Professional Documents

Culture Documents

Finance Management Lecture Presentations

Finance Management Lecture Presentations

Uploaded by

Rahul FouzdarCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Petrolera Zuata Petrozuata CA. AnswerDocument8 pagesPetrolera Zuata Petrozuata CA. AnswerKelvinItemuagbor100% (1)

- Drainage Manual 6th Edition PDFDocument468 pagesDrainage Manual 6th Edition PDFDavid100% (6)

- Lesson 1 - PMP Auth Exam PrepDocument64 pagesLesson 1 - PMP Auth Exam PrepDiego Pérez Ortega100% (1)

- Capital Budgeting Maruthi SuzukiDocument55 pagesCapital Budgeting Maruthi Suzukikeerthi78% (9)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Finance Chapter 9Document36 pagesFinance Chapter 9mamarcus-1100% (2)

- Top 50 Investment Banking Interview Questions and AnswersDocument12 pagesTop 50 Investment Banking Interview Questions and AnswersPrasad SuryawanshiNo ratings yet

- Welcome To: Presentation On Module B-HRM, CAIIBDocument32 pagesWelcome To: Presentation On Module B-HRM, CAIIBRahul FouzdarNo ratings yet

- Kanatal Factsheet - The Heavenly Hill Stattion in ChambaDocument5 pagesKanatal Factsheet - The Heavenly Hill Stattion in ChambaRahul FouzdarNo ratings yet

- Carrie-StephenKing AnchorMM ExcerptDocument8 pagesCarrie-StephenKing AnchorMM ExcerptHenrique BarbozaNo ratings yet

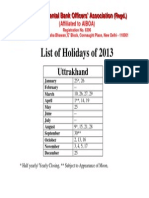

- List of Holidays of 2013: UttrakhandDocument1 pageList of Holidays of 2013: UttrakhandRahul FouzdarNo ratings yet

- JAIIB Principles and Practices of Banking Q & ADocument13 pagesJAIIB Principles and Practices of Banking Q & ARahul FouzdarNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingRahul FouzdarNo ratings yet

- Project Report On The Degree of Pest Management in Paddy Cultivation.Document62 pagesProject Report On The Degree of Pest Management in Paddy Cultivation.Rahul Fouzdar50% (2)

- JAIIB Principles and Practices of Banking Q & ADocument13 pagesJAIIB Principles and Practices of Banking Q & ARahul FouzdarNo ratings yet

- Hospital Management 110913Document21 pagesHospital Management 110913Muhammad UsmaanNo ratings yet

- ACC 222 Practice SetDocument4 pagesACC 222 Practice SetAdam CuencaNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- PMP Formulas 01234Document12 pagesPMP Formulas 01234Waqas AhmedNo ratings yet

- Midterm 1 Cheat SheetDocument2 pagesMidterm 1 Cheat SheetAhmad AttiaNo ratings yet

- Financial Analysis AssignmentDocument5 pagesFinancial Analysis AssignmentSaifiNo ratings yet

- Vault Guide To Real Estate CareersDocument104 pagesVault Guide To Real Estate CareersAyp510No ratings yet

- CF Qs C4 (B11)Document6 pagesCF Qs C4 (B11)shah gNo ratings yet

- Ch10 PPTDocument62 pagesCh10 PPTmuhammad Adeel0% (1)

- Last AssignmentDocument27 pagesLast Assignmentsecret studentNo ratings yet

- PDD 8MW Cabulig River Minihydroelectric Power ProjectDocument51 pagesPDD 8MW Cabulig River Minihydroelectric Power Projectjaysenorin100% (1)

- Apollo Global Management, LLC August Investor PresentationDocument33 pagesApollo Global Management, LLC August Investor PresentationOkkishoreNo ratings yet

- Cbi So Model Paper 2022Document37 pagesCbi So Model Paper 2022himanshu agrawalNo ratings yet

- Top 15 Financial Functions in Excel - WallStreetMojoDocument31 pagesTop 15 Financial Functions in Excel - WallStreetMojov_u_ingle2003No ratings yet

- CA Inter FM Handbook (Revised) - CA Ganesh BharadwajDocument363 pagesCA Inter FM Handbook (Revised) - CA Ganesh BharadwajKrrishna priya s.m.No ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Solution CF Cash Flow Practice Problem 2Document12 pagesSolution CF Cash Flow Practice Problem 2Zarieq EricNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- Ceng 6301Document118 pagesCeng 6301Dawit AlemuNo ratings yet

- Strategic ManagementDocument42 pagesStrategic ManagementMd Nahiduzzaman NahidNo ratings yet

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- Mortgage MathDocument40 pagesMortgage MathAmit KumarNo ratings yet

- Factors Affecting Bidding Decisions of Company and Contemporary Bidding ModelsDocument12 pagesFactors Affecting Bidding Decisions of Company and Contemporary Bidding ModelsDebasish DeyNo ratings yet

- Financial Management Strategy FinalDocument24 pagesFinancial Management Strategy FinalsayedhossainNo ratings yet

Finance Management Lecture Presentations

Finance Management Lecture Presentations

Uploaded by

Rahul FouzdarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Management Lecture Presentations

Finance Management Lecture Presentations

Uploaded by

Rahul FouzdarCopyright:

Available Formats

CAIIB-FM-Module D topics

Marginal Costing

Capital Budgeting

Cash Budget

Working Capital

COSTING

Cost accounting system provides relevent

information about cost

Aim : best use of resources and maximization

of returns

cost = amount of expenditure incurred(

actual+ notional)

