Professional Documents

Culture Documents

Global Strategic Management Report: Topic-Strategy in Emerging Markets

Global Strategic Management Report: Topic-Strategy in Emerging Markets

Uploaded by

Gautam Siddharth SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Strategic Management Report: Topic-Strategy in Emerging Markets

Global Strategic Management Report: Topic-Strategy in Emerging Markets

Uploaded by

Gautam Siddharth SharmaCopyright:

Available Formats

Global Strategic Management Report

Topic- Strategy in Emerging Markets

Gautam Siddharth 11020241017 Div-A

STRATEGY IN EMERGING MARKETS

Opinion and learning

In emerging markets, one of the measures of economic prosperity is the number of successful western brands that enter the local markets. A country like India, with the gradual opening up of its economy, saw an influx of international brands into the country. The likes of KFC, Volkswagen and McDonalds, which previously shied away from entering the Indian Market, suddenly wanted to grab their share of pie in the market. These companies knew that despite the issues related to lackadaisical decision making, weak intellectual property rights, local competition etc., these markets were too attractive to be missed out upon. Also, these companies realised that their present markets reached a saturation point and that they needed to find newer markets to sell their products. This, coupled with rapid economic growth in countries like India, China, Mexico and Brazil, created a readymade market for their products. However, many of these companies that entered the emerging markets underestimated the need for a localised strategy to complement their global strategy. They simply assumed that one size fits all would work wonders for them even in the newer markets. It wasnt long before these companies realised that this approach wouldnt really work in countries like India. There is certainly a need to develop a proper strategy for these emerging markets because the conditions prevailing in these markets are quite different from developed markets. The following articles will corroborate the point.

1) The Great Rebalancing. The article, written by Peter Bisson, Rick Kirkland and Elizabeth Stephenson and published in the McKinsey quarterly 2010 is basically an attempt to remind the western companies that they need to look at the Developing Economies in a different light. At present, these countries, which include the likes of India, China, African countries etc., are treated by these companies as peripheral players in the market, a source of low cost goods and services, rather than a hub of innovation. However, this is going to change in the next decade or so, there is a high probability that these countries will become large scale providers of Capital, Talent and Innovation. For all companiesboth established multinationals and emerging-market challengersthis great rebalancing will force major adjustments in strategic focus. No longer can established companies treat emerging markets as a sideshow. Emerging markets will increasingly become the locus of

growth in consumption, production, andmost of allinnovation. More and more, global leadership will depend on winning in the emerging markets first. The opportunity is there, the swelling middle class population in these countries are a readymade market for these companies. However, it is not all that simple; one of the major reasons why these companies may face a tough time is because of the fact that in order to succeed in these countries, innovative products need to be sold at a low cost. The example of Tata Nano is a case in point. These companies also need to innovate when it comes to designing their distribution channel as well as promotional strategy. Also, most of the companies are under a false illusion that low cost innovators will never be able to catch up with them. Caterpillar, for example, is the worlds largest construction-equipment manufacturer. Its revenues are twice those of the next-largest player. No Chinese company makes the top ten by this measure, so China might appear to be a distant threat. But unit sales numbers tell a different story. Ranked by the number of vehicles sold, 9 of the industrys 12 largest manufacturers of wheel loadersthe second-largest-selling piece of construction equipmentare Chinese. Nor do these players have an advantage only in their home market: Chinese manufacturers now supply a third of the wheel-loader volume in emerging markets outside China and are beginning to hit their stride in developed markets too. However, to assume that emerging markets are only about costs is a folly because the likes of India and China are slowly but steadily catching up with the developed world when it comes to technology. The Chinese telecom manufacturer, Huawei, led the world in patent applications in the year 2009 and has also built some of the most sophisticated network anywhere in the world. The prospect of this innovation wave unleashed by the great rebalancing should serve as a wake-up call to any CEO. Emerging markets are more than enormous growth opportunities; they are where tomorrows champions will hone their long-term competitiveness. Pursuing incremental product line extensions in developed markets, though profitable in the short run, will not suffice to build the critical muscle required. Link to the articlehttps://www.mckinseyquarterly.com/Strategy/Globalization/The_great_rebalancing_2627

