Professional Documents

Culture Documents

Balance Sheet Equation Assets Liabilities + Stockholders' Equity

Balance Sheet Equation Assets Liabilities + Stockholders' Equity

Uploaded by

Asma RizviOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet Equation Assets Liabilities + Stockholders' Equity

Balance Sheet Equation Assets Liabilities + Stockholders' Equity

Uploaded by

Asma RizviCopyright:

Available Formats

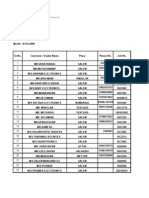

BALANCE SHEET EQUATION ASSETS = LIABILITIES + STOCKHOLDERS EQUITY Hector Lopez opens his own bicycle shop, Biwheels

Company on January 2, 2012. Show how the following transactions affect the balance sheet: 1. 2. 3. 4. 5. The first transaction was the investment by the owner of $400,000 in the business bank account. Borrowed $100,000 from a bank by signing a promissory note. Acquired store equipment for $15,000 cash Acquired bicycles for $120,000 cash from a manufacturer Bought bicycle parts for $10,000 from a manufacturer on Jan 5. The manufacturer requires $4,000 by Jan 10, balance in 30 days 6. Bought more bicycles from another manufacturer for $30,000. He requires a cash down payment of $10,000 and Biwheels must pay the remaining balance in 60 days. 7. Biwheels sells a store showcase (part of store equipment) to a business neighbor for cash, after Lopez decides he has no use for it. Its selling price $1,000 is its cost. 8. Biwheels returns some inventory (which it had acquired on January 6 for $800) to the manufacturer for full credit 9. Paid $4,000 to the manufacturer described in transaction 5. 10. (a) Biwheels sales for the entire month of January amount to $160,000 on open account. (b)The cost of the inventory sold (as given in the above transaction) is $100,000. 11.The company collects $5,000 of its accounts receivable in January. 12.On Jan 10, Biwheels made a payment of $6,000 for its store rent covering Jan, Feb, Mar. The rent is due for payment only on the last day of each month. 13.Recognize expiry of rental services for the month of January. 14. Recognize depreciation expenses on store equipment for January $100 15.Lopez remodels his home for $35,000 paying by cheque from his personal bank account.

The following transactions occurred during February: 16.Collections of accounts receivable $130,000 17.Payments of accounts payable $15,000 18.Acquisitions of inventory on open account, $80,000 and for cash $10,000 19.Sales of merchandise for $176,000 of which $125,000 was on open account and $51,000 was for cash. Biwheels carried the sold merchandise in inventory at a cost of 110,000. 20.Recognition of rent expense for February. 21.Recognition of depreciation expense for February. 22.Borrowing of $10,000 from a bank, which Biwheels used to buy store equipment on February 28. Problem ( issue of share capital): Biwheels Company had issued 10,000 shares each having a face value of $10 to the shareholders for their investment of $400,000. What is the par value of his share? What is the total paid in capital in excess of par value (also called additional paid in capital)? What is the issue price of the share? If the company declares 20% dividend, how much would a shareholder who has 1,000 shares receive? What total amount has been paid out as dividends to shareholders? What is the return on investment on each share?

Balance sheet of Biwheels company on Feb 28, 20X2 (before declaring dividend)

Statement of retained earnings for the month ended Feb 28, 20X2:

You might also like

- Double Entry Pratice QuestionsDocument3 pagesDouble Entry Pratice QuestionsVeronica Bailey100% (10)

- ProblemsDocument19 pagesProblemsJames CastañedaNo ratings yet

- Accounting Equation-Examples and ProblemsDocument3 pagesAccounting Equation-Examples and ProblemsMuhammed Hasan100% (3)

- Exercises On Journalizing (Debit and Credit)Document2 pagesExercises On Journalizing (Debit and Credit)kim100% (6)

- Accounting Problem Book 2011Document103 pagesAccounting Problem Book 2011Sveta Chernica100% (1)

- Accouting Equation HandoutDocument5 pagesAccouting Equation HandoutALI ZAFAR� LIAQAT UnknownNo ratings yet

- Q1. Frontier Park Was Started On April 1 by H. Hillenmeyer. The Following Selected Events and Transactions Occurred During AprilDocument3 pagesQ1. Frontier Park Was Started On April 1 by H. Hillenmeyer. The Following Selected Events and Transactions Occurred During AprilShamun Zia100% (1)

- Exercise Revision: Chap 1Document2 pagesExercise Revision: Chap 1Phương LinhNo ratings yet

- Fin. Acc - Chapter-2 JournalDocument4 pagesFin. Acc - Chapter-2 JournalFayez AmanNo ratings yet

