Professional Documents

Culture Documents

Future of Private Sector Banks in India

Future of Private Sector Banks in India

Uploaded by

Navpreet SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Future of Private Sector Banks in India

Future of Private Sector Banks in India

Uploaded by

Navpreet SinghCopyright:

Available Formats

FUTURE OF PRIVATE BANK IN INDIA

Presented To: Mrs. Neena Sareen Presented By: Ashima Garg B.Com- Prof.-I Roll No. 5908

1

Aims of Presentation

Examines the future prospects for the private banking / wealth management industry Recaps key trends Focuses on sources of new profitable growth:

Geographical areas Client relationship deepening. New areas / propositions Future industry structure Critical success factors.

2

Key Future Trends

Private banking firms need to develop their

businesses models and change (or enhance) their

strategic focus in order to take advantage of the

opportunities afforded by higher growth markets

and product segments. Global private banks are actively developing activities in the three key markets of India Growth in the offshore wealth management area is expected to lag that of onshore business.

3

Transformation of wealth management

Sources of new profitable growth

Geographic participation. Potential growth opportunities in established and new markets Client relationship deepening. Increasing the penetration and loyalty of existing clients, and targeting new client segments New propositions. Developing product and service innovations and personalising the wealth management advisory role.

Geographic participation

New emerging wealth markets:

Particular attention has focused on the BRIC economies Such as India has projected economic growth over the coming decades. Indias economy could be larger than Japans by 2032 Chinas larger than the US by 2041 (and the second biggest economy in the world by 2016) Goldman Sachs forecasts show that the combined BRIC economies will be larger than the current G6 (US, Japan, UK, Germany, France and Italy) by 2039.

Overtaking the G6: when BRICs US$GDP would exceed G6

Source: Goldman Sachs (2003).

The largest economies in 2050

Source: Goldman Sachs 2003.

HNWI financial wealth forecast by region, 20042009E (US$ trillions)

Source: Capgemini Merrill Lynch (2005), World Wealth Report Capgemini.

Growth of multigenerational client relationships, by client type, 20022004

Source: Capgemini Merrill Lynch (2005), World Wealth Report. Capgemini. 10

New Clients

New clients will emanate primarily from those economies expected to have the greatest economic growth potential, namely Russia, India and China These will have created their wealth through entrepreneurial activity and will seek services that reflect their greater familiarity with more complex financing options coupled with relatively strong protection elements

11

Non-financial lifestyle services

Lifestyle services are an umbrella term referring to a wide range of services designed to support, facilitate and improve the lifestyles of wealthy clients Includes: 1. Lifestyle organization services aimed at assisting in organizing and facilitating aspects of individuals lives such as leisure, entertainment, shopping and event planning. 2. Travel services aimed at supporting and arranging individuals travel requirements. 3. Property and home services aimed at assisting with individuals household and property requirements including finding, purchasing, moving and maintaining the home. 4. Luxury asset acquisition services aimed at helping wealthy individuals in the purchase and management of large-scale luxury items.

12

Increasing client penetration and loyalty

Understanding the needs and aspirations of clients Focusing on higher-value clients Creating value-added services for clients.

Focus on delivering relevant value to targeted clients. That, of course, requires wealth managers to understand the needs and expectations of clients and also really demands that the relationship manager understands more precisely what clients value.

Confidentiality Security and Performance are important value-enhancing propositions.

13

Lifestyle services

Source: Datamonitor, Incorporating Lifestyle Services into the Wealth Management Proposition Survey 14 , May 2003,

Aggregator role

The industry is increasingly being viewed (and talked about) as an aggregator, whereby a whole range of suppliers, both internal and external to the bank, offer a range of services that can be offered individually or bundled together to meet client needs. Such aggregation activity means that wealth managers have to be much more nimble and efficient in sourcing, distributing and identifying value-enhancing services (for both the client and the bank). The aggregator function of wealth managers, and the growing focus on value-added advice led sales, has encouraged (or forced) the industry to consider developing their business along similar lines to the family office, with the aim of offering holistic and independent advice.

15

Industry Structure - Evolving to the next level of a global trusted advisor?

16

Winners and losers in European wealth management over the next 3 to 5 years

Source: Mercer Oliver Wyman (2005).

17

Key is to develop common skills in building relationships

Source: IBM Consulting Services (2005).

