Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

39 viewsIntroduction To Basic Contracts in Islamic Banking

Introduction To Basic Contracts in Islamic Banking

Uploaded by

NorAtika Azimifinance economic

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 9 Frequency Response of BJT & MosfetDocument54 pagesChapter 9 Frequency Response of BJT & Mosfetshubhankar palNo ratings yet

- The Contracting Meeting - Peter Block, Flawless ConsultingDocument16 pagesThe Contracting Meeting - Peter Block, Flawless ConsultingJonathan H West100% (1)

- Module 5 Session 06-ProjectAppraisalDocument16 pagesModule 5 Session 06-ProjectAppraisalNorAtika AzimiNo ratings yet

- All Types of Listening PDFDocument2 pagesAll Types of Listening PDFNorAtika Azimi100% (1)

- BC31403 Ekonomi Alam Sekitar - Group Assignment BC31403 Sem 1 2013 2014Document1 pageBC31403 Ekonomi Alam Sekitar - Group Assignment BC31403 Sem 1 2013 2014NorAtika AzimiNo ratings yet

- What Is Open HouseDocument4 pagesWhat Is Open HouseNorAtika AzimiNo ratings yet

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- A General Framework For The Integration of Computational Fluid Dynamics and Process Simulation - 2000 - F - Bezzo PDFDocument6 pagesA General Framework For The Integration of Computational Fluid Dynamics and Process Simulation - 2000 - F - Bezzo PDFRaúl RivasNo ratings yet

- Ksef CategoriesDocument1 pageKsef Categoriesochieng josephNo ratings yet

- Stak Pellet Mills General Operating Handbook 1Document18 pagesStak Pellet Mills General Operating Handbook 1g_junk5213No ratings yet

- Classification of MSME in IndiaDocument7 pagesClassification of MSME in Indiaaishu patilNo ratings yet

- Bhagyalaxmi Cotton: Bank Name - Icici Bankaccount No.-655705502528 IFCI CODE-ICIC0006557Document2 pagesBhagyalaxmi Cotton: Bank Name - Icici Bankaccount No.-655705502528 IFCI CODE-ICIC0006557patni psksNo ratings yet

- Catalog KiepeDocument6 pagesCatalog KiepeTacuNo ratings yet

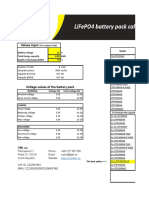

- The Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)Document2 pagesThe Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)HirenNo ratings yet

- Introducing Hitachi Storage ArchitectureDocument210 pagesIntroducing Hitachi Storage ArchitecturevcosminNo ratings yet

- IJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFDocument8 pagesIJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFAli jeffreyNo ratings yet

- Land LawDocument19 pagesLand LawRitesh KumaiNo ratings yet

- De La Llana V Alba 112 Scra 659Document2 pagesDe La Llana V Alba 112 Scra 659Anthony Arcilla PulhinNo ratings yet

- Laguna Lake Development Authority V CA GR No. 120865-71 December 7, 1995Document1 pageLaguna Lake Development Authority V CA GR No. 120865-71 December 7, 1995MekiNo ratings yet

- Prospekt Serie 900 US 버터플라이밸브 카달로그Document8 pagesProspekt Serie 900 US 버터플라이밸브 카달로그kyeong cheol leeNo ratings yet

- Structure Gad DrawingsDocument56 pagesStructure Gad Drawingsdheeraj sehgalNo ratings yet

- Excel Formulas and Functions ListDocument25 pagesExcel Formulas and Functions ListB15 Likitha100% (1)

- Self Declaration CertificateDocument1 pageSelf Declaration CertificatePuran SinghNo ratings yet

- HDFC Bank 8501Document7 pagesHDFC Bank 8501Divya DhumalNo ratings yet

- Zp43E Operating ManualDocument97 pagesZp43E Operating Manuallinus@len.co.id100% (1)

- Case DigestDocument5 pagesCase DigestChrissy SabellaNo ratings yet

- Responsible Leadership ReportDocument7 pagesResponsible Leadership ReportRNo ratings yet

