Professional Documents

Culture Documents

Determination of National Income For UK

Determination of National Income For UK

Uploaded by

rashelcuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Determination of National Income For UK

Determination of National Income For UK

Uploaded by

rashelcuCopyright:

Available Formats

Determination of National Income for UK

Determination of National Income for UK

i) ii) iii) iv) v) vi)

The stock of factors of production Labour Capital Enterprise State of technical knowledge Political Stability

Explanation of the Government Economic Policy of UK

Explanation of the Government Economic Policy of UK

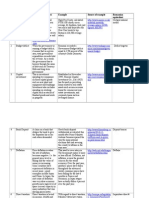

i) Economic Growth: The economic growth is most important for the Government of a country. For UK Government it has become more important as it is fighting to overcome the recession. UK faces the negative economic growth during the recession period. However, the expected growth rate for 2013/2014 economic year is 2.14 (Daily Mail, 2013). In order to achieve the expected growth rate the Government is encouraging the investment in the economy

Explanation of the Government Economic Policy of UK

ii) Inflation: In flatiron is general increase of the commodities that reduce the real value of the money. As inflection restricts the real growth of economy Government plans to reduce the inflation rate of the county. According to Bank of England the existing inflation rate in UK is 2.2% and the organization is planning reduce it to 2%.

Explanation of the Government Economic Policy of UK

iii) Unemployment: Current unemployment rate in UK is 7.5%. The highest unemployment rate is one of the major obstacles of the economy. This also recites economic growth as well as the distribution of income in the society. In order reduce the unemployment, the Government is encouraging the investment, the apprenticeships and developing the new business.

Explanation of the Government Economic Policy of UK

iv) Interest Rate: Lower interest rate encourages the investment and expenditure which keep the economy moving. This is why the UK Government set the lower interest rate in UK.

Explanation of the Government Economic Policy of UK

v) Government Spending: The UK government spends approximately 400bn a year. Over a third of this money goes in welfare benefits such as pensions, unemployment benefit and other forms of income support. The rest is spent on health, education, defence, roads, law and order and on supporting businesses and local communities.

Explanation of the Government Economic Policy of UK

vi) Taxation: UK Government is following a flexible taxation policy to encourage in investment in the economy. Vii) Legislation: Legislation are the laws that affect the way that a person or business can act. The UK Government spends over 400bn a year and takes about the same in taxes. It also passes legislation. These affect the way business can act, e.g. what it can produce, how much it costs and who it can employ. It also affects the way that consumers spend their money.

Impact of Macro-economic Environment of Business Organization

Impact of Macro-economic Environment of Business Organization

The main factors that affect the economic environment are: (a)Economic Conditions (b)Economic Policies

Impact of Macro-economic Environment of Business Organization

Important Economic Policies Industrial policy a) Monetary policy b) Fiscal policy c) Foreign investment policy d) Export-Import policy

You might also like

- (Solved) Entrance Exam Sample QuestionDocument19 pages(Solved) Entrance Exam Sample Questionmrkalvy101No ratings yet

- Short Feasibility Study For A Hotel Project in Asaba, Delta StateDocument37 pagesShort Feasibility Study For A Hotel Project in Asaba, Delta StateCedric Johnson100% (1)

- Chinese Dream - Helen WangDocument26 pagesChinese Dream - Helen WangShawna WangNo ratings yet

- Globalization - A Basic TextDocument3 pagesGlobalization - A Basic TextJohnny Yang100% (1)

- Economics Assignment:: Type of EconomyDocument3 pagesEconomics Assignment:: Type of EconomyZafeer Aaryan RezaNo ratings yet

- Investing in The FutureDocument13 pagesInvesting in The FuturekkarajanevaNo ratings yet

- Chancellor For A DayDocument5 pagesChancellor For A DayNigel WatsonNo ratings yet

- UK Economy HND AssignmentDocument11 pagesUK Economy HND AssignmentShakirAhamedNo ratings yet

