Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

34 viewsGroup5.Lehman Brothers

Group5.Lehman Brothers

Uploaded by

Thuy Nguyen PhuongBursting of the housing bubble caused the values of securities tied to U.S. Real estate pricing to plummet. Over 65 u.s banks have become insolvent and have been taken over by the FDIC. In 2007, Lehman net revenue was 19. Billion dollars, total assets reached the level of USD 691 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Transport Business PlanDocument4 pagesTransport Business Plancmakande100% (2)

- Lux Project.Document27 pagesLux Project.Fatimah Shoukat100% (3)

- Private Wealth Management Resource Guide 2008-2009Document12 pagesPrivate Wealth Management Resource Guide 2008-2009Nian GuNo ratings yet

- DDDocument4 pagesDDsutapanNo ratings yet

- Mba 513 - Security Analysis and Portfolio ManagementDocument1 pageMba 513 - Security Analysis and Portfolio ManagementlogicballiaNo ratings yet

- Final KabuDocument39 pagesFinal KabuAbera Dinku100% (1)

- Chopra Meindl SCM Ch1 PDFDocument19 pagesChopra Meindl SCM Ch1 PDFKausarAtique100% (1)

- Trading SimulationDocument9 pagesTrading SimulationЭрдэнэ-Очир НОМИНNo ratings yet

- Chapter 9 Multiple-Choice QuizDocument4 pagesChapter 9 Multiple-Choice Quizලකි යාNo ratings yet

- HHHHHHHHHHHHHHHHHHHHDocument1 pageHHHHHHHHHHHHHHHHHHHHGh UnlockersNo ratings yet

- Emirates AirlineDocument14 pagesEmirates AirlineTehniyat AkhtarNo ratings yet

- Application No / Reg. No: 21034694 Application No / Reg. No: 21034694 Application No / Reg. No: 21034694Document1 pageApplication No / Reg. No: 21034694 Application No / Reg. No: 21034694 Application No / Reg. No: 21034694Bikon RabhaNo ratings yet

- Marketing Assignment For UnileverDocument16 pagesMarketing Assignment For UnileverRounak Agrawal100% (1)

- International Marketing MCQDocument29 pagesInternational Marketing MCQjaspreet82% (11)

- e-StatementBRImo 030601059070501 Feb2024 20240419 101303Document12 pagese-StatementBRImo 030601059070501 Feb2024 20240419 101303andrebulungnNo ratings yet

- Raymond Williams, The Writer-Commitment and AlignmentDocument4 pagesRaymond Williams, The Writer-Commitment and AlignmentnathanhNo ratings yet

- Media Planning and StrategyDocument31 pagesMedia Planning and StrategyjaydmpatelNo ratings yet

- HW 2Document4 pagesHW 2Marino NhokNo ratings yet

- Saastr The Ultimate Guide To Hiring A Great VP of SalesDocument50 pagesSaastr The Ultimate Guide To Hiring A Great VP of SalesTanika JewelsNo ratings yet

- © 1999. Omega Research, Inc. Miami, FloridaDocument160 pages© 1999. Omega Research, Inc. Miami, Floridajamesfin68100% (1)

- 13 - Cost of ProductionDocument43 pages13 - Cost of ProductionExequielCamisaCrusperoNo ratings yet

- Harshad Mehta CaseDocument16 pagesHarshad Mehta Casegunjan67% (3)

- Business Finance Module3Document5 pagesBusiness Finance Module3Colene Anne R. SantosNo ratings yet

- Importance of Gold: in Indian EconomyDocument4 pagesImportance of Gold: in Indian EconomyTapan anandNo ratings yet

- Market Growth Strategies in XYZ Healthcare, MalaysiaDocument15 pagesMarket Growth Strategies in XYZ Healthcare, MalaysiaAzamNo ratings yet

- Ord2022vol32no3 4Document16 pagesOrd2022vol32no3 4bkNo ratings yet

- The Value of A Millisecond - Full StudyDocument46 pagesThe Value of A Millisecond - Full StudytabbforumNo ratings yet

- Toaz - Info Quiz On Foreign Transactions PRDocument4 pagesToaz - Info Quiz On Foreign Transactions PRoizys131No ratings yet