- Bridge Erection MethodDocument9 pagesBridge Erection MethodChi-chi Rahayu HarikeNo ratings yet

- Vortex Wind TurbineDocument11 pagesVortex Wind TurbineTanviNo ratings yet

- Gujarat Technological University: W.E.F. AY 2018-19Document3 pagesGujarat Technological University: W.E.F. AY 2018-19Bhavesh PatelNo ratings yet

- GNLD - International and Foster Sponsoring - NewDocument9 pagesGNLD - International and Foster Sponsoring - NewNishit KotakNo ratings yet

- ISCN 2015 Abstract Summary PDFDocument26 pagesISCN 2015 Abstract Summary PDFJen LinaresNo ratings yet

- BOQ For Bought Out Items (Purified Water) PDFDocument1 pageBOQ For Bought Out Items (Purified Water) PDFsppatilNo ratings yet

- Performance Management System: Business Essentials Business Accelerators Business ValuesDocument10 pagesPerformance Management System: Business Essentials Business Accelerators Business ValuesVishwa Mohan PandeyNo ratings yet

Introduction To Basic Contracts in Islamic Banking

Introduction To Basic Contracts in Islamic Banking

Uploaded by

NorAtika Azimi0 ratings0% found this document useful (0 votes)

39 views44 pagesfinance economic

Original Title

Introduction to Basic Contracts in Islamic Banking

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinance economic

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

39 views44 pagesIntroduction To Basic Contracts in Islamic Banking

Introduction To Basic Contracts in Islamic Banking

Uploaded by

NorAtika Azimifinance economic

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 44

GROUP MEMBERS

1) ALAN PHANG KIAN YUNG

2) DIONYSIA GINSOS

3) LEONG KAT FUN

4) LOW AIVY

5) MICELLY HULO LEWAT

It is important to understand the basic contracts in

Islamic banking in terms of the characteristics based on

the terms and conditions.

In the profit and loss sharing agreements, there are two

main types of contracts which are Musharakah (joint

venture profit sharing) and Mudharabah (trustee profit

sharing).

For the contract of sales, exchange goods for money such

as bay al muajjal (example bai al murabahah, bai

bithaman ajil, bai al istina, bai al salam,bai as-sarf),

and exchange of services for money such as qard-hassan

(al-ijarah and al-jualah).

Shariah aspects of Islamic banking contracts meet the

Shariah requirements that referring to avoidance of

prohibitions, and ensuring that the contracts have all

their essential elements with their necessary

conditions.

The word riba has been used in the Holy Quran on several

occasions.

Riba has been extracted from Raba. (increase).

In the Shariah, riba technically refers to the premium that must

be paid by the borrower to the lender along with the principal

amount as a condition for the loan or for an extension in its

maturity.

In this sense riba has the same meaning as interest in accordance

with the consensus of all jurists without any exception.

So the Holy Quran and the Hadith do not make any such difference

between usury and interest.

Riba al-nasiah,

Riba al-fadl.

Islam, however, wishes to eliminate not merely the exploitation

that is intrinsic in the institution of interest, but also that which is

inherent in all forms of unjust exchange in business transactions.

Riba al-fadl is the excess over and above the loan paid in kind. It

lies in the payment of an addition by the debtor to the creditor in

exchange of commodities of the same kind. The following tradition

of the Prophet Muhammad (saw) is cited as evidence. It is related

that Abu Said al-Khurdi said: the Prophet Muhammad (saw) has

said that gold in return for gold, silver for silver, wheat for wheat,

barley for barley, dates for dates and salt for salt, can be traded if

and only if they are in the same quantity and that is should be hand

to hand. If someone gives more or takes, then he is engaged in riba

and accordingly has committed a sin.

Riba is prohibited in Islam as it appears explicitly in the Holy Quran.

There is complete unanimity among all Islamic schools of thought

regarding the prohibition of riba. Since the Quran is the undisputed

source of guidance in Islam for all Muslims, there is unanimous

agreement on the fact that Islam has forbidden the practice of riba.

