Professional Documents

Culture Documents

35.procedures For Import & Export

35.procedures For Import & Export

Uploaded by

mercatuzCopyright:

Available Formats

You might also like

- CurrentBillDownload 1 PDFDocument4 pagesCurrentBillDownload 1 PDFElena Moronta100% (1)

- Air Cargo TariffDocument3 pagesAir Cargo TariffSafijo AlphonsNo ratings yet

- Custom ClearanceDocument24 pagesCustom ClearanceManasi BundeNo ratings yet

- Ignou AED-01 Export Procedures and Documenntation Important Questions and Answers (Note:Attempt All Questions in Exam)Document77 pagesIgnou AED-01 Export Procedures and Documenntation Important Questions and Answers (Note:Attempt All Questions in Exam)Hazel Grace100% (3)

- Orchids The International SchoolDocument1 pageOrchids The International SchoolPrafulla Kailash TajaneNo ratings yet

- Procedures For Export and ImportDocument3 pagesProcedures For Export and ImportSriram MuraleedharanNo ratings yet

- EXIM ProcedureDocument5 pagesEXIM ProcedureSandeep GoleNo ratings yet

- Procedure For Import and ExportDocument3 pagesProcedure For Import and ExportPooja GujarathiNo ratings yet

- Import Export DocumentsDocument32 pagesImport Export DocumentsPriya Shah100% (1)

- 7 Pdfsam Datey Customs ActDocument1 page7 Pdfsam Datey Customs ActdskrishnaNo ratings yet

- Procedures For ImportDocument12 pagesProcedures For ImportRodeoKenanNo ratings yet

- What Is ICD?Document3 pagesWhat Is ICD?manishiesNo ratings yet

- Import Procedure: Prof. C. K. SreedharanDocument68 pagesImport Procedure: Prof. C. K. Sreedharanamiit_pandey3503No ratings yet

- Procedure For Import and ExportDocument10 pagesProcedure For Import and Exportswapneel234No ratings yet

- Air Export CustomsDocument7 pagesAir Export CustomsDivyabhan SinghNo ratings yet

- Kyg 2 - Royal Wings 1Document24 pagesKyg 2 - Royal Wings 1Shoaib ShaikhNo ratings yet

- Mamta BhushanDocument26 pagesMamta BhushanDinesh HegdeNo ratings yet

- Export Import Procedures Part 2Document18 pagesExport Import Procedures Part 2neelonNo ratings yet

- What Is Inland Container Depot (ICD) ?Document2 pagesWhat Is Inland Container Depot (ICD) ?Safijo AlphonsNo ratings yet

- Customs Clearance in IndiaDocument16 pagesCustoms Clearance in IndiaAdNo ratings yet

- Procedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41Document23 pagesProcedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41niharaNo ratings yet

- Custom Clerarance: Area of Operations and AuthorityDocument4 pagesCustom Clerarance: Area of Operations and AuthorityRajeev VyasNo ratings yet

- Processing An Export Order: I. Confirmation of OrderDocument4 pagesProcessing An Export Order: I. Confirmation of Orderkaran singhNo ratings yet

- Logistics For Baklava From Turkey To IndiaDocument7 pagesLogistics For Baklava From Turkey To IndiaMeghna SivakumarNo ratings yet

- Clearance of Export GoodsDocument10 pagesClearance of Export GoodsPromila ChetriNo ratings yet

- Eip Presentation 97Document16 pagesEip Presentation 97শারাফাত হোসাইন আরিয়ানNo ratings yet

- Procedure For Clearance of Export GoodsDocument11 pagesProcedure For Clearance of Export GoodssahuanNo ratings yet

- Customs Regulations Export Import Procedures SEZ FTP 2014Document287 pagesCustoms Regulations Export Import Procedures SEZ FTP 2014chetanpatelhNo ratings yet

- Chapter Five Customs DutyDocument14 pagesChapter Five Customs DutyVijai AnandNo ratings yet

- Export OrderDocument3 pagesExport OrderJia MakhijaNo ratings yet

- Shipment of Export CargoDocument4 pagesShipment of Export CargogkrehmanNo ratings yet

- Export Procedure in IndiaDocument16 pagesExport Procedure in IndiaRohan AroraNo ratings yet

