Professional Documents

Culture Documents

A Report On Essential Banking Services Expected by

A Report On Essential Banking Services Expected by

Uploaded by

Rahul SahuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Report On Essential Banking Services Expected by

A Report On Essential Banking Services Expected by

Uploaded by

Rahul SahuCopyright:

Available Formats

Rahul kumar sahu (1101)

Harshvardhan sahi(1074)

Ram shrivastava(1017)

Rahul kumar mishra (1073)

A bank can be defined as an institution

that accepts deposits and pools those funds to

provide credit, either directly by lending, or indirectly

by investing through the capital markets.

In lay mans voice bank can be defined as a place wherein

keeping cash is safe as well as profitable and also that gives

quite a lot of services to the customers.

Savings and current a/c

Loans and advances

Cheques and drafts

Fixed deposits

Card facilities

Mobile banking and net banking

Consultancy services

Locker facility

Our area of work is defined from Firayalal chowk to Sujata

chowk.

The area has plenty of nationalized banks like bank of india,

allahabad bank, canara bank, ICICI bank, state bank of india,

axis bank, IDBI bank etc.

Also the area has a lot many number of customers belonging

to business class which help build the customer base for the

banks

Our method of study was as follows :-

1) General market survey to enquire about the customer

type, number, their behaviour, and also about the banks and

their services.

2) Personal interview from the proprietors of the

organisation to know about their actual satisfaction from

the banking services being provided to them.

3) Questionnaires

Analysis of the questionnaire

The customers are using the basic banking services

very widely.

Being an area governed by business class

customers are having a lot of current account.

Time taken by the withdrawal counter was a bit on

a higher side.

Long and tough procedure for loans.

Lesser RTGS/NEFT facility.

Clearance issue.

Services expected by customers

A gentle behaviour of staff.

Providing quick services.

Providing requisite information to customers and

guiding members of public.

Making rules and regulations simple and

understandable.

Making small loan documents and procedure

simple and fast moving.

Starting counters in time and extending services

right upto closing time.

Suggestions and conclusion

Officers and employees need to put in more effort and

time in their work.

A proper complaint redrressal system has to be there.

Particular help desk in each and every branch.

A proper distribution network of cash to help ATMs

open for 24*7.

Contd..

Creating awareness among the customers about the new

uses of banks like RTGS/NEFT, internet and mobile

banking.

Regular training programme for employees to update

their knowledge and skills to work effectively.

Thank you!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Cambridge Legal Studies HSC TextbookDocument0 pagesCambridge Legal Studies HSC TextbookCao Anh Quach100% (2)

- Letters To A Young Lawyer by DershowitzDocument225 pagesLetters To A Young Lawyer by DershowitzKent Barcenas100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Examination of Conscience For Seminarians 27th Nov 2005Document2 pagesExamination of Conscience For Seminarians 27th Nov 2005FrDylan James100% (5)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Advac Guerero Chapter 14 CompressDocument29 pagesAdvac Guerero Chapter 14 Compressnon existingNo ratings yet

- Sins Against The CommandmentsDocument5 pagesSins Against The CommandmentsBella75% (8)

- Plaintiff Elizabeth Kogucki Brief in Support of Complaint For Administrative ReviewDocument16 pagesPlaintiff Elizabeth Kogucki Brief in Support of Complaint For Administrative ReviewGregory J. Bueche100% (1)

- 12262/Csmt Duronto Ex Third Ac (3A)Document2 pages12262/Csmt Duronto Ex Third Ac (3A)Abhishek DashNo ratings yet

- Tatlong Taong Walang DiyosDocument2 pagesTatlong Taong Walang DiyosCyberVODSNo ratings yet

- App Iii Summer Midterm ExamDocument9 pagesApp Iii Summer Midterm ExamCharmaine PamintuanNo ratings yet

- Surrogacy in The PhilippinesDocument1 pageSurrogacy in The PhilippinesNadine DiamanteNo ratings yet

- Regel Gallia Corsica USA KDocument2 pagesRegel Gallia Corsica USA KRoger HarvardNo ratings yet

- Carlyle and RuskinDocument9 pagesCarlyle and RuskinAnda NeguraNo ratings yet

- Quality IssueDocument2 pagesQuality IssueethandanfordNo ratings yet

- 206-2000 SeedDocument14 pages206-2000 SeedyechaleNo ratings yet

- Ms. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phDocument26 pagesMs. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phCrisangel de LeonNo ratings yet

- GGSR G 5 The Firm and The ConsumersDocument12 pagesGGSR G 5 The Firm and The ConsumersJohn FranzNo ratings yet

- FIDIC Pink Book The MDB Harmonised Edition of The Red BookDocument6 pagesFIDIC Pink Book The MDB Harmonised Edition of The Red BookMichael A FarinNo ratings yet

- GrapeCity - Wikipedia, The Free EncyclopediaDocument7 pagesGrapeCity - Wikipedia, The Free EncyclopediaSoni SahuNo ratings yet

- Cabang vs. BasayDocument7 pagesCabang vs. BasayAlfred LacandulaNo ratings yet

- A-2 ResinDocument6 pagesA-2 Resinthehighlife1080No ratings yet

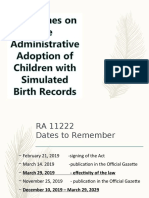

- Guidelines of RA 11222 LatestDocument52 pagesGuidelines of RA 11222 LatestAna Shiella SaavedraNo ratings yet

- Abup Emm Solution en v04 2Document21 pagesAbup Emm Solution en v04 2api-470092246No ratings yet

- Maria Imelda Manotoc Vs CADocument2 pagesMaria Imelda Manotoc Vs CAAlexylle Garsula de ConcepcionNo ratings yet

- Essay Fintech Vs Traditional Tech - Angela Putri KeziaDocument4 pagesEssay Fintech Vs Traditional Tech - Angela Putri KeziaAngela KeziaNo ratings yet

- Kyko Global Seek A Temporary Restraining Order To Enjoin Defendants Prithvi Information SolutionsDocument25 pagesKyko Global Seek A Temporary Restraining Order To Enjoin Defendants Prithvi Information SolutionsMegan FinleyNo ratings yet

- Introduction To Financial Markets and Institutions NotesDocument11 pagesIntroduction To Financial Markets and Institutions NotesFe ValenciaNo ratings yet

- FPSC 16Document2 pagesFPSC 16Zakir HussainNo ratings yet

- Socsc 1-Phil. Hist-Modules (New)Document157 pagesSocsc 1-Phil. Hist-Modules (New)april rose astreroNo ratings yet

- December 20 2013Document48 pagesDecember 20 2013fijitimescanadaNo ratings yet

- MGBMC2012 02Document7 pagesMGBMC2012 02Mark Juan Abelon100% (1)