- Ya ChunDocument16 pagesYa ChunThomasNo ratings yet

- Depository AssignmentDocument11 pagesDepository AssignmentDinesh GodhaniNo ratings yet

Group5.Lehman Brothers

Group5.Lehman Brothers

Uploaded by

Thuy Nguyen Phuong0 ratings0% found this document useful (0 votes)

34 views68 pagesBursting of the housing bubble caused the values of securities tied to U.S. Real estate pricing to plummet. Over 65 u.s banks have become insolvent and have been taken over by the FDIC. In 2007, Lehman net revenue was 19. Billion dollars, total assets reached the level of USD 691 billion.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBursting of the housing bubble caused the values of securities tied to U.S. Real estate pricing to plummet. Over 65 u.s banks have become insolvent and have been taken over by the FDIC. In 2007, Lehman net revenue was 19. Billion dollars, total assets reached the level of USD 691 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

34 views68 pagesGroup5.Lehman Brothers

Group5.Lehman Brothers

Uploaded by

Thuy Nguyen PhuongBursting of the housing bubble caused the values of securities tied to U.S. Real estate pricing to plummet. Over 65 u.s banks have become insolvent and have been taken over by the FDIC. In 2007, Lehman net revenue was 19. Billion dollars, total assets reached the level of USD 691 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 68

Part 1

Triggered by a complex interplay of valuation and liquidity

problems in the U.S banking system.

The bursting of the U.S. housing bubble caused the values

of securities tied to U.S. real estate pricing to plummet.

Resulted in the collapse of large financial institutions,

the bailout of banks by national governments and downturns in

stock markets around the world.

Over 65 U.S. banks have become insolvent and have been taken

over by the FDIC. These banks held over $55 billion in deposits,

and the takeovers cost the federal government an estimated $17

billion

1. THE FINANCIAL CRISIS OF 2008

2.OVERVIEW OF LEHMAN

BROTHERS

2. OVERVIEW OF LEHMAN BROTHERS

The victim of the U.S subprime

financial crisis

Filed for bankruptcy on

15/9/2008

$639 billion in assets and

$619 billion in debt

The largest bankruptcy ever

*Business Overview

Ranked 47

th

among the

Americas largest corporations,

4

th

largest investment bank in US

in 2007

Had long been considered one of

the highest return, highest risk

small investment banking firm in

Wall Street

Since the IPO in 1994 Lehman

had steadily increased revenues.

In 2007, Lehman net revenue

was 19.2 billion dollars, total

assets reached the level of USD

691 billion

*Business Overview

Doing business in investment banking, capital

market and investment management

During the 2000s, roughly 40% of Lehman's net

revenues had come from fixed income sales

and trading (including derivatives and swaps;

mortgage-backed securities (MBS) and futures,

leading to the heavy reliance of LB on capital

markets

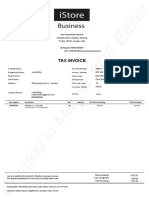

Net revenue by division of Lehman Brothers 2007

16%

64%

20%

Capital Markets

Investment Banking

Investment Management

*Business Overview

In 2003 and 2004, the U.S. housing boom was well under way

Lehman acquired five mortgage lenders, including subprime lender

BNC Mortgage and Aurora Loan Services

Due to the acquisitions, record revenues from Lehman's real estate

businesses enabled revenues in the capital markets unit to surge 56%

from 2004 to 2006

The firm securitized $146 billion of mortgages in 2006, a 10%

increase from 2005

LEHMAN FAILURE

&

RESPONSES OF FED

PART 2

Cause 1:

Internal Reasons

*The victim of its own risky

business decisions

*Lehman used securitization => risky bond package relating real

estate

*Involved the sub- prime debt crisis in America 2007-2008.

*Lehman also invested directly or indirectly in commercial real

estate. When the real estate market went down, property values

also declined.

*Its CEO, Dick Fulds decisions became riskier activities and

decisions

*In 2005, Michael Gelband had to resign because of opposing

views on these risky strategies.

In June 2008, he was reinvited to the director in charge of

global capital market to save it.

this was too late action.

