Professional Documents

Culture Documents

Widening Gap Oregon Factsheet

Widening Gap Oregon Factsheet

Uploaded by

Statesman JournalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Widening Gap Oregon Factsheet

Widening Gap Oregon Factsheet

Uploaded by

Statesman JournalCopyright:

Available Formats

The Widening Gap Update

Oregon paid its full annual pension contribution four times from 2005 to 2010, and the system was 87 percent funded in scal year 2010 but still faced an $8 billion funding gap. Most experts agree that a scally sustainable system should be at least 80 percent funded. The state also had a $768 million bill for retiree health care costs, 31 percent of which was funded, well above the 8 percent national average in 2010. Lawmakers have raised taxpayer contributions to the pension system and are considering other changes to their retirement system.

OREGON

TOTAL BILL COMING DUE

Oregons retirement plans had a liability of $60.1 billion and the state has fallen $8 billion short in setting aside money to pay for it.

Pensions

87%

Percent Funded

Retiree Health Care

$59.3B

Total Liability

31%

$0.8B

Total Liability

Percent Funded

ANNUAL RECOMMENDED CONTRIBUTION

In 2010, Oregon paid 100 percent of the recommended contribution to its pension plan and just 69 percent of what the state should have paid to fund retiree health benets.

Pensions

Full Recommended Contribution

Retiree Health Care

Full Recommended Contribution

$472M $472M

Actual

$49M $33M

Actual

HOW DID THIS STATE FARE?

Oregon needed to improve how It handled its long-term liabilities for pensions and was a solid performer at handling its retiree health care bill.

Pensions

Retiree Health Care

solid performer

needs improvement

serious concerns

The grades for pensions and retiree health bene ts assess how well the states have managed these liabilities. The pension grade is based on being above 80 percent funded (2 points), having an unfunded liability that is less than the payroll for active members (1 point), and paying at least 90 percent of the recommended pension contribution over the last ve years (1 point). Plans that got all four points were solid performers, plans with two or three needed improvement, and plans with one or no points were cause for serious concern. Grades for retiree health bene ts were based on whether the states bene ts had a funding level above the national average (1 point), whether 90 percent of the recommended contribution was made in the most recent year (1 point), and whether the states plans were better funded based on the most recent data than they were in the prior year (1 point). States with two or three points were solid performers, those with just one point needed improvement, and states with no points were cause for serious concern. This fact sheet stems from a 50-state analysis of states retiree bene t obligations by the Pew Center on the States. The full report and 50 state fact sheets can be found at

www.pewstates.org.

You might also like

- Module 2 Lesson 3 MISSIONARY RESPONSEDocument1 pageModule 2 Lesson 3 MISSIONARY RESPONSEHarriz Diether DomingoNo ratings yet

- $203 Billion and Counting: Total Debt For State and Local Retirement Benefits in IllinoisDocument35 pages$203 Billion and Counting: Total Debt For State and Local Retirement Benefits in IllinoisIllinois PolicyNo ratings yet

- Spending For Federal Benefits and Services For People With Low Income, FY08-FY11Document15 pagesSpending For Federal Benefits and Services For People With Low Income, FY08-FY11The Daily Caller100% (1)

- LISTENING SCRIPT Pathway To English 3 WajibDocument16 pagesLISTENING SCRIPT Pathway To English 3 WajibELa Noviana57% (21)

- Case Digests in Agrarian LawDocument6 pagesCase Digests in Agrarian Lawemman2g.2baccayNo ratings yet

- Widening Gap Factsheet: CaliforniaDocument1 pageWidening Gap Factsheet: Californiajon_ortizNo ratings yet

- Pew Pensions Update California Fact SheetDocument1 pagePew Pensions Update California Fact Sheetjon_ortizNo ratings yet

- 0813 Econ SnapshotDocument1 page0813 Econ SnapshotThe Dallas Morning NewsNo ratings yet

- Ca Debt PDFDocument12 pagesCa Debt PDFjdrietzNo ratings yet

- Funding GapDocument2 pagesFunding GapURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- The National Bureau of Economic ResearchDocument31 pagesThe National Bureau of Economic ResearchThiago LimaNo ratings yet

