Professional Documents

Culture Documents

Eco Envt of Business V

Eco Envt of Business V

Uploaded by

Akash MahajanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eco Envt of Business V

Eco Envt of Business V

Uploaded by

Akash MahajanCopyright:

Available Formats

Economic Environment of Business

Indias Fiscal Policy

Fiscal Policy

Also referred to as Budgetary Policy It is a policy under which the govt. uses its revenue & expenditure programs to produce desirable effects & avoid undesirable effects on national income, production & employment

Became popular after the Great Depression

: PGM, 2011

Objectives of Fiscal Policy

Mobilization & Allocation of resources Provision of social goods Distribution Equitable distribution of resources Stabilization Through its effect on aggregate demand & level of economic activity Economic Growth Employment Price Stability

: PGM, 2011

Instruments Public Expenditure

Public Expenditure consists of Govt. purchases of goods & services (eg.defence); Govt. transfer payments (eg.pensions); Public enterprises & Capital formation Increasing expenditure increases aggregate demand which increases money with pvt. sector & this leads to an increase in wages & salaries which also increases demand (& vice versa)

: PGM, 2011

Public Expenditure (cont.)

But while decreasing expenditure only non productive expenditure should be decreased & not developmental otherwise supply side will also get affected

To increase equity govt. expenditure should be directed towards eradicating poverty & providing subsidies to socially desirable sectors & rations, etc.

: PGM, 2011

Instruments - Taxation

Taxation source of public revenue taxes are either Direct (eg. income & wealth tax) or Indirect (eg. excise & custom) Direct taxes are progressive & Indirect taxes are regressive but this can be rectified by taxing goods used by high income groups Indirect Taxes have a wider coverage but they increase inflation

: PGM, 2011

Taxation (cont.)

Increasing Taxes decreases purchasing power by affecting incomes & prices Increasing Taxes also decreases rate of return for business & therefore decreases investment Other govt. receipts include non-tax revenue receipts like commercial & administration receipts & capital receipts like grants, recoveries of loans & disinvestment

: PGM, 2011

Instruments Public Debt

Public Debt Borrowings from RBI, domestic & external By borrowing govt. takes away purchasing power & funds get transferred from pvt. to public sector but govt. should spend these funds for production & not consumption otherwise it adds to inflation Govt. should avoid paying back loans during inflation

: PGM, 2011

Trends in Indias Fiscal Policy

Public Expenditure has been increasing over the years but it is not reaching the poor Tax/GDP ratio has increased from 6.3% in 1950-51 to 15.8% in 1991-92 Direct taxes have fallen from 40% to 16% of total taxes during the same period Indirect taxes are being used for revenue generation & not allocational efficiency Fiscal deficit is increasing

: PGM, 2011

Trends (cont.)

Main components of expenditure are Subsidies, Wages & Salaries, Interest Payments & Defence Expenditure Till recently the tax rates were very high, there was a multiplicity of slabs, services & agriculture were not covered, there were a no. of concessions & exemptions & widespread evasion As compared to discretionary measures, automatic measures only minimize cyclical effects, they do not eliminate them

: PGM, 2011

Trends (cont.)

When a new measure is introduced there are lags - Inside (Recognition, Decision & Action Lags) & Outside which mitigate its effect

: PGM, 2011

Reforms in Indias Fiscal Policy

Fiscal Responsibility & Budget Management Act was introduced in 2004 Decrease interest payments & non interest expenditure on subsidies, assistance to non-viable & inefficient enterprises, staff & defence Simplification of the tax structure by reduction in the rates & the no. of slabs; introduction of VAT & service tax; better administration & enforcement

: PGM, 2011

Reforms (cont.)

Decrease deficit to 3% of GDP by March 2009 Link fiscal & monetary policy & make fiscal policy more equitable Optimal rate of taxation

: PGM, 2011

You might also like

- Possessory Estates ChartDocument8 pagesPossessory Estates ChartJulia Bienstock100% (10)

- ICICI Home Loans Project ReportDocument109 pagesICICI Home Loans Project ReportJohn Paul86% (21)

- Prescription - 540660 - 12 11 2020 - Dr. Bikash Majumder - Apollo 247Document2 pagesPrescription - 540660 - 12 11 2020 - Dr. Bikash Majumder - Apollo 247soumitra choudhuryNo ratings yet

- Sample Exam Questions Behavioral FinanceDocument2 pagesSample Exam Questions Behavioral FinanceDorian Jaumotte100% (1)

