Professional Documents

Culture Documents

Document 2

Document 2

Uploaded by

Un Konown Do'erOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Document 2

Document 2

Uploaded by

Un Konown Do'erCopyright:

Available Formats

Accounting Topics Test Yourself Bookkeeping Q&A Careers Dictionary Pro Materials

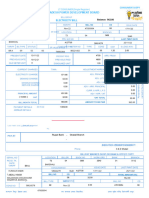

Quiz for the Topic... Financial Ratios Print (PDF) NOTE: For multiple-choice and true/false questions, simply place your cursor over what you think is the correct answer. (There is no need to click the answer.) For fill-in-the-blank questions place your cursor over the _________. If you have difficulty answering the following questions, learn more about this topic by reading our Financial Ratios Explanation. We also have Crosswords and Q&A for this topic. 1. Which of the following is not a current asset? Inventory Prepaid Insurance Fixtures 2. Current asset MINUS current liabilities is the current ratio net worth working capital 3. Current assets DIVIDED BY current liabilities is the current ratio the net worth ratio working capital 4. The quick ratio EXCLUDES which of the following? Accounts Receivable Inventory Cash

Use the following information to answer items 5 - 7: At December 31 a company's records show the following information: Cash $ 10,000 Accounts Receivable 30,000 Inventory 80,000 Prepaid Insurance 6,000 Long-term Assets 200,000 Accounts Payable 30,000 Notes Payable due in 10 months 25,000 Wages Payable 5,000 Long-term Liabilities 70,000

Stockholders' (Owner's) Equity

196,000

5. The company's working capital is $60,000 $66,000 $196,000 6. The company's current ratio is 1.0 : 1 2.0 : 1 2.1 : 1 7. The company's quick ratio is 0.7 : 1 1.0 : 1 2.0 : 1

Use the following information to answer items 8 - 11: For its most recent year a company had Sales (all on credit) of $830,000 and Cost of Goods Sold of $525,000. At the beginning of the year its Accounts Receivable were $80,000 and its Inventory was $100,000. At the end of the year its Accounts Receivable were $86,000 and its Inventory was $110,000. 8. 4.8 9. 6.3 10. 27 11. 14 The inventory turnover ratio for the year was 5.0 7.9 The accounts receivable turnover ratio for the year was 7.5 10.0 On average how many days of sales were in Accounts Receivable during the year? 37 49 On average how many days of sales were in Inventory during the year? 46 73

Use the following information for items 12 and 13: A company's net income after tax was $400,000 for its most recent year. The company's income statement included Income Tax Expense of $140,000 and Interest Expense of $60,000. At the beginning of the year the company's stockholders' equity was $1,900,000 and at the end of the year it was $2,100,000. 12. 6.7 13. 20% What is the times interest earned for the company? 9.0 10.0 What is the after-tax return on stockholder's equity for the year? 25% 30%

14. The debt to equity ratio is computed as: (Total Liabilities Total ______________ _______) : 1 15. Which of the following are likely to have the reported amounts on the balance sheet being close to their current value? Current Assets Long-term Assets Stockholders' Equity 16. A corporation's excellent reputation will be listed among the corporation's assets on its balance sheet. True False 17. The current market value of a corporation is approximately the amount reported on the balance sheet as stockholders' equity. True False 18. Free cash flow is the cash provided by operating activities minus the cash used by financing activities. True False 19. The quality of a company's earnings are suspect when the company's net income is more than the cash flow from which activities? Operating Investing Financing 20. A balance sheet which reports percentages of total assets instead of dollar amounts is referred to as a ___________ ________ balance sheet

You might also like

- Problem Set 1 SolutionsDocument13 pagesProblem Set 1 SolutionsVictor100% (1)

- HBP FinanceDocument20 pagesHBP FinancePrerna Goel56% (9)

- Wall Street Prep Premium Exam Flashcards QuizletDocument1 pageWall Street Prep Premium Exam Flashcards QuizletRaghadNo ratings yet

- Case Study (WACC)Document17 pagesCase Study (WACC)Joshua Hines100% (1)

- Study+school+slides Market Risk ManagementDocument64 pagesStudy+school+slides Market Risk ManagementEbenezerNo ratings yet

- FIN 370 Final Exam 30 Questions With AnswersDocument11 pagesFIN 370 Final Exam 30 Questions With Answersassignmentsehelp0% (1)

