Professional Documents

Culture Documents

ADB's Fiscal Roundup: FRIDAY, 08 APRIL 2011 10:08

ADB's Fiscal Roundup: FRIDAY, 08 APRIL 2011 10:08

Uploaded by

Abdullah AfzalCopyright:

Available Formats

You might also like

- Pelican Stores Data Analysis ChartDocument17 pagesPelican Stores Data Analysis ChartNaresh Kumar NareshNo ratings yet

- Economic Outlook: Table 1.1: Macroeconomic IndicatorsDocument9 pagesEconomic Outlook: Table 1.1: Macroeconomic IndicatorsBilal SolangiNo ratings yet

- MPD May 11 (Eng)Document3 pagesMPD May 11 (Eng)Osama ZiaNo ratings yet

- Getting To The Core: Budget AnalysisDocument37 pagesGetting To The Core: Budget AnalysisfaizanbhamlaNo ratings yet

- 2012 Budget PublicationDocument71 pages2012 Budget PublicationPushpa PatilNo ratings yet

- Monetary Policy Sep 2010Document3 pagesMonetary Policy Sep 2010Hamad RasoolNo ratings yet

- Union Budget 2012-13: The Past and The Present Budget - BackgroundDocument18 pagesUnion Budget 2012-13: The Past and The Present Budget - BackgrounddivertyourselfNo ratings yet

- Fiscal Policy of PakistanDocument9 pagesFiscal Policy of PakistanRehanAdil100% (1)

- MPS Apr 2012 EngDocument3 pagesMPS Apr 2012 Engbeyond_ecstasyNo ratings yet

- Monetary Policy Statement: State Bank of PakistanDocument32 pagesMonetary Policy Statement: State Bank of Pakistanbenicepk1329No ratings yet

- Government Borrowing From The Banking System: Implications For Monetary and Financial StabilityDocument26 pagesGovernment Borrowing From The Banking System: Implications For Monetary and Financial StabilitySana NazNo ratings yet

- Pakistan Monetry Policy 2011Document3 pagesPakistan Monetry Policy 2011ibrahim53No ratings yet

- Budget Main PagesDocument43 pagesBudget Main Pagesneha16septNo ratings yet

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigDocument9 pagesMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadNo ratings yet

- Fiscal Deficit InfoDocument12 pagesFiscal Deficit InfoSanket AiyaNo ratings yet

- MPS Oct 2012 EngDocument2 pagesMPS Oct 2012 EngQamar AftabNo ratings yet

- Runaway Budget DeficitsDocument4 pagesRunaway Budget Deficitsimtiazahmad116No ratings yet

- Rep Paul Ryan On Obamas 2012 Budget and BeyondDocument19 pagesRep Paul Ryan On Obamas 2012 Budget and BeyondKim HedumNo ratings yet

- Analysing Budget 2009-10Document3 pagesAnalysing Budget 2009-10muhammadasifrashidNo ratings yet

- State Bank of Pakistan: Monetary Policy DecisionDocument2 pagesState Bank of Pakistan: Monetary Policy DecisionSumeet MetaiNo ratings yet

- Seb Merchant Banking - Country Risk Analysis 28 September 2016Document6 pagesSeb Merchant Banking - Country Risk Analysis 28 September 2016Aylin PolatNo ratings yet

- Gaining Insights: Budget Analysis 2010Document40 pagesGaining Insights: Budget Analysis 2010Shashank ShekharNo ratings yet

- Monetary Policy Statement: State Bank of PakistanDocument42 pagesMonetary Policy Statement: State Bank of PakistanScorpian MouniehNo ratings yet

- Public Sector Budgeting Short Essay QuestionDocument7 pagesPublic Sector Budgeting Short Essay QuestionBrilliant MycriNo ratings yet

- Monetary Policy - July-December, 2018Document3 pagesMonetary Policy - July-December, 2018মোঃ আশিকুর রহমান শিবলুNo ratings yet

- Lao GDP Update April2007Document2 pagesLao GDP Update April2007api-3745429100% (1)

- Prospects 2010Document5 pagesProspects 2010IPS Sri LankaNo ratings yet

- ICRA Union Budget 2012-13Document7 pagesICRA Union Budget 2012-13NIKUNJ_SARAF11No ratings yet

