Professional Documents

Culture Documents

IDG Enterprise Mobility Research 2011 Excerpt

IDG Enterprise Mobility Research 2011 Excerpt

Uploaded by

IDG_WorldCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDG Enterprise Mobility Research 2011 Excerpt

IDG Enterprise Mobility Research 2011 Excerpt

Uploaded by

IDG_WorldCopyright:

Available Formats

2011 Enterprise Mobility Solutions

Research conducted across the IDG Enterprise brands: CIO, CSO, Computerworld, InfoWorld, ITworld & Network World

MOBILITY

MOBILITY

Purpose & Methodology

Purpose

The survey was designed to explore how organizations are investing in mobile technology now and in the future as well as the important challenges or barriers to implementing mobile solutions, and factors used to evaluate mobile technologies. It also looked at how IT is addressing management and support of mobile devices and platforms, and how the proliferation of mobile technologies is effecting organizations on a company-wide scale, and within the IT organization,. The survey was conducted across IDG Enterprise brand (CIO, Computerworld, CSO, InfoWorld, ITworld and Network World) via pop-ups on sites, through newsletters and email invitations, and the Computerworld Inner Circle and the Network World Technology Opinion Panels. All survey respondents are involved in the purchase of mobile products and services at their organization. Survey fielded from August 27 October 5, 2010 Total Respondents: 1,238 Margin of error: +/- 2.8 percentage points

Methodology

METHODOLOGY RESULTS CONCLUSION DEMOGRAPHICS

Source: 2011 IDG Enterprise Mobility Research, October 2010

MOBILITY

Productivity and Customer Support are Top Drivers

Gaining productivity advantages Improving customer support or services Need for real-time information Gaining a competitive/information edge Improving accuracy of data collected in the field Lowering operating costs Expanding revenue opportunities Improving supply chain management 42% 71% 70% 67% 87% 86% 84% 79%

METHODOLOGY

Q. How important are the following as business drivers of investments in mobile technology?

Source: 2011 CIO Mobility Survey, October 2010 Note: Responses based on moderate or high investment priority.

RESULTS CONCLUSION DEMOGRAPHICS

MOBILITY

Company Size Impacts Mobile Security Challenges

Data Leak Prevention Preventing Data Loss Due to Lost Mobile Devices Data Encryption Patch and Vulnerability Management Setting and Maintaining Security Policies Maintaining an Active Inventory of Active Mobile Devices Virus and Spam Detection/Prevention Intrusion Detection/Prevention Ensuring Technology Compliance Backup and Recovery Managing Access to Data None of the Above Not Sure 25% 35% 45% 45% 42% 41% 38% 35% 33% 37% 30% 26% 58% 54% 48% 50% 56% 56% 52% 64%

58% 54% <1000 Employees

2% 0% 2% 2%

1000+ Employees

METHODOLOGY

Q. What are your organizations top challenges with regards to ensuring and maintaining the security of

mobile technology?

Source: 2011 CSO Mobility Survey, October 2010

RESULTS CONCLUSION DEMOGRAPHICS

MOBILITY

Mobile Purchase Process an Average of 19.7 Weeks

Mobile Devices Mobile Applications Wireless Networks Security or Data Management Middleware

6.4 7

5 5.4

5.9 6.6

17.3 weeks 19 weeks 19.3 weeks

7

7.8 8.4

5.3

5.8 6.2

Make a Short List

7

6.9 7.6

Make a Purchase

20.5 weeks 22.2 weeks

Research Products / Opportunities

METHODOLOGY

Q. When a need for the following mobile technology types is determined, how long (in weeks) does it typically take

your organization toresearch products/opportunities, make a short list, make a purchase?

Source: 2011 InfoWorld Mobility Survey, October 2010

RESULTS CONCLUSION DEMOGRAPHICS

MOBILITY

Conclusion

Productivity, Customer Support and Need for Real-Time Information are top drivers of investments in mobile technology Security and reliability of mobile solutions are critical to organizations IT department is burdened with the spread of mobile technology

Support of personally owned devices in multiple platforms Primarily responsible for mobile purchases.