- Custom Clearance Process in India: Sebastian JosephDocument21 pagesCustom Clearance Process in India: Sebastian JosephSebastian JosephNo ratings yet

- Import Procedures & DocumentationDocument20 pagesImport Procedures & DocumentationM HarikrishnanNo ratings yet

- Customs ClearanceDocument4 pagesCustoms Clearancemacho_heroNo ratings yet

- Customs Clearance / IntroductionDocument3 pagesCustoms Clearance / IntroductionSK LashariNo ratings yet

- Indian Customs Manual - Procedure For Clearance of Imported and Export Goods PDFDocument5 pagesIndian Customs Manual - Procedure For Clearance of Imported and Export Goods PDFshivam_dubey4004No ratings yet

- Complete Export ProcessDocument15 pagesComplete Export ProcessasifanisNo ratings yet

- Import Export ProcedureDocument13 pagesImport Export ProcedureManinder SinghNo ratings yet

- L.N - Aas - Unit - 3Document14 pagesL.N - Aas - Unit - 3Nambi RajanNo ratings yet

- Handout 5 - Entry and Export of CargoDocument5 pagesHandout 5 - Entry and Export of CargoAmara OtoNo ratings yet

- Import Export DocumentsDocument21 pagesImport Export Documentsshehzaib tariqNo ratings yet

- Import Export DocumentsDocument20 pagesImport Export Documentsshehzaib tariqNo ratings yet

- CustomsDocument14 pagesCustomsHamza MasalawalaNo ratings yet

- Export DocumentationDocument21 pagesExport DocumentationIndrani ThotaNo ratings yet

- 3 The 'Person in Charge of Conveyance' (Carrier of Goods) HasDocument22 pages3 The 'Person in Charge of Conveyance' (Carrier of Goods) HasDurga ShankarNo ratings yet

- (A) Registration:: II. ExportDocument11 pages(A) Registration:: II. ExportThanigai SelvanNo ratings yet

- ADL 85 Export, Import Procedures & Documentation V2Document23 pagesADL 85 Export, Import Procedures & Documentation V2ajay_aju212000No ratings yet

- Bluedart Express LTD - Customs-Country Information-IndiaDocument6 pagesBluedart Express LTD - Customs-Country Information-Indiaad2avNo ratings yet

- Evidencia 8 Presentation Steps To Export Pendiente Por EnvioDocument13 pagesEvidencia 8 Presentation Steps To Export Pendiente Por Envioeduardo mercado100% (1)

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- Export ManagementDocument18 pagesExport Managementrash4ever2uNo ratings yet

- AED1Document18 pagesAED1Rajni KumariNo ratings yet

- Import Export Processes and ProceduresDocument13 pagesImport Export Processes and ProceduresAna Platil100% (3)

- Quality Control Inspection Pharmaceutical Product: International TradeDocument4 pagesQuality Control Inspection Pharmaceutical Product: International TradeSanal B. KrishnanNo ratings yet

- Export ProcedureDocument21 pagesExport ProcedurekanikaNo ratings yet

- Import Clearance ProceduresDocument16 pagesImport Clearance Proceduresjoy kathureNo ratings yet

- Smooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1From EverandSmooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1No ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Certificate of Deposit: Add-On CdsDocument4 pagesCertificate of Deposit: Add-On CdsmercatuzNo ratings yet

- 67.ifrs ConvergenceDocument2 pages67.ifrs ConvergencemercatuzNo ratings yet

- 17.role of Tax ConsultantsDocument4 pages17.role of Tax Consultantsmercatuz100% (1)

- 33.tax Planning Under Indirect TaxationsDocument3 pages33.tax Planning Under Indirect TaxationsmercatuzNo ratings yet

- 65.role of A ConsultantDocument2 pages65.role of A ConsultantmercatuzNo ratings yet

- 8.global WarmingDocument3 pages8.global WarmingmercatuzNo ratings yet

- 7.stpi & SezDocument3 pages7.stpi & SezmercatuzNo ratings yet

- 9.corporate GovernanceDocument3 pages9.corporate GovernancemercatuzNo ratings yet

- 63 KaizenDocument4 pages63 KaizenmercatuzNo ratings yet

- 6.standards On Quality ControlDocument2 pages6.standards On Quality ControlmercatuzNo ratings yet