Purposes: know about profit from each

job/product/division/segment. Pricing decision

+control +profit planning +inter firm

comparison

Marginal costing

Marginal costing distinguishes between

fixed cost and variable cost

Marginal cost is nothing but variable cost

of additional unit

Marginal cost= variable cost

MC= Direct Material + Direct Labour

+Direct expenses

Marginal costing problems

Sales (-) variable cost (=)

contribution

Contribution(/ divided by) sales

(=) C.S. Ratio

Contribution and Fixed costs

determine the Break even point

Fixed Cost (/ divided by)

contribution per unit = break even units

Basic formula

Sales price (-) variable cost= contribution

SP less VC =

Contribution

10 6 = 4

9 6 = 3

8 6 = 2

7 6 = 1

6 6 = 0

5 6 = (1)

4 6 = (2)

Marginal costing problems

SP = Rs.10, VC =Rs.6 Fixed Cost

Rs.60000

Find

- Break even point (in Rs. & in units)

- C/S ratio

- Sales to get profit of Rs.20000

Marginal costing problems

Sales Rs.100000

Fixed Cost Rs.20000

B.E.Point Rs.80000

What is the profit ?

Management decisions- assessing profitability

CONTRIBUTION/SALES=C.S.RATIO

Product sp vc

Contribtion

c/s Ratio % ranking

A 20 10 10 10/20 50% 1

B 30 20 10 10/30

33%

2

C 40 30 10 10/40 25% 3

DECISION when limiting factors

SP Rs.14 Rs.11

VC 8 7

Contribution

Per unit

6 4

Labour hr. pu 2 1

Contri.per hr 3 4

Other managerial DECISIONS

Make or buy decisions

Close department

Accept or reject order

Marginal costing

cost-volume-profit analysis is reliant upon a

classification of costs in which fixed and variable

costs are separated from one another. Fixed

costs are those which are generally time related

and are not influenced by the level of activity.

Variable costs , on the other hand, are directly

related to the level of activity; if activity

increases, variable costs will increase and

vice-versa .

Marginal costing

USES OF COST-VOLUME-PROFIT ANALYSIS

The ability to analyse and use cost-volume-profit

relationship is an important management tool. The

knowledge of patterns of cost behaviour offers insights

valuable in planning and controlling short and long-run

operations. The example of increasing capacity is a good

illustrations of the power of the technique in planning.

The implications of changes in the level of activity can be

measured by flexing a budget using knowledge of cost

behaviour, thereby permitting comparison to be made of

actual and budgeted performance for any level of

activity.

Marginal costing

LIMITATIONS OF COST-VOLUME-PROFIT

ANALYSIS

A major limitation of conventional CVP analysis that we

have already identified is the assumption and use of

linear relationships. Yet another limitation relates to the

difficulty of dividing fixed costs among many products

and/or services. Whilst variable costs can usually be

identified with production services, most fixed cost

usually can only be divided by allocation and

apportionment methods reliant upon a good deal of

judgement. However, perhaps the major limitation of the

technique relates to the initial separation of fixed and

variable costs.

Marginal costing

ADVANTAGES AND DISADVANTAGES OF

MARGINAL COSTING

ADVANTAGES

1. More efficient pricing decisions can be made, since

their impact on the contribution margin can be

measured.

2. Marginal costing can be adapted to all costing

system.

3. Profit varies in accordance with sales, and is not

distorted by changes in stock level.

4. It eliminates the confusion and misunderstanding

that may occur by the presence of

over-or-under-absorbed overhead costs in the profit and

loss account.

Marginal costing

5. The reports based on direct costing are far more

effective for management control than those based on

absorption costing. First of all, the reports are more

directly related to the profit objective or budget for the

period. Deviations from standards are more readily

apparent and can be corrected more quickly. The

variable cost of sales changes in direct proportion with

volume. The distorting effect of production on profit is

avoided, especially in month following high production

when substantial amount of fixed costs are carried in

inventory over to next month. A substantial increase in

sales in the month after high production under

absorption costing will have a significant negative impact

on the net operating profit as inventories are liquidated.

Marginal costing

6. Marginal costing can help to pinpoint

responsibility according to organisational lines:

individual performance can be evaluated on

reliable and appropriate data based on current

period activity. Operating reports can be

prepared for all segments of the company, with

costs separated into fixed and variable and the

nature of any variance clearly shown. The

responsibility for costs and variances can then

be more readily attributed to specific individuals

and functions, from top management to down

management

Marginal costing

DISADVANTAGES OF MARGINAL COSTING

1. Difficulty may be experienced in trying to segregate

the fixed and variable elements of overhead costs for the

purpose of marginal costing.

2. The misuse of marginal costing approaches to

pricing decisions may result in setting selling prices that

do not allow the full recovery of overhead costs.

3. Since production cannot be achieved without

incurring fixed costs, such costs are related to

production, and total absorprtion costing attempts to

make an allowance for this relationship. This avoids the

danger inherent in marginal costing of creating the

illusion that fixed costs have nothing to do with

production.

CAPITAL BUDGETING

It involves current outlay of funds in the

expectation of a stream of benefits

extending far into the future

Year Cash flow

0 (100000)

1 30000

2 40000

3 50000

4 50000

CAPITAL BUDGETING

A capital budgeting decision is one that involves the

allocation of funds to projects that will have a life of

atleast one year and usually much longer.

