Professional Documents

Culture Documents

The AXA Way - Improving Quality of Services

The AXA Way - Improving Quality of Services

Uploaded by

amitmaharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The AXA Way - Improving Quality of Services

The AXA Way - Improving Quality of Services

Uploaded by

amitmaharCopyright:

Available Formats

Presented by:-

Ketan Thakur

Swati Dheshmukh

Ashrit Mehta

Arpit Vishnoi

Bhanu Partap

Case introduction

AXA is a French global company headquartered in Paris.

Engaged in life health insurance and investment management.

Operates in Western Europe ,North America and Asia-Pacific and

Middle-East.

In 1988, merger between AXA and Company Du Midi ,

In the same year AXA got listed in Paris stock exchange.

It has 42 subsidiaries ,1600 employees and 4000 general

agents.

Its turnover is around $45 million(US).

In 1994, AXA established AXA Asset management in

Europe and later renamed it as AXA Investment Managers.

In 1996, AXA came out with an American Depositary

receipts and got listed in New York Stock Exchange.

In 1999, the acquisition of Guardian Royal Exchange made

AXA the largest player in Ireland non-life Insurance

industry.

This group encompasses 5 operating business segment

Life & Savings -This product segment offers a wide range of product for

individuals and group. Includes life, health, saving and retirement related

products.

Property and Casualty- Includes automotive, homeowners, houshold

property for small to medium sized companies.

International Insurance- corporate solutions

Asset Management- specialist teams who look after the activities in western

Europe, United states and Asia Pacific.

Other financial services - Includes cash flow management, bank account

services to AXA-clients .

Problems

In 2001, economic slow down due to which decline in corporate earnings.

In the life insurance segment, insurance companies faced pressure on

their investment margins and low fees on universal life insurance products.

Poor economic conditions in Japan adversely affected the consumer

confidence in financial products.

Due to global recession in 2001 AXA revenues dropped by 6.25%

compared to 2000.

AXA had to deal with several management issues, legal issues, capital

allocation, integrating people and process due its merge with different

companies

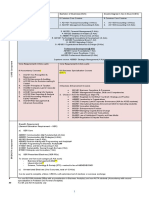

The dmaic principles

D - Define

M - Measure

A - Analysis

I - Improve

C - Control

DMAIC PRINCIPLE- THE AXA WAY

Implementation @axa

D identification of complaints

M audit of a sample of payments

A instance of inaccurate payments and the

causes of mistake

I correct commission rates,

C - query system

Customer focus Fact Based Method

Listening to the voice of the customers(VoC) Data Driven approach

Improving processes performance to meet customer key measures identified

Expectations

Continuously listening to VoC Employee ownership

Transfer to tools and method to

systematically Control and act on the empowering employees

performance. to act on the performance

Building a customer and performance of their processes

Oriented culture.

EMPLOYEE OWNERSHIP - AXA way

Being a service industry :-

AXA considered its employees as its most valuable asset and

believed in keeping them motivated.

AXA kept its employees informed about the strategies and

objectives of the group.

AXA had been conducting scope surveys for its employee to

measure employee satisfaction.

Proper work environment .

CONTINUOUS IMPROVEMENT

Regular customer feedback & incorporating it into its products

and services across the organization.

AXA Ireland started Mad House Program

VOC was used by AXA to introduce several new products.

AXA introduced Multihelp(Germany), comprising of four

different insurance products.

Driving Help -insurance to drivers

Travel help -loss cause due to flight delay

Home Help -security services

Insurance according to the mileage estimate(Italy)

BENEFIT OF THE IMPLEMENTATION OF

AXA WAY

Ranked as most preferred company.

23 companies accounted 90 percent of the

growth revenues.

Customer satisfaction

Customer retention

Annual benefits-technical gains, productivity

gains, reduction in general expenses, incremental

revenues, cost reduction

Wide range of the product

Changes

In a span of one year 200 ideas were presented of which 20

were implemented.

Scope survey score increased from 36 in 2003 to 47 in 2005.