- System Audit: Foundations of Information System AuditingDocument4 pagesSystem Audit: Foundations of Information System AuditingmercatuzNo ratings yet

- 61.forensic AccountingDocument3 pages61.forensic Accountingmercatuz0% (1)

- 62.insider TradingDocument5 pages62.insider TradingmercatuzNo ratings yet

- Due Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist TheDocument4 pagesDue Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist ThemercatuzNo ratings yet

- 58.process CostingDocument3 pages58.process CostingmercatuzNo ratings yet

- 55.profesional EthicsDocument5 pages55.profesional EthicsmercatuzNo ratings yet

- 56.IFRS Vs IASDocument3 pages56.IFRS Vs IASmercatuzNo ratings yet

- 51.limited Liability PartnershipDocument8 pages51.limited Liability PartnershipmercatuzNo ratings yet

- 57.pricing DecisionsDocument3 pages57.pricing DecisionsmercatuzNo ratings yet

- 54.banking Regulation ActDocument5 pages54.banking Regulation ActmercatuzNo ratings yet

- 49.transfer PricingDocument4 pages49.transfer PricingmercatuzNo ratings yet

- 5.money LaunderingDocument3 pages5.money LaunderingmercatuzNo ratings yet

- 50.cost Control & Cost ReductionDocument6 pages50.cost Control & Cost ReductionmercatuzNo ratings yet

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- 52.analysis For Decision MakingDocument4 pages52.analysis For Decision MakingmercatuzNo ratings yet

- 43.enterprise Resource PlanningDocument5 pages43.enterprise Resource PlanningmercatuzNo ratings yet

- 45.working Capital ManagementDocument5 pages45.working Capital ManagementmercatuzNo ratings yet

- 44 LokpalDocument3 pages44 LokpalmercatuzNo ratings yet

- 41.international Standards On Related ServicesDocument4 pages41.international Standards On Related ServicesmercatuzNo ratings yet

- 40.schedule XIII Compliance With Sec 209Document5 pages40.schedule XIII Compliance With Sec 209mercatuzNo ratings yet

- 716 Bob StatementDocument10 pages716 Bob Statementअभिषेक मिश्राNo ratings yet

- A.P. Moller - Maersk: South Africa Local Charges 2020/2021Document14 pagesA.P. Moller - Maersk: South Africa Local Charges 2020/2021ronnieBNo ratings yet

- 14 Chapter 7Document45 pages14 Chapter 7SanjayNo ratings yet

- LC DraftDocument3 pagesLC DraftNRVision Exim100% (3)

- ABAP KT Tracker v1.0-2Document119 pagesABAP KT Tracker v1.0-2Kalikinkar LahiriNo ratings yet

- Receipt For SOLOMON FOLASHAYO - Payment For UNDERGRADUATE FEESDocument1 pageReceipt For SOLOMON FOLASHAYO - Payment For UNDERGRADUATE FEESjesseamobi10No ratings yet

- WHSmith Indonesia Shortened Presentation Mar 2014Document28 pagesWHSmith Indonesia Shortened Presentation Mar 2014Benjamin James SmithNo ratings yet

- Bayarind E-Wallet Binding 2022Document15 pagesBayarind E-Wallet Binding 2022Steven AdrianusNo ratings yet

- Bruno Alphonse Union BankDocument5 pagesBruno Alphonse Union Bankbindu mathaiNo ratings yet

- CNLYw FBP BPKBV TunDocument3 pagesCNLYw FBP BPKBV TunSUBHALAXMI DASNo ratings yet

- Statement of Axis Account No:917010056046995 For The Period (From: 30-09-2021 To: 29-12-2021)Document9 pagesStatement of Axis Account No:917010056046995 For The Period (From: 30-09-2021 To: 29-12-2021)Divya satya Srinivas kondaNo ratings yet

- Taxation On Individuals - ReviewerDocument2 pagesTaxation On Individuals - ReviewerLouiseNo ratings yet

- Income Taxation - MidtermDocument5 pagesIncome Taxation - MidtermJalyn Jalando-onNo ratings yet

- Bims ChalanDocument1 pageBims Chalannoah87619No ratings yet

- Gul BargaDocument916 pagesGul BargaShihan Ali KhanNo ratings yet

- 1 of 6 Hosur MR Raja Jegatheesh Devaraj NO 105 Gandhi NagarDocument6 pages1 of 6 Hosur MR Raja Jegatheesh Devaraj NO 105 Gandhi NagarGnanavel VelNo ratings yet