2) Is your emerging market strategy local enough? ANALYSIS

This article, written by Yuval Atsmon, Ari Kertesz, and Ireena Vittal and published in Mckinsey Quarterly in the year 2011 mainly focuses on how the companies need to localise their emerging market strategy. According to the article, there is no denying the fact that in order to continue their growth. Companies definitely need to focus more on the emerging markets since most of the markets in the developed world have reached a level of saturation and in order to grow, the focus needs to be on the developing markets like India, China, Brazil etc. Unfortunately, even a country like China,

remains a relatively small market for most multinational corporations5 to 10 percent of global sales; often less in profits. To accelerate growth in China, India, Brazil, and other large emerging markets, it isnt enough, as many multinationals do, to develop a country-level strategy. Opportunities in these markets are also rapidly moving beyond the largest cities, often the focus of many of these companies. For sure, the top cities are important: by 2030, Mumbais economy, for example, is expected to be larger than Malaysias is today. Even so, Mumbai would in that year represent only 5 percent of Indias economy and the countrys 14 largest cities, 24 percent. China has roughly 150 cities with at least one million inhabitants. Their population and income characteristics are so different and changing so rapidly that our forecasts for their consumption of a given product category, over the next five to ten years, can range from a drop in sales to growth five times the national average. Understanding such variability can help companies invest more shrewdly and ahead of the competition rather than following others into the fiercest battlefield.

LINKhttps://www.mckinseyquarterly.com/Strategy/Growth/Is_your_emerging_market_strategy_loc al_enough_2790

Rethinking emerging market strategies Despite the fact that many companies have successfully shifted base to developing countries in order to control costs, there is a still of lot of concern in the developed markets about issues as diverse as terrorism to unsafe products being manufactured in these developing countries. So what do companies do? A survey conducted by Deloitte clearly shows that despite all these concerns, companies all across the world are still bullish about expanding their market to developing economies. Most of the companies have started attaching strategic importance to these economies, most of them being well aware of the fact that in order to stay relevant, they need to stop treating these countries as markets which take their product for granted. These companies have realised that shifting some of their important value chain functions to emerging markets will reap rich rewards (eg. Nokia in India) One of the changes that have been observed is the fact that the operations that are set up in the emerging markets not just cater to these markets, but have also become the hub for Global operations. The example of Apple setting up their base in China comes to mind when one talks about this.

Another change that has been observed is that even commercial operations have become an important growth area for many of the companies in emerging markets. After sales services, sales and marketing etc. are some of the areas where growth is being observed. However, as the market is being flooded with more and more companies, there is a possibility that many of these companies may not actually benefit from entering these markets. The survey suggests that a few of the areas which the companies need to look into are 1) Capability- It is very important for companies to move up in the engineering value chain. It can be beneficial to the companies to make use of the skills available in markets like India and China to cater to the regional as well as the global markets. 2) Risk- As they say, all that glitters is not gold. Though no one can doubt the fact that emerging markets are the markets of the future, they come with an equally high risk. These risks include commercial, Political, labour and many other types of risks. In order to succeed, a proper risk analysis must be done before taking a decision to enter a new market. 3) Location-Emerging market strategy begins, and perhaps also ends, when deciding where to establish the various functions of the value chain. As one of the most complex decisions a business can make, it needs to be aligned with the strategy rather than country rankings by macro-level indicators.

LINKhttp://www.deloitte.com/view/en_US/us/43cc586731101210VgnVCM100000ba42f00aRCRD.htm

You might also like

- International Management Managing Across Borders and Cultures Text and Cases 9th Edition Deresky Solutions Manual DownloadDocument26 pagesInternational Management Managing Across Borders and Cultures Text and Cases 9th Edition Deresky Solutions Manual DownloadByron Lindquist100% (28)

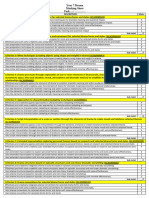

- Year 7 Drama Marking SheetDocument2 pagesYear 7 Drama Marking Sheetruthdoyle76No ratings yet

- Accenture Outlook New Paths To Growh Age of Aggression StrategyDocument10 pagesAccenture Outlook New Paths To Growh Age of Aggression StrategyNarayanan SubramanianNo ratings yet

- Eastar SpecificationsDocument2 pagesEastar SpecificationsUmar ShamsudinNo ratings yet

