Professional Documents

Culture Documents

Cma 051812

Cma 051812

Uploaded by

BeerCopyright:

Available Formats

You might also like

- Question: On Extracting A Trial Balance, The Accountant of Extra ConsultDocument2 pagesQuestion: On Extracting A Trial Balance, The Accountant of Extra ConsultMustafa Khudhair50% (2)

- Marathon S 2023 2024 Global Credit Whitepaper 1678838357Document23 pagesMarathon S 2023 2024 Global Credit Whitepaper 1678838357SwaggyVBros MNo ratings yet

- Buyantanshi Member BookletDocument36 pagesBuyantanshi Member BookletBenson MwambaNo ratings yet

- Goldman's Strong Man in Puerto RicoDocument4 pagesGoldman's Strong Man in Puerto Ricosnbhatti82100% (2)

- Hard Money LendingDocument16 pagesHard Money Lendingnikhilraheja100% (1)

- Assignment Subprime MortgageDocument6 pagesAssignment Subprime MortgagemypinkladyNo ratings yet

- Verizon UnderwritingDocument2 pagesVerizon UnderwritingUsama FarooqNo ratings yet

- Building A Strong Syndicated Credit FacilityDocument5 pagesBuilding A Strong Syndicated Credit Facilitymajed.taheri100% (1)

- Goldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisDocument14 pagesGoldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisAkanksha BehlNo ratings yet

- Private-Equity Payout Debt Surges: Ryan DezemberDocument3 pagesPrivate-Equity Payout Debt Surges: Ryan Dezemberpaliacho77No ratings yet

- Citigroup To Pay $968 Million To Fannie Mae in Mortgage Settlement - InvestorsDocument1 pageCitigroup To Pay $968 Million To Fannie Mae in Mortgage Settlement - InvestorsCarrieonicNo ratings yet

- 1 Covered Bond Council Mortgage Loan Securitization FINAL 1Document3 pages1 Covered Bond Council Mortgage Loan Securitization FINAL 1Richard RydstromNo ratings yet

- 1.11.10 5:00 P.M.Document13 pages1.11.10 5:00 P.M.ga082003No ratings yet

- Sub Prime Overview For Samir 1 Final 97-2003 FormatDocument10 pagesSub Prime Overview For Samir 1 Final 97-2003 FormatAliasgar SuratwalaNo ratings yet

- An Introduction To Mortgage Securitization and Foreclosures Involving Securitized TrustsDocument17 pagesAn Introduction To Mortgage Securitization and Foreclosures Involving Securitized TrustsOccupyOurHomes100% (2)

- Aba 012811Document12 pagesAba 012811doh22No ratings yet

- U.S. Subprime Mortgage Crisis (A & B)Document8 pagesU.S. Subprime Mortgage Crisis (A & B)prabhat kumarNo ratings yet

- $8.9Bln of U.S. CMBS Prices During 3Q: 3Q Investment-Sales in NYC Up 110% From 10Document10 pages$8.9Bln of U.S. CMBS Prices During 3Q: 3Q Investment-Sales in NYC Up 110% From 10danielpmoynihanNo ratings yet

- Marathon's 2023-2024 Credit Cycle White PaperDocument23 pagesMarathon's 2023-2024 Credit Cycle White PaperVincentNo ratings yet

- Q: - "Why Is British Banking in Crisis?" Provide Reasons and Suggest Possible Solutions?Document6 pagesQ: - "Why Is British Banking in Crisis?" Provide Reasons and Suggest Possible Solutions?scorpio786No ratings yet

- US Covered BondsDocument4 pagesUS Covered Bondskingkv23No ratings yet

- The Great Recession: The burst of the property bubble and the excesses of speculationFrom EverandThe Great Recession: The burst of the property bubble and the excesses of speculationNo ratings yet

- Get Homework/Assignment DoneDocument8 pagesGet Homework/Assignment DoneHomework PingNo ratings yet

- 100 Introductory Facts About Mortgage Securitization: 4closurefraudDocument17 pages100 Introductory Facts About Mortgage Securitization: 4closurefraudscottyup8No ratings yet

- US Subprime Crisis (In Layman Terms)Document4 pagesUS Subprime Crisis (In Layman Terms)Vipul GuptaNo ratings yet

- High-Flying Fund May Bar EntryDocument8 pagesHigh-Flying Fund May Bar EntryamvonaNo ratings yet

- Assignment No.2 Inside JobDocument6 pagesAssignment No.2 Inside JobJill SanghrajkaNo ratings yet

- Big Banks Muscle in On Perr To Peer LendingDocument1 pageBig Banks Muscle in On Perr To Peer LendingFrancisco Antonio Álvarez CanoNo ratings yet

- Finance Assignment 2: Financial Crisis of 2008: Housing Market in USADocument2 pagesFinance Assignment 2: Financial Crisis of 2008: Housing Market in USADipankar BasumataryNo ratings yet

- PART 1: How We Got Here?Document5 pagesPART 1: How We Got Here?Abdul Wahab ShahidNo ratings yet

- Executive Summary and Business PlanDocument7 pagesExecutive Summary and Business PlanGeorge J. BethanisNo ratings yet

- Subprime Lending Is The Practice of Extending Credit To Borrowers With CertainDocument4 pagesSubprime Lending Is The Practice of Extending Credit To Borrowers With CertainPraffulla Chandra RayNo ratings yet

- 2007 Subprime Mortgage Financial CrisisDocument12 pages2007 Subprime Mortgage Financial CrisisJonJonNo ratings yet

- Citigroup Inc. & The RecessionDocument11 pagesCitigroup Inc. & The RecessionUmar IyoobNo ratings yet

- How Destruction Happened?: FICO Score S of Below 620. Because TheseDocument5 pagesHow Destruction Happened?: FICO Score S of Below 620. Because ThesePramod KhandelwalNo ratings yet

- ProjectDocument7 pagesProjectmalik waseemNo ratings yet

- Special Problems of Syndicated Loans and Multi Tiered Financings - September 2023Document13 pagesSpecial Problems of Syndicated Loans and Multi Tiered Financings - September 2023reeemu93No ratings yet

- The World Economy... - 09/03/2010Document2 pagesThe World Economy... - 09/03/2010Rhb InvestNo ratings yet

- Ellen Brown 24032023Document7 pagesEllen Brown 24032023Thuan TrinhNo ratings yet

- The Makng of A Bank FailureDocument5 pagesThe Makng of A Bank FailureFayçal SinaceurNo ratings yet

- This Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCDocument28 pagesThis Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCRaymond Behnke [STUDENT]No ratings yet

- 3.foreign Loan SyndicationDocument19 pages3.foreign Loan SyndicationAPOLLO BISWASNo ratings yet

- Bankruptcy of Lehman Brothers - A Pointer of Subprime CrisisDocument7 pagesBankruptcy of Lehman Brothers - A Pointer of Subprime Crisisvidovdan9852No ratings yet

- FI K204040181 - TranGiaHanDocument7 pagesFI K204040181 - TranGiaHanHân TrầnNo ratings yet

- Crisis FinancieraDocument4 pagesCrisis Financierahawk91No ratings yet

- SF Chronicle - Modified Mortgages - Lenders Talking, Then BalkingDocument5 pagesSF Chronicle - Modified Mortgages - Lenders Talking, Then BalkingTA WebsterNo ratings yet

- The Private Credit Golden Moment' - Financial TimesDocument12 pagesThe Private Credit Golden Moment' - Financial TimesMauricio HdzNo ratings yet

- Why Perpetual Bonds' Are Rocking Credit Markets - QuickTake - BloombergDocument4 pagesWhy Perpetual Bonds' Are Rocking Credit Markets - QuickTake - BloombergLow chee weiNo ratings yet

- Summary Chapter 8Document6 pagesSummary Chapter 8Zahidul AlamNo ratings yet

- Investment Banking CareerDocument5 pagesInvestment Banking CareerVikash BinaniNo ratings yet

- A Primer On Syndicated Term Loans PDFDocument4 pagesA Primer On Syndicated Term Loans PDFtrkhoa2002No ratings yet

- AssignmentDocument5 pagesAssignmentDao DuongNo ratings yet

- CIT Files BankruptcyDocument2 pagesCIT Files BankruptcyAdam HollierNo ratings yet

- Derivatives Case StudyDocument2 pagesDerivatives Case Studysw_rlkNo ratings yet

- Steven Glaze Presented How Home Improvement Can Ease Your Pain.Document34 pagesSteven Glaze Presented How Home Improvement Can Ease Your Pain.StevenGlazeKansasCityNo ratings yet

- Why Giants Like Lehman Brothers & Many More FailedDocument12 pagesWhy Giants Like Lehman Brothers & Many More Failedtarunsoni88No ratings yet

- Financial Innovation in The Mortgage MarketsDocument4 pagesFinancial Innovation in The Mortgage MarketsRonald Samuel GozaliNo ratings yet

- The Rise of The Originate-to-Distribute ModelDocument14 pagesThe Rise of The Originate-to-Distribute ModeloatsubscribedNo ratings yet

- Collateralized Debt Obligation (CDO) - 7Document3 pagesCollateralized Debt Obligation (CDO) - 7Aavish GuptaNo ratings yet

- SSRN-Stabilize Housing Market and All Will FollowDocument3 pagesSSRN-Stabilize Housing Market and All Will FollowMartin AndelmanNo ratings yet

