Professional Documents

Culture Documents

Hindalco

Hindalco

Uploaded by

Abhinav PrakashOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hindalco

Hindalco

Uploaded by

Abhinav PrakashCopyright:

Available Formats

Company Profile:

Hindalco-

Metals flagship company of the Aditya Birla Group.

World's largest aluminium rolling company and one of the biggest

producers of primary aluminium in Asia.

Established in 1958, Hindalco commissioned its aluminium facility at

Renukoot in Eastern U.P. in 1962.

The acquisition of Novelis Inc. in 2007 positioned it among the top five

aluminium majors worldwide and the largest vertically integrated

aluminium company in India.

Group Companies:

-Novelis Inc

-Aditya Birla Minerals Ltd

-Hindalco-Almex Aerospace Ltd.

Product range of the company includes:

Alumina chemicals.

Aluminas and hydrates

Minerals.

Primary aluminium

Ingots.

Wire rods

Billets.

Aluminium extrusions. Aluminium rolled products. Aluminium foil

& packaging. Aluminium alloy wheels.

Copper cathodes

Continuous cast copper rods.

Other:-

Sulphuric acid.

Phosphoric acid.

Phospho gypsum.

Copper slag.

Management Information:

Kumar Birla Non-Executive Chairman of the Board

Praveen Maheshwari Chief Financial Officer

Bharat Jha Senior President - Corporate Projects & Procurement

Anil Malik Compliance Officer, Company Secretary

Debnarayan Bhattacharya Managing Director, Executive Director

Vineet Kaul Chief People Officer

Satish pai CEO of Hindalcos Aluminium Business

Registered Office: Mumbai

Major Plants:

1. Renukoot,UP

2. Renusagar, Sonbhadra,UP

3. Khanvel,Silvassa (Dadra & Nagar Haweli)

4. Bharuch, Gujarat

5. Belurmath, Howrah

6. Alupuram, Ernakulum, Kerela

7. Sambalpur,Orissa

8. Sarguja,Chattisgarh

Novelis with presence in four continents and being world leader in

aluminium rolling and recycling business was stategic acquisition for Aditya

Birla group

Due to bad management decision it suffered huge losses in 2006 and its

debt-equity ratio stood at 7.23:1

Aditya Birla Group acquired Novelis for $3.6 b

The acquisition propelled Aditya Birla Group in fortune 500 group

After merger Hindalco emerged as biggest rolled aluminium products maker

and fifth largest integrated aluminium manufacturer in the world

Major Promoters of Hindalco:

No. Name of the Shareholder

Total Shares held

Number

As a % of

grand total

1 Igh Holdings Private Limited 228,963,487 11.96

2

Turquoise Investment And Finance

Pvt Limited

99,012,468 5.17

3 Trapti Trading & Investments Pvt Ltd 93,063,124 4.86

4 Grasim Industries Ltd 54,542,475 2.85

5 Aditya Birla Nuvo Limited 33,506,337 1.75

6 Pilani Investment & Ind. Corp. Ltd. 29,185,398 1.52

7 Umang Commercial Company Ltd 26,442,761 1.38

8

Birla Institute Of Technology And

Science

21,583,090 1.13

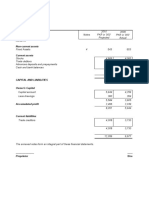

Highlights of the Notes to Financial Statements:

In case of foreign subsidiaries, being non-integral foreign operations,

revenue items are translated at the average rates prevailing during the

period. Assets, liabilities and equity are translated at the closing rate. Any

exchange difference arising on translation is recognized in the Foreign

Currency Translation Reserve.

Fixed Assets:

(a) Tangible Assets are stated at cost less accumulated depreciation and

impairment loss, if any. Cost comprises of purchase price and any directly

attributable cost of bringing the assets to its working condition for its

intended use.

(b) Intangible Assets are stated at cost less accumulated amortization and

impairment loss, if any. Cost includes any directly attributable expenditure

on making the asset ready for its intended use.

(c) Machinery spares which can be used only in connection with an item of

Tangible Asset and whose use is not of regular nature are written off over

the estimated useful life of the relevant asset.

(d) Certain directly attributable pre-operative expenses during construction

period are included under Capital Work in Progress. These expenses are

allocated to the cost of Fixed Assets when the same are ready for intended

use.

Highlights Continued.

Depreciation and Amortization:

(a) Depreciation on Tangible Fixed Assets are provided using

straight line method based on estimated useful life or on

the basis of depreciation rates prescribed under respective

local laws.

(b) Mining Rights and leasehold land are amortized over the

period of lease on straight line basis.

