Professional Documents

Culture Documents

Authority: Actual Apparent Inherent Ratification Estoppel

Authority: Actual Apparent Inherent Ratification Estoppel

Uploaded by

Brick295Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Authority: Actual Apparent Inherent Ratification Estoppel

Authority: Actual Apparent Inherent Ratification Estoppel

Uploaded by

Brick295Copyright:

Available Formats

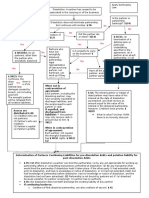

Authority

Actual

Express

Apparent Inherent Ratification Estoppel

Implied

RTA s.2.01 RTA s.2.03

RSA 8A

(RTA Strikes)

RTA 4.01 RTA s2.05

P to A P to TP P ratifies A NO AGENT

Agent acts

reasonably on

Ps

manifestations

that P wants A

so to act.

Conduct,

words, or

implied by

conduct

Based on A's

reasonable

perception

Power held by

A to affect P

when TP rbly

believes A has

authority to act

based on Ps

manifestation

to TP

Sub Agent

RTA 1.04(8)

A of A to

conduct P's

business in

scope of A

authority

Look to past

conduct

"Such powers

are as

reasonably

necessary to

carry out the

duties

Undisclosed

Principal

Or

"Rogue" A

Disclosed

Principal

Agent & TP are

parties to

agree.

Liability of

Agent on K

R3rd s.6.03

Duty is on A to disclose P

Look to K to

clarify A's

authority

App Imp

Authority: put

agent in place

for TP to rbly

believe A has

auth.

P liable for A if A's

acts are within auth

usually confided in

an agent who

normally has that

auth (can K out)

Look for

undisclosed P

P gen. Undiscl.

RSA 161

RTA expands RSA

capture "Rogues

No act or app P

may be liable to TP

based on A if:

P is

intention

or

careless

of TP

belief

P is on

notice of

TP belief

and does

not try to

stop

Affirmance of prior

act done by A

Manifest

assent

that act

will affect

legal

relations

P acts to

justify rnbl

assumptn

of consent

A must be

acting ON P's

BEHALF!

IMPLIED

affirmance = P

conduct, P

must have

reason to

know

P must have

choice, cannot

be AFTER act

Undisclosed

Principal

Unidentified

Principal

A is NOT party

UNLESS

agree

otherwise

A IS party

UNLESS

agree

otherwise

A & TP ARE

party UNLESS

agree

otherwise

Nonagent Ind.

Contractor

Liability of P on

TP on Tort

Employee

Nonemplee

Agent

NOT Liable

NO CONTROL

UNLESS:

P NOT liable

unless:

P liable if

within scope of

employment

CONTROL

Not on Agency, on KIND of Ag

RTA 7.03(1)

Direct

RTA 7.07

Employee

RTA 7.08

Apparent A

Day-to-day control, distinct operation, custom, skill, tools, time,

compensation, party belief, business or not (7.07)

POLICY Control, esp ownership

and profits tends to infer agency

Labels don't matter

RSA 1.01 P must have control

Control over actual instrument

Respondeat superior as limit

7.07 - SCOPE:

Engaging in conduct subject

to P's control

Liability = if harm is

foreseeable from conduct of

EEs

7.07 - Intentional

Look at type of tort

P assert control

P negligent

Non-delegable

P volunteers to

take duty

Apparent

Authority

"Nuisance per

se

Incompt

Contractor OR

Financ. Incom.

Nondelegable

duty

OFFICERS are

AGENTS OF

CORPORATIONS

PRES has inh auth to

bind C for K

Agent's Duties

Duty of Care

RTA 8.08, .09

Loyalty

W/in Scope &

Comply w/

Instructions

8.09

Reasonable

Care 8.08

Adverse

Dealings

8.03

Personal

Benefit

8.02

Proprietary

Inform

8.05

Competing

8.04

Personal

Profits from

Position

Reading

Grabbing &

Leaving

Town &

Contry

Usurping

Business

Singer

Fiduciary

Duties

Waiver

Waiver

Waiver Waiver Waiver

May take steps

in preparation

to compete

When in

connection to

agency

relationship

Not use

property of P

for own or TP

Cannot communicate confidential information for A

or TPs benefit

P MAY consent to

Conflict of Interest

8.01

A must act in

good faith

Disclose

MATERIAL

information

Deal fairly

P's consent

must be

specific to act

or transaction

If Breach:

Disgorge

profits to P

Worse than K

case b/c not

damages,

disgorge

Trade secured

through years

of bus. and

advertise, $$

Partnership

Unlimited liability, limit

transferability, single taxation,

limited access to capital,

informal, less regulation w/in

PS agreement, life limited to

partner

101(6); assc of

2 or more as

co-owners, for

profit

101(10):

almost any

entity can be

partner

201(a): PS is

distinct from

partners

RUPA is basis

default rules

Non-Waivable

Duty of Loyalty,

Care, Good Faith,

Inspection

(1) Agreement

b/t parties

(2) Written, not

needed

(3) Co-

property not

determinative

(4) Share in

profits,

presumed,

UNLESS

debt

wages

rent

Annuity/retire

Debt service

Sale goodwill

or property

(5) Share in

management

401(f)