- En The Credit CrisisDocument3 pagesEn The Credit CrisisDubstep ImtiyajNo ratings yet

- WSJ - Printing How Fed Intervention Saved CarnivalDocument4 pagesWSJ - Printing How Fed Intervention Saved Carnivaljudas_sNo ratings yet

- Break The Glass Plan For The US Treasury Dept. by Neel KashkariDocument10 pagesBreak The Glass Plan For The US Treasury Dept. by Neel KashkariBeerNo ratings yet

- A Reporter at Large: Eight Days, The Battle To Save The American Financial SystemDocument24 pagesA Reporter at Large: Eight Days, The Battle To Save The American Financial SystemBeer100% (1)

- Dynamic Econometric Loss ModelDocument46 pagesDynamic Econometric Loss ModelBeerNo ratings yet

- Grant's Interest Rate Observer Summer Issue (Free)Document24 pagesGrant's Interest Rate Observer Summer Issue (Free)hblodget100% (1)

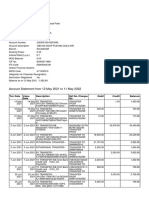

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMANISH VYASNo ratings yet

- Fees 2016 Francisco HomesDocument9 pagesFees 2016 Francisco HomesGolden SunriseNo ratings yet

- Bcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)Document1 pageBcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)Lei Anne GatdulaNo ratings yet

- Statement - 2022 01 19Document4 pagesStatement - 2022 01 19Emily RiceNo ratings yet

- Understanding Financial Statements 11th Edition Fraser Test BankDocument12 pagesUnderstanding Financial Statements 11th Edition Fraser Test BankKaylaCruzjcoma100% (13)

- Unit 3 - Final SFMDocument16 pagesUnit 3 - Final SFMFalguni ChaudhariNo ratings yet

- Math162 HW1 PDFDocument2 pagesMath162 HW1 PDFMarjolaine de la PeñaNo ratings yet

- Engineering Economy PDFDocument37 pagesEngineering Economy PDFSummer Wynn DacwagNo ratings yet

- Interim Report 2010Document38 pagesInterim Report 2010YennyNo ratings yet

- Cash Management ReportDocument118 pagesCash Management Reportkamdica85% (20)

- Central Bank of India: New Business GroupDocument7 pagesCentral Bank of India: New Business GroupAbhishek BoseNo ratings yet

- Trent - Q4FY22 Result - DAMDocument6 pagesTrent - Q4FY22 Result - DAMRajiv BharatiNo ratings yet

- Review of Operational Shipyards in Serbia: M.C.I. Shipyard, Novi BecejDocument3 pagesReview of Operational Shipyards in Serbia: M.C.I. Shipyard, Novi BecejDarko GrobarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Immanuel Suman ShijuNo ratings yet

- FLDGDocument6 pagesFLDGSaurabh MalooNo ratings yet

- XUIHq MJ Ev Yr BN VFuDocument7 pagesXUIHq MJ Ev Yr BN VFuAbhijit SahaNo ratings yet

- Label The Graph in Figure 1 With Respect To The Three Phases of The Business Cycle and The Cycle Turning PointsDocument5 pagesLabel The Graph in Figure 1 With Respect To The Three Phases of The Business Cycle and The Cycle Turning PointsBrown AbbeyNo ratings yet

- CUB - Account DetailsDocument1 pageCUB - Account DetailsAsim DasNo ratings yet

- Factoring and ForfaitingDocument3 pagesFactoring and ForfaitingSushant RathiNo ratings yet

- Chapter 3-Comparison and Selection Among AlternativesDocument35 pagesChapter 3-Comparison and Selection Among AlternativesSaeed KhawamNo ratings yet

- Stern Corporation Case SolutionDocument4 pagesStern Corporation Case SolutionAmanNo ratings yet

- Financial Appraisal Chapter 3Document36 pagesFinancial Appraisal Chapter 3mahlet tesfayeNo ratings yet

- T24 Islamic Banking - Commodity MurabahaDocument52 pagesT24 Islamic Banking - Commodity MurabahaSaif RehmanNo ratings yet

- Vanguard Long-Term Government Bond ETF 10+Document2 pagesVanguard Long-Term Government Bond ETF 10+Roberto PerezNo ratings yet

- FIN3212 - Individual Assignment - April 2019Document24 pagesFIN3212 - Individual Assignment - April 2019Amanda LimNo ratings yet

- Formule Corporate FinanceDocument6 pagesFormule Corporate FinanceБота Омарова100% (1)

- Report - 2021-05-20T125815.594Document1 pageReport - 2021-05-20T125815.594Faheem LatifNo ratings yet

- Challan Name CorrectionDocument1 pageChallan Name CorrectionZeeshan ShahNo ratings yet

Cma 051812

Cma 051812

Uploaded by

BeerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cma 051812

Cma 051812

Uploaded by

BeerCopyright:

Available Formats

See GRAPEVINE on Back Page

THE GRAPEVINE

MAY 18, 2012

12 REIT CREDIT RATINGS

14 LARGE LOANS IN SPECIAL SERVICING

3 Principal, Canada Pension Snag Mezz

3 CIBC, Blackstone Turn to JP Morgan

3 Capital One, JP Morgan Win Big Loan

4 JP Morgan to Back Ex-Lembi Rentals

6 Invesco Seeks Loan for Safeway Deal

6 Fund Shop Writes Chicago, NY Loans

7 Confab Focus: New Rules, Bad Debt

7 CRE Finance Council Names Offcers

8 Guggenheim Adds Four Executives

8 Eightfold Snags Another B-Piece

9 Capstone, KABR Scoop Up Sour Debt

10 Huntington Shops Fla. Apartment Debt

10 CBRE Inks Colo., Texas Freddie Loans

10 Blackstone Funds Mezz for Normandy

10 Beech Street Lines Up Fannie Loans

Cantor Fitzgerald hired Edward Petti

this week as a managing director on

its origination team in New York. Petti

previously was an executive director with

Ladder Capital, originating bridge loans

and mortgages for the New York frms

commercial MBS program. Hell work on

the same kinds of deals at Cantor, with a

focus on fxed-rate loans. He reports to

Anthony Orso, chief executive of Cantor

Commercial Real Estate. Petti had previ-

ous stints at Arbor Commercial Mortgage

of Uniondale, N.Y., and Credit Suisse.

Timothy Hallock joined Bancorp Bank

last week as a managing director of

CMBS Shops Eye Loan on GGPs Vegas Malls

General Growth Properties is on the prowl for $650 million of debt on two shop-

ping centers on the Las Vegas Strip.

Te collateral is the Grand Canal Shoppes at the Venetian and the Shoppes at

the Palazzo, which are connected by pedestrian walkways. Te properties, which

encompass 768,000 square feet, currently have separate loans.

Te early buzz is that the assignment is likely to end up in the securitization

market. While commercial MBS lenders have had difculty competing with life

companies recently for large loans on high-end malls, the size and the specifc

nature of the collateral make it more suitable for securitization platforms, lenders

said.

Te Chicago REIT, which is being advised by Eastdil Secured, prefers a mortgage

with a term of 5-7 years and will consider fxed- and foating-rate proposals.

Te 498,000-sf Grand Canal Shoppes is inside the Venetian casino. Te Venice-

themed mall has 80 shops and restaurants, but no anchor stores. Tenants include

See VEGAS on Page 8

Financial Jitters Send CMBS Spreads Wider

Volatile market conditions and other factors prompted commercial MBS buyers

to demand higher yields than expected on two multi-borrower oferings this week,

forcing new-issue spreads wider than they had been all year.

Te benchmark super-senior class of a $1.6 billion conduit issue by Jefferies

LoanCore, Goldman Sachs, Citigroup and Archetype Mortgage Capital was being

shopped yesterday at 130-135 bp over swaps. Tat was up from earlier price talk

of 120-125 bp and from the 120-bp issuance spread on equivalent 10-year bonds in

the previous multi-borrower issue, on April 24. By late yesterday, the dealers had

lined up buyers for about 70% of the $673.9 million tranche. Te transaction was

expected to price today.

A $933 million conduit ofering by Cantor Fitzgerald and Deutsche Bank is

expected to price soon afer the Jeferies deal, at similar spreads. Tat deals $409.2

See JITTERS on Page 11

Tishman to Buy SF Tower, Seeks Financing

Tishman Speyer has agreed to buy the ofce building at 650 California Street in

San Francisco and is shopping for $130 million of fnancing.

New York-based Tishman is acquiring the property from investment manager

AEW Capital of Boston. Lenders said the loan-to-value ratio on the proposed mort-

gage would be about 60%, indicating that the purchase price is roughly $220 mil-

lion.

Tishman is seeking a fxed-rate loan with a term of 7-10 years. Eastdil Secured,

which is brokering the sale for AEW, is also advising Tishman on the loan. It is

showing the assignment mainly to insurers and other portfolio lenders.