(c) Intangible assets are amortized over their estimated

useful lives on straight line basis.

(d) Depreciation on assets acquired under finance lease is

spread over the lease term.

Directors Message:

Mahan Coal: The Group of Ministers constituted by the Government of

India to consider environmental and developmental issues related to

coal mining etc, has recommended the granting of forest clearance by

the Ministry of Environment & Forest [MoEF] for the Mahan Coal

block on certain conditions. In this regard, further communication

from MoEF is awaited.

Expansion plans in Brazil and Asia to be completed by 2014.

Environment Protection and Pollution Control

Company is committed to sustainable development. Company is

a signatory to the Global Compact and subscribes to the

principle of triple-bottom line accountability.

A separate chapter in this report deals at length with Company''s

initiatives and commitment to environment conservation.

Recent news about Hindalco:

Hindalco manages to refinance Rs 4,700 crore from

SBI and Axis Bank for its Utkal alumina project.

FINANCIAL REPORT

ANALYSIS

Investment

Valuation

Ratio

March 2013 March 2012 Change Definition Implications

Face Value

1

1

The nominal

value or dollar

value of a

security stated by

the issuer. For

stocks, it is the

original cost of

the stock shown

on the certificate

Dividend per

share

140

155

-15

Dividend per

share (DPS) is

the total

dividends paid

out over an entire

year (including

interim

dividends but

not including

special

dividends)

divided by the

number of

outstanding

ordinary shares

issued.

Return on

Investment

Ratio

March 2013 March 2012 Change Definition Implication

Return on

net worth

0.0483

0.0672

The ratio

measures the net

profit earned on

equity

shareholders

funds. It is the

measure of

overall

profitability of a

company

Earnings per

share

8.88

11.69

The ratio

measures the

overall

profitability in

terms of per

equity share of

capital

contributed.This

is the most

widely used ratio

across industries

Solvency

Ratios

March 2013 March 2012 Change Definition Implication

Debt to

Equity Ratio

0.619

0.338

The ratio

measures the

proportion of

debt and capital

both equity and

preference in the

capital structure

of a company. It

helps in knowing

whether a

company is

relying more on

debt or capital

for financing its

assets

Interest

Coverage

Ratio

7.26 12.67

The ratio

measures the

ability of a

company to

service the

interest

obligations out

of its cash

profits. Higher

the ratio, greater

is the ability

Liquidity

Ratio

March 2013 March

2012

Change Definition Implicatio

n

Current Ratio 2.396747 1.668245

The ratio measures the

ability of a company to

discharge its day to day

obligations. A company

should possess adequate

level of current assets

over current liabilities to

be able to do so. A current

ratio of more than 1

indicates that value of

short-term assets is more

than short-term

liabilities. A current ratio

of less than 1 indicates

poor liquidity

Inventory

Holding

Period

162.84

160.19

The ratio measures the

average period for which

cash is blocked in

inventory. In other words

the ratio explains how fast

the company is able to

convert its inventory into

cash.

Liquidity

Ratio

March 2013 March 2012 Change Definition Implication

Quick Ratio

.617737

.53015

The ratio measures as

to how fast the

company is able to

meet its current

obligations as and

when they fall due.

This is also known as

acid-test ratio.

Inventory and

working capital limits

are taken out of

current assets and

current liabilities

respectively. A quick

ratio of 1: 1 is

indicates highly

solvent position

Turnover

Ratios

March 2013 March 2012 Change(%) Definition Implication

Debtors

Turnover

Ratio

21.22

19.58

0.083

It represents the

number of times

average dues

from customers

are realised.

Higher the ratio,

the better is the

position.

Overall

Efficiency

Ratio

0.46 0.58 (0.206)

It shows how

effectively the

capital employed

has helped in

revenue

generation.

Higher the ratio

greater is the

efficiency

Inventory

Turnover

Ratio

2.24

2.28

(0.01754)

The ratio

measures the

amount of

capital tied up in

raw material,

W.I.P. and

finished goods

Profitability

Ratio

March 2013 March 2012 Change Definition Implication

Gross profit

margin

0.361

0.351

This reflects the

efficiency with

which

management

produces each

unit of output. It

also indicates the

spread between

the cost of goods

sold and the

sales revenue

Operating

Profit

.975

.931

This ratio

indicates

profitability from

operating

activities. A

higher margin

implies better

sales realisation

and effective cost

control.

Profitability

Ratio

March 2013

March 2012

Change Definition Implication

Net Profit

Margin

.065

.084

The ratio is the

overall measure of

the firms ability to

earn profit per

rupee of sales. It

also establishes

relationship

between

manufacturing,

administering and

selling the

products.

