Professional Documents

Culture Documents

Marketing Strategy Analysis: Group Guided by

Marketing Strategy Analysis: Group Guided by

Uploaded by

maheshwari.vineet8949Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marketing Strategy Analysis: Group Guided by

Marketing Strategy Analysis: Group Guided by

Uploaded by

maheshwari.vineet8949Copyright:

Available Formats

Marketing strategy analysis

Group

Arya Dipta Dash (9)

Manish Bhasin (23)

Sunpreet Singh (50)

Vineet Kr Maheshwari (60)

Guided by

Prof. Jaydeep Mukherjee

Agenda

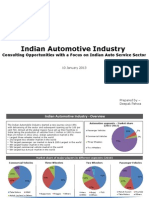

Environment Scan

Market Size, Product Segmentation

Targeting, Positioning, Price

Marketing Recommendation

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

0

500000

1000000

1500000

2000000

2500000

3000000

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Passenger Car sales

Number Growth

0

50000

100000

150000

200000

250000

300000

350000

400000

450000

500000

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Car Exports

Exports

Environment Scan

Key Domestic Players Chosen

Maruti Suzuki

Tata Motors

Mahindra and Mahindra

2011 Recessionary period for

auto industry

Increasing per Capita income

Yr 2011 USD 3608

Yr 2015 (Est.) USD 4965

Easier Finance options

Maruti Sales Numbers for Nov 2011

Source: Maruti press release of Dec-2011

Key developments

Sub-800 cc optimism

Nov-2011: Maruti decides to enter with 660cc

car

Nov-2011: Nano-2012 announced

Sep-2011: EON launched by Hyundai

Market shares for big existing players going

south

Fuel economy and costs have got highest

priority in minds of majority buyers

Diesel cars sales rose to 30% from 20% last

year

Hybrid cars

MPV like Vans Launches due in Diesel engines

(M&M Maxximo, Maruti Ertiga)

2 wheelers sales/revenues continues to grow

Bajaj Autos: 25% YoY growth in Nov 2011, 331k bikes sold (129k exports)

Increased focus on alternate fuels/hybrid technology

M&M recently bought Reva to aquire electric automotive technology

Demand Passenger Cars in

India

2010

2568

3859

0

500

1000

1500

2000

2500

3000

3500

4000

4500

1

9

9

0

-

9

1

1

9

9

1

-

9

2

1

9

9

6

-

9

7

1

9

9

7

-

9

8

1

9

9

8

-

9

9

1

9

9

9

-

0

0

2

0

0

0

-

0

1

2

0

0

1

-

0

2

2

0

0

2

-

0

3

2

0

0

3

-

0

4

2

0

0

4

-

0

5

2

0

0

5

-

0

6

2

0

0

6

-

0

7

2

0

0

7

-

0

8

2

0

0

8

-

0

9

2

0

0

9

-

1

0

2

0

1

0

-

1

1

2

0

1

1

-

1

2

2

0

1

2

-

1

3

2

0

1

3

-

1

4

2

0

1

4

-

1

5

2

0

1

9

-

2

0

Demand Curve

Demand (in th)

Source: http://www.indiastat.com

Market size: Appprox 4 million passenger cars /yr

Potential buyers: 10 million (Income 5k to 7k USD /yr)

Selected Company

Tata Motors

Product:

NANO

Priced at Rs 1.53lac

624cc engine

Predicted sales of 250k cars/ yr

It is 8 percent smaller bumper to bumper and has 21

percent larger seating capacity than Maruti 800 Mr. Tata

Segmentation

Segmentation basis

Demographic Income level

Roughly 300-400 million emerging

middle class population in India

Roughly 80 million are categorized

as lower middle class with income

<5 lacs

Psychographic Lifestyle/Attitude

Travel Habits

Mileage preference

Over Rs 1.0

mn

1%

Rs 501,000

to Rs 1.0

mn

3%

Rs 301,000

to Rs

500,000

49%

Under Rs

300,000

47%

Price range based

Segments (%)

NANO Targeting

Target Segment (Micro-segments)

Low income group, family income < 5 lacs per

annum

Nuclear Families

Existing users of 2 wheelers

User preference for running costs versus style

and comfort

NANO Positioning

Common mans car

Got labeled as a Cheap car

Promise: Travel together at low costs

Fulfills the familys dream of travelling together in the

comforts and safety of a car

S

t

y

l

e

Verna, City

EON

NANO

NANO-2012

Swift, Desire

Honda City

Indigo

Bike/Scooter

Alto

Price

Created New Category

Competition

Maruti Pallete,

MR Wagon

Hyundai Eon

and more

Competitive

Forces

Industry Rivalry

Little (Big market)