Te 492,000-square-foot building, between Kearny Street and Grant Avenue,

is regarded as one of San Franciscos top-tier ofce properties. Its occupancy rate

is 92%. Tenants include law frm Littler Mendelson (111,000 sf until 2016), Credit

Suisse (62,000 sf until 2020) and advertising agency Goodby Silverstein (51,000 sf

See TISHMAN on Page 8

Atlantic | Pacic Companies: Founder Alan Cohen, Executive Vice President Stanley Cohen, CFO Ken Cohen, CEO Howard Cohen

Commercial Real Estate

At Wells Fargo, we build strong relationships with commercial real estate companies like

Atlantic | Pacic Companies. A | P Companies purchases, develops, leases and manages

residential and commercial properties throughout the United States. Because we ofer

the full spectrum of commercial real estate services including lending, capital markets,

and advisory services weve been able to help Atlantic | Pacic Companies succeed

through all economic cycles. To learn how your real estate company can benet from

working with the largest and most experienced commercial real estate lender in the

industry, go to wellsfargo.com/realestate.

With you when

the strength of your relationship counts

Atlantic | Pacic Companies

Customer since: 2003

Services provided:

Construction and bridge nancing

GSE loan origination

Equity and mezzanine capital

Interest rate risk management

Treasury management

1

Wealth management

Insurance

2

2012 Wells Fargo and Company

1

Member FDIC.

2

Insurance products are ofered through non-bank insurance agency afliates of Wells Fargo & Company and are underwritten by unafliated insurance companies, with the exception

of crop and food insurance. Crop and food insurancemay beunderwrittenbyWells Fargo Insurance Services afliate,Rural Community Insurance Company. Banking and insurance

decisions are made independently and do not infuence each other. MC-4025

MC-4025 RE Alert_Atlantic_Pacific_WYW_ad_8x10.indd 1 4/11/12 11:45 AM

May 18, 2012

Commercial Mortgage

ALERT 3

Principal, Canada Pension Snag Mezz

Principal Real Estate and Canada Pension Plan have funded

$80 million of mezzanine debt on the Walden Galleria mall in

suburban Bufalo.

Te debt is the junior portion of a $350 million fnancing

package that J.P. Morgan arranged for the malls owner, Pyramid

Cos. of Syracuse, N.Y. Te bank is securitizing the senior $270

million portion via a stand-alone commercial MBS ofering

that is expected to price today (see article on Page 1).

Principal, an investment manager in Des Moines, Iowa, took

down $30 million of senior mezzanine debt. Toronto-based

Canada Pension, a defned-beneft plan that provides pension,

disability and survivor benefts to Canadian residents, funded

the $50 million junior mezzanine piece.

Te fxed-rate debt package, which closed on April 26, has a

10-year term. Te coupon on the senior portion is 4.88%. Te

mezzanine debt has a weighted average interest rate of 5.875%.

J.P. Morgans decision to securitize the senior portion in a

single-asset transaction took many in the market by surprise.

Te bank was expected to break the loan into pieces and include

them in two or more multi-borrower transactions.

Its unclear why the bank might have changed course. But

rival lenders said that if J.P. Morgan wrote the loan with the

expectation of securitizing it via multi-borrower transactions,

it may now take a hit. Tats because single-borrower paper

typically commands lower prices. Whats more, the size of the

senior portion is at the low end of the range at which single-

asset transactions are economical.

Te debt package is backed by 1.2 million square feet of the

1.6 million-sf mall, which is in Cheektowaga, N.Y. Te stores of

anchor tenants Macys and Lord & Taylor are separately owned

and arent part of the collateral. Te other anchors are Sears and

JC Penney. Te collateral space, which was appraised at $600

million, is 87.4% occupied. Te in-line space has average sales

of $580/sf.

Pyramid used $291 million of the J.P. Morgan loan to retire

a maturing debt package. Eurohypo securitized the senior $232

million portion via a $1.6 billion foating-rate deal in 2007 (J.P.

Morgan Chase Commercial Mortgage Securities Corp., 2007-

FL1).

Tis is the second time this year that Pyramid is tapping

Canada Pension for mezzanine fnancing. Earlier, the Cana-

dian institution provided the $145 million senior mezzanine

portion of a $420 million foating-rate debt package that J.P.

Morgan arranged on the Carousel Center/Destiny USA retail

complex in Syracuse.

CIBC, Blackstone Turn to JP Morgan

CIBC World Markets and Blackstone have tapped J.P. Morgan

to underwrite the securitization of $750 million of commercial

mortgages that they originated via a joint venture.

Blackstone will retain the junior classes of the long-

awaited securitization, which is expected to hit the market

in June.

CIBC and Blackstone formed the joint venture, called CIBX,

in late 2010. It was capitalized with $125 million of equity and

$625 million of debt. CIBC provided the debt in the form of a

warehouse line, while both frms kicked in equity. CIBC and

Blackstone are equal partners in managing the operation, but

loan underwriting is overseen by CIBC.

Te CIBC deal will be part of a busy June lineup of multi-

borrower oferings. Also on tap for that month are a $1.5 billion

deal by Deutsche Bank, Ladder Capital and Guggenheim Part-

ners, a $1.4 billion issue by Wells Fargo and RBS, a $1.3 billion

transaction by J.P. Morgan and a $1.4 billion ofering by UBS,

Barclays, Archetype Mortgage Capital and KeyBank.

Meanwhile, a $1 billion deal by Morgan Stanley and Bank of

America that was previously expected in June now is on track to

hit the market in July.

Capital One, JP Morgan Win Big Loan

Capital One and J.P. Morgan have agreed to provide about

$135 million of fnancing for Starwood Capitals pending pur-

chase of the leasehold interest in the ofce building at 1372

Broadway in Midtown Manhattan.

Te foating-rate loan is structured as $110 million of senior

debt and a $25 million mezzanine piece.

Te two banks will evenly divide the senior portion, which

has a three-year term and two one-year extension options. Te

junior debt will evidently be placed with one or more high-

yield investors.

Te duo beat out several other banks for the assignment,

including New York Community Bank, which was also a fnalist.

Starwood, a fund shop in Greenwich, Conn., is buying the

leasehold interest from a Lloyd Goldman partnership for about

$185 million. New York Life has agreed to purchase the ground

beneath the 572,000-square-foot building for an unspecifed

price. Starwood will sign a 99-year ground lease.

Te sellers partners include David Werner, another New

York investor. Te group acquired the building in 2008 from a

partnership between Wachovia and New York-based SL Green

for $294 million. Wachovia had bought its majority stake the

previous year in a deal that valued the building substantially

higher, at $335 million.

Te Goldman-Werner team presumably took the unusual

step of selling the ownership of the building and land sepa-

rately because that produced the highest price.

Te 21-story property is between West 37th and West 38th

Streets, fve blocks south of Times Square. It was fully reno-

vated in 1999 and is nearly fully leased.

Researching a Deal? Use Commercial Mortgage Alerts CMBS

Database to zero in on any issue backed by commercial and

multi-family properties. This powerful research tool complete

with pricing details on thousands of issues is FREE at CMAlert.

com if youre a subscriber to Commercial Mortgage Alert.

JP Morgan to Back Ex-Lembi Rentals

J.P. Morgan has agreed to write $105 million of long-term

loans for an investment group that is seeking to seize a portfo-

lio of San Francisco apartment properties owned by the Lembi

family, one of that citys biggest landlords.

Te borrower, a joint venture between local operator Veritas

Investments and an unidentifed institutional investor, would

use the proceeds to recapitalize the 437-unit portfolio. Te

Veritas team holds mezzanine debt on the properties and has

moved to foreclose. Last year, Veritas acquired a separate port-

folio that had been surrendered by the Lembis.

J.P. Morgan would write individual mortgages on the 14

properties via its commercial term lending program. Its

unclear if the bank plans to sell the loans to a federal mortgage

agency.

Te portfolio consists of garden-style complexes and mid-

rise properties. Among them is a 70-unit property at 645

Stockton Street in the Nob Hill district, across from the Ritz-

Carlton hotel, a 33-unit property at 2677 Larkin Street and a

35-unit property at 1340-1390 Taylor Street. Te portfolio was

82% occupied as of September 2011, according to the most-

recent data available in a servicer

report.

Te Lembi family lined up a

$103.3 million interest-only debt

package on the portfolio in 2007

from UBS. Te bank securitized

the senior $73.6 million piece

via a $3.6 billion pooled ofering

(LB-UBS Commercial Mortgage

Trust, 2007-C2). Te remaining

$29.7 million of the fve-year,

fxed-rate debt package was

structured as mezzanine debt.

Te Lembi family failed to pay

of the debt when it matured in

March. Te Veritas partnership,

which is being advised by Eastdil

Secured, will use some of the

proceeds from the J.P. Morgan

loan to retire the securitized

portion.

Last year, Veritas, which is

headed by Yat-Pang Au, acquired

eight San Francisco apartment

properties that the Lembi family

had surrendered in bankruptcy

proceedings. Veritas fnanced the

$55 million acquisition with a

$39 million fxed-rate loan from

Capital Source. Te properties,

with 346 total units, were in the

Nob Hill, Alamo Square, Upper

Market and Civic Center sub-

markets. HFF arranged that fve-

year loan.

May 18, 2012

Commercial Mortgage

ALERT 4

Subject to Auction Terms and Conditions. Auction.com, LLC, 1 Mauchly, Irvine, CA 92618 (800) 499-6199.

AUC024-04-104950-1

www.auction.com/commercial

The nations leading online

real estate marketplace.

UPCOMING OPPORTUNITIES

TO QUICKLY SELL YOUR

COMMERCIAL ASSETS.