- Facts and Figures On UK's Fiscal Deficit (2000-2010) .Document10 pagesFacts and Figures On UK's Fiscal Deficit (2000-2010) .Aditya NayakNo ratings yet

- A Plan For JobsDocument36 pagesA Plan For JobsChristianNo ratings yet

- Eco Project UKDocument16 pagesEco Project UKPankesh SethiNo ratings yet

- Edexcel As Econ Unit 2 FullDocument198 pagesEdexcel As Econ Unit 2 Fullloca_sanamNo ratings yet

- The United Kingdom: Done By: Zafeer Aaryan RezaDocument10 pagesThe United Kingdom: Done By: Zafeer Aaryan RezaZafeer Aaryan RezaNo ratings yet

- Lord John Eatwell, Shadow Treasury Minister Speech To Debate On Queen's Speech (Day 2 of 4) Business, The Economy, Local Government and TransportDocument4 pagesLord John Eatwell, Shadow Treasury Minister Speech To Debate On Queen's Speech (Day 2 of 4) Business, The Economy, Local Government and Transportapi-110464801No ratings yet

- Executive Summary: The UK Economy and Public FinancesDocument5 pagesExecutive Summary: The UK Economy and Public FinancesalbasudNo ratings yet

- Autumn Statement 2014Document5 pagesAutumn Statement 2014Martin ForsytheNo ratings yet

- Monetary PolicyDocument28 pagesMonetary PolicycoetranslationNo ratings yet

- Government SpendingDocument15 pagesGovernment Spendingmihirjoshi5727No ratings yet

- Government Fiscal PolicyDocument37 pagesGovernment Fiscal PolicyLavanya TheviNo ratings yet

- Analysis of Canada Economically and Politically Along With Its Performance With The Rest of The WorldDocument8 pagesAnalysis of Canada Economically and Politically Along With Its Performance With The Rest of The WorldNikitaNo ratings yet

- Macro Tutorial 7Document4 pagesMacro Tutorial 7RonNo ratings yet

- Autumn Budget 2018Document106 pagesAutumn Budget 2018edienewsNo ratings yet

- Budget Report 2012: Summary of The Main Taxation Provisions Announced by The Chancellor of The Exchequer On 21 March 2012Document32 pagesBudget Report 2012: Summary of The Main Taxation Provisions Announced by The Chancellor of The Exchequer On 21 March 2012api-110844481No ratings yet

- Treasury's Covid-19 Economic ScenariosDocument16 pagesTreasury's Covid-19 Economic ScenariosHenry Cooke100% (1)

- NIESR Election Briefing - The Macroeconomics of Parties' Tax and Spending PlansDocument8 pagesNIESR Election Briefing - The Macroeconomics of Parties' Tax and Spending PlansAshutoshAparajNo ratings yet

- The Dominant ChallengeDocument4 pagesThe Dominant Challengemarcello.didonatoNo ratings yet

- Fiscal Policy in UkDocument27 pagesFiscal Policy in UkFazil Abbas BanatwalaNo ratings yet

- 2024 SH2 H2 Econ Revision 2 (Suggested Answer)Document15 pages2024 SH2 H2 Econ Revision 2 (Suggested Answer)evermorenicole42No ratings yet

- Case Study - Macroeconomic Analysis: Executive SummaryDocument9 pagesCase Study - Macroeconomic Analysis: Executive Summaryharika vanguruNo ratings yet

- A New Macroeconomic Strategy WebReady FinalDocument36 pagesA New Macroeconomic Strategy WebReady FinalHeathwoodPressNo ratings yet

- Final Budget Statementfor Fy 2020 - 21Document86 pagesFinal Budget Statementfor Fy 2020 - 21Oscar MasindeNo ratings yet

- A-09.21.013 ALA UDDIN KOI FIN204 Ass 2 Research ReportDocument11 pagesA-09.21.013 ALA UDDIN KOI FIN204 Ass 2 Research ReportAustin GomesNo ratings yet

- UK PestelDocument78 pagesUK Pestelshams78600No ratings yet

- Uk Pestle Analysis Part 3Document10 pagesUk Pestle Analysis Part 3S Waris HussainNo ratings yet

