Professional Documents

Culture Documents

April 2012

April 2012

Uploaded by

dietchokeCopyright:

Available Formats

You might also like

- 100.105.01 (CBRN-TPS70 (V) 5-AN-1) Antenna OM-ocrDocument330 pages100.105.01 (CBRN-TPS70 (V) 5-AN-1) Antenna OM-ocrJuan Miguel Yate Alcala100% (1)

- GlobalFoundries 2014 US Tech Seminar - Proceeding Book PDFDocument316 pagesGlobalFoundries 2014 US Tech Seminar - Proceeding Book PDFWeikai SunNo ratings yet

- Matching Dell Case SolutionDocument3 pagesMatching Dell Case SolutionAnuj Kumar HatoneyaNo ratings yet

- Dell Case Study FinalDocument27 pagesDell Case Study FinalPrabudh Jain67% (3)

- Python PDFDocument217 pagesPython PDFR Rama Naidu71% (14)

- Ede 1112Document60 pagesEde 1112javierodNo ratings yet

- Optical Components and Their Role in Optical NetworksDocument4 pagesOptical Components and Their Role in Optical NetworksManveen KaurNo ratings yet

- Signal Hill: Communications Technology: Q4 2011 M&A ReviewDocument12 pagesSignal Hill: Communications Technology: Q4 2011 M&A ReviewAnonymous Feglbx5No ratings yet

- ReviewDocument3 pagesReviewPrasanna VenkateshNo ratings yet

- Analog DevicesDocument10 pagesAnalog Devicesxavier25No ratings yet

- EETimes July-August 2012Document56 pagesEETimes July-August 2012Brzata PticaNo ratings yet

- Led Suppliers Directory: Leds Magazine ReviewDocument52 pagesLed Suppliers Directory: Leds Magazine ReviewChris RogersNo ratings yet

- Wireless Telecommunications Carriers in The US Industry ReportDocument44 pagesWireless Telecommunications Carriers in The US Industry ReportSwapneel ChhayaNo ratings yet

- Market Analysis Worldwide Service Provider Router 2011-2015 ForecastDocument21 pagesMarket Analysis Worldwide Service Provider Router 2011-2015 ForecastBudhaditya BanerjeeNo ratings yet

- Analog Devices Inc-1Document18 pagesAnalog Devices Inc-1Divyesh ChadotraNo ratings yet

- Mwee 201111Document32 pagesMwee 201111Petros TsenesNo ratings yet

- NB-IOT Huawei PDFDocument23 pagesNB-IOT Huawei PDFadvaleri070100% (2)

- Maxsys Elite Versus AbcDocument3 pagesMaxsys Elite Versus AbcamshincaNo ratings yet

- 2012 WP Ieee 802 11ac Understanding Enterprise Wlan Challenges PDFDocument0 pages2012 WP Ieee 802 11ac Understanding Enterprise Wlan Challenges PDFVenu MadhavNo ratings yet

- MSCC Corporate PresentationDocument21 pagesMSCC Corporate PresentationAmir GorenNo ratings yet

- Issue 91267Document100 pagesIssue 91267Steve NguyenNo ratings yet

- PCBDesign Dec2012Document77 pagesPCBDesign Dec2012Anonymous pHi4dXNo ratings yet

- Research & AnalysisDocument9 pagesResearch & AnalysisSANo ratings yet

- Communication & Energy Wire World Summary: Market Values & Financials by CountryFrom EverandCommunication & Energy Wire World Summary: Market Values & Financials by CountryNo ratings yet

- Dell Computer Corporation: James HsuDocument37 pagesDell Computer Corporation: James HsuHoang HaNo ratings yet

- Honeywell Automation 2009 ReportDocument4 pagesHoneywell Automation 2009 ReportmworahNo ratings yet

- ATMLDocument32 pagesATMLsskiller001No ratings yet

- 802 11 WiFi Wireless Standards and Facts PDFDocument6 pages802 11 WiFi Wireless Standards and Facts PDFFanny Tarida TampubolonNo ratings yet

- Mis Dell 1227965308312360 9Document14 pagesMis Dell 1227965308312360 9Nayana MakwanaNo ratings yet