METHODOLOGY RESULTS CONCLUSION DEMOGRAPHICS

MOBILITY

Contact

To view the full study please contact Bob Melk at bmelk@idgenterprise.com

METHODOLOGY RESULTS CONCLUSION DEMOGRAPHICS

You might also like

- Samsung STP - Assignment 1Document10 pagesSamsung STP - Assignment 1strictlythomas60% (5)

- Tesla Symp06 CarlsonDocument12 pagesTesla Symp06 Carlsondragon314159No ratings yet

- IDG 2018 Cloud Computing ResearchDocument8 pagesIDG 2018 Cloud Computing ResearchIDG_World100% (4)

- 2017 IDG Customer Engagement ExcerptDocument8 pages2017 IDG Customer Engagement ExcerptIDG_WorldNo ratings yet

- Sumitomo Cyclo 6000Document249 pagesSumitomo Cyclo 6000Pedro Miguel Solórzano67% (9)

- Din en 693Document45 pagesDin en 693Evaldo Gualberto RosaNo ratings yet

- IDG Enterprise Consumerization of IT 2012 ExcerptDocument9 pagesIDG Enterprise Consumerization of IT 2012 ExcerptIDG_WorldNo ratings yet

- IoT Use Case EbookDocument11 pagesIoT Use Case EbookScott Poole100% (3)

- Group 4Document18 pagesGroup 4TRISHAL ARORANo ratings yet

- InfoWorld Navigating IT Research 2011Document9 pagesInfoWorld Navigating IT Research 2011IDG_WorldNo ratings yet

- Manage The Invasion of Consumer TechnologyDocument30 pagesManage The Invasion of Consumer TechnologyDany AravindrajNo ratings yet

- Informed Cio Striking A Security Usability Balance 205251Document14 pagesInformed Cio Striking A Security Usability Balance 205251Anish Jonathan RaoNo ratings yet

- Labtech LT WP Mobile DevicesDocument4 pagesLabtech LT WP Mobile DevicesDuane AubinNo ratings yet

- Mobile CommerceDocument10 pagesMobile CommerceAbel JacobNo ratings yet

- IoT Signals Edition 3 Thought Paper enDocument57 pagesIoT Signals Edition 3 Thought Paper enYounggi서No ratings yet

- Group1 Cis ReportDocument12 pagesGroup1 Cis ReportLealyn Martin BaculoNo ratings yet

- IoT Signals - Edition 2 - EnglishDocument53 pagesIoT Signals - Edition 2 - Englishjohnlondon125No ratings yet

- IDC Innovators - Geospatial Traceability and Analytics in Supply Chain, 2018Document4 pagesIDC Innovators - Geospatial Traceability and Analytics in Supply Chain, 2018Jayshree ChauhanNo ratings yet

- IoT Applications in ManufacturingDocument5 pagesIoT Applications in ManufacturingRasika JayawardanaNo ratings yet

- Roberto Junco, CISCO en Summit País Digital 2015Document26 pagesRoberto Junco, CISCO en Summit País Digital 2015Fundación País DigitalNo ratings yet

- The Development of Technology Acceptance Model For Adoption of Mobile Banking in PakistanDocument14 pagesThe Development of Technology Acceptance Model For Adoption of Mobile Banking in PakistanDa ArchNo ratings yet

- Whitepaper Internet of Things 2017 DH v1Document17 pagesWhitepaper Internet of Things 2017 DH v1mohammed abrarNo ratings yet

- Minder Chen: A Methodology For Building Mobile Computing ApplicationsDocument25 pagesMinder Chen: A Methodology For Building Mobile Computing Applicationsjhosep_darioNo ratings yet

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocument11 pagesName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentJiwooKimNo ratings yet

- CMMA2015 SummitBrochureDocument20 pagesCMMA2015 SummitBrochureFrank HayesNo ratings yet

- EMEUS Draft Agenda31.01.12Document6 pagesEMEUS Draft Agenda31.01.12cinfungNo ratings yet

- 3.1 Article Online Information ShaingDocument13 pages3.1 Article Online Information ShaingIshaNo ratings yet

- Title: To Develop Marketing Strategy For The Infrastructure Storage and Security System in Effective MannerDocument16 pagesTitle: To Develop Marketing Strategy For The Infrastructure Storage and Security System in Effective MannerTamil VelanNo ratings yet

- Deloitte IoTDocument54 pagesDeloitte IoTmarkanapier100% (2)

- Tata Steel IdeationDocument12 pagesTata Steel IdeationReecha Sinha100% (1)

- Written Assignment Unit 7: University of The PeopleDocument6 pagesWritten Assignment Unit 7: University of The PeopleEphrem GetiyeNo ratings yet

- Role of It in Knowledge ManagementDocument11 pagesRole of It in Knowledge ManagementShaik Mohamed ThafreezNo ratings yet

