Professional Documents

Culture Documents

Financial System of Any Country Consists of Financial Markets, Financial Intermediation and Financial Instruments or Financial Products

Financial System of Any Country Consists of Financial Markets, Financial Intermediation and Financial Instruments or Financial Products

Uploaded by

swati_rathourOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial System of Any Country Consists of Financial Markets, Financial Intermediation and Financial Instruments or Financial Products

Financial System of Any Country Consists of Financial Markets, Financial Intermediation and Financial Instruments or Financial Products

Uploaded by

swati_rathourCopyright:

Available Formats

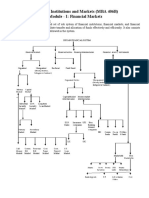

Financial System of any country consists of financial markets, financial intermediation and financial instruments or financial products

Organized Financial System

Financial Services

Financial Instruments

Financial Markets

Financial Intermediaries

Forex Market

Capital Market

Money Market

Credit Market

Primary Market Secondary Market

Money Market Instrument

Capital Market Instrument

2

A Financial Market could be defined as a market in which financial assets are created and transferred. As compared to a real market transaction that involves exchange of money & currency for physical goods or services, a financial transaction involves creation or transfer of a financial asset. Financial Assets or Financial Instruments represents a claim for payment of a sum of money sometime in the future and /or periodic payment in the form of interest or dividend. Thus A financial market is simply a market for transacting in financial assets. If we buy or sell financial assets, we will participate in financial markets in some way or the other.

The financial markets exist in an economy because the savings of various individuals, corporations and governments during a period of time are available for investment in certain assets. By real assets we mean such thing as houses buildings equipment inventories and durable goods.

Financial markets play a fundamental role in allocating resources in an economy by performing three important functions: 1. Facilitates transfer of money: It helps in making seekers & givers of money meet each other so that people can use the available financial resources in best possible manner. Well organized financial markets seem to be remarkably efficient in growth of business & economy.

2. Providing liquidity: Investors can readily sell their assets through the mechanism of financial markets. In the absence of financial markets which provide such liquidity, the motivation of investors to save & buy financial assets will be absent. It is possible for companies to raise long term funds from investors. 3. Reduced cost of money: In a developed financial market, there are number of investment options available, to any company looking for finance & cost of money is in relation to the risk involved. Thus a developed market ensures reasonable rate of interest.

There are different ways of classifying financial markets. Most popular way is to classify financial markets by the maturity of claims. Money Market Capital Market

The market for short term whole sale financial assets is referred to as the money market and the market for long term financial claims is called the capital market. Traditionally the cut off between short term and long term financial has been one year. Since short term financial claims are almost invariably debt claims, the money market is the market for short term debt instruments. The capital market is the market for long term debt instruments and equity instruments.

Mobilization of Savings & acceleration of Capital Formation Promotion of Industrial Growth Raising of long term Capital Ready & Continuous Markets Proper Channelisation of Funds Provision of a variety of Services

Indian Capital Market

Market

Instruments

Intermediaries Regulator

SEBI

Primary

Secondary

Brokers Investment Bankers Stock Exchanges Underwriters Hybrid Debt

Equity

Players

Corporate Intermediaries

Individual

Banks/FI

FDI /FII

10

Equity

Conv. shares

Conv. Bond

Debt

Equity Shares

Preference Shares

ADR / GDR

Debentures Zero coupon bonds

Deep Discount Bonds

11

Market for short-term money and financial assets that are near substitutes for money. Short-Term means generally period upto one year and near substitutes to money is used to denote any financial asset which can be quickly converted into money with minimum transaction cost

12

It is a place for Large Institutions and government to manage their short-term cash needs.

It is a subsection of the Fixed Income Market. It specializes in very short-term debt securities.

They are also called as Cash Investments.

