Professional Documents

Culture Documents

Content: SR No. Particulars Page No

Content: SR No. Particulars Page No

Uploaded by

PiNak JogiaCopyright:

Available Formats

You might also like

- CreditLimit UpdateDocument5 pagesCreditLimit UpdateadeelrsNo ratings yet

- Financial Servises Provided by Anand RathiDocument48 pagesFinancial Servises Provided by Anand RathiVarsha WahaneNo ratings yet

- Scope of E-Marketing - WWWDocument109 pagesScope of E-Marketing - WWWaryanboxer78667% (3)

- Rishabh Jain - Team Project and PresentationsDocument28 pagesRishabh Jain - Team Project and PresentationsRishabh JainNo ratings yet

- Axis BankDocument22 pagesAxis Bankअक्षय गोयल67% (3)

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelNo ratings yet

- Finm News Analysis of RelianceDocument21 pagesFinm News Analysis of RelianceHimanshi SisodiyaNo ratings yet

- Financial Statement Analysis of Ashok Leyland Limited, IndiaDocument9 pagesFinancial Statement Analysis of Ashok Leyland Limited, IndiaShubham NamdevNo ratings yet

- Moil Limited: (A Govt. of India Enterprise) Moil Bhawan, 1-A Katol Road, NAGPUR - 440 013Document9 pagesMoil Limited: (A Govt. of India Enterprise) Moil Bhawan, 1-A Katol Road, NAGPUR - 440 013amits3989No ratings yet

- Data 2010Document9 pagesData 2010krittika03No ratings yet

- NPA History of IDBI Bank MainDocument7 pagesNPA History of IDBI Bank MainMonish SelvanayagamNo ratings yet

- Subodha Accounts Term PaperDocument51 pagesSubodha Accounts Term PaperRakesh KumarNo ratings yet

- A Mini Project Report On Fiancial ManagementDocument15 pagesA Mini Project Report On Fiancial ManagementAmit SharmaNo ratings yet

- Fuidamental AnalysisDocument3 pagesFuidamental AnalysisPrashant MujumdarNo ratings yet

- FIN435 ProjectDocument18 pagesFIN435 ProjectIshtiaque HasanNo ratings yet

- Arvind MillsDocument33 pagesArvind MillshasmukhNo ratings yet

- ) L Ey÷ela Ey E: Dion Global Solutions LimitedDocument10 pages) L Ey÷ela Ey E: Dion Global Solutions LimitedJack MartinNo ratings yet

- Chapter - 1 Introduction Company Profile and Industry ProfileDocument66 pagesChapter - 1 Introduction Company Profile and Industry ProfileUday GowdaNo ratings yet

- Ratio Analysis of AmulDocument51 pagesRatio Analysis of Amulrachitvalecha92No ratings yet

- Chapter One: Broad ObjectiveDocument19 pagesChapter One: Broad ObjectiveGolam Samdanee TaneemNo ratings yet

- Chapter - 1 1.1 AccountingDocument40 pagesChapter - 1 1.1 AccountingShrinivasa NNo ratings yet

- Aditya Birla CapitalDocument9 pagesAditya Birla Capitalashish kumarNo ratings yet

- ICICI Bank - ProjectDocument17 pagesICICI Bank - ProjectTejasvi KatiraNo ratings yet

- Account Project OrginalDocument41 pagesAccount Project OrginalshankarinadarNo ratings yet

- Industry Profile: Overview of The IndustryDocument17 pagesIndustry Profile: Overview of The Industrysainandan pvnNo ratings yet

- Session 1 Financial Accounting Infor Manju JaiswallDocument41 pagesSession 1 Financial Accounting Infor Manju JaiswallpremoshinNo ratings yet

- A Financial ReportDocument28 pagesA Financial ReportLavanya BhoirNo ratings yet

- Chapter-1: 1. Industry Scenario 1.1 Macro ProspectiveDocument52 pagesChapter-1: 1. Industry Scenario 1.1 Macro Prospectivemubeen902No ratings yet

- DLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverDocument15 pagesDLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverShashi ShekharNo ratings yet

- I Have Learned The: TH THDocument12 pagesI Have Learned The: TH THmayankNo ratings yet

- "Financial Health of Reliance Industries Limited": A Project Report OnDocument52 pages"Financial Health of Reliance Industries Limited": A Project Report Onsagar029No ratings yet

- Unit 6 Management of Cash: StructureDocument21 pagesUnit 6 Management of Cash: StructurerolandodavalosNo ratings yet

- Training and Development RelienceDocument81 pagesTraining and Development RelienceAbdullah KhanNo ratings yet