(6) Partners

may be

creditors

Partnership Windup

306(a): All

Ps j/s

liable for

all

liabilities

308(e): if

not PSs w/

each

other, not

PSs to 3

rd

parties

807(a):

after

creditors,

surplus to

PS by

rights to

distribution

(7) Look at

who's at risk at

dissolution

301(1): Each partner is agent

of all UNLESS (1) P does not

have authority, AND (2) TP

knows or should know P

doesn't have author

Allows APPARENT AGENCY

(ordinary)

305(a): PS is

liable for act of

Ps if act in

ordinary

course of

business

306(a): all Ps j/

s/l for all

Late-Coming

Partners NOT

liable for

previous

incurred oblg

Partnership By Estoppel

P must show

express or

implied

holding out of

PS by D

Represent

was made by

D or person

alleged PS

Reason.

Reliance by

TP in good

faith

TP is harmed

Effect of PS by Estoppel

If D purports

to be PS and

TP relies, D is

liable to TP

IF MADE IN

PUBLIC

MANNER, D

as PSbE is

liable even if

doesn't know

If PS liability,

then that

PSbE is liable

as if P were

partner

Good Conduct

"catch-aII" 8.10

Partnership

Duty

RUPA 404(b):

duty of loyalty,

inc "approp of

partnership

opportunity

"Punctilio of an

honor most

sensative

Meinhard

Notice

+

Opportunity

RUPA 103b3:

Cannot elim loyalty,

but can id certain

categories, if not

manifestly

unreasonable

Elim duty of loyalty

when poss, limit notice,

time period limit,

change "PS

opportunity meaning

Interested party

cannot vote in

ratification of self-

interested

opportunity

Perreta v.

Prometh

RUPA

404(d):

PS must

discharge w/

obligation of

good faith &

fair dealing

Partnership

Disassociation

RUPA 601(3)

P may be

expelled as

terms of PS

Agr

RUPA 602b1:

Wrongful

expel ONLY

IF breach

express term

of PS Ag

Partnership Transfer

401(i):

All Ps must

consent to sell

PS interest

502 & 503:

PS has

personal

interest in prof

& losses &

distributions

501:

P is not co-

owner of PS

property,

cannot

transfer

504(a)-(b): Creditor MAY get

judgment against P interest

(8) Mgmt equal

rights for all Ps

unless PS Ag

says otherwise

401(j): Diff in mgmt, majority wins, if not

ordinary, must have consent of all Ps

PS FREEZEOUTS! - P v. TP

305(c) & 401(c): PS is liable for

ordinary bus of P tort, must

indemnify P if in ordinary course

103(a) PS Ag may alter relations B/T Ps &

103(b) lists non-alter in PS Ag

Partnership

Disassociation

603(a)

FOR TERM

602(b)(2): if in

term:

Owen v Cohen: if P provides loan to PS,

presumed "for term if pay of loan is out of

profits

Dissolution & Wind Up

Article 8

Continuation of Business

Article 7

602(a)

P may disass

any time, right

or wrong, by

express will

602(c)

Wrongful

disass = P

liable for

damages to

PS for disass

RUPA 801(5)

(i) economic

purpose

frustrated

(ii) one P

engag in

conduct that

makes PS not

reasonably

conduct

(iii) no longer

reasonably

practicable to

contin PS

under PS Ag

(i) P withdraws by

express will

(ii) P expelled by

judicial determ.

(iii) P becomes

debtor in bankrupt.

(iv) P expelled or

disass b/c dissolv

or termination

AT WILL

601(1): notice

by P to withdr

P may be creditor and P,

and may pursue own

interests - 404(d)

RUPA 701

Value at

windup is

greater of:

Liquidation

value, OR

Value based

on sale of bus

as going

concern w/o

disass P

(1) Voluntary Association

(2) Primacy of K PS Ag

EXPULSION: if not

permitted in PS Ag, cannot

expel, can seek dissolve but

404d

BUYOUT:

"Some objective

determination of value

needed

Fair Market Value

Wind Up

Process

807a-b: Creditors paid, then Ps

807b: profits & losses from liquidation charged

to Ps accounts

803c: person WU may dispose of and transfer

the assets

Kovacik Rule: Ps share in profits and losses

UNLESS one P is only skill & labor

Conflict w/ 401(b) proportionate shares

Amount = Capital Account (book) + avg prior 3

years profits/gains paid to GP

802(a) PS continues after dissol and

terminates when WU done fees split as in PS

Shareholder Suits

Direct

Derivative

(recovery goes to Corp)

(1) personal action by SH for injury

of SH

(2) SH as individual

(3) recovery to P-SH

(1) SH files on behalf of injury to

corporation

(2) COA belongs to corp

(3) recovery to corp

(4) special pleading required 23.1

Evaluate the HARM, who is

harmed?