Examples would include the development of a major

new product, a plant site location, or an equipment

replacement decision.

Capital budgeting decision must be approached with

great care because of the following reasons:

1. Long time period: consequences of capital expenditure

extends into the future and will have to be endured for a

longer period whether the decision is good or bad.

CAPITAL BUDGETING

2. . Substantial expenditure: it involves large

sums of money and necessitates a careful

planning and evaluation.

3. Irreversibility: the decisions are quite often

irreversible, because there is little or no second

hand market for may types of capital goods.

4. Over and under capacity: an erroneous

forecast of asset requirements can result in

serious consequences. First the equipment

must be modern and secondly it has to be of

adequate capacity

CAPITAL BUDGETING

Difficulties

There are three basic reasons why capital expenditure

decisions pose difficulties for the decision maker. These

are:

1. Uncertainty: the future business success is todays

investment decision. The future in the real world is never

known with certainty.

2. Difficult to measure in quantitative terms: Even if

benefits are certain, some might be difficult to measure

in quantitative terms.

3. Time Element: the problem of phasing properly the

availability of capital assets in order to have them come

on stream at the correct time.

CAPITAL BUDGETING

Methods of classifying investments

Independent

Dependent

Mutually exclusive

Economically independent and statistically

dependent

Investment may fall into two basic categories,

profit-maintaining and profit-adding when

viewed from the perspective of a business, or

service maintaining and service-adding when

viewed from the perspective of a government or

agency.

CAPITAL BUDGETING

Expansion and new product investment

1. Expansion of current production to meet

increased demand

2. Expansion of production into fields closely

related to current operation horizontal

integration and vertical integration.

3. Expansion of production into new fields not

associated with the current operations.

4. Research and development of new products.

CAPITAL BUDGETING

Reasons for using cash flows

Economic value of a proposed investment can be

ascertained by use of cash flows.

Use of cash flows avoids accounting ambiguities

Cash flows approach takes into account the time value

of money

For any investment project generating either expanded

revenues or cost savings for the firm, the appropriate

cash flows used in evaluating the project must be

incremental cash flow.

The computation of incremental cash flow should follow

the with and without principle rather than the before

and after principle

Types of capital investments

New unit

Expansion

Diversification

Replacement

Research & Development

Significance of capital budgeting

Huge outlay

Long term effects

Irreversibility

Problems in measuring future cash flows

Facets of project analysis

Market analysis

Technical analysis

Financial analysis

Economic analysis

Managerial analysis

Ecological analysis

Financial analysis

Cost of project

Means of finance

Cost of capital

Projected profitability

Cash flows of the projects

Project appraisal

Decision process

PLANNING PHASE

EVALUATION PHASE

SELECTION PHASE

IMPLEMENTATION PHASE

CONTROL PHASE

AUDITING PHASE

INVESTMENT OPPORTUNITIES

PROPOSALS

ONLINE PROJECTS

PROJECTS

ACCEPTED PROJECTS

PROJECT TERMINATION

PROPOSALS

I

m

p

r

o

v

e

m

e

n

t

i

n

p

l

a

n

n

i

n

g

&

E

v

a

l

u

a

t

i

o

n

p

r

o

c

e

d

u

r

e

I

m

p

r

o

v

e

m

e

n

t

i

n

p

l

a

n

n

i

n

g

&

E

v

a

l

u

a

t

i

o

n

p

r

o

c

e

d

u

r

e

N

E

W

I

N

V

E

S

T

M

E

N

T

O

P

P

O

R

T

U

N

I

T

I

E

S

Methods of capital investment

appraisal

DISCOUNTING NON-DISCOUNTING

Net present value (NPV) Pay back period

Internal rate of return

(IRR)

Accounting rate of

return

Profitability Index or

Benefit cost ratio

Present value of cash flow stream-

(cash outlay Rs.15000)@ 12%

Year Cash flow

PV factor

@12%

PV

1 1000 0.893 893

2 2000 0.799 1594

3 2000 0.712 1424

4 3000 0.636 1908

5 3000 0.567 1701

6 4000 0.507 2028

7 4000 0.452 1808

8 5000 0.404 2020

13376

Present value of cash flow stream-

(cash outlay Rs.15000 )@10%

Year Cash flow

PV factor

@10%

PV

1 2000 0.909 1818

2 2000 0.826 1652

3 2000 0.751 1502

4 3000 0.683 2049

5 3000 0.621 1863

6 4000 0.564 2256

7 4000 0.513 2052

8 5000 0.466 2330

15522

Methods of capital investment

appraisal

Solution IRR NPV

Project A 20% 309

Project B 15% 1441

These project are mutually exclusive

The IRR ranks project A higher, whereas the NPV ranks

project B first.

The conflict arises because B is ten times the size of A.

This gives a higher NPV but in relative terms it is less

profitable with a lower percentage return. Naturally, B is

preferable because it gives the greatest increase in

shareholders wealth.

Methods of capital investment

appraisal

The advantages of IRR over NPV are:

1. It gives a percentage return which is easy to

understanding at all levels of management.

2. The discount rate/required rate of return

does not have to be known to calculate IRR. It

does have to be decided upon at sometime

because IRR must be compared with something.

The discussion as to what is an acceptable rate

of return can however be left until much later

stage. In a NPV calculation the discount rate

must be specified prior to any calculation being

performed.