* The risky strategy of Lehman Brothers in the sub- prime mortgage is the internal reason for its closing

day. The board of directors do not also have the same voice in management that led to the inconsistent

development and risk management strategy.

* Lawrence G.McDonald regarded the closing of Lehman Brothers as a colosal failure of common

sense. This empire collapsed because Lehman Brothers had the "frivolous" and "dull" kings.

* Three Ls that killed Lehman:

1.Leverage

2.Liquidity

3.Losses

Sub-prime debt crisis in America 2007-2008 =lax management in sub-prime credit lending +the

greed of the market.

Securitization is a smart financial tool but it was taken advantage for the bad intention =>it created

the unpredictable consequences.

I nvestors need to understand the risks before buying the complex financial products in order to avoid

heavy losses.

These are big lessons to challenge for any country in the process of integration and development.

Cause2.

Short

sellers

Legal

Sell securities that are not your

possesses but borrow them from

other party

net negative position

Borrowing to sell at one price,

but repurchasing to give back at

lower price

Making profits by the declining

stock price

Often speculators are short sellers

Critics : accused Lehman for being dishonest about their true

losses

-->Lehman lost investors cause they believed in statement of

critics

Short sellers : spreading rumors to drive down the stock price

to make benefits

June 9, 2008: loss of $2.8 billion announced + lack of trust

from investors

Can not raise capital franchising price = 0

45% plunging in stock price

66% spike in credit-default swaps

hedge fund clients began pulling out

while its short-term creditors cut credit lines

Sep 9, 2008:

Stock lost 50% its value

S&P 500 down 3.4%

eroded investor confidence

The Dow Jones lost nearly 300 points the same day on

investors concerns about the security of the bank

Cause 3. responses of FED

March 2008: established Term Securities

Lending Facility (TSLF)

Later in March: established Primary Dealer

Credit Facility (PDCF)

Invoked Section 13 (3) of the Federal Reserve

Act

Lehman Brothers have base to believe that Fed would help it

Bailed out Bear Sterns : provide $29bl to cover loss

for Maiden Lane acquire Bear

July 2008 : authorize loans to Fannie Mae and

Freddie Mac, putting them into government

receivership.

Failed because

potential bank

borrower can not

face their own

loss and acquire

losses of Lehman

August 2008 : refusal

of Fed to guarantee

$65 billion in

potential bad loans

of Lehman Bank

of America and

Barclays refused to

buy parts of Lehman.

Bank is split into

good bank and bad

bank.

Responses of Fed considered as direct and

most significant cause of Lehman bankruptcy.

2 .ANALISING THE

FED RESPONSE

are two government-sponsored

enterprises (GSE)

The corporations' purpose:

- expanding the secondary mortgage

market by securitizing

mortgages in the form of

mortgage-backed securities (MBS)

- allowing lenders to reinvest their

assets into more lending and in

effect increasing the number of

lenders in the mortgage market by

reducing the reliance on thrifts

*

*

Before the subprime mortgage crisis:

- owned or guaranteed $1.4 trillion, or 40%, of

all U.S. mortgages.

- only held $168 billion in subprime mortgages -

but it was enough to capsize the two

If they were to collapse, mortgages would be

harder to obtain and much more expensive.

If they went bankrupt, all the investments

would go to 0, and there would be mass

upheaval on a global scale

*

is an American multinational insurance

corporation

In the United States, AIG is the largest

underwriter of commercial and industrial

insurance

AIG suffered from a liquidity crisis when its

credit ratings were downgraded below "AA"

levels in September 2008

*

Main reasons why AIG was saved

- AIG is too big (with assets of over $1 trillion), it

also covers too much and has an intimate

relationship

- AIGs insurance policies have accessed to many

Americans (and customers around the world)

- the insurance business of AIG makes a lot of

money

-> the collapse of AIG would have greater global

impact than Lehman Brothers

*

Grown significantly since the early 2000s

Top ten firms in terms of the number of MBS, ABS and commercial mortgage

backed securities originated each year

November 30, 2007: revenues of $16.1 billion

$13.40 trillion in derivative financial instruments

$28 billion in level 3 assets on its books

net equity position of only $11.1 billion

leverage ratio of 35.5 to 1

December 2007, Bear Stearns announced

a loss of $854 million

2007 metrics

Goldman

Sachs

Group

(GS)