Who would recover?

P was SH at time of act or

became through transfer of

SH who was at time

MBCA 7.41

SH fairly & adequately

represents interests of corp

in enforcing corp

MBCA 7.42

Demand Requirement

Written, specific demand

made upon C to take

suitable action (wrongdoers)

90 days have expired from

demand, OR demand

refused, OR 90 too long

FRCP 23.1 Must

state desired result

in demand

Demand Futility -

(1 of 3)

Majority BoD conflicted int

Del: Majority BoD not indp by

domination or control (NY: not

informed themselves)

Charged transaction not subject

to BJR BD no BJR

Show by reason. Doubt

that BD cannot decide

demand w/ part. facts

BD Accepts BD Denies

BD takes over the lawsuit

Denial is

subject to

BJR

P-SH must

overturn

BJR to

pass denial

If demand

made,

cannot

claim futility

BUSINESS JUDGMENT

RULE

Presume BD acts with good

faith and promoting best int

of corp

Overturned w/ part. facts

showing bad faith, conf int,

AND breach of fid duty

NY Rule: part facts

(2) fail to inform

(3) trans = BJR not

possible

Del Rule: reas doubt -

(2) bd lacks indp

(3) trans not valid

exercise of BJR

Special Litigation Committee

(SLC) small comm of non-interest

BD members to review demand

(1) SLC

member selc

process

review

(2) proced

used by SLC

to reach sub

review

(3) Substan

outcome

NOT

reviewed

Bd member experience with contested trans,

prior affilitations, completeness of inquiry, good

faith, no pro-forma/shallow investig, "eminent

special counsel - but TAINTED BD can appoint

SLC members

Auerbach standard Zapata standard

(1) Bd Indp &

good faith

(2) Bases

supp decision

(2) Ct applies

own "indp BJ

whether to

dismiss

More substantive review into

decision & eliminates potential

structural bias subject to Summ

Judgment Standard Rule 56 look

at personal ties (Stanford Conspir)

SH

C

Standing

NY Del

Demand Sent

Demand Requirement

Blasius Standard:

(1) P must show Bd acts with

effort to deny SH vote right

(2) Bd must provide "compelling

justification

Revlon Duty:

Duty of Bd

changes on

liquidation

duty to max

value for SHs

If SH loses

derivative suit

SH may

have to pick

up tab for D/O

and must pay

own fees

When Ds are

def in case

Public

Agency Costs

Cost of Contracting

Bonding

Cost of Monitoring

Residual Loss

Effect of

Corporation

MBCA 8.01 C power in Bd,

supervises

8.03-04: Election of Directors

Shareholders:

10.03, 10.20: Amend bylaw or Art of

Incorporation

11.04: Fundamental trans (merg)

Corporation

Basics

Public v

Private

Private

Publicly held

Big enterprise

More captz

Traded shares

Closely held

Smaller

Shares illiquid

Sm # of SHs

Like PSs

Mostly LLC now

Separation of Ownership & Control

Flexible capital structure

Equity v. Debt

Authorized Shares Outstanding Shares

Auth but Unissued Treasury Stock

Book Value Market Cap

Corporation

Creation

Terms

MBCA 2.02

# shares authorized

Corporate Name

Office & registered agent

Name & address of incoporator

Bylaw provisions

Director names

Limited liability of directors to SH

Indemnification & other

Act

2.01

File with the Sec of State

Draft Articles of Incorp

After Incorp

2.05 Elect directors, adopt by, app

officers, carry on business

MBCA 2.06 adopt bylaws, incl

management terms

Incorp

Contracts

2.04 Promoter is j/s/l for Ks

pre-inc if knew Arts not filed

2.04 Promoter liable if Art not

filed

De Facto Estoppel

Organizers:

(1) good faith

tried to incp

(2) had legal right

to do so

(3) acted as Corp

Third Party:

(1) thought other

party was Corp

(2) would suffer

detriment if not a

corp

MBCA 6.22: SH NOT personally liable,

unless own act or conduct

Limited

Liability

MBCA 6.22(b): SH NOT personally for

debts of corp

Piercing Corp Veil: 6.22 SH liable

for corporate action

Single enterprise liability v. PCV = only corp

entity would be financially respons while in

SEL single SH personally liab

Risks = regulatory, legal, operational,

reputational, interest rate, market, political,

tech, governance, fortuitous

Illinois Piercing Law Unity of interest in

ownership no diff

b/t Corp and SH

Adhering to fiction of

sep leads to (1)

FRAUD or (2)

injustice

No maint C

form or records

Commingling of

funds

Under-

capitalization

Mix use of

assets

Must be more than liability more "wrong

(i.e. tax fraud or personal expenses)