Methods of capital investment

appraisal

The advantages of NPV over IRR are:

1. NPV gives an absolute measure of profitability and hence

immediately shows the increase in shareholders wealth due to an

investment decision.

2. NPV gives a clear answer in an accept/reject decision. IRR

gives multiple answers.

3. NPV always gives the correct ranking for mutually exclusive

project while IRR may not.

4. NPVs of projects are additive while IRRs are not.

5. Any changes in discount rates over the life of a project can

more easily be incorporated into the NPV calculation.

The NPV approach provides as absolute measure that fully

represents in value of the company if a particular project is

undertaken. The IRR by contrast, provides a percentage figure from

which the size of the benefits in terms of wealth creation cannot

always be grasped.

The timing of the cash flows is critical for

determining the Project's value.

below the line for cash investments or

above the line for returns.

Rs.51 Lakh Rs.51 Lakh Rs.61 Lakh

Year 1 Year 2 Year 3

Rs.102 lakh

Year 0

Net Present Value

Year Cash Flow Dis. Factor Present

@10% Value

0 -102 1 -102

1 51 0.91 46.36

2 51 0.83 42.15

3 61 0.75 45.83

NPV 32.34

@27% Value

0 -102 1 -102

1 51 0.78740 40

2 51 0.62000 32

3 61 0.48818 30

NPV 0

The evaluation of any project

depends on the magnitude of the

cash flows, the timing and the

discount rate.

The discount rate is highly

subjective. The higher the rate , the

less a rupee in the future would be

worth today.

The risk of the project should

determine the discount rate.

Internal Rate of Return

(IRR)

IRR is the rate at which

the discounted cash flows

in the future equal the

value of the investment

today. To find the IRR one

must try different rates

until the NPV equals zero.

BUDGET

Quantitative expression of

management objective

Budgets and standards

Budgetary control

Cash budget

PROFIT PLANNING

Budget & budgetary control

Marginal costing

CVP and break even point

Comparative cost analysis

ROCE

PRICING DECISIONS

Full cost pricing

Conversion cost pricing

Marginal cost pricing

Market based pricing

PRICING DECISIONS

PRICING AND ITS OBJECTIVES

The objective of pricing in practice will probably

be one of the following:

(a) To skim the market (in the case of new

products) by the use of high prices;

(b) To penetrate deeply into the market (again

with new products) at an early stage, before

competition produces similar goods;

(c) To earn a particular rate of return on the

funds invested via the generating of revenue; and

(d) To make a profit on the product range as a

whole, which may involve using certain items in

the range as loss leaders, and so forth.

PRICING DECISIONS

Full cost pricing

The object is to recover all costs incurred

plus a percentage of profit. It is a method

best used where the product is clearly

differentiated and not in immediate, direct

competition. It would not lend itself to

situation where price tended to be

determined by the market,

PRICING DECISIONS

Conversion cost pricing

Conversion cost consists of direct labour

cost and factory overhead, ignoring the

cost of the raw material on the grounds

that profit should be made within the

factory and not upon materials bought

from suppliers.

PRICING DECISIONS

Marginal cost pricing

Briefly it is that cost which would not be incurred if the

production of the product were discontinued. An

important advantage of differential cost of pricing is the

flexibility it gives to meet special short-term

circumstances, while accepting that full costs must be

recovered in the long term. This is by no means always

desirable in the short term. For example, there may be

surplus productive capacity in a factory, in which case

any opportunity to accept an order which covers

differential cost and makes a contribution to fixed cost

and profit should be accepted. Any contribution is better

than none.

PRICING DECISIONS

Market based pricing

This can be based on the value to a customer of

goods or services and involves variable pricing.

It also takes account of the price he is able and

willing to pay for the goods or services.

Businesses using this approach develop special

products or services which command premium

prices.

The other market-based approach is to price on

the basis of what competitors are charging.

Operating leverage

Financial leverage

OL= amount of fixed cost in a cost

structure. Relationship between sales and

op. profit

FL= effect of financing decisions on return

to owners. Relationship between operating

profit and earning available to equity

holders (owners)

Working capital

Current assets less current liabilities = net

working capital or net current assets

Permanent working capital vs. variable

working capital

Working capital cycle

cash> Raw material > Work in progress >

finished goods > Sales > Debtors >

Cash>

Operating cycle it is a length of time

between outlay on RM /wages /others

AND inflow of cash from the sale of the

goods

Matching approach to asset financing

Fixed Assets

Permanent Current Assets

Total Assets

Fluctuating Current Assets

Time

$

Short-term

Debt

Long-term

Debt +

Equity

Capital

THE WORKING CAPITAL

CYCLE

(OPERATING CYCLE)

Accounts Payable

Cash

Raw

Materials

W I P

Finished

Goods

Value Addition

Accounts

Receivable

SALES

Operating cycle concept

A companys operating cycle typically consists of

three primary activities:

Purchasing resources,

Producing the product and

Distributing (selling) the product.

These activities create funds flows that are both

unsynchronized and uncertain.

Unsynchronized because cash disbursements (for

example, payments for resource purchases) usually take

place before cash receipts (for example collection of

receivables).

They are uncertain because future sales and costs, which

generate the respective receipts and disbursements,

cannot be forecasted with complete accuracy.

