Professional Documents

Culture Documents

8 Graphs On Gold Price Movements

8 Graphs On Gold Price Movements

Uploaded by

Mudit KakkarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8 Graphs On Gold Price Movements

8 Graphs On Gold Price Movements

Uploaded by

Mudit KakkarCopyright:

Available Formats

8 graphs on gold price movements (86 years data)

January 25, 2012 92 comments

45Share

Today I want to show you some patterns of gold prices from last few decades. There is no interpretation or conclusion but some findings and observations on gold price fluctuations in India. From last 10 yrs gold has been on a bull run and prices have multiplied many folds. In the last couple of weeks, gold prices have been extremely volatile and some analysts also predict that gold price upside movement is in threat. So I found gold prices for last 86 yrs (1925 2011) and did some number crunching and some graphs from which we get some interesting findings.

4 yrs Price difference (absolute returns

I found out the price difference for every 4 yrs period i.e. from 1928 to 1925 (yrs) and saw what exactly was the difference in the

prices, then 1929 1926 and so on till 2007-2011. Just to give you an idea, gold price in 2008 was 12,500 and in 2011 it was 26,400; so the price difference was 111.20%. I used these data to plot a running 4 yrs price difference so at any point of time you can see how much was the return in those 4 yrs prior to that point. Note that this change in absolute in difference. The major point to note is that majority people think that gold has performed outstanding post 2000 in a time frame of 4 yrs. But from the graph you can see that in 70s time the 4 yrs period return was much more than what investors saw in recent time.

8 yrs Absolute Price difference runnin

This one is just like above chart, but this time its 8 yrs price difference. We are trying to catch that was the price change in an 8 yrs period. So for example, price in year 1980 was Rs 1330, then after 8 yrs in 1987, the price was Rs 2570, which is a 93.23% So like this I calculated the price difference for all the 8 yrs period and graphed it. There are very less 8 yr holding period when the returns from gold was negative, that happened 50s and 60s and just 90s end.

4 yrs CAGR running

The next chart is the CAGR return chart for 4 yrs time frame and the graph is for running periods that means 1925-1928, 19261929 2008-2011. CAGR return is the main indicator of the performance of any instrument. If you look at the chart below you can see the ups and downs in gold performance and you can see how gold has performed in short run (4 yrs period) for a long time line. You can see that gold returns touched 20%-25% in 70s and even in recent time it has performed wonderfully which we all are aware of .

8 yrs CAGR running

Then you can see the graph below which shows CAGR return on 8 yr running period. The interesting a little obvious fact is that it hardly gave any negative return in any 8 yrs time frame, only during 50s and late 90s it has performed badly.

20 yrs CAGR running

The real test of gold comes from a very long term performance and if we see a 20 yrs CAGR return on rolling basis (1925 1944, 1926-1945 1992-2011), then you can see that most of the times the returns has been in the range of 5-10% and only in the 80s people got best return if they had bought it in 60s.

CAGR from 1926 (base year)

This chart is interesting; it calculates the CAGR return of GOLD from 1926 to all the years. I mean CAGR return from 1925- 1926, 1925-1927, 1925-1928 and then 1925-2011 So the base year is always 1925. This shows you what was the very long term CAGR return of gold considering it was bought in 1925. In a way this does not give us very strong conclusion, but still shows us some perspective.

CAGR from 1960 (base year)

This graph is same as above just that the base year taken was 1960 so considering gold was bought in 1960, the graph shows the CAGR return for different holding periods. You can see that apart from those who sold the gold in 80s realised the best CAGR return, but those who held it for long, still have the returns in range of below 10%.

CAGR from 1980 (base year)

The last chart I want to show is with base year of 1980, you can see that over the long term the returns have converged to 10% & only in the last 10 yrs you can see the returns again going up.

What are your conclusions based on these charts ? What do you think about gold movement from this point onwards ?

What affects gold prices in India?

Other than basic jewellery demand, there are two other factors that affect gold prices in India?International prices Gold works on price parity, which means 10g of gold has the same value all over the world, hence international prices are important. Hedge: Other than for its ornamental purpose, gold has been used as an investment asset. This is because gold can be used to protect against any depreciation in other financial assets which happens at times of uncertainty. This is why historically gold has been used as currency.

