Professional Documents

Culture Documents

Risk Management in The Global Economy: Issues and Strategies

Risk Management in The Global Economy: Issues and Strategies

Uploaded by

Reema DawraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management in The Global Economy: Issues and Strategies

Risk Management in The Global Economy: Issues and Strategies

Uploaded by

Reema DawraCopyright:

Available Formats

Risk Management in the Global Economy

Issues and Strategies

Multinational Enterprises

International businesses may be classified as either limited international enterprises (LIEs) or multinational enterprises (MNEs). An LIE is a business whose major activity is either exporting its product to other nations, or importing the products of foreign firms. By contrast, an MNE not only sells, but also produces, in foreign markets.

International Risk Management

1.

Why do companies seek cross-border transactions?

Why do countries seek to protect their domestic markets (including insurance)? What is the real impact of international trade on domestic economies? How can an enterprise manage the risks associated with cross-border transactions?

2.

3.

4.

International Risk Management

How does risk management in an MNE differ from that in a domestic firm?

In principle, the concepts of protecting the organization against unbearable loss are the same for both types of companies. However, the environment in which these decisions are made can be quite different.

International Issues for Risk Managers

Local insurance regulations and practices

Prohibitions against non-admitted coverage Centralization vs. decentralization of risk management (global vs. local coverage) Local support for risk management (e.g., loss prevention, loss reduction)

Valuation of property for coverage purposes

Foreign currency fluctuations

International Issues for Risk Managers

Local legal environment (due process)

Impact of language on coverage issues Cultural differences: religious beliefs, gender roles, work attitudes, etc. Economic systems: planned vs. market Political structure

Local/Admitted Coverage

What is it? What are the advantages?

Compliance with local law, good citizenship Often needed for local financing Premiums paid locally are tax-deductible Claim payment income not subject to tax Local servicing of claims and coverage issues Premiums and claims paid locally are insulated from exchange rate fluctuation Overcoming local currency restrictions

Local/Admitted Coverage

What are the disadvantages?

Higher costs from bureau rates/tariffs Coverage possibly not as broad as domestic (e.g., U.S.) policies Incompatibility with global insurance programs in terms of renewal dates, limits, deductibles, etc. Possibly difficult to manage (decentralized)

Piecemeal approach can result in costlier program with coverage gaps

May be contrary to risk retention strategy

Local/Admitted Coverage

What are (more) of the disadvantages?

Local services may not be sufficient/appropriate (e.g., loss prevention, loss reduction) Sense of urgency may not be sufficient Potential financial solvency/capacity issues Language issues, coverage interpretations

Non-Admitted Coverage

What is it?

What are the advantages?

Potentially lower costs

Potentially broader coverages

Standardization of expiration dates, limits, deductibles, etc. Easier to manage (centralized) Common currency Greater stability of markets

Non-Admitted Coverage

What are (more) of the advantages?

Common language Coverage disputes subject to domestic law

Non-Admitted Coverage

What are the disadvantages?

May be prohibited by local laws; possible fines and penalties, loss of good citizenship status Domestic premiums not tax-deductible locally or domestically Taxes on claim payments Claims management may be difficult without local service Local management may purchase local/admitted coverage anyway

Centralization vs. Decentralization: Strategic Issues

Should decision making with respect to pure risks be delegated to the management of foreign subsidiaries/affiliates?

One answer: Since the decision to commit assets to foreign operations is made by the parent corporation, the parent should likewise make the decision regarding the methods best suited for protecting those assets.

Agree or disagree?

Centralization vs. Decentralization: Strategic Issues

Can an MNE with a centralized risk management program still buy insurance locally?

Centralized risk management is not inconsistent with decentralized insurance purchases. Purchase of insurance might be delegated to the foreign affiliate, but with guidelines and strict performance standards.

Centralization vs. Decentralization: Strategic Issues

Often, foreign affiliates prefer to deal with local insurers.

In cases where a foreign affiliate was acquired by an MNE, the affiliate may have long-term relationships with local insurers. Reciprocal business advantages may be gained from local purchase of insurance.

Centralization vs. Decentralization: Strategic Issues

In countries where a competitive insurance market does not exist, the MNE may be faced with excessive prices. Are the economic benefits from non-admitted coverage sufficient to offset local financial penalties and escape local insurance entirely? Sometimes, risk managers purchase the minimum permissible amount of insurance locally, and cover the bulk of exposures under a non-admitted difference-in-conditions policy.