- ASTM D6433-09 Pagina 16Document224 pagesASTM D6433-09 Pagina 16Angel Ananias Balbin Saenz100% (1)

- Public Finance and Fiscal PolicyDocument37 pagesPublic Finance and Fiscal PolicykittuNo ratings yet

- Presentation On Fiscal Policy of India: Submitted To:-Mrs. Anuradha MittalDocument19 pagesPresentation On Fiscal Policy of India: Submitted To:-Mrs. Anuradha MittalpreetsinghjjjNo ratings yet

- Fiscal Policy Business EnvironmentDocument37 pagesFiscal Policy Business EnvironmentvikashkalpNo ratings yet

- EconomicsDocument32 pagesEconomicsSahil BansalNo ratings yet

- Slide 10 Demand Side Policies Fiscal PolicyDocument100 pagesSlide 10 Demand Side Policies Fiscal Policycrazyboy94372No ratings yet

- Business Taxation - BasicsDocument14 pagesBusiness Taxation - Basicsrutvi.khatri.20No ratings yet

- Fiscal Policy MeaningDocument47 pagesFiscal Policy MeaningKapil YadavNo ratings yet

- Ec MacrobudgetfpDocument3 pagesEc MacrobudgetfpNicholas TehNo ratings yet

- Managerial Economics Unit VDocument14 pagesManagerial Economics Unit VTanmay JainNo ratings yet

- Budget NotesDocument17 pagesBudget NotesHeer SirwaniNo ratings yet

- The Indian Economy and Budget 2013: Prof. Kapil BhopatkarDocument56 pagesThe Indian Economy and Budget 2013: Prof. Kapil BhopatkarVarun ParekhNo ratings yet

- Fiscal PolicyDocument29 pagesFiscal Policyjay100% (1)

- Fiscal PolicyDocument25 pagesFiscal PolicyJivanjot SinghNo ratings yet

- Economics Notes Year 11Document9 pagesEconomics Notes Year 11conorNo ratings yet

- Why Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Document29 pagesWhy Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Nikki ShresthaNo ratings yet

- Fiscal Policy of The Philippine GovernmentDocument55 pagesFiscal Policy of The Philippine GovernmentJervin Paul ManzanoNo ratings yet

- Government Budget and The Economy-STDocument14 pagesGovernment Budget and The Economy-STSafwa KhasimNo ratings yet

- Economics Assignment: Mohib M QureshiDocument56 pagesEconomics Assignment: Mohib M QureshiMohibQureshiNo ratings yet

- Fiscal Policy: Jersey Ramos Billy Jean Pagdonsolan Mikee Merle Jeffrey VillabrilleDocument18 pagesFiscal Policy: Jersey Ramos Billy Jean Pagdonsolan Mikee Merle Jeffrey VillabrilleJersey RamosNo ratings yet

- MacroDocument11 pagesMacroAditya RajNo ratings yet

- India Fiscal PolicyDocument32 pagesIndia Fiscal Policychinum1No ratings yet

- Fiscal Policy Assignment 2Document9 pagesFiscal Policy Assignment 2Shafique UR Rehman JuttNo ratings yet

- Presentation On Economic Survey Final 2014-15 FinalDocument87 pagesPresentation On Economic Survey Final 2014-15 FinaltrvthecoolguyNo ratings yet

- Roll No: 20134026 Name: Jegatheesh P Topic: Taxation What Is Taxation?Document6 pagesRoll No: 20134026 Name: Jegatheesh P Topic: Taxation What Is Taxation?Jegatheesh PNo ratings yet

- Fiscal Crisis in IndiaDocument8 pagesFiscal Crisis in IndiaKapil YadavNo ratings yet

- Chapter 4 Role Og Government PolicyDocument48 pagesChapter 4 Role Og Government PolicyNurul AdilaNo ratings yet

- Effect of Government Spending On Indian EconomyDocument15 pagesEffect of Government Spending On Indian EconomyprashantNo ratings yet

- Corporate Karzaa MaafiDocument6 pagesCorporate Karzaa MaafiKaustubh AgrawalNo ratings yet

- Fiscal PolicyDocument10 pagesFiscal PolicyDr.Reenu MohanNo ratings yet

- Fiscal Policy: Dr. A.K.PanigrahiDocument22 pagesFiscal Policy: Dr. A.K.PanigrahiDr.Ashok Kumar PanigrahiNo ratings yet