Single Enterprise Theory

Alter Ego

Parent liable for

action of subsidiary

but subs not resp for

other subs

Generally same,

unity in ownership,

commingling,

holding as one,

same office, EEs

Mere Instrumentality

Common Ds and Os, common business depts, consol financial statements/

returns, parent finances sub, P incor S, grossly inadequate capital, P pays

salaries, S business only serves P, operations comb, business prac

Direct Liability

Rest T s.324a: P

may be liable if TP

relies on

Short-Form

Merger DGLC

253

(1) No SH approv needed

(2) Bd of parent approves

(3) Parent must own 90% of

each class of stock of sub

(4) minor SH entitled to jud

value

Proxy Issues

RECORD SH

MBCA 7.01 Annual SH Mtg

MBCA 7.02 Special SH Mtg

MBCA 7.25 & DG 216:

Majority approval of SHs

(DG requires present)

(MBCA more for than ag)

Require majority of OS SHs:

Mergers, Amend Charter, etc

Election of Ds - plurality of

votes cast

Proxy Contest Electoral & Issue

Insurgents must win to be

reimbursed (not personal)

(1) Must be policy issue quest

(2) C reimb only reasonable & proper expenses

(3) C can reimb incumb W/L

(4) C reimb Inc if win & SH ratify

Proxy Fraud Rule 14a-9

No fraud permitted in proxy

statement (material)

Section 27 allows Direct &

Deriv private COA

Generally direct (loss vote)

but C can sue derivatively

Intris fairness

not aff def when

material fact

omitted if in

proxy, & proxy

was essen link

Prove

material

Prove

Essen link

Split wheth reliance

needed OM-no, Mis-yes

Injunc

damages - reciss

Attorney fees

allowed

Negligence

is standard

Excluding Proxy

Rule 14a-8

SH $2000 or 1%

If SH fails to

satisfy elig

or violates

14a-8i

Mgmt

excludes w/

burden filing

to SEC

Includes

legal

rationale

Mgmt must

notify SH w/

option to

remedy

SEC

determ.

Nonbinding

phrasing Subject to

BJR if

excluded

Insignificant/irrel proposals - >5% total

assets, net earn, and not sig to business

operations

Not nor bus

operations

Intrude on

mgmt role

Personal

grievance

Revolves around

elections

Pertains to partic

Board seat or

procedure

SH Record

Inspection

DGCL 220

SH must make proper

demand w/ prop. purpose

If SH wants SH list, burden

on mgmt to say why not

For other, burden on SH,

unless req from foreign C

(for NY statute)

Proper: (1) Subj intent to pursue

proper inter, (2) Obj std if prop pur.

Improper: info for non-C purpose,

trolling for bus, harassment

MB 3.01a & DG 101(a) -

Purpose = lawful business

MANAGER v.

SHAREHOLDER v.

DIRECTOR v. BUSINESS

FUTURE

Cum/

Line

Voting

Duty of Care BJR

Corporate

Fiduciary Duties

Standard of

Liability

Efficient Capital Market

Hypothesis (ECMH)

Lack of GF (3), Waste,

Gross Negligence

Stand of Conduct

(aspirational)

MBCA 8.30:

Good Faith

Reasonable Belief

Reasonable Care

MBCA 6.40

Distributions to

SHs

Money or other

property to SHs

subject to BJR

Weak: mrkt incorporates PAST

information

Semi-Strong: mrkt

incorporates PAST &

CURRENT information

A Ds have obl using

BJR to maximize

income for benefit of all

persons having a stake

in welfare of corporate

entity v. Dodge

Overturning

BJR

BJR is informed if directors

have informed themselves

prior to making decision of

material reas avail to them

Van Gorkam

MBCA 2.02(b)(4): Art of In may

limit liability of dir or SHs for

money damages for any action

taken [not interest, intl harm,

unlawful distrib, criminal act]

Duty of Care:

Owed to Corp

Action:

Loss b/c of ill

advised or

negligence

Inaction:

Unconsid failure of

Bd to act when act

would prevent loss

Evaluate PROCESS

Process P Must Show:

Inatt to Mis-mgmt OR Mgmt abuse

Ds knew/

should

know of

wrongful

conduct

Bd took

no steps

in good

faith to

remedy

Inaction

was prox

cause of

the loss

Duty of Loyalty: Duty owed to the Corp to act with Good Faith & Reasonable Belief of acting in

Best Int of Corp ALL Ds liable UNLESS dissent in writing (or absent)

Interested

Transactions

Usurpation of

Corp Activity

D or O cause C

to enter deal

with personal

inter for D or O

D or O takes for

personal gain a

deal from C in

which prop int

Particularized Showing Overturns BJR

No

loyalty

prob in

fact

existed

Trans

app'd by

dis-int

Ds or

SHs

"Entire

Trans

was

fair

Review "Entire Transaction"

Stock Author

MBCA 6.01 &

DGCL 151: must

say how much &

voting rights

Examine who proposes the

deal terms, look at who

promotes (deception?), control

of votes, dominate discussion?