- Public Finances: Outlook and Risks: Carl Emmerson, Soumaya Keynes and Gemma Tetlow (IFS)Document30 pagesPublic Finances: Outlook and Risks: Carl Emmerson, Soumaya Keynes and Gemma Tetlow (IFS)1 2No ratings yet

- Pakistan's Economic Performance Is Notable Despite ChallengesDocument11 pagesPakistan's Economic Performance Is Notable Despite ChallengesAli Rehman NaqiNo ratings yet

- Budget Analysis 2011 12Document7 pagesBudget Analysis 2011 12s lalithaNo ratings yet

- Financial Highlights of Pakistan Economy 08-09Document5 pagesFinancial Highlights of Pakistan Economy 08-09Waqar AliNo ratings yet

- 2012 Midyear RevenueDocument8 pages2012 Midyear RevenueNick ReismanNo ratings yet

- Structural Problems Sap Pak Economy of VigourDocument3 pagesStructural Problems Sap Pak Economy of VigourRaza WazirNo ratings yet

- Fiscal Situation of PakistanDocument9 pagesFiscal Situation of PakistanMahnoor ZebNo ratings yet

- Revenue Deficit & Fiscal DeficitDocument3 pagesRevenue Deficit & Fiscal DeficitMahesh T MadhavanNo ratings yet

- Macro AssignmentDocument4 pagesMacro AssignmentShahxaib KhanNo ratings yet

- Karachi:: GDP Growth DefinitionDocument4 pagesKarachi:: GDP Growth DefinitionVicky AullakhNo ratings yet

- Domestic & External Debt: 6.1 OverviewDocument12 pagesDomestic & External Debt: 6.1 OverviewSaba JogezaiNo ratings yet

- UBL A A Dec 2011 12 Feb 2012 For Web (Revised)Document107 pagesUBL A A Dec 2011 12 Feb 2012 For Web (Revised)rabia2090No ratings yet

- MPD 24 May English)Document3 pagesMPD 24 May English)Aazar Aziz KaziNo ratings yet

- Express Business: Inflation Drops To 22-Month Low On New FormulaDocument7 pagesExpress Business: Inflation Drops To 22-Month Low On New Formulak.shaikhNo ratings yet

- Union Budget 2012-13 - ReviewDocument8 pagesUnion Budget 2012-13 - Reviewkrkamaldevnlm4028No ratings yet

- GDP Growth Sustained: Total Expenditure Has Increased by Rs. 192669 Crore in 2016-17 (BE) From 2015-16 (RE)Document4 pagesGDP Growth Sustained: Total Expenditure Has Increased by Rs. 192669 Crore in 2016-17 (BE) From 2015-16 (RE)Aryan DeepNo ratings yet

- Current Economic Situation of PakistanDocument5 pagesCurrent Economic Situation of PakistanKhurram SherazNo ratings yet

- Monetary Policy Statement Jan 11 EngDocument28 pagesMonetary Policy Statement Jan 11 EngHamad RasoolNo ratings yet

- SBP First Quarterly Report 2010-11: An AssessmentDocument4 pagesSBP First Quarterly Report 2010-11: An Assessmentabbaz1986No ratings yet

- Budget 2010-11: A Deft Balancing Act: Mumbai: Given The Political Constraints and The Fledgling Nature of TheDocument4 pagesBudget 2010-11: A Deft Balancing Act: Mumbai: Given The Political Constraints and The Fledgling Nature of Thepremkumar7No ratings yet

- Budget 2023-24 - An Astonishing ReadDocument5 pagesBudget 2023-24 - An Astonishing ReadCSS AspirantsNo ratings yet

- Monitory Policy 2010Document3 pagesMonitory Policy 2010Waheed KhanNo ratings yet

- India: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetDocument4 pagesIndia: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetVishal PranavNo ratings yet

- Kelkar Committee On Fiscal ConsolidationDocument3 pagesKelkar Committee On Fiscal ConsolidationgowsikhNo ratings yet

- Pub Blic D Debt: CH Apter 9Document21 pagesPub Blic D Debt: CH Apter 9Umair UddinNo ratings yet

- Budget PublicationDocument50 pagesBudget PublicationAmit RajputNo ratings yet

- Snapshot of Bosnia and HerzegovinaDocument53 pagesSnapshot of Bosnia and HerzegovinaDejan ŠešlijaNo ratings yet