- 22mbr002-Sapm Mini ProjectDocument23 pages22mbr002-Sapm Mini ProjectABUBAKAR SIDIQ M 22MBR002No ratings yet

- Annual Report 2012 Bank Bukopin SyariahDocument257 pagesAnnual Report 2012 Bank Bukopin SyariahMMujahid10No ratings yet

- Analysis of Financial Statement of Tata MotorsDocument16 pagesAnalysis of Financial Statement of Tata MotorsErya modiNo ratings yet

- Automobile Industry PresentationDocument25 pagesAutomobile Industry PresentationMurali DaranNo ratings yet

- Corporate Social Responsibility (CSR) at Hindustan Uniliver Ltd. - A Case StudyDocument7 pagesCorporate Social Responsibility (CSR) at Hindustan Uniliver Ltd. - A Case StudyShalini VermaNo ratings yet

- JK Tyre Industries LTDDocument15 pagesJK Tyre Industries LTDAlex KuruvillaNo ratings yet

- Annual Report 2013 Axis BankDocument211 pagesAnnual Report 2013 Axis BankRahul PagariaNo ratings yet

- Term 1 ProjectDocument9 pagesTerm 1 ProjectNiraj ThakurNo ratings yet

- Fundamentals of FinancemangementDocument103 pagesFundamentals of FinancemangementjajoriavkNo ratings yet

- Equity Research: Si No. Questions 1Document14 pagesEquity Research: Si No. Questions 1ShilpaNo ratings yet

- Cbs VijayaDocument14 pagesCbs Vijayamusik loveNo ratings yet

- Ratio Analysis SampleDocument16 pagesRatio Analysis SampleRitoshree paulNo ratings yet

- Annual Report - 2010 OnidaDocument116 pagesAnnual Report - 2010 Onidasdg20No ratings yet

- DCM Shriram 2014Document109 pagesDCM Shriram 2014MailtodisposableMailtodisposable100% (1)

- Advanced Financial ManagementDocument11 pagesAdvanced Financial ManagementshubhiNo ratings yet

- Financial Sources of Reliance Industries: Chaubey Anandvardhan NagendraDocument9 pagesFinancial Sources of Reliance Industries: Chaubey Anandvardhan NagendraSUNNY GULATI-DM 21DM202No ratings yet

- Working Capital Management With Reference To Union BankDocument62 pagesWorking Capital Management With Reference To Union Bankvaishalipress1978No ratings yet

- Financial Modeling Dabur Template-DCFDocument87 pagesFinancial Modeling Dabur Template-DCFSidharthNo ratings yet

- Management of CashDocument21 pagesManagement of CashKarthikNo ratings yet

- RIL Annual Report 2013Document228 pagesRIL Annual Report 2013Amar ItagiNo ratings yet

- Reliance Industries LimitedDocument15 pagesReliance Industries LimitedBhavNeet SidhuNo ratings yet

- Indian Rayon FinanceDocument72 pagesIndian Rayon FinanceDipak DiyoraNo ratings yet

- Company Profile: Hero Motocorp LimitedDocument25 pagesCompany Profile: Hero Motocorp LimitedjupinderNo ratings yet

- Ruff Draft1Document70 pagesRuff Draft1Kalpit TrivediNo ratings yet

- Security Analysis and Portfolio Management Analysis of Shares of Icici Bank LTDDocument15 pagesSecurity Analysis and Portfolio Management Analysis of Shares of Icici Bank LTDjosephadayanNo ratings yet

- Hindalco Industries Ltd000Document19 pagesHindalco Industries Ltd000Parshant Chohan100% (1)

- Research Analysis: Prepared by Darshan PatiraDocument8 pagesResearch Analysis: Prepared by Darshan Patiradarshan jainNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Jikku CVDocument2 pagesJikku CVjikkuabraham2No ratings yet

- Remittance Directory: Metrobank Foreign Branches & SubsidiariesDocument11 pagesRemittance Directory: Metrobank Foreign Branches & SubsidiariesJay PelitroNo ratings yet

- Equity Derivatives: Market Round UpdateDocument2 pagesEquity Derivatives: Market Round UpdateNaleep GuptaNo ratings yet

- Forex GrailDocument17 pagesForex GrailVeeraesh MSNo ratings yet

- How To Read Your MT4 Trading StatementDocument7 pagesHow To Read Your MT4 Trading StatementwanfaroukNo ratings yet

- Summary:: The Annual GDP of India Gets Traded in The Money Market in Just One Day. Even Though TheDocument70 pagesSummary:: The Annual GDP of India Gets Traded in The Money Market in Just One Day. Even Though Thenigamshatru100% (10)