- Value of BT LEDocument8 pagesValue of BT LEShu HuiNo ratings yet

- Company Turns LED Ceiling Lights Into Wireless Internet SourceDocument13 pagesCompany Turns LED Ceiling Lights Into Wireless Internet SourcePrashant KhullerNo ratings yet

- Case DELL Overtake HP Final - EdDocument20 pagesCase DELL Overtake HP Final - Edas1klh0No ratings yet

- View From The Top Global Technology Trends and Performance October 2012 February 2013Document24 pagesView From The Top Global Technology Trends and Performance October 2012 February 2013Euglena VerdeNo ratings yet

- 10 Must Watch FuturisticDocument6 pages10 Must Watch FuturisticSannena GovindaNo ratings yet

- Individual Assignment KKKJ 6063Document5 pagesIndividual Assignment KKKJ 6063Faisal MahmodNo ratings yet

- American Switching Systems: Development Project ChoiceDocument11 pagesAmerican Switching Systems: Development Project ChoiceHoney Singh OmnifariousNo ratings yet

- March 16 - IM Processors DigiTimesDocument5 pagesMarch 16 - IM Processors DigiTimesRyanNo ratings yet

- Ssales of Optos SensorsDocument2 pagesSsales of Optos SensorsShiv DesaiNo ratings yet

- Fiber Optic Cable World Summary: Market Values & Financials by CountryFrom EverandFiber Optic Cable World Summary: Market Values & Financials by CountryNo ratings yet

- Electronic Components-EDM PDFDocument526 pagesElectronic Components-EDM PDFEduardo J. KwiecienNo ratings yet

- ON Semi WriteupDocument15 pagesON Semi WriteupTim DiasNo ratings yet

- Dell Global DataDocument41 pagesDell Global DataMhamudul HasanNo ratings yet

- QCT OverviewDocument37 pagesQCT OverviewFarooq KhanNo ratings yet

- Fighting Fit: Implantable Electronics Set To Improve Quality of Life by Countering Chronic ConditionsDocument52 pagesFighting Fit: Implantable Electronics Set To Improve Quality of Life by Countering Chronic ConditionsMaxNo ratings yet

- 1988 Analog Devices Linear Products DatabookDocument772 pages1988 Analog Devices Linear Products Databookkgrhoads100% (2)

- Broadcom Corporation: 2012 Annual Report and 10-K (Jan 2013) 2011 Annual Report and 10-K (Jan 2012)Document3 pagesBroadcom Corporation: 2012 Annual Report and 10-K (Jan 2013) 2011 Annual Report and 10-K (Jan 2012)shikhar19No ratings yet

- Coaxial Cable Market - North America Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018Document8 pagesCoaxial Cable Market - North America Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018api-247970851No ratings yet

- News Archive: MAC Software, Protocol Analyzer, CE Certification, U.fl, SingleChipDocument8 pagesNews Archive: MAC Software, Protocol Analyzer, CE Certification, U.fl, SingleChipelracoNo ratings yet

- Mte April2011webDocument23 pagesMte April2011webb_b_yNo ratings yet

- Research Assignment Financial Analysis: Apple Computer Inc.: Financial and Managerial Accounting (AC 630 B)Document11 pagesResearch Assignment Financial Analysis: Apple Computer Inc.: Financial and Managerial Accounting (AC 630 B)ReenaNaipalNo ratings yet

- DELL Report EditedDocument26 pagesDELL Report EditedNimish DeshmukhNo ratings yet

- Written Analysis and Communication II: Case Analysis: Apple Inc. in 2010Document3 pagesWritten Analysis and Communication II: Case Analysis: Apple Inc. in 2010Angshuman DasNo ratings yet

- Time To Change The ClockDocument17 pagesTime To Change The ClockMoaz ElsayedNo ratings yet

- Electric Appliance, TV & Radio Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandElectric Appliance, TV & Radio Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sdad 11 12 Onlinepdf FinalDocument154 pagesSdad 11 12 Onlinepdf FinalMitsuo SakamotoNo ratings yet

- CostandProfitabilityDriversforFTTH ElDocument2 pagesCostandProfitabilityDriversforFTTH ElFarisAbbasNo ratings yet

- Automotive Power ElecronicsDocument44 pagesAutomotive Power Elecronicsjameschall1No ratings yet