18

Conclusion

Examines the future prospects for the private banking / wealth management industry Focuses on sources of new profitable growth:

Geographical areas China, India, Russia Client relationship deepening focus on mid-wealth HNWIs and intergenerational wealth planning services + focus on holistic advice New areas / propositions women, ethnic groups, lifestyle services, family office style services Future industry structure Critical success factors - building on relationships, more value-based approach to business and clients

19

You might also like

- Minutes of The Homeroom MeetingDocument1 pageMinutes of The Homeroom MeetingRichard Tan Alagos100% (16)

- Changing Role of The Women in The Past 25 YearsDocument11 pagesChanging Role of The Women in The Past 25 YearsNavpreet Singh79% (52)

- Compendium of Logistics Policies Volume III PDFDocument219 pagesCompendium of Logistics Policies Volume III PDFDon-Juan Casanova92% (12)

- Indus Valley CivilizationDocument16 pagesIndus Valley CivilizationNavpreet Singh100% (2)

- A Study On Customer Attitude Towards Yamaha Sports Bike in Lucknow CityDocument6 pagesA Study On Customer Attitude Towards Yamaha Sports Bike in Lucknow CityChandan SrivastavaNo ratings yet

- Development of Human Resource at Tata SteelDocument79 pagesDevelopment of Human Resource at Tata SteelBimal Kumar DashNo ratings yet

- Contribution of Elton MayoDocument10 pagesContribution of Elton MayoNavpreet SinghNo ratings yet

- CSP 20-21 App Development Planning GuideDocument7 pagesCSP 20-21 App Development Planning GuideJoel MamanNo ratings yet

- Karvy Report On Comparative Study On Mutual FundsDocument57 pagesKarvy Report On Comparative Study On Mutual FundsNishant GoldyNo ratings yet

- Organisation Report On Reliance FreshDocument17 pagesOrganisation Report On Reliance FreshMADHU SUDHANNo ratings yet

- A Study On The Effectiveness of Performance Appraisal at Quantum It InnovationsDocument79 pagesA Study On The Effectiveness of Performance Appraisal at Quantum It InnovationsShahzad SaifNo ratings yet

- MANAPASANDDocument93 pagesMANAPASANDAnonymous V9E1ZJtwoENo ratings yet

- Customer PerceptionDocument19 pagesCustomer PerceptionKesavan KeshavNo ratings yet

- CSR Report UpdatedDocument33 pagesCSR Report Updatedyash chavanNo ratings yet

- Customer Satisfaction Towards Idea SimDocument62 pagesCustomer Satisfaction Towards Idea SimSunaina KhoslaNo ratings yet

- "A Study On The Financial Performance of Hindustan Unilever Limited"Document60 pages"A Study On The Financial Performance of Hindustan Unilever Limited"career pathNo ratings yet

- Big Bazaar Final ReportDocument79 pagesBig Bazaar Final ReportPoojaNo ratings yet

- CSR by SBIDocument33 pagesCSR by SBIPooja MoreNo ratings yet

- MBA Ojt Study of Working Capital at SJVN ShimlaDocument41 pagesMBA Ojt Study of Working Capital at SJVN Shimlaashishnaval_29No ratings yet

- A Study On Customer Perception of Airtel Broadband Services Among Small Medium EnterprisesDocument72 pagesA Study On Customer Perception of Airtel Broadband Services Among Small Medium EnterprisesHardeep Rajput100% (1)

- A Study On Budget N Budgetary Control in VPT-CHDDocument117 pagesA Study On Budget N Budgetary Control in VPT-CHDBabikiran Appasani100% (1)

- Summer Internship ReportDocument62 pagesSummer Internship ReportFaisal ArifNo ratings yet

- Project ReportDocument87 pagesProject Reportkiranchetry88No ratings yet

- Dissertation Report OF A Study On Measuring Customer Satisfaction at Reliance Fresh' Retail Outlet in New DelhiDocument88 pagesDissertation Report OF A Study On Measuring Customer Satisfaction at Reliance Fresh' Retail Outlet in New DelhiFaheem QaziNo ratings yet

- A Study On Employee Relation and Employee Communication at CIPSA, TEC PVT LTDDocument93 pagesA Study On Employee Relation and Employee Communication at CIPSA, TEC PVT LTDSukruth SNo ratings yet

- MBA Project PDFDocument77 pagesMBA Project PDFshravan suvarna-mangaloreNo ratings yet