- CHAP 1 IntroductionDocument5 pagesCHAP 1 IntroductionyaswayanadNo ratings yet

- Ado2014 PakistanDocument6 pagesAdo2014 PakistanAbdul Ghaffar BhattiNo ratings yet

- EIB Working Papers 2019/08 - Investment: What holds Romanian firms back?From EverandEIB Working Papers 2019/08 - Investment: What holds Romanian firms back?No ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Revision Process of MeasurementDocument3 pagesRevision Process of MeasurementAISHAH IWANI BINTI ZULKARNAIN A22DW0732No ratings yet

- Procurement Material Submission List - R1Document9 pagesProcurement Material Submission List - R1NhanVoNo ratings yet

- Dr. N.G.P. Institute of Technology - Coimbatore-48: Analog and Digital Integrated CircuitsDocument48 pagesDr. N.G.P. Institute of Technology - Coimbatore-48: Analog and Digital Integrated CircuitsMrs.S.Divya BMENo ratings yet

- D3E8008FB63-Body On Board DiagnosticDocument172 pagesD3E8008FB63-Body On Board DiagnosticAymen HammiNo ratings yet

- The Strategic Highway Research ProgramDocument4 pagesThe Strategic Highway Research ProgramMuhammad YahdimanNo ratings yet

- Bar Matter No. 1153Document1 pageBar Matter No. 1153Neldy VeeNo ratings yet

- SAFe Foundations (v4.0.6)Document33 pagesSAFe Foundations (v4.0.6)PoltakJeffersonPandianganNo ratings yet

- Class 2Document21 pagesClass 2md sakhwat hossainNo ratings yet

- Special Power of AttorneyDocument1 pageSpecial Power of Attorneyruby anaNo ratings yet

- Decree 4725 of 2005: RequirementsDocument1 pageDecree 4725 of 2005: Requirementsapi-541617564No ratings yet

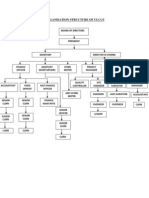

- Organisation Structure of Ulccs: Director in ChargeDocument1 pageOrganisation Structure of Ulccs: Director in ChargeMohamed RiyasNo ratings yet

- Nato HF Modem PerspectiveDocument28 pagesNato HF Modem PerspectiveMax PowerNo ratings yet

- Opportunity Recognition ProcessDocument10 pagesOpportunity Recognition ProcessLes BTSNo ratings yet

- CBEprom Data BookDocument65 pagesCBEprom Data BookChelle2100% (2)

- EIA ReportDocument11 pagesEIA ReportSid WorldNo ratings yet

- Competition Brief AND Guidelines: BY: Madhumitha.E 160101601023Document10 pagesCompetition Brief AND Guidelines: BY: Madhumitha.E 160101601023MADHU MITHANo ratings yet

- Pic 16 F 1527Document354 pagesPic 16 F 1527Attila IllésNo ratings yet

- Storytelling For Marketing and Entrepreneurship: - Course ManualDocument41 pagesStorytelling For Marketing and Entrepreneurship: - Course ManualRebeca CapelattoNo ratings yet

- Atari VCS 2600 Supercharger Tape File FormatDocument2 pagesAtari VCS 2600 Supercharger Tape File FormatAlainleGuirecNo ratings yet

- En Ian8k b1000 Msan r330 r340 Icm3ge User v1.4 PDFDocument227 pagesEn Ian8k b1000 Msan r330 r340 Icm3ge User v1.4 PDFمنصورالمغربيNo ratings yet

- Loss of Containment Manual 2012 PDFDocument68 pagesLoss of Containment Manual 2012 PDFpetrolhead1No ratings yet

- Monthly Power Consumption: Electric GyserDocument3 pagesMonthly Power Consumption: Electric Gyserdeshpande KingNo ratings yet

- Underwater Explosive Shock Testing UNDEX CM2000Document11 pagesUnderwater Explosive Shock Testing UNDEX CM2000Maryam RehanNo ratings yet

- Installation Guide C175-C172 All Models Appendix C 242 Rev BDocument52 pagesInstallation Guide C175-C172 All Models Appendix C 242 Rev BJonathan Miguel Gómez MogollónNo ratings yet