Dollar dynamics: Moreover, gold is used as a hedge against movement in the US dollar, which means typically gold prices move inversely to change in strength or value of dollar. Exchange-traded funds: Globally, demand for ETFs has increased. Typically, funds are required to maintain the value of ETFs sold in the form of physical gold, driving up overall demand. Rupee vs dollar As imported gold is valued in dollars and then converted to a rupee value for consumption, the rupee-dollar exchange rate is important. Thus, even though international gold prices have corrected in the last 2-3 months, domestic gold prices have risen, because the rupee depreciated around 8% against the dollar since February this year.

You might also like

- Andrew Biel - Trail Guide To Movement-Books of Discovery (2015)Document284 pagesAndrew Biel - Trail Guide To Movement-Books of Discovery (2015)mindcontrolpseNo ratings yet

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- Gold Price HistoryDocument1 pageGold Price HistoryIbukun Moboluwaduro AbassNo ratings yet

- Practice Toeic Reading Test 2021 03 - Tests + AnswerDocument19 pagesPractice Toeic Reading Test 2021 03 - Tests + AnswerAVRILLIA CLEMENTINENo ratings yet

- CS504 Solved MCQs Final Term by JUNAIDDocument48 pagesCS504 Solved MCQs Final Term by JUNAIDHassan Tariq86% (7)

- Current Reality and Gsaps ReviewDocument21 pagesCurrent Reality and Gsaps Reviewapi-440230265No ratings yet

- Gold Price HistoryDocument1 pageGold Price HistoryBaihaqi MohamadNo ratings yet

- Four Pillars Finance Outlook 2012Document67 pagesFour Pillars Finance Outlook 2012Kanwal Kishore AroraNo ratings yet

- ME, Deepraj Paul, Roll 12, 1st Sem, Mini ProjectDocument10 pagesME, Deepraj Paul, Roll 12, 1st Sem, Mini ProjectNitesh KumarNo ratings yet

- Gold and Silver Update: 09-08-12Document12 pagesGold and Silver Update: 09-08-12hunghl9726No ratings yet

- Know Your MarketsDocument21 pagesKnow Your MarketsJames RussellNo ratings yet

- Nifty 50 Analysis Research PaperDocument5 pagesNifty 50 Analysis Research Paperbibaswanm7No ratings yet

- Gold VS Equity As An Asset (Jeet Kumar Paul)Document3 pagesGold VS Equity As An Asset (Jeet Kumar Paul)jeet paul academyNo ratings yet

- Foreign Exchange Market: TOPIC: Commodity-Forex RelationshipDocument9 pagesForeign Exchange Market: TOPIC: Commodity-Forex Relationshipsharmadevendra1186No ratings yet

- CNBC Dec4 Shamik Gold InterviewDocument4 pagesCNBC Dec4 Shamik Gold InterviewshamikbhoseNo ratings yet

- Analysis On Gold ReportDocument19 pagesAnalysis On Gold ReportRohit PandeyNo ratings yet

- What Are The Real Drivers of Gold Prices?: HEC, Paris Jouy-en-Josas FranceDocument15 pagesWhat Are The Real Drivers of Gold Prices?: HEC, Paris Jouy-en-Josas FrancePilot On BoardNo ratings yet

- What Are The Real Drivers of Gold Prices?: HEC, Paris Jouy-en-Josas FranceDocument15 pagesWhat Are The Real Drivers of Gold Prices?: HEC, Paris Jouy-en-Josas FrancePilot On BoardNo ratings yet

- A Golden Bet: Gold Mining Equities Versus Gold: Claude Erb TR February 17, 2014Document33 pagesA Golden Bet: Gold Mining Equities Versus Gold: Claude Erb TR February 17, 2014dpbasicNo ratings yet

- Forex and Gold Market CourseDocument32 pagesForex and Gold Market CourseBaqar Zaidi100% (3)

- Citi Corporate SolutionsDocument9 pagesCiti Corporate Solutionsapi-26094277No ratings yet

- Gold Gold GoldDocument2 pagesGold Gold GoldJeroNo ratings yet

- Silver Likely To Touch 50K Within 2yrsDocument4 pagesSilver Likely To Touch 50K Within 2yrskevulya_janiNo ratings yet

- Gold As An InvestmentDocument17 pagesGold As An Investmenttimothy454No ratings yet

- QT - Final PresentationDocument36 pagesQT - Final PresentationZeba BNo ratings yet

- Price Stability andDocument1 pagePrice Stability andneelakanthkumarNo ratings yet

- Arif HabibDocument2 pagesArif HabibUpdesh ThakwaniNo ratings yet

- Relationship Between Gold Price and Stock MarketDocument9 pagesRelationship Between Gold Price and Stock MarketSandeep Madival0% (1)