- AavinDocument51 pagesAavinAjay VickyNo ratings yet

- A Study On Employee Job Satisfaction at Metro Cash and Carry, Bengaluru.Document74 pagesA Study On Employee Job Satisfaction at Metro Cash and Carry, Bengaluru.noel sannaNo ratings yet

- MSR PROJect ArbaazDocument62 pagesMSR PROJect ArbaazNeeraj ThakurNo ratings yet

- Project On Telecom SectorDocument114 pagesProject On Telecom SectorSuresh100% (1)

- Consumer Beahviour and Perception of Women Towards LakmeDocument73 pagesConsumer Beahviour and Perception of Women Towards Lakmegaurav9910609218No ratings yet

- Customer Satisfaction On Airtel MarketingDocument34 pagesCustomer Satisfaction On Airtel MarketingJaiHanumankiNo ratings yet

- Consumer Satisfaction in Consumer Durables-A Case Study On LG, Videocon & PhilipsDocument95 pagesConsumer Satisfaction in Consumer Durables-A Case Study On LG, Videocon & PhilipsGirish ShettyNo ratings yet

- A Project Report On Customer Satisfaction in Tvs MotorsDocument81 pagesA Project Report On Customer Satisfaction in Tvs MotorsMathan KumarNo ratings yet

- RM Project ReportDocument17 pagesRM Project ReportRajesh FarawayNo ratings yet

- Customer Satisfaction at Reliance Mutual FundDocument47 pagesCustomer Satisfaction at Reliance Mutual FundPrince Satish ReddyNo ratings yet

- Training Project ReportDocument55 pagesTraining Project ReportyashwantpujaNo ratings yet

- CRM at Rudvik RealtorsDocument87 pagesCRM at Rudvik RealtorsankitaNo ratings yet

- Youth and Agripreneurship - Problems and ProspectsDocument42 pagesYouth and Agripreneurship - Problems and ProspectsSufairaNo ratings yet

- Big BazarDocument59 pagesBig BazarBimal Kumar DashNo ratings yet

- Equity Research On FMCGDocument58 pagesEquity Research On FMCGSagar TanksaleNo ratings yet

- Chapter IDocument59 pagesChapter Isiranjeevi100% (1)

- Final Research ProjectDocument86 pagesFinal Research Projectranjha8988% (8)

- Project Report On Inventory MNGMTDocument94 pagesProject Report On Inventory MNGMTJaynand Patalia100% (1)

- 007 - Review of LiteratureDocument15 pages007 - Review of LiteratureNamrata SaxenaNo ratings yet

- Study On Consumer Sales Promotion of Apparel Retail StoresDocument53 pagesStudy On Consumer Sales Promotion of Apparel Retail Storesparinaym143100% (5)

- A Project Report On ExideDocument90 pagesA Project Report On ExidePiyush Bhardwaj100% (3)

- Employee SatisfactionDocument50 pagesEmployee SatisfactionConnect Net cafeNo ratings yet

- Amity Business School: Submitted by Tanya Sharma M.B.A (HR) 2008-2010 (A0102308288)Document68 pagesAmity Business School: Submitted by Tanya Sharma M.B.A (HR) 2008-2010 (A0102308288)Chaiten GuptaNo ratings yet

- Bse Trading Mini Project ReportDocument77 pagesBse Trading Mini Project ReportBabasab Patil (Karrisatte)No ratings yet

- A Project Report OnDocument32 pagesA Project Report OnshivaroraNo ratings yet

- A Study On Working Capital ManagementDocument88 pagesA Study On Working Capital ManagementGopinath Basavaiah Siddaiah60% (5)

- Performance Evaluation of Mutual FundsDocument84 pagesPerformance Evaluation of Mutual Fundsmansee_861398No ratings yet

- Study The Job Satisfaction of Employees in SBI LTD 2Document51 pagesStudy The Job Satisfaction of Employees in SBI LTD 2Ashish NavalNo ratings yet

- Consume Behavior BanksDocument109 pagesConsume Behavior BanksAnish NagpalNo ratings yet

- ProjectDocument60 pagesProject1142Suraj PawarNo ratings yet

- A Study On Customer Buying Behaviour and Brand Preference Towards Automobiles-3Document36 pagesA Study On Customer Buying Behaviour and Brand Preference Towards Automobiles-3ADIDEV TsNo ratings yet