- International Business Strategy - 55ADocument4 pagesInternational Business Strategy - 55AVishwadeep MishraNo ratings yet

- Accenture Emerging Markets Product Development and InnovationDocument16 pagesAccenture Emerging Markets Product Development and InnovationMahinChowdhuryNo ratings yet

- Your Strategy in The New Global LandscapeDocument6 pagesYour Strategy in The New Global LandscapeSourabh DuttaNo ratings yet

- Marketing To and From Emerging Markets: Based On The Lecture of Prof. Kusum AilawaidiDocument7 pagesMarketing To and From Emerging Markets: Based On The Lecture of Prof. Kusum Ailawaidiemury70No ratings yet

- Outward Bound - Why Australian Companies Should Look Offshore For Growth - McKinseyDocument11 pagesOutward Bound - Why Australian Companies Should Look Offshore For Growth - McKinseyBilal AhmadNo ratings yet

- Accenture Emerging Market EntryDocument16 pagesAccenture Emerging Market EntryPrateek JainNo ratings yet

- Assignment 1 Bottom of The Pyramid and Food Retail Market (Super Market) in Vietnam I. What Is "Bottom of The Pyramid" (B.O.P)Document20 pagesAssignment 1 Bottom of The Pyramid and Food Retail Market (Super Market) in Vietnam I. What Is "Bottom of The Pyramid" (B.O.P)vothongtu100% (1)

- The End of Corporate: MperiaiismDocument10 pagesThe End of Corporate: MperiaiismkalikaNo ratings yet

- BA 220-Starting International Operations-Keith BuduanDocument15 pagesBA 220-Starting International Operations-Keith BuduanScribd UserNo ratings yet

- Agri Export ManagementDocument59 pagesAgri Export ManagementVikas BhardwajNo ratings yet

- Manager's Guide To Competitive Marketing Strategies .13Document15 pagesManager's Guide To Competitive Marketing Strategies .13Ameya KambleNo ratings yet

- ASS8 Beales Straba 2BSA 3Document4 pagesASS8 Beales Straba 2BSA 3larinelopezNo ratings yet

- Strategic Management Creating Competitive Advantages Canadian 4Th Edition Dess Solutions Manual Full Chapter PDFDocument43 pagesStrategic Management Creating Competitive Advantages Canadian 4Th Edition Dess Solutions Manual Full Chapter PDFdisfleshsipidwcqzs100% (8)

- AsianDocument4 pagesAsianMaanendra SinghNo ratings yet

- Unit I: Globalization ImperativesDocument19 pagesUnit I: Globalization ImperativesPamela DumriqueNo ratings yet

- A1 - Individual Assignment - Emerging MarketsDocument8 pagesA1 - Individual Assignment - Emerging MarketsFawad H. KhanNo ratings yet

- Business To Business MarketingDocument604 pagesBusiness To Business MarketingWael Khattab100% (1)

- Emerging MarketsDocument44 pagesEmerging MarketsKrishnendu GhoshNo ratings yet

- Playing To Win:: The New Global Competition For Corporate ProfitsDocument26 pagesPlaying To Win:: The New Global Competition For Corporate ProfitsRyan ScallanNo ratings yet

- Emerging Markets 5Document19 pagesEmerging Markets 5Misbah UllahNo ratings yet

- Competitive Market Strategy For Emerging IndustryDocument23 pagesCompetitive Market Strategy For Emerging IndustryVikasSharmaNo ratings yet

- BoozCo 2012 China Innovation SurveyDocument12 pagesBoozCo 2012 China Innovation Surveyanantg7567No ratings yet

- Marketing in Global DiversityDocument12 pagesMarketing in Global DiversityAnthony_Oeswadi_481No ratings yet

- PranDocument10 pagesPranAsif FaiyedNo ratings yet

- Political Economy of Multinational Corporations and Its Implication To The Filipino BusinessmenDocument11 pagesPolitical Economy of Multinational Corporations and Its Implication To The Filipino BusinessmenSatomi NakanoNo ratings yet

- Summary CHPT 1-7 Emerging MarketsDocument8 pagesSummary CHPT 1-7 Emerging MarketsRene SerranoNo ratings yet

- How Strong Is ChinaDocument16 pagesHow Strong Is ChinaShashank ShashuNo ratings yet