- An Open Letter To Kentucky LegislatorsDocument3 pagesAn Open Letter To Kentucky LegislatorsWKMS NewsNo ratings yet

- Born Broke SummaryDocument16 pagesBorn Broke SummaryZachary JanowskiNo ratings yet

- States' Medicaid Spending GrowingDocument7 pagesStates' Medicaid Spending GrowingThe Council of State GovernmentsNo ratings yet

- What Is The Result of States Not Expanding Medicaid?Document9 pagesWhat Is The Result of States Not Expanding Medicaid?maxblauNo ratings yet

- Health Politics and Policy in The United StatesDocument32 pagesHealth Politics and Policy in The United StatesDave WNo ratings yet

- BENTE RCSD Budget Analysis FinalDocument5 pagesBENTE RCSD Budget Analysis FinalmarybadamsNo ratings yet

- Medicaid Stabilization Fact Sheet OFFICE OF GOVERNOR PAT QUINNDocument2 pagesMedicaid Stabilization Fact Sheet OFFICE OF GOVERNOR PAT QUINNSFLDNo ratings yet

- Retiree Health Benefits 031615Document20 pagesRetiree Health Benefits 031615Jon OrtizNo ratings yet

- Connecticut 2014.01.09 Opm Debt Reduction ReportDocument17 pagesConnecticut 2014.01.09 Opm Debt Reduction ReportHelen BennettNo ratings yet

- CHIP Annual Report 2011Document16 pagesCHIP Annual Report 2011State of UtahNo ratings yet

- SSRN Id1596679 PDFDocument27 pagesSSRN Id1596679 PDFwood1024No ratings yet

- IncomeEligibilityUnderACA FINAL v2Document6 pagesIncomeEligibilityUnderACA FINAL v2kirs0069No ratings yet

- Reset Report May2010Document39 pagesReset Report May2010underw54No ratings yet

- Health Care Systems: Getting More Value For Money: Economics Department Policy Note No. 2Document12 pagesHealth Care Systems: Getting More Value For Money: Economics Department Policy Note No. 2Hybird RyantoeNo ratings yet

- Half-a-Million and One Broken PromisesDocument14 pagesHalf-a-Million and One Broken PromisesPublic Policy and Education Fund of NYNo ratings yet

- Weekly Economic Commentary 9/30/2013Document4 pagesWeekly Economic Commentary 9/30/2013monarchadvisorygroupNo ratings yet

- Following Farm Bill's Senate Passage, Sessions Reiterates Need For Welfare ReformDocument2 pagesFollowing Farm Bill's Senate Passage, Sessions Reiterates Need For Welfare Reformapi-127658921No ratings yet

- CaidActuarial Report 2011Document59 pagesCaidActuarial Report 2011QMx2014No ratings yet

- Kaiser: MedicaidDocument24 pagesKaiser: MedicaidAnonymous RrGVQjNo ratings yet

- Crisis in Long Term CareDocument15 pagesCrisis in Long Term CareAgingServicesMNNo ratings yet

- Dollars and SenseDocument2 pagesDollars and SensesevensixtwoNo ratings yet

- Budget Primer 2012Document8 pagesBudget Primer 2012bee5834No ratings yet

- Public Pensions: Emerging TrendsDocument2 pagesPublic Pensions: Emerging TrendsThe Council of State GovernmentsNo ratings yet

- St. and Local PensionsDocument14 pagesSt. and Local PensionsJbrownie HeimesNo ratings yet

- Citizens Guide 2007Document12 pagesCitizens Guide 2007JacquesVacaNo ratings yet

- Executive Summary: Covering The Low-Income, Uninsured in Oklahoma: Recommendations For A Medicaid Demonstration ProposalDocument5 pagesExecutive Summary: Covering The Low-Income, Uninsured in Oklahoma: Recommendations For A Medicaid Demonstration ProposalOK-SAFE, Inc.No ratings yet

- A New Health-Care System for America: Free Basic Health CareFrom EverandA New Health-Care System for America: Free Basic Health CareNo ratings yet

- Attacking The Fiscal Crisis - What The States Have Taught Us About The Way ForwardDocument7 pagesAttacking The Fiscal Crisis - What The States Have Taught Us About The Way ForwardDamian PanaitescuNo ratings yet