- Cyber 02Document72 pagesCyber 02JohnNo ratings yet

- The Way Forward For Electronic DesignDocument32 pagesThe Way Forward For Electronic DesignEDA360No ratings yet

- CapstoneDocument7 pagesCapstonehasan_tvuNo ratings yet

- Transform Telecom: A Data-Driven Strategy For Digital TransformationDocument16 pagesTransform Telecom: A Data-Driven Strategy For Digital TransformationSharavi Ravi ChanderNo ratings yet

- Deloite Mobiletrends 2005Document3 pagesDeloite Mobiletrends 2005Sylvia GraceNo ratings yet

- CatchBEST Camera API Programming IntroductionDocument23 pagesCatchBEST Camera API Programming IntroductionK'rlo EscaNo ratings yet

- HackerHouse HandsOn Hacking GuideDocument10 pagesHackerHouse HandsOn Hacking GuideJohn100% (1)

- Grid Eye Specifications (Reference)Document27 pagesGrid Eye Specifications (Reference)lalalala123No ratings yet

- Yuzu LogDocument20 pagesYuzu LogAllan MoralesNo ratings yet

- Qualys Patch Management Getting Started Guide - ENDocument48 pagesQualys Patch Management Getting Started Guide - ENNarciso JuniorNo ratings yet

- Ug - Embedded - Ip Embedded Peripherals IP User Guide PDFDocument571 pagesUg - Embedded - Ip Embedded Peripherals IP User Guide PDFCristian BordaNo ratings yet

- Laptop Lenovo Foxcon-TPC02Document33 pagesLaptop Lenovo Foxcon-TPC02حسن علي نوفلNo ratings yet

- Yuzu LogDocument10 pagesYuzu LogMilric Soncio Liporada Jr.No ratings yet

- Exception HandlingDocument34 pagesException HandlingSheeba DhuruvarajNo ratings yet

- C++ Copy ConstructorDocument4 pagesC++ Copy ConstructorAnshu RajputNo ratings yet

- C ApiDocument211 pagesC ApiJDNo ratings yet

- General Isolation and Gate Drivers Overview UpdatedDocument77 pagesGeneral Isolation and Gate Drivers Overview UpdatedDebayan DuttaNo ratings yet

- Getting Started With Windows Batch ScriptingDocument42 pagesGetting Started With Windows Batch ScriptingCarlos Whitten100% (1)

- Daf NutDocument1 pageDaf Nut911sonNo ratings yet

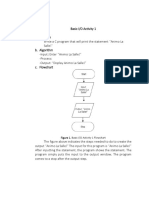

- Figure 1. Basic I/O Activity 1 FlowchartDocument22 pagesFigure 1. Basic I/O Activity 1 FlowchartThrowaway TwoNo ratings yet

- Power FactorDocument25 pagesPower FactorSri Sai ComputersNo ratings yet

- Extended ECM Family 22.3 Release NotesDocument56 pagesExtended ECM Family 22.3 Release Notesanil barkadeNo ratings yet

- Scalability Strategies: Managing Growing Oracle Databases: E-GuideDocument18 pagesScalability Strategies: Managing Growing Oracle Databases: E-GuideBiswajit DasNo ratings yet

- ch1 Revision Tour-1Document29 pagesch1 Revision Tour-1Kaviyan ParthibanNo ratings yet

- Opentext™ Extended Ecm Ce 23.1: Product Released: 2023-02-28Document59 pagesOpentext™ Extended Ecm Ce 23.1: Product Released: 2023-02-28rezente doutel sarmento moraisNo ratings yet

- Memory Tables Answer Key: Appendix CDocument18 pagesMemory Tables Answer Key: Appendix CRicardo SanchezNo ratings yet

- Verilog BasicsDocument42 pagesVerilog BasicsKarthik SharmaNo ratings yet

- TRIO Manual enDocument4 pagesTRIO Manual enmihailmiNo ratings yet

- Mad Lab Ec354r19 Manual 2021-2022Document85 pagesMad Lab Ec354r19 Manual 2021-2022avk.3471No ratings yet

- Arduino RFID Lock TutorialDocument8 pagesArduino RFID Lock TutorialBorodiAdrianNo ratings yet

- 85010-0071 - EST3 Liquid Crystal Display ModuleDocument4 pages85010-0071 - EST3 Liquid Crystal Display ModuleVinod RjNo ratings yet