- Ee-2 3Document18 pagesEe-2 3RaviShankarNo ratings yet

- Fiscal Policy MalaysiaDocument18 pagesFiscal Policy Malaysiaainmohamed100% (3)

- Macro Problem Set 3 Reading - FY2009 Budget HighlightsDocument18 pagesMacro Problem Set 3 Reading - FY2009 Budget HighlightsTeh Kok HoeNo ratings yet

- What Is Fiscal Policy?Document10 pagesWhat Is Fiscal Policy?Samad Raza KhanNo ratings yet

- Session 14Document18 pagesSession 14Sid Tushaar SiddharthNo ratings yet

- Fiscal Policy and Monetary Policy.Document19 pagesFiscal Policy and Monetary Policy.wayandragon247100% (1)

- Fiscal Policy of PakistanDocument15 pagesFiscal Policy of PakistanAXAD BhattiNo ratings yet

- Fiscal Policy: Dr. Neeraj Assistant Professor MsobDocument19 pagesFiscal Policy: Dr. Neeraj Assistant Professor MsobNidhi WadaskarNo ratings yet

- As Fiscal PolicyDocument8 pagesAs Fiscal PolicyZunaira JamilNo ratings yet

- Fiscal PolicyDocument3 pagesFiscal PolicyHarshit mittalNo ratings yet

- Thesis Full Page - FinalDocument125 pagesThesis Full Page - FinalMADHU KHANALNo ratings yet

- Fiscal Policy 2019Document23 pagesFiscal Policy 2019DNLNo ratings yet

- Fiscal PolicyDocument24 pagesFiscal PolicyAnnie MehmoodNo ratings yet

- Fiscal PolicyDocument24 pagesFiscal Policyરહીમ હુદ્દાNo ratings yet

- Chapter 10 Govt BudgetDocument11 pagesChapter 10 Govt BudgetBhagya aggarwalNo ratings yet

- Role of GovernmentDocument5 pagesRole of GovernmentFergus DeanNo ratings yet

- Fiscal Policy-Formulation and Management: Submitted byDocument23 pagesFiscal Policy-Formulation and Management: Submitted bynirgude_swapnilNo ratings yet

- Govt. Budgeconomy Budget: It Is An Annual Financial Statement of TheDocument8 pagesGovt. Budgeconomy Budget: It Is An Annual Financial Statement of TheTirsha BiswasNo ratings yet

- Fiscal Policy of India - Almost FinalDocument30 pagesFiscal Policy of India - Almost FinalBhagyashree SatheNo ratings yet

- All Receipts Are Not Earned and Some Are BorrowedDocument23 pagesAll Receipts Are Not Earned and Some Are BorrowedMukesh YadavNo ratings yet

- Fiscal Policy of IndiaDocument19 pagesFiscal Policy of IndiaAnonymous y3E7iaNo ratings yet

- BEE (2019-20) Handout 08 (Fiscal Policy)Document4 pagesBEE (2019-20) Handout 08 (Fiscal Policy)Saurabh SinghNo ratings yet

- Fiscal PolicyDocument22 pagesFiscal Policyshailendersingh74No ratings yet

- ECONOMIC ANALYSIS DaburDocument5 pagesECONOMIC ANALYSIS DaburEKANSH DANGAYACH 20212619No ratings yet

- Types & CritisismDocument4 pagesTypes & Critisismsgaurav_sonar1488No ratings yet

- What Is Fiscal Policy ?: Objectives CompositionDocument20 pagesWhat Is Fiscal Policy ?: Objectives CompositionYash Raj SinghNo ratings yet

- Public FinanceDocument16 pagesPublic FinanceJawwad RindNo ratings yet

- By Group 4 Safwan Prarthana.N Sharath Kirthi Sabitha Twinkle Swathi ShahinDocument23 pagesBy Group 4 Safwan Prarthana.N Sharath Kirthi Sabitha Twinkle Swathi ShahinsafwanagNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Mumbai Land ReclamationDocument8 pagesMumbai Land ReclamationAkash MahajanNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Eco Envt of Business IVDocument9 pagesEco Envt of Business IVAkash MahajanNo ratings yet

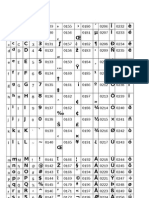

- Aaa 1 BBB 2 CCC 3 DDD 4 Eee 5 FFF 6 GGG 7 HHH 8 Iii 9 JJJ 0 K K ' L LDocument2 pagesAaa 1 BBB 2 CCC 3 DDD 4 Eee 5 FFF 6 GGG 7 HHH 8 Iii 9 JJJ 0 K K ' L LAkash MahajanNo ratings yet