Customer satisfaction on servicing increased from 64 to 69

percent, and in customer satisfaction on selling , it increased

from 64 to 79 percent

Customer retention in Japan, surrender rate(10.6% in 2002 to

6.6% in 2004), reinvestment rate for maturities in

Portugal(48% in 2004 to 57% in 2005), reinvestment rate in

Italy(27% in 2004 to 44% in 2005) & in Spain(23% in 2004 to

42% in 2005)

Increase in annual benefits 38 million(2003) to 200

million(2006)

You might also like

- Axis Bank Statement 2024Document5 pagesAxis Bank Statement 2024abhitash6sep1992No ratings yet

- Simulation Case Study WORLDSustainDocument15 pagesSimulation Case Study WORLDSustainWaqar Ahmad KhanNo ratings yet

- Response To RFPDocument8 pagesResponse To RFPRohan JadhavNo ratings yet

- IBM IIW OverviewDocument36 pagesIBM IIW Overviewd_sengNo ratings yet

- Company Smart With TQM, Six Sigma, Iso As QmsDocument31 pagesCompany Smart With TQM, Six Sigma, Iso As QmsMay Jovi JalaNo ratings yet

- Axaway CaseDocument4 pagesAxaway Caseer4sallNo ratings yet

- Bayerde Mexico Asuntol LiquidDocument63 pagesBayerde Mexico Asuntol LiquidOscar Ccaccya AncaNo ratings yet

- SWOT Analysis For HEMAS HOLDINGDocument21 pagesSWOT Analysis For HEMAS HOLDINGShibly93% (15)

- Daikin StakeholdersDocument97 pagesDaikin StakeholdersSaba Khalid100% (1)

- 514515461Document20 pages514515461adithya100% (1)

- Ben & Jerry's PresentationDocument14 pagesBen & Jerry's PresentationamitmaharNo ratings yet

- Case Analysis of Micro FridgeDocument8 pagesCase Analysis of Micro Fridgeamitmahar100% (1)

- The AXA WayDocument18 pagesThe AXA WaysaurabhNo ratings yet

- The AXA Way: Improving Quality of ServicesDocument19 pagesThe AXA Way: Improving Quality of ServicesDhirendra YadavNo ratings yet

- Corporate Governance - Project Case Studies: Media Company - Embedding Risk Management Into The OperationsDocument2 pagesCorporate Governance - Project Case Studies: Media Company - Embedding Risk Management Into The OperationsGrand OverallNo ratings yet

- Axa - PPT FormatDocument21 pagesAxa - PPT FormatshahinmandaviyaNo ratings yet

- Axa LivecycleDocument2 pagesAxa LivecycleGul Zaib ChatthaNo ratings yet

- Final Strama PaperDocument68 pagesFinal Strama Paperthrezce_1350% (2)

- Final Strama PaperDocument62 pagesFinal Strama PaperHelen Meriz Sagun100% (1)

- Chapter 1 - Introduction A. Company ProfileDocument63 pagesChapter 1 - Introduction A. Company ProfileRengie SalesNo ratings yet

- Factsheet Guidewire CompanyOverviewDocument2 pagesFactsheet Guidewire CompanyOverviewSaiKiran TanikantiNo ratings yet

- CYBAEA PCA Vodafone NetherlandsDocument2 pagesCYBAEA PCA Vodafone NetherlandsInkari Djoph wataraNo ratings yet

- ACS Consultnats - Sales PresentationDocument26 pagesACS Consultnats - Sales PresentationACSConsultantsNo ratings yet

- The Organization's Process of Formulating Its Technology Strategy and Technology PlanDocument7 pagesThe Organization's Process of Formulating Its Technology Strategy and Technology PlanJustine UrbanNo ratings yet

- Axa Life InsuranceDocument30 pagesAxa Life InsuranceVinay VarshneyNo ratings yet

- Organizational Study at ACISDocument20 pagesOrganizational Study at ACISAbhilash KurupNo ratings yet

- Norbert Wiener Private University School of Engineering and BusinessDocument11 pagesNorbert Wiener Private University School of Engineering and Businessjherson pebe burgaNo ratings yet

- Parceforce WorldwideDocument10 pagesParceforce Worldwidevioletta1707No ratings yet