The debate on whether interest is riba or not has been settled. The

ulama have made crystal clear that interest is riba. The modern

banking system is organized on the basis of a fixed payment called

interest. That is why the practices of the modern banking system are

in conflict with the principles of Islam which strictly prohibit riba.

Islam is opposed to exploitation in every form and stands for fair and

equitable dealings among all men. To charge interest from someone

who is constrained to borrow to meet his essential consumption

requirement is considered an exploitative practice in Islam. Charging

of interest on loans taken for productive purposes is also prohibited

because it is not an equitable form of transaction. Now lets have a

look on the prohibition of interest in the light of the Quran and the

Sunnah (tradition of Prophet Muhammad (saw).

That which ye lay out for increase through the property of

(other) people, will have no increase with Allah: But that which

ye lay out for charity, seeking the countenance of Allah (will

increase): it is these who will get a recompense multiplied.

(30:39)

That they took riba (usury), through they were forbidden and

that they devoured mens substance wrongfully We have

prepared for those among men who reject faith a grievous

punishment. (4:161)

O ye who believe! Devour not usury doubled and multiplied;

but fear Allah, that ye may (really) prosper. 3:140)

Jabir reported: The Prophet (saw) cursed the

receiver and the payer of interest, the one who

records it (the contract) and the two witnesses

to the transaction and said, They are all alike (in

guilt).

Jabir ibn Abdullah, giving a report on the

Prophets farewell pilgrimage, said: The Prophet

(saw), addressed the people and said, All the

riba al-jahiliyyah is annulled, the first riba that I

annulled is our riba, accruing to al-Abbas ibn

Abdul Mutalib (the Prophets uncle).

Despite the fact that interest occupies a central position in modern

economic system and that it became the very life blood of the existing

financial institutions, Islam considers that the principle of charging interest

is quite opposite of that of business in the spirit of sharing and cooperation

and that lending on interest is not as a business in the real sense.

In legalizing trade and condemning interest, Islam considers that there are

fundamental differences between the nature of profit resulting from

interest charges and that earned by trade. In interest-based transactions,

there may be no equitable division of profit between the buyer who makes a

profit on the sale of good purchased, and the seller who derives a profit in

consideration of the labour and time spent in procuring the goods.

Moreover, there could be no end for an interest-based transaction, since

there could always be interests of unpaid interests as long as the principle

amount loaned is not fully returned. This could, in extreme cases, create

un-repayable debt for generations.

a) Profit-and-loss sharing contracts (mudarabah)

The Islamic bank pools investors' money and

assumes a share of the profits and losses

agreed upon with the depositors

filter parses company balance sheets

determine whether any sources of income to the

corporation are prohibited

i. Declining-Balance Shared Equity:

Commonly used to finance a home purchase

the investor to purchase the home jointly

ii. Lease-to-Own

similar to the declining balance one described above

except that the financial institution puts up most

iii. Installment (Cost-Plus) Sale (murabaha):

This is an action where an intermediary buys the home

with free and clear title to it

This credit sale is an acceptable form of finance and is

not to be confused with an interest-bearing loan.

b) Partnership and joint stock ownership

(musharakah)

c) Leasing ('ijarah/'ijar)

The sale of the right to use an object (usufruct) for a

specific time period

the lessor must own the leased object for the

duration of the lease

'ijarah wa 'iqtina provides for a lease to be written

These are rare forms of financing, used for

certain types of business

exception to gharar

The price for the item is prepaid

the item is delivered at a definite point in the

future

is a partnership contract between

rabbul mal and mudarib in which the

rabbul mal provides capital to the

mudarib for investing it in a business

enterprise by applying his skill and

labour.

The financer is known as rabbul mal

or shahibul mal, while the

entrepreneur is known as mudarib.

Mudarabah

is a contract between the partners to

contribute capital to an enterprise or a

venture, whether existing or new, or to

owner of a real estate or moveable asset,

either on a temporary or permanent basis.

Musharakah

The proportionate share in profit is determined

by mutual agreement.

Profit is shared between the rabbul mal and

mudarib according to a pre-determined profit

sharing ratio.