- INF5430 Introduction To Verification With SVDocument17 pagesINF5430 Introduction To Verification With SVnvenkatesh485No ratings yet

- William Stallings Computer Organization and ArchitectureDocument28 pagesWilliam Stallings Computer Organization and ArchitectureAhmed Hassan MohammedNo ratings yet

April 2012

April 2012

Uploaded by

dietchokeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April 2012

April 2012

Uploaded by

dietchokeCopyright:

Available Formats

VOLUME 10, ISSUE 4

April 25, 2012

First Quarter Data Converter Market Update

Errors using inadequate data are much less then those using data at all. Charles Babbage (1791-1871), Mathematician, Engineer, Philosopher and Inventor

RECENT TRACKERS

Q1-2012 Semiconductor Market Tracker Q1-2012 Networking Market Tracker Q1-2012 Power Management Market Tracker Q1-2012 Data Converter Market Tracker Q1-2012 Logic Market Tracker Q1-2012 Amplifiers Market Tracker

As members of the mixed signal IC market, data converters have been affected by those very same supply and demand pressures that have influenced the general semiconductor industry over the first several months of the year. In particular, weak consumer demand from the U.S. and Europe has lingered in the first quarter. PC sales have continued to perform very poorly, while the LCD HDTV market is in turmoil due to lack of consumer interest, over-saturation, and poor margins coinciding with the rise of ultra-low cost LCD production in China. At the flip side, sales of smartphones and tablets have only accelerated during this period, and there has also been a sustained rebound in the automotive and industrial manufacturing markets which first began in the latter part of 2011 and has continued on into 2012. It is expected that these markets will help offset the weakness seen in the consumer and PC spaces as the high inventory levels are now being worked off and demand is steadily returning. Table 1: 2011 and 2010 Worldwide Data Converter Revenue Share by Supplier Company Analog Devices Texas Instruments Maxim Integrated Products Linear Technology Intersil Others Total databeans Estimates As the guiding force in the data converters market, Analog Devices currently has a global market share that is approaching 50 percent, or double that of its next closest competitor in this market. The firm also claims the industrys most extensive portfolio of ADCs and DACs, and, as a result, is responsible for many of the industry's latest advances in data converter design. For example, in December 2011, the firm introduced the AD5780 and AD5790 high-precision DACs, which combine 20-bit and 18-bit performance, ultra-low noise, and integrated precision reference conditioning 2011 Rank 1 2 3 4 5 2011 $M 1,312 625 185 125 69 392 2,707 2011 Share 48.5% 23.1% 6.8% 4.6% 2.5% 14.5% 2010 Rank 1 2 3 4 7 2010 $M 1,422 659 197 142 71 500 2,991 2010 Share 47.5% 22.0% 6.6% 4.7% 2.4% 16.7% Y/Y % -8% -5% -6% -12% -3% -22% -9%

RECENT REPORTS

2011 Sensors and MEMs 2012 Microcontrollers 2012 Automotive Apps 2012 Process Control 2011 Performance Analog 2011 Wireless

Reno, Nevada 775.624.6200 www.databeans.net sales@databeans.net

Page 1

VOLUME 10, ISSUE 4 VOLUME 9 ISSUE 8

The Databeans Monthly

April 25, 2012

RECENT TRACKERS

Q1-2012 Semiconductor Market Tracker Q1-2012 Networking Market Tracker Q1-2012 Power Management Market Tracker Q1-2012 Data Converter Market Tracker Q1-2012 Logic Market Tracker Q1-2012 Amplifiers Market Tracker