Working capital cycle Working capital cycle

Working capital

FACTORS DETERMINING WORKING CAPITAL

1. Nature of the Industry

2. Demand of Industry

3. Cash requirements

4. Nature of the Business

5. Manufacturing time

6. Volume of Sales

7. Terms of Purchase and Sales

8. Inventory Turnover

9. Business Turnover

10. Business Cycle

11. Current Assets requirements

12. Production Cycle

Working capital

Working Capital Determinants (Contd)

13. Credit control

14. Inflation or Price level changes

15. Profit planning and control

16. Repayment ability

17. Cash reserves

18. Operation efficiency

19. Change in Technology

20. Firms finance and dividend policy

21. Attitude towards Risk

TYPES OF WORKING CAPITAL

WORKING CAPITAL

BASIS OF

CONCEPT

BASIS OF

TIME

Gross

Working

Capital

Net

Working

Capital

Permanent

/ Fixed

WC

Temporary

/ Variable

WC

Regular

WC

Reserve

WC

Special

WC

Seasonal

WC

Working capital

Working Capital Levels in Different Industries

A retailing company usually has high levels of

finished goods stock and very low levels of

debtors. Most of the retailers sales will be for

cash, and an independent credit card company or

a financial subsidiary of the retail business (which

on occasions is not consolidated in the group

accounts). The retailing company, however,

usually has high levels of creditors. It pays its

suppliers after an agreed period of credit. The

levels of working capital required are therefore

low:

Working capital

Excess of current assets over current liabilities are called

the net working capital or net current assets.

Working capital is really what a part of long term finance

is locked in and used for supporting current activities.

The balance sheet definition of working capital is

meaningful only as an indication of the firms current

solvency in repaying its creditors.

When firms speak of shortage of working capital they in

fact possibly imply scarcity of cash resources.

In fund flow analysis an increase in working capital, as

conventionally defined, represents employment or

application of funds.

Working capital

In contrast, a manufacturing company will

require relatively high levels of working

capital with investments in raw materials,

work-in-progress and finished goods

stocks, and with high levels of debtors.

The credit terms offered on sales and

taken on purchases will be influenced by

the normal contractual arrangements in

the industry.

Working capital

Debtors Volume of credit sales

Length of credit given

Effective credit control and cash collection

Stocks Lead time & safety level

Variability of demand

Production cycle

No. of product lines

Volume of

planned output

actual output

sales

Payables Volume of purchases

Length of credit allowed

Length of credit taken Discounts

Short-term finance All the above

Other payments/receipts

Availability of credit Interest rates

Working capital

Cash Levels

it is necessary to prepare a cash budget where

the minimum balances needed from month to

month will be defined.

business is seasonal, cash shortages may arise in certain

periods. Generally it is thought better to keep only

sufficient cash to satisfy short-term needs, and to

borrow if longer-term requirements occur

The problem, of course, is to balance the cost of this

borrowing against any income that might be obtained

from investing the cash balances.

The size of the cash balance that a company might need

depends on the availability of other sources of funds at

short notice, the credit standing of the company and the

control of debtors and creditors

Working capital

Debtors

The debtors problem again revolves around the

choice between profitability and liquidity. It

might, for instance, be possible to increase sales

by allowing customers more time to pay, but

since this policy would reduce the companys

liquid resources it would not necessarily result in

higher Profits.

historical analysis or the use of established

credit ratings to classify groups of customers in

terms of credit risk

Working capital

1. Establish clear credit practices as a matter of

company policy.

2. Make sure that these practices are clearly

understood by staff, suppliers and customers.

3. Be professional when accepting new accounts,

and especially larger ones.

4. Check out each customer thoroughly before you

offer credit. Use credit agencies, bank

references, industry sources etc.

5. Establish credit limits for each customer... and

stick to them.

6. Have the right mental attitude to the control of

credit and make sure that it gets the priority it

deserves.

Working capital

7. Continuously review these limits when you suspect

tough times are coming or if operating in a volatile sector.

8. Keep very close to your larger customers.

9. Invoice promptly and clearly.

10. Consider charging penalties on overdue accounts.

11. Consider accepting credit /debit cards as a

payment option.

12. Monitor your debtor balances and ageing

schedules, and don't let any debts get too large or too old.

DIMENSIONS OF RECEIVABLES MANAGEMENT

OPTIMUM LEVEL OF INVESTMENT IN TRADE RECEIVABLES

Profitability

Costs &

Profitability Optimum Level

Liquidity

Stringent Liberal

Working capital-FACTORING

Factoring

Definition:

Factoring is defined as a continuing legal relationship

between a financial institution (the factor) and a

business concern (the client), selling goods or providing

services to trade customers (the customers) on open

account basis whereby the Factor purchases the clients

book debts (accounts receivables) either with or without

recourse to the client and in relation thereto controls the

credit extended to customers and administers the sales

ledgers.

Working capital-FACTORING

It is the outright purchase of credit approved

accounts receivables with the factor assuming

bad debt losses.

Factoring provides sales accounting service, use

of finance and protection against bad debts.

Factoring is a process of invoice discounting by

which a capital market agency purchases all

trade debts and offers resources against them.

Working capital-FACTORING

Debt administration:

The factor manages the sales ledger of

the client company. The client will be

saved of the administrative cost of book

keeping, invoicing, credit control and debt

collection. The factor uses his computer

system to render the sales ledger

administration services.

Working capital-FACTORING

Different kinds of factoring services

Credit Information: Factors provide credit

intelligence to their client and supply periodic

information with various customer-wise analysis.

Credit Protection: Some factors also insure

against bad debts and provide without recourse

financing.