- BGE Minta SzóbeliDocument2 pagesBGE Minta Szóbelieniko0330No ratings yet

- Lecture9 Chapter14 JHDocument29 pagesLecture9 Chapter14 JHJerónimo BedoyaNo ratings yet

- Project On Analysis of Financial Performance (KNSB LTD)Document73 pagesProject On Analysis of Financial Performance (KNSB LTD)Ronit Singh100% (2)

- Beter Balance Cash HoldingsDocument28 pagesBeter Balance Cash HoldingsJemal SeidNo ratings yet

- Equitable Pci v. Tan, GR 165339Document12 pagesEquitable Pci v. Tan, GR 165339vylletteNo ratings yet

- Chapter 5 Acceptance of Deposits by CompaniesDocument52 pagesChapter 5 Acceptance of Deposits by CompaniesAbhay SharmaNo ratings yet

- Pradhan Mantri Jan Dhan YojanaDocument6 pagesPradhan Mantri Jan Dhan YojanaSweta SharmaNo ratings yet

- Lux Leaks RevisitedDocument158 pagesLux Leaks RevisitedLuxembourgAtaGlanceNo ratings yet

- 101 Money Secrets PDFDocument58 pages101 Money Secrets PDFvishaligarg67% (3)

- 059 Spouses Rabat v. PNBDocument2 pages059 Spouses Rabat v. PNBAquino, JPNo ratings yet

- White Marketing Development Corporation vs. Grand WoodDocument1 pageWhite Marketing Development Corporation vs. Grand WoodAnonymous nBo7g7J49No ratings yet

- Investment Analysis: A Study OnDocument77 pagesInvestment Analysis: A Study OnrameshNo ratings yet

- TAMDocument7 pagesTAMErnani TumampoNo ratings yet

- IndiaDocument85 pagesIndiaAnik DuttaNo ratings yet

- Strategic Change - 2016 - Durkin - Relationship Banking in Practice Perspectives From Retired and Serving Retail BranchDocument17 pagesStrategic Change - 2016 - Durkin - Relationship Banking in Practice Perspectives From Retired and Serving Retail BranchhaadiNo ratings yet

- US Department of Justice Antitrust Case Brief - 00702-2004Document6 pagesUS Department of Justice Antitrust Case Brief - 00702-2004legalmattersNo ratings yet

- The Crescent Standard Investment Bank LimitedDocument3 pagesThe Crescent Standard Investment Bank LimitedhammasNo ratings yet

- PF Combined ChallanDocument137 pagesPF Combined ChallanPraveen SaxenaNo ratings yet

- Anton R. Valukas, Examiners Report - in Re Lehman Brothers Inc., Et Al., (2010-03-10) - Volume 7 - Appendices 2 - 7Document511 pagesAnton R. Valukas, Examiners Report - in Re Lehman Brothers Inc., Et Al., (2010-03-10) - Volume 7 - Appendices 2 - 7Meliora CogitoNo ratings yet

- Wa0013.Document7 pagesWa0013.viphainhumNo ratings yet

- Risk Analysis in LendingDocument2 pagesRisk Analysis in Lendingjoshua omondiNo ratings yet

Content: SR No. Particulars Page No

Content: SR No. Particulars Page No

Uploaded by

PiNak JogiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Content: SR No. Particulars Page No

Content: SR No. Particulars Page No

Uploaded by

PiNak JogiaCopyright:

Available Formats

CONTENT

Sr no. 1 2 3 4 5 6 Particulars Introduction of RIL Company Profile Financial Information of RIL Financial Analysis of RIL Findings & Suggesions Conclusion & Bibliography Page No. 5 7 8 13 20 22

Introduction

The Reliance Group, founded by Dhirubhai H. Ambani (1932-2002), is India's largest private sector enterprise, with businesses in the energy and materials value chain. Group's annual revenues are in excess of US$ 58 billion. The flagship company, Reliance Industries Limited, is a Fortune Global 500 company and is the largest private sector company in India. Backward vertical integration has been the cornerstone of the evolution and growth of Reliance. Starting with textiles in the late seventies, Reliance pursued a strategy of backward vertical integration - in polyester, fibre intermediates, plastics, petrochemicals, petroleum refining and oil and gas exploration and production - to be fully integrated along the materials and energy value chain. The Group's activities span exploration and production of oil and gas, petroleum refining and marketing, petrochemicals (polyester, fibre intermediates, plastics and chemicals), textiles, retail, infotel and special economic zones. Reliance enjoys global leadership in its businesses, being the largest polyester yarn and fibre producer in the world and among the top five to ten producers in the world in major

2

petrochemical products. Major Group Companies are Reliance Industries Limited, including its subsidiaries and Reliance Industrial Infrastructure Limited.