In principal, any financial loss under

mudharabah financing must be borne by

Islamic banking institution.

However, if the loss is caused by negligence,

management or breach of contracted terms by

the customer, then the customer is liable for

loss.

It is an agreement between the

bank and the depositors, who

agree to put their money into

the banks investment account

and to share profits with it.

First tier

It is an agreement between the

bank and the entrepreneurs

who seek finance from the

bank on the condition that

profits accruing from their

business will be shared

between them and the bank in

a previously mutually agreed

proportion, but that loss shall

be borne by the financier only.

Second

tier

a. Contracting parties

Mudarabah gives the right to the contracting parties to

share the profit, while liability for losses is borne by

the participants.

b. Offer and Acceptance

Mudarabah has two pillars of offer and acceptance.

Mudarabah is concluded when the parties use words

that clearly indicate the contract of mudarabah in their

offer and acceptance.

c. Capital

The capital in this partnership must be in absolute

currency, it should be ready cash and not form in the

debt.

d. Profit

Any profit made will be share between the

rabb-ul-maal and the mudarib according to

an agreed ratio while losses are borne solely

by the rabb-ul-maal.

e. Work/Labour

The rabb-ul-maal has no right to participate

in the management which is carried out by

the mudarib only.

Restricted Mudarabah (al-

mudarabah al muqayyadah)

The rabbul mal may specify a

particular type of business or to

a particular location or specified

period for the mudarib, in which

case he shall invest the money

in that particular business only.

Restricted mudarabah divided

into 3 parts:

i. Restriction in respect of

specified time or period.

ii. Restriction in respect of

specified place or location.

iii. Restriction with respect of

specific business.

Unrestricted Mudarabah ( al-

mudarabah al-mutlaqah)

It is a contract in which the

rabbul mal permits the mudarib

to admister the mudarabah fund

without any restriction.

In this case, the mudarib has a

wide range of business options

on the basis of trust and the

business expertise he has

acquired.

Mudarabah interbank

investments (MII) refers to a

mechanism whereby a deficit

Islamic banking institution

investee bank can obtain

investment from a surplus

Islamic banking institution

investor bank based on

mudarabah.

The literal meaning of Musharakah is sharing.

The root of the word Musharakah in Arabic is

Shirkah, which means engagement of two or more

parties who have a common interest to form a

partnership.

It is a contract of partnership between two or more

parties in which all the partners contribute capital,

participate in the management, share the profit in

proportion to their capital or as per pre-agreed

ratio and bear the losses (if any) in proportion to

their capital ratio.

a. Capital

The contract of musharakah can be based

only on money and not on commodities. The

share capital of a joint venture must be in

monetary form. No part of it can be

contributed in kind.

b. Contracting Parties

Parties involved in a partnership

arrangement contribute funds to and have

the right to exercise executive powers in

that project in accordance with an agreed

formula.

c. Work

The partners must belong to the same trade and

they should work in one place. Besides, all the

partners should participate in actual work and

should get profit according to their work.

d. Risk

The musharakah financing entails lower risks,

since it involves risk sharing through partnership.

The number of individuals who are in a position

to provide musharakah financing is limited ,

although modern musharakah funding through

equity market participation may have much

smaller risks because of the ease of divestment.

Musharakah

Shirkah al-milk (non-

contractual partnership)

Shirkah al-uqood

(contractual

partnership)

Shirkah al-milk (non-contractual) implies co-

ownership and comes into existence when

two or more persons happen to get joint-

ownership of some asset without having

entered into a formal partnership agreement

for example, two persons receiving an

inheritance or a gift of land or property

which may or may not be divisible.

The partners have to share the gift, or

inherited property or its income, in

accordance with their share in it until they

decide to divide it.

Shirkah al-uqood (contractual partnership)

however can be considered a proper partnership

because the parties concerned have willingly

entered into a contractual agreement for joint

investment and the sharing of profits and risks.

Shirkah al-uqood has been divided in the fiqh

books into four kinds:

i. al-mufawadah (full authority and obligation)

ii. al-inan (restricted authority and obligation)

iii. al-abdan (labour, skill and management)

iv. al-wujuh (goodwill, credit-worthiness and

contracts)

-An legal exchange of a useful and desirable thing for

a similar thing by mutual consent for the alienation of

property.

