Professional Documents

Culture Documents

The Efficient Markets Hypothesis: Mohammad Ali Saeed

The Efficient Markets Hypothesis: Mohammad Ali Saeed

Uploaded by

Balach MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Efficient Markets Hypothesis: Mohammad Ali Saeed

The Efficient Markets Hypothesis: Mohammad Ali Saeed

Uploaded by

Balach MalikCopyright:

Available Formats

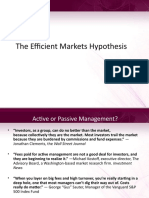

The Efficient Markets

Hypothesis

Mohammad Ali Saeed

Active or Passive

Management?

Investors, as a group, can do no better than the market,

because collectively they are the market. Most investors

trail the market because they are burdened by

commissions and fund expenses. Jonathan Clements, the

Wall Street Journal,

June 17, 1997

Fees paid for active management are not a good deal for

investors, and they are beginning to realize it. Michael

Kostoff, executive director, The Advisory Board, a Washington-

based market research firm. InvestmentNews, February 8, 1999

When you layer on big fees and high turnover, youre

really starting in a deep hole, one that most managers cant

dig their way out of. Costs really do matter. George

Gus Sauter, Manager of the Vanguard S&P 500 Index Fund

Active or Passive

Management?

G

r

o

s

s

(

b

e

f

o

r

e

c

o

s

t

s

)

N

e

t

(

a

f

t

e

r

c

o

s

t

s

)

G

r

o

s

s

(

b

e

f

o

r

e

c

o

s

t

s

)

G

r

o

s

s

(

b

e

f

o

r

e

c

o

s

t

s

)

N

e

t

(

a

f

t

e

r

c

o

s

t

s

)

N

e

t

(

a

f

t

e

r

c

o

s

t

s

)

Definition of Efficient

Markets

An efficient capital market is a market that is efficient

in processing information.

We are talking about an informationally efficient

market, as opposed to a transactionally efficient

market. In other words, we mean that the market

quickly and correctly adjusts to new information.

In an informationally efficient market, the prices of

securities observed at any time are based on

correct evaluation of all information available at that

time.

Therefore, in an efficient market, prices immediately

and fully reflect available information.

Definition of Efficient

Markets (cont.)

Professor Eugene Fama, who coined the

phrase efficient markets, defined market

efficiency as follows:

"In an efficient market, competition among the

many intelligent participants leads to a situation

where, at any point in time, actual prices of

individual securities already reflect the effects of

information based both on events that have

already occurred and on events which, as of now,

the market expects to take place in the future. In

other words, in an efficient market at any point in

time the actual price of a security will be a good

estimate of its intrinsic value."

History

Prior to the 1950s it was generally believed that the

use of fundamental or technical approaches could

beat the market (though technical analysis has

always been seen as something akin to voodoo).

In the 1950s and 1960s studies began to provide

evidence against this view.

In particular, researchers found that stock price

changes (not prices themselves) followed a random

walk.

They also found that stock prices reacted to new

information almost instantly, not gradually as had

been believed.

The Efficient Markets

Hypothesis

The Efficient Markets Hypothesis (EMH)

is made up of three progressively

stronger forms:

Weak Form

Semi-strong Form

Strong Form

The EMH Graphically

In this diagram, the

circles represent the

amount of information

that each form of the

EMH includes.

Note that the weak form

covers the least amount

of information, and the

strong form covers all

information.

Also note that each

successive form

includes the previous

ones.

Strong Form

Semi-Strong

Weak Form

All information, public and private

All public information

All historical prices and returns

The eak !orm

The weak form of the EMH says that past prices, volume, and

other market statistics provide no information that can be used

to predict future prices.

If stock price changes are random, then past prices cannot be

used to forecast future prices.

Price changes should be random because it is information that

drives these changes, and information arrives randomly.

Prices should change very quickly and to the correct level when

new information arrives (see next slide).

This form of the EMH, if correct, repudiates technical analysis.

Most research supports the notion that the markets are weak

form efficient.

Price A"#$stment %ith &e%

'nformation

At 10AM EST, the U.S. Supreme ourt refused to hear a! appeal

from MS"T re#ardi!# its a!ti$trust case. The stoc% immediatel&

dropped. This e'ample, o!e of hu!dreds a(ailable e(er& da&,

illustrates that prices ad)ust e'tremel& rapidl& to !e* i!formatio!.