Bargaining power of Suppliers

With rising volumes, Becoming

significant

Bargaining power of Buyers

Very low price, Lesser

options

Threat of New Entrants

MNCs with advanced technologies

and appetite to compete on prices

Threat of Substitutes

Compared with bikes, targeted

population of migration from bikes

TCO Comparison

Lowest cost of ownership across

Source: http://cars.zimbly.com/2009/03/running-costs-nano-vs-competition/

TCO Comparison for NANO

Assumptions

Average drive of 35 kms a day, 22x12 days/yr

Mileage of bike is 35km/l and petrol @ Rs 40/l

Need to get this data from friends????

Difference between M-800 and NANO is significant leading to higher

consumer surplus for relatively same feature set.

There is a room to create another variant with slightly higher price tag

and address different segment

In Rs Lac

NANO Promotions and Channels

Existing dealers of TM

Financing - Rs 15,000 is all that one needs to

get it

Issues

Existing Tata dealership difficult to scale for mass

distribution

Confuses customers with NANO selling alongside

Tata Aria/Indigo Manza

Communication

Advertisements targeting nuclear family

Low Cost

Marketing Strategy Recommendations

Targeting and Positioning

Include Middle class into the target consumer segment

Youth (18-25 years)

East India - Low-cost models, low per capita income

Replacement to bike

Product and Pricing

Change the image of a Poor Mans car by improving interiors and

providing add-on features

Increase price by Rs40-50k (possibly for Diesel variant i.e. Rs 2.15

lacs)

Promotion

Down payment - sub 10k level

College students Competition, Test Drive

Communication

Mass media Regional TV channels, newspapers

Message: More Convenience, Safe, Lower Cost/km and easier

to maintain, compare it with two wheelers, For someone you

care for

Ease of maintenance

Post purchase behavior is key to success

Marketing Strategy Recommendations

Marketing Strategy Recommendations

Distribution

Create NANO exclusive showrooms to facilitate

Next to shops where bikes are sold/serviced

Direct to home delivery model may be used

Easy to assemble kits nearby garage

Franchising for repair

Like Eureka Forbes

NANO Evolution

NANO Evolution Contd

Thanks

Concept car Showcased at Auto expo in Geneva 2011

Sales and EBIDTA for 3 Cos.

GDP

Market Share in Passenger

Cars

India Demographics

Source: http://populationcommission.nic.in/facts1.htm

Source: http://populationcommission.nic.in/facts1.htm

R&D Expenditure

Cost of ownership - breakup

Fuel Maintenance Repairs Insurance

Up to 6

months

74.2% 1.7% 0.7% 23.4%

36 months 69.9% 6.2% 4.9% 19%

Bibliography

1 http://www.tatamotors.com/investors/pdf/2011/businessReviewQ2FY12.pdf

2 http://www.capitaline.com

3 http://www.siamindia.com/

4 http://www.business-standard.com/india/news/crisil-cuts-india-gdp-forecast-for-fy12-to-76/148625/on

5 http://www.hyundai.com/in/en/wcm/groups/webcontent/@in/documents/webvehiclecontent/290683.pd

f

6 http://www.mahindra.com/mahindra/resource.page

7 http://knowledgenetwork.thunderbird.edu/research/2010/08/24/vw-bric/

8 http://www.team-bhp.com/web/plugins/p2_news/printarticle.php?p2_articleid=11

9 http://www.indiacar.com/infobank/nfo_autocar/nfoautocar.htm

10 http://www.thehindubusinessline.in/2003/05/23/stories/2003052301990200.htm

11 http://cars.zimbly.com/2009/03/running-costs-nano-vs-competition/

12 http://www.thehindu.com/business/Economy/article1498167.ece

13 http://www.thehindu.com/business/companies/article438770.ece

14 http://www.siamindia.com/upload/AMP.pdf

15 http://www.businessweek.com/innovate/NussbaumOnDesign/archives/2008/01/new_distribution_syste

m_for_indias_nano_car_from_tata.html

16 http://blogs.hbr.org/cs/2011/01/learning_from_tatas_nano_mista.html

You might also like

- PestelDocument2 pagesPestelprateek67875% (4)