A form of an exchange value or

consideration, return, wages, or rent of

services of an asset

Contract between two parties, the lessor and

lessee, where the lessee enjoys or reaps a

specific service or benefit against a specified

consideration or rent from the asset owned

by the lessor.

BANK

(Lessor)

PROPERTY

(1) Bank buys property

(3) Customer pays rental

(2) Bank leases property

Ijarah (cont)

PEOPLE

(Lessee)

A party undertakes to pay another party a

specified amount of money as a fee for

rendering a specific service in accordance

to the terms of the contract stipulated

between the two parties.

-For example, Ahmad (Jail) declares that if

anyone(Amil) recovers his lost property, he

will give him RM10.

Contract between a buyer and a seller which

the seller sells specific goods allowed under

Shariah principles to the buyer at a cost plus

agreed profits payable in cash on any fixed

future date in a lump sum or by instalments.

Bai al-Murabahah (cont..)

Bank

Customer

Supplier of

commodity

1.Customer identifies

commodity

2.Customer

approaches bank,

promises to buy

commodity from

bank

3.Bank buys

commodity on

cash basis

4. Customer buys

commodity via

murabahah on

deferred payment

terms

Contract of a sale and purchase transaction for

the financing of an asset on a deferred payment

basis with a pre-agreed payment period.

Buyer and Seller are not restricted from dealing in

business transactions. In addition, they are not

bankrupt and safih (an extraordinarily extravagant

person/spendthrift) and are not being forced to

enter into contract. The seller must be the real

owner of the merchandise and able to deliver the

merchandise to buyer and the asset is free from

any circumstance.

The asset has the following characteristic, such

as in the form of Mal (valuable asset) halal/

lawful, valuable (has trade value). Besides that,

the asset should not be an unusable material

according to shariah.

A contract in which advance payment is

made and the goods will be delivered later

on. The seller supply specific goods to the

buyer at a future date while an advance

price is fully paid at the time of contract.

Salam (cont)

Contract for the acquisition of goods by

specification or order.

The sale of goods by way of ordering where

the price is paid in advance or

progressively but the assets are

manufactured and delivered at a later

specified/defined date.

Customer identifies

commodity and the

design

Customer approaches bank, promises to

buy commodity from bank through

Istisnaa contract

The bank then enters

into a back-to-back

Istisna'a contract with

a third party to have

the subject commodity

manufactured, built or

assembled.

Bank sell the commodity by

cost+profit to customer once

bank own the commodity

A sale in order to get cash, not property or a sale

in which a commodity is sold for a deferred

payment (thaman mu ajjal) and then resold to

the seller on cash basis (which is cheaper than

deferred payment price).

Such an organised same-item sale-repurchase

between the same parties is not allowed in many

jurisdictions.

Islamic contract and transaction need to

confirm to the principle of Shariah without

involving any prohibited elements such as riba

and gharar.

Islamic banks contract performance provides

signal to the banks management whether to

improve its deposit services or financing

services or both in order to improve banks

earnings.

Every contract exposed to various types of

risks so it requires proper, adequate and sound

risk management infrastructure and internal

controls to manage the risks.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 9 Frequency Response of BJT & MosfetDocument54 pagesChapter 9 Frequency Response of BJT & Mosfetshubhankar palNo ratings yet

- The Contracting Meeting - Peter Block, Flawless ConsultingDocument16 pagesThe Contracting Meeting - Peter Block, Flawless ConsultingJonathan H West100% (1)

- Module 5 Session 06-ProjectAppraisalDocument16 pagesModule 5 Session 06-ProjectAppraisalNorAtika AzimiNo ratings yet

- All Types of Listening PDFDocument2 pagesAll Types of Listening PDFNorAtika Azimi100% (1)

- BC31403 Ekonomi Alam Sekitar - Group Assignment BC31403 Sem 1 2013 2014Document1 pageBC31403 Ekonomi Alam Sekitar - Group Assignment BC31403 Sem 1 2013 2014NorAtika AzimiNo ratings yet