Company profile

Date of Establishment Revenue Market Cap Corporate Address 1966 58006.5 ( USD in Millions ) 2444525.33559075 ( Rs. in Millions ) 3rd Floor Maker Chambers IV,222 Nariman Point, Mumbai-400021, Maharashtra www.ril.com Chairperson - Mukesh D Ambani MD - Mukesh D Ambani Directors - Ashok Misra, Dharam Vir Kapur, Dipak C Jain, Dr Dharam Vir Kapur, Dr Raghunath A Mashelkar, Hardev Singh Kohli, Hital R Meswani, K Sethuraman, Mahesh P Modi, Mansingh L Bhakta, Mukesh D Ambani, Nikhil R Meswani, P M S Prasad, Pawan Kumar Kapil, Prof Ashok Misra, Prof Dipak C Jain, R Ravimohan, Raghunath A Mashelkar, Ramniklal H Ambani, S Venkitaramanan, Vinod M Ambani, Yogendra P Trivedi Refineries The Reliance Group, founded by Dhirubhai H. Ambani , is India's largest private sector enterprise, with businesses in the energy and materials value chain. Group's annual revenues are in excess of $ 30 billion. The flagship company, Reliance Industries Limited, is a Fortune Global 500 company and is the largest private sector company in India. Dhirubhai Ambani founded Reliance as a textile company and le Total Income - Rs. 2515891.1 Million ( year ending Mar 2011) Net Profit - Rs. 202863 Million ( year ending Mar 2011) K Sethuraman ABN Amro Bank, Allahabad Bank , Andhra Bank, Bank of America, Bank of Baroda, Bank of India , Bank of Maharashtra, Calyon Bank, Canara Bank , Central Bank

Management Details

Business Operation Background

Financials

Company Secretary Bankers

of India, Citi Bank, Corporation Bank, Deutsche Bank, HDFC Bank, HSBC Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, Oriental Bank of Commerce, Punjab National Bank, Standard Chartered Bank, State Bank of Hyderabad, State Bank of India, State Bank of Patiala, State Bank of Saurashtra, Syndicate

Financial Information of Reliance Industries Limited

Working capital

Each and every company wants to have sufficient capital in the hand of cop up with the capital blocked in inventories and receivables.

Working capital refers to that part of capital which is not tie up in fixed assets but it is used for the day to day requirements of business it is invested in current assets like cash, stock, bills, receivables and debtors etc.

This type of capital is used to make payments for purchase or raw materials, wages and to meet other expenses till goods are sold and money is collected against it.

Net working capital refers to the difference between current assets and current liabilities. Without adequate working capital that can be no progress in industry.

Components of working capital

There are some important components of working capital which requires attention. Since, working capital is excess of current assets over current liabilities the forecast for working capital requirements can be made only after estimating the among of different continents or working capital in include stock of raw materials, work in progress and goods.

1. Inventories: Inventories are one of the main components of working capital in any industry. There are total three 3 kinds of inventories the company can have as like: a. stock of raw materials b. stock of work in progress c. Stock of finished goods.

2. Sundry debtors: Sundry debtors are also one of the important elements of working capital of the company. Liquidity of the company is depends on how well they manage the time lags of debtors 3. Cash & Bank balance:

The amount of money to be kept as cash in hand or cash as bank can be estimated on the basis of past experience.

4. Sundry creditors:

The lag in payment to suppliers of raw materials, goods etc and likely credit purchase to be made during the period will help in estimating amount of creditors.

As receipts from debtors are to be managed well, payment to creditors is also to be managed well to maintain good liquid position of the company.

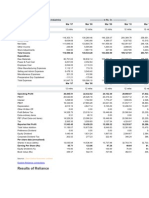

BALANCE SHEET ( in Cr.)