Morgan

Stanley

Merrill

Lynch

Lehman

Brothers

Bear

Stearns

Gross earnings ($B) 45.6 23.1 -6.1 19.3 2.2

Pre-tax income ($M) 17,604 3,441 -12,831 6,013 193

1-yr revenue growth (%) 23 -9.7 N/A 9.5 -52

Equity origination revenue

($B)

1,382 1,570 1,629 1,015 N/A

M&A advisory revenue ($B) 4,222 2,541 1,740 1,337 828

Debt underwriting revenue

($B)

1,951 1,427 1,550 1,551 N/A

Fixed Income Sales

and Trading

Revenues as % of

Total Revenues

(1998-2005)

Trading as % of Net

Assets

Avg. Trading

Efficiency

Lehman

Brothers

40% 2.75% 60

Bear Stearns 35% 1.75% 50

Goldman

Sachs

27% 2.00% 55

Morgan

Stanley

20% 1.25% 35

Merrill Lynch 15% 1.9% 25

*Time!

March: the system was not ready for Bear or

too big to fail institutions to fail -> lead to a

confidence crisis

September: better prepare to deal with the

consequences of a failure

*

*Lehman missed its own opportunities to save

Lehman, FED needs to break the law

unpredictable consequences for the US legal

and financial system.

*Moreover, Lehman cannot prove adequately

guaranteed assets to receive support as other

groups (eg. AIG)

*

Moral hazard:

If Government bailed out create moral

hazard (company will take not less risky

investments)

- create an extremely bad precedent.

- may cause a Domino effect in financial

system.

*Political pressure:

- Presidental election Debate: Is it possible to

use tax paid by people to save a for-profit

firm?

- A sacrifice is essential for the market

+ Cannot be AIG, Freddy Mac of Fannie Mae

(why?)

+The best option is Lehman

*Government was limited by Budget constraint,

relationship between tax and bond.

*If budget was spent rescuing Lehman

ineffective action lose peoples confidence

in US Government.

*In our review, there may be a reasonable

implication:

- FED stopped at rescuing Bear Stearns

- Afterwards, giving out a program to refinance

for financial system, framework of punishment

for collapsed firms.

*

a lesson for the others

BUT

*

27 thousand people were unemployed

during the financial market crisis,

contributing to the extremely high rate

of unemployment of this period.

not simply just a financial crisis anymore but an economic

recession that affects all other sectors in the economy.

The lost of rescuing money insiders gave to Lehman made a

caution and afraid of being empty-handed in investors so they

never want or ready to help the other banks on the edge of

bankruptcy again.

So who will? FED again?

the weight on FED shoulder

might be even heavier.

PART 3

*Understand and monitor counterparty, market, and credit

risks

*Measure, monitor and manage liquidity risk

*Increase the operational effectiveness of collateral

management and accurately capture contractual terms

*Know their investments

*Hedge funds and other users of prime brokerage are

seeking alternative custody models to separate the

custodian and trade finance functions

*Stress the importance of transparency of internal controls

STAY HUMBLE

STAY REALISTIC

STAY CAUSTIOUS

*Warran Buffet theory:

Never bought derivative

investment products

That he did not understand

=> If you cant understand the prospectus, the offering documents

or an investment guide, its time to get nervous.

* Within days of Lehmans collapse:

* net asset value < traditional $1 share price for

a money-market fund

*the fund had $785 million of Lehman debt went

to zero

=> The fund was not quite the same as everyone

else.

* The Reserve Primary breaking the buck=> money rushed out

of prime money market funds=> investors who panicked

lost a whole lot more.

=> investors found themselves swamped and in the middle of

the crisis=> needed to stay calm in order to make the right

move.

*At the worst of the 2008 panic, a lot of investors desperately

trying to win their money back => made a bad situation

worse.

sticking with your original strategy

is wiser than trying something more

risky as a quick fix

* investors bailed out on the rumors. consumers find

themselves in financial trouble for counting on troubled

employers to keep paying them => Lehman Brothers failed

= > The financial crisis validated strategies that involve paying

off debt and amassing a big emergency fund rarely seems to

work in all market conditions.