- FA Week 1Document8 pagesFA Week 1Azure JohnsonNo ratings yet

- Chqpte 1 7 Practice TestsDocument6 pagesChqpte 1 7 Practice TestsI IvaNo ratings yet

- Accounting CycleDocument12 pagesAccounting CycleAwais KhanNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Chapter 2 Math For PracticeDocument3 pagesChapter 2 Math For Practiceehratul.bagNo ratings yet

- Accounting EquationDocument30 pagesAccounting EquationJenniferNo ratings yet

- Accounting Problem Book 2011 PDFDocument103 pagesAccounting Problem Book 2011 PDFViệt Đức Lê67% (3)

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- ACC 205 Complete Class HomeworkDocument40 pagesACC 205 Complete Class HomeworkSwadesh BangladeshNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- SInversions T2 1 Part1 Exercicis PreguntesDocument9 pagesSInversions T2 1 Part1 Exercicis PreguntesjoanNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Exercise Section 1Document2 pagesExercise Section 1ENG ZI QINGNo ratings yet

- Ac 119 Tutorial Questions.Document3 pagesAc 119 Tutorial Questions.adhiza83No ratings yet

- Exercise For Chapter 1Document1 pageExercise For Chapter 1phamthao7404No ratings yet

- Example of Accounting TransactionDocument3 pagesExample of Accounting TransactionMylen Noel Elgincolin Manlapaz100% (1)

- Principles of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsDocument3 pagesPrinciples of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsYumna TauqeerNo ratings yet

- Bookkeeping Problem Accounting CycleDocument2 pagesBookkeeping Problem Accounting CycleMa Christina EncinasNo ratings yet

- Chapter 1 - Some Basic QuestionsDocument6 pagesChapter 1 - Some Basic QuestionsBracu 2023No ratings yet

- Accounting Terms and ConceptsDocument4 pagesAccounting Terms and ConceptsNirajNo ratings yet

- 1 Finance-Exam-1Document22 pages1 Finance-Exam-1ashish25% (4)

- Practice Exam Pool 1Document11 pagesPractice Exam Pool 1Ey ZalimNo ratings yet

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- Ledger Posting/ Trial Balance / Financial StatementsDocument6 pagesLedger Posting/ Trial Balance / Financial StatementsSora 1211No ratings yet

- Accounting ProblemsDocument2 pagesAccounting Problemssuneel kumarNo ratings yet

- Financial Accounting Practice ProblemsDocument15 pagesFinancial Accounting Practice ProblemsFaryal Mughal100% (1)

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Quest 1Document7 pagesQuest 1btetarbeNo ratings yet

- Review Sec2pp AccountingDocument2 pagesReview Sec2pp AccountingWiferriss ShinjinaraNo ratings yet

- Fundamentals of Abm 1 Quarter 2, Week 1Document2 pagesFundamentals of Abm 1 Quarter 2, Week 1Shiellai Mae PolintangNo ratings yet

- Assignment On Merchandise Inventory-Fall 23Document2 pagesAssignment On Merchandise Inventory-Fall 23www.kazimarzanjsbmsc570No ratings yet

- Questions For ForumDocument4 pagesQuestions For ForumMarcel JonathanNo ratings yet

- Um22ac142b 20230217121409Document21 pagesUm22ac142b 20230217121409Vismaya SNo ratings yet

- Accounting Midterm Test JounalsDocument4 pagesAccounting Midterm Test JounalsEzequiel ZubkoNo ratings yet

- Revision Worksheet FundamentalsDocument2 pagesRevision Worksheet Fundamentalssshyam3100% (1)

- Double Entry Bookkeeping - T-AccountsDocument4 pagesDouble Entry Bookkeeping - T-AccountsAbdulla Maseeh100% (1)

- Answers of Journal EntriesDocument3 pagesAnswers of Journal EntriesSaad8808No ratings yet

- Problem Set CompleteDocument18 pagesProblem Set Completevicencio39No ratings yet

- ACC 205 Complete Class AssignmentsDocument39 pagesACC 205 Complete Class AssignmentsDecemberjaan0% (1)

- FABM1 Quarter 1 Week 3Document47 pagesFABM1 Quarter 1 Week 3FERNANDO TAMZ2003No ratings yet

- Tutorial 05Document3 pagesTutorial 05Janidu KavishkaNo ratings yet

- Business Studies Chapter 6 - Grade 10Document4 pagesBusiness Studies Chapter 6 - Grade 10Maneesha DulanjaliNo ratings yet

- Accounting EquationDocument31 pagesAccounting EquationKathuria AmanNo ratings yet

- Live Session 2 - Question To Be SubmittedDocument2 pagesLive Session 2 - Question To Be SubmittedJack LewisNo ratings yet

