet

- Michael C Hayes Charging DocsDocument7 pagesMichael C Hayes Charging DocsMatt DriscollNo ratings yet

- Chart of Accounts For HotelDocument24 pagesChart of Accounts For HotelJonathan Oni100% (3)

- 06-28 Staff Report W AttachDocument125 pages06-28 Staff Report W AttachMatthew JensenNo ratings yet

- 201209arena SummaryDocument3 pages201209arena SummaryKING 5 NewsNo ratings yet

- 201209arena FaqDocument5 pages201209arena FaqKING 5 NewsNo ratings yet

- Downtown Arena Framework Responses To Councillors QuestionsDocument13 pagesDowntown Arena Framework Responses To Councillors QuestionsMonsieurLeLoucheNo ratings yet

- Village (At Avon) Litigation Settlement Financial Questions and AnswersDocument18 pagesVillage (At Avon) Litigation Settlement Financial Questions and AnswersvaildailyNo ratings yet

- Summary of Host Community Agreement Between Palmer and Mohegan SunDocument5 pagesSummary of Host Community Agreement Between Palmer and Mohegan SunMassLiveNo ratings yet

- Downtown Arena Master AgreementDocument31 pagesDowntown Arena Master AgreementEmily MertzNo ratings yet

- Coliseum, Lott Group/Fortress Term Sheet For Oakland Raiders StadiumDocument30 pagesColiseum, Lott Group/Fortress Term Sheet For Oakland Raiders StadiumBayAreaNewsGroupNo ratings yet

- Item 7 6-8-04Document56 pagesItem 7 6-8-04RecordTrac - City of OaklandNo ratings yet

- Date: To: From: Re: May 17, 2006Document4 pagesDate: To: From: Re: May 17, 2006LancasterFirstNo ratings yet

- McPier Airport Departure Tax LawsuitDocument64 pagesMcPier Airport Departure Tax Lawsuitdannyecker_crain100% (1)

- Hidden Risks SummaryDocument1 pageHidden Risks SummaryJon RalstonNo ratings yet

- KFC Yum! Center White PaperDocument38 pagesKFC Yum! Center White PaperAlbrecht Stahmer67% (3)

- Brian Davies Complaint CA Govt Code 910 - 910.2Document48 pagesBrian Davies Complaint CA Govt Code 910 - 910.2Brian DaviesNo ratings yet

- American Dream Bond Doc - FinancingDocument7 pagesAmerican Dream Bond Doc - Financingeric_roperNo ratings yet

- CF Classwrok 1 TVMDocument2 pagesCF Classwrok 1 TVMfalconsgroupNo ratings yet

- 10.25 Redlined FINAL Downtown Conference Center MOUDocument12 pages10.25 Redlined FINAL Downtown Conference Center MOUWorkstation PageNo ratings yet

- Sale Agreement Between City of Kalamazoo and Developers For Lot 2Document29 pagesSale Agreement Between City of Kalamazoo and Developers For Lot 2Malachi BarrettNo ratings yet

- Oakland Howard Terminal Waterfront Project ATTACHMENTS 1 Through 6Document152 pagesOakland Howard Terminal Waterfront Project ATTACHMENTS 1 Through 6Zennie AbrahamNo ratings yet

- Intro Partnerships ProblemsDocument36 pagesIntro Partnerships ProblemsSana MinatozakiNo ratings yet

- Sponsorship Agreement Termination AgreementDocument3 pagesSponsorship Agreement Termination AgreementAnonymous NbMQ9YmqNo ratings yet

- 15 Chapter Partnerships FormationDocument13 pages15 Chapter Partnerships Formationmurtle0% (1)

- Diamondbacks SuitDocument40 pagesDiamondbacks SuitDeadspinNo ratings yet

- 08 Joint ArrangementDocument3 pages08 Joint ArrangementMelody Gumba0% (1)

- Ansonia Bond ResolutionDocument4 pagesAnsonia Bond ResolutionThe Valley IndyNo ratings yet

- Accounting For Joint OperationDocument4 pagesAccounting For Joint OperationMaurice AgbayaniNo ratings yet

- Forgivable Loan Agreement Between The City of Wichita and Apex Engineering InternationalDocument10 pagesForgivable Loan Agreement Between The City of Wichita and Apex Engineering InternationalBob WeeksNo ratings yet