Corporate Opportunity

Del Standard:

C is

finan.

able to

take

oppt

C has

int. or

expectc

y in

oppor

Embr opp

would

create

conf b/t D

& Corp

interest

Disclosure: removes

judicial oversight

"Deliberate indifference & inaction in

face of duty to act is conduct clearly

disloyal to Corp. (not exclusive)

Idemnification

Right to Fire Off

DGCL 141(a)

Bd has right of

oversee mgmt

Only if D/O acted in good faith my C

indemnify

Shareholder

Care/Action

SHs owe NO

fiduciary

duties to other

SHs

CONTROL SHs owe fid

duties to minority SHs

Ratification

DGCL 144

Interested transaction not

voidable b/c of interest if

disclosed & appr by maj. of:

(1) Disinterested Directors

(2) SHs entitled to vote

(3) K or transaction is fair to C

(1) Interested

trans b/t

CORP and

DIRECTORS

= ratif by

disinterested

SHs then

subject to BJR

(2) Interested

trans b/t

CORP &

CONTR SH

If rat by

major of

minor SH, P

must show

unfairness

If no rat by

disint SHs,

control SH

must prove

"entire

fairness

Strong: Mrkts incorporate all

information (even not public)

Executive

Compensation

Flagrant

Diversion

Disclosure to

Shareholders

Insider

Information

Entrechment

Essentially

stealing C

assets allows

C to sue for brh

When Os

salary > fair

mrkt value

Providing SHs

false or

deceptive info

to detriment

See next page

Mgmt uses

governing

structure to

divert power

Rebut presump that D

perform honestly & well-

meaning, decisions

rationally undertaken

(1) Shield Ds from PR

(2) Insul Bd decisions Waste:

Lack of rational purpose

Care = Not in Good Faith:

(1) Fraud (2) Con of Interest

(3) Illegality

Gross Negligence:

Lack of reason effort to inform

DGCL 141(e): DIR may rely on compensation experts & may trust

decisions of mgmt, employees, legal counsel, bd committee, etc.

MBCA 8.30(e)-(f): Directors can rely on reps

made by mgmt, experts, counsel, comm, etc

Board Reliance

To Defend

(1 of 3):

Interested

Conduct

Subj

intent to

harm

Gross

Negl - w/o

intent

Derelict of

Duty -

cons

disregard

Spectrum of Bad Faith - Loy to Care

DGCL 102b7 Art of Incp may

eliminate or limit DIR (not O)

pers liabl for breach of fiduciary

duty

Exculpation of DIR

(not officers)

Effect

Overcoming

DG 145(a) - May indem D or O for suit expenses

brought by SH or TP (jud, fines, and setlm)

DG 145(b) - suits brought by C, only indem att'y fees

DG 145(c) - MUST indem if succ on MERITS

DG 145(c) - if lose, C MAY if 145a/b applies

DG 145(e) - may ADVANCE, must return if not indem

DG 145(f) - D & O may K for more coverage

MB 8.51(a) Permissible indem if (1) good faith OR

(2) conduct which may/must be indem by C

MB 8.51(c) termination of suit is not determinative

that D did not meet standard (settlements allowed)

MB 8.51(d)(1) C cannot indem if suit brought by C

UNLESS reas expens if D/O met standard

MB 8.51(d)(2) C cannot indem if D/O liable for harm

in which D/O received financial benefit

MB 8.56 - ADVANCE - D/O yes, Off no if C brings or

bad faith, disloyalty, intentional crim conduct

MB 8.52 - REQUIRED IND - if D/O wholly successful

MB 8.53 - D must provide (1) written aff of GF, (2)

promise to repay if not ent to mandatory indem

Advance payments subject to

reasonable expenses

Close Corp (35 or < SHs)

Majority must

have legitimate

business pur

If yes, minor

must show other

means poss.

Ct must

balance

legit bus

pur agst

practi of

prop alt

Del Standard

BJR:

Burden

on P to

rebut

Bds act

IFT:

Maj get

ben +

exc min

+ at exp

of min

Close Freeze-Out

MA Rule: Maj frustrates Min's

reason expectation of ben of own

Remedy: reason expect of min req

factual determination

Min w/ veto has fid duty to maj

Min Veto

Model Code

Del Code

Close Corp Ag

to Prevent

MB 7.30:

Voting Trust

MB 7.31: Voting

Agreements

SH Ag CANNOT

bind Directors as D

UNLESS

(1) Close Corp

(2) Min nonpart no

object, AND (3)

terms = reasonab Remedy as specific perform. OR

recission OR strike votes (Ringling)

Must show CAUSE & LOSS

Securities Act &

SEC Regulation

Basics

Will generally include if

control rights are not

possible and capital is

basis for invest

Attrib of Stock

1933 Act s. 11

SA 2(a)(1) - defines security

(1) right to divid &

profit

(2) negotiability

(3) ab to pledge/

hypothecate

(4) voting rights

(5) capacity to

appreciate in value

Any contract where investment in

common enterprise purposed on

expectation of profit by work of TP

"Profit soley on efforts of

promoter or TP

Look to passivity & control

Atrib of LLC

(1) contracted

allocation of prof, not

share

(2) membership not

freely alienable

(3) Mems cld pledge

econ int but not

control rights

1933 Process Cannot sell sec. register

Offer but no sale

SEC Review: adq of

disclosure, not merits

Registration Statement

= Effective

Sales allowed &

prospectus must be

delivered

Liabilities

1933 Act

s.12(a)(1)