- Occupational Health Hazards Due To Mine Dust: Unit-14Document9 pagesOccupational Health Hazards Due To Mine Dust: Unit-14Dinesh dhakarNo ratings yet

- Construction Planning 2019 MemoDocument6 pagesConstruction Planning 2019 MemoNtokozo JiyanaNo ratings yet

- Baires Dev PreentrevistaDocument3 pagesBaires Dev PreentrevistaCarlos Gonzalo Maravi ArensNo ratings yet

- The Potential and Challenges of Dairy Products in The Malaysian Market 2015Document99 pagesThe Potential and Challenges of Dairy Products in The Malaysian Market 2015Hương ChiêmNo ratings yet

- Steam BoilerDocument3 pagesSteam BoilerMohammad AzlanNo ratings yet

ADB's Fiscal Roundup: FRIDAY, 08 APRIL 2011 10:08

ADB's Fiscal Roundup: FRIDAY, 08 APRIL 2011 10:08

Uploaded by

Abdullah AfzalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ADB's Fiscal Roundup: FRIDAY, 08 APRIL 2011 10:08

ADB's Fiscal Roundup: FRIDAY, 08 APRIL 2011 10:08

Uploaded by

Abdullah AfzalCopyright:

Available Formats

ADBs fiscal roundup

FRIDAY, 08 APRIL 2011 10:08

The Asian Development Bank has reinforced what many economists in the country already feared: an impending economic fiasco, with fiscal problems leading the way. The report, titled Asian Development Outlook 2011, recalled the fiscal faux pas committed by the countrys government, with the fiscal deficit widening from 5.3 percent of GDP in FY09 to 6.3 percent in FY10. The decline in tax revenues is largely to be blamed for the deterioration of the fiscal position, with the tax-to-GDP ratio hitting a 30-year low of 9 percent in FY10. The expenditure side also played its part, with rigid budgetary outlays (interest, security, pension payments) taking up 82 percent of FBRs tax receipts. The overrun had to be covered via a drop in public sector development programme (PSDP), while loss-making SOEs continued to wreak further havoc. Another key area warranting particular attention is the debt quandary of Pakistan. While the governments domestic debt stood at a hefty 37 percent of GDP, external debt was not far behind at 32 percent in FY10. Debt service payments highlight the gravity of having such a sizeable debt portfolio even more. The heavy interest payments accounted for over 40 percent of FBRs tax revenue last fiscal year. As the country trudges along through FY11, it would be idealistic to expect any sweeping improvement, especially since the July-August floods left a deep mark on the countrys economic tell-tales. The ADB criticised the tax revenue target set at the beginning of FY11 as being a tad unrealistic, even if RGST had been imposed, considering a 26 percent growth in tax

receipts was envisaged for FY11 against a 5-year average growth of 14 percent in tax revenues. With RGST falling prey to political strife, the fiscal front seems to be bracing itself for another doom scenario. A 50 percent increase in government wages, way-higher-thananticipated power sector subsidies, and energy-related circular debt will maintain the strain on the governments fiscal wallet. In such a scenario, PSDP continues to play the role of the scapegoat, with less than 25 percent of the earmarked Rs280 billion in the federal budget made available for PSDP activities in 1HFY11. And the scarcity of funding sources leads to another economic menace excessive government borrowing from the banking system. By 12 February 2011, government borrowing from the banking system had gone up to Rs379 billion in FY11, compared to Rs330 billion for FY10 as a whole. But behold the optimism of the ADB: the bank is expectant of a fiscal recovery in FY12, hopeful that the political environment will sober up to facilitate better revenue generation and fiscal management. Needless to say, there remains a question to the practicality of ADBs expectations, especially regards the political front.

http://www.brecorder.com/home/br-research/pakistan-macroeconomics/fiscal-policy/10437-adbsfiscal-roundup.html

You might also like

- Pelican Stores Data Analysis ChartDocument17 pagesPelican Stores Data Analysis ChartNaresh Kumar NareshNo ratings yet

- Economic Outlook: Table 1.1: Macroeconomic IndicatorsDocument9 pagesEconomic Outlook: Table 1.1: Macroeconomic IndicatorsBilal SolangiNo ratings yet