- Eco Envt of Business VIDocument8 pagesEco Envt of Business VIAkash MahajanNo ratings yet

- HRM Unit 1Document10 pagesHRM Unit 1Akash MahajanNo ratings yet

- QuestionnaireDocument2 pagesQuestionnaireAkash MahajanNo ratings yet

- BMS Hons Prospectus 2020Document24 pagesBMS Hons Prospectus 2020SaraNo ratings yet

- Material Eqv StdsDocument6 pagesMaterial Eqv StdsShreyas IyengarNo ratings yet

- 2023-06-01 KandyDocument48 pages2023-06-01 KandyEverton Concolato VieiraNo ratings yet

- Accurate Feeder Bvd2042gbDocument8 pagesAccurate Feeder Bvd2042gbAnthonyNo ratings yet

- INVOICE #01-5271: Order Date Shipping TRMDocument3 pagesINVOICE #01-5271: Order Date Shipping TRMLuis Felipe Rangel LemirNo ratings yet

- Qa-Qc Plan For Sharq R-0aDocument163 pagesQa-Qc Plan For Sharq R-0akbldamNo ratings yet

- 5 TH Sem Advanced Accounting PPT - 2.pdf382Document21 pages5 TH Sem Advanced Accounting PPT - 2.pdf382Azhar Ali100% (3)

- The Tissue Level of Organization: Lecture Slides Prepared by Curtis Defriez, Weber State UniversityDocument64 pagesThe Tissue Level of Organization: Lecture Slides Prepared by Curtis Defriez, Weber State UniversitySeira SusaNo ratings yet

- Bookmyshow Balanced ScorecardDocument3 pagesBookmyshow Balanced ScorecardSirsha PattanayakNo ratings yet

- III 1 Electrification 1 28Document30 pagesIII 1 Electrification 1 28Kevin LampaanNo ratings yet

- 7227 Lrdi3Document4 pages7227 Lrdi3Gang BhasinNo ratings yet

- Siemens Iso CDocument6 pagesSiemens Iso CFrancisco Diaz100% (2)

- Notes-OscillationsDocument9 pagesNotes-OscillationsMordecai ChimedzaNo ratings yet

- Session-4 Microsoft-Case HK Caslin-LiuDocument27 pagesSession-4 Microsoft-Case HK Caslin-LiuandresfvargasfbNo ratings yet

- Bank of Baroda1705050717972Document46 pagesBank of Baroda1705050717972venkittsureshNo ratings yet

- ZKAccess3.5 Security System User Manual V3.0 PDFDocument97 pagesZKAccess3.5 Security System User Manual V3.0 PDFJean Marie Vianney Uwizeye100% (2)

- 2022 Acl-Long 524Document18 pages2022 Acl-Long 524katono7302No ratings yet

- Conceptual DesignDocument10 pagesConceptual DesignJerjy ElsoussNo ratings yet

- Nervous SystemDocument48 pagesNervous SystemSuvalari Mimi JonathanNo ratings yet

- 2 The Power of Positive ThinkingDocument15 pages2 The Power of Positive ThinkingMark Laurence GuillesNo ratings yet

- The Relationship Between Boron Content and Crack Properties in FCAW Weld MetalDocument6 pagesThe Relationship Between Boron Content and Crack Properties in FCAW Weld MetalVizay KumarNo ratings yet

- Project Report (Vikas Chandel)Document89 pagesProject Report (Vikas Chandel)Manju SharmaNo ratings yet

- Exploratory Research in Clinical and Social PharmacyDocument5 pagesExploratory Research in Clinical and Social PharmacyHu Ri AbbaxiNo ratings yet

- Answer All Questions. Figures at The Right Hand Margin Indicate Marks All Parts of A Question Should Be Answered at One Place Q.No. Marks 1 (3+2+1)Document2 pagesAnswer All Questions. Figures at The Right Hand Margin Indicate Marks All Parts of A Question Should Be Answered at One Place Q.No. Marks 1 (3+2+1)NIRANJANNo ratings yet

- Matrix FinalDocument13 pagesMatrix FinalLizel ViernesNo ratings yet

- Organisational Structure and DesignDocument25 pagesOrganisational Structure and DesignBright MulengaNo ratings yet