- Investment Analysis and Lockheed Tri Star: V C KGDocument6 pagesInvestment Analysis and Lockheed Tri Star: V C KGKrishna Prasad NNo ratings yet

- Ordinance - FC Cincinnati Public Infrastructure Improvements (00244781xC2130)Document12 pagesOrdinance - FC Cincinnati Public Infrastructure Improvements (00244781xC2130)WCPO 9 NewsNo ratings yet

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- General Fundtrial Balance JANUARY 1, 2018 Debits CreditsDocument2 pagesGeneral Fundtrial Balance JANUARY 1, 2018 Debits CreditsTehone TeketelewNo ratings yet

- Miami Heat AuditDocument69 pagesMiami Heat AuditFrancisco AlvaradoNo ratings yet

- The CID PetitionDocument16 pagesThe CID PetitionMichael PowersNo ratings yet

- UntitledDocument28 pagesUntitledapi-286598530No ratings yet

- Measure CDocument125 pagesMeasure CApril BolingNo ratings yet

- Burlington PDFDocument5 pagesBurlington PDFAlivia HasnandaNo ratings yet

- OkDocument5 pagesOkpleasetryagain12345No ratings yet

- Core Concepts of Government and Not For Profit Accounting 2nd Edition Granof Test BankDocument13 pagesCore Concepts of Government and Not For Profit Accounting 2nd Edition Granof Test BankChristopherDayasptr100% (16)

- 153 Chapter 8 Solutions ManualDocument22 pages153 Chapter 8 Solutions Manualnicka83100% (2)

- Test Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition GranofDocument17 pagesTest Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition Granofhaeric0gas100% (22)

- TRC News and Notes 4-11-12Document1 pageTRC News and Notes 4-11-12James Van BruggenNo ratings yet

- Solutiondone 2-115Document1 pageSolutiondone 2-115trilocksp SinghNo ratings yet

- Construction Funds Trust Agreement-CDocument46 pagesConstruction Funds Trust Agreement-CRicardo NavaNo ratings yet

- Diagnostic Exam Advanced AccountingDocument12 pagesDiagnostic Exam Advanced AccountingNhajNo ratings yet

- Lancaster County Letter To DcedDocument38 pagesLancaster County Letter To DcedLancasterFirstNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- The King Takes Your Castle: City Laws That Restrict Your Property RightsFrom EverandThe King Takes Your Castle: City Laws That Restrict Your Property RightsNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Promoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3From EverandPromoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3No ratings yet

- Rebuttal To Draft Report (06!29!2012)Document23 pagesRebuttal To Draft Report (06!29!2012)Matt DriscollNo ratings yet

- Case 412-2010 - Summit Law GroupDocument2 pagesCase 412-2010 - Summit Law GroupJeff ReifmanNo ratings yet

- Lawsuit Filed Against Cedar Grove CompostingDocument28 pagesLawsuit Filed Against Cedar Grove CompostingMatt DriscollNo ratings yet

- Lawsuit Filed Against Cedar Grove CompostingDocument15 pagesLawsuit Filed Against Cedar Grove CompostingMatt DriscollNo ratings yet

- Ernesto Ruelas-Rodriguez Charging DocumentsDocument4 pagesErnesto Ruelas-Rodriguez Charging DocumentsMatt DriscollNo ratings yet

- Floyd Hutchins Determination of Probable Cause PDFDocument4 pagesFloyd Hutchins Determination of Probable Cause PDFMatt DriscollNo ratings yet

- Gregoire's 2013-2015 Budget ProposalDocument5 pagesGregoire's 2013-2015 Budget ProposalMatt DriscollNo ratings yet

- Seattle University SPD Use of Force StudyDocument32 pagesSeattle University SPD Use of Force StudyMatt DriscollNo ratings yet

- Tobacco Sales To Minors in King CountyDocument4 pagesTobacco Sales To Minors in King CountyMatt DriscollNo ratings yet

- D'Vontaveous Hoston ChargesDocument7 pagesD'Vontaveous Hoston ChargesMatt DriscollNo ratings yet

- Washington's New Marriage CertificateDocument2 pagesWashington's New Marriage CertificateMatt Driscoll0% (1)

- Troy Fisher Charging DocsDocument3 pagesTroy Fisher Charging DocsMatt DriscollNo ratings yet

- Sylvester Haliburton ChargesDocument2 pagesSylvester Haliburton ChargesMatt DriscollNo ratings yet