+ut, did the price ad)ust correctl&, -!l& time *ill tell, but it does

seem that o(er the !e't hour the mar%et is searchi!# for the correct

le(el.

Notes. Each bar represe!ts hi#h, lo*, a!d close for o!e$mi!ute. Each solid #ridli!e represe!ts the top of a! hour, a!d each

dotted #ridli!e represe!ts a half$hour.

The (emi)strong !orm

The semi-strong form says that prices fully

reflect all publicly available information and

expectations about the future.

This suggests that prices adjust very rapidly

to new information, and that old information

cannot be used to earn superior returns.

The semi-strong form, if correct, repudiates

fundamental analysis.

Most studies find that the markets are

reasonably efficient in this sense, but the

evidence is somewhat mixed.

Analysts Performance

This chart from the /all Street 0our!al, sho*s that *he! a!al&sts issue

sell recomme!datio!s, those stoc%s fre1ue!tl& outperform those *ith

bu& or hold rati!#s. 2f the professio!als ca!3t #et it ri#ht, *ho ca!,

M$t$al !$n" Performance

Generally, most academic studies have found that

mutual funds do not consistently outperform their

benchmarks, especially after adjusting for risk and

fees.

Even choosing only past best performing funds (say,

5-star funds by Morningstar) is of little help. A study

by Blake and Morey finds that 5-star funds dont

significantly outperform 3- and 4-star funds over time.

However, it does seem that you can weed out the

bad funds (1- and 2-stars). Funds that have

performed badly in the past seem to continually

perform badly in the future.

The (trong !orm

The strong form says that prices fully

reflect all information, whether publicly

available or not.

Even the knowledge of material, non-

public information cannot be used to

earn superior results.

Most studies have found that the

markets are not efficient in this sense.

Tests of the (trong !orm

Corporate Insiders.

Specialists.

Mutual Funds.

Studies have shown that insiders and

specialists often earn excessive profits, but

mutual funds (and other professionally

managed funds) do not.

In fact, in most years, around 85% of all

mutual funds underperform the market.

Anomalies

Anomalies are unexplained empirical

results that contradict the EMH:

The Size effect.

The Incredible January Effect.

P/E Effect.

Day of the Week (Monday Effect).

The (i*e Effect

Beginning in the early 1980s a number of

studies found that the stocks of small firms

typically outperform (on a risk-adjusted basis)

the stocks of large firms.

This is even true among the large-

capitalization stocks within the S&P 500. The

smaller (but still large) stocks tend to

outperform the really large ones.

The 'ncre"i+le ,an$ary

Effect

Stock returns appear to be higher in

January than in other months of the

year.

This may be related to the size effect

since it is mostly small firms that

outperform in January.

It may also be related to end of year tax

selling.

The P-E Effect

It has been found that portfolios of low P/E

stocks generally outperform portfolios of high

P/E stocks.

This may be related to the size effect since

there is a high correlation between the stock

price and the P/E.

It may be that buying low P/E stocks is

essentially the same as buying small

company stocks.

The Day of the eek

Effect

Based on daily stock prices from 1963 to 1985 Keim

found that returns are higher on Fridays and lower on

Mondays than should be expected.

This is partly due to the fact that Monday returns

actually reflect the entire Friday close to Monday

close time period (weekend plus Monday), rather

than just one day.

Moreover, after the stock market crash in 1987, this

effect disappeared completely and Monday became

the best performing day of the week between 1989

and 1998.

($mmary of Tests of the

EMH

Weak form is supported, so technical analysis cannot

consistently outperform the market.

Semi-strong form is mostly supported , so

fundamental analysis cannot consistently outperform

the market.

Strong form is generally not supported. If you have

secret (insider) information, you CAN use it to earn

excess returns on a consistent basis.

Ultimately, most believe that the market is very

efficient, though not perfectly efficient. It is unlikely

that any system of analysis could consistently and

significantly beat the market (adjusted for costs and

risk) over the long run.