Invoice Discounting or Financing : Factors

advance 75% to 80% against the invoice of

their clients. The clients mark a copy of the

invoice to the factors as and when they raise the

invoice on their customers.

Working capital-FACTORING

Services rendered by factor

Factor evaluated creditworthiness of the customer

(buyer of goods)

Factor fixes limits for the client (seller) which is an

aggregation of the limits fixed for each of the customer

(buyer).

Client sells goods/services.

Client assigns the debt in favour of the factor

Client notifies on the invoice a direction to the customer

to pay the invoice value of the factor.

Working capital-FACTORING

Client forwards invoice/copy to factor along with

receipted delivery challans.

Factor provides credit to client to the extent of

80% of the invoice value and also notifies to the

customer

Factor periodically follows with the customer

When the customer pays the amount of the

invoice the balance of 20% of the invoice value

is passed to the client recovering necessary

interest and other charges.

If the customer does not pay, the factor takes

recourse to the client.

Working capital-FACTORING

Benefits of factoring

The client will be relieved of the work relating to sales ledger

administration and debt collection

The client can therefore concentrate more on planning production

and sales.

The charges paid to a factor which will be marginally high at 1 to

1.5% than the bank charges will be more than compensated by

reductions in administrative expenditure.

This will also improve the current ratio of the client and

consequently his credit rating.

The subsidiaries of the various banks have been rendering the

factoring services.

The factoring service is more comprehensive in nature than the

book debt or receivable financing by the bankers.

Working capital- INVENTORY

MANAGEMENT

Managing inventory is a juggling act.

Excessive stocks can place a heavy burden on

the cash resources of a business.

Insufficient stocks can result in lost sales, delays

for customers etc.

INVENTORIES INCLUDE

RAW MATERIALS, WIP & FINISHED

GOODS

FACTORS INFLUENCING INVENTORY

MANAGEMENT

Lead Time

Cost of Holding Inventory

Material Costs

Ordering Costs

Carrying Costs

Cost of tying-up of Funds

Cost of Under stocking

Cost of Overstocking

Working capital

Cost of Working capital

The other aspect of the working capital problem

concerns obtaining short-term funds. Every source of

finance, including taking credit from suppliers, has a

cost; the point is to keep this cost to the minimum. The

cost involved in using trade credit might include

forfeiting the discount normally given for prompt

payment, or loss of goodwill through relying on this

strategy to the point of abuse. Some other sources of

short-term funds are bank credit, overdrafts and loans

from other institutions. These can be unsecured or

secured, with charges made against inventories, specific

assets or general assets.

Working capital

Disadvantages of Redundant or Excess Working Capital

Idle funds, non-profitable for business, poor ROI

Unnecessary purchasing & accumulation of inventories

over required level

Excessive debtors and defective credit policy, higher

incidence of B/D.

Overall inefficiency in the organization.

When there is excessive working capital, Credit

worthiness suffers

Due to low rate of return on investments, the market

value of shares may fall

Working capital

Disadvantages or Dangers of Inadequate or Short Working

Capital

Cant pay off its short-term liabilities in time.

Economies of scale are not possible.

Difficult for the firm to exploit favourable market

situations

Day-to-day liquidity worsens

Improper utilization the fixed assets and ROA/ROI falls

sharply

Working capital cycle

Example: X Company plans to attain a sales of Rs 5 crores. It has the following information for

production and selling activity. It is assumed that the activities are evenly spread through out the

year.

(a) Average time raw materials are kept in store prior to issue for production.2months

(b) Production cycle time or work-in-progress cycle time. 2months

(c) Average time finished stocks are kept in sale in unsold condition 1/2 months

(d) Average credit available from suppliers 1 1/2 months

(e) Average credit allowed to customer 1 1/2 months

(f) Analysis of cost plus profit for above sales:

% Rs. In Crores

Raw Materials 50 2.50

Direct Labour 20 1.00

Overheads 10 0.50

Profit 20 1.00

Total 100 5.00

-----------

Working capital cycle

Calculation of Wokring Capital Requirement:

1. Total months to be financed to Raw Material

Months

Time in raw material store 2

Working progress cycle 2

Finished goods store 1/2

Credit given to customer 1 1/2

6

Less: Credit available from suppliers 1

----------------

Total months to be financed to Raw Materials 4

----------------

2. Total months to be financed to Labour

Production cycle 2

In Finished stock store

Credit to customer 1

Total Months to be financed 4

Working capital cycle

3. Total months to be finacned to overhead

Production cycle 2

In finished goods stores

Credit to customer 1

-------------

4

Less: Credit from suppliers 1

-------------

Total months to be financed 2

4. Maximum working capital required Rs in crores

Raw Materials 4 / 12 2.50 0.94

Direct Labour 4 / 12 1.00

0.33

Overheads 2 0.50 0.10

-------

Maximum Working Capital 1.37

-------

Questions for practice

If the average annual rate of return for

common stocks is 13%, and treasury bills

is 3.8%, what is the average market risk

premium?

13.%

3.8%

9.2%

None of the above

Questions for practice

Minimum Stock Levels is calculated as:

a Re-order Level (Average Usage x Average

Lead Time)

b Re-order Level + (Average Usage +

Average Lead Time)

c Re-order Level (Average Usage + Average

Lead Time)

Questions for practice

Maximum Stock Level is calculated as:

a Re-order Level (Minimum Usage x

Minimum Lead Time) + Re-order Quantity.

b Re-order Level + (Minimum x Minimum

Lead Time) Re-order Quantity.