- Autumn StatementDocument4 pagesAutumn StatementAPCO WorldwideNo ratings yet

- BEE (2019-20) Handout 08 (Fiscal Policy)Document4 pagesBEE (2019-20) Handout 08 (Fiscal Policy)Saurabh SinghNo ratings yet

- ECO209 Present OutlineDocument3 pagesECO209 Present OutlineManda ChungNo ratings yet

- Fiscal PolicyDocument49 pagesFiscal PolicyAnum ImranNo ratings yet

- UntitledDocument14 pagesUntitledNaimee PareshaNo ratings yet

- Ch30 Fiscal Policy 06052020 032020pm 04102022 091523amDocument50 pagesCh30 Fiscal Policy 06052020 032020pm 04102022 091523ammaazhassanofficialNo ratings yet

- News/uk-News/uk-Average-Salary-26500 - Figures-3002995Document7 pagesNews/uk-News/uk-Average-Salary-26500 - Figures-3002995AnaMariaNo ratings yet

- XII - ECONOMICS - UNIT Government Budget and The Economy - NotesDocument7 pagesXII - ECONOMICS - UNIT Government Budget and The Economy - NotesJanvi AhluwaliaNo ratings yet

- MJC H2 Econs CSQ2 Q ADocument7 pagesMJC H2 Econs CSQ2 Q AKaren TanNo ratings yet

- What Is The Role of Fiscal Policy in The EconomyDocument28 pagesWhat Is The Role of Fiscal Policy in The EconomyJackson BlackNo ratings yet

- PGP14226 - Shreya Swarnkar - SectionE Shreya SwarnkarDocument1 pagePGP14226 - Shreya Swarnkar - SectionE Shreya SwarnkarshivaNo ratings yet

- Ten Ways To Kickstart The EconomyDocument6 pagesTen Ways To Kickstart The EconomyMilindShahNo ratings yet

- Pestle Analysis of UkDocument3 pagesPestle Analysis of UkDAS RUMPANo ratings yet

- Evaluating The Contemporary Business EnvironmentDocument14 pagesEvaluating The Contemporary Business Environmentjubairneaz4No ratings yet

- Discuss The Various Roles That Fiscal Policy Might Play in The Australian Economy 2Document3 pagesDiscuss The Various Roles That Fiscal Policy Might Play in The Australian Economy 2Dhivyaa Thayalan100% (1)

- 38 Impact and Problems of Macroeconomic PoliciesDocument2 pages38 Impact and Problems of Macroeconomic PoliciesLeah BrocklebankNo ratings yet

- Labour'S Plan For Enterprise, Innovation and GrowthDocument18 pagesLabour'S Plan For Enterprise, Innovation and GrowthInemie-ebi NiweighaNo ratings yet

- Undertaking A Fiscal ConsolidationDocument24 pagesUndertaking A Fiscal ConsolidationInstitute for GovernmentNo ratings yet

- 8783 BIS Sustainable Growth WEBDocument32 pages8783 BIS Sustainable Growth WEBbisgovukNo ratings yet

- ECO 102 NotesDocument76 pagesECO 102 NotesSabira RahmanNo ratings yet

- Fiscal PolicyDocument5 pagesFiscal PolicyAmnaAnwar100% (1)

- Causes of InflationDocument6 pagesCauses of InflationAhver ChaudharyNo ratings yet

- Fiscal PolicyDocument13 pagesFiscal PolicyAakash SaxenaNo ratings yet

- Question BankDocument4 pagesQuestion Bankarushi singhNo ratings yet

- Things We Should KnowDocument32 pagesThings We Should KnowPrakash SinghNo ratings yet

- Economic AnalysisDocument11 pagesEconomic Analysisacademicsexpert1No ratings yet

- Macro MCQDocument31 pagesMacro MCQVaibhavNo ratings yet

- FRSE 2022-23 Topic 2Document26 pagesFRSE 2022-23 Topic 2Ali Al RostamaniNo ratings yet