Particulars Sources Of Funds Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Reserves Revaluation Reserves Networth Secured Loans Unsecured Loans Total Debt Total Liabilities 3,273.37 3,273.37 0.00 0.00 142,799.95 5,467.00 151,540.32 10,571.21 56,825.47 67,396.68 218,937.00 Mar '11 12 mths Application Of Funds Gross Block Less: Accum. Depreciation Net Block Capital Work in Progress Investments Inventories Sundry Debtors Cash and Bank Balance Total Current Assets Loans and Advances Fixed Deposits Total CA, Loans & Advances Deffered Credit Current Liabilities Provisions Total CL & Provisions Net Current Assets Miscellaneous Expenses Total Assets Contingent Liabilities 221,251.97 78,545.50 142,706.47 12,819.56 33,019.27 29,825.38 17,441.94 604.57 47,871.89 17,320.60 31,162.56 96,355.05 0.00 61,399.87 4,563.48 65,963.35 30,391.70 0.00 218,937.00 41,825.13 215,864.71 62,604.82 153,259.89 12,138.82 19,255.35 26,981.62 11,660.21 362.36 39,004.19 10,517.57 17,073.56 66,595.32 0.00 48,018.65 3,565.43 51,584.08 15,011.24 0.00 199,665.30 25,531.21 149,628.70 49,285.64 100,343.06 69,043.83 20,268.18 14,836.72 4,571.38 500.13 19,908.23 13,375.15 23,014.71 56,298.09 0.00 42,664.81 3,010.90 45,675.71 10,622.38 0.00 200,277.45 36,432.69 104,229.10 42,345.47 61,883.63 23,005.84 20,516.11 14,247.54 6,227.58 217.79 20,692.91 18,441.20 5,609.75 44,743.86 0.00 29,228.54 2,992.62 32,221.16 12,522.70 0.00 117,928.28 37,157.61 3,270.37 3,270.37 0.00 0.00 125,095.97 8,804.27 137,170.61 11,670.50 50,824.19 62,494.69 199,665.30 Mar '10 12 mths 1,573.53 1,573.53 69.25 0.00 112,945.44 11,784.75 126,372.97 10,697.92 63,206.56 73,904.48 200,277.45 Mar '09 12 mths 1,453.39 1,453.39 1,682.40 0.00 77,441.55 871.26 81,448.60 6,600.17 29,879.51 36,479.68 117,928.28 Mar '08 12 mths Mar '11 12 mths Mar '10 12 mths Mar '09 12 mths Mar '08 12 mths

Book Value (Rs)

446.25

392.51

727.66

542.74

Financial Analysis of Reliance Industries Limited

Financial Analysis

By determining the amount of current assets and current liabilities. The assessment of working capital requirements can be made on the basis of current assets for the business and credit facility available for the acquisition of such current assets and current liabilities. Without adequate working capital that can be no progress in industry. Net working capital refers to the difference between current assets and current liabilities. So, working capital can be found out by deducting total current assets from total current liabilities of the company.

Statement of net working capital for last four years

FOR THE YEAR 2008-2009

Particulars

CURRENT ASSETS: Inventories Sundry debtors Cash & Bank balance Total current assets CURRENT LIABILITIES: Current liabilities Total current liabilities

Amount

Amount

98832.14 6227.58 217.79 105277.51

29228.54 29228.54

NET WORKING CAPITAL

76048.97

FOR THE YEAR 2009-2010

Particulars

CURRENT ASSETS: Inventories Sundry debtors Cash & Bank balance Total current assets CURRENT LIABILITIES: Current liabilities Total current liabilities

Amount

Amount

109284.34 4571.38 500.13 114355.85

42664.81 42664.81

NET WORKING CAPITAL

71691.04

10

FOR THE YEAR 2010-2011

Particulars

CURRENT ASSETS: Inventories Sundry debtors Cash & Bank balance Total current assets CURRENT LIABILITIES: Current liabilities Total current liabilities

Amount

Amount

153689.01 11660.21 362.36 165711.58

48018.65 48018.65

NET WORKING CAPITAL

117692.93

11

FOR THE YEAR 2011-2012

Particulars

CURRENT ASSETS: Inventories Sundry debtors Cash & Bank balance Total current assets CURRENT LIABILITIES: Current liabilities Total current liabilities

Amount

Amount

198076.21 17441.94 604.57 216122.72

61399.87 61399.87

NET WORKING CAPITAL

154722.85

12

Net working capital

Year Amount (in Rs.)

2008-2009 2009-2010 2010-2011 2011-2012

76048.97 71691.04 117692.93 154722.85

Analysis

13

Average of net working capital requirement of the company is about Rs. 150000. (In cr.) As the requirement of company is net working capital is adequate and it increase and highest in the year 2011-2012 and the lowest net working capital was in the year 2009-2010.

Findings & Suggestions

Findings

As we all are privy about current economic scenario in which each & every industry strive diligently to sustain & survive in this competitive arena. Every industry plays vital & pivotal role in this globe. They have their own contribution in the global economy. As it is rightly said in our linguafranka, Little knowledge is dangerous thing. Therefore we should dwell deep into particular matter to get the knowledge of all nitty-gritty aspects of the industry.

This company is global player in most of the products & it focuses on import as well as export of its products. This company is market leader in Information technology. Customers are regarded as the king of the market. This company also gives considerable consideration to its customers. It adopts customization approach. As we all are privy about global financial crisis but this company has no any kind of adverse impact of this financial fiasco. This company considers human resource to be important assets for bringing about continuous growth & development. This company is very conscious about its quality. They believe that customers must get its products with the best quality and at reasonable price. They also focus on Quality assurance & Quality policy.