- Bir 2306 FormDocument47 pagesBir 2306 FormTheresa Faye De GuzmanNo ratings yet

- Bus Bar Trunking System: Product Name Brand Capacity HS CodeDocument3 pagesBus Bar Trunking System: Product Name Brand Capacity HS CodeEast West Medical College & HospitalNo ratings yet

- Rajasthan State Road Transport Corporation E-Reservation TicketDocument1 pageRajasthan State Road Transport Corporation E-Reservation TicketAbhijeet SinghNo ratings yet

- Reading Comprehension-2: False True False True TrueDocument2 pagesReading Comprehension-2: False True False True TrueGamze PişginNo ratings yet

- Macariola Auditing Solutions Manual-1 PDFDocument157 pagesMacariola Auditing Solutions Manual-1 PDFTrisha CabralNo ratings yet

- Import and Warehouse ChargesDocument1 pageImport and Warehouse ChargesNatsu DeAcnologiaNo ratings yet

- SampoornaDocument1 pageSampoornaimam janiNo ratings yet

- Politica de Dezvoltare Regională În RomâniaDocument34 pagesPolitica de Dezvoltare Regională În RomânialaNo ratings yet

- Summary of Account As On 31-03-2018 I. Operative Account in INRDocument1 pageSummary of Account As On 31-03-2018 I. Operative Account in INRjayakrishna joshiNo ratings yet

- Net of Tax Meaning - Google SearchDocument1 pageNet of Tax Meaning - Google SearchEmmanuel ShaushiNo ratings yet

- 5th Module Management Air CargoDocument18 pages5th Module Management Air CargoFiza MajidNo ratings yet

35.procedures For Import & Export

35.procedures For Import & Export

Uploaded by

mercatuzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

35.procedures For Import & Export

35.procedures For Import & Export

Uploaded by

mercatuzCopyright:

Available Formats

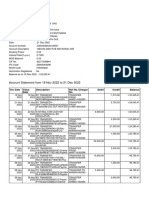

Procedures for Export and Import

Import Procedures Basic document is Entry Loading and unloading at specified places only Computerisation of customs procedures Amendment to documents Entry in relation to goods means entry made in Bill of Entry, Shipping Bill or Bill of Export. In case of import by post, label or declaration accompanying goods is entry Imported goods can be unloaded only at specified places. Goods can be exported only from specified places. Customs procedures are largely computerised. Most of documents have to be e-filed. Documents submitted to customs can be amended with permission In case of bill of entry, shipping bill or bill of export, it can be amended after clearance only on the basis of documentary evidence which was in existence at the time the goods were cleared, warehoused or exported, and not on basis of any subsequent document. [proviso to section 149]. Imported and export goods are usually handled in containers. These can be stored in Inland Container Depot (ICD) or Container Freight Station (CFS). They function like dry port for handling and temporary storage of imported/export goods and empty containers. Boat Notes are used for transferring small cargo from ship to shore, or from shore to ship, without berthing the ship. Goods can be transshipped from one conveyance to other after following required procedure. Such transhipment may be to any major port or airport in India. The goods can be transshipped to any other customs station in India if Customs Officer is satisfied that the goods are bona fide intended for transhipment to any customs station. The facility is available at all customs ports and Inland Container Depots (ICDs). Procedures have been prescribed for coastal goods, even if there is neither import nor export.

ICD and CFS

Boat Notes Transshipment of goods

Coastal goods

Basic document is Entry Loading and unloading at specified places only Computerisation of customs procedures Amendment to documents

Entry in relation to goods means entry made in Bill of Entry, Shipping Bill or Bill of Export. In case of import by post, label or declaration accompanying goods is entry Imported goods can be unloaded only at specified places. Goods can be exported only from specified places. Customs procedures are largely computerised. Most of documents have to be e-filed. Documents submitted to customs can be amended with permission In case of bill of entry, shipping bill or bill of export, it can be amended after clearance only on the basis of documentary evidence which was in existence at the time the goods were cleared, warehoused or exported, and not on basis of any subsequent document. [proviso to section 149]. Imported and export goods are usually handled in containers. These can be stored in Inland Container Depot (ICD) or Container Freight Station (CFS). They function like dry port for handling and temporary storage of imported/export goods and empty containers. Boat Notes are used for transferring small cargo from ship to shore, or from shore to ship, without berthing the ship. Goods can be transshipped from one conveyance to other after following required procedure. Such transhipment may be to any major port or airport in India. The goods can be transshipped to any other customs station in India if Customs Officer is satisfied that the goods are bona fide intended for transhipment to any customs station. The facility is available at all customs ports and Inland Container Depots (ICDs). Procedures have been prescribed for coastal goods, even if there is neither import nor export.