- Commodity Market Report PDFDocument8 pagesCommodity Market Report PDFHusen AliNo ratings yet

- 1-31-12 Golden CrossDocument4 pages1-31-12 Golden CrossThe Gold Speculator100% (1)

- Altın Grafik Desenleri - (Crypto Grafik Desenleri)Document4 pagesAltın Grafik Desenleri - (Crypto Grafik Desenleri)Gökdeniz CengizNo ratings yet

- karvysSpecialReports 2009111611242Document4 pageskarvysSpecialReports 2009111611242r.elakkiya mscNo ratings yet

- Great Gold Silver Ride 2012Document26 pagesGreat Gold Silver Ride 2012shamikbhoseNo ratings yet

- Will Gold Continue To Shine?: MarketDocument6 pagesWill Gold Continue To Shine?: MarketdpbasicNo ratings yet

- Gold Report 2010Document13 pagesGold Report 2010auroeaNo ratings yet

- ABML Commodities PresentationDocument24 pagesABML Commodities PresentationAlpanshu BhargavaNo ratings yet

- Retail Research: Gold ETF and Gold Funds - A ReviewDocument27 pagesRetail Research: Gold ETF and Gold Funds - A ReviewVenkat GVNo ratings yet

- Gold and Your PortfolioDocument7 pagesGold and Your Portfolioapi-26324170No ratings yet

- Swot AnalysisDocument67 pagesSwot AnalysisMohmmedKhayyumNo ratings yet

- Assessment - 2 - S3867445 2Document10 pagesAssessment - 2 - S3867445 2ng kelvinNo ratings yet

- Gold Market Forecast 2010Document8 pagesGold Market Forecast 2010Anonymous fE2l3DzlNo ratings yet

- Five Reasons Silver Glitters More Than Gold ArticleDocument4 pagesFive Reasons Silver Glitters More Than Gold ArticleNeha MahajanNo ratings yet

- 2-22-12 Charting GoldDocument2 pages2-22-12 Charting GoldThe Gold SpeculatorNo ratings yet

- AHA Article - Review of TradesDocument6 pagesAHA Article - Review of TradesMaheswarReddy SathelaNo ratings yet

- How Does Gold'S Value Change With The Stock Market?Document12 pagesHow Does Gold'S Value Change With The Stock Market?bharathandcompanyNo ratings yet

- Wrap Sheet - Jun 17, 2011Document2 pagesWrap Sheet - Jun 17, 2011jpkoningNo ratings yet

- Gold Prices in India: Study of Trends and PatternsDocument7 pagesGold Prices in India: Study of Trends and PatternsDevendar SharmaNo ratings yet

- Gold-Physical Vs MF DemystifiedDocument4 pagesGold-Physical Vs MF Demystifiedmcube4uNo ratings yet

- Guide To Investing in Gold & SilverDocument12 pagesGuide To Investing in Gold & Silveravoman123100% (1)

- Hi Ho Silver - The White Metal's Wild Ride May Not Be Over YetDocument17 pagesHi Ho Silver - The White Metal's Wild Ride May Not Be Over YetHighlander2010SPNo ratings yet

- TDGBook 2016Document138 pagesTDGBook 2016MarcoBarisonNo ratings yet

- 7-31-12 Breakout in Gold?Document3 pages7-31-12 Breakout in Gold?The Gold SpeculatorNo ratings yet

- In-Class Writing 2908Document3 pagesIn-Class Writing 2908Trinh Phuong HaNo ratings yet

- Big Picture by FMaggioniDocument7 pagesBig Picture by FMaggioniFrancesco MaggioniNo ratings yet

- Is Silver Is A Better Investment Than Gold ?Document7 pagesIs Silver Is A Better Investment Than Gold ?LalitKumar GangwarNo ratings yet

- ABC Goldbuyer-101 FinalDocument16 pagesABC Goldbuyer-101 FinaluighuigNo ratings yet

- Fundamental and Technical AnalysisDocument80 pagesFundamental and Technical AnalysisPrasad SandepudiNo ratings yet

- Poster Presentation: Relation Between Gold and Crude Oil PricesDocument2 pagesPoster Presentation: Relation Between Gold and Crude Oil PricesRaviNo ratings yet

- Adrian Douglas: Gold Market Isn't 'Fixed' It's RiggedDocument12 pagesAdrian Douglas: Gold Market Isn't 'Fixed' It's RiggedChrys AureusNo ratings yet