- Data Link Institute of Business and TechnologyDocument6 pagesData Link Institute of Business and TechnologySonal AgarwalNo ratings yet

- 5178 Kotabe Chap 01Document13 pages5178 Kotabe Chap 01Maciel García FuentesNo ratings yet

- Are You Enjoying Globalization Yet? The Surprising Implications For BusinessDocument11 pagesAre You Enjoying Globalization Yet? The Surprising Implications For Businessgal3688No ratings yet

- Local Vs MNCDocument13 pagesLocal Vs MNCAlka Himanshu SinghNo ratings yet

- Strategic Planning in The Next Millennium-SDocument6 pagesStrategic Planning in The Next Millennium-Srohan_jangid8No ratings yet

- Fdi in Retail Sector Research PaperDocument7 pagesFdi in Retail Sector Research Paperqwmojqund100% (1)

- The Importance of International BusinessDocument5 pagesThe Importance of International BusinessIrfaN TamimNo ratings yet

- Global Marketing Notes PDFDocument43 pagesGlobal Marketing Notes PDFknabpsho100% (1)

- Emerging Market Characteristics & StrategiesDocument6 pagesEmerging Market Characteristics & StrategiestallalbasahelNo ratings yet

- Maneesh KR TarunDocument9 pagesManeesh KR Tarungoel_anshipu87No ratings yet

- Module 8 AssignmentDocument5 pagesModule 8 AssignmentMuafa BasheerNo ratings yet

- Chapter 8Document25 pagesChapter 8Ibrahim HussainiNo ratings yet

- Emerging Market Entry Strategies of Multinational Corporations: The Intel Case StudyDocument20 pagesEmerging Market Entry Strategies of Multinational Corporations: The Intel Case StudyFranciane SilveiraNo ratings yet

- Critical Mass and International Marketing Strategy: Vern Terpstra, PH.DDocument14 pagesCritical Mass and International Marketing Strategy: Vern Terpstra, PH.D:-*kiss youNo ratings yet

- Business Environment BBA LLB 2021Document7 pagesBusiness Environment BBA LLB 2021Amshul BhatiaNo ratings yet

- Global Marketing: How Do Standardise and Customise The Products Globally?Document7 pagesGlobal Marketing: How Do Standardise and Customise The Products Globally?RajaRajeswari.LNo ratings yet

- Final ReportDocument60 pagesFinal ReportakankshaboobnaNo ratings yet

- The Global Companys ChallengeDocument5 pagesThe Global Companys ChallengeEric XuNo ratings yet

- 02 International Strategic PlanningDocument11 pages02 International Strategic PlanningTine MontaronNo ratings yet

- A Study On New Prospect Identification in Emerging MarketsDocument65 pagesA Study On New Prospect Identification in Emerging MarketsrohanjavagalNo ratings yet

- Emerging Giants - Building World-Class Companies in Developing CountriesDocument17 pagesEmerging Giants - Building World-Class Companies in Developing CountriesTanuj BaraiNo ratings yet

- Assignment - 2 - IFMDocument7 pagesAssignment - 2 - IFMJyoti Prakash DasNo ratings yet

- IBS AssignmentDocument4 pagesIBS AssignmentAnand KVNo ratings yet

- The Advisory FinalDocument8 pagesThe Advisory FinalAnonymous Feglbx5No ratings yet

- The Advisory FinalDocument4 pagesThe Advisory FinalAnonymous Feglbx5No ratings yet

- Performance of Mnc'sDocument26 pagesPerformance of Mnc'sMohmmed KhayyumNo ratings yet

- Assignment No 3 International Business Environment Date of Submission: May 5Document2 pagesAssignment No 3 International Business Environment Date of Submission: May 5Shoaib Kodi BengreNo ratings yet

- CDFwhitepaperyingwenDocument19 pagesCDFwhitepaperyingwenFinal ShineNo ratings yet

- Multinational Corporations and Emerging MarketsFrom EverandMultinational Corporations and Emerging MarketsRating: 1 out of 5 stars1/5 (1)

- Fast Second (Review and Analysis of Markrides and Geroski's Book)From EverandFast Second (Review and Analysis of Markrides and Geroski's Book)No ratings yet