- What Is Open HouseDocument4 pagesWhat Is Open HouseNorAtika AzimiNo ratings yet

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- A General Framework For The Integration of Computational Fluid Dynamics and Process Simulation - 2000 - F - Bezzo PDFDocument6 pagesA General Framework For The Integration of Computational Fluid Dynamics and Process Simulation - 2000 - F - Bezzo PDFRaúl RivasNo ratings yet

- Ksef CategoriesDocument1 pageKsef Categoriesochieng josephNo ratings yet

- Stak Pellet Mills General Operating Handbook 1Document18 pagesStak Pellet Mills General Operating Handbook 1g_junk5213No ratings yet

- Classification of MSME in IndiaDocument7 pagesClassification of MSME in Indiaaishu patilNo ratings yet

- Bhagyalaxmi Cotton: Bank Name - Icici Bankaccount No.-655705502528 IFCI CODE-ICIC0006557Document2 pagesBhagyalaxmi Cotton: Bank Name - Icici Bankaccount No.-655705502528 IFCI CODE-ICIC0006557patni psksNo ratings yet

- Catalog KiepeDocument6 pagesCatalog KiepeTacuNo ratings yet

- The Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)Document2 pagesThe Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)HirenNo ratings yet

- Introducing Hitachi Storage ArchitectureDocument210 pagesIntroducing Hitachi Storage ArchitecturevcosminNo ratings yet

- IJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFDocument8 pagesIJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFAli jeffreyNo ratings yet

- Land LawDocument19 pagesLand LawRitesh KumaiNo ratings yet

- De La Llana V Alba 112 Scra 659Document2 pagesDe La Llana V Alba 112 Scra 659Anthony Arcilla PulhinNo ratings yet

- Laguna Lake Development Authority V CA GR No. 120865-71 December 7, 1995Document1 pageLaguna Lake Development Authority V CA GR No. 120865-71 December 7, 1995MekiNo ratings yet

- Prospekt Serie 900 US 버터플라이밸브 카달로그Document8 pagesProspekt Serie 900 US 버터플라이밸브 카달로그kyeong cheol leeNo ratings yet

- Structure Gad DrawingsDocument56 pagesStructure Gad Drawingsdheeraj sehgalNo ratings yet

- Excel Formulas and Functions ListDocument25 pagesExcel Formulas and Functions ListB15 Likitha100% (1)

- Self Declaration CertificateDocument1 pageSelf Declaration CertificatePuran SinghNo ratings yet

- HDFC Bank 8501Document7 pagesHDFC Bank 8501Divya DhumalNo ratings yet

- Zp43E Operating ManualDocument97 pagesZp43E Operating Manuallinus@len.co.id100% (1)

- Case DigestDocument5 pagesCase DigestChrissy SabellaNo ratings yet

- Responsible Leadership ReportDocument7 pagesResponsible Leadership ReportRNo ratings yet

- Bridge Erection MethodDocument9 pagesBridge Erection MethodChi-chi Rahayu HarikeNo ratings yet

- Vortex Wind TurbineDocument11 pagesVortex Wind TurbineTanviNo ratings yet

- Gujarat Technological University: W.E.F. AY 2018-19Document3 pagesGujarat Technological University: W.E.F. AY 2018-19Bhavesh PatelNo ratings yet

- GNLD - International and Foster Sponsoring - NewDocument9 pagesGNLD - International and Foster Sponsoring - NewNishit KotakNo ratings yet

- ISCN 2015 Abstract Summary PDFDocument26 pagesISCN 2015 Abstract Summary PDFJen LinaresNo ratings yet

- BOQ For Bought Out Items (Purified Water) PDFDocument1 pageBOQ For Bought Out Items (Purified Water) PDFsppatilNo ratings yet

- Performance Management System: Business Essentials Business Accelerators Business ValuesDocument10 pagesPerformance Management System: Business Essentials Business Accelerators Business ValuesVishwa Mohan PandeyNo ratings yet