- MPD May 11 (Eng)Document3 pagesMPD May 11 (Eng)Osama ZiaNo ratings yet

- Getting To The Core: Budget AnalysisDocument37 pagesGetting To The Core: Budget AnalysisfaizanbhamlaNo ratings yet

- 2012 Budget PublicationDocument71 pages2012 Budget PublicationPushpa PatilNo ratings yet

- Monetary Policy Sep 2010Document3 pagesMonetary Policy Sep 2010Hamad RasoolNo ratings yet

- Union Budget 2012-13: The Past and The Present Budget - BackgroundDocument18 pagesUnion Budget 2012-13: The Past and The Present Budget - BackgrounddivertyourselfNo ratings yet

- Fiscal Policy of PakistanDocument9 pagesFiscal Policy of PakistanRehanAdil100% (1)

- MPS Apr 2012 EngDocument3 pagesMPS Apr 2012 Engbeyond_ecstasyNo ratings yet

- Monetary Policy Statement: State Bank of PakistanDocument32 pagesMonetary Policy Statement: State Bank of Pakistanbenicepk1329No ratings yet

- Government Borrowing From The Banking System: Implications For Monetary and Financial StabilityDocument26 pagesGovernment Borrowing From The Banking System: Implications For Monetary and Financial StabilitySana NazNo ratings yet

- Pakistan Monetry Policy 2011Document3 pagesPakistan Monetry Policy 2011ibrahim53No ratings yet

- Budget Main PagesDocument43 pagesBudget Main Pagesneha16septNo ratings yet

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigDocument9 pagesMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadNo ratings yet

- Fiscal Deficit InfoDocument12 pagesFiscal Deficit InfoSanket AiyaNo ratings yet

- MPS Oct 2012 EngDocument2 pagesMPS Oct 2012 EngQamar AftabNo ratings yet

- Runaway Budget DeficitsDocument4 pagesRunaway Budget Deficitsimtiazahmad116No ratings yet

- Rep Paul Ryan On Obamas 2012 Budget and BeyondDocument19 pagesRep Paul Ryan On Obamas 2012 Budget and BeyondKim HedumNo ratings yet

- Analysing Budget 2009-10Document3 pagesAnalysing Budget 2009-10muhammadasifrashidNo ratings yet

- State Bank of Pakistan: Monetary Policy DecisionDocument2 pagesState Bank of Pakistan: Monetary Policy DecisionSumeet MetaiNo ratings yet

- Seb Merchant Banking - Country Risk Analysis 28 September 2016Document6 pagesSeb Merchant Banking - Country Risk Analysis 28 September 2016Aylin PolatNo ratings yet

- Gaining Insights: Budget Analysis 2010Document40 pagesGaining Insights: Budget Analysis 2010Shashank ShekharNo ratings yet

- Monetary Policy Statement: State Bank of PakistanDocument42 pagesMonetary Policy Statement: State Bank of PakistanScorpian MouniehNo ratings yet

- Public Sector Budgeting Short Essay QuestionDocument7 pagesPublic Sector Budgeting Short Essay QuestionBrilliant MycriNo ratings yet

- Monetary Policy - July-December, 2018Document3 pagesMonetary Policy - July-December, 2018মোঃ আশিকুর রহমান শিবলুNo ratings yet

- Lao GDP Update April2007Document2 pagesLao GDP Update April2007api-3745429100% (1)

- Prospects 2010Document5 pagesProspects 2010IPS Sri LankaNo ratings yet

- ICRA Union Budget 2012-13Document7 pagesICRA Union Budget 2012-13NIKUNJ_SARAF11No ratings yet

- Public Finances: Outlook and Risks: Carl Emmerson, Soumaya Keynes and Gemma Tetlow (IFS)Document30 pagesPublic Finances: Outlook and Risks: Carl Emmerson, Soumaya Keynes and Gemma Tetlow (IFS)1 2No ratings yet

- Pakistan's Economic Performance Is Notable Despite ChallengesDocument11 pagesPakistan's Economic Performance Is Notable Despite ChallengesAli Rehman NaqiNo ratings yet

- Budget Analysis 2011 12Document7 pagesBudget Analysis 2011 12s lalithaNo ratings yet

- Financial Highlights of Pakistan Economy 08-09Document5 pagesFinancial Highlights of Pakistan Economy 08-09Waqar AliNo ratings yet