- Electronics BBA MBA Project ReportDocument50 pagesElectronics BBA MBA Project ReportpRiNcE DuDhAtRaNo ratings yet

- Consumer Buying Behaviour Towards Aqua Guard: Mrs. S. Rabia KulsumDocument31 pagesConsumer Buying Behaviour Towards Aqua Guard: Mrs. S. Rabia KulsumsathvikaNo ratings yet

- Comperative Analysis of Products & Services of Axis Bank Wiith Its Competitors Ayushi AgarwalDocument62 pagesComperative Analysis of Products & Services of Axis Bank Wiith Its Competitors Ayushi AgarwalAnonymous CUwjARNo ratings yet

- Green Products A Complete Guide - 2020 EditionFrom EverandGreen Products A Complete Guide - 2020 EditionRating: 5 out of 5 stars5/5 (1)

- 20 - Future of Private Banking in IndiaDocument30 pages20 - Future of Private Banking in IndiaPranab ParidaNo ratings yet

- Soft Copy of Project... 2Document21 pagesSoft Copy of Project... 2Jahid KhanNo ratings yet

- Addressing Customer Needs For Full Financial Inclusion: Financial Inclusion 2020 Addressing Customer Needs Working GroupDocument16 pagesAddressing Customer Needs For Full Financial Inclusion: Financial Inclusion 2020 Addressing Customer Needs Working GroupCenter for Financial InclusionNo ratings yet

- Wealth Management: Trends and IssuesDocument17 pagesWealth Management: Trends and Issuesagrawal.ace9114100% (1)

- Partnership FirmDocument15 pagesPartnership FirmNavpreet SinghNo ratings yet

- Features of Directing: Submitted To: Submitted byDocument15 pagesFeatures of Directing: Submitted To: Submitted byNavpreet SinghNo ratings yet

- Autobiography of Apj Abdul KalamDocument5 pagesAutobiography of Apj Abdul KalamNavpreet Singh100% (1)

- Quetionnnaire:) Print Media 2 SMS On Mobile 3) Internet 4) OutdoorDocument8 pagesQuetionnnaire:) Print Media 2 SMS On Mobile 3) Internet 4) OutdoorNavpreet SinghNo ratings yet

- Questionnaire IIDocument2 pagesQuestionnaire IINavpreet SinghNo ratings yet

- Egypt CivlizationDocument12 pagesEgypt CivlizationNavpreet SinghNo ratings yet

- The Doctrine of Separation of PowersDocument3 pagesThe Doctrine of Separation of PowersNavpreet SinghNo ratings yet

- Bank Financing of Agriculture Sector in PunjabDocument48 pagesBank Financing of Agriculture Sector in PunjabNavpreet SinghNo ratings yet

- Grievance Handling at Solitaire InfosysDocument13 pagesGrievance Handling at Solitaire InfosysNavpreet Singh0% (1)

- Arithmetic ProgressionDocument10 pagesArithmetic ProgressionNavpreet SinghNo ratings yet

- Ozone: - Stratosphere Ozone Layer - UVBDocument15 pagesOzone: - Stratosphere Ozone Layer - UVBNavpreet SinghNo ratings yet

- Contribution of Elton MayoDocument10 pagesContribution of Elton MayoNavpreet SinghNo ratings yet

- Signling in FinanceDocument85 pagesSignling in FinanceNavpreet SinghNo ratings yet

- A Questionnaire On Consumer AwarenessDocument1 pageA Questionnaire On Consumer AwarenessNavpreet SinghNo ratings yet

- Importance of Social Sites in PromotionDocument10 pagesImportance of Social Sites in PromotionNavpreet SinghNo ratings yet

- Ebay Finalize ProjectDocument26 pagesEbay Finalize ProjectNavpreet SinghNo ratings yet

- Corporate Social ResponsibilityDocument12 pagesCorporate Social ResponsibilityNavpreet SinghNo ratings yet

- PHP ProjectDocument65 pagesPHP ProjectNavpreet SinghNo ratings yet

- 11 Thesis PlanDocument33 pages11 Thesis PlanNavpreet SinghNo ratings yet

- Fantastic - Trip by NASADocument68 pagesFantastic - Trip by NASANavpreet SinghNo ratings yet

- Project Report On Employee SatisfactionDocument75 pagesProject Report On Employee SatisfactionNavpreet Singh100% (1)