1933 Act

s.12(a)(2)

Private Rights of

Action

Fraud in regis statement

No req of reliance or cause

Due diligence defense

Strt liab for ill offers/sales

Recission remedy

Fraud in prospectus or oral

sales communication

1934 s. 10(b), Rule 10b-5

Rule 14a & proxy rules

Exemptions from

Registration

1934 Act s. 4

Rule 14a & proxy rules

Private placements & trans done by other

than person, issuer, or dealer

Small, limited offerings

Private

Placement

Test

Number of

offerees &

relation to

issuer

Number

of units

offered

Size

of

offering

Manner

of

offering

Total # offered,

sophistication,

access to info

Materiality:

nfo an "avg prudent investor ought reason. Have before purchasing

No liab if (1) reason investigation, (2) reason to believe, (3) did

believe that when regis became effective statements were true

Cannot claim ignorance

Unlawful for person to

use instru thru mail or

commerce to

Use or employ deception in

sale of publicly traded secur

to bypass SEC rules

Employ device, scheme, or artiface to

defraud

Make untrue statement of material fact

or omit material fact to justify

misleading statements

Engage in any act or business which

operates as fraud or deceit upon another

in connection to sale of security

Min recklessness

required

Only purchasers or

buyers have standing

Silence not

actionable

Causation & Reliance required element

Fraud on the Market

Theory:

Price of stock in

public depends on

material information

available

Loss

Causation:

Fraud causes

the LOSS

Horizontal D

Trans

Causation:

Fraud caused

the investment

Material

Misrepresent

(fraud/deceit)

Scienter

(recklessness or

wrongful mind)

Connection to

sale of security

Reliance

Economic

Loss

Loss

Causation

Manipulations

Wash sale

Matched sale

Sarbanes Oxley:

Transactions

Procedures - Sturct

S. 304 CEO/CFO comp

deduct when finan misst

S. 306 no exec trades

when EE cant trade

S. 404 no loans to

company executives

S. 404 annual internal

control reports

S. 406 code of ethics for

senior officers

S. 407 financial expertise

of audit comm members

S. 301 audit comm req w/

specified composition

options included

Prove with expert

analysis

Basic - trans cause West - loss cause Dura - prove loss

Insider Trading

1934 s.16(b)

Os, Ds, and 10% SH

if possess material

inside info, must

disclose or not trade

Only if Material balance b/t

prob that event will occur and

magnitude of event in light of

totality of company activity

Must be in CONNECTION

with sale & must be insider

(actual or temp fiduciary)

Emphasis on

equal access to

information

Tipee

Derivative: Tipee assumes

FID Duty of SH if (1) tipper

breached fid duty to share

info & (2) tipee knows/

should know of breach

Misappropriate Theory

Misapp confid info for secur

trade in breach owed

1934 Section 16(a)

Short-Swing Profits

Directly or indirectly owner GR

THAN 10% any class of any

equity (t cross 10% no count)

Director or officer of issuer

either purchase or sale

Any profit realized from any

purchase or sale w/in any period

of less than 6 months = disgorge

Strict Liab

Only stock &

convertible debt

not all securities

like 10b-5

SHs can sue

derivatively

Match lowest pur

$ w/ highest sales

$ w/in 6 mo.

Options = strike

+ premium

You might also like

- Question 1 (1 Point)Document44 pagesQuestion 1 (1 Point)milanchabhadiya288No ratings yet

- Gilbert Law Summaries On Torts (2008) 726 PagesDocument726 pagesGilbert Law Summaries On Torts (2008) 726 PagesBILLYNo ratings yet

- FlowchartsDocument6 pagesFlowchartsesanchezfloat100% (2)

- Torts Weisberg 2018 OutlineDocument28 pagesTorts Weisberg 2018 OutlineLeopold bloomNo ratings yet

- Biz Orgs Attack OutlineDocument5 pagesBiz Orgs Attack OutlineSam Hughes100% (2)

- Corporations OutlineDocument61 pagesCorporations OutlineDan StewartNo ratings yet

- Bus. Org. OutlineDocument73 pagesBus. Org. OutlineJAY DEENo ratings yet

- Checklist PRDocument8 pagesChecklist PRDouglas GromackNo ratings yet

- Professional Responsibility - Morgan - Spring 2006Document33 pagesProfessional Responsibility - Morgan - Spring 2006tyuuNo ratings yet

- Torts Short SheetDocument2 pagesTorts Short SheetDerik Tyson SandersNo ratings yet

- FL Con Law OutlineDocument157 pagesFL Con Law Outlineomaidadelgado100% (3)

- Corporations, Kraakman, Fall 2012Document61 pagesCorporations, Kraakman, Fall 2012Chaim SchwarzNo ratings yet