14

Suggestions

After getting the findings we have clear cut idea about this company as well a sits plans, policies, rules & regulations. To paraphrase Dr. Covey Keep the end in your mind. While taking decisions, one should have to think about the END Because to take the right decision at the right time is not everyones cup of tea.

It is rightly said that Every end has new beginning as well as Every dark cloud has silver lining. Following are some golden nuggets work as recommendations or suggestions: Every single thing depends upon the fundamentals. Thus try to create strong fundamentals for local, glocal & global level. Contemporary era is competitive era but in current situation Competition cum cooperation serves as survival sutra. It is good that company has great achievement in international marketing but company should also give proper consideration to its local market. As far as customers are concerned, there is need to adopt, adapt & adept survival sutra i.e. lose your profit but never lose your customers. Change is only the certain thing in economy. This company is also aware about this matter & thats why it adopt, adapt & adept KEIZEN Philosophy. It is nothing but constant change.

15

Conclusion & Bibliography

Conclusion

To summarized the subject of cost working capital and profit planning or management accountancy. I have select subject Working Capital.

In short, I would like to summarize this report of this industrial unit by showing that this unit has achieved a rapid growth and progress in very short time period of time in 10 to 20 years. As their labors and employees have no problem as they get superior facility. This industrial unit does not have trade union. There is harmonious and peaceful relationship between labors, employees and management. The management of this industrial unit is efficient and effective. Thus, this industrial unit has completed 24 glorious year of excellence and growth and welcomed 25th year.

As the requirement of company is net working capital is adequate and it increase and highest in the year 2011-2012 and the lowest net working capital was in the year 2009-2010.

16

Bibliography

1. Company Websites : -www.reliancegroup.com -www.RIL.com

2. Any other websites: - www.moneycontrol.com

17

You might also like

- CreditLimit UpdateDocument5 pagesCreditLimit UpdateadeelrsNo ratings yet

- Financial Servises Provided by Anand RathiDocument48 pagesFinancial Servises Provided by Anand RathiVarsha WahaneNo ratings yet

- Scope of E-Marketing - WWWDocument109 pagesScope of E-Marketing - WWWaryanboxer78667% (3)

- Rishabh Jain - Team Project and PresentationsDocument28 pagesRishabh Jain - Team Project and PresentationsRishabh JainNo ratings yet

- Axis BankDocument22 pagesAxis Bankअक्षय गोयल67% (3)

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelNo ratings yet

- Finm News Analysis of RelianceDocument21 pagesFinm News Analysis of RelianceHimanshi SisodiyaNo ratings yet

- Financial Statement Analysis of Ashok Leyland Limited, IndiaDocument9 pagesFinancial Statement Analysis of Ashok Leyland Limited, IndiaShubham NamdevNo ratings yet

- Moil Limited: (A Govt. of India Enterprise) Moil Bhawan, 1-A Katol Road, NAGPUR - 440 013Document9 pagesMoil Limited: (A Govt. of India Enterprise) Moil Bhawan, 1-A Katol Road, NAGPUR - 440 013amits3989No ratings yet

- Data 2010Document9 pagesData 2010krittika03No ratings yet

- NPA History of IDBI Bank MainDocument7 pagesNPA History of IDBI Bank MainMonish SelvanayagamNo ratings yet

- Subodha Accounts Term PaperDocument51 pagesSubodha Accounts Term PaperRakesh KumarNo ratings yet

- A Mini Project Report On Fiancial ManagementDocument15 pagesA Mini Project Report On Fiancial ManagementAmit SharmaNo ratings yet

- Fuidamental AnalysisDocument3 pagesFuidamental AnalysisPrashant MujumdarNo ratings yet

- FIN435 ProjectDocument18 pagesFIN435 ProjectIshtiaque HasanNo ratings yet

- Arvind MillsDocument33 pagesArvind MillshasmukhNo ratings yet

- ) L Ey÷ela Ey E: Dion Global Solutions LimitedDocument10 pages) L Ey÷ela Ey E: Dion Global Solutions LimitedJack MartinNo ratings yet

- Chapter - 1 Introduction Company Profile and Industry ProfileDocument66 pagesChapter - 1 Introduction Company Profile and Industry ProfileUday GowdaNo ratings yet

- Ratio Analysis of AmulDocument51 pagesRatio Analysis of Amulrachitvalecha92No ratings yet

- Chapter One: Broad ObjectiveDocument19 pagesChapter One: Broad ObjectiveGolam Samdanee TaneemNo ratings yet

- Chapter - 1 1.1 AccountingDocument40 pagesChapter - 1 1.1 AccountingShrinivasa NNo ratings yet