- Final Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017Document10 pagesFinal Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017The (Bergen) RecordNo ratings yet

- BRM AssignmentDocument11 pagesBRM AssignmentSalman ButtNo ratings yet

- Paths To Prosperity: Patient-Centred Health CareDocument16 pagesPaths To Prosperity: Patient-Centred Health CareDoug AllanNo ratings yet

- The Federal Government's Financial HealthDocument12 pagesThe Federal Government's Financial HealthMaria DelgadoNo ratings yet

- Pennsylvania State Spending: by Nathan Benefield Commonwealth FoundationDocument25 pagesPennsylvania State Spending: by Nathan Benefield Commonwealth FoundationCommonwealth FoundationNo ratings yet

- Health Affairs: For Reprints, Links & PermissionsDocument19 pagesHealth Affairs: For Reprints, Links & PermissionsitteNo ratings yet

- Enacted Budget OverviewDocument7 pagesEnacted Budget OverviewJohn R Drexelius Jr.No ratings yet

- Issue Brief #2Document4 pagesIssue Brief #2kirs0069No ratings yet

- Governor Releases May Revision With, As Promised, "Absolutely Terrible Cuts," No Tax IncreasesDocument9 pagesGovernor Releases May Revision With, As Promised, "Absolutely Terrible Cuts," No Tax Increasessmf 4LAKidsNo ratings yet

- SRS Report (09-26-2011 PED Report)Document34 pagesSRS Report (09-26-2011 PED Report)Bobby CogginsNo ratings yet

- The Future of Public PensionsDocument39 pagesThe Future of Public PensionsNational Press FoundationNo ratings yet

- Health Care in CanadaDocument13 pagesHealth Care in CanadaGayatri PandeyNo ratings yet

- Liberty Index 2012 AppropriationsDocument25 pagesLiberty Index 2012 AppropriationsbobguzzardiNo ratings yet

- Paul - Krugman - Increasing Returns and Economic GeographyDocument28 pagesPaul - Krugman - Increasing Returns and Economic GeographyZvonimirNo ratings yet

- Trends in Health Care Cost Growth and ACADocument29 pagesTrends in Health Care Cost Growth and ACAiggybauNo ratings yet

- US Healthcare Delivering A Heart Attack!Document2 pagesUS Healthcare Delivering A Heart Attack!Ron RobinsNo ratings yet

- Sample Policy MemosDocument21 pagesSample Policy MemosIoannis Kanlis100% (1)

- Health Care Transparency Final PaperDocument19 pagesHealth Care Transparency Final Paperapi-242664158No ratings yet

- Sinking Flagships and HealthDocument4 pagesSinking Flagships and HealthIraSinghalNo ratings yet

- Restoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostFrom EverandRestoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostNo ratings yet

- Tax Policy and the Economy, Volume 35From EverandTax Policy and the Economy, Volume 35Robert A. MoffittNo ratings yet

- 2023 Drone Sample MapsDocument6 pages2023 Drone Sample MapsStatesman JournalNo ratings yet

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

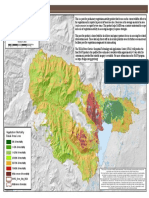

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

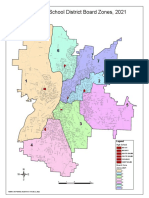

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

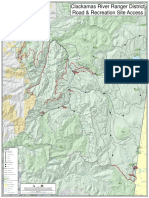

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- Gcab - Personal Electronic Devices and Social Media - StaffDocument2 pagesGcab - Personal Electronic Devices and Social Media - StaffStatesman JournalNo ratings yet

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- Resource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeDocument3 pagesResource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeStatesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- Statement From Marion County Medical Examiner's Office On Heat-Related DeathsDocument1 pageStatement From Marion County Medical Examiner's Office On Heat-Related DeathsStatesman JournalNo ratings yet

- 2021 Ironman 70.3 Oregon Traffic ImpactDocument2 pages2021 Ironman 70.3 Oregon Traffic ImpactStatesman JournalNo ratings yet

- Op Ed - Anthony MedinaDocument2 pagesOp Ed - Anthony MedinaStatesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- Schools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramDocument3 pagesSchools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramStatesman Journal100% (1)