Difference-in-Conditions Policies

An MNE with multiple insurance purchases in different jurisdictions can purchase a difference-in-conditions (DIC) policy that serves as a wrap-around, bringing the overall level of protection to a specified level.

A DIC property policy typically affords openperil protection covering losses that local/admitted named-peril policies do not cover.

A DIC policy typically accounts for other coverage differences as well

The Global Insurance Program

A global insurance program is purchased centrally, with a master contract covering all the MNEs risks.

Negotiated in the MNEs home country Combines benefits of non-admitted and admitted coverage Combines coverage of both the MNEs domestic and foreign exposures

One obvious advantage is the potential economy from centralized buying

The Global Insurance Program

One potential difficulty is finding an insurer with a global network of engineers, claim adjusters, and other service personnel. An MNE can easily segment its foreign and domestic exposures, setting up a foreign insurance program separate and distinct from its domestic program.

Global Insurers

Leading U.S. insurers with a significant presence in the international market include AIG, CIGNA, Ace, and Chubb. Non-U.S. insurers with a significant presence include Zurich, Winterthur, Swiss Re, Gerling, Allianz, XL, et al. Buyers usually can access global programs through New York, London, or other major financial centers.

Global Brokers

Several leaders have emerged from a combination of U.S., U.K., and other international brokers:

Marsh, Inc. (MMC) Aon Willis IRMG

These international brokerage/consulting firms are present in most countries, maintaining contacts with local admitted insurers, and capable of creating global programs.

The Global Master Policy

A global master policy is issued on a nonadmitted basis.

The global underwriter instructs local affiliates what policies to issue (subject to local regulations). The master policy provides excess and DIC over local/admitted policies.

Increased limits may be needed if there is a possibility of liability in a country other than where damage occurred (e.g., Bhopal).

A major issue is communication.

Global Communication

Among . . .

Corporate risk manager Local affiliate managers Global broker/consultant Local broker/consultant Global underwriter Local underwriter

Who monitors this complex web?

Foreign Exchange Risks

One of the most significant risks facing an MNE involves variations in foreign exchange rates. An exchange rate represents the number of units of one currency that can be exchanged for another. When a foreign currency declines in value relative to the dollar, a U.S. company suffers a loss from any assets payable in that currency.

Approaches to Dealing with Foreign Exchange Risks

Minimize holding of foreign currencies

Retain currency risks internally. Hedge in the options/futures market for foreign currencies.

Political Risks

MNEs are frequently exposed to political risks.

These are caused by any local governments action (or failure to act) that diminishes the value of a firm operating within its borders. These risks include:

Acts of local governments Acts of local political organizations

Acts of local competing businesses

Acts of terrorists/criminals

Major Political Risks

Expropriation, confiscation, or nationalization of assets of a local subsidiary/affiliate without sufficient compensation Contract frustration or repudiation Changing restrictions on convertibility of currency Damage to property or personnel by antigovernment activity Kidnapping/murder of firms employees War, insurrection, terrorism

Milder Political Risk

Local actions that differentiate between local and international firms:

Changing requirements that MNEs employ some minimum percentage of local nationals Changing requirements that MNEs invest in local social and economic projects Discriminatory practices (e.g., higher taxes, higher utility charges)

Requirements to pay higher wages than a local company

Expectation of bribery/political payoffs

Political Risk Identification

Consider local government history - how power is transferred, etc.

Consider the stability of both national and sub-national governments. Who influences power? Is the rule of law - due process - afforded both locals and foreigners? How can religious/cultural issues impact MNEs employees, product/service reception?

Managing Political Risks

Shared ownership reduces both the likelihood and the potential severity of loss. Enter into a joint venture with local investors:

to establish local support for the firm, and to provide better information on the countrys political/economic conditions.

Limit the amount of capital invested in the local subsidiary/affiliate.

Managing Political Risks

Integrative strategy:

Integrate within the social/economic fabric of the local country.

Borrow funds locally to lessen investment exposure should nationalization occur.

Train managers to become familiar with local culture, customs, and managerial styles.

Managing Political Risk

More Defensive Strategy:

Keep fixed investments and assets to a minimum by leasing whenever possible, and by retaining R&D activities domestically. Maintain ability to move operations quickly and easily to another country. Minimize reliance on local services and utilities.