- Aditya Birla CapitalDocument9 pagesAditya Birla Capitalashish kumarNo ratings yet

- ICICI Bank - ProjectDocument17 pagesICICI Bank - ProjectTejasvi KatiraNo ratings yet

- Account Project OrginalDocument41 pagesAccount Project OrginalshankarinadarNo ratings yet

- Industry Profile: Overview of The IndustryDocument17 pagesIndustry Profile: Overview of The Industrysainandan pvnNo ratings yet

- Session 1 Financial Accounting Infor Manju JaiswallDocument41 pagesSession 1 Financial Accounting Infor Manju JaiswallpremoshinNo ratings yet

- A Financial ReportDocument28 pagesA Financial ReportLavanya BhoirNo ratings yet

- Chapter-1: 1. Industry Scenario 1.1 Macro ProspectiveDocument52 pagesChapter-1: 1. Industry Scenario 1.1 Macro Prospectivemubeen902No ratings yet

- DLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverDocument15 pagesDLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverShashi ShekharNo ratings yet

- I Have Learned The: TH THDocument12 pagesI Have Learned The: TH THmayankNo ratings yet

- "Financial Health of Reliance Industries Limited": A Project Report OnDocument52 pages"Financial Health of Reliance Industries Limited": A Project Report Onsagar029No ratings yet

- Unit 6 Management of Cash: StructureDocument21 pagesUnit 6 Management of Cash: StructurerolandodavalosNo ratings yet

- Training and Development RelienceDocument81 pagesTraining and Development RelienceAbdullah KhanNo ratings yet

- 22mbr002-Sapm Mini ProjectDocument23 pages22mbr002-Sapm Mini ProjectABUBAKAR SIDIQ M 22MBR002No ratings yet

- Annual Report 2012 Bank Bukopin SyariahDocument257 pagesAnnual Report 2012 Bank Bukopin SyariahMMujahid10No ratings yet

- Analysis of Financial Statement of Tata MotorsDocument16 pagesAnalysis of Financial Statement of Tata MotorsErya modiNo ratings yet

- Automobile Industry PresentationDocument25 pagesAutomobile Industry PresentationMurali DaranNo ratings yet

- Corporate Social Responsibility (CSR) at Hindustan Uniliver Ltd. - A Case StudyDocument7 pagesCorporate Social Responsibility (CSR) at Hindustan Uniliver Ltd. - A Case StudyShalini VermaNo ratings yet

- JK Tyre Industries LTDDocument15 pagesJK Tyre Industries LTDAlex KuruvillaNo ratings yet

- Annual Report 2013 Axis BankDocument211 pagesAnnual Report 2013 Axis BankRahul PagariaNo ratings yet

- Term 1 ProjectDocument9 pagesTerm 1 ProjectNiraj ThakurNo ratings yet

- Fundamentals of FinancemangementDocument103 pagesFundamentals of FinancemangementjajoriavkNo ratings yet

- Equity Research: Si No. Questions 1Document14 pagesEquity Research: Si No. Questions 1ShilpaNo ratings yet

- Cbs VijayaDocument14 pagesCbs Vijayamusik loveNo ratings yet

- Ratio Analysis SampleDocument16 pagesRatio Analysis SampleRitoshree paulNo ratings yet

- Annual Report - 2010 OnidaDocument116 pagesAnnual Report - 2010 Onidasdg20No ratings yet

- DCM Shriram 2014Document109 pagesDCM Shriram 2014MailtodisposableMailtodisposable100% (1)

- Advanced Financial ManagementDocument11 pagesAdvanced Financial ManagementshubhiNo ratings yet

- Financial Sources of Reliance Industries: Chaubey Anandvardhan NagendraDocument9 pagesFinancial Sources of Reliance Industries: Chaubey Anandvardhan NagendraSUNNY GULATI-DM 21DM202No ratings yet

- Working Capital Management With Reference To Union BankDocument62 pagesWorking Capital Management With Reference To Union Bankvaishalipress1978No ratings yet

- Financial Modeling Dabur Template-DCFDocument87 pagesFinancial Modeling Dabur Template-DCFSidharthNo ratings yet

- Management of CashDocument21 pagesManagement of CashKarthikNo ratings yet

- RIL Annual Report 2013Document228 pagesRIL Annual Report 2013Amar ItagiNo ratings yet

- Reliance Industries LimitedDocument15 pagesReliance Industries LimitedBhavNeet SidhuNo ratings yet

- Indian Rayon FinanceDocument72 pagesIndian Rayon FinanceDipak DiyoraNo ratings yet

- Company Profile: Hero Motocorp LimitedDocument25 pagesCompany Profile: Hero Motocorp LimitedjupinderNo ratings yet