- BMS Auto Platform Automobile Industry-Key Market TrendsDocument8 pagesBMS Auto Platform Automobile Industry-Key Market TrendsMohnish HasrajaniNo ratings yet

- Prashaste - Indian Automotive Industry - 10 JanuaryDocument14 pagesPrashaste - Indian Automotive Industry - 10 JanuaryDeepakPahwaNo ratings yet

- Automobile Sector-Two Wheeler SegmentDocument41 pagesAutomobile Sector-Two Wheeler SegmentSandhya UpadhyayNo ratings yet

- Project On (Tata Motors)Document61 pagesProject On (Tata Motors)SATYABRAT MAHALIK100% (1)

- Automotive Industry in India Industry Analysis: Regional Clusters of ManufacturingDocument5 pagesAutomotive Industry in India Industry Analysis: Regional Clusters of ManufacturingVinay BharajNo ratings yet

- The Indian Automotive Industry A Perspective: 1 New Delhi Insitute of ManagementDocument23 pagesThe Indian Automotive Industry A Perspective: 1 New Delhi Insitute of ManagementparulkakNo ratings yet

- Strategy of M/s Maruti Suzuki: Team MembersDocument34 pagesStrategy of M/s Maruti Suzuki: Team MembersDeepak Ch33% (3)

- A Presentation On "Landscape of Automobile Industry Sector": Consulting ClubDocument22 pagesA Presentation On "Landscape of Automobile Industry Sector": Consulting ClubaddyamitNo ratings yet

- Presentation of Project ReportDocument30 pagesPresentation of Project ReportAnuj GuptaNo ratings yet

- Market Analysis of Consumer Response Towards Tata MotorsDocument25 pagesMarket Analysis of Consumer Response Towards Tata MotorsHarshit TharejaNo ratings yet

- Hindustan MotorsDocument57 pagesHindustan MotorsSwathi Velisetty100% (3)

- Nano "A Dream Car For The Poor"Document3 pagesNano "A Dream Car For The Poor"anurag_jecrcNo ratings yet

- Tata Motors Limited: Future Strategy & Growth PlansDocument37 pagesTata Motors Limited: Future Strategy & Growth PlansRavi K MauryaNo ratings yet

- A Study On Measuring The Service Quality of Car Dealers in AllepeyDocument66 pagesA Study On Measuring The Service Quality of Car Dealers in AllepeyshashimuraliNo ratings yet

- Business Analysis of Auto IndusrtyDocument29 pagesBusiness Analysis of Auto IndusrtySaurabh Ambaselkar100% (1)

- MR Resport SampleDocument49 pagesMR Resport SampleAakash MehraNo ratings yet

- Pricing Strategy of Tata NexonDocument4 pagesPricing Strategy of Tata NexonSanJana NahataNo ratings yet

- AlmeraDocument30 pagesAlmeraPui LiNo ratings yet

- Project On Tvs Vs BajajDocument63 pagesProject On Tvs Vs BajajSk Rabiul Islam100% (1)

- Porter 5 Forces - Nano by RVDocument13 pagesPorter 5 Forces - Nano by RVRahul VermaNo ratings yet

- Automobile SectorDocument33 pagesAutomobile SectorPriya UpadhyayNo ratings yet

- New Product Development Process For HyundaiDocument33 pagesNew Product Development Process For HyundaiDheeraj Kumar100% (1)

- Group11 SM2 SecA Tata NanoDocument19 pagesGroup11 SM2 SecA Tata Nanomridulkatiyar06_5470No ratings yet

- Automobiles Industry ReportDocument5 pagesAutomobiles Industry ReportvaasurastogiNo ratings yet

- Literature Review On Automobile Industry in IndiaDocument4 pagesLiterature Review On Automobile Industry in Indiaea59j0hqNo ratings yet

- Case Study TataDocument7 pagesCase Study TataSamNo ratings yet

- AutomobileDocument17 pagesAutomobileIha BansalNo ratings yet

- Introduction To The Study On Brand ImageDocument79 pagesIntroduction To The Study On Brand ImageArun Mannur0% (1)

- Maruti Suzuki - WagonrDocument30 pagesMaruti Suzuki - WagonrKhushboo GuptaNo ratings yet

- Team Paladins: Theme ADocument14 pagesTeam Paladins: Theme AGourab RayNo ratings yet