- Chapter 1 - Research Methdology: Objective of The StudyDocument86 pagesChapter 1 - Research Methdology: Objective of The StudyHiren PrajapatiNo ratings yet

- Basic Accounting and Financial ManagementDocument163 pagesBasic Accounting and Financial ManagementBernard Owusu100% (1)

- Timber Mart South Sample 1Q 2012 NewsDocument35 pagesTimber Mart South Sample 1Q 2012 Newspoitan2No ratings yet

- 2016 14 PPT Acctg1 Adjusting EntriesDocument20 pages2016 14 PPT Acctg1 Adjusting Entriesash wu100% (3)

- Terms Sheet SampleDocument4 pagesTerms Sheet SampleKamil JagieniakNo ratings yet

- Guidelines On The ImplementationSenior High School Voucher ProgramDocument32 pagesGuidelines On The ImplementationSenior High School Voucher ProgramBautista Aileen IvyNo ratings yet

- MathematicsDocument31 pagesMathematicsShance RainbowsphereNo ratings yet

- UB FinalDocument35 pagesUB FinalTrupti GoudarNo ratings yet

- Answer Key: Chapter 01 Environment and Theoretical Structure of Financial AccountingDocument47 pagesAnswer Key: Chapter 01 Environment and Theoretical Structure of Financial AccountingLouiseNo ratings yet

- FORMS OF FUTURE WILL or BE GOING TODocument13 pagesFORMS OF FUTURE WILL or BE GOING TOtatiana100% (1)

- Madura 4 DUDocument23 pagesMadura 4 DUIffat RuhanNo ratings yet

- Ifrs 15Document99 pagesIfrs 15Eddie MutizwaNo ratings yet

- Multi Fire ProtectionDocument2 pagesMulti Fire Protectionpmcmbharat264No ratings yet

- Desktop Rates July 2023 1Document3 pagesDesktop Rates July 2023 1Ahsan RiazNo ratings yet

- ImrozDocument3 pagesImrozShivendra PandeyNo ratings yet

- 22 - Self Employed Declaration Form For IndividualsDocument1 page22 - Self Employed Declaration Form For Individualswriter pkNo ratings yet

- 3 Resource Backflush AccountingDocument7 pages3 Resource Backflush AccountingNaveed Mughal AcmaNo ratings yet

- Financial Instrument NotesDocument3 pagesFinancial Instrument NotesKrishna AdhikariNo ratings yet

- Introduction To Financial ManagementDocument6 pagesIntroduction To Financial ManagementDrveerapaneni SuryaprakasaraoNo ratings yet

- Intramuros Adminstration - Exec Summary 06Document9 pagesIntramuros Adminstration - Exec Summary 06Anonymous p47liBNo ratings yet

- Unit3 Econ Test (7, 8, 9Document11 pagesUnit3 Econ Test (7, 8, 9Katie MartinezNo ratings yet

- Info About Various ServicesDocument6 pagesInfo About Various ServicesSreekanth Reddy100% (1)

- Trắc nghiệm IFRS chương 1 2Document9 pagesTrắc nghiệm IFRS chương 1 2QUOC NGUYEN THAINo ratings yet

- Rohit Summer Internship Report.....Document69 pagesRohit Summer Internship Report.....Manas Pandey100% (2)

- Mango Peel Product Final With FSDocument49 pagesMango Peel Product Final With FSJhasper Managyo100% (1)

- 4 2 Technical Analysis Fibonacci PDFDocument11 pages4 2 Technical Analysis Fibonacci PDFDis JovscNo ratings yet

- Comparing The Aicpa Code To The Global StandardDocument6 pagesComparing The Aicpa Code To The Global StandardNoveldaNo ratings yet

Arena Summary Security

Arena Summary Security

Uploaded by

Matt DriscollOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Arena Summary Security

Arena Summary Security

Uploaded by

Matt DriscollCopyright:

Available Formats

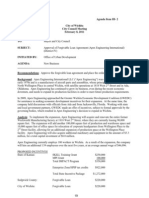

May 16, 2012

Arena MOU and ILA Summary and Security Provisions

Copies of the MOU and ILA can be found on the City of Seattles website: http://www.seattle.gov/arena/