Political Risk Insurance

Political risk insurance provides protection against three broad types of risks:

Seizure of assets

Currency inconvertibility

Interference with contractual performance

Does not cover credit risk or kidnap-andransom risks.

Political Risk Insurance

1.

Sources of political risk insurance are extremely limited:

1. 2. 3.

OPIC and MIGA AIG, Chubb, ACE, Zurich Lloyds of London

You might also like

- Investment Analysis and Portfolio Management Reilly 10th Edition Solutions ManualDocument11 pagesInvestment Analysis and Portfolio Management Reilly 10th Edition Solutions ManualMonicaAcostagzqkx100% (79)

- Accepted For Value Tutorial 2018Document7 pagesAccepted For Value Tutorial 2018Pratus Williams100% (23)

- Managerial Accounting Excel Project 2Document8 pagesManagerial Accounting Excel Project 2John GuerreroNo ratings yet

- Chapter 019Document14 pagesChapter 019mallumainhunmailNo ratings yet

- TQMDocument20 pagesTQMReema DawraNo ratings yet

- CombinepdfDocument129 pagesCombinepdfMary Jane G. FACERONDANo ratings yet

- 3rd Quarter - BUS4 BlankDocument7 pages3rd Quarter - BUS4 BlankKian Barredo0% (1)

- Topic 5 Types of RisksDocument11 pagesTopic 5 Types of Riskskenedy simwingaNo ratings yet

- Financial and Non Financial RiskDocument5 pagesFinancial and Non Financial Riskpriti mishraNo ratings yet

- Types of Companies: Drivers: Product Mix, People, Production, Market Mix, Vision, Mission (Transition)Document34 pagesTypes of Companies: Drivers: Product Mix, People, Production, Market Mix, Vision, Mission (Transition)Rohan PatelNo ratings yet

- Nature and Importance InsuranceDocument54 pagesNature and Importance Insurancejakowan0% (2)

- Introduction To D&O Insurance: Allianz Global Corporate & SpecialtyDocument11 pagesIntroduction To D&O Insurance: Allianz Global Corporate & SpecialtyUngurasu AndreiNo ratings yet

- Pre-Investment Planning: AvoidanceDocument3 pagesPre-Investment Planning: AvoidanceRishabh JainNo ratings yet

- Types of Risk in International BusinessDocument9 pagesTypes of Risk in International BusinessBappa P M BaruaNo ratings yet

- 8 International Aspect of FM - Jan 2012Document10 pages8 International Aspect of FM - Jan 2012Moud KhalfaniNo ratings yet

- International Finance - Assignment 1Document3 pagesInternational Finance - Assignment 1Betty MudondoNo ratings yet

- 1065a FIC Briefing Paper Formatting8 7 14 - tcm3171-621037Document5 pages1065a FIC Briefing Paper Formatting8 7 14 - tcm3171-621037Djordje NedeljkovicNo ratings yet

- Chapter 1 Saunders Cornett McGrawDocument58 pagesChapter 1 Saunders Cornett McGrawAlice WenNo ratings yet

- Political Risk AnalysisDocument25 pagesPolitical Risk AnalysisMurali DarenNo ratings yet

- Module-1 International Financial Environment: Rewards & Risk of International FinanceDocument17 pagesModule-1 International Financial Environment: Rewards & Risk of International FinanceAbhishek AbhiNo ratings yet

- Question 1 - Explain The Risk Management Methods. Answer - 1Document11 pagesQuestion 1 - Explain The Risk Management Methods. Answer - 1Raghavendra SoniNo ratings yet

- Challenges of Political and Legal EnvironmentDocument10 pagesChallenges of Political and Legal EnvironmentKhaleeda AzwaNo ratings yet

- Classification of RisksDocument7 pagesClassification of RisksAnurag GargNo ratings yet

- Top 9 Problems Faced by International MarketingDocument4 pagesTop 9 Problems Faced by International MarketingwondesenNo ratings yet

- ASSIGNMENT of IBMDocument7 pagesASSIGNMENT of IBMAbdulmajeedNo ratings yet

- Assignment of International BusinessDocument7 pagesAssignment of International BusinessbeyonnetshNo ratings yet

- International BusinessDocument8 pagesInternational BusinessIftakhar R. TusharrNo ratings yet

- International Business 4aDocument24 pagesInternational Business 4aRahul DewakarNo ratings yet

- Business Risk and Its TypesDocument47 pagesBusiness Risk and Its TypesAtia KhalidNo ratings yet