- Kinema TicsDocument16 pagesKinema TicsNavpreet SinghNo ratings yet

- A Presentation On Corporate GovernanceDocument20 pagesA Presentation On Corporate GovernanceNavpreet Singh100% (1)

- Feasibility OF Training in HCL: By: Yamini KatariaDocument15 pagesFeasibility OF Training in HCL: By: Yamini KatariaNavpreet SinghNo ratings yet

- Role of GovernorDocument1 pageRole of GovernorNavpreet SinghNo ratings yet

- Am-Fm Radio ReceiversDocument11 pagesAm-Fm Radio ReceiversNavpreet SinghNo ratings yet

- Production History: Type Place of OriginDocument15 pagesProduction History: Type Place of Originjason maiNo ratings yet

- The Measures of Central TendencyDocument40 pagesThe Measures of Central TendencyMark Lester Brosas TorreonNo ratings yet

- Tatalaksana Gizi BurukDocument80 pagesTatalaksana Gizi BurukIntania FadillaNo ratings yet

- Cheatsheet Gimp-Letter PDFDocument1 pageCheatsheet Gimp-Letter PDFRox DiazNo ratings yet

- Aristo Alhakim IndonesiaDocument2 pagesAristo Alhakim Indonesiaaristo anadyaNo ratings yet

- Appendix H PDFDocument59 pagesAppendix H PDFarif_rubinNo ratings yet

- Technical DescriptionDocument5 pagesTechnical DescriptionTimothy Roger Reyes0% (1)

- Barangay Health Worker Registration FormDocument1 pageBarangay Health Worker Registration FormJairah Marie100% (2)

- First Observation - Lesson PlanDocument2 pagesFirst Observation - Lesson Planapi-391549505No ratings yet

- Lyrics of I'm Yours by Jason MrazDocument2 pagesLyrics of I'm Yours by Jason MrazSofia JavillonarNo ratings yet

- Musician VC YGO IV 2021Document1 pageMusician VC YGO IV 2021Ari J PalawiNo ratings yet

- Correction Level 5Document9 pagesCorrection Level 5nika wikaNo ratings yet

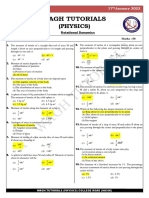

- Mock Test - 98 (17 Jan 2023) Rotational DynamicsDocument1 pageMock Test - 98 (17 Jan 2023) Rotational DynamicsparamNo ratings yet

- The Golden Fish Keeps A Promise StoryDocument2 pagesThe Golden Fish Keeps A Promise StoryDe Guzman Diane Marie B.No ratings yet

- Asian School Change in Profit Sharing Ratio Sample PaperDocument2 pagesAsian School Change in Profit Sharing Ratio Sample PaperMan your voice is breaking kuttyNo ratings yet

- FCP Notes RevisedDocument34 pagesFCP Notes Revisedpavana.sNo ratings yet

- Semantic Segmentation Data Labelling: Classes and InstructionsDocument9 pagesSemantic Segmentation Data Labelling: Classes and InstructionsMar FieldsNo ratings yet

- QuickRide LogcatDocument179 pagesQuickRide Logcatap131096No ratings yet

- Later Middle Ages:: Lord John Alfred Fernandez BsedDocument36 pagesLater Middle Ages:: Lord John Alfred Fernandez BsedJohn Alfred FernandezNo ratings yet

- TDS - Emaco R907 PlusDocument2 pagesTDS - Emaco R907 PlusVenkata RaoNo ratings yet

- 003.ladders - Rev. 0Document25 pages003.ladders - Rev. 0narasimhamurthy414No ratings yet

- Angel Baby LyricsDocument1 pageAngel Baby LyricsBianca Mongaya100% (1)

- Neo FuturismDocument16 pagesNeo Futurismboddutilak100% (1)

- Level Control Trainer FinalDocument6 pagesLevel Control Trainer FinalSiddhartha SharmaNo ratings yet

- Personal Style ScaleDocument3 pagesPersonal Style ScalesomaNo ratings yet

- Fida Ur Rehman SP19-BBA-022 Section - A Assignment #1Document4 pagesFida Ur Rehman SP19-BBA-022 Section - A Assignment #1N ZaibNo ratings yet

- Radiographic Technique 2: Ysmael O. Alip, RRTDocument81 pagesRadiographic Technique 2: Ysmael O. Alip, RRTMarts Rivera100% (1)