Overview: The Memorandum of Understanding (MOU) is a binding document between the City of Seattle, King County, and ArenaCo (the entity that will construct, operate and maintain the arena). It identifies the responsibilities of each party as they relate to the construction of the arena. The Interlocal Agreement (ILA) is a binding agreement between the City and County identifying obligations between the City and County related to the MOU with ArenaCo. It spells out City responsibilities, City and County joint responsibilities, public financing and project oversight. Project Description: The project is to develop, build, and operate a multi-purpose sports and entertainment arena. Cost: Approx. $490 million ($290 million from investor; up to $200 million from City and County). Size: Approx. 700,000 sq.ft. Accommodate: approximately 19,000 attendees for concerts; 18,500 attendees for NBA games; 17,500 attendees for NHL games. Ownership: Public ownership of land (at first installment) and building (at second installment). Public Financing First Installment: Acquisition of project site by City for price not to exceed $100 million. Second Installment: o If both an NBA and NHL team are ready to play in the completed facility, then the County obligation will be $80 million and the City obligation will be the amount that, in combination with the first installment, totals $120 million. o If only an NBA team is ready to play in the completed facility then; The County obligation is the lesser of $5 million or the amount supported by the Countys Arena related taxes; and The City obligation is, in combination with the First Installment and the Countys contribution, the lesser of $120 million and the amount that can be supported by base rent and Arena Tax Revenues.

Repayment for public financing is from rent paid by ArenaCo and new tax revenue directly attributable to the arena. Security Provisions The MOU contains a number of security provisions ensuring that the City and County general funds are protected and that the public is protected from financial risk. Construction Cost Overruns ArenaCo is responsible for construction of the facility and any cost overruns that may occur. The City and County are beneficiaries of completion guaranty.

1

May 16, 2012

Annual Revenue Pledge Payments sufficient to support public annual debt service are provided by ArenaCo. If tax revenues come in below estimate, ArenaCo pays additional rent to cover any gap. Reserve Account Prior to any public financial support, a security reserve equivalent to a full year of the City and County debt service will be funded by ArenaCo and held in escrow. In addition, there is an annual Coverage Ratio requirement of 2.0x Net Arena Revenues to annual debt service; if not met, ArenaCo has to make additional contributions to Reserve Account. First Position in ArenaCo Revenues The City and the County will be in a priority position to receive annual payments for debt service ahead of other payments to lenders. City and County will have first position on all Arena Revenues which include premium seating revenues, all naming rights revenues, and all Arena sponsorship revenues. Guaranty of Parent The parent company which will own both ArenaCo and the Team will provide a guaranty of ArenaCos obligations. Non-Relocation Agreement with Liquidated Damages Each Team will enter into a binding non-relocation agreement for the full term of the public financing. The agreement will include Specific Performance and Liquidated damages in case of a breach. These are agreements that the leagues also recognize. Capital Expenditure Fund ArenaCo will contribute $2 million annually to a capital expenditure fund. These funds will be used for capital work done in the Arena. A separate City-County Capital Expenditure Fund will also be funded by excess taxes generated at the Arena. Locally Domiciled The teams will be required to domicile in Seattle for tax purposes, ensuring that business revenues are subject to local taxes. No Operational Financial Risk ArenaCo is entirely responsible to operate and run the facility. The public will bear no costs for operations. Maximum Public Financing Limit The City and the County would contribute no more than $200 million combined towards the project, which includes purchase of the land. The amount would be limited to $120 million if the Arena opens with only an NBA Team. Project Ownership The City and County will own the land from the outset of the project. The City/County will have an ownership interest in the arena upon completion, and complete ownership after the termination of the team leases. City/County Costs The agreement requires ArenaCo to reimburse the City/County for up to $5M in expenses associated with their participation in the project.

You might also like

- Formula 1 Draft ContractDocument33 pagesFormula 1 Draft Contractal_crespoNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Gsa and The OverstandingDocument43 pagesGsa and The OverstandingJoshua Sygnal Gutierrez100% (13)

- BPCA AgreementDocument7 pagesBPCA AgreementEliot Brown / New York Observer100% (1)

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 AnswersAhmed Zeeshan100% (25)

- Lockeed 5 StarDocument6 pagesLockeed 5 StarAjay SinghNo ratings yet

- Chapter 9 Governmental and Non-For-profit Accounting Test BankDocument16 pagesChapter 9 Governmental and Non-For-profit Accounting Test BankAngelo Mendez100% (2)

- Term Sheet: Shinnecock Nation & Gateway Casino ResortsDocument12 pagesTerm Sheet: Shinnecock Nation & Gateway Casino ResortsArchive ItNo ratings yet