Date Auction Assets Committed to Date

July 16 - 18 30+ States $300+ Million in Assets

July 23 - 25 Multi-Family $300+ Million in Assets

July 24 - 26 Hospitality $300+ Million in Assets

August 6 - 8 Ofce & Retail $350+ Million in Assets

August 13 - 15 35+ States $350+ Million in Assets

Hurry! Submission deadlines are quickly approaching.

Maximize your recoveries. Choose one of our

upcoming auctions, then contact us to be included.

For a complimentary portfolio evaluation,

contact Ken.Rivkin@auction.com.

Drill down deep into our market

statistics. Go to The Marketplace

section of CMAlert.com and

click on CMBS Market

Statistics, which lets you see the

data points behind all the charts

that Commercial Mortgage Alert

publishes each week. Its free.

Moving with confidence in the real estate capital markets.

Global Capital Markets

lnvestment So|es & Acqu|s|t|ons

Lqu|t,, ue5t & Structured l|nonce

Corporote l|nonce & lnvestment 8onk|ng

In 2007, Cushman & Wakefield joined forces

with Sonnenblick Goldman, a leader in real

estate financial services, to create

Cushman & Wakefield Sonnenblick Goldman.

Together we have offered clients a

coordinated global approach to making the

most informed investment and finance

decisions. Now five years later, with a

combined expertise spanning more than

200 years, Cushman & Wakefield

Sonnenblick Goldman will now be

known as...

Cushman & Wakefield

Lqu|t,, ue5t & Structured l|nonce

Invesco Seeks Loan for Safeway Deal

Invesco Real Estate is hunting for $100 million of debt to

fnance its acquisition of four shopping centers in California

and Hawaii.

Te investment shop acquired the properties for $198.8 mil-

lion in two stages in recent months from supermarket chain

Safeway, which leased back much of the space.

Invesco prefers a fxed-rate loan with a term of 7-10 years.

Te Dallas investment manager is pitching the lending assign-

ment solely to insurance companies via Eastdil Secured, which

also brokered the portfolio sale.

Te 283,000-square-foot portfolio, which attracted intense

interest from investors, was one of the highest-quality packages

of grocery-anchored shopping centers to hit the block in years.

Te properties, which were built or re-modeled in the past four

years, are 97.8% occupied.

Te anchor Safeway stores, which account for 80% of the

space, are top performers for the chain. Within three miles of

each center, the average population is 151,000 and the average

household income is $103,000.

Te Pleasanton, Calif., grocery chain signed a 20-year lease

on each store. Safeway operates 1,700 stores nationwide with a

combined $41 billion of sales.

Invesco acquired three of the properties in December for

$149.7 million:

Te 79,000-sf Safeway Kapahulu, at 888 Kapahulu Avenue

in Honolulu. Occupancy rate: 100%. Built: 2007.

Te 70,000-sf Safeway Burlingame, at 1450 Howard Avenue

in Burlingame, Calif. Occupancy rate: 92.8%. Built: 2011.

Te 65,000-sf Shamrock Plaza, at 7499 Dublin Boulevard

in Dublin, Calif. Occupancy rate: 100%. Built: 2001. Reno-

vated: 2007.

In March, Invesco closed on the $49.1 million acquisition of

the 70,000-sf Pavilions Marketplace in West Hollywood, Calif.

Tat property, at 8969 Santa Monica Boulevard, was built in

2009. Its occupancy rate is 98.3%. Te anchor is Pavilions, Safe-

ways upscale brand.

Fund Shop Writes Chicago, NY Loans

Prime Finance has originated two foating-rate mortgages

totaling $202 million on commercial properties in Chicago and

Midtown Manhattan.

Te New York fund shop closed both loans within the past

two weeks. Each has a three-year term and two one-year exten-

sion options.

Te larger loan, for $145 million, went to a joint venture

thats working to stabilize a mixed-use development in Chicago

called Roosevelt Collection. Te property has 342 luxury apart-

ments that are nearly fully occupied and 400,000 square feet

of retail space that is mostly vacant, plus a 1,500-space garage.

McCaffery Interests of Chicago and Los Angeles fund shop

Canyon Capital Realty took over the property in March 2011,

afer buying its $285 million debt package from Bank of Amer-

ica for $160 million, or 56 cents on the dollar. Te previous

owner, a partnership between fund shop Angelo, Gordon & Co.

of New York and Centrum Properties of Chicago, then surren-

dered the keys.

Te McCafery-Canyon partnership will use some of the

loan proceeds to reposition and lease up the retail space. Te

debt was arranged by HFF. Markets players previously said the

joint venture planned to pump in roughly $70 million of addi-

tional equity.

In New York, Prime wrote a $57 million mortgage to ref-

nance a 230-room hotel, Club Quarters Rockefeller Center, at

25 West 51st Street. Te borrower is Rockwood Capital, a New

York fund operator. Jones Lang LaSalle Hotels brokered the

fnancing. Te property includes the Terrace Club, a private

restaurant and networking club on the buildings seventh foor,

and ground-foor retail space.

Correction

A May 11 article, Morgan Stanley Syndicating Normandy

Floater, misidentifed the collateral for a $110 million senior

mortgage that Morgan Stanley originated for Normandy Real

Estate Partners. Te loan, which closed this week, is backed by

a 787,000-square-foot portfolio of ofce buildings in Northern

Virginia and Columbia, Md. It wasnt used to refnance a 1.1

million-sf portfolio of ofce and industrial buildings in Mas-

sachusetts and New Jersey that are owned by a Normandy part-

nership. (See article on Page 10.)

May 18, 2012

Commercial Mortgage

ALERT 6

NOTICE OF PUBLIC SALE OF COLLATERAL

Please take notice that 100% of the membership interests

in 2279-2283 Third Avenue Associates LLC, a New York limited

liability company (the "Owner) and all other "Collateral as defned

in that certain First Amended and Restated Ownership Interests

Pledge and Security Agreement (the Security Agreement), dated

April 3, 2009, by and between 2279-2283 Third Avenue Development

LLC (Debtor) and HSBC Capital (USA) Inc. on behalf of HSBC

Real Estate Mezzanine Partners USA, L.P. (Original Lender),

which Security Agreement and obligations secured thereby were

subsequently assigned to LCP-GC LLC (Secured Party) and all

proceeds of any of Collateral (all such assets, the Collateral) will

be offered for sale at a public auction by Secured Party as secured

party and sold to the highest Qualihed Bidder on June 7, 2012 at

10:00 a.m. at the ofces of Secured Party's counseI, Perkins

Coie LLP, 30 RockefeIIer PIaza, 25th FIoor, New York, New York,

10112.

This sale is held to enforce the rights of the Secured Party

under the Security Agreement. The Secured Party reserves the

right to reject all bids, modify the Terms and Conditions (defned

below) and terminate or adjourn the sale to another time, without

further publication.

Interested parties who would like additional information regarding

the Collateral and the terms and conditions of the Sale (the Terms

and Conditions) should visit the website www.perkinscoie.com/

thirdavenuedevelopmentsecuredpartysale (the Website). Secured

Party reserves the right to post additional terms and conditions to the

Website. For further information contact counsel for Secured Party,

Perkins Coie LLP, 30 Rockefeller Plaza, 25th Floor, New York, New

York, 10112, Attn: Gary F. Eisenberg, Esq., at 212-262-6902 or by

email at geisenberg@perkinscoie.com.

Confab Focus: New Rules, Bad Debt

Regulatory issues and strategies for dealing with distressed

debt will take center stage next month when about 1,000 real

estate fnance professionals converge on the nations capital.

About 650 market participants have already signed up for

the CRE Finance Councils midyear conference, to be held June

11-13 at the JW Marriott Hotel in Washington. Tat puts atten-

dance on track to meet or exceed last years tally of 1,010.

Te annual confab has traditionally been held in New York.

Te change in venue refects the major role in fnance that the

federal government has played since the credit crunch. Te

councils other big annual conference, held in January, returned

to its longtime home in Miami Beach this year afer being held

in Washington in 2010 and 2011.

Next months event will enable attendees to interact with

regulators, who have been invited to attend for free, said

Stephen Renna, the trade groups chief executive. Among the

speakers will be bank regulator Thomas Curry, who was sworn

in last month as Comptroller of the Currency.

While the commercial-mortgage industry faces a wave of

legislative and regulatory reforms, the issue

of top concern is risk-retention require-

ments for securitizations mandated by the

Dodd-Frank Act. More than a year ago,

the comptrollers ofce and fve other fed-

eral regulators unveiled a detailed plan

for implementing those requirements, but

received strong pushback from the indus-

try during the public-comment period. Te

agencies have repeatedly indicated theyd

like to fnalize the rules this year and have

them take efect for commercial MBS two

years later. But many mortgage pros are urg-

ing amendments and another round of pub-

lic comment.

Te lending outlooks for both CMBS pro-

grams and portfolio shops is likely to domi-

nate panel discussions and cocktail-party

chatter. Tere also fgures to be a heightened

focus on investments in distressed commer-

cial mortgages, including workout strategies,

said Renna, who noted that recent council-

sponsored events on distressed debt drew

strong turnouts in New York and Santa Mon-

ica, Calif.

Afer the credit crunch took hold four

years ago, scores of high-yield investors

raised capital to scoop up bad loans at steep

discounts. But many banks and other lenders

refused to dump loans at fre-sale prices, in

some cases because they didnt have enough

capital to absorb the losses. Now, a lot of

the banks balance sheets have improved,

Renna said. Teyre seeing what loans have

recovered and what have not. Tat, in turn,

is leading to better workouts and more clarity in strategy, he

added. Tats what everybody has been waiting for, and they

want to talk about it.