- Cybersecurity in The Age of MobilityDocument20 pagesCybersecurity in The Age of MobilityMirena ChardakovaNo ratings yet

- An Exploration and ConfirmatioDocument32 pagesAn Exploration and ConfirmatioBowie WongNo ratings yet

- 2008 06 00 Larry Clinton Presentation For BankingDocument17 pages2008 06 00 Larry Clinton Presentation For BankingisallianceNo ratings yet

- Building Value From Visibility: 2012 Enterprise Internet of Things Adoption Outlook October 2012Document18 pagesBuilding Value From Visibility: 2012 Enterprise Internet of Things Adoption Outlook October 2012Walid GradaNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Notes IctDocument8 pagesNotes IctYesha LopenaNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- Mobile Survey ToolkitDocument24 pagesMobile Survey ToolkitOxfamNo ratings yet

- IoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsFrom EverandIoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsNo ratings yet

- 2018 U.S. State of Cybercrime SurveyDocument9 pages2018 U.S. State of Cybercrime SurveyIDG_WorldNo ratings yet

- CIOs Are Driving Digital Transformation InfographicDocument1 pageCIOs Are Driving Digital Transformation InfographicIDG_World100% (1)

- 2018 CIO Tech Poll: Economic OutlookDocument8 pages2018 CIO Tech Poll: Economic OutlookIDG_World100% (1)

- A Guide To Understanding How Organizations Are Evolving To A Digital-First Business ModelDocument1 pageA Guide To Understanding How Organizations Are Evolving To A Digital-First Business ModelIDG_WorldNo ratings yet

- 2018 IDG Cloud Computing InfographicDocument1 page2018 IDG Cloud Computing InfographicIDG_WorldNo ratings yet

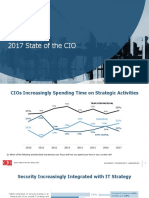

- State of The CIO 2017Document9 pagesState of The CIO 2017IDG_World100% (1)

- 2018 IDG Digital Business SurveyDocument9 pages2018 IDG Digital Business SurveyIDG_World100% (3)

- 2018 IDG Security Priorities SurveyDocument9 pages2018 IDG Security Priorities SurveyIDG_WorldNo ratings yet

- State of The CIO 2018Document9 pagesState of The CIO 2018IDG_WorldNo ratings yet

- CW Forecast 2017 SampleDocument8 pagesCW Forecast 2017 SampleIDG_World100% (1)

- CIO Tech Poll: Tech Priorities 2018Document7 pagesCIO Tech Poll: Tech Priorities 2018IDG_WorldNo ratings yet

- 2017 Global State of Information Security SurveyDocument7 pages2017 Global State of Information Security SurveyIDG_World100% (1)

- 2017 U.S. State of Cybercrime SurveyDocument8 pages2017 U.S. State of Cybercrime SurveyIDG_WorldNo ratings yet

- 2018 Global State of Information Security SurveyDocument9 pages2018 Global State of Information Security SurveyIDG_WorldNo ratings yet

- CSO 2016 SIEM Vendor Scorecard ResearchDocument7 pagesCSO 2016 SIEM Vendor Scorecard ResearchIDG_WorldNo ratings yet

- State of The Network 2017Document8 pagesState of The Network 2017IDG_WorldNo ratings yet

- Tech Priorities 2017 SampleDocument7 pagesTech Priorities 2017 SampleIDG_WorldNo ratings yet

- IDG 2017 Security Priorities StudyDocument8 pagesIDG 2017 Security Priorities StudyIDG_WorldNo ratings yet

- Demand GenerationDocument9 pagesDemand GenerationIDG_World100% (1)

- IDG 2016 Cloud Computing SurveyDocument9 pagesIDG 2016 Cloud Computing SurveyIDG_World100% (7)

- 2016 Data & Analytics InfographicDocument1 page2016 Data & Analytics InfographicIDG_World100% (3)

- Enterprise Architects: Bridging IT & BusinessDocument1 pageEnterprise Architects: Bridging IT & BusinessIDG_World100% (2)

- Next Gen Enterprise DevelopersDocument1 pageNext Gen Enterprise DevelopersIDG_World100% (1)

- 2016 IDG Data & Analytics SurveyDocument11 pages2016 IDG Data & Analytics SurveyIDG_World100% (4)

- Today's Cloud Focus & MotivatorsDocument1 pageToday's Cloud Focus & MotivatorsIDG_World100% (2)