- A Quantum Explanation of Sheldrakes Morphic Resonance by A GoswamiRupert SheldrakeDocument13 pagesA Quantum Explanation of Sheldrakes Morphic Resonance by A GoswamiRupert SheldrakeDavid Jaramillo KlinkertNo ratings yet

- Attack SheetDocument3 pagesAttack SheettoddmbakerNo ratings yet

- Rincipal Gent Iability IN ORT: UnlessDocument4 pagesRincipal Gent Iability IN ORT: UnlessLaura CNo ratings yet

- Business Associations RosenDocument64 pagesBusiness Associations RosenLarry RogersNo ratings yet

- Con Law OutlineDocument23 pagesCon Law OutlineJonathan EspNo ratings yet

- Business OrganizationsDocument71 pagesBusiness Organizationsjdadas100% (2)

- Professional Responsibility MaymesterDocument64 pagesProfessional Responsibility MaymesterSierra ChildersNo ratings yet

- BA Outline - OKellyDocument69 pagesBA Outline - OKellylshahNo ratings yet

- Legislation and Regulation TushnetDocument33 pagesLegislation and Regulation TushnetSarah HuffNo ratings yet

- PPR Rules For MidtermDocument11 pagesPPR Rules For MidtermRonnie Barcena Jr.No ratings yet

- Bar - Professional Responsibility OutlineDocument7 pagesBar - Professional Responsibility OutlineNaama ShemeshNo ratings yet

- Biz Orgs OutlineDocument74 pagesBiz Orgs OutlineRonnie Barcena Jr.No ratings yet

- Basic Analysis For IntestacyDocument10 pagesBasic Analysis For IntestacyVictoria ZingerNo ratings yet

- Products Liability OutlineDocument23 pagesProducts Liability OutlineYifei HeNo ratings yet

- BA OutlineDocument63 pagesBA Outlinex3pia100% (1)

- Business Associations Berdejo Fall 2020 MC4xNzI3NTkwMADocument105 pagesBusiness Associations Berdejo Fall 2020 MC4xNzI3NTkwMARhyzan CroomesNo ratings yet

- PR TemplateDocument9 pagesPR TemplateHaifa NeshNo ratings yet

- Standard Test Chart Deal I MBC ADocument16 pagesStandard Test Chart Deal I MBC ADevorah GillianNo ratings yet

- Corporation Essay ChecklistDocument5 pagesCorporation Essay ChecklistCamille2221No ratings yet

- Contracts Outline Spring 2008Document29 pagesContracts Outline Spring 2008chaiseproctorNo ratings yet

- Real Prop MiniDocument17 pagesReal Prop MiniGil CrochiereNo ratings yet

- Biz Orgs Outline: ÑelationshipsDocument26 pagesBiz Orgs Outline: ÑelationshipsTyler PritchettNo ratings yet

- Legislation and Regulation Class OutlineDocument9 pagesLegislation and Regulation Class OutlineIan Ghrist0% (1)

- Corporations Characteristics: Corporation PartnershipDocument16 pagesCorporations Characteristics: Corporation PartnershipSamantha AbenesNo ratings yet

- Family Law OutlineDocument18 pagesFamily Law OutlineBill TrecoNo ratings yet

- Property Attack Sheet & Outline - GW Prof. Kieff 2009 - Text Merrill & SmithDocument36 pagesProperty Attack Sheet & Outline - GW Prof. Kieff 2009 - Text Merrill & SmithlpignateNo ratings yet

- Community PropertyDocument2 pagesCommunity Propertyjm9887No ratings yet

- Outline Draft 1Document28 pagesOutline Draft 1Rishabh Agny100% (1)

- UPA DissolutionDocument1 pageUPA DissolutionNiraj ThakkerNo ratings yet

- Professional Responsibility - MODEL RULES CHARTDocument14 pagesProfessional Responsibility - MODEL RULES CHARTGabbyNo ratings yet

- Charted Information - JimDocument4 pagesCharted Information - JimCharles CrewsNo ratings yet

- Professional Resp ExamDocument5 pagesProfessional Resp ExamMaybach Murtaza100% (1)

- Business Association OutlineDocument91 pagesBusiness Association OutlineJorgeIvanPardo100% (1)

- Ethics OutlineDocument35 pagesEthics OutlinePaul UlitskyNo ratings yet

- Business Associations OutlineDocument52 pagesBusiness Associations OutlineChi Wen YeoNo ratings yet

- Con Law II - Final OutlineDocument27 pagesCon Law II - Final OutlineKeiara Pather100% (1)

- Bus Org OutlineDocument31 pagesBus Org OutlineporkyxpNo ratings yet

- Remedies Checklist of TopicsDocument1 pageRemedies Checklist of Topicsyoung4180% (1)

- Agency N PartnershipDocument19 pagesAgency N Partnershipbi2345No ratings yet

- Con Law 2 OutlineDocument48 pagesCon Law 2 OutlineNolaMayoNo ratings yet

- Quick Attack SheetDocument2 pagesQuick Attack SheetBrianStefanovicNo ratings yet