You might also like

- The Essential P/E: Understanding the stock market through the price-earnings ratioFrom EverandThe Essential P/E: Understanding the stock market through the price-earnings ratioRating: 4 out of 5 stars4/5 (1)

- Beat The MarketDocument13 pagesBeat The Marketquantext100% (3)

- Corporate FinanceDocument13 pagesCorporate FinanceNguyễn Thanh LâmNo ratings yet

- Sap Best Practices PDFDocument8 pagesSap Best Practices PDFmeddebyounesNo ratings yet

- The Efficient Markets Hypothesis: Dr. Kumail Rizvi, CFA, FRMDocument15 pagesThe Efficient Markets Hypothesis: Dr. Kumail Rizvi, CFA, FRMWajeeha IqbalNo ratings yet

- EMH Corporate FinanceDocument38 pagesEMH Corporate FinanceIsma NizamNo ratings yet

- The Efficient Markets HypothesisDocument19 pagesThe Efficient Markets HypothesisAjitNo ratings yet

- Efficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?Document26 pagesEfficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?james4819No ratings yet

- CHAPTER 5 Market Efficiency and TradingDocument23 pagesCHAPTER 5 Market Efficiency and TradingLasborn DubeNo ratings yet

- Notes On Efficient Market HypothesisDocument4 pagesNotes On Efficient Market HypothesiskokkokkokokkNo ratings yet

- No. 13 EMHDocument33 pagesNo. 13 EMHayazNo ratings yet

- Efficient Market Hypothesis Faisal MeerDocument37 pagesEfficient Market Hypothesis Faisal MeerMuneeza Akhtar Muneeza AkhtarNo ratings yet

- The Ef Cient Market Hypothesis and Its Critics: Burton G. MalkielDocument24 pagesThe Ef Cient Market Hypothesis and Its Critics: Burton G. MalkielNguyen Thi Thu HaNo ratings yet

- Securities Analysis and Portfolio ManagementDocument5 pagesSecurities Analysis and Portfolio ManagementtalhaNo ratings yet

- Efficient Capital Markets PDFDocument6 pagesEfficient Capital Markets PDFSDPAS100% (1)

- SAIMDocument6 pagesSAIMNishtha SethNo ratings yet

- Exploring The Link Between Behavioural Finance and Technical AnalysisDocument4 pagesExploring The Link Between Behavioural Finance and Technical AnalysisSonia BradNo ratings yet

- FIN 2010 Lecture 10: Market Efficiency & Behavioral Finance: Prof. Jangwoo Lee The Chinese University of Hong KongDocument56 pagesFIN 2010 Lecture 10: Market Efficiency & Behavioral Finance: Prof. Jangwoo Lee The Chinese University of Hong KongWai Lam HsuNo ratings yet

- IA&M-Module 3 EMHDocument17 pagesIA&M-Module 3 EMHShalini HSNo ratings yet

- Dissertation Efficient Market HypothesisDocument5 pagesDissertation Efficient Market Hypothesissherryfergusonarlington100% (2)

- Emh (Efficient Market Hypothesis)Document6 pagesEmh (Efficient Market Hypothesis)Sumit SrivastavNo ratings yet

- Practical Investment Management 4Th Edition Strong Solutions Manual Full Chapter PDFDocument28 pagesPractical Investment Management 4Th Edition Strong Solutions Manual Full Chapter PDFAdrianLynchpdci100% (12)

- Historical Background: Louis BachelierDocument6 pagesHistorical Background: Louis BachelierchunchunroyNo ratings yet

- Portfolio & Investment Analysis Efficient-Market HypothesisDocument137 pagesPortfolio & Investment Analysis Efficient-Market HypothesisVicky GoweNo ratings yet

- (HNS) - IIIyrSem6 - FundamentalsOfInvestments - Week4 - DR - KanuDocument17 pages(HNS) - IIIyrSem6 - FundamentalsOfInvestments - Week4 - DR - Kanumuzamil BhuttaNo ratings yet

- The Capital Markets and Market Efficiency: EightnineDocument9 pagesThe Capital Markets and Market Efficiency: EightnineAnika VarkeyNo ratings yet

- Stock Market EfficiencyDocument5 pagesStock Market EfficiencyKim DonguyaNo ratings yet

- Research Project of AnomliesDocument12 pagesResearch Project of AnomliesAnonymous ZTKO03nvNo ratings yet

- Efficient Market HypothesisDocument4 pagesEfficient Market HypothesisRabia KhanNo ratings yet

- SA&PMDocument102 pagesSA&PMAnkita TripathiNo ratings yet

- Malkiel. The Efficient-Market Hypothesis and The Financial Crisis 102611Document59 pagesMalkiel. The Efficient-Market Hypothesis and The Financial Crisis 102611Alex WilsonNo ratings yet