ICD and CFS

Boat Notes Transshipment of goods

Coastal goods

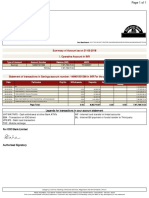

Export Procedure Entry Outward Export manifest/Export report Registration with DGFT and EPC Third party exports Loading in conveyance can start after Entry Outward is given by customs officer. Person in charge of conveyance is required to submit Export Manifest or Export Report. Exporter has to be obtain IEC number from DGFT is advance. He should be registered with Export Promotion Council if he intends to claim export benefits. Export can be by manufacturer himself or third party (i.e. by exporter on behalf of another). Merchant exporter means a person engaged in trading activity and exporting or intending to export goods Advance authorisation, DEPB etc. should be registered if exports are under Export Promotion Scheme.

Registration of documents under Export Promotion Scheme Shipping Bill

FEMA formalities Noting, assessment, examination Certification of documents for export incentives Let export order

Export is required to submit Shipping Bill with required documents for obtaining permission to export. There are five forms : (a) Shipping Bill for export of goods under claim for duty drawback - these should be in Green colour (b) Shipping Bill for export of dutiable goods - this should be yellow colour (c) Shipping bill for export of duty free goods - it should be white colour (d) shipping bill for export of duty free goods ex-bond - i.e. from bonded store room - it should be pink colour (e) Shipping Bill for export under DEPB scheme - Blue colour. GR/SDF/Softex form (under FEMA) is required to be submitted. The shipping bill is noted, goods are assessed and examined. Export duty is paid, if applicable. If export is under export incentives, relevant documents are checked and certified. Then proof of export is obtained on ARE1. Conveyance can leave only after Let Export order is issued.

Questions 1.What are the documents to be submitted at the time of import of goods? 2.When is a Shipping Bill issued? What are the forms of Shipping Bill? 3.When is a Let export order issued?

Source www.dateyvs.com Complied by Tracy tracyannbenson@yahoo.co.in Mob No: 9946794732

You might also like

- CurrentBillDownload 1 PDFDocument4 pagesCurrentBillDownload 1 PDFElena Moronta100% (1)

- Air Cargo TariffDocument3 pagesAir Cargo TariffSafijo AlphonsNo ratings yet

- Custom ClearanceDocument24 pagesCustom ClearanceManasi BundeNo ratings yet

- Ignou AED-01 Export Procedures and Documenntation Important Questions and Answers (Note:Attempt All Questions in Exam)Document77 pagesIgnou AED-01 Export Procedures and Documenntation Important Questions and Answers (Note:Attempt All Questions in Exam)Hazel Grace100% (3)

- Orchids The International SchoolDocument1 pageOrchids The International SchoolPrafulla Kailash TajaneNo ratings yet

- Procedures For Export and ImportDocument3 pagesProcedures For Export and ImportSriram MuraleedharanNo ratings yet

- EXIM ProcedureDocument5 pagesEXIM ProcedureSandeep GoleNo ratings yet

- Procedure For Import and ExportDocument3 pagesProcedure For Import and ExportPooja GujarathiNo ratings yet

- Import Export DocumentsDocument32 pagesImport Export DocumentsPriya Shah100% (1)

- 7 Pdfsam Datey Customs ActDocument1 page7 Pdfsam Datey Customs ActdskrishnaNo ratings yet

- Procedures For ImportDocument12 pagesProcedures For ImportRodeoKenanNo ratings yet

- What Is ICD?Document3 pagesWhat Is ICD?manishiesNo ratings yet

- Import Procedure: Prof. C. K. SreedharanDocument68 pagesImport Procedure: Prof. C. K. Sreedharanamiit_pandey3503No ratings yet