Individual

cost expenses

to sale ratio

0.657

0.670

These ratios

measure the

proportion of

individual items of

cost and expense in

relation to sales.

They also assist the

analyst in cost

minimisation and

cost reduction.

Profitability

Ratio

March 2013 March 2012 Change Definition Implicatio

n

Effective Tax

Rate

18.636

20.558

The ratio measures

the actual effective

rate at which a

company pays

income tax as

against the

statutory rate

DUPONT

Analysis

4.72

6.68

RONW is a

function of Net

Profit Margin and

Net worth

Turnover. DU

PONT analysis

seeks to measure

and establish this

relationship

between the two

determinants.

Through these

ratios a firm can

devise suitable

remedies to

overcome the weak

area of overall

performance.

COMPARISION WITH A

COMPETITOR

RATIO

HINDALCO

VEDANTA

Current Ratio

2.069

1.28

Debt to equity ratio

0.61

0.99

Earnings per share

8.88

51.3

Quick ratio

0.617

0.127

RATIO

HINDALCO

VEDANTA

Operating Profit Margin

.975

.1177

Net profit margin

.0652

.1111

Effective tax rate

18.63

23.50

Dupont Analysis

4.72

28.90

You might also like

- TSLA Q4 2023 UpdateDocument32 pagesTSLA Q4 2023 UpdateSimon AlvarezNo ratings yet

- Hero Motocorp FinalDocument40 pagesHero Motocorp FinalSuraj SinghNo ratings yet

- Assignment Liquidation Lump SumDocument10 pagesAssignment Liquidation Lump SumCresenciano Malabuyoc100% (1)

- Corporate Finance ProjectDocument18 pagesCorporate Finance ProjectRohan SaxenaNo ratings yet

- Ratio Analysis Project GMR Infra LTDDocument15 pagesRatio Analysis Project GMR Infra LTDRaja SekharNo ratings yet

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Chart of Accounts Format - OdsDocument5 pagesChart of Accounts Format - OdsAnonymous PKLGaHnx100% (1)

- FM CiaDocument20 pagesFM CiaN SUDEEP 2120283No ratings yet

- Financial Modelling Case I and Case II PDFDocument4 pagesFinancial Modelling Case I and Case II PDFnewaybeyene5No ratings yet

- Working CapitalDocument31 pagesWorking CapitalHiya SanganiNo ratings yet

- Atul LTDDocument4 pagesAtul LTDFast SwiftNo ratings yet

- Project Financial Accounting For Managers PGDM 2013-2015Document11 pagesProject Financial Accounting For Managers PGDM 2013-2015minalgargNo ratings yet

- Final Ratio AnalysisDocument40 pagesFinal Ratio AnalysisShruti PatilNo ratings yet

- Financial Statement Analysis: Draft For ReviewDocument21 pagesFinancial Statement Analysis: Draft For ReviewDisha RupaniNo ratings yet

- Measuring and Evaluating Financial PerformanceDocument12 pagesMeasuring and Evaluating Financial PerformanceNishtha SisodiaNo ratings yet

- Manac I - Group 4Document14 pagesManac I - Group 4Yaswanth R K SurapureddyNo ratings yet

- Hindalco Industries Ltd000Document19 pagesHindalco Industries Ltd000Parshant Chohan100% (1)

- Analysis of Financial Statement of Tata MotorsDocument16 pagesAnalysis of Financial Statement of Tata MotorsErya modiNo ratings yet

- Mittal School of Business (Msob)Document12 pagesMittal School of Business (Msob)Aatif KhanNo ratings yet

- Financial Accounting and Reporting Analysis-Term 1: Godrej Consumer Products LimitedDocument6 pagesFinancial Accounting and Reporting Analysis-Term 1: Godrej Consumer Products LimitedNamit BaserNo ratings yet

- Financial Management Practices of Upl LimitedDocument17 pagesFinancial Management Practices of Upl LimitedSaurabh PrasadNo ratings yet

- Financial Ratio Analysis of Indus Motor Company LTDDocument40 pagesFinancial Ratio Analysis of Indus Motor Company LTDAurang ZaibNo ratings yet

- Adani AssigDocument15 pagesAdani AssigSandeep SinghNo ratings yet

- Aditya Birla Draft 1Document5 pagesAditya Birla Draft 1Vishruth KhareNo ratings yet

- Rishabh Jain - Team Project and PresentationsDocument28 pagesRishabh Jain - Team Project and PresentationsRishabh JainNo ratings yet