circuitry into a single device that reportedly enables complex new applications in a wide range of industries. The DACs also can provide a 60 percent reduction in board space compared to competing standalone data converters, according to the firm. Shortly after, in February 2012, Analog Devices introduced the AD9737A, a brand-new 11-bit DAC that enables cable television and broadband operators to synthesize the entire cable spectrum up to 1 GHz into a single RF port, while also only consuming a maximum of 1.1 W of power, according to the firm. The AD9737A also improves QAM (quadrature amplitude modulation) channel density by 20 times over present cable modem implementations, which, according to ADI, allows for the design of next-generation services such as interactive television, high-definition broadcasts and new specialty channels. As a consequence of ADIs heavy reliance on the data converter market, its company-wide fiscal performance has also been closely tied to those in the general data converter industry. Specifically, ADIs revenue declined during its first quarter of 2012 ending in February as consumer demand for products using data converters diminished. For its first quarter, ADI reported revenue of just over $648 million, which was down almost 10 percent from the previous quarter, and 11 percent lower than its first quarter period one year ago. The good news is that ADI believe that the first quarter marked the bottom of the industry cycle, and the firm expects that all of its business segments will see improvements beginning in the second quarter of 2012 and will continue throughout the remainder of the year. Texas Instruments is the second largest supplier by revenue share with roughly 23 percent of the market, and while trailing ADI in market share, has also been responsible for many of the major advances in the data converter market over the past several months. For one the company has been at the forefront of releasing highly integrated data converter devices that incorporate ADCs, DACs, amplifiers and some digital functionality all on a single chip. This allows for the design of unique systems with lower power consumption. For example, in the January 2012, TI introduced its low-power, 12-bit AFE7225 AFE. The AFE7225, which was designed for femtocell base stations and portable software-defined radio (SDR) applications, integrates a dual 125-MSPS ADC and a dual 250-MSPS DAC. According to TI, the integrated chip operates 25 percent faster than the competition, while increasing the signal-to-noise ratio (SNR) by 2 dB and providing up to five times the DAC output current.

RECENT REPORTS

2011 Sensors and MEMs 2012 Microcontrollers 2012 Automotive Apps 2012 Process Control 2011 Performance Analog 2011 Wireless

Reno, Nevada 775.624.6200 www.databeans.net sales@databeans.net

Page 2

VOLUME 10, ISSUE 4 VOLUME 9 ISSUE 8

The Databeans Monthly

April 25, 2012

The company also introduced what it claims to be the industry's fastest 16-Bit DAC in February 2012. According to TI, the new quad DAC34SH84 is a full 50percent faster and uses 50-percent less power than the closest 16-Bit DAC alternative, clocking in at 1.5 GSPS and consuming only 362 mW per channel. TI has managed to remain a major innovator in this market thanks in part to its industry leading manufacturing processes. Specifically, many of TIs new data converter and signal conditioner products make use of its most recent high-performance BiCMOS SiGe process technology. The remainder of the data converter industry is populated by numerous smaller suppliers, led by Californias Maxim Integrated Products with a share of nearly 7 percent in 2011, followed by Linear Technology with 4.6 percent and Intersil with 2.5 percent. Even though many of these smaller firms have much smaller converter portfolios than leaders Analog Devices and Texas Instruments, they are often responsible for highly innovative new products in this space. For example, in November 2011, Linear Technology introduced its LTC2369-18, which it claims is the industry's highest performing serial 18-bit pseudo-differential SAR ADC. The LTC2369 -18 manages to achieve an impressive 96.5dB signal-to-noise ratio (SNR) and -120dB total harmonic distortion (THD), consuming only 18mW. Despite the high levels of innovation that have been taking place in data converter design in recent times, the market as a whole actually declined for the entire year in 2011. However, this was generally viewed as a temporary setback and most suppliers are united in their belief that 2012 will mark a rebound for data converter sales. This will be boosted by the increasing sophistication of consumer, wireless, and PC products which are placing new demands on and for signal conversion technology. In fact, the chips that manage this signal conversion are the very same that in most instances define the high performance capabilities of the cutting edge technology products that consumers have come to love. This information above is provided from Databeans Inc., in the Q1-2012 Data Converter Market Tracker which was published on April 10, 2012. For Inquiries related to the data included in this article or any other Databeans products, please contact Brice Esplin (brice@databeans.net)

RECENT TRACKERS

Q1-2012 Semiconductor Market Tracker Q1-2012 Networking Market Tracker Q1-2012 Power Management Market Tracker Q1-2012 Data Converter Market Tracker Q1-2012 Logic Market Tracker Q1-2012 Amplifiers Market Tracker

RECENT REPORTS

2011 Sensors and MEMs 2012 Microcontrollers 2012 Automotive Apps 2012 Process Control 2011 Performance Analog 2011 Wireless