Meanwhile, the council has revised its conference agenda

this year as part of its ongoing efort to broaden its appeal to

all types of real estate fnance pros, not just those involved with

securitization. Instead of holding a single series of panel dis-

cussions, sometimes there will be two running concurrently,

with no more than one focusing on CMBS-related issues.

One session will focus on the global impact of the European

debt crisis, as well as its efect on the U.S. commercial real estate

market. Another will feature a panel of senior managers from

the CMBS groups at all six rating agencies that grade deals in

the sector. Teyve been of the stage for a while, Renna said,

referring to previous conferences. Its time for stress-testing

the rating agencies.

Te conference admission fees match those for the January

gathering in Miami: $1,350 for council members and $1,950

for non-members until June 1. Afer that, the fee to register

at the door will be $1,450 for members and $2,150 for non-

members.

May 18, 2012

Commercial Mortgage

ALERT 7

CRE Finance Council Names Offcers

Te CRE Finance Council has lined up its ofcers for the next year.

Te trade groups board of governors has chosen Keith Gollenberg of

Oaktree Capital as its next president-elect. In June 2013, he will succeed

Citigroups Paul Vanderslice, who begins a one-year term as president next

month.

Te board has appointed three other industry veterans to one-year terms

as ofcers on its executive committee, and re-appointed two others. Tey

and Gollenberg will take their posts during the organizations annual mid-

year conference, June 11-13 at the JW Marriott Hotel in Washington.

Gollenberg is a managing director on Oaktrees commercial real estate invest-

ment team in New York. He will join Vanderslice, Citis co-head of commercial

MBS in the U.S., and outgoing president Jack Cohen, chief executive of Cohen

Financial, as leaders of the trade groups 11-member executive committee.

Te new vice president will be Tim Gallagher, a managing director at

Morgan Stanley who oversees trading of commercial real estate debt. Hell

replace Warren Friend, a managing director at BlackRocks risk advisory arm,

BlackRock Solutions.

Te other incoming executive ofcers are secretary Kathleen Olin, a vice

president at CWCapital in Washington, and policy-committee chairman John

DAmico, the former general counsel of servicer Centerline Capital.

Te returning ofcers are treasurer Dan Bober, an executive vice president in

the commercial-mortgage servicing area at Wells Fargo, and membership chair-

man Brian Olasov, a managing director at law frm McKenna Long in Atlanta.

Gollenberg, Gallagher and Olin will join the executive committee when

they take ofce next month. DAmico has served the last year as an at-large

member. Vanderslice will soon appoint three at-large members to be ratifed

by the board of governors.

Te executive committee advises the councils governing board, which

consists of about 60 members and meets four times a year. Te councils

full-time chief executive, Stephen Renna, works closely with the committee.

Guggenheim Adds Four Executives

Guggenheim Partners recruited four stafers this month for

its real estate fnance team, which is led by Rob Brennan.

Ted King will start next week in the Atlanta ofce as a

managing director. He will oversee servicing and asset

management for Guggenheim Commercial Real Estate Finance

and for Pillar Multifamily, the Fannie Mae lending shop that

Guggenheim controls. King was previously a director at

ING Investment Management. At Guggenheim, he reports to

Michelle Paretti, chief operating ofcer of the real estate fnance

group.

Meanwhile, two originators have joined the group in New

York. John Barker started this week and Jonathan Greenhouse

came aboard last week as managing directors, responsible for

originating and sourcing commercial real estate loans for Gug-

genheims portfolio, for its clients and for securitization. Tey

report to origination co-heads Rob Russell and Kieran Quinn.

Barker was previously a director at Arbor Commercial Mort-

gage, and Greenhouse was an executive director at CIBC World

Markets.

Shawn Conover joined two weeks ago as a vice president for

loan underwriting. He was previously a vice president at Fund

Core Finance.

Eightfold Snags Another B-Piece

Eightfold Real Estate Capital has circled its second B-piece.

Te Miami frm, launched this year by a handful of former

LNR Property executives, has agreed to buy the subordinate

classes of a $1.5 billion commercial MBS deal that Deutsche

Bank, Ladder Capital and Guggenheim Partners are expected to

launch in June.

Eightfold previously circled the junior classes of a $932.8

million ofering by Deutsche and Cantor Fitzgerald. Tat trans-

action was on track to price this week.

Eightfold, backed by Boston hedge fund operator Abrams

Capital, also invests in B-notes and mezzanine debt, and pro-

vides rescue capital to distressed borrowers.

Vegas ... From Page 1

Sephora, Wolfgang Pucks Postrio Bar & Grill and Madame Tus-

sauds Wax Museum. Te mall had $50 million of net operating

income last year, up from $46.6 million in 2010.

Te Grand Canal Shoppes currently has a $368.1 million

mortgage that Goldman Sachs originated in 2004 and secu-

ritized via two pooled transactions (GS Mortgage Securities

Corp. II, 2004-GG2, and Greenwich Capital Commercial Fund-

ing Corp., 2005-GG3). Te 4.78% loan, which had an original

balance of $427 million, was scheduled to mature in 2009, but

the term was extended to 2014 as part of General Growths 2009

bankruptcy.

Te 270,000-sf Shoppes at the Palazzo, which is next to the

Palazzo Las Vegas casino, is 97.9% occupied. It is more akin to

a traditional department store-anchored retail center. Barneys

New York has an 85,000-sf store that isnt part of the collateral.

Te Palazzo mall contains a number of ultra-high-end retail-

ers, including Chloe, Christian Louboutin, Diane von Fursten-

burg, Fendi and Michael Kors.

Shoppes at the Palazzo carries $241.3 million of debt that

matures in 2017. A bank syndicate consisting of Bank of Amer-

ica, Citigroup, Deutsche Bank, Goldman and Wachovia provided

that foating-rate loan, pegged to Libor plus 300 bp, in 2007.

Market players said a couple of factors make the package

more suitable for a CMBS lender than for an insurer. For one

thing, the Grand Canal Shoppes doesnt ft the mold of a retail

property typically pursued by life companies: a large regional

center with well-defned anchor stores. Whats more, risk-

averse insurers remain wary of Nevadas economy, which was

battered by the fnancial crisis. Vegas, as far as its strength as

a market, is still kind of questionable, said one executive with

an insurance company.

As of yearend, General Growth was carrying Grand Canal

at a $765.7 million valuation, and the Palazzo mall at $289.8

million.

Just two weeks ago, Goldman securitized a $1.4 billion

fxed-rate mortgage on another General Growth property, the

Ala Moana mall in Honolulu.

Tishman ... From Page 1

until 2017). Leases on 50% of the space roll over by 2016.

Tat was pitched as a plus for potential bidders because rising

demand for ofce space in the city should provide the opportu-

nity to raise rents as leases expire.

AEW bought the 33-story building in 2007 from Arizona

developer William S. Levine on behalf of a client that was

believed to be a UBS afliate. It acquired the building at the top

of the market, paying around $300 million.

Te Financial District property, previously known as the

Hartford Building, was the tallest structure in California when

Hartford Insurance developed it in 1964 as its West Coast head-

quarters.

May 18, 2012

Commercial Mortgage

ALERT 8

Top Loan Contributors to CMBS Deals

Top CMBS Underwriters

Mortgage-Conduit Operators

Top Law Firms in CMBS

Top Mortgage Servicers

And many more industry rankings

View them all for FREE in The Marketplace section

of www.CMAlert.com.

Identify the Leaders

In Your Business

Capstone, KABR Scoop Up Sour Debt

Two New Jersey frms that make opportunistic investments

in commercial real estate closed this month on their ffh joint

purchase of distressed debt.

Capstone Realty and KABR Real Estate Investment paid spe-

cial servicer LNR Partners just under 40 cents on the dollar for

the $19.1 million defaulted mortgage on a Long Island ofce

property. Te frms have now co-purchased about $85 million of

distressed debt over the last two years, targeting deals that allow

them to take control of suburban New York ofce buildings.

Te Long Island property consists of two ofce buildings at

330-350 Motor Parkway in Hauppauge, N.Y., that total 131,000

square feet, plus a pad site thats leased to a Wendys restaurant.

Te buildings are 65% occupied. Eurohypo originated the 10-year

loan to CLK Properties of Woodbury, N.Y., in 2006 and securi-

tized it in a $4.9 billion pooled ofering (J.P. Morgan Chase Com-

mercial Mortgage Securities Trust, 2006-LDP9). Payments were

long past due, and LNR had begun foreclosure proceedings. It

sold the loan via its Auction.com afliate.

Also within the past couple of weeks, the Capstone-KABR

team accepted the deed in lieu of foreclosure on a 98,000-sf

ofce building in Valhalla, N.Y. Tey paid GE Capital roughly

$7 million about six weeks ago for a $13.6 million distressed

loan on the Westchester County property. GE had originated

the loan in 2008, with an initial balance of $16.5 million, for

Abbey Road Advisors of Westport, Conn., and Guardian Life to

acquire the property. Te three-story building, at 465 Colum-

bus Avenue, is 66% occupied. Te New York City Department

of Environmental Protection, which owns the nearby Kensico

Reservoir, leases about half the space until 2024.