- 2012 Midyear RevenueDocument8 pages2012 Midyear RevenueNick ReismanNo ratings yet

- Structural Problems Sap Pak Economy of VigourDocument3 pagesStructural Problems Sap Pak Economy of VigourRaza WazirNo ratings yet

- Fiscal Situation of PakistanDocument9 pagesFiscal Situation of PakistanMahnoor ZebNo ratings yet

- Revenue Deficit & Fiscal DeficitDocument3 pagesRevenue Deficit & Fiscal DeficitMahesh T MadhavanNo ratings yet

- Macro AssignmentDocument4 pagesMacro AssignmentShahxaib KhanNo ratings yet

- Karachi:: GDP Growth DefinitionDocument4 pagesKarachi:: GDP Growth DefinitionVicky AullakhNo ratings yet

- Domestic & External Debt: 6.1 OverviewDocument12 pagesDomestic & External Debt: 6.1 OverviewSaba JogezaiNo ratings yet

- UBL A A Dec 2011 12 Feb 2012 For Web (Revised)Document107 pagesUBL A A Dec 2011 12 Feb 2012 For Web (Revised)rabia2090No ratings yet

- MPD 24 May English)Document3 pagesMPD 24 May English)Aazar Aziz KaziNo ratings yet

- Express Business: Inflation Drops To 22-Month Low On New FormulaDocument7 pagesExpress Business: Inflation Drops To 22-Month Low On New Formulak.shaikhNo ratings yet

- Union Budget 2012-13 - ReviewDocument8 pagesUnion Budget 2012-13 - Reviewkrkamaldevnlm4028No ratings yet

- GDP Growth Sustained: Total Expenditure Has Increased by Rs. 192669 Crore in 2016-17 (BE) From 2015-16 (RE)Document4 pagesGDP Growth Sustained: Total Expenditure Has Increased by Rs. 192669 Crore in 2016-17 (BE) From 2015-16 (RE)Aryan DeepNo ratings yet

- Current Economic Situation of PakistanDocument5 pagesCurrent Economic Situation of PakistanKhurram SherazNo ratings yet

- Monetary Policy Statement Jan 11 EngDocument28 pagesMonetary Policy Statement Jan 11 EngHamad RasoolNo ratings yet

- SBP First Quarterly Report 2010-11: An AssessmentDocument4 pagesSBP First Quarterly Report 2010-11: An Assessmentabbaz1986No ratings yet

- Budget 2010-11: A Deft Balancing Act: Mumbai: Given The Political Constraints and The Fledgling Nature of TheDocument4 pagesBudget 2010-11: A Deft Balancing Act: Mumbai: Given The Political Constraints and The Fledgling Nature of Thepremkumar7No ratings yet

- Budget 2023-24 - An Astonishing ReadDocument5 pagesBudget 2023-24 - An Astonishing ReadCSS AspirantsNo ratings yet

- Monitory Policy 2010Document3 pagesMonitory Policy 2010Waheed KhanNo ratings yet

- India: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetDocument4 pagesIndia: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetVishal PranavNo ratings yet

- Kelkar Committee On Fiscal ConsolidationDocument3 pagesKelkar Committee On Fiscal ConsolidationgowsikhNo ratings yet

- Pub Blic D Debt: CH Apter 9Document21 pagesPub Blic D Debt: CH Apter 9Umair UddinNo ratings yet

- Budget PublicationDocument50 pagesBudget PublicationAmit RajputNo ratings yet

- Snapshot of Bosnia and HerzegovinaDocument53 pagesSnapshot of Bosnia and HerzegovinaDejan ŠešlijaNo ratings yet

- CHAP 1 IntroductionDocument5 pagesCHAP 1 IntroductionyaswayanadNo ratings yet

- Ado2014 PakistanDocument6 pagesAdo2014 PakistanAbdul Ghaffar BhattiNo ratings yet

- EIB Working Papers 2019/08 - Investment: What holds Romanian firms back?From EverandEIB Working Papers 2019/08 - Investment: What holds Romanian firms back?No ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Revision Process of MeasurementDocument3 pagesRevision Process of MeasurementAISHAH IWANI BINTI ZULKARNAIN A22DW0732No ratings yet