13

You might also like

- Introduction To Financial MarketDocument53 pagesIntroduction To Financial MarketAddy Khan100% (1)

- Financial MarketDocument18 pagesFinancial MarketHusain BohraNo ratings yet

- Fin Sys-Unit-1Document90 pagesFin Sys-Unit-1Priyanka KhandelwalNo ratings yet

- Financial MarketDocument5 pagesFinancial MarketRoxanne Jhoy Calangi VillaNo ratings yet

- Merchant BankingDocument235 pagesMerchant BankingKarthikeyan Elangovan100% (1)

- Capital Market and Money MarketDocument15 pagesCapital Market and Money MarketAkshi JainNo ratings yet

- Indian Financial System For BBADocument11 pagesIndian Financial System For BBARajat Pawan0% (2)

- Jaspal and ParminderDocument25 pagesJaspal and ParminderAnonymous 7nMwL9No ratings yet

- of BST Chapter 10 - (Financial Market)Document41 pagesof BST Chapter 10 - (Financial Market)teutongaming256No ratings yet

- Introduction of Financial MarketDocument11 pagesIntroduction of Financial Marketatul AgalaweNo ratings yet

- Indian Economy by AshishDocument33 pagesIndian Economy by AshishBRAIN HUTNo ratings yet

- Ch.1 Introduction: Sarma V. Nityanand, Banking and Financial System (Foundation Books, C.U.P.I. PVT - LTD.)Document14 pagesCh.1 Introduction: Sarma V. Nityanand, Banking and Financial System (Foundation Books, C.U.P.I. PVT - LTD.)nirshan rajNo ratings yet

- IFS Unit-1 Notes - 20200717114457Document9 pagesIFS Unit-1 Notes - 20200717114457Vignesh C100% (1)

- A Quanittative Study of Nepalese Stock ExchangeDocument87 pagesA Quanittative Study of Nepalese Stock ExchangenirajNo ratings yet

- Raja Shekar ReddyDocument42 pagesRaja Shekar ReddypavithrajiNo ratings yet

- The Financial SystemDocument2 pagesThe Financial SystemDeathstrike RequienNo ratings yet

- Financial Market TopicDocument31 pagesFinancial Market TopicGautam MahtoNo ratings yet

- Notes On Financial SystemsDocument62 pagesNotes On Financial SystemsamitNo ratings yet

- An Overview OF Indian Financial SystemDocument16 pagesAn Overview OF Indian Financial SystemArthiKalisamyNo ratings yet

- Lecture NotesDocument36 pagesLecture NotesAmritNo ratings yet

- Unit 2-FMDocument29 pagesUnit 2-FMankit.ital21No ratings yet

- Nature and Importance of Financial Market The Financial MarketDocument4 pagesNature and Importance of Financial Market The Financial MarketPerbielyn BasinilloNo ratings yet

- 2.1 To 2.6 CONCEPT & FINANCIAL MARKET STRUCTURE IN INDIA PDFDocument30 pages2.1 To 2.6 CONCEPT & FINANCIAL MARKET STRUCTURE IN INDIA PDFImran KhanNo ratings yet

- Financial Markets BomdDocument7 pagesFinancial Markets BomdMadan VNo ratings yet

- Financial MarketDocument64 pagesFinancial MarketPooja Yadav0% (1)

- Unit Iii (International Business Environment)Document22 pagesUnit Iii (International Business Environment)RAMESH KUMARNo ratings yet

- BusFin Group 3-4 NotesDocument7 pagesBusFin Group 3-4 NotesEduard Phil OrilloNo ratings yet

- 1-Bond MarketDocument85 pages1-Bond Marketdharmtamanna80% (5)

- Sathyabama University Faculty of Business AdministrationDocument16 pagesSathyabama University Faculty of Business AdministrationGracyNo ratings yet

- Indian Financial Market: Rahul Kumar Department of Business AdminestrationDocument52 pagesIndian Financial Market: Rahul Kumar Department of Business AdminestrationDhruv MishraNo ratings yet

- What Are Financial MarketsDocument12 pagesWhat Are Financial Marketsyared haftuNo ratings yet

- Financial Markets and Institutions - PART1Document75 pagesFinancial Markets and Institutions - PART1shweta_46664100% (3)

- Capital MarketDocument66 pagesCapital MarketPriya SharmaNo ratings yet

- Unit 4Document35 pagesUnit 4Harshita Kaushik AI002390No ratings yet

- Financial MarketDocument15 pagesFinancial Marketrishu ashiNo ratings yet

- Financial MarketsDocument31 pagesFinancial MarketsCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Financial AssetDocument14 pagesFinancial AssetkhushboogeetaNo ratings yet