- AR Case StudyDocument15 pagesAR Case StudyRajesh RamakrishnanNo ratings yet

- Wa0000.Document6 pagesWa0000.areejalkhateeb1977No ratings yet

- Exdion: One of Our Success StoriesDocument2 pagesExdion: One of Our Success StoriesSaravanakumar NNo ratings yet

- New Dimensions in MarketingDocument37 pagesNew Dimensions in MarketingknpunithrajNo ratings yet

- Accenture 2Document28 pagesAccenture 2Harsh SaxenaNo ratings yet

- SHRM Group 1 ThesisDocument22 pagesSHRM Group 1 ThesisMark FeatherNo ratings yet

- Functional StrategyDocument22 pagesFunctional StrategyMark FeatherNo ratings yet

- Sustainability Report 2020Document66 pagesSustainability Report 2020Fadilah RahmawatiNo ratings yet

- CA - Casestudy HealthcareDocument1 pageCA - Casestudy Healthcareakilgus52No ratings yet

- Takaful Report - EuromoneyDocument2 pagesTakaful Report - EuromoneyroytanladiasanNo ratings yet

- Axa Way CaseDocument13 pagesAxa Way CaseDhirendra JainNo ratings yet

- Index: Wipro Company AnalysisDocument20 pagesIndex: Wipro Company AnalysisRehan TyagiNo ratings yet

- Havells IR 22-23Document339 pagesHavells IR 22-23Pratiksha TiwariNo ratings yet

- ERM-Group 6 - AckoDocument11 pagesERM-Group 6 - AckoChandru JeyaramNo ratings yet

- Genivar 2009 Annual ReportDocument110 pagesGenivar 2009 Annual Reportz.alarbiNo ratings yet

- RR1813A04 - Home Work 2 - MGT631 - CRMDocument12 pagesRR1813A04 - Home Work 2 - MGT631 - CRMYesh MehraNo ratings yet

- Mbad Strategic ManagementDocument7 pagesMbad Strategic ManagementCHERRYNo ratings yet

- Boardroom Challenge CRISISDocument5 pagesBoardroom Challenge CRISISHrishikesh AshtaputreNo ratings yet

- PNB MetLife Annual Report 2021Document187 pagesPNB MetLife Annual Report 2021Nikhil GadeNo ratings yet

- Subject Outline: Advanced Diploma of Management - BSB60407Document9 pagesSubject Outline: Advanced Diploma of Management - BSB60407Manjeet SinghNo ratings yet

- Entrep Business Plan PresentationDocument53 pagesEntrep Business Plan PresentationGennelyn IsraelNo ratings yet

- Corporate Profile.Document22 pagesCorporate Profile.shilpa.dec02No ratings yet

- SM Simulation: The Balanced ScorecardDocument17 pagesSM Simulation: The Balanced ScorecardNeevalNo ratings yet

- Driving Success in The: Subscriptio N EconomyDocument68 pagesDriving Success in The: Subscriptio N Economykaushal guptaNo ratings yet

- STPRDocument13 pagesSTPRRohit KamraNo ratings yet

- BainDocument3 pagesBainSamson Guanglin LeeNo ratings yet

- 1service and Manufacturing CompanyDocument18 pages1service and Manufacturing CompanyTRUPTI SAVLANo ratings yet

- Marketing Strategy Case StudyDocument3 pagesMarketing Strategy Case StudyAnupam KarmarkarNo ratings yet

- Mini Case-Merchants Insurance GroupDocument1 pageMini Case-Merchants Insurance Groupfaisal shahzadNo ratings yet

- Genpact Company Overview DocketDocument16 pagesGenpact Company Overview Docketamitbharadwaj7No ratings yet

- FinalDocument18 pagesFinalnt.trung0209No ratings yet

- Vienna Insurance GroupDocument6 pagesVienna Insurance GroupКаринаNo ratings yet

- MANB1133 - Final PresentationDocument7 pagesMANB1133 - Final PresentationNaz NawNo ratings yet

- Sales & Key Account ManagementDocument46 pagesSales & Key Account Managementamitmahar100% (3)

- Presentation RM Oct-12 Group-6Document14 pagesPresentation RM Oct-12 Group-6amitmaharNo ratings yet