- BA OutlineDocument17 pagesBA OutlineCarrie AndersonNo ratings yet

- Corporations OutlineDocument4 pagesCorporations OutlineKeith DyerNo ratings yet

- My Ethics TemplatesDocument52 pagesMy Ethics TemplatesAlejandro CuevasNo ratings yet

- Business Associations Pollman Spring 2018 2Document75 pagesBusiness Associations Pollman Spring 2018 2Missy Meyer100% (1)

- Constitutional Law Essay OneDocument8 pagesConstitutional Law Essay OneshizukababyNo ratings yet

- Constitutional Law I Funk 2005docDocument24 pagesConstitutional Law I Funk 2005docLaura SkaarNo ratings yet

- I. The Supreme Court Rises: (Conservative)Document8 pagesI. The Supreme Court Rises: (Conservative)izdr1No ratings yet

- Criminal Law Outline Spring 2010Document17 pagesCriminal Law Outline Spring 2010BUbobby24No ratings yet

- RCPI v. NTCDocument2 pagesRCPI v. NTCYodh Jamin OngNo ratings yet

- Hot-Rolled Carbon, Low-Alloy, High-Strength Low-Alloy, and Alloy Steel Floor PlatesDocument10 pagesHot-Rolled Carbon, Low-Alloy, High-Strength Low-Alloy, and Alloy Steel Floor PlatesSama UmateNo ratings yet

- Cs302-Finalterm Solved Mcqs With Refrences by DR Abdul SaboorDocument51 pagesCs302-Finalterm Solved Mcqs With Refrences by DR Abdul SaboorPervez Shaikh100% (1)

- Sindhi Literature During Different PeriodsDocument7 pagesSindhi Literature During Different PeriodsRashid AbbasNo ratings yet

- Contoh PPT Seminar Proposal PbiDocument35 pagesContoh PPT Seminar Proposal Pbidinda mawaddahNo ratings yet

- Artikel - Esensi Dan Urgensi Integritas Nasional Di Lingkungan Mahasiswa Universitas Sriwijaya Dalam Bhinneka Tunggal IkaDocument8 pagesArtikel - Esensi Dan Urgensi Integritas Nasional Di Lingkungan Mahasiswa Universitas Sriwijaya Dalam Bhinneka Tunggal IkaAkmal DwiNo ratings yet

- English 8 Third Quarter Curriculum MapDocument5 pagesEnglish 8 Third Quarter Curriculum MapAgnes Gebone TaneoNo ratings yet

- ProxxonDocument32 pagesProxxonZoran LazicNo ratings yet

- Risks Factors LBP Young AthletesDocument9 pagesRisks Factors LBP Young AthletesCONSTANZA PATRICIA BIANCHI ALCAINONo ratings yet

- Foreign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)Document15 pagesForeign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)TanuNo ratings yet

- Brain Teasers: GMAT: Problem SolvingDocument5 pagesBrain Teasers: GMAT: Problem SolvingHarsh MalhotraNo ratings yet

- Trillion DollarsDocument95 pagesTrillion DollarsVyacheslav GrzhibovskiyNo ratings yet

- GTNetS ManualDocument148 pagesGTNetS ManualJatin JaniNo ratings yet

- LJMU Student Guide v1.9Document49 pagesLJMU Student Guide v1.9Venice LaufeysonNo ratings yet

- Introduction of Korean 1000MW USC BoilerDocument27 pagesIntroduction of Korean 1000MW USC BoilerDiego Martínez FernándezNo ratings yet

- Depth-First Search: COMP171 Fall 2005Document27 pagesDepth-First Search: COMP171 Fall 2005Praveen KumarNo ratings yet

- C37 012-Ieee PDFDocument54 pagesC37 012-Ieee PDFanupama jakka100% (1)

- Passing Package PDFDocument10 pagesPassing Package PDFAddds Muhammmed100% (1)

- Notes Industrial Security ConceptsDocument40 pagesNotes Industrial Security ConceptsAC GonzagaNo ratings yet

- Mohit Bansal2 MRF Project ReportDocument87 pagesMohit Bansal2 MRF Project ReportMohit BansalNo ratings yet

- Drinking Water Literature ReviewDocument7 pagesDrinking Water Literature Reviewaiqbzprif100% (1)

- Old Age Pension VeteranDocument2 pagesOld Age Pension VeteranLADY LYN SANTOSNo ratings yet

- 1967 1 EngDocument17 pages1967 1 EngTateNo ratings yet

- Rift Valley University: Department: - Weekend Computer ScienceDocument13 pagesRift Valley University: Department: - Weekend Computer ScienceAyele MitkuNo ratings yet

- Lexical and Syntax Analysis: TopicsDocument5 pagesLexical and Syntax Analysis: TopicsReshma PiseNo ratings yet

- DoctrineDocument54 pagesDoctrinefredrick russelNo ratings yet

- Oana Adriana GICADocument42 pagesOana Adriana GICAPhilippe BrunoNo ratings yet

- PolymerDocument95 pagesPolymerG M Ali KawsarNo ratings yet