C Re-order Level (Minimum Usage x

Minimum Lead Time) Re-order Quantity.

Questions for practice

The formulae for Present Value is:

1/ (1 + r) to the power of n

1/ (1 r) to the power of n

1 (1 x r) to the power of n

1 (1/r) to the power of n

Questions for practice

Profitability Index Equals to

PV of cash in flow / PV of Cash out flow

PV of Initial outlay / PV of Final out lay

P I / (1 r) to the power of n

None of the above

The following is one of the method in

Discounted Cash Flow Techniques:

Pay Back Period

Average Rate of Return

Discount to Sales Ratio

Net Present Value

Questions for practice

In break even analysis, the break even point

symbolizes:

No profit and no loss situation

No profit but loss situation

No loss but profit situation

None of the above

Break even in Term Lending is a tool for appraisal.

The level of break even should be:

Higher

Lower

Any of the above

None of the above

Questions for practice

A firm has break-even point Units no. of 1000 and

fixed cost of .40,000. What is the contribution per

unit ?

30

32

36

40

Working capital management involves all but one of

the following. Identify?:

a)The level of cash needs to be on call at various dates.

b)The level of inventory we need to maintain.

c)The period of credit do we grant to our debtors.

d)Suppliers Payments.

e)Proportion of assets should be financed by long-term funds.

Questions for practice

Of the following assets, which is generally

the most liquid?

Plant and equipment

Inventory

Goodwill

Accounts receivable

Intangible fixed assets would include

Building

Machinery

Trademarks

Equipment

Questions for practice

Which of the following is not included in current assets?

Accounts receivable

Accrued wages

Cash

Inventories

The main difference between short term and long term

finance is:

The risk of long term cash flows being more important than

short term risks

The present value of long term cash flows being greater than

short term cash flows

The timing of short term cash flow being within a year or less

All of the above

Questions for practice

The cash budget is the primary short-run financial

planning tool. The key reasons a cash budget is

created are:

To estimate your investment in assets

To estimate the size and timing of your new cash flows

To prepare for potential financing needs

A and B

B and C

Cash inflow in cash budgeting comes mainly from:

Collection on accounts receivable

Short-term debt

Issue of securities

None of the above

Questions for practice

Common sources of short-term financing include:

Stretching payables

Issuing bonds

Reducing inventory

All of the above

Factoring refers to:

Determining the aging schedule of the firm's accounts

receivable

The sale of a firm's accounts receivable to another

firm

The determination of the average collection period

Scoring a customer based on the 5 C's of credit

Questions for practice

A number of steps could be taken to shorten this operating

cycle. One of them is not true . Choose it

The amount of debtors could be cut by a quicker collection of

accounts.

Finished goods could be turned over more rapidly.

The level of raw material inventory could be reduced or

The production period could be lengthened

Firms would need to hold zero cash when:

Transaction-related needs are greater than cash inflows

Transaction-related needs are less than cash inflows

Transaction-related needs are not perfectly synchronized with

cash inflows

Transaction-related needs are perfectly synchronized with cash

inflows

Questions for practice

Change in cost due to change in the volume

of activity is called -----

Fixed Cost

Variable Cost

Shutdown Cost

All of the above

Actual Sales minus Break Even Sales means

Profit on Sales

Loss on Sales

Margin of Safety Sales

None of the above

Questions for practice

The size of Cash Balance a company should maintain

should depend on:

a Sources of funds at short notice

b Credit standing of the company

c Control of debtors and creditors

d All of the above

. EOQ is calculated as:

a Square of 2AC/H where A=stock usage, C=cost of

ordering and H= Stock holding cost per unit of cost.

b Square root of 2AC/H where A = Stock usage, C= Cost

of ordering and H=Stock holding cost per unit of cost.

c Square root of AC/2H where A=Stock usage, C=Cost of

ordering and H=Stock holding cost per unit of cost.

Questions for practice

A retail Company normally has

High levels of finished goods stock

High levels of debtors

None of the above

The Tandon Working Group introduced the

concept of

Project Balance sheet

Maximum permissible Bank Finance

Current Asset Management

dCurrent Liability Management

Questions for practice

Contribution is equal to

Variable cost less fixed cost

Sales less fixed cost

Sales less semi variable cost

Sales less variable cost

Break even point can be calculated as:

Total Variable Cost / Contribution per Unit

Total Fixed Cost / Variable Cost per Unit

Total Fixed Cost / Contribution per unit

Contribution per unit / total fixed cost

Questions for practice

Master Budget Covers various

Products Budget

Functional Budget

Customer Budget

All of the above

A company manufacturing washing machines has annual

capacity for producing 5000 units. The variable cost per unit

comes to Rs.1,600/- and each machine is sold for Rs.2,000/-.

Fixed cost amount Rs.5,00,000/-. Break even point in terms

of UNITS would be

1,000 units

1,250 units

1,200 units

Questions for practice

Under Cash Budget System method of Working Capital

is determined by:

Ascertaining level of Current Assets

Ascertaining level of Current Liabilities

Finding Cash Gap after taking in account projected Cash

inflows and outflows

All of above

Which of the following investment rules does not use

the time value of the money concept?