* yield-hungry investors will go further up the

risk scale without recognizing anything

promising a higher yield coming with interest-

rate risk and credit risk.

=> end up badly if you are letting greed drive

your strategy during good times.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Transport Business PlanDocument4 pagesTransport Business Plancmakande100% (2)

- Lux Project.Document27 pagesLux Project.Fatimah Shoukat100% (3)

- Private Wealth Management Resource Guide 2008-2009Document12 pagesPrivate Wealth Management Resource Guide 2008-2009Nian GuNo ratings yet

- DDDocument4 pagesDDsutapanNo ratings yet

- Mba 513 - Security Analysis and Portfolio ManagementDocument1 pageMba 513 - Security Analysis and Portfolio ManagementlogicballiaNo ratings yet

- Final KabuDocument39 pagesFinal KabuAbera Dinku100% (1)

- Chopra Meindl SCM Ch1 PDFDocument19 pagesChopra Meindl SCM Ch1 PDFKausarAtique100% (1)

- Trading SimulationDocument9 pagesTrading SimulationЭрдэнэ-Очир НОМИНNo ratings yet

- Chapter 9 Multiple-Choice QuizDocument4 pagesChapter 9 Multiple-Choice Quizලකි යාNo ratings yet

- HHHHHHHHHHHHHHHHHHHHDocument1 pageHHHHHHHHHHHHHHHHHHHHGh UnlockersNo ratings yet

- Emirates AirlineDocument14 pagesEmirates AirlineTehniyat AkhtarNo ratings yet

- Application No / Reg. No: 21034694 Application No / Reg. No: 21034694 Application No / Reg. No: 21034694Document1 pageApplication No / Reg. No: 21034694 Application No / Reg. No: 21034694 Application No / Reg. No: 21034694Bikon RabhaNo ratings yet

- Marketing Assignment For UnileverDocument16 pagesMarketing Assignment For UnileverRounak Agrawal100% (1)

- International Marketing MCQDocument29 pagesInternational Marketing MCQjaspreet82% (11)

- e-StatementBRImo 030601059070501 Feb2024 20240419 101303Document12 pagese-StatementBRImo 030601059070501 Feb2024 20240419 101303andrebulungnNo ratings yet

- Raymond Williams, The Writer-Commitment and AlignmentDocument4 pagesRaymond Williams, The Writer-Commitment and AlignmentnathanhNo ratings yet

- Media Planning and StrategyDocument31 pagesMedia Planning and StrategyjaydmpatelNo ratings yet

- HW 2Document4 pagesHW 2Marino NhokNo ratings yet

- Saastr The Ultimate Guide To Hiring A Great VP of SalesDocument50 pagesSaastr The Ultimate Guide To Hiring A Great VP of SalesTanika JewelsNo ratings yet

- © 1999. Omega Research, Inc. Miami, FloridaDocument160 pages© 1999. Omega Research, Inc. Miami, Floridajamesfin68100% (1)

- 13 - Cost of ProductionDocument43 pages13 - Cost of ProductionExequielCamisaCrusperoNo ratings yet

- Harshad Mehta CaseDocument16 pagesHarshad Mehta Casegunjan67% (3)

- Business Finance Module3Document5 pagesBusiness Finance Module3Colene Anne R. SantosNo ratings yet

- Importance of Gold: in Indian EconomyDocument4 pagesImportance of Gold: in Indian EconomyTapan anandNo ratings yet

- Market Growth Strategies in XYZ Healthcare, MalaysiaDocument15 pagesMarket Growth Strategies in XYZ Healthcare, MalaysiaAzamNo ratings yet

- Ord2022vol32no3 4Document16 pagesOrd2022vol32no3 4bkNo ratings yet

- The Value of A Millisecond - Full StudyDocument46 pagesThe Value of A Millisecond - Full StudytabbforumNo ratings yet

- Toaz - Info Quiz On Foreign Transactions PRDocument4 pagesToaz - Info Quiz On Foreign Transactions PRoizys131No ratings yet

- Ya ChunDocument16 pagesYa ChunThomasNo ratings yet

- Depository AssignmentDocument11 pagesDepository AssignmentDinesh GodhaniNo ratings yet