Reno, Nevada 775.624.6200 www.databeans.net sales@databeans.net

Page 3

You might also like

- 100.105.01 (CBRN-TPS70 (V) 5-AN-1) Antenna OM-ocrDocument330 pages100.105.01 (CBRN-TPS70 (V) 5-AN-1) Antenna OM-ocrJuan Miguel Yate Alcala100% (1)

- GlobalFoundries 2014 US Tech Seminar - Proceeding Book PDFDocument316 pagesGlobalFoundries 2014 US Tech Seminar - Proceeding Book PDFWeikai SunNo ratings yet

- Matching Dell Case SolutionDocument3 pagesMatching Dell Case SolutionAnuj Kumar HatoneyaNo ratings yet

- Dell Case Study FinalDocument27 pagesDell Case Study FinalPrabudh Jain67% (3)

- Python PDFDocument217 pagesPython PDFR Rama Naidu71% (14)

- Ede 1112Document60 pagesEde 1112javierodNo ratings yet

- Optical Components and Their Role in Optical NetworksDocument4 pagesOptical Components and Their Role in Optical NetworksManveen KaurNo ratings yet

- Signal Hill: Communications Technology: Q4 2011 M&A ReviewDocument12 pagesSignal Hill: Communications Technology: Q4 2011 M&A ReviewAnonymous Feglbx5No ratings yet

- ReviewDocument3 pagesReviewPrasanna VenkateshNo ratings yet

- Analog DevicesDocument10 pagesAnalog Devicesxavier25No ratings yet

- EETimes July-August 2012Document56 pagesEETimes July-August 2012Brzata PticaNo ratings yet

- Led Suppliers Directory: Leds Magazine ReviewDocument52 pagesLed Suppliers Directory: Leds Magazine ReviewChris RogersNo ratings yet

- Wireless Telecommunications Carriers in The US Industry ReportDocument44 pagesWireless Telecommunications Carriers in The US Industry ReportSwapneel ChhayaNo ratings yet

- Market Analysis Worldwide Service Provider Router 2011-2015 ForecastDocument21 pagesMarket Analysis Worldwide Service Provider Router 2011-2015 ForecastBudhaditya BanerjeeNo ratings yet

- Analog Devices Inc-1Document18 pagesAnalog Devices Inc-1Divyesh ChadotraNo ratings yet

- Mwee 201111Document32 pagesMwee 201111Petros TsenesNo ratings yet

- NB-IOT Huawei PDFDocument23 pagesNB-IOT Huawei PDFadvaleri070100% (2)

- Maxsys Elite Versus AbcDocument3 pagesMaxsys Elite Versus AbcamshincaNo ratings yet

- 2012 WP Ieee 802 11ac Understanding Enterprise Wlan Challenges PDFDocument0 pages2012 WP Ieee 802 11ac Understanding Enterprise Wlan Challenges PDFVenu MadhavNo ratings yet

- MSCC Corporate PresentationDocument21 pagesMSCC Corporate PresentationAmir GorenNo ratings yet

- Issue 91267Document100 pagesIssue 91267Steve NguyenNo ratings yet

- PCBDesign Dec2012Document77 pagesPCBDesign Dec2012Anonymous pHi4dXNo ratings yet

- Research & AnalysisDocument9 pagesResearch & AnalysisSANo ratings yet

- Communication & Energy Wire World Summary: Market Values & Financials by CountryFrom EverandCommunication & Energy Wire World Summary: Market Values & Financials by CountryNo ratings yet

- Dell Computer Corporation: James HsuDocument37 pagesDell Computer Corporation: James HsuHoang HaNo ratings yet

- Honeywell Automation 2009 ReportDocument4 pagesHoneywell Automation 2009 ReportmworahNo ratings yet

- ATMLDocument32 pagesATMLsskiller001No ratings yet

- 802 11 WiFi Wireless Standards and Facts PDFDocument6 pages802 11 WiFi Wireless Standards and Facts PDFFanny Tarida TampubolonNo ratings yet

- Mis Dell 1227965308312360 9Document14 pagesMis Dell 1227965308312360 9Nayana MakwanaNo ratings yet

- Value of BT LEDocument8 pagesValue of BT LEShu HuiNo ratings yet

- Company Turns LED Ceiling Lights Into Wireless Internet SourceDocument13 pagesCompany Turns LED Ceiling Lights Into Wireless Internet SourcePrashant KhullerNo ratings yet