- Procedure For Import and ExportDocument10 pagesProcedure For Import and Exportswapneel234No ratings yet

- Air Export CustomsDocument7 pagesAir Export CustomsDivyabhan SinghNo ratings yet

- Kyg 2 - Royal Wings 1Document24 pagesKyg 2 - Royal Wings 1Shoaib ShaikhNo ratings yet

- Mamta BhushanDocument26 pagesMamta BhushanDinesh HegdeNo ratings yet

- Export Import Procedures Part 2Document18 pagesExport Import Procedures Part 2neelonNo ratings yet

- What Is Inland Container Depot (ICD) ?Document2 pagesWhat Is Inland Container Depot (ICD) ?Safijo AlphonsNo ratings yet

- Customs Clearance in IndiaDocument16 pagesCustoms Clearance in IndiaAdNo ratings yet

- Procedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41Document23 pagesProcedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41niharaNo ratings yet

- Custom Clerarance: Area of Operations and AuthorityDocument4 pagesCustom Clerarance: Area of Operations and AuthorityRajeev VyasNo ratings yet

- Processing An Export Order: I. Confirmation of OrderDocument4 pagesProcessing An Export Order: I. Confirmation of Orderkaran singhNo ratings yet

- Logistics For Baklava From Turkey To IndiaDocument7 pagesLogistics For Baklava From Turkey To IndiaMeghna SivakumarNo ratings yet

- Clearance of Export GoodsDocument10 pagesClearance of Export GoodsPromila ChetriNo ratings yet

- Eip Presentation 97Document16 pagesEip Presentation 97শারাফাত হোসাইন আরিয়ানNo ratings yet

- Procedure For Clearance of Export GoodsDocument11 pagesProcedure For Clearance of Export GoodssahuanNo ratings yet

- Customs Regulations Export Import Procedures SEZ FTP 2014Document287 pagesCustoms Regulations Export Import Procedures SEZ FTP 2014chetanpatelhNo ratings yet

- Chapter Five Customs DutyDocument14 pagesChapter Five Customs DutyVijai AnandNo ratings yet

- Export OrderDocument3 pagesExport OrderJia MakhijaNo ratings yet

- Shipment of Export CargoDocument4 pagesShipment of Export CargogkrehmanNo ratings yet

- Export Procedure in IndiaDocument16 pagesExport Procedure in IndiaRohan AroraNo ratings yet

- Custom Clearance Process in India: Sebastian JosephDocument21 pagesCustom Clearance Process in India: Sebastian JosephSebastian JosephNo ratings yet

- Import Procedures & DocumentationDocument20 pagesImport Procedures & DocumentationM HarikrishnanNo ratings yet

- Customs ClearanceDocument4 pagesCustoms Clearancemacho_heroNo ratings yet

- Customs Clearance / IntroductionDocument3 pagesCustoms Clearance / IntroductionSK LashariNo ratings yet

- Indian Customs Manual - Procedure For Clearance of Imported and Export Goods PDFDocument5 pagesIndian Customs Manual - Procedure For Clearance of Imported and Export Goods PDFshivam_dubey4004No ratings yet

- Complete Export ProcessDocument15 pagesComplete Export ProcessasifanisNo ratings yet

- Import Export ProcedureDocument13 pagesImport Export ProcedureManinder SinghNo ratings yet

- L.N - Aas - Unit - 3Document14 pagesL.N - Aas - Unit - 3Nambi RajanNo ratings yet

- Handout 5 - Entry and Export of CargoDocument5 pagesHandout 5 - Entry and Export of CargoAmara OtoNo ratings yet

- Import Export DocumentsDocument21 pagesImport Export Documentsshehzaib tariqNo ratings yet

- Import Export DocumentsDocument20 pagesImport Export Documentsshehzaib tariqNo ratings yet

- CustomsDocument14 pagesCustomsHamza MasalawalaNo ratings yet

- Export DocumentationDocument21 pagesExport DocumentationIndrani ThotaNo ratings yet

- 3 The 'Person in Charge of Conveyance' (Carrier of Goods) HasDocument22 pages3 The 'Person in Charge of Conveyance' (Carrier of Goods) HasDurga ShankarNo ratings yet