- Paper 1 Each Questions Is Followed by Options A, B, and C. Circle The Correct AnswerDocument9 pagesPaper 1 Each Questions Is Followed by Options A, B, and C. Circle The Correct AnswerWan SafinaNo ratings yet

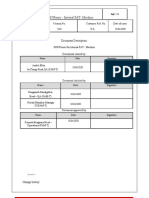

- SOP - Internal FAT-MachineDocument12 pagesSOP - Internal FAT-MachineSarvesh DaradeNo ratings yet

- Process Flow ChartDocument22 pagesProcess Flow ChartKumar Ashutosh100% (1)

- Business Freedom: An Animated Powerpoint TemplateDocument19 pagesBusiness Freedom: An Animated Powerpoint TemplateKevin LpsNo ratings yet

- A Study of Language Maintenance and Shift in The Sylheti Community in LeedsDocument405 pagesA Study of Language Maintenance and Shift in The Sylheti Community in Leedsstore1024gbNo ratings yet

- Elements Cmpds Mix Ws-AnswersDocument2 pagesElements Cmpds Mix Ws-Answerseric sivaneshNo ratings yet

- Higher Eng Maths 9th Ed 2021 Solutions ChapterDocument17 pagesHigher Eng Maths 9th Ed 2021 Solutions ChapterAubrey JosephNo ratings yet

- Psychosocial Support Activity Sheet No. 2Document2 pagesPsychosocial Support Activity Sheet No. 2Rizza De MesaNo ratings yet

- Textbook - Thermal Physics PopleDocument26 pagesTextbook - Thermal Physics PoplecowsarechillNo ratings yet

- 134.4902.06 - DM4170 - DatasheetDocument7 pages134.4902.06 - DM4170 - DatasheetVinicius MollNo ratings yet

- Is Codes ListDocument37 pagesIs Codes Listmoondonoo7No ratings yet

- Employee Training & DevelopmentDocument27 pagesEmployee Training & DevelopmentEnna Gupta100% (2)

- 14 Sept Quiz Chapter 1 SoalanDocument5 pages14 Sept Quiz Chapter 1 SoalanLukman MansorNo ratings yet

- Free - Space W - Band Setup For The Electrical Characterization of Materials and MM - Wave ComponentsDocument44 pagesFree - Space W - Band Setup For The Electrical Characterization of Materials and MM - Wave ComponentsthomasNo ratings yet

- The Dino GameDocument1 pageThe Dino Game296 004 Aditya ChaudhariNo ratings yet

- Newsela - A New Boredom Study Is Anything But BoringDocument3 pagesNewsela - A New Boredom Study Is Anything But Boringafolden91683No ratings yet

- Bread Board - Transformer - PCB - Soldering - LectureDocument31 pagesBread Board - Transformer - PCB - Soldering - Lectureananyautkarsh140904No ratings yet

- Mayank Selection & Recruitment Process BluedartDocument5 pagesMayank Selection & Recruitment Process BluedartMayank SahuNo ratings yet

- UPS Technical Data Sheet (MS-DD-SAP01-ELE-DS-0015 - Rev2)Document6 pagesUPS Technical Data Sheet (MS-DD-SAP01-ELE-DS-0015 - Rev2)Muhammad YusufNo ratings yet

- SociologyDocument185 pagesSociologyHansraj shahNo ratings yet

- Ujian General Mobile CraneDocument5 pagesUjian General Mobile CraneAgil Wahyu PamungkasNo ratings yet

- DMA Actuator Drives For - Motorised Butterfly Valve DMK - Motorised Throttle DMLDocument8 pagesDMA Actuator Drives For - Motorised Butterfly Valve DMK - Motorised Throttle DMLemil_88No ratings yet

- En0389 (Utilities Ii) PDFDocument127 pagesEn0389 (Utilities Ii) PDFGabriel GabrielNo ratings yet

- Sample Essay 2 - MLA FormatDocument4 pagesSample Essay 2 - MLA FormatSimon JonesNo ratings yet

- Connector: C175T: Powertrain Control Module (PCM) 15525 12A650Document2 pagesConnector: C175T: Powertrain Control Module (PCM) 15525 12A650Matias MartinezNo ratings yet

- Model Course 1.07 PDFDocument75 pagesModel Course 1.07 PDFShiena CamineroNo ratings yet