- GoldDocument5 pagesGoldReshma RaghuniitNo ratings yet

- Precious Metals FinalDocument54 pagesPrecious Metals FinalsmritakachruNo ratings yet

- Economics Case Study-Assignment Part (A)Document9 pagesEconomics Case Study-Assignment Part (A)mslworldNo ratings yet

- Aadhaar: Digital Inclusion and Public Services in IndiaDocument16 pagesAadhaar: Digital Inclusion and Public Services in IndiaAkash ManiNo ratings yet

- 2010-2016: Formation and Pre-Debut Activities: The X FactorDocument1 page2010-2016: Formation and Pre-Debut Activities: The X FactorHQNo ratings yet

- What Global Issues Have Emerged Because of Miscommunication DocxDocument10 pagesWhat Global Issues Have Emerged Because of Miscommunication DocxAvery SheperdNo ratings yet

- Mathematics Grade 12 21 Century Skills Based TestDocument7 pagesMathematics Grade 12 21 Century Skills Based TestChester Austin Reese Maslog Jr.No ratings yet

- Nicole Elyse NelsonDocument3 pagesNicole Elyse Nelsonapi-331206184No ratings yet

- Solve Splits Feedback ToolDocument6 pagesSolve Splits Feedback ToolkabyaNo ratings yet

- Name: Aldrich Fernandes Roll No: 06 Subject: Business Ethics and Corporate Governance Purpose: Assignment On Question & AnswersDocument5 pagesName: Aldrich Fernandes Roll No: 06 Subject: Business Ethics and Corporate Governance Purpose: Assignment On Question & AnswersAldrich FernandesNo ratings yet

- Catálogo de Bombas de Diafragma - ARODocument52 pagesCatálogo de Bombas de Diafragma - AROIvan RodrigoNo ratings yet

- 416F SpecalogDocument9 pages416F Specalogagegnehutamirat100% (1)

- Fina6000 Module 4 - Capital Budgeting ADocument40 pagesFina6000 Module 4 - Capital Budgeting AMar SGNo ratings yet

- Color FinalDocument10 pagesColor Finalapi-205280725No ratings yet

- M5 Questions and AnswersDocument14 pagesM5 Questions and AnswersAвнιѕнєк SVNo ratings yet

- Agency Competition AnalysisDocument15 pagesAgency Competition Analysischauhan1983anupamNo ratings yet

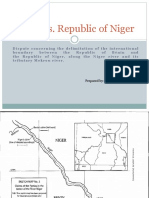

- Benin V NigerDocument9 pagesBenin V NigerRonika ThapaNo ratings yet

- AI and Digital BankingDocument13 pagesAI and Digital BankingFarrukh NaveedNo ratings yet

- Valve Employee HandbookDocument37 pagesValve Employee HandbookMilan ThakkerNo ratings yet

- Lecture 2: Drawing Basics - P1 : 1Document9 pagesLecture 2: Drawing Basics - P1 : 1roseNo ratings yet

- 1 245 2 1330 1 RP881 D4PRO DatasheetDocument1 page1 245 2 1330 1 RP881 D4PRO DatasheetJesús Lares SarabiaNo ratings yet

- Ramdump Modem 2023-09-07 07-20-23 PropsDocument26 pagesRamdump Modem 2023-09-07 07-20-23 PropsIván Carrera YentzenNo ratings yet

- RCC Teen - Task 5 - BandwidthDocument2 pagesRCC Teen - Task 5 - BandwidthRares AndreiNo ratings yet

- Governance Modes in Supply Chains and Financial Performance at Buyer, Supplier and Dyadic Levels: The Positive Impact of Power BalanceDocument30 pagesGovernance Modes in Supply Chains and Financial Performance at Buyer, Supplier and Dyadic Levels: The Positive Impact of Power BalancegiovanniNo ratings yet

- 2400W Power Supply With Single Output: SeriesDocument10 pages2400W Power Supply With Single Output: SeriesBogdan IlieNo ratings yet

- Vernacular Architecture of Hills IndiaDocument12 pagesVernacular Architecture of Hills IndiaTushar JainNo ratings yet

- Monty 1510: Spare Parts List Tire ChangerDocument24 pagesMonty 1510: Spare Parts List Tire ChangerJonathan FullumNo ratings yet

- 21cs644 Module 3Document95 pages21cs644 Module 3gmaheshreddy229No ratings yet

- WB9CYY HW8 Mods 20240403Document27 pagesWB9CYY HW8 Mods 20240403bcpsr7sc86No ratings yet