- (A) Registration:: II. ExportDocument11 pages(A) Registration:: II. ExportThanigai SelvanNo ratings yet

- ADL 85 Export, Import Procedures & Documentation V2Document23 pagesADL 85 Export, Import Procedures & Documentation V2ajay_aju212000No ratings yet

- Bluedart Express LTD - Customs-Country Information-IndiaDocument6 pagesBluedart Express LTD - Customs-Country Information-Indiaad2avNo ratings yet

- Evidencia 8 Presentation Steps To Export Pendiente Por EnvioDocument13 pagesEvidencia 8 Presentation Steps To Export Pendiente Por Envioeduardo mercado100% (1)

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- Export ManagementDocument18 pagesExport Managementrash4ever2uNo ratings yet

- AED1Document18 pagesAED1Rajni KumariNo ratings yet

- Import Export Processes and ProceduresDocument13 pagesImport Export Processes and ProceduresAna Platil100% (3)

- Quality Control Inspection Pharmaceutical Product: International TradeDocument4 pagesQuality Control Inspection Pharmaceutical Product: International TradeSanal B. KrishnanNo ratings yet

- Export ProcedureDocument21 pagesExport ProcedurekanikaNo ratings yet

- Import Clearance ProceduresDocument16 pagesImport Clearance Proceduresjoy kathureNo ratings yet

- Smooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1From EverandSmooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1No ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Certificate of Deposit: Add-On CdsDocument4 pagesCertificate of Deposit: Add-On CdsmercatuzNo ratings yet

- 67.ifrs ConvergenceDocument2 pages67.ifrs ConvergencemercatuzNo ratings yet

- 17.role of Tax ConsultantsDocument4 pages17.role of Tax Consultantsmercatuz100% (1)

- 33.tax Planning Under Indirect TaxationsDocument3 pages33.tax Planning Under Indirect TaxationsmercatuzNo ratings yet

- 65.role of A ConsultantDocument2 pages65.role of A ConsultantmercatuzNo ratings yet

- 8.global WarmingDocument3 pages8.global WarmingmercatuzNo ratings yet

- 7.stpi & SezDocument3 pages7.stpi & SezmercatuzNo ratings yet

- 9.corporate GovernanceDocument3 pages9.corporate GovernancemercatuzNo ratings yet

- 63 KaizenDocument4 pages63 KaizenmercatuzNo ratings yet

- 6.standards On Quality ControlDocument2 pages6.standards On Quality ControlmercatuzNo ratings yet

- System Audit: Foundations of Information System AuditingDocument4 pagesSystem Audit: Foundations of Information System AuditingmercatuzNo ratings yet

- 61.forensic AccountingDocument3 pages61.forensic Accountingmercatuz0% (1)

- 62.insider TradingDocument5 pages62.insider TradingmercatuzNo ratings yet

- Due Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist TheDocument4 pagesDue Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist ThemercatuzNo ratings yet

- 58.process CostingDocument3 pages58.process CostingmercatuzNo ratings yet

- 55.profesional EthicsDocument5 pages55.profesional EthicsmercatuzNo ratings yet

- 56.IFRS Vs IASDocument3 pages56.IFRS Vs IASmercatuzNo ratings yet

- 51.limited Liability PartnershipDocument8 pages51.limited Liability PartnershipmercatuzNo ratings yet

- 57.pricing DecisionsDocument3 pages57.pricing DecisionsmercatuzNo ratings yet

- 54.banking Regulation ActDocument5 pages54.banking Regulation ActmercatuzNo ratings yet

- 49.transfer PricingDocument4 pages49.transfer PricingmercatuzNo ratings yet

- 5.money LaunderingDocument3 pages5.money LaunderingmercatuzNo ratings yet

- 50.cost Control & Cost ReductionDocument6 pages50.cost Control & Cost ReductionmercatuzNo ratings yet

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- 52.analysis For Decision MakingDocument4 pages52.analysis For Decision MakingmercatuzNo ratings yet

- 43.enterprise Resource PlanningDocument5 pages43.enterprise Resource PlanningmercatuzNo ratings yet

- 45.working Capital ManagementDocument5 pages45.working Capital ManagementmercatuzNo ratings yet

- 44 LokpalDocument3 pages44 LokpalmercatuzNo ratings yet

- 41.international Standards On Related ServicesDocument4 pages41.international Standards On Related ServicesmercatuzNo ratings yet