Te 50-50 joint venture between Capstone, of Englewood,

N.J., and KABR, of Ridgefeld Park, N.J., targets both debt

and equity investments. It seeks out distressed debt with an

eye toward persuading the borrower to hand over the deed

which sometimes happens quickly, as in the Valhalla case. If a

borrower resists, the team will seek to seize its property. Afer

taking over, the frms typically make substantial improvements

before considering a sale.

Capstone was founded in 1997 by co-managing partner

Mitchell Adelstein, who previously spent 10 years as a man-

aging director of Ernst & Young. Te company is backed by

wealthy individuals and institutional investors. Te other prin-

cipals are co-managing partner Robert Friedberg and partner

Brad Gillman. Since late 2008, the frm has bought $100 million

of defaulted commercial mortgages.

KABR, which was formed in 2008, is led by stock-market

veteran Kenneth Pasternak, Laurence Rappaport and Adam

Altman. Tose three partners contributed about half of the

$90 million of equity thats split evenly between the frms two

funds, which target opportunistic and value-added investments

in underperforming and distressed ofce, retail and multi-

family properties in the New York metropolitan area and South

Florida. With leverage, KABR now has about $200 million of

real estate assets under management.

May 18, 2012

Commercial Mortgage

ALERT 9

NOTICE OF PUBLIC SALE OF COLLATERAL

Please take notice that all of the equity interests

owned by Michael F. Waldman (Pledgor) in:

1. St. Georges Crescent LLC, a New York limited

liability company;

2. Paris LIC Realty LLC, a New York limited liability

company;

3. 69 E. 130th L.L.C., a New York limited liability

company;

4. 345 Greenwich Street, LLC, a New York limited

liability company;

5. 2002 Fifth Avenue LLC, a New York limited

liability company;

6. Idaho Associates LLC, a New York limited liability

company;

7. 54 Barrow Realty, LLC, a New York limited liability

company;

8. Mawash Realty Corp., a New York limited liability

company (Pledgors ownership of this Collateral

is disputed by Walter Sakow in pending litigation);

and all other "Collateral as defned in those certain

Ownership Interests Pledge and Security Agreements

(the Security Agreements), each dated April 3, 2009,

each by and between Pledgor and HSBC Capital (USA)

Inc. on behalf of HSBC Real Estate Mezzanine Partners

USA, L.P. (Original Lender),which Security Agreements

and obligations secured thereby were subsequently

assigned to LCP-GC LLC (Secured Party) and all

proceeds of any of Collateral (all such assets, the

Collateral) will be offered for sale at a public auction by

Secured Party as secured party and sold to the highest

Qualihed Bidder on June 7, 2012 at 10:00 a.m. at the

ofces of Secured Party's counseI, Perkins Coie LLP,

30 RockefeIIer PIaza, 25th FIoor, New York, New York,

10112. The CoIIateraI with respect to each of the

above entities does not constitute aII of the equity

interests in certain entities; for further information,

pIease consuIt the Website (dened beIow).

This sale is held to enforce the rights of the Secured

Party under the Security Agreements. The Secured Party

reserves the right to reject all bids, modify the Terms and

Conditions (defned below) and terminate or adjourn the

sale to another time, without further publication.

Interested parties who would like additional

information regarding the Collateral and the terms and

conditions of the Sale (the Terms and Conditions)

should visit the website www.perkinscoie.com/

waldmanthirdavenuedevelopmentsecuredpartysale

(the Website). Secured Party reserves the right to

post additional terms and conditions to the Website.

For further information contact counsel for Secured

Party, Perkins Coie LLP, 30 Rockefeller Plaza, 25th

Floor, New York, New York, 10112, Attn: Gary F.

Eisenberg, Esq., at 212-262-6902 or by email at

geisenberg@perkinscoie.com.

Huntington Shops Fla. Apartment Debt

Huntington National Bank is trying to sell its majority stake

in a defaulted $41.5 million construction loan on a luxury

apartment complex in Tampa.

Te Cleveland bank holds $27.7 million of the syndicated

debt, which fnanced development of the 250-unit Casa Bella

on Westshore, a planned condominium complex that was

switched to rentals. Te nonperforming loan matured in

December and a forbearance agreement expired April 1.

Huntington is marketing its share of the loan via DebtX.

First-round bids are due May 24. Te loans terms stipulate that

only commercial banks with at least $500 million of assets are

eligible to take over Huntingtons position.

Fifth Third Bank, also of Cleveland, holds the other $13.8

million slice of the debt. Fifh Tird originated the interest-

only loan in 2006, retaining a third of it and splitting the rest

between Huntington and Sky Bank of North Olmsted, Ohio.

Huntington doubled its share when it took over Sky in 2007.

Te property is 96% occupied and was appraised at $47.5

million in February. It consists of three Mediterranean-style

buildings at 6601 South Westshore Boulevard, about eight

miles southwest of downtown Tampa.

Plans to sell the units as condos were abandoned when the

market collapsed, and Casa Bella opened in 2008 as a rental

apartment complex. Te switch contributed to a legal dispute

between the borrowers and Fifh Tird that was settled under

undisclosed terms three years ago.

CBRE Inks Colo., Texas Freddie Loans

CBRE Capital Markets has originated about $65 million of

Freddie Mac loans to fnance the acquisitions of two apartment

complexes, in Colorado and Texas.

Te 10-year, foating-rate loans were closed and funded

about two weeks ago.

Te larger is a $40.5 million mortgage on the 356-unit Lodge

at Castle Pines in Castle Pines, Colo. Advenir, an Aventura, Fla.,

investment shop, bought the complex for $50.9 million, giv-

ing the mortgage a loan-to-value ratio of about 79%. Te note,

priced at 197 bp over Treasurys, is interest-only for the frst two

years, then amortizes on a 30-year schedule. Lodge at Castle

Pines was built in 2002 at 520 Dale Court, near Interstate 25

about 20 miles south of Denver. Te 28-acre complex has a

24-hour ftness center, a swimming pool and spa, a clubhouse

and a business center.

Te second loan, for $24.2 million, is backed by the 246-

unit Legacy Point in Arlington, Texas. Momentum Real Estate

Partners of Miami bought the apartment property from Connor

Group of Centerville, Ohio. Te terms of the sale were unavail-

able. Te mortgage carries a rate of 201 bp over Treasurys and

is interest-only for four years before amortizing on a 30-year

schedule. Legacy Point is at 1901 Northeast Green Oaks Bou-

levard, about midway between Dallas and Forth Worth. It was

built in 1995. Amenities include a pool, ftness center and club-

house.

Blackstone Funds Mezz for Normandy

Blackstone has originated a $30 million foating-rate mez-

zanine loan for Normandy Real Estate on a Mid-Atlantic ofce

portfolio.

Te debt is subordinate to a $110 million foating-rate loan

that Morgan Stanley closed this week. Te bank plans to syndi-

cate the entire senior loan.

Normandy, of Morristown, N.J., acquired the 787,000-square-

foot portfolio in late 2006 from the U.S. Army/Air Force Mutual

Aid Association for $157 million. Te portfolio, which is 93%

occupied, encompasses nine buildings in Northern Virginia

and one in Columbia, Md. Te largest property is the 214,000-

sf Stoneleigh 1&2 complex in Chantilly, Va.

Normandy, which was advised by Cassidy Turley, used the

proceeds from the Morgan Stanley and Blackstone loans to help

retire a $144.6 million foating-rate loan that Morgan Stanley

arranged in 2007. Morgan Stanley securitized the senior $85

million portion via a $1.4 billion pooled deal (Morgan Stan-

ley Capital I Inc., 2007-XLF). Te remaining $59.6 million was

structured as mezzanine debt. Blackstone held a portion of that

mezzanine debt when it funded the new loan.

Beech Street Lines Up Fannie Loans

Beech Street Capital has agreed to originate $68 million of

Fannie Mae loans over the next several months to refnance

four apartment complexes in the Philadelphia area.

Te properties, two in Pennsylvania and two in Delaware,

are owned by Galman Group of Philadelphia, which will use the

fxed-rate mortgages to retire existing debt on the 1,106-unit

portfolio. Te four current loans can be prepaid without pen-

alty at various dates over the next several months. Te Fannie

mortgages will be funded as the existing notes reach their pre-

payment dates.

Te agreement with Beech Street allows Galman to lock in

interest rates now while avoiding prepayment penalties.

Te properties are:

Te 634-unit Castlebrook Apartments, on 38 acres at 550

South Dupont Parkway in New Castle, Del.

Te 378-unit Buckingham Place complex, at 25 Windsor

Circle in Newark, Del.

Te 101-unit North Lane Apartments, at 102-110 West

North Lane in Conshohocken, Pa.

Te 93-unit Sedgwick Station, at 303 East Mount Pleasant

Avenue in the Mount Airy section of Philadelphia.

May 18, 2012

Commercial Mortgage

ALERT 10

Unless your company holds a multi-user license, it is a violation of

U.S. copyright law to photocopy or reproduce any part of this

publication, or forward it electronically, without first obtaining

permission from Commercial Mortgage Alert. For details about

licenses, contact JoAnn Tassie at 201-234-3980 or

jtassie@hspnews.com.

Jitters ... From Page 1

million class of benchmark paper was being marketed yester-

day at 130 bp.