- Ruff Draft1Document70 pagesRuff Draft1Kalpit TrivediNo ratings yet

- Security Analysis and Portfolio Management Analysis of Shares of Icici Bank LTDDocument15 pagesSecurity Analysis and Portfolio Management Analysis of Shares of Icici Bank LTDjosephadayanNo ratings yet

- Hindalco Industries Ltd000Document19 pagesHindalco Industries Ltd000Parshant Chohan100% (1)

- Research Analysis: Prepared by Darshan PatiraDocument8 pagesResearch Analysis: Prepared by Darshan Patiradarshan jainNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Jikku CVDocument2 pagesJikku CVjikkuabraham2No ratings yet

- Remittance Directory: Metrobank Foreign Branches & SubsidiariesDocument11 pagesRemittance Directory: Metrobank Foreign Branches & SubsidiariesJay PelitroNo ratings yet

- Equity Derivatives: Market Round UpdateDocument2 pagesEquity Derivatives: Market Round UpdateNaleep GuptaNo ratings yet

- Forex GrailDocument17 pagesForex GrailVeeraesh MSNo ratings yet

- How To Read Your MT4 Trading StatementDocument7 pagesHow To Read Your MT4 Trading StatementwanfaroukNo ratings yet

- Summary:: The Annual GDP of India Gets Traded in The Money Market in Just One Day. Even Though TheDocument70 pagesSummary:: The Annual GDP of India Gets Traded in The Money Market in Just One Day. Even Though Thenigamshatru100% (10)

- BGE Minta SzóbeliDocument2 pagesBGE Minta Szóbelieniko0330No ratings yet

- Lecture9 Chapter14 JHDocument29 pagesLecture9 Chapter14 JHJerónimo BedoyaNo ratings yet

- Project On Analysis of Financial Performance (KNSB LTD)Document73 pagesProject On Analysis of Financial Performance (KNSB LTD)Ronit Singh100% (2)

- Beter Balance Cash HoldingsDocument28 pagesBeter Balance Cash HoldingsJemal SeidNo ratings yet

- Equitable Pci v. Tan, GR 165339Document12 pagesEquitable Pci v. Tan, GR 165339vylletteNo ratings yet

- Chapter 5 Acceptance of Deposits by CompaniesDocument52 pagesChapter 5 Acceptance of Deposits by CompaniesAbhay SharmaNo ratings yet

- Pradhan Mantri Jan Dhan YojanaDocument6 pagesPradhan Mantri Jan Dhan YojanaSweta SharmaNo ratings yet

- Lux Leaks RevisitedDocument158 pagesLux Leaks RevisitedLuxembourgAtaGlanceNo ratings yet

- 101 Money Secrets PDFDocument58 pages101 Money Secrets PDFvishaligarg67% (3)

- 059 Spouses Rabat v. PNBDocument2 pages059 Spouses Rabat v. PNBAquino, JPNo ratings yet

- White Marketing Development Corporation vs. Grand WoodDocument1 pageWhite Marketing Development Corporation vs. Grand WoodAnonymous nBo7g7J49No ratings yet

- Investment Analysis: A Study OnDocument77 pagesInvestment Analysis: A Study OnrameshNo ratings yet

- TAMDocument7 pagesTAMErnani TumampoNo ratings yet

- IndiaDocument85 pagesIndiaAnik DuttaNo ratings yet

- Strategic Change - 2016 - Durkin - Relationship Banking in Practice Perspectives From Retired and Serving Retail BranchDocument17 pagesStrategic Change - 2016 - Durkin - Relationship Banking in Practice Perspectives From Retired and Serving Retail BranchhaadiNo ratings yet

- US Department of Justice Antitrust Case Brief - 00702-2004Document6 pagesUS Department of Justice Antitrust Case Brief - 00702-2004legalmattersNo ratings yet

- The Crescent Standard Investment Bank LimitedDocument3 pagesThe Crescent Standard Investment Bank LimitedhammasNo ratings yet

- PF Combined ChallanDocument137 pagesPF Combined ChallanPraveen SaxenaNo ratings yet

- Anton R. Valukas, Examiners Report - in Re Lehman Brothers Inc., Et Al., (2010-03-10) - Volume 7 - Appendices 2 - 7Document511 pagesAnton R. Valukas, Examiners Report - in Re Lehman Brothers Inc., Et Al., (2010-03-10) - Volume 7 - Appendices 2 - 7Meliora CogitoNo ratings yet

- Wa0013.Document7 pagesWa0013.viphainhumNo ratings yet

- Risk Analysis in LendingDocument2 pagesRisk Analysis in Lendingjoshua omondiNo ratings yet