- Case DELL Overtake HP Final - EdDocument20 pagesCase DELL Overtake HP Final - Edas1klh0No ratings yet

- View From The Top Global Technology Trends and Performance October 2012 February 2013Document24 pagesView From The Top Global Technology Trends and Performance October 2012 February 2013Euglena VerdeNo ratings yet

- 10 Must Watch FuturisticDocument6 pages10 Must Watch FuturisticSannena GovindaNo ratings yet

- Individual Assignment KKKJ 6063Document5 pagesIndividual Assignment KKKJ 6063Faisal MahmodNo ratings yet

- American Switching Systems: Development Project ChoiceDocument11 pagesAmerican Switching Systems: Development Project ChoiceHoney Singh OmnifariousNo ratings yet

- March 16 - IM Processors DigiTimesDocument5 pagesMarch 16 - IM Processors DigiTimesRyanNo ratings yet

- Ssales of Optos SensorsDocument2 pagesSsales of Optos SensorsShiv DesaiNo ratings yet

- Fiber Optic Cable World Summary: Market Values & Financials by CountryFrom EverandFiber Optic Cable World Summary: Market Values & Financials by CountryNo ratings yet

- Electronic Components-EDM PDFDocument526 pagesElectronic Components-EDM PDFEduardo J. KwiecienNo ratings yet

- ON Semi WriteupDocument15 pagesON Semi WriteupTim DiasNo ratings yet

- Dell Global DataDocument41 pagesDell Global DataMhamudul HasanNo ratings yet

- QCT OverviewDocument37 pagesQCT OverviewFarooq KhanNo ratings yet

- Fighting Fit: Implantable Electronics Set To Improve Quality of Life by Countering Chronic ConditionsDocument52 pagesFighting Fit: Implantable Electronics Set To Improve Quality of Life by Countering Chronic ConditionsMaxNo ratings yet

- 1988 Analog Devices Linear Products DatabookDocument772 pages1988 Analog Devices Linear Products Databookkgrhoads100% (2)

- Broadcom Corporation: 2012 Annual Report and 10-K (Jan 2013) 2011 Annual Report and 10-K (Jan 2012)Document3 pagesBroadcom Corporation: 2012 Annual Report and 10-K (Jan 2013) 2011 Annual Report and 10-K (Jan 2012)shikhar19No ratings yet

- Coaxial Cable Market - North America Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018Document8 pagesCoaxial Cable Market - North America Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018api-247970851No ratings yet

- News Archive: MAC Software, Protocol Analyzer, CE Certification, U.fl, SingleChipDocument8 pagesNews Archive: MAC Software, Protocol Analyzer, CE Certification, U.fl, SingleChipelracoNo ratings yet

- Mte April2011webDocument23 pagesMte April2011webb_b_yNo ratings yet

- Research Assignment Financial Analysis: Apple Computer Inc.: Financial and Managerial Accounting (AC 630 B)Document11 pagesResearch Assignment Financial Analysis: Apple Computer Inc.: Financial and Managerial Accounting (AC 630 B)ReenaNaipalNo ratings yet

- DELL Report EditedDocument26 pagesDELL Report EditedNimish DeshmukhNo ratings yet

- Written Analysis and Communication II: Case Analysis: Apple Inc. in 2010Document3 pagesWritten Analysis and Communication II: Case Analysis: Apple Inc. in 2010Angshuman DasNo ratings yet

- Time To Change The ClockDocument17 pagesTime To Change The ClockMoaz ElsayedNo ratings yet

- Electric Appliance, TV & Radio Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandElectric Appliance, TV & Radio Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sdad 11 12 Onlinepdf FinalDocument154 pagesSdad 11 12 Onlinepdf FinalMitsuo SakamotoNo ratings yet

- CostandProfitabilityDriversforFTTH ElDocument2 pagesCostandProfitabilityDriversforFTTH ElFarisAbbasNo ratings yet

- Automotive Power ElecronicsDocument44 pagesAutomotive Power Elecronicsjameschall1No ratings yet

- Cyber 02Document72 pagesCyber 02JohnNo ratings yet

- The Way Forward For Electronic DesignDocument32 pagesThe Way Forward For Electronic DesignEDA360No ratings yet