Meanwhile, J.P. Morgan is expected today to price a $270 mil-

lion securitization of a 10-year loan on 1.2 million square feet of

the 1.6 million-sf Walden Galleria mall in suburban Bufalo. Te

single-asset deals $217.5 million of 9.5-year bonds, rated triple-

A by S&P, Morningstar and Kroll, were being marketed with an

anticipated spread of 140-145 bp. Te price talk on the rest of

the bonds, which have 9.9-year terms, was 190-bp area on the

double-As and 220-bp area on the notes rated A/A/A+.

Te fxed-rate ofering is backed by the senior portion of a

$350 million loan that J.P. Morgan arranged for Pyramid Cos.

of Syracuse, N.Y. Te loan-to-value ratio is 45% on the senior

mortgage and 58% on the overall debt, including $80 million of

mezzanine debt placed with Principal Real Estate and Canada

Pension Plan (see article on Page 3).

Renewed buy-side concerns about the escalating debt crisis

in Europe are mostly to blame for the recent spread-widening

on the conduit issues, which are the CMBS markets main type

of transaction. It didnt help that yields on 10-year benchmark

swaps have dropped 25 bp since the previous transaction, a

$1.4 billion ofering by UBS, Barclays and Archetype.

Investors are pushing back on the absolute yield because

swaps have rallied so much, one CMBS trader said. Te other

thing is, the world is really shaky out there.

Te recent spread-widening may cut into lender profts as

CMBS issuers including some of those in the market this

week prepare to foat an additional $5 billion of multi-bor-

rower issues by the end of June. Many of the commercial mort-

gages slated for deals in the near-term pipeline were written

early this year, when new-issue spreads were still tightening.

Spreads at issuance for benchmark super-seniors contracted

from 130-150 bp over swaps in December to 120 bp in late Jan-

uary, when Goldman, Citi and Archetype priced the frst CMBS

ofering of the year (GS Mortgage Securities Trust, 2012-GC6).

By early March, those spreads had tightened to 105 bp, their

lowest levels in over a year. But they started rising again last

month amid renewed fnancial-market turmoil.

Meanwhile, the Federal Reserve Bank of New York is prepar-

ing to sell another large batch of commercial real estate CDO

paper in the secondary market. BlackRock is running the auc-

tion Tuesday for Maiden Lane 3, one of two vehicles created

by the Fed to support the 2008 government bailout of AIG. Te

ofering consists of six senior classes of bonds, with outstand-

ing balances totaling $688.4 million, from a $2 billion issue

that Boston money manager Putnam Advisory foated via two

installments 10 years ago (Putnam Structured Product CDO

Ltd., 2002-1). CMBS makes up more than 60% of the collateral.

Te rest is a mix of residential mortgage bonds, asset-backed

securities and other CDOs. Te CDO paper being ofered for

sale, now rated Ba1 by Moodys, could fetch bids of 85-89

cents on the dollar.

May 18, 2012

Commercial Mortgage

ALERT 11

In the know?

Commercial Mortgage Alert, the weekly

newsletter that guarantees your edge in

real estate finance and securitization.

Start your free trial at CMAlert.com or call 201-659-1700.

May 18, 2012

Commercial Mortgage

ALERT 12

REIT Credit Ratings for Senior Unsecured Debt

Offce Moodys S&P Fitch

Liberty Property Baa1 BBB BBB+

Boston Properties Baa2 A- BBB

PS Business Parks Baa2 BBB+

Digital Realty Baa2 BBB BBB

Mack-Cali Realty Baa2 BBB BBB

Piedmont Offce Realty Baa2 BBB

Vornado Realty Baa2 BBB BBB

Alexandria Real Estate Baa2 BBB-

BioMed Realty Baa3 BBB-

Brookfeld Offce Properties Baa2 BBB-

CommonWealth REIT Baa2 BBB-

Duke Realty Baa2 BBB- BBB-

Highwoods Properties Baa3 BBB- BBB-

Kilroy Realty Baa3 BBB-

Wells REIT Baa3 BBB-

Brandywine Realty Baa3 BBB- BB+

Government Properties Income Baa3 BBB-

American Realty Capital Ba2 B+

SL Green Ba1 BBB- BB+

DuPont Fabros Technology Ba1 BB

Retail

Simon Property A3 A- A-

Federal Realty Investment Baa1 BBB+ A-

Kimco Realty Baa1 BBB+ BBB+

Realty Income Baa1 BBB BBB+

National Retail Properties Baa2 BBB BBB

Regency Centers Baa2 BBB BBB

Tanger Factory Outlet Centers Baa2 BBB

Weingarten Realty Baa2 BBB

Equity One Baa3 BBB-

First Capital Realty Baa3

Entertainment Properties Baa3 BB+ BBB-

DDR Baa3 BB+ BB+

General Growth Properties BB+

Glimcher Realty Ba3 B-

Brixmor Caa1 B BB-

Multi-Family

AvalonBay Communities Baa1 BBB+

Equity Residential Properties Baa1 BBB+ BBB+

Camden Property Baa1 BBB BBB

BRE Properties Baa2 BBB BBB

Essex Property Baa2 BBB BBB

UDR Baa2 BBB

Home Properties BBB

Mid-America Apartment Communities BBB

American Campus Communities Baa3 BBB-

Post Properties Baa3 BBB-

Colonial Properties Ba1 BBB- BB+

Apartment Investment & Management Ba1 BB+

Associated Estates Realty Ba1 BB- BB+

Healthcare Moodys S&P Fitch

HCP Baa2 BBB BBB+

Ventas Baa2 BBB BBB+

Health Care REIT Baa2 BBB- BBB

Healthcare Realty Baa3 BBB- BBB-

Healthcare Trust of America Baa3 BBB-

Senior Housing Properties Baa3 BBB-

Medical Properties Ba1 BB

Omega Healthcare Investors Ba2 BBB-

Sabra Health B1 BB-

Aviv REIT B1 B+

Extendicare Real Estate Investment B1

Hotel

Hospitality Properties Baa2 BBB-

Host Hotels & Resorts Ba1 BB

FelCor Lodging B3

Industrial

Eastgroup Properties BBB

ProLogis Baa2 BBB- BBB-

First Industrial Realty Ba3 BB- BB

Self Storage

Public Storage A3 A A

CubeSmart Baa3 BBB-

Sovran Self Storage BBB- BBB-

Diversifed

Washington Real Estate Investment Baa1 BBB+

Prime Property Fund Baa2 A-

LNR Property Ba2 BB-

Forest City B3 B-

Other

American Tower Baa3 BB+ BBB-

Corrections Corp. of America Ba1 BB BB+

Capital Automotive Ba3 B+

CNL Lifestyle Ba3 B+

GEO Group B1 B+

iStar Financial Caa1 B+ B-

Spirit Finance Caa1 CCC+

Notes: In some cases, REITs issue securities through operating

partnerships. Some of the above ratings are prospective, so securities

may not have been issued.

Dear Subscriber:

A number of Commercial Mortgage Alert readers, who are concerned

about violating copyright law, have been asking about the terms of our

Multi-User Licenses.

Heres how they work: Licenses cater to companies that require wide

distribution of the newsletter. For an annual fee, a company is

authorized to make enough copies of each issue to accommodate a

specific group of employees. To assist you in distributing the newsletter,

we can send each weeks issue directly to any employees you specify.

You choose the method of delivery: e-mail or postal.

Such arrangements have become popular ways for corporate subscribers to

comply with U.S. copyright laws.

From our standpoint, theres nothing wrong with occasionally copying a page

or two from our newsletter to pass along to an associate. In addition, we are

happy to authorize a subscriber to reproduce at no extra charge any of

our articles or tables for a report or some other type of presentation. And if a

subscriber is preparing for a conference or some other type of meeting, were

glad to provide free copies of the newsletter for attendees.

Whats unacceptable is the routine reproduction or electronic forwarding

of our newsletters for use by others without first obtaining a license.

This is a blatant, actionable violation of our copyright. We routinely

monitor forwarding of the publication by employing email-tracking

technology such as ReadNotify.com.

Feel free to call me at 201-234-3960 if youd like additional information

about Multi-User Licenses.

Sincerely,

Andrew Albert

Publisher

5 Marine View Plaza, Suite 400

Hoboken NJ 07030-5795

201-659-1700

FAX: 201-659-4141

May 18, 2012

Commercial Mortgage

ALERT 14

Large Loans Recently Transferred to Special Servicing

Current Sent to

Balance Loan Maturity Special

($Mil.) Type Date Date Servicer Status Securitization

Franklin Mills, Philadelphia (Retail) $290.0 Fixed 5/4/07 6/1/17 4/16/12 Current Various

Marley Station, Glen Burnie, Md. (Retail) 114.4 Fixed 6/9/05 7/1/12 4/20/12 Current BACM 05-3

Regency Square Mall, Jacksonville 86.2 Fixed 6/13/03 7/15/15 4/27/12 Current Various

Boulder Green offce & industrial portfolio 62.0 Fixed 4/4/07 5/1/12 5/2/12 Matured, nonperf. CMLT 08-LS1

Thanksgiving Tower, Dallas (Offce) 58.5 Floating 2/20/07 6/15/12 4/18/12 Matured, perf. BSCMS 07-BBA8

Southside Works, Pittsburgh (Mixed-use) 49.6 Fixed 1/4/07 2/1/17 4/13/12 30-59 days late JPMCC 07-CIBC18

Crowne Plaza Metro, Chicago (Hotel) 48.4 Fixed 5/17/07 6/1/12 5/1/12 Current JPMCC 07-CIBC19