- Ashok LeylandDocument12 pagesAshok LeylandvenkatmatsNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Blue Star Limited: Accounting Policies Followed by The CompanyDocument8 pagesBlue Star Limited: Accounting Policies Followed by The CompanyRitika SorengNo ratings yet

- Indo-MIM Private LimitedDocument7 pagesIndo-MIM Private Limitedankityad129No ratings yet

- Asahi India Glass LimitedDocument11 pagesAsahi India Glass Limitedshristisinghania001No ratings yet

- Apollo Tyres Final)Document65 pagesApollo Tyres Final)Mitisha GaurNo ratings yet

- Icfai University: DehradunDocument8 pagesIcfai University: DehradunShankeyNo ratings yet

- Danish - FinancialDocument5 pagesDanish - FinancialAtul GirhotraNo ratings yet

- AAL Annual Report 2010-11Document54 pagesAAL Annual Report 2010-11Vinay JosephNo ratings yet

- Ace Designers-R-05042018 PDFDocument7 pagesAce Designers-R-05042018 PDFkachadaNo ratings yet

- DBL Arfy13Document184 pagesDBL Arfy13Vaibhav PrasadNo ratings yet

- Bhel Ratio AnalysisDocument9 pagesBhel Ratio Analysissumit mittalNo ratings yet

- Bharti Airtel ReportDocument39 pagesBharti Airtel ReportYatin DhallNo ratings yet

- 1Document38 pages1hajinic433No ratings yet

- Ongc Company AnalysisDocument34 pagesOngc Company AnalysisApeksha SaggarNo ratings yet

- Sfad Final Project LMS-1Document13 pagesSfad Final Project LMS-1Mansoor ArshadNo ratings yet

- Executive SummeryDocument18 pagesExecutive SummeryImtiaz RashidNo ratings yet

- FMCIA3SEM3Document66 pagesFMCIA3SEM3Rohit GoyalNo ratings yet

- Assignment On Financial Statement Analysis Berger Paints: School of Management StudiesDocument26 pagesAssignment On Financial Statement Analysis Berger Paints: School of Management StudiesAlkesh Mishra50% (2)

- Rating Report - Daikin Airconditioning India PVT LTD - August 2017Document7 pagesRating Report - Daikin Airconditioning India PVT LTD - August 2017Bhavin SagarNo ratings yet

- A Project Report On Ratio AnanlysisDocument16 pagesA Project Report On Ratio AnanlysisBinal DesaiNo ratings yet

- TCS 2010 AnalysisDocument22 pagesTCS 2010 AnalysisDilip KumarNo ratings yet

- Working Capital Management Working Capital Management: Analysis of Analysis ofDocument23 pagesWorking Capital Management Working Capital Management: Analysis of Analysis ofNitesh KumarNo ratings yet

- A Financial ReportDocument28 pagesA Financial ReportLavanya BhoirNo ratings yet

- JK Tyre Industries LTDDocument15 pagesJK Tyre Industries LTDAlex KuruvillaNo ratings yet

- Acknit Industries Limited: Summary of Rating ActionDocument7 pagesAcknit Industries Limited: Summary of Rating ActionprasanthNo ratings yet

- Financial Ratio'S of Honda Motor Corporation LTD.: Vision StatementDocument7 pagesFinancial Ratio'S of Honda Motor Corporation LTD.: Vision StatementHammad AhmadNo ratings yet

- Financial Analysis of Indigo Airlines From Lender's PerspectiveDocument12 pagesFinancial Analysis of Indigo Airlines From Lender's PerspectiveAnil Kumar Reddy100% (1)

- Case Study On AccountingDocument23 pagesCase Study On Accountingashusinghb43No ratings yet

- Subodha Accounts Term PaperDocument51 pagesSubodha Accounts Term PaperRakesh KumarNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Independent Auditor's Report To The Chief Executive Officer The Hongkong and Shanghai Banking Corporation Limited - India BranchesDocument56 pagesIndependent Auditor's Report To The Chief Executive Officer The Hongkong and Shanghai Banking Corporation Limited - India BranchesAbhinav PrakashNo ratings yet

- Annual Report 2008 09 PDFDocument48 pagesAnnual Report 2008 09 PDFAbhinav PrakashNo ratings yet

- Annual Report 2012-13 PDFDocument48 pagesAnnual Report 2012-13 PDFAbhinav PrakashNo ratings yet

- Annual Report 2011 12 PDFDocument66 pagesAnnual Report 2011 12 PDFAbhinav PrakashNo ratings yet