- Day 2 Chap 12 Rev. FI5 Ex PRDocument9 pagesDay 2 Chap 12 Rev. FI5 Ex PRCollin EdwardNo ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- Financial Ratios (Practice Quiz)Document4 pagesFinancial Ratios (Practice Quiz)MoniqueNo ratings yet

- Financial Ratios Quiz - Accounting CoachDocument3 pagesFinancial Ratios Quiz - Accounting CoachSudip Bhattacharya100% (1)

- Problems-Finance Fall, 2014Document22 pagesProblems-Finance Fall, 2014jyoon2140% (1)

- Fin 370-Week 1-5 W/final Exam - Updated June 8 2014Document5 pagesFin 370-Week 1-5 W/final Exam - Updated June 8 2014Rambo Gant75% (4)

- Какаунтинг питаннячкоDocument8 pagesКакаунтинг питаннячкоДенис ЗаславскийNo ratings yet

- Study Guide Fin 4440 For FinalsDocument8 pagesStudy Guide Fin 4440 For FinalsmariavcromeroNo ratings yet

- FIN 370 Final Exam - AssignmentDocument11 pagesFIN 370 Final Exam - AssignmentstudentehelpNo ratings yet

- Financial Management 2Document6 pagesFinancial Management 2Julie R. UgsodNo ratings yet

- Introduction To Accounting Ratios and InterpretationDocument21 pagesIntroduction To Accounting Ratios and InterpretationAnasNo ratings yet

- Alazov Elvin M Ssis Nin Maliyy SiDocument9 pagesAlazov Elvin M Ssis Nin Maliyy SiNgân LêNo ratings yet

- Financial RatiosDocument7 pagesFinancial RatiosmelisaNo ratings yet

- Introduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Document10 pagesIntroduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Shelly SantiagoNo ratings yet

- Q&P Financial Statements PDFDocument9 pagesQ&P Financial Statements PDFHiểu LêNo ratings yet

- Midterm Review Term 3 2011 - 2012Document4 pagesMidterm Review Term 3 2011 - 2012Milles ManginsayNo ratings yet

- Final - Problem Set FM FinalDocument25 pagesFinal - Problem Set FM FinalAzhar Hussain50% (2)

- Quiz MKL 4Document3 pagesQuiz MKL 4ninaNo ratings yet

- 1determine A FirmDocument50 pages1determine A FirmCHATURIKA priyadarshaniNo ratings yet

- 2009-04-03 181856 ReviewDocument18 pages2009-04-03 181856 ReviewAnbang XiaoNo ratings yet

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDocument3 pagesRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNo ratings yet

- AccountingDocument4 pagesAccountingellishNo ratings yet

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 202422070825No ratings yet

- Chapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankDocument24 pagesChapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (5)

- ABMDocument5 pagesABMAli HasanieNo ratings yet

- Management Advisory Services: ReviewerDocument17 pagesManagement Advisory Services: ReviewerMarc Anthony Max MagbalonNo ratings yet

- Tutorial 12Document72 pagesTutorial 12Irene WongNo ratings yet

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 2024phamminhngoc2k4No ratings yet

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- STR 581 Final Exam Capstone Part 2 Week 4Document9 pagesSTR 581 Final Exam Capstone Part 2 Week 4Mike Russell100% (3)

- Quiz Financial AccountingDocument6 pagesQuiz Financial AccountingNhi Nguyễn Trần LiênNo ratings yet

- Chapter 3 Working With Financial Statement - Student VersionDocument4 pagesChapter 3 Working With Financial Statement - Student Versionnamle999101No ratings yet

- FIN 571 Final Exam: FIN 571 Final Exam Ansers For Uop - UOP E Tutorsinal ExamDocument17 pagesFIN 571 Final Exam: FIN 571 Final Exam Ansers For Uop - UOP E Tutorsinal ExamUOP E TutorsNo ratings yet

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocument6 pagesManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNo ratings yet

- 1Document20 pages1needscribNo ratings yet

- Testbank For Business FinanceDocument49 pagesTestbank For Business FinanceSpencer1234556789No ratings yet

- Longenecker-Materi KomplemenDocument13 pagesLongenecker-Materi KomplemenAtyaFitriaRiefantsyahNo ratings yet

- Chapter 3 Working With Financial Statement - Student VersionDocument4 pagesChapter 3 Working With Financial Statement - Student VersionNga PhamNo ratings yet

- Chap 003Document89 pagesChap 003kwathom1100% (2)

- Chapter 03Document97 pagesChapter 03HaNo ratings yet

- Test 3 Fall Section HADocument5 pagesTest 3 Fall Section HAVin JohnNo ratings yet

- Chapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFDocument24 pagesChapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFChristian GoNo ratings yet

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- Accounting Textbook Solutions - 17Document19 pagesAccounting Textbook Solutions - 17acc-expertNo ratings yet

- Financial Management (Chapter 18: Working Capital Management)Document25 pagesFinancial Management (Chapter 18: Working Capital Management)kayleNo ratings yet

- Concepts Rev Iew and Critical Thinking QuestionsDocument8 pagesConcepts Rev Iew and Critical Thinking Questionsdt0035620No ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringFrom EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo ratings yet

- 50 Financial Modelling Questions and AsnwersDocument51 pages50 Financial Modelling Questions and AsnwersyanceNo ratings yet

- Corporate Restructuring Ch.23Document13 pagesCorporate Restructuring Ch.23Elizabeth StephanieNo ratings yet

- Knitwell Apparels FpiDocument1 pageKnitwell Apparels Fpislim_incNo ratings yet

- BF Q3M7 PDFDocument27 pagesBF Q3M7 PDFConeymae TulabingNo ratings yet

- Do It!: SolutionDocument9 pagesDo It!: Solutionaura fitrah auliya SomantriNo ratings yet

- Introduction To Quantity SurveyingDocument41 pagesIntroduction To Quantity SurveyingJohn Mofire100% (1)

- Merger & AcquisitionDocument29 pagesMerger & AcquisitionHamizar HassanNo ratings yet

- Scrip Symbol Company Name Quantity Avg Buy Price TotalDocument9 pagesScrip Symbol Company Name Quantity Avg Buy Price TotalGurpreet singhNo ratings yet

- II MBA (B&I) - 3rd Semester SyllabusDocument7 pagesII MBA (B&I) - 3rd Semester SyllabusVadivel MuruganNo ratings yet

- Real OptionsDocument18 pagesReal OptionsmakeyourcosmosNo ratings yet

- Purchase-To-Payment Process Assessment - Sample 2Document36 pagesPurchase-To-Payment Process Assessment - Sample 2viswaja100% (1)

- Redminote5 Invoice PDFDocument1 pageRedminote5 Invoice PDFvelmurug_balaNo ratings yet

- TimelineDocument478 pagesTimelineAnonymous wDuVFh0KcxNo ratings yet

- Chapter-13 Marginal CostingDocument26 pagesChapter-13 Marginal CostingAdi PrajapatiNo ratings yet

- New Electricity BillDocument2 pagesNew Electricity BillhumaunarabNo ratings yet

- Ba5101 IqDocument15 pagesBa5101 IqNISHANT SAHANo ratings yet

- Brochure - The Barbados Blockchain PropositionDocument5 pagesBrochure - The Barbados Blockchain PropositionOpnSourcererNo ratings yet

- Setting Up A Ready-Mix Concrete Manufacturing Plant-875187 PDFDocument73 pagesSetting Up A Ready-Mix Concrete Manufacturing Plant-875187 PDFGaneshNo ratings yet

- Mgac AnsDocument23 pagesMgac AnsMark Ivan JagodillaNo ratings yet

- From Brand Acquisitions To Brand RationalizationDocument6 pagesFrom Brand Acquisitions To Brand RationalizationSourav SarafNo ratings yet

- Santa Barbara Budget Book 10-11 CompleteDocument716 pagesSanta Barbara Budget Book 10-11 CompleteGlenn HendrixNo ratings yet

- Mobile Banking Dissertation TopicsDocument4 pagesMobile Banking Dissertation TopicsWritingPaperServicesSingapore100% (1)

- Multiple Choice QuestionDocument3 pagesMultiple Choice QuestionEka FerranikaNo ratings yet

- Transfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Document71 pagesTransfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Abid Siddiq Murtazai100% (1)

- Counsel's Report On FEC Complaint Against Chris McDanielDocument28 pagesCounsel's Report On FEC Complaint Against Chris McDanielJonathan AllenNo ratings yet

- NACH FormDocument2 pagesNACH FormShreyas WaghmareNo ratings yet

- MS Multiple Choice Part IIDocument4 pagesMS Multiple Choice Part IIENo ratings yet

- Advanced Financial Accounting Course OutlineDocument5 pagesAdvanced Financial Accounting Course OutlineEriqNo ratings yet

- City of BaltimoreDocument4 pagesCity of BaltimoreAnonymous Feglbx5No ratings yet