- City of Salem Photo Red Light Program 2021 Legislative ReportDocument8 pagesCity of Salem Photo Red Light Program 2021 Legislative ReportStatesman JournalNo ratings yet

- SB Agenda 20210415 EnglishDocument1 pageSB Agenda 20210415 EnglishStatesman JournalNo ratings yet

- School Board Zone MapDocument1 pageSchool Board Zone MapStatesman JournalNo ratings yet

- OM-UHT Plant PDFDocument138 pagesOM-UHT Plant PDFToni0% (1)

- Msc1813ep MeduDocument2 pagesMsc1813ep MedumichaelsudjonoNo ratings yet

- 08 Proceduri de UrgentaDocument9 pages08 Proceduri de UrgentaSorescu Radu VasileNo ratings yet

- Letter To Parents (RVHS Incident)Document2 pagesLetter To Parents (RVHS Incident)dontspreadaboutmeNo ratings yet

- GMCO FOR INDUSTRIAL SERVICES - Welding Procedure SpecificationsDocument2 pagesGMCO FOR INDUSTRIAL SERVICES - Welding Procedure SpecificationsMohamedNo ratings yet

- Glamphouse Tents Brochure DigitalDocument2 pagesGlamphouse Tents Brochure Digitalgatrio2001No ratings yet

- 20T Wheat Flour Milling PlantDocument12 pages20T Wheat Flour Milling Plantshio29100% (2)

- QM 34 - TanksDocument10 pagesQM 34 - Tanksmohamed elmasryNo ratings yet

- Wafer Level Package and Technology (Amkor)Document17 pagesWafer Level Package and Technology (Amkor)David GiulianoNo ratings yet

- Unit Hydrographs: Transforming The RunoffDocument69 pagesUnit Hydrographs: Transforming The RunoffShriganesh ChaudhariNo ratings yet

- Michelin Guide Bangkok 2018 Press ReleaseDocument2 pagesMichelin Guide Bangkok 2018 Press ReleaseMonica BurtonNo ratings yet

- 1 Human Reaction On Different WordsDocument13 pages1 Human Reaction On Different Wordsshamim islam limonNo ratings yet

- New Haven AnalysisDocument2 pagesNew Haven AnalysisHelen BennettNo ratings yet

- GSG 300 EditedDocument10 pagesGSG 300 Editedvtz2ruhNo ratings yet

- DCP082 Motorized Screw JackDocument3 pagesDCP082 Motorized Screw JackANAND KRISHNANNo ratings yet

- Minetruck MT436B 9851 2249 01N tcm835-1540890 PDFDocument4 pagesMinetruck MT436B 9851 2249 01N tcm835-1540890 PDFCristian Cabrera0% (1)

- Homeopathic Remedies For 'Flu - Flow ChartDocument1 pageHomeopathic Remedies For 'Flu - Flow Chartisadore97% (32)

- Estogrout MP70Document2 pagesEstogrout MP70Lei100% (1)

- TAD 1630 GE: Genset Engine - Gen PacDocument2 pagesTAD 1630 GE: Genset Engine - Gen PacselfyNo ratings yet

- Traulsen RLT - ALT Freezer DUTDocument2 pagesTraulsen RLT - ALT Freezer DUTwsfc-ebayNo ratings yet

- HECAT Module AODDocument26 pagesHECAT Module AODririhenaNo ratings yet

- Safety Data Sheet: Section 1: Identification of The Substance and SupplierDocument9 pagesSafety Data Sheet: Section 1: Identification of The Substance and Supplier12030440No ratings yet

- Dr. Salinas FormatDocument1 pageDr. Salinas FormatSanray SansNo ratings yet

- Personal Hygiene: How To Keep Your Body CleanDocument13 pagesPersonal Hygiene: How To Keep Your Body CleanneleaNo ratings yet

- Body of Research Paper 2Document5 pagesBody of Research Paper 2uxy lolNo ratings yet

- Latihan Autocad KIMI-A2 - PlanDocument1 pageLatihan Autocad KIMI-A2 - PlanMuhd HakimieNo ratings yet

- Rele Ups CyberDocument4 pagesRele Ups CyberFrancisco Javier Duran MejiasNo ratings yet