- Soccer Development Deal For Council-2Document17 pagesSoccer Development Deal For Council-2petersoe0No ratings yet

- Letter of Intent Relating To Development of WaterWalk Hotel 2010-01-12Document10 pagesLetter of Intent Relating To Development of WaterWalk Hotel 2010-01-12Bob WeeksNo ratings yet

- Doraville MOUDocument39 pagesDoraville MOUZachary HansenNo ratings yet

- Valuing ProjectsDocument5 pagesValuing ProjectsAjay SinghNo ratings yet

- Emil Haag Charging DocumentsDocument1 pageEmil Haag Charging DocumentsMatt DriscollNo ratings yet

- Michael C Hayes Charging DocsDocument7 pagesMichael C Hayes Charging DocsMatt DriscollNo ratings yet

- Chart of Accounts For HotelDocument24 pagesChart of Accounts For HotelJonathan Oni100% (3)

- 06-28 Staff Report W AttachDocument125 pages06-28 Staff Report W AttachMatthew JensenNo ratings yet

- 201209arena SummaryDocument3 pages201209arena SummaryKING 5 NewsNo ratings yet

- 201209arena FaqDocument5 pages201209arena FaqKING 5 NewsNo ratings yet

- Downtown Arena Framework Responses To Councillors QuestionsDocument13 pagesDowntown Arena Framework Responses To Councillors QuestionsMonsieurLeLoucheNo ratings yet

- Village (At Avon) Litigation Settlement Financial Questions and AnswersDocument18 pagesVillage (At Avon) Litigation Settlement Financial Questions and AnswersvaildailyNo ratings yet

- Summary of Host Community Agreement Between Palmer and Mohegan SunDocument5 pagesSummary of Host Community Agreement Between Palmer and Mohegan SunMassLiveNo ratings yet

- Downtown Arena Master AgreementDocument31 pagesDowntown Arena Master AgreementEmily MertzNo ratings yet

- Coliseum, Lott Group/Fortress Term Sheet For Oakland Raiders StadiumDocument30 pagesColiseum, Lott Group/Fortress Term Sheet For Oakland Raiders StadiumBayAreaNewsGroupNo ratings yet

- Item 7 6-8-04Document56 pagesItem 7 6-8-04RecordTrac - City of OaklandNo ratings yet

- Date: To: From: Re: May 17, 2006Document4 pagesDate: To: From: Re: May 17, 2006LancasterFirstNo ratings yet

- McPier Airport Departure Tax LawsuitDocument64 pagesMcPier Airport Departure Tax Lawsuitdannyecker_crain100% (1)

- Hidden Risks SummaryDocument1 pageHidden Risks SummaryJon RalstonNo ratings yet

- KFC Yum! Center White PaperDocument38 pagesKFC Yum! Center White PaperAlbrecht Stahmer67% (3)

- Brian Davies Complaint CA Govt Code 910 - 910.2Document48 pagesBrian Davies Complaint CA Govt Code 910 - 910.2Brian DaviesNo ratings yet

- American Dream Bond Doc - FinancingDocument7 pagesAmerican Dream Bond Doc - Financingeric_roperNo ratings yet

- CF Classwrok 1 TVMDocument2 pagesCF Classwrok 1 TVMfalconsgroupNo ratings yet

- 10.25 Redlined FINAL Downtown Conference Center MOUDocument12 pages10.25 Redlined FINAL Downtown Conference Center MOUWorkstation PageNo ratings yet

- Sale Agreement Between City of Kalamazoo and Developers For Lot 2Document29 pagesSale Agreement Between City of Kalamazoo and Developers For Lot 2Malachi BarrettNo ratings yet

- Oakland Howard Terminal Waterfront Project ATTACHMENTS 1 Through 6Document152 pagesOakland Howard Terminal Waterfront Project ATTACHMENTS 1 Through 6Zennie AbrahamNo ratings yet

- Intro Partnerships ProblemsDocument36 pagesIntro Partnerships ProblemsSana MinatozakiNo ratings yet

- Sponsorship Agreement Termination AgreementDocument3 pagesSponsorship Agreement Termination AgreementAnonymous NbMQ9YmqNo ratings yet

- 15 Chapter Partnerships FormationDocument13 pages15 Chapter Partnerships Formationmurtle0% (1)