- Index Executive Summary of Capital Markets Chapter 1 Investment BasicsDocument23 pagesIndex Executive Summary of Capital Markets Chapter 1 Investment Basicsswapnil_bNo ratings yet

- Components of Financial SystemDocument11 pagesComponents of Financial SystemromaNo ratings yet

- Abstract of Financial Market 1Document8 pagesAbstract of Financial Market 1mmkrishnan94100% (1)

- Financial MarketDocument19 pagesFinancial MarketAshishNo ratings yet

- Financial Management Sessions 1 - 10Document18 pagesFinancial Management Sessions 1 - 10AshutoshNo ratings yet

- MAS 2 Grp1 Written ReportDocument12 pagesMAS 2 Grp1 Written ReportRenda QiutiNo ratings yet

- Financial MarktDocument15 pagesFinancial Marktlakshitas2007No ratings yet

- Financial System and MarketsDocument32 pagesFinancial System and Marketsmohamedsafwan0480No ratings yet

- Financial Markets and Institutionschap 2Document8 pagesFinancial Markets and Institutionschap 2Ini IchiiiNo ratings yet

- Fim NotesDocument13 pagesFim Notesabdul samadNo ratings yet

- Brokerage Services mfs-1Document28 pagesBrokerage Services mfs-1Abhi ShriNo ratings yet

- Financial MarketDocument27 pagesFinancial Marketramesh.kNo ratings yet

- An Overview of Stock and Commodity Market.: Financial SystemDocument43 pagesAn Overview of Stock and Commodity Market.: Financial SystemNational JournalNo ratings yet

- Topic 2Document5 pagesTopic 2Jeffrey RiveraNo ratings yet

- Financial Market and Institutions Lecture-1, 2, 3Document4 pagesFinancial Market and Institutions Lecture-1, 2, 3Tyler vanPersieNo ratings yet

- Capital MarketDocument3 pagesCapital MarketPratap, BiswasNo ratings yet

- Financial Markets and Financial InstrumentsDocument80 pagesFinancial Markets and Financial Instrumentsabhijeit86100% (2)

- AssignmentDocument30 pagesAssignmentKavita BagewadiNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- US Banking StructureDocument40 pagesUS Banking Structureswati_rathourNo ratings yet

- Accounting For Decision MakingDocument6 pagesAccounting For Decision Makingswati_rathour0% (1)

- Proceedural Aspects of Opening Business Accounts With BanksDocument3 pagesProceedural Aspects of Opening Business Accounts With Banksswati_rathourNo ratings yet

- Types of Bank AccountsDocument11 pagesTypes of Bank Accountsswati_rathour50% (2)

- Money and Payment SystemDocument20 pagesMoney and Payment Systemswati_rathourNo ratings yet

- Businesspolicystrategicmanagement Notes 2011-12-111001044206 Phpapp02Document428 pagesBusinesspolicystrategicmanagement Notes 2011-12-111001044206 Phpapp02ashishkumar14No ratings yet

- Ratio Analysis: Accounting For ManagersDocument30 pagesRatio Analysis: Accounting For ManagersVishal JogiNo ratings yet

- The Capital Budgeting Decision: (Chapter 12)Document19 pagesThe Capital Budgeting Decision: (Chapter 12)shagungupta44100% (2)

- Distance TimeDocument43 pagesDistance Timeswati_rathourNo ratings yet

- International TaxationDocument8 pagesInternational Taxationsrinivas kolaganiNo ratings yet

- Relationship Between Banker & CustomerDocument4 pagesRelationship Between Banker & Customerswati_rathourNo ratings yet

- Retail BankingDocument71 pagesRetail Bankingswati_rathourNo ratings yet

- Regulations For NR AccountsDocument7 pagesRegulations For NR Accountsswati_rathourNo ratings yet

- FinanceDocument10 pagesFinanceswati_rathourNo ratings yet

- Risk ManagementDocument21 pagesRisk Managementswati_rathourNo ratings yet

- Private Banks & RRBDocument20 pagesPrivate Banks & RRBswati_rathourNo ratings yet

- Reserve Bank of IndiaDocument14 pagesReserve Bank of Indiaswati_rathourNo ratings yet