- Procurement Material Submission List - R1Document9 pagesProcurement Material Submission List - R1NhanVoNo ratings yet

- Dr. N.G.P. Institute of Technology - Coimbatore-48: Analog and Digital Integrated CircuitsDocument48 pagesDr. N.G.P. Institute of Technology - Coimbatore-48: Analog and Digital Integrated CircuitsMrs.S.Divya BMENo ratings yet

- D3E8008FB63-Body On Board DiagnosticDocument172 pagesD3E8008FB63-Body On Board DiagnosticAymen HammiNo ratings yet

- The Strategic Highway Research ProgramDocument4 pagesThe Strategic Highway Research ProgramMuhammad YahdimanNo ratings yet

- Bar Matter No. 1153Document1 pageBar Matter No. 1153Neldy VeeNo ratings yet

- SAFe Foundations (v4.0.6)Document33 pagesSAFe Foundations (v4.0.6)PoltakJeffersonPandianganNo ratings yet

- Class 2Document21 pagesClass 2md sakhwat hossainNo ratings yet

- Special Power of AttorneyDocument1 pageSpecial Power of Attorneyruby anaNo ratings yet

- Decree 4725 of 2005: RequirementsDocument1 pageDecree 4725 of 2005: Requirementsapi-541617564No ratings yet

- Organisation Structure of Ulccs: Director in ChargeDocument1 pageOrganisation Structure of Ulccs: Director in ChargeMohamed RiyasNo ratings yet

- Nato HF Modem PerspectiveDocument28 pagesNato HF Modem PerspectiveMax PowerNo ratings yet

- Opportunity Recognition ProcessDocument10 pagesOpportunity Recognition ProcessLes BTSNo ratings yet

- CBEprom Data BookDocument65 pagesCBEprom Data BookChelle2100% (2)

- EIA ReportDocument11 pagesEIA ReportSid WorldNo ratings yet

- Competition Brief AND Guidelines: BY: Madhumitha.E 160101601023Document10 pagesCompetition Brief AND Guidelines: BY: Madhumitha.E 160101601023MADHU MITHANo ratings yet

- Pic 16 F 1527Document354 pagesPic 16 F 1527Attila IllésNo ratings yet

- Storytelling For Marketing and Entrepreneurship: - Course ManualDocument41 pagesStorytelling For Marketing and Entrepreneurship: - Course ManualRebeca CapelattoNo ratings yet

- Atari VCS 2600 Supercharger Tape File FormatDocument2 pagesAtari VCS 2600 Supercharger Tape File FormatAlainleGuirecNo ratings yet

- En Ian8k b1000 Msan r330 r340 Icm3ge User v1.4 PDFDocument227 pagesEn Ian8k b1000 Msan r330 r340 Icm3ge User v1.4 PDFمنصورالمغربيNo ratings yet

- Loss of Containment Manual 2012 PDFDocument68 pagesLoss of Containment Manual 2012 PDFpetrolhead1No ratings yet

- Monthly Power Consumption: Electric GyserDocument3 pagesMonthly Power Consumption: Electric Gyserdeshpande KingNo ratings yet

- Underwater Explosive Shock Testing UNDEX CM2000Document11 pagesUnderwater Explosive Shock Testing UNDEX CM2000Maryam RehanNo ratings yet

- Installation Guide C175-C172 All Models Appendix C 242 Rev BDocument52 pagesInstallation Guide C175-C172 All Models Appendix C 242 Rev BJonathan Miguel Gómez MogollónNo ratings yet

- Occupational Health Hazards Due To Mine Dust: Unit-14Document9 pagesOccupational Health Hazards Due To Mine Dust: Unit-14Dinesh dhakarNo ratings yet

- Construction Planning 2019 MemoDocument6 pagesConstruction Planning 2019 MemoNtokozo JiyanaNo ratings yet

- Baires Dev PreentrevistaDocument3 pagesBaires Dev PreentrevistaCarlos Gonzalo Maravi ArensNo ratings yet

- The Potential and Challenges of Dairy Products in The Malaysian Market 2015Document99 pagesThe Potential and Challenges of Dairy Products in The Malaysian Market 2015Hương ChiêmNo ratings yet

- Steam BoilerDocument3 pagesSteam BoilerMohammad AzlanNo ratings yet