- EXERCISE 3.11 Journalizing, Posting, and Preparing A Trial: Balance Page 123Document24 pagesEXERCISE 3.11 Journalizing, Posting, and Preparing A Trial: Balance Page 123Ifrah BashirNo ratings yet

- New Principle Exercise Trial BalanceDocument2 pagesNew Principle Exercise Trial BalancetotiNo ratings yet

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45No ratings yet

- CRPF InstructionsDocument3 pagesCRPF InstructionsGyanaranjan BeheraNo ratings yet

- Bhaichung BhutiyaDocument8 pagesBhaichung BhutiyaPriyankaSinghNo ratings yet

- G.R. No. 116524 - People Vs Flores (18 Jan 96)Document7 pagesG.R. No. 116524 - People Vs Flores (18 Jan 96)jdz1988No ratings yet

- Final Summative Assessment: Instruction: Answer The Following QuestionsDocument3 pagesFinal Summative Assessment: Instruction: Answer The Following QuestionsArgefe JuegosNo ratings yet

- Steps To Protest 20 Aug 2004 OverviewDocument1 pageSteps To Protest 20 Aug 2004 OverviewSabdo RahayuNo ratings yet

- B) CW PipingDocument2 pagesB) CW PipingGopal RamalingamNo ratings yet

- Muslim Law 12Document6 pagesMuslim Law 12Apurva SingaraveluNo ratings yet

- F. Recording SettlementDocument4 pagesF. Recording SettlementCharlene ChawNo ratings yet

- Business Case - ACTPACO (ACCTBaefA2)Document4 pagesBusiness Case - ACTPACO (ACCTBaefA2)Lourfame Prieto NellasNo ratings yet

- Hajj 2017 - Ballot ResultDocument2 pagesHajj 2017 - Ballot ResultYaseen MuhammadNo ratings yet

- Ramos vs. NCIP G.R. No. 192112 19 Aug. 2020Document2 pagesRamos vs. NCIP G.R. No. 192112 19 Aug. 2020Rosalia L. Completano LptNo ratings yet

- Franchisee Claim Report Format (1) (Version 1)Document32 pagesFranchisee Claim Report Format (1) (Version 1)ramanikarthiNo ratings yet

- 50 Marta C Ortega Vs Daniel Leonardo103 Phil 870Document3 pages50 Marta C Ortega Vs Daniel Leonardo103 Phil 870Nunugom SonNo ratings yet

- IES-ISS-2022 WR-Name Eng 24082022Document8 pagesIES-ISS-2022 WR-Name Eng 24082022Abhigyan MitraNo ratings yet

- MSDS - Prominent-Phenol - Red - Photometer - (USA)Document6 pagesMSDS - Prominent-Phenol - Red - Photometer - (USA)Tanawat ChinchaivanichkitNo ratings yet

- Facilities and Equipment in FootballDocument10 pagesFacilities and Equipment in Footballpat patNo ratings yet

- Background Check (US)Document1 pageBackground Check (US)TanishNo ratings yet

- History of Asset ManegmantsDocument9 pagesHistory of Asset ManegmantsDinesh PansaraNo ratings yet

- Calo Vs DegamoDocument1 pageCalo Vs Degamoaudreydql5No ratings yet

- PITKIN. Hanna. Obligation and ConsentDocument10 pagesPITKIN. Hanna. Obligation and ConsentYago PaivaNo ratings yet

- Section 15 CommentaryDocument3 pagesSection 15 CommentaryTejasviNo ratings yet

- Syllabus (November 2010)Document9 pagesSyllabus (November 2010)RZ ZamoraNo ratings yet

- New Law College Name: Karishma Shah Class: S.Y.LLB D' Roll No.: 349 Subject: Criminology and Correction AdministrationDocument12 pagesNew Law College Name: Karishma Shah Class: S.Y.LLB D' Roll No.: 349 Subject: Criminology and Correction AdministrationKarishmaNo ratings yet

- Kitaab At-Tawheed Complete - RESIZEDDocument232 pagesKitaab At-Tawheed Complete - RESIZEDToyib D'SenatorNo ratings yet

- Student Credit Card Application DetailsDocument2 pagesStudent Credit Card Application DetailsAziz AnsariNo ratings yet

- 5 - Pauls First Missionary JourneyDocument7 pages5 - Pauls First Missionary JourneyMike GNo ratings yet

- A Brief History of Kolehiyo NG SubicDocument14 pagesA Brief History of Kolehiyo NG SubicBart JavillonarNo ratings yet

- Beginning SyllablesDocument1 pageBeginning Syllablesapi-3820232No ratings yet

- Bid Securing DeclarationDocument8 pagesBid Securing DeclarationRowell Ian Gana-anNo ratings yet

- Home Designer Suite 2021 Users GuideDocument122 pagesHome Designer Suite 2021 Users Guiderick.mccort2766No ratings yet