The payback period

IRR

NPV

All above

Questions for practice

Preferably, cash flows for a project are estimated as:

Cash flows before taxes

Cash flows after taxes

Earnings before taxes

Earnings after taxes

Money that a firm has already spent or committed to

spend regardless of whether a project is taken is

called:

Sunk costs

Fixed costs

Opportunity costs

None of the above

Questions for practice

The opportunity cost of capital for a risky

project is

The expected rate of return on a government

security having the same maturity as the

project

The expected rate of return on a well

diversified portfolio of common stocks

The expected rate of return on a portfolio of

securities of similar risks as the project

None of the above

Questions for practice

The payback period rule accepts all

projects for which the payback period is

Greater than the cut-off value

Less than the cut-off value

Is positive

An integer

Your queries

ANY QUERIES MAY PLEASE BE ADDRESSED

TO

bansalsc2006@yahoo.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Petrolera Zuata Petrozuata CA. AnswerDocument8 pagesPetrolera Zuata Petrozuata CA. AnswerKelvinItemuagbor100% (1)

- Drainage Manual 6th Edition PDFDocument468 pagesDrainage Manual 6th Edition PDFDavid100% (6)

- Lesson 1 - PMP Auth Exam PrepDocument64 pagesLesson 1 - PMP Auth Exam PrepDiego Pérez Ortega100% (1)

- Capital Budgeting Maruthi SuzukiDocument55 pagesCapital Budgeting Maruthi Suzukikeerthi78% (9)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Finance Chapter 9Document36 pagesFinance Chapter 9mamarcus-1100% (2)

- Top 50 Investment Banking Interview Questions and AnswersDocument12 pagesTop 50 Investment Banking Interview Questions and AnswersPrasad SuryawanshiNo ratings yet

- Welcome To: Presentation On Module B-HRM, CAIIBDocument32 pagesWelcome To: Presentation On Module B-HRM, CAIIBRahul FouzdarNo ratings yet

- Kanatal Factsheet - The Heavenly Hill Stattion in ChambaDocument5 pagesKanatal Factsheet - The Heavenly Hill Stattion in ChambaRahul FouzdarNo ratings yet

- Carrie-StephenKing AnchorMM ExcerptDocument8 pagesCarrie-StephenKing AnchorMM ExcerptHenrique BarbozaNo ratings yet

- List of Holidays of 2013: UttrakhandDocument1 pageList of Holidays of 2013: UttrakhandRahul FouzdarNo ratings yet

- JAIIB Principles and Practices of Banking Q & ADocument13 pagesJAIIB Principles and Practices of Banking Q & ARahul FouzdarNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingRahul FouzdarNo ratings yet

- Project Report On The Degree of Pest Management in Paddy Cultivation.Document62 pagesProject Report On The Degree of Pest Management in Paddy Cultivation.Rahul Fouzdar50% (2)

- JAIIB Principles and Practices of Banking Q & ADocument13 pagesJAIIB Principles and Practices of Banking Q & ARahul FouzdarNo ratings yet

- Hospital Management 110913Document21 pagesHospital Management 110913Muhammad UsmaanNo ratings yet

- ACC 222 Practice SetDocument4 pagesACC 222 Practice SetAdam CuencaNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- PMP Formulas 01234Document12 pagesPMP Formulas 01234Waqas AhmedNo ratings yet

- Midterm 1 Cheat SheetDocument2 pagesMidterm 1 Cheat SheetAhmad AttiaNo ratings yet

- Financial Analysis AssignmentDocument5 pagesFinancial Analysis AssignmentSaifiNo ratings yet

- Vault Guide To Real Estate CareersDocument104 pagesVault Guide To Real Estate CareersAyp510No ratings yet

- CF Qs C4 (B11)Document6 pagesCF Qs C4 (B11)shah gNo ratings yet

- Ch10 PPTDocument62 pagesCh10 PPTmuhammad Adeel0% (1)

- Last AssignmentDocument27 pagesLast Assignmentsecret studentNo ratings yet

- PDD 8MW Cabulig River Minihydroelectric Power ProjectDocument51 pagesPDD 8MW Cabulig River Minihydroelectric Power Projectjaysenorin100% (1)

- Apollo Global Management, LLC August Investor PresentationDocument33 pagesApollo Global Management, LLC August Investor PresentationOkkishoreNo ratings yet

- Cbi So Model Paper 2022Document37 pagesCbi So Model Paper 2022himanshu agrawalNo ratings yet

- Top 15 Financial Functions in Excel - WallStreetMojoDocument31 pagesTop 15 Financial Functions in Excel - WallStreetMojov_u_ingle2003No ratings yet

- CA Inter FM Handbook (Revised) - CA Ganesh BharadwajDocument363 pagesCA Inter FM Handbook (Revised) - CA Ganesh BharadwajKrrishna priya s.m.No ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Solution CF Cash Flow Practice Problem 2Document12 pagesSolution CF Cash Flow Practice Problem 2Zarieq EricNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- Ceng 6301Document118 pagesCeng 6301Dawit AlemuNo ratings yet

- Strategic ManagementDocument42 pagesStrategic ManagementMd Nahiduzzaman NahidNo ratings yet

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- Mortgage MathDocument40 pagesMortgage MathAmit KumarNo ratings yet

- Factors Affecting Bidding Decisions of Company and Contemporary Bidding ModelsDocument12 pagesFactors Affecting Bidding Decisions of Company and Contemporary Bidding ModelsDebasish DeyNo ratings yet

- Financial Management Strategy FinalDocument24 pagesFinancial Management Strategy FinalsayedhossainNo ratings yet