- Financial InnovationDocument19 pagesFinancial InnovationSiva ShankarNo ratings yet

- Introduction To Risk ManagementDocument21 pagesIntroduction To Risk ManagementRaghavendra.K.ANo ratings yet

- IF Lecture 3Document13 pagesIF Lecture 3Rk BainsNo ratings yet

- Micro InsuranceDocument17 pagesMicro InsurancerishipathNo ratings yet

- Risk Analysis: Absolute vs. Relative RiskDocument2 pagesRisk Analysis: Absolute vs. Relative RiskAsmara NoorNo ratings yet

- Risk & Risk Management:: Role of Financial DerivativesDocument24 pagesRisk & Risk Management:: Role of Financial DerivativesChirag ParakhNo ratings yet

- Explain Price Risk and Its TypesDocument33 pagesExplain Price Risk and Its TypesAmanpreet Formay0% (1)

- Go Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Document12 pagesGo Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Mayur SoNo ratings yet

- Introduction and Risk MGT 3Document21 pagesIntroduction and Risk MGT 3Mridul SethNo ratings yet

- Thesis Foreign Exchange Risk ManagementDocument6 pagesThesis Foreign Exchange Risk ManagementSomeToWriteMyPaperSingapore100% (2)

- Political RiskDocument3 pagesPolitical RiskHarleenNo ratings yet

- Response: Consultative Document On Margin Requirements For Non-Centrally-Cleared DerivativesDocument15 pagesResponse: Consultative Document On Margin Requirements For Non-Centrally-Cleared DerivativesBusiness RoundtableNo ratings yet

- Affinity News October 2013 PDFDocument4 pagesAffinity News October 2013 PDFFinchSheffieldNo ratings yet

- Webinar 8Document23 pagesWebinar 8Hélio Julião NgoveNo ratings yet

- Two Marks Question: 1. What Is Hedging?Document6 pagesTwo Marks Question: 1. What Is Hedging?akshataNo ratings yet

- International FinanceDocument26 pagesInternational FinanceRk BainsNo ratings yet

- 1554207851unit 2 Types of RiskDocument16 pages1554207851unit 2 Types of RiskWongNo ratings yet

- Trade RiskDocument26 pagesTrade RiskAngelyn MortelNo ratings yet

- UNIT 3 RiskDocument4 pagesUNIT 3 RiskAnkush SharmaNo ratings yet

- Financial Risk Management & Derivatives: Unit 1Document30 pagesFinancial Risk Management & Derivatives: Unit 1DEEPIKA S R BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Financial Risk ManagementDocument6 pagesFinancial Risk ManagementMohammadAhmadNo ratings yet

- InsuranceDocument2 pagesInsuranceRavi AgarwalNo ratings yet

- Unit 4 3Document43 pagesUnit 4 3manjarisingh2502No ratings yet

- Dec08 138 Microfinance en FINAL2Document4 pagesDec08 138 Microfinance en FINAL2Hedato M DatuNo ratings yet

- FRM Group 1 Assignment 3Document4 pagesFRM Group 1 Assignment 3Ridhi MusaddiNo ratings yet

- UNIT 4 Contractual RiskDocument22 pagesUNIT 4 Contractual RiskNEEPANo ratings yet

- FM AssignmentDocument5 pagesFM AssignmentVianca FernilleNo ratings yet

- TFG 2008 CH 8Document2 pagesTFG 2008 CH 8anon_344986524No ratings yet

- Managing Risk in BusinessDocument3 pagesManaging Risk in BusinesstkurasaNo ratings yet

- ROLE OF International FINANCIAL MANAGEMENTDocument8 pagesROLE OF International FINANCIAL MANAGEMENTMihir GaurNo ratings yet

- Understanding and Evaluating Sovereign RiskDocument8 pagesUnderstanding and Evaluating Sovereign RiskjeffreyblNo ratings yet

- Introduction To Insurance ExtendedDocument68 pagesIntroduction To Insurance ExtendedMohamed AhmedNo ratings yet

- F3 Chapter 8Document12 pagesF3 Chapter 8Ali ShahnawazNo ratings yet

- Guide For Identifying Financial RisksDocument3 pagesGuide For Identifying Financial RisksbillpaparounisNo ratings yet

- Chapter 18-Cross Border TransactionDocument9 pagesChapter 18-Cross Border Transaction1954032027cucNo ratings yet