- Mppa Efficient Market PortfolioDocument5 pagesMppa Efficient Market PortfoliozaphneathpeneahNo ratings yet

- Analytical Essay Efficient Market HypothesisDocument6 pagesAnalytical Essay Efficient Market Hypothesistiffanyyounglittlerock100% (2)

- NT 2b Behavioral FinanceDocument7 pagesNT 2b Behavioral FinanceCarmenNo ratings yet

- AnswerDocument9 pagesAnswerAnika VarkeyNo ratings yet

- What Is Market EfficiencyDocument8 pagesWhat Is Market EfficiencyFrankGabiaNo ratings yet

- Efficient Market HypothesisDocument14 pagesEfficient Market Hypothesissashankpandey9No ratings yet

- Commodities Fixed Income: Question 1: Strengths and Weakness of Markowitz Theory andDocument23 pagesCommodities Fixed Income: Question 1: Strengths and Weakness of Markowitz Theory andHà anh PhạmNo ratings yet

- EmtDocument9 pagesEmtcktacsNo ratings yet

- Mba PortfolioDocument6 pagesMba Portfoliokapil3518No ratings yet

- Efficient HypothesisDocument19 pagesEfficient HypothesisRawMessNo ratings yet

- Efficient Market HypothesisDocument8 pagesEfficient Market HypothesisGaara165100% (1)

- Market Efficiency and Empirical EvidenceDocument86 pagesMarket Efficiency and Empirical EvidenceVaidyanathan RavichandranNo ratings yet

- Literature Review On Stock Market EfficiencyDocument4 pagesLiterature Review On Stock Market Efficiencyafmzslnxmqrjom100% (1)

- Info 9the Great Divide Over Market Efficiency 1Document19 pagesInfo 9the Great Divide Over Market Efficiency 1Baddam Goutham ReddyNo ratings yet

- Stock Market and Investment-DikonversiDocument59 pagesStock Market and Investment-DikonversiAkbar 1No ratings yet

- Lect01 EffMarkDocument30 pagesLect01 EffMarkRomana BangashNo ratings yet

- The Efficient Market HypothesisDocument5 pagesThe Efficient Market HypothesisRamya DeviNo ratings yet

- Efficient Market HypothsisDocument15 pagesEfficient Market HypothsisAnnas AmanNo ratings yet

- Individual Stock ReturnsDocument16 pagesIndividual Stock Returnsmbilalkhan88No ratings yet

- Chapter # 2 Efficient Capital Market For PrintDocument36 pagesChapter # 2 Efficient Capital Market For PrintBappyNo ratings yet

- MF0001Document19 pagesMF0001Brijesh SalianNo ratings yet

- Topic 4A - EMHDocument23 pagesTopic 4A - EMHNoluthando MbathaNo ratings yet

- Efficient Market HypothesisDocument3 pagesEfficient Market Hypothesismeetwithsanjay100% (1)

- Markets Can Be Wrong and The Price Is Not Always Right - FTDocument2 pagesMarkets Can Be Wrong and The Price Is Not Always Right - FTAloy31stNo ratings yet

- Efficient Market TheoryDocument6 pagesEfficient Market TheoryRahul BisenNo ratings yet

- SWM EMH Evidence Oct 09Document2 pagesSWM EMH Evidence Oct 09pasudlowNo ratings yet

- Efficient Market Hypothesis: Weak-Form EfficiencyDocument2 pagesEfficient Market Hypothesis: Weak-Form EfficiencyAbdullah ShahNo ratings yet

- PMGT AssignmentDocument8 pagesPMGT AssignmentArvin KovanNo ratings yet

- BIT 163 Introduction To AccountingDocument26 pagesBIT 163 Introduction To AccountingBalach MalikNo ratings yet

- Ifrs Allow FIFO and GAAP Allow LIPODocument5 pagesIfrs Allow FIFO and GAAP Allow LIPOBalach MalikNo ratings yet

- MGT211 Introduction To Business More Than 200 MCQs For Preparation of Midterm ExamDocument21 pagesMGT211 Introduction To Business More Than 200 MCQs For Preparation of Midterm ExamBalach Malik57% (7)