- Diamondbacks SuitDocument40 pagesDiamondbacks SuitDeadspinNo ratings yet

- 08 Joint ArrangementDocument3 pages08 Joint ArrangementMelody Gumba0% (1)

- Ansonia Bond ResolutionDocument4 pagesAnsonia Bond ResolutionThe Valley IndyNo ratings yet

- Accounting For Joint OperationDocument4 pagesAccounting For Joint OperationMaurice AgbayaniNo ratings yet

- Forgivable Loan Agreement Between The City of Wichita and Apex Engineering InternationalDocument10 pagesForgivable Loan Agreement Between The City of Wichita and Apex Engineering InternationalBob WeeksNo ratings yet

- Investment Analysis and Lockheed Tri Star: V C KGDocument6 pagesInvestment Analysis and Lockheed Tri Star: V C KGKrishna Prasad NNo ratings yet

- Ordinance - FC Cincinnati Public Infrastructure Improvements (00244781xC2130)Document12 pagesOrdinance - FC Cincinnati Public Infrastructure Improvements (00244781xC2130)WCPO 9 NewsNo ratings yet

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- General Fundtrial Balance JANUARY 1, 2018 Debits CreditsDocument2 pagesGeneral Fundtrial Balance JANUARY 1, 2018 Debits CreditsTehone TeketelewNo ratings yet

- Miami Heat AuditDocument69 pagesMiami Heat AuditFrancisco AlvaradoNo ratings yet

- The CID PetitionDocument16 pagesThe CID PetitionMichael PowersNo ratings yet

- UntitledDocument28 pagesUntitledapi-286598530No ratings yet

- Measure CDocument125 pagesMeasure CApril BolingNo ratings yet

- Burlington PDFDocument5 pagesBurlington PDFAlivia HasnandaNo ratings yet

- OkDocument5 pagesOkpleasetryagain12345No ratings yet

- Core Concepts of Government and Not For Profit Accounting 2nd Edition Granof Test BankDocument13 pagesCore Concepts of Government and Not For Profit Accounting 2nd Edition Granof Test BankChristopherDayasptr100% (16)

- 153 Chapter 8 Solutions ManualDocument22 pages153 Chapter 8 Solutions Manualnicka83100% (2)

- Test Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition GranofDocument17 pagesTest Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition Granofhaeric0gas100% (22)

- TRC News and Notes 4-11-12Document1 pageTRC News and Notes 4-11-12James Van BruggenNo ratings yet

- Solutiondone 2-115Document1 pageSolutiondone 2-115trilocksp SinghNo ratings yet

- Construction Funds Trust Agreement-CDocument46 pagesConstruction Funds Trust Agreement-CRicardo NavaNo ratings yet

- Diagnostic Exam Advanced AccountingDocument12 pagesDiagnostic Exam Advanced AccountingNhajNo ratings yet

- Lancaster County Letter To DcedDocument38 pagesLancaster County Letter To DcedLancasterFirstNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- The King Takes Your Castle: City Laws That Restrict Your Property RightsFrom EverandThe King Takes Your Castle: City Laws That Restrict Your Property RightsNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Promoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3From EverandPromoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3No ratings yet

- Rebuttal To Draft Report (06!29!2012)Document23 pagesRebuttal To Draft Report (06!29!2012)Matt DriscollNo ratings yet

- Case 412-2010 - Summit Law GroupDocument2 pagesCase 412-2010 - Summit Law GroupJeff ReifmanNo ratings yet

- Lawsuit Filed Against Cedar Grove CompostingDocument28 pagesLawsuit Filed Against Cedar Grove CompostingMatt DriscollNo ratings yet

- Lawsuit Filed Against Cedar Grove CompostingDocument15 pagesLawsuit Filed Against Cedar Grove CompostingMatt DriscollNo ratings yet

- Ernesto Ruelas-Rodriguez Charging DocumentsDocument4 pagesErnesto Ruelas-Rodriguez Charging DocumentsMatt DriscollNo ratings yet

- Floyd Hutchins Determination of Probable Cause PDFDocument4 pagesFloyd Hutchins Determination of Probable Cause PDFMatt DriscollNo ratings yet

- Gregoire's 2013-2015 Budget ProposalDocument5 pagesGregoire's 2013-2015 Budget ProposalMatt DriscollNo ratings yet

- Seattle University SPD Use of Force StudyDocument32 pagesSeattle University SPD Use of Force StudyMatt DriscollNo ratings yet