- Bajaj Auto LTDDocument17 pagesBajaj Auto LTDAvinav ThapaNo ratings yet

- Automobile Industry in IndiaDocument7 pagesAutomobile Industry in IndiaRakesh SinghNo ratings yet

- Presentation TranscriptDocument1 pagePresentation TranscriptDivanshu GuptaNo ratings yet

- Marktng Proj Group 9Document22 pagesMarktng Proj Group 9Ashutosh K TripathyNo ratings yet

- MotorcyclesDocument13 pagesMotorcyclesImraan MalikNo ratings yet

- Automobile Sector: Tvs MotorsDocument20 pagesAutomobile Sector: Tvs MotorsBellapu Durga vara prasadNo ratings yet

- Marketing Mix On Tata NanoDocument11 pagesMarketing Mix On Tata NanoDeepak100% (4)

- Customer S Satisfaction of Honda Two WheelersDocument58 pagesCustomer S Satisfaction of Honda Two WheelersAbhinash KanigelpulaNo ratings yet

- SGC Report Maruti SuzukiDocument18 pagesSGC Report Maruti SuzukiKehar Singh80% (5)

- Marketing Plan For Mid Sized SedanDocument9 pagesMarketing Plan For Mid Sized SedansoumyanicNo ratings yet

- Indian Automobile Industry: OverviewDocument9 pagesIndian Automobile Industry: Overviewcoolaadi69No ratings yet

- Tvs Scanning (Autosaved)Document14 pagesTvs Scanning (Autosaved)Mohammed TahirNo ratings yet

- Final Report Passenger CarsDocument20 pagesFinal Report Passenger CarsAditya Nagpal100% (2)

- Marketing Plan - KIA RioDocument5 pagesMarketing Plan - KIA RioWajahat ShahNo ratings yet

- MBI Presentation - Chandershekher JoshiDocument8 pagesMBI Presentation - Chandershekher JoshiChander ShekherNo ratings yet

- ASP Project Report Group - SplashDocument32 pagesASP Project Report Group - SplashzebNo ratings yet

- Changing Scenario of Buyer Behavior of Automobile in India: Prepared by Alok KumarDocument29 pagesChanging Scenario of Buyer Behavior of Automobile in India: Prepared by Alok KumarAlok KumarNo ratings yet

- Indian Automobile Industry Research PaperDocument8 pagesIndian Automobile Industry Research Paperjpccwecnd100% (1)

- Automotive Perspective - 2012 and Beyond: The India OpportunityDocument2 pagesAutomotive Perspective - 2012 and Beyond: The India OpportunitySameer SamNo ratings yet

- A Study On Customers Satisfaction Towards Selected Marketing Mix of Shubh Honda Raipur CGDocument51 pagesA Study On Customers Satisfaction Towards Selected Marketing Mix of Shubh Honda Raipur CGjassi7nishadNo ratings yet

- Five Forces Analysis Indian Automobile IndustryDocument10 pagesFive Forces Analysis Indian Automobile IndustryAmit BharwadNo ratings yet

- Automobilies & Auto Ancillaries Setor PresentationDocument63 pagesAutomobilies & Auto Ancillaries Setor PresentationVarun BaxiNo ratings yet

- Business Strategy-I Project On Tvs Motors: Submitted To: Prof. A.K. MitraDocument12 pagesBusiness Strategy-I Project On Tvs Motors: Submitted To: Prof. A.K. Mitranitindewan10No ratings yet

- Automobiles 1Document25 pagesAutomobiles 1Prashant GuptaNo ratings yet

- Tvs Porters Five Force ModelDocument12 pagesTvs Porters Five Force Modelachint9100% (1)

- 13 - Conclusion and SuggestionDocument8 pages13 - Conclusion and Suggestionsiddhartha karNo ratings yet

- Bajaj Auto Ltd. (BAL) Is One of The Oldest and The Largest Manufacturer ofDocument19 pagesBajaj Auto Ltd. (BAL) Is One of The Oldest and The Largest Manufacturer ofSadaf RazzaqueNo ratings yet

- Post Graduate Diploma in Business Management: On The Partial Fulfillment of 3 Tri-Semester ofDocument42 pagesPost Graduate Diploma in Business Management: On The Partial Fulfillment of 3 Tri-Semester ofnishisavlaNo ratings yet

- Car Buying BehaviorDocument42 pagesCar Buying BehaviorJitesh SalviNo ratings yet