- 40.schedule XIII Compliance With Sec 209Document5 pages40.schedule XIII Compliance With Sec 209mercatuzNo ratings yet

- 716 Bob StatementDocument10 pages716 Bob Statementअभिषेक मिश्राNo ratings yet

- A.P. Moller - Maersk: South Africa Local Charges 2020/2021Document14 pagesA.P. Moller - Maersk: South Africa Local Charges 2020/2021ronnieBNo ratings yet

- 14 Chapter 7Document45 pages14 Chapter 7SanjayNo ratings yet

- LC DraftDocument3 pagesLC DraftNRVision Exim100% (3)

- ABAP KT Tracker v1.0-2Document119 pagesABAP KT Tracker v1.0-2Kalikinkar LahiriNo ratings yet

- Receipt For SOLOMON FOLASHAYO - Payment For UNDERGRADUATE FEESDocument1 pageReceipt For SOLOMON FOLASHAYO - Payment For UNDERGRADUATE FEESjesseamobi10No ratings yet

- WHSmith Indonesia Shortened Presentation Mar 2014Document28 pagesWHSmith Indonesia Shortened Presentation Mar 2014Benjamin James SmithNo ratings yet

- Bayarind E-Wallet Binding 2022Document15 pagesBayarind E-Wallet Binding 2022Steven AdrianusNo ratings yet

- Bruno Alphonse Union BankDocument5 pagesBruno Alphonse Union Bankbindu mathaiNo ratings yet

- CNLYw FBP BPKBV TunDocument3 pagesCNLYw FBP BPKBV TunSUBHALAXMI DASNo ratings yet

- Statement of Axis Account No:917010056046995 For The Period (From: 30-09-2021 To: 29-12-2021)Document9 pagesStatement of Axis Account No:917010056046995 For The Period (From: 30-09-2021 To: 29-12-2021)Divya satya Srinivas kondaNo ratings yet

- Taxation On Individuals - ReviewerDocument2 pagesTaxation On Individuals - ReviewerLouiseNo ratings yet

- Income Taxation - MidtermDocument5 pagesIncome Taxation - MidtermJalyn Jalando-onNo ratings yet

- Bims ChalanDocument1 pageBims Chalannoah87619No ratings yet

- Gul BargaDocument916 pagesGul BargaShihan Ali KhanNo ratings yet

- 1 of 6 Hosur MR Raja Jegatheesh Devaraj NO 105 Gandhi NagarDocument6 pages1 of 6 Hosur MR Raja Jegatheesh Devaraj NO 105 Gandhi NagarGnanavel VelNo ratings yet

- Bir 2306 FormDocument47 pagesBir 2306 FormTheresa Faye De GuzmanNo ratings yet

- Bus Bar Trunking System: Product Name Brand Capacity HS CodeDocument3 pagesBus Bar Trunking System: Product Name Brand Capacity HS CodeEast West Medical College & HospitalNo ratings yet

- Rajasthan State Road Transport Corporation E-Reservation TicketDocument1 pageRajasthan State Road Transport Corporation E-Reservation TicketAbhijeet SinghNo ratings yet

- Reading Comprehension-2: False True False True TrueDocument2 pagesReading Comprehension-2: False True False True TrueGamze PişginNo ratings yet

- Macariola Auditing Solutions Manual-1 PDFDocument157 pagesMacariola Auditing Solutions Manual-1 PDFTrisha CabralNo ratings yet

- Import and Warehouse ChargesDocument1 pageImport and Warehouse ChargesNatsu DeAcnologiaNo ratings yet

- SampoornaDocument1 pageSampoornaimam janiNo ratings yet

- Politica de Dezvoltare Regională În RomâniaDocument34 pagesPolitica de Dezvoltare Regională În RomânialaNo ratings yet

- Summary of Account As On 31-03-2018 I. Operative Account in INRDocument1 pageSummary of Account As On 31-03-2018 I. Operative Account in INRjayakrishna joshiNo ratings yet

- Net of Tax Meaning - Google SearchDocument1 pageNet of Tax Meaning - Google SearchEmmanuel ShaushiNo ratings yet

- 5th Module Management Air CargoDocument18 pages5th Module Management Air CargoFiza MajidNo ratings yet