- Changing The Look Transforming The Outlook: Annual 2012 - 13Document171 pagesChanging The Look Transforming The Outlook: Annual 2012 - 13Reema DawraNo ratings yet

- 7 An Overview Enterprise Resource Planning ERPDocument20 pages7 An Overview Enterprise Resource Planning ERPReema DawraNo ratings yet

- Nontariff Trade Barriers and New ProtectionismDocument30 pagesNontariff Trade Barriers and New ProtectionismReema DawraNo ratings yet

- Books ListDocument1 pageBooks ListReema DawraNo ratings yet

- Adjustment To Brand Portfolio & Brand Portfolio RationalizationDocument14 pagesAdjustment To Brand Portfolio & Brand Portfolio RationalizationReema Dawra50% (2)

- Evolution of PDCADocument11 pagesEvolution of PDCAReema DawraNo ratings yet

- Cheque Truncation ProjectDocument26 pagesCheque Truncation ProjectReema Dawra0% (1)

- Second Generation Economic Reforms in IndiaDocument42 pagesSecond Generation Economic Reforms in IndiaReema Dawra100% (2)

- CFAS - Module 1 PDFDocument22 pagesCFAS - Module 1 PDFKashato BabyNo ratings yet

- Group Work Fa1 - FPTDocument28 pagesGroup Work Fa1 - FPTCẩm NhungNo ratings yet

- Intermediate Accounting, Volume 1: Donald E. Kieso PH.D., C.P.ADocument9 pagesIntermediate Accounting, Volume 1: Donald E. Kieso PH.D., C.P.AFitriani Alletha100% (1)

- CH 22 - 26Document43 pagesCH 22 - 26Mahammad AliyevNo ratings yet

- Chapter 6 Employee Benefits 2Document16 pagesChapter 6 Employee Benefits 2Thalia Rhine AberteNo ratings yet

- REVTOA ReceivablesDocument5 pagesREVTOA ReceivablesJoanna Marie UrbienNo ratings yet

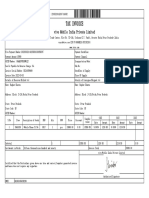

- Tax Invoice: Vivo Mobile India Private LimitedDocument1 pageTax Invoice: Vivo Mobile India Private LimitedRaghav SharmaNo ratings yet

- Auditing I-Chapter 1 MLCDocument13 pagesAuditing I-Chapter 1 MLCHilew TSegayeNo ratings yet

- Accounting For Income, Collections and Related TransactionsDocument12 pagesAccounting For Income, Collections and Related TransactionsMichaela Krishia100% (1)

- Bai Type Code GuideDocument31 pagesBai Type Code Guideswathipotla100% (1)

- POs Pre Joining Study Material PDFDocument152 pagesPOs Pre Joining Study Material PDFKushagra Pratap SinghNo ratings yet

- Paryant Agarwal SIP ReportDocument59 pagesParyant Agarwal SIP ReportjatinNo ratings yet

- UOB Business BankingDocument10 pagesUOB Business BankingJasmine SoniNo ratings yet

- Level III Essay Questions 2014 PDFDocument80 pagesLevel III Essay Questions 2014 PDFwNo ratings yet

- Ratio Analysis Notes (Theory)Document3 pagesRatio Analysis Notes (Theory)Karishma KatiyarNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationJerome DizonNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument94 pagesChapter 16 Advanced Accounting Solution ManualVanessa DozonNo ratings yet

- Liddell & Co DigestDocument2 pagesLiddell & Co DigestJoey PastranaNo ratings yet

- AP14e ch03 Solutions ManualDocument5 pagesAP14e ch03 Solutions Manual22004079No ratings yet

- Katowice Banks 2020 Credit Portfolio AlignmentDocument52 pagesKatowice Banks 2020 Credit Portfolio AlignmentComunicarSe-Archivo100% (1)

- Finance Notes SifdDocument104 pagesFinance Notes SifdSuresh KumarNo ratings yet

- Russia M&ADocument48 pagesRussia M&Adshev86No ratings yet

- ME51N-Create A Purchase Requisition For ServicesDocument6 pagesME51N-Create A Purchase Requisition For ServicesAndrea EllisNo ratings yet

- What Is Section 10 of The Income Tax ActDocument15 pagesWhat Is Section 10 of The Income Tax Actdevam05006No ratings yet

- Nota Maintenance of Share CapitaDocument8 pagesNota Maintenance of Share CapitaPraveena RaviNo ratings yet