- RayovacDocument9 pagesRayovacNarinderNo ratings yet

- An Analysis On Advantages and Disadvantages of C2C E-Commerce in EntrepreneurshipDocument3 pagesAn Analysis On Advantages and Disadvantages of C2C E-Commerce in EntrepreneurshipnafuturoNo ratings yet

- Trading Strategies Involving OptionsDocument19 pagesTrading Strategies Involving OptionsPatriciaNo ratings yet

- 281-Article Text-1977-1-10-20220324 PDFDocument16 pages281-Article Text-1977-1-10-20220324 PDFSulthon NaqueinNo ratings yet

- Econ 9e One Click ch10Document26 pagesEcon 9e One Click ch10Yash PandeyNo ratings yet

- Solution Manuals, Test Banks and More1Document13 pagesSolution Manuals, Test Banks and More1blacksword_generalz25% (4)

- Relaunch of HMT WatchesDocument17 pagesRelaunch of HMT WatchesSachin Hundekar100% (2)

- Amul Case StudyDocument3 pagesAmul Case StudyRohan JainNo ratings yet

- Tutorial5 Answers 3Document8 pagesTutorial5 Answers 3Konstantinos DelaportasNo ratings yet

- Competitive Strategies For Market LeadersDocument24 pagesCompetitive Strategies For Market LeadersAmir KhanNo ratings yet

- What Are Porter Five (5) ForcesDocument3 pagesWhat Are Porter Five (5) ForcesSaurabh NinaveNo ratings yet

- Chapter 15Document13 pagesChapter 15mahrukhNo ratings yet

- 3 Managerial EconomicDocument8 pages3 Managerial EconomicBoSs GamingNo ratings yet

- Imc Report For CafelysDocument11 pagesImc Report For CafelysSOPHIA MARI GAMBOANo ratings yet

- 32-Bba 1701951735Document65 pages32-Bba 1701951735Awais TareqNo ratings yet

- Applied Economics: Introduction-For ABM-12 Rembrandt 10:30-11:30 - Oct 2020Document21 pagesApplied Economics: Introduction-For ABM-12 Rembrandt 10:30-11:30 - Oct 2020Arjae Dantes100% (2)

- CARDEKHO Case StudyDocument4 pagesCARDEKHO Case StudyDebarghya Das100% (2)

- Securities Analysis and Portfolio Management: Prices Usually Always Move in TrendsDocument8 pagesSecurities Analysis and Portfolio Management: Prices Usually Always Move in TrendsStuti Jain100% (1)

- Demand and Supply Analysis: ObjectivesDocument15 pagesDemand and Supply Analysis: ObjectivesGladz De ChavezNo ratings yet

- Integrating Marketing Communications To Build Brand EquityDocument45 pagesIntegrating Marketing Communications To Build Brand EquityUrooj MustafaNo ratings yet

- Lecture 3 New Product DevelopmentDocument33 pagesLecture 3 New Product DevelopmentWilliam DC RiveraNo ratings yet

- Candlestick Success Rate 60 PercentDocument12 pagesCandlestick Success Rate 60 PercentClipper52aNo ratings yet

- Brand EquityDocument15 pagesBrand EquityAsad NaeemNo ratings yet

- ECO - CA FoundationDocument16 pagesECO - CA Foundationsuresh sheerviNo ratings yet

- Marketing Mix at JerseyDocument86 pagesMarketing Mix at JerseynaveenNo ratings yet

- Palepu 3e - TB - Ch02 Class Exercise Chapter 2Document6 pagesPalepu 3e - TB - Ch02 Class Exercise Chapter 2nur zakirahNo ratings yet

- Rent SeekingDocument2 pagesRent SeekingMylene HeragaNo ratings yet

- Assignment Topic-Pricing Strategies in B2B Geographic Pricing Competitive Bidding Transfer Pricing Leasing Boot & BlotDocument17 pagesAssignment Topic-Pricing Strategies in B2B Geographic Pricing Competitive Bidding Transfer Pricing Leasing Boot & BlotVipul TyagiNo ratings yet

- Nike Segmentation and Targeting PDFDocument3 pagesNike Segmentation and Targeting PDFKrunal MalveNo ratings yet