- Current Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16From EverandCurrent Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- EIB Investment Report 2023/2024 - Key Findings: Transforming for competitivenessFrom EverandEIB Investment Report 2023/2024 - Key Findings: Transforming for competitivenessNo ratings yet

- Borrowing Costs: (International Accounting Standard (IAS) 23)Document25 pagesBorrowing Costs: (International Accounting Standard (IAS) 23)অরূপ মিস্ত্রী বলেছেনNo ratings yet

- Entrepreneurship Development in North EastDocument10 pagesEntrepreneurship Development in North Eastpranjit sarmahNo ratings yet

- Practice Test 9Document13 pagesPractice Test 9Yer ChangNo ratings yet

- Hapag LloydDocument9 pagesHapag LloydzubinpujaraNo ratings yet

- Botswana Financial Statistics - October 2022Document120 pagesBotswana Financial Statistics - October 2022THATO GUNDUNo ratings yet

- 7-29-21 Gov McMaster To Dir Leach Re Federal SNAP ExtensionDocument3 pages7-29-21 Gov McMaster To Dir Leach Re Federal SNAP ExtensionABC15 NewsNo ratings yet

- Apparel Export DocumentationDocument68 pagesApparel Export DocumentationarivaazhiNo ratings yet

- Cup - Basic ParcorDocument8 pagesCup - Basic ParcorJerauld BucolNo ratings yet

- Service Letter: 1.0 Issue - Incorrectly Located Boom Lifting HolesDocument5 pagesService Letter: 1.0 Issue - Incorrectly Located Boom Lifting HolesedwinNo ratings yet

- Resume of Dr. Manmohan Singh (Prime Minister of India)Document3 pagesResume of Dr. Manmohan Singh (Prime Minister of India)Abhi SharmaNo ratings yet

- Airline IndustryDocument57 pagesAirline IndustryAchal_jainNo ratings yet

- Curvas de IndifDocument2 pagesCurvas de IndifJulioMartínezReynosoNo ratings yet

- SIS With LSPO and Regular PayDocument3 pagesSIS With LSPO and Regular PayJyoti PandeyNo ratings yet

- Industrialisation by InvitationDocument9 pagesIndustrialisation by InvitationRandy Self-obsessedNarcissistic CorneliusNo ratings yet

- HBA INTEREST CALCULATOR ShareDocument1 pageHBA INTEREST CALCULATOR ShareLazy BuoyNo ratings yet

- 9D Research GroupDocument9 pages9D Research Groupapi-291828723No ratings yet

- Strategic Planning in The Next Millennium-SDocument6 pagesStrategic Planning in The Next Millennium-Srohan_jangid8No ratings yet

- Supply and Demand SimulationDocument6 pagesSupply and Demand SimulationfloresgioNo ratings yet

- Hawkins Cookers Limited: Summary of Rated Instruments Instrument# Rated Amount (In Rs. Crore) Rating ActionDocument6 pagesHawkins Cookers Limited: Summary of Rated Instruments Instrument# Rated Amount (In Rs. Crore) Rating ActionViral VaishnavNo ratings yet

- Stock Pitch GuideDocument4 pagesStock Pitch GuideanmolsomethingnewNo ratings yet

- Globalization RiskDocument3 pagesGlobalization RiskSohel Kabir100% (1)

- Chapter 8 Theories of Global StratificationDocument5 pagesChapter 8 Theories of Global StratificationmAmei DiwataNo ratings yet

- اختبار فرضيتي العجز التوأم والتكافؤ الريكارديDocument23 pagesاختبار فرضيتي العجز التوأم والتكافؤ الريكارديAhmed DanafNo ratings yet

- Geo May'14 Highres-4578Document8 pagesGeo May'14 Highres-4578deepak_gupta_pritiNo ratings yet

- Case ReportDocument2 pagesCase ReportJezz VilladiegoNo ratings yet

- CH 22 Production and Growth MoodleDocument37 pagesCH 22 Production and Growth MoodleEcem Eryılmaz100% (1)