- International Business Project - Mango FrootiDocument42 pagesInternational Business Project - Mango FrootiamitmaharNo ratings yet

- Corporate Taxation IntroductionDocument48 pagesCorporate Taxation IntroductionSatyajeet MohantyNo ratings yet

- Question Bank MBA 4 SemDocument2 pagesQuestion Bank MBA 4 SemShrikant BagdeNo ratings yet

- Banking and Insurance Law 2020-1Document179 pagesBanking and Insurance Law 2020-1jinNo ratings yet

- Coa C2012-001Document58 pagesCoa C2012-001Stephen C AmistadNo ratings yet

- Reliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy ScheduleDocument5 pagesReliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy Schedulezaid AhmedNo ratings yet

- 2020 Owner Deductible Letterpdf PDFDocument1 page2020 Owner Deductible Letterpdf PDFlogonwheelerNo ratings yet

- BlackRock US Equity Index Segregated FundDocument1 pageBlackRock US Equity Index Segregated Fundarrow1714445dongxinNo ratings yet

- Test Bank For Medical Insurance 8th Edition by ValeriusDocument16 pagesTest Bank For Medical Insurance 8th Edition by ValeriusroytuyenbauNo ratings yet

- Kotak E-Term PlanDocument9 pagesKotak E-Term Planriya sethNo ratings yet

- Finman 10 24Document3 pagesFinman 10 24Noneh EardNo ratings yet

- PGM Structure - For Year 1 Students Admitted in 2019Document5 pagesPGM Structure - For Year 1 Students Admitted in 2019C.TangibleNo ratings yet

- Driver AbstractDocument3 pagesDriver AbstractbhupinderNo ratings yet

- Prs Ra SebiDocument1,186 pagesPrs Ra Sebidsn24eximNo ratings yet

- IC 83 - Compressed-5Document50 pagesIC 83 - Compressed-5purnachandrashee1No ratings yet

- Activa Insurance 2023-2023Document3 pagesActiva Insurance 2023-2023Mind ReliefNo ratings yet

- (1142805388) Certificate - Victor Commercial Motor Policy From Victor InsuranceDocument12 pages(1142805388) Certificate - Victor Commercial Motor Policy From Victor InsuranceDiaconescu TimoteiNo ratings yet

- Case Scenario 1 ETHICSDocument3 pagesCase Scenario 1 ETHICSJJNo ratings yet

- IandF - CM1A - 202304 - Examiner ReportDocument15 pagesIandF - CM1A - 202304 - Examiner ReportFoo Zi YeeNo ratings yet

- Chapter 11 12Document29 pagesChapter 11 12Add All31% (13)

- Small Business Health Care Tax Credit 2021Document2 pagesSmall Business Health Care Tax Credit 2021Finn KevinNo ratings yet

- New Lube CFA AgreementDocument31 pagesNew Lube CFA AgreementMANISH AGRAWALNo ratings yet

- TY2020 - Fair Fight Action - Form 990-PDocument78 pagesTY2020 - Fair Fight Action - Form 990-PWashington ExaminerNo ratings yet

- Solidbank v. Mindanao Ferroalloy CorpDocument3 pagesSolidbank v. Mindanao Ferroalloy CorpIra Francia AlcazarNo ratings yet

- Married Couples Case PDFDocument5 pagesMarried Couples Case PDFSeemaNo ratings yet

- NC Gov. Cooper Proposed Budget FY2022-2023Document238 pagesNC Gov. Cooper Proposed Budget FY2022-2023WCNC DigitalNo ratings yet

- Tax267 FormDocument3 pagesTax267 Form2021202082No ratings yet

- 2023-2024 WAY Student HandbookDocument28 pages2023-2024 WAY Student Handbookkaiching LamNo ratings yet

- Tom Tat Ly ThuyetDocument34 pagesTom Tat Ly ThuyetK60 NGUYỄN XUÂN HOANo ratings yet

- Standard Chart of Accounts For Smaller Law OfficesDocument1 pageStandard Chart of Accounts For Smaller Law OfficesVivian NarvajaNo ratings yet