- Auditing Chapter 2Document26 pagesAuditing Chapter 2Balach MalikNo ratings yet

- Managers Today Are Sensitive To Issues of Social Responsibility Because of Pressure From All of The Following Stakeholders ExceptDocument4 pagesManagers Today Are Sensitive To Issues of Social Responsibility Because of Pressure From All of The Following Stakeholders ExceptBalach MalikNo ratings yet

- Environment, Management Attitude, and Organizational Learning in AlliancesDocument11 pagesEnvironment, Management Attitude, and Organizational Learning in AlliancesBalach MalikNo ratings yet

- Group 7 - Excel - Destin BrassDocument9 pagesGroup 7 - Excel - Destin BrassSaumya SahaNo ratings yet

- Grand Livre LibelleDocument363 pagesGrand Livre LibelleyassirNo ratings yet

- B2B Marketing Unit VDocument67 pagesB2B Marketing Unit VEgorov ZangiefNo ratings yet

- Introduction To Topic: "Customer Satisfaction Towards Shoppers Stop". It Is A VeryDocument4 pagesIntroduction To Topic: "Customer Satisfaction Towards Shoppers Stop". It Is A Veryuniversal printerNo ratings yet

- Mutual Funds: Submitted By: Bhasker Verma Section-A Roll No.46 Submitted To: Prof. Subhas ChavanDocument18 pagesMutual Funds: Submitted By: Bhasker Verma Section-A Roll No.46 Submitted To: Prof. Subhas ChavanOjas LeoNo ratings yet

- SLC NotesDocument803 pagesSLC NotesManishankar SharmaNo ratings yet

- Wills LifestyleDocument44 pagesWills Lifestyleshivatalwar100% (5)

- TransFORM 2014 Appendices Glossaries 8SEPT14Document63 pagesTransFORM 2014 Appendices Glossaries 8SEPT14Puthpura PuthNo ratings yet

- Us CB Five Keys To Elevating Guest ExperiencesDocument2 pagesUs CB Five Keys To Elevating Guest ExperiencesMarina PintoNo ratings yet

- Multiple Choice Wps OfficeDocument4 pagesMultiple Choice Wps OfficeRengie CanalesNo ratings yet

- GsnubeDocument169 pagesGsnubeAnonymous 4yXWpDNo ratings yet

- Chapter 14 InventoryDocument3 pagesChapter 14 InventorybibekNo ratings yet

- An Industrial Report On Balaji WafersDocument31 pagesAn Industrial Report On Balaji Wafersrohan amrutiyaNo ratings yet

- Stages of International Marketing InvolvementDocument7 pagesStages of International Marketing InvolvementRochelle Martirez100% (1)

- Tugas Akmen Ch. 9 - Eva Nabila - 023165021Document22 pagesTugas Akmen Ch. 9 - Eva Nabila - 023165021EvaNabilaDwiPratiwiNo ratings yet

- Full Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full ChapterDocument36 pagesFull Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full Chapterpledgerzea.rus7as100% (25)

- Keyfigurelist Bw7 3Document92 pagesKeyfigurelist Bw7 3ashokNo ratings yet

- 02 - Tutorial 2 - Week 4 SolutionsDocument8 pages02 - Tutorial 2 - Week 4 SolutionsJason ChowNo ratings yet

- Advanced Steps in The Selling Process of VeetDocument5 pagesAdvanced Steps in The Selling Process of VeetMoeed SaeedNo ratings yet

- Valuation of TTK PrestigeDocument20 pagesValuation of TTK PrestigeVivek KumarNo ratings yet

- FabmDocument28 pagesFabmHanissandra Franz V. DalanNo ratings yet

- Imc DoveDocument6 pagesImc Dovepoonam_popatNo ratings yet

- Swot AnalysisDocument5 pagesSwot AnalysisSrinivasan SrinivasanNo ratings yet

- PERT Problem For PracticeDocument2 pagesPERT Problem For PracticedivyaNo ratings yet

- TijoriDocument15 pagesTijoriमधुर माधव मिश्राNo ratings yet

- 01 AC212 Lecture 1-Material PDFDocument30 pages01 AC212 Lecture 1-Material PDFJam JamNo ratings yet

- MATLAB For Finance FRM CFADocument20 pagesMATLAB For Finance FRM CFAShivgan JoshiNo ratings yet

- Financial Analysis and Decision Making OutlineDocument8 pagesFinancial Analysis and Decision Making OutlinedskymaximusNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesDocument11 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesAngelaNo ratings yet