- Maruti Suzuki India: PrintDocument2 pagesMaruti Suzuki India: PrintAbhinav Prakash100% (1)

- PDFDocument189 pagesPDFAbhinav PrakashNo ratings yet

- Maruti Suzuki Annual Report 2014Document189 pagesMaruti Suzuki Annual Report 2014Naushad213No ratings yet

- Maruti Suzuki India: PrintDocument2 pagesMaruti Suzuki India: PrintAbhinav Prakash100% (1)

- Non Verbal CommunicationDocument19 pagesNon Verbal CommunicationAbhinav PrakashNo ratings yet

- Rules of The Game:: Please Refer To The Next Sheet 'Sectors and Companies' For The Closing PricesDocument8 pagesRules of The Game:: Please Refer To The Next Sheet 'Sectors and Companies' For The Closing PricesAbhinav PrakashNo ratings yet

- Audit of Property, Plant, and Equipment - Hahu Zone - 1622367787308Document8 pagesAudit of Property, Plant, and Equipment - Hahu Zone - 1622367787308Iam AbdiwaliNo ratings yet

- Of The Consideration Given or The Intangible Asset Received, Whichever Is Clearly EvidentDocument3 pagesOf The Consideration Given or The Intangible Asset Received, Whichever Is Clearly EvidentGabrielle OlaesNo ratings yet

- Jimma UniversityDocument37 pagesJimma Universitymubarek oumerNo ratings yet

- Monika Project ReportDocument59 pagesMonika Project ReportMonikamorya100% (1)

- Company Info - Print Financials 2Document2 pagesCompany Info - Print Financials 2Sebastian MichaelNo ratings yet

- Standard Chart of AccountsDocument4 pagesStandard Chart of AccountsMihai FildanNo ratings yet

- 2022-30 BOA TOS FinalDocument38 pages2022-30 BOA TOS Finalsara mejiaNo ratings yet

- DepreciationDocument13 pagesDepreciationHarshitPalNo ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingNumber ButNo ratings yet

- Financial StatementsDocument8 pagesFinancial Statementstrisha joy de laraNo ratings yet

- Asset Management Plant PDFDocument42 pagesAsset Management Plant PDFJose Antonio100% (1)

- Bharat Petroleum Corporation Ltd. (India) : SourceDocument6 pagesBharat Petroleum Corporation Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Accounting Concepts Multiple Choice QuestionsDocument5 pagesAccounting Concepts Multiple Choice QuestionsKudakwashe Chakona100% (1)

- Basic Accounting Summary NotesDocument13 pagesBasic Accounting Summary NotescristieNo ratings yet

- Garments Store FinancialsDocument7 pagesGarments Store Financialstmir_1No ratings yet

- Company Update: Hyundai E&CDocument11 pagesCompany Update: Hyundai E&CAnant JadhavNo ratings yet

- A14 Ipsas - 05Document13 pagesA14 Ipsas - 05Marius SteffyNo ratings yet

- Chart of Accounts For Small Business Template V 1.1Document3 pagesChart of Accounts For Small Business Template V 1.1Zubair Alam100% (1)

- CMA Part I PDFDocument173 pagesCMA Part I PDFNicolai AquinoNo ratings yet

- As-28 (Impairment of Assets)Document11 pagesAs-28 (Impairment of Assets)api-3828505100% (1)

- Financial Statement Analysis-Test BankDocument41 pagesFinancial Statement Analysis-Test BankZyad MohamedNo ratings yet

- O - MOHAMED ISMAIL MOHAMED SHARIFF v. ZAIN AZAHARI ZAINAL ABIDIN & ORSDocument17 pagesO - MOHAMED ISMAIL MOHAMED SHARIFF v. ZAIN AZAHARI ZAINAL ABIDIN & ORSJamie TehNo ratings yet

- Vsia Ip AssetsDocument56 pagesVsia Ip AssetsAbelGuilherminoNo ratings yet

- Statement of Financial Position: 1. True 6. True 2. False 7. True 3. True 8. False 4. False 9. True 5. True 10. FALSEDocument10 pagesStatement of Financial Position: 1. True 6. True 2. False 7. True 3. True 8. False 4. False 9. True 5. True 10. FALSEMcy CaniedoNo ratings yet

- 2 Abm Fabm2 12 W1 Melc 2 1BDocument8 pages2 Abm Fabm2 12 W1 Melc 2 1BRializa Caro BlanzaNo ratings yet

- Intangible AssetsDocument4 pagesIntangible AssetsMarc Eric RedondoNo ratings yet

- International Taxation Question PaperDocument7 pagesInternational Taxation Question PaperVigneshNo ratings yet