- Tobacco Sales To Minors in King CountyDocument4 pagesTobacco Sales To Minors in King CountyMatt DriscollNo ratings yet

- D'Vontaveous Hoston ChargesDocument7 pagesD'Vontaveous Hoston ChargesMatt DriscollNo ratings yet

- Washington's New Marriage CertificateDocument2 pagesWashington's New Marriage CertificateMatt Driscoll0% (1)

- Troy Fisher Charging DocsDocument3 pagesTroy Fisher Charging DocsMatt DriscollNo ratings yet

- Sylvester Haliburton ChargesDocument2 pagesSylvester Haliburton ChargesMatt DriscollNo ratings yet

- Chapter 1 - Research Methdology: Objective of The StudyDocument86 pagesChapter 1 - Research Methdology: Objective of The StudyHiren PrajapatiNo ratings yet

- Basic Accounting and Financial ManagementDocument163 pagesBasic Accounting and Financial ManagementBernard Owusu100% (1)

- Timber Mart South Sample 1Q 2012 NewsDocument35 pagesTimber Mart South Sample 1Q 2012 Newspoitan2No ratings yet

- 2016 14 PPT Acctg1 Adjusting EntriesDocument20 pages2016 14 PPT Acctg1 Adjusting Entriesash wu100% (3)

- Terms Sheet SampleDocument4 pagesTerms Sheet SampleKamil JagieniakNo ratings yet

- Guidelines On The ImplementationSenior High School Voucher ProgramDocument32 pagesGuidelines On The ImplementationSenior High School Voucher ProgramBautista Aileen IvyNo ratings yet

- MathematicsDocument31 pagesMathematicsShance RainbowsphereNo ratings yet

- UB FinalDocument35 pagesUB FinalTrupti GoudarNo ratings yet

- Answer Key: Chapter 01 Environment and Theoretical Structure of Financial AccountingDocument47 pagesAnswer Key: Chapter 01 Environment and Theoretical Structure of Financial AccountingLouiseNo ratings yet

- FORMS OF FUTURE WILL or BE GOING TODocument13 pagesFORMS OF FUTURE WILL or BE GOING TOtatiana100% (1)

- Madura 4 DUDocument23 pagesMadura 4 DUIffat RuhanNo ratings yet

- Ifrs 15Document99 pagesIfrs 15Eddie MutizwaNo ratings yet

- Multi Fire ProtectionDocument2 pagesMulti Fire Protectionpmcmbharat264No ratings yet

- Desktop Rates July 2023 1Document3 pagesDesktop Rates July 2023 1Ahsan RiazNo ratings yet

- ImrozDocument3 pagesImrozShivendra PandeyNo ratings yet

- 22 - Self Employed Declaration Form For IndividualsDocument1 page22 - Self Employed Declaration Form For Individualswriter pkNo ratings yet

- 3 Resource Backflush AccountingDocument7 pages3 Resource Backflush AccountingNaveed Mughal AcmaNo ratings yet

- Financial Instrument NotesDocument3 pagesFinancial Instrument NotesKrishna AdhikariNo ratings yet

- Introduction To Financial ManagementDocument6 pagesIntroduction To Financial ManagementDrveerapaneni SuryaprakasaraoNo ratings yet

- Intramuros Adminstration - Exec Summary 06Document9 pagesIntramuros Adminstration - Exec Summary 06Anonymous p47liBNo ratings yet

- Unit3 Econ Test (7, 8, 9Document11 pagesUnit3 Econ Test (7, 8, 9Katie MartinezNo ratings yet

- Info About Various ServicesDocument6 pagesInfo About Various ServicesSreekanth Reddy100% (1)

- Trắc nghiệm IFRS chương 1 2Document9 pagesTrắc nghiệm IFRS chương 1 2QUOC NGUYEN THAINo ratings yet

- Rohit Summer Internship Report.....Document69 pagesRohit Summer Internship Report.....Manas Pandey100% (2)

- Mango Peel Product Final With FSDocument49 pagesMango Peel Product Final With FSJhasper Managyo100% (1)

- 4 2 Technical Analysis Fibonacci PDFDocument11 pages4 2 Technical Analysis Fibonacci PDFDis JovscNo ratings yet

- Comparing The Aicpa Code To The Global StandardDocument6 pagesComparing The Aicpa Code To The Global StandardNoveldaNo ratings yet