- CapstoneDocument7 pagesCapstonehasan_tvuNo ratings yet

- Transform Telecom: A Data-Driven Strategy For Digital TransformationDocument16 pagesTransform Telecom: A Data-Driven Strategy For Digital TransformationSharavi Ravi ChanderNo ratings yet

- Deloite Mobiletrends 2005Document3 pagesDeloite Mobiletrends 2005Sylvia GraceNo ratings yet

- CatchBEST Camera API Programming IntroductionDocument23 pagesCatchBEST Camera API Programming IntroductionK'rlo EscaNo ratings yet

- HackerHouse HandsOn Hacking GuideDocument10 pagesHackerHouse HandsOn Hacking GuideJohn100% (1)

- Grid Eye Specifications (Reference)Document27 pagesGrid Eye Specifications (Reference)lalalala123No ratings yet

- Yuzu LogDocument20 pagesYuzu LogAllan MoralesNo ratings yet

- Qualys Patch Management Getting Started Guide - ENDocument48 pagesQualys Patch Management Getting Started Guide - ENNarciso JuniorNo ratings yet

- Ug - Embedded - Ip Embedded Peripherals IP User Guide PDFDocument571 pagesUg - Embedded - Ip Embedded Peripherals IP User Guide PDFCristian BordaNo ratings yet

- Laptop Lenovo Foxcon-TPC02Document33 pagesLaptop Lenovo Foxcon-TPC02حسن علي نوفلNo ratings yet

- Yuzu LogDocument10 pagesYuzu LogMilric Soncio Liporada Jr.No ratings yet

- Exception HandlingDocument34 pagesException HandlingSheeba DhuruvarajNo ratings yet

- C++ Copy ConstructorDocument4 pagesC++ Copy ConstructorAnshu RajputNo ratings yet

- C ApiDocument211 pagesC ApiJDNo ratings yet

- General Isolation and Gate Drivers Overview UpdatedDocument77 pagesGeneral Isolation and Gate Drivers Overview UpdatedDebayan DuttaNo ratings yet

- Getting Started With Windows Batch ScriptingDocument42 pagesGetting Started With Windows Batch ScriptingCarlos Whitten100% (1)

- Daf NutDocument1 pageDaf Nut911sonNo ratings yet

- Figure 1. Basic I/O Activity 1 FlowchartDocument22 pagesFigure 1. Basic I/O Activity 1 FlowchartThrowaway TwoNo ratings yet

- Power FactorDocument25 pagesPower FactorSri Sai ComputersNo ratings yet

- Extended ECM Family 22.3 Release NotesDocument56 pagesExtended ECM Family 22.3 Release Notesanil barkadeNo ratings yet

- Scalability Strategies: Managing Growing Oracle Databases: E-GuideDocument18 pagesScalability Strategies: Managing Growing Oracle Databases: E-GuideBiswajit DasNo ratings yet

- ch1 Revision Tour-1Document29 pagesch1 Revision Tour-1Kaviyan ParthibanNo ratings yet

- Opentext™ Extended Ecm Ce 23.1: Product Released: 2023-02-28Document59 pagesOpentext™ Extended Ecm Ce 23.1: Product Released: 2023-02-28rezente doutel sarmento moraisNo ratings yet

- Memory Tables Answer Key: Appendix CDocument18 pagesMemory Tables Answer Key: Appendix CRicardo SanchezNo ratings yet

- Verilog BasicsDocument42 pagesVerilog BasicsKarthik SharmaNo ratings yet

- TRIO Manual enDocument4 pagesTRIO Manual enmihailmiNo ratings yet

- Mad Lab Ec354r19 Manual 2021-2022Document85 pagesMad Lab Ec354r19 Manual 2021-2022avk.3471No ratings yet

- Arduino RFID Lock TutorialDocument8 pagesArduino RFID Lock TutorialBorodiAdrianNo ratings yet

- 85010-0071 - EST3 Liquid Crystal Display ModuleDocument4 pages85010-0071 - EST3 Liquid Crystal Display ModuleVinod RjNo ratings yet

- INF5430 Introduction To Verification With SVDocument17 pagesINF5430 Introduction To Verification With SVnvenkatesh485No ratings yet

- William Stallings Computer Organization and ArchitectureDocument28 pagesWilliam Stallings Computer Organization and ArchitectureAhmed Hassan MohammedNo ratings yet