- CIO Economic Outlook 2016Document5 pagesCIO Economic Outlook 2016IDG_WorldNo ratings yet

- State of The CIO 2016 SampleDocument8 pagesState of The CIO 2016 SampleIDG_WorldNo ratings yet

- 2016 Customer Engagement ResearchDocument14 pages2016 Customer Engagement ResearchIDG_World100% (1)

- Concrete Slab Formwork - Safety GuideDocument53 pagesConcrete Slab Formwork - Safety GuideThành KC100% (4)

- Analysis of Delay Damages For Site Overhead: Dr. William Ibbs and Long D. NguyenDocument4 pagesAnalysis of Delay Damages For Site Overhead: Dr. William Ibbs and Long D. NguyenarqsarqsNo ratings yet

- Berline Machine Catalog PuneDocument12 pagesBerline Machine Catalog PuneDINESHNo ratings yet

- ST 14Document40 pagesST 14harshNo ratings yet

- Test Suite Generation With Memetic Algorithms: Gordon Fraser Andrea Arcuri Phil McminnDocument8 pagesTest Suite Generation With Memetic Algorithms: Gordon Fraser Andrea Arcuri Phil McminnJatin GeraNo ratings yet

- 4M Change Monitoring Sheet: If There Is Any Change During The Shift Mark It With RedDocument1 page4M Change Monitoring Sheet: If There Is Any Change During The Shift Mark It With RedDINESHCHOUDHARY88No ratings yet

- Session 4 - 1 - Hussain Ali - Drag Reduction On A Production VehicleDocument20 pagesSession 4 - 1 - Hussain Ali - Drag Reduction On A Production VehicleALP1981100% (1)

- Rent To Own FlyerDocument1 pageRent To Own FlyerLevi L. BinamiraNo ratings yet

- Blended Wing Body - Seminar Report, PPT, PDF For MechanicalDocument2 pagesBlended Wing Body - Seminar Report, PPT, PDF For MechanicalkuldeepNo ratings yet

- BCM FrameworkDocument14 pagesBCM FrameworkPappu0% (1)

- Employee Central SpecificationsDocument9 pagesEmployee Central SpecificationsRajNo ratings yet

- YL60 Sounder EK00 III enDocument6 pagesYL60 Sounder EK00 III enAnonymous waSxJGoNo ratings yet

- B&G 3DX LiteratureDocument2 pagesB&G 3DX LiteratureAnonymous 7xHNgoKE6eNo ratings yet

- 2005 - The New Fundamental Tree AlgorithmDocument14 pages2005 - The New Fundamental Tree AlgorithmBurcu KaraözNo ratings yet

- Final Report of 360 Degree Rotating CarDocument42 pagesFinal Report of 360 Degree Rotating CarP24 Innovation CenterNo ratings yet

- GE Case Competition - Final PresentationDocument5 pagesGE Case Competition - Final PresentationSonali SaxenaNo ratings yet

- Yilmaz - Abdurrahim-In The Apparel Industry and A Model ProposalDocument7 pagesYilmaz - Abdurrahim-In The Apparel Industry and A Model ProposalMianAbrarAnjumNo ratings yet

- Technical Writer / Technical IllustratorDocument3 pagesTechnical Writer / Technical Illustratorapi-77528138No ratings yet

- Testex Gauge1Document6 pagesTestex Gauge1MuthuKumarNo ratings yet

- Drivers Training PPT BMP Download DriversDocument26 pagesDrivers Training PPT BMP Download DriversPramod Bodne100% (1)

- Infineum S1876Document1 pageInfineum S1876Carlos Enrique Mora Cortez100% (1)

- Upgrade Standard Adjustments - SPDD - SPAU - SummaryDocument27 pagesUpgrade Standard Adjustments - SPDD - SPAU - SummaryVicky AnselmiNo ratings yet

- Manuale d'uso User's manual Manuel de l'utilisateur Bedienerhandbuch Manual de uso Аналоговые приборыDocument11 pagesManuale d'uso User's manual Manuel de l'utilisateur Bedienerhandbuch Manual de uso Аналоговые приборыIzzu IsuramuNo ratings yet

- University of The Punjab, Lahore: Institute of Business & Information TechnologyDocument4 pagesUniversity of The Punjab, Lahore: Institute of Business & Information TechnologyAfnan MahmoodNo ratings yet

- Industrial AutomationDocument83 pagesIndustrial AutomationalnemangiNo ratings yet

- ResumeDocument4 pagesResumeAnonymous 4hTJWWPNo ratings yet