- Quality Enrichment Programme: MAINS 2020Document1 pageQuality Enrichment Programme: MAINS 2020Mithun VasanthaKumarNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Metal Industry Report - IndiaDocument2 pagesMetal Industry Report - IndiaAISHWARYA CHAUHANNo ratings yet

- Gujarat Philatelists' Association: 1/M, National Chambers, Ashram Road, Navrangpura, Ahmedabad-380009Document5 pagesGujarat Philatelists' Association: 1/M, National Chambers, Ashram Road, Navrangpura, Ahmedabad-380009Sunil SangamnerkarNo ratings yet

- List of Maharatna, Navratna and Miniratna CPSEsDocument4 pagesList of Maharatna, Navratna and Miniratna CPSEsxyzsachin33No ratings yet

- L & T Glass Installation QuoteDocument4 pagesL & T Glass Installation QuoteJessica Spears100% (1)

- Philex Mining Corp Vs CIRDocument2 pagesPhilex Mining Corp Vs CIRPat EspinozaNo ratings yet

- Skip A Payment HolidayDocument1 pageSkip A Payment HolidayRacquel DawsonNo ratings yet

- Session: 2023-24: Class - II Mathematics Term - IDocument64 pagesSession: 2023-24: Class - II Mathematics Term - IHimani AggarwalNo ratings yet

- U.S. Real Estate: A Storm Is Brewing: PIMCO AlternativesDocument6 pagesU.S. Real Estate: A Storm Is Brewing: PIMCO AlternativesForeclosure FraudNo ratings yet

- Instruments of Trade Promotion in IndiaDocument12 pagesInstruments of Trade Promotion in Indiaphysics.gauravsir gauravsir100% (1)

- Cubes and Comparing QuantitiesDocument3 pagesCubes and Comparing QuantitiesnitikaNo ratings yet

- Maceda vs. Macaraig DigestDocument2 pagesMaceda vs. Macaraig DigestElaine HonradeNo ratings yet

- 07 Sept Aceh DelegationDocument3 pages07 Sept Aceh Delegationfadli_zulNo ratings yet

- The Global Workforce Crisis BCG PDFDocument28 pagesThe Global Workforce Crisis BCG PDFAnonymous s6WwRJVSxmNo ratings yet

- Poverty & Inequality (Uruguay)Document17 pagesPoverty & Inequality (Uruguay)Stephanie CliffNo ratings yet

- Homework 7: Pulp FrictionDocument5 pagesHomework 7: Pulp FrictionAriefNo ratings yet

- Palu-3 Coal Fired Steam Power Plant (2 X 50 MW) : Comments Resolution SheetsDocument4 pagesPalu-3 Coal Fired Steam Power Plant (2 X 50 MW) : Comments Resolution SheetsAnto DamanikNo ratings yet

- E Book DecemberDocument251 pagesE Book DecemberAnonymous ABzZaSpcfNo ratings yet

- LIRRDocument2 pagesLIRRMinina AjmeraNo ratings yet

- GK Power Capsule March 2016Document40 pagesGK Power Capsule March 2016Guttula EswaraRaoNo ratings yet

- Optimizing The Exploitation of Natural Energy Resources in Nigeria For Accelerated Socio-Economic Development: Strategies and Opportunities For InvestmentDocument57 pagesOptimizing The Exploitation of Natural Energy Resources in Nigeria For Accelerated Socio-Economic Development: Strategies and Opportunities For InvestmentState House Nigeria100% (1)

- Septic Tank - New Regulations - Tamil NaduDocument24 pagesSeptic Tank - New Regulations - Tamil NadukayalonthewebNo ratings yet

- ReadingDocument2 pagesReadingCẩm TúNo ratings yet

- Ge-Mckinsey Matrix: Definition and IntroductionDocument6 pagesGe-Mckinsey Matrix: Definition and IntroductionNguyễnVũHoàngTấnNo ratings yet

- Summary Notes 1.3Document4 pagesSummary Notes 1.3FATIMA ABDULHUSAIN ISA ABDULLANo ratings yet

- Montes Et Al. (2016)Document16 pagesMontes Et Al. (2016)DiegoPachecoNo ratings yet

- Buczek Law Memo - International Bill of Exchahnge & HJR192 73-10 & 48Document14 pagesBuczek Law Memo - International Bill of Exchahnge & HJR192 73-10 & 48Bob HurtNo ratings yet

- Business TaxationDocument7 pagesBusiness TaxationMahes WaranNo ratings yet