6303 Barfeld Road, Atlanta (Offce) 41.1 Fixed 4/13/05 5/1/13 4/6/12 Current JPMCC 050CIBC12

Corporate Center, Ft. Lauderdale, Fla. (Offce) 39.5 Fixed 3/10/06 4/6/16 4/16/12 90+ days late GCCFC 06-GG7

Almaden Financial Plaza, San Jose (Offce) 37.0 Floating 4/27/07 6/15/12 5/9/12 Matured, perf. LBFRC 07-LLF C5

IPC New York offce portfolio 34.0 Fixed 5/31/05 6/1/15 4/4/12 30-59 days late BACM 05-3

Park Hyatt Beaver Creek, Avon, Colo. (Hotel) 31.6 Floating 5/24/07 6/15/12 4/12/12 Current LBFRC 07-LLF C5

TownePlace Suites Colorado portfolio (Hotel) 30.5 Floating 5/7/07 5/7/12 5/8/12 Matured, nonperf. BALL 07-BMB1

1020 Holcombe Boulevard, Houston (Offce) 28.9 Fixed 11/1/02 11/1/12 4/30/12 Current BACM 03-1

Flushing Landmark, Flushing, N.Y. (Offce) 28.9 Fixed 7/20/06 6/1/16 5/2/12 60-89 days late BACM 06-4

Tamarac Plaza, Denver (Offce) 27.4 Fixed 7/27/04 8/10/12 5/2/12 Current GSMS 04-GG2

Research Park Plaza, Austin, Texas (Offce) 23.6 Floating 6/1/07 6/15/12 4/12/12 Current LBFRC 07-LLF C5

Parkview Village, Long Beach, Calif. (Mixed-use) 23.4 Fixed 5/15/07 6/8/17 4/18/12 Current MLCFC 07-7

Landmark Offce Center, Indianapolis (Offce) 23.2 Fixed 10/2/07 11/1/17 4/27/12 Current JPMCC 07-C1

Tempe Commerce, Tempe, Ariz. (Offce) 22.8 Fixed 4/20/07 5/6/14 5/4/12 Current GSMS 07-GG10

Source: Trepp

xxx

Commercial Mortgage

ALERT 1

MARKET MONITOR

CMBS SPREADS

10YR, AAA SPREAD OVER SWAPS CMBS SPREADS OVER SWAPS

WORLDWIDE CMBS

LOAN SPREADS CMBS TOTAL RETURNS

ASKING SPREADS OVER TREASURYS ASKING OFFICE SPREADS CMBS INDEX

REIT BOND ISSUANCE

UNSECURED NOTES, MTNs, ($Bil.) MONTHLY ISSUANCE ($Bil.) SPREADS

Data points for all charts can be found in The Marketplace section of CMAlert.com

0

100

200

300

400

5/11 6/11 7/11 8/11 9/11 10/11 11/11 12/11 1/12 2/12 3/12 4/12 5/12

Source: Trepp

US MONTHLY ISSUANCE ($Bil.)

0

1

2

3

4

5

6

7

M A M J J A S O N D J F M A M

0

1,000

2,000

3,000

4,000

5,000

6,000

AAA AA A BBB BBB-

Current

6 months ago

YTD YTD

Category 2012 2011 2011

US Total 10.8 9.6 32.7

Non-US Total 1.9 1.3 3.3

TOTAL 12.7 10.9 36.0

Spread (bp)

Fixed Rate Avg. Week 52-wk

(Conduit) Life 5/16 Earlier Avg.

AAA

5.0

10.0

S+165

S+232

S+148

S+210

+197

+239

AA 10.0 S+1,996 S+1,975 +2,105

A 10.0 S+2,619 S+2,589 +2,667

BBB 10.0 T+4,278 T+4,241 +4,211

Dollar Price

Week 52-wk

Markit CMBX 05-1 5/16 Earlier Avg.

AAA 91.1 92.5 91.4

AA 42.2 45.0 47.2

A 28.2 30.9 35.1

BBB 18.1 18.2 19.4

BB 5.0 5.0 5.0

Sources: Trepp, Markit

Month

5/11 Earlier

Office 220 206

Retail 213 195

Multi-family 203 184

Industrial 210 189

Source: Trepp

0

50

100

150

200

250

300

O N D J F M A M

10-year loans with 50-59% LTV

Total Return (%)

Avg. Month Year Since

As of 5/16 Life to Date to Date 1/1/97

Inv.-grade 3.8 -0.4 3.7 176.5

AAA 3.5 -0.2 2.7 169.6

AA 4.0 -0.5 4.3 68.6

A 4.4 -0.8 5.1 52.0

BBB 4.5 -0.9 6.8 48.9

Source: Barclays

0

3

6

9

12

15

18

J F M A M J J A S O N D

0

1

2

3

4

M A M J J A S O N D J F M A M

Rating Amount Spread CDS

5/11 Maturity (M/S) ($Mil.) (bp) (bp)

Kimco 10/19 Baa1/BBB+ 300 T+195 141

Simon Property 3/22 A3/A- 600 T+149 94

Equity Residential 12/21 Baa1/BBB+ 1,000 T+165 125

Prologis 3/20 Baa2/BBB- 540 T+230 167

AvalonBay 1/21 Baa1/BBB+ 250 T+135 92

Duke Realty 3/20 Baa2/BBB- 250 T+210 165

Boston Properties 5/21 Baa2/A- 850 T+155 122

Health Care Property 2/21 Baa2/BBB 1,200 T+200 149

Regency Centers 4/21 Baa2/BBB 250 T+215

Liquid REIT Average Baa1/BBB+ 582 T+184 132

Source: Wells Fargo

2011

2012

May 18, 2012

Commercial Mortgage

ALERT 15

TO SUBSCRIBE

Signature:

COMMERCIAL MORTGAGE ALERT www.CMAlert.com

THE GRAPEVINE

... From Page 1

May 18, 2012

Commercial Mortgage

ALERT 16

commercial mortgage securitization

for the Wilmington, Del., online bank.

Hallock was a senior originator at

Wachovia until 2007 and has since

had stints at Centerline Capital and

Carl Marks Advisory. He reports to Ron

Wechsler, head of the securitization

program that Bancorp Bank rolled

out in March. Alex Leybov also joined

the New York unit last week as a vice

president, working on originations,

underwriting and securitization.

Leybov spent the past six years at RAIT

Financial, a Philadelphia REIT, where

Wechsler formerly co-headed the CMBS

group. Bancorp Bank is still on the

prowl for a head underwriter and at

least one more originator.

Commercial real estate attorney Brian

Smetana lef the law frm of Winston &

Strawn two weeks ago to join New York-

based Rosenberg & Estis, where he is of

counsel. He specializes in helping major

lenders arrange senior mortgages,

including loans to be securitized, on

commercial and residential properties.

Smetana also has worked with develop-

ers on purchases, sales and fnancings

of New York City properties. He had

been an associate at Winston, also in

New York, since coming aboard from

Herzfeld & Rubin in 2006.

Moodys has hired lawyer Simon Burce

as an assistant vice president in New

York. He started April 23, working

for senior vice president Dan Rubock,

an attorney in the CMBS group who

focuses on deal structures and legal

issues pertaining to ratings in that

sector. Burce spent the last four years

at Alston & Bird, also in New York, as

an associate in the law frms real estate

fnance and investment group.

CMBS trader George Geotes resigned

this week as a vice president of Nomura

to join Credit Suisse. He will start next

month as a director in the Swiss banks

New York ofce, where he will continue

to focus on trading and distribution of

agency bonds. He will report to manag-

ing director Christopher Callahan, who

previously worked at Nomura and hired

Geotes there in 2004. Geotes replaces

John McGrath, who lef Credit Suisse in

early March to spearhead agency-CMBS

trading at Goldman Sachs. McGrath

started his new job on May 7.

Anne Space recently joined the asset-

management group of UBS. She was

formerly an assistant vice president of

real estate investments at Hartford Invest-

ment, where she had worked since 2006.

Invesco Real Estate is looking for a

senior investment analyst to work with

its opportunistic and structured invest-

ments team, which is based in Dallas.

Responsibilities include underwriting

and structuring of new investments, as

well as portfolio management. Candi-

dates should have 1-3 years of experi-

ence. Contact Bert Crouch at

bert.crouch@invesco.com.

YES! Sign me up for a one-year subscription to Commercial Mortgage

Alert at a cost of $4,097. I understand I can cancel at any time and receive

a full refund for the unused portion of my 46-issue subscription.

DELIVERY (check one): q E-mail. q Mail.

PAYMENT (check one): q Check enclosed, payable to Commercial

Mortgage Alert. q Bill me. q American Express. q Mastercard.

q Visa.

Account #:

Exp. date:

Name:

Company:

Address:

City/ST/Zip:

Phone:

E-mail:

MAIL TO: Commercial Mortgage Alert www.CMAlert.com

5 Marine View Plaza #400 FAX: 201-659-4141

Hoboken NJ 07030-5795 CALL: 201-659-1700

Telephone: 201-659-1700 Fax: 201-659-4141 E-mail: info@hspnews.com

Donna Knipp Managing Editor 201-234-3967 dknipp@hspnews.com

Bob Mura Senior Writer 201-234-3978 bmura@hspnews.com

Richard Quinn Senior Writer 201-234-3997 rquinn@hspnews.com