Professional Documents

Culture Documents

Companies Act

Companies Act

Uploaded by

Neel ModyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Companies Act

Companies Act

Uploaded by

Neel ModyCopyright:

Available Formats

The Companies Act

Topics covered

Characteristics of a company

Formation of a company

Types of companies

Management of a company

Meetings

Accounts and Audit

Company

Company means a company formed and

registered under the Companies Act, 2013 or

under any previous company law

Governing laws

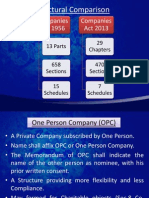

The Companies Act, 1956

The Companies Act, 2013

Rules prescribed thereunder

Important regulatory authorities under

the Companies Act

Ministry of Corporate Affairs, Central Government

Comprising Secretary, Joint Secretary, Deputy

Secretary, Director of Inspection & Investigation,

etc.

Registrar of Companies (ROC);

Regional Director;

Company Law Board (CLB) at Delhi with benches

in the north, south, east and west; and

Official Liquidator.

NCLT, NFRA and SFIO - CA 2013

4

Types of companies

Public company

Private company

One person company (CA 2013)

Limited by shares or guarantee

Unlimited company

Association not for profit

Foreign company

Government company

Holding and subsidiary company

Public Company [ Section 2 (71)]

has minimum paid-up share capital of

Rs.500,000 or such other amount as may be

prescribed.

Minimum number of members - 7

a private company which is a subsidiary of a

public company.

Private Company

Minimum paid-up share capital of Rs.100,000/- or such

higher amount as may be prescribed.

restricts right to transfer shares

Minimum number of members - 2

Maximum number of members - 200

Prohibits invitation to the public for shares

Prohibits any invitation or acceptance of deposits from

persons other than its members, directors or their

relatives.

One person company

Single person as member

Limited by shares or guarantee

Limited by shares

Liability of members is

restricted to the amount

unpaid on shares

Limited by guarantee

Undertaking to contribute

to assets of the company in

the event of winding up

etc.,

Eg: clubs, charities etc.

Unlimited company

A company not having any limit on the liability of its

members. However liability is towards company and not

towards companys creditors directly or indirectly.

8

Associations not for profit

Need not add the word Private Limited or

Limited.

Formed for promotion of commerce, art, science,

sports, education, research, social welfare,

religion, charity, protection of environment or any

such other object;

Intends to apply its profits or other income in the

promotion of its objects

Does not intend to pay any dividend

Holding and subsidiary company

A company shall be a subsidiary, if the holding

company:

controls the composition of its Board of Directors,

controls directly or together with one or more other

subsidiary companies more than half of the total share

capital

Is a subsidiary of any company which is that others

subsidiary.

Foreign Company

Company incorporated outside India having a place of

business in India

Government company

Company in which not less than 51% of the paid up

share capital is held by:

Central government (CG)

State government(s) (SG)

Partly by CG and partly by one or more SG

also includes subsidiary of a government company

Essentials for a company

Certificate of incorporation

Corporate Identification Number (CIN)

Certificate of commencement of business

Memorandum of Association

Articles of Association

Registered office

Minimum number of directors

12

Characteristics of a company

Separate legal entity

Limited liability

Perpetual succession

Separate property

Transferability of shares

Common seal

Capacity to sue and be sued

Contractual rights

Limitation of action

Separate Management

Voluntary association for profit

Created by law and hence can only be terminated by

law.

Formation of a company

Check name availability on MCA 21 portal adhere to the

name availability guidelines

Apply to Registrar of Companies (ROC) for name in

e-form 1A

In case the name includes the name of group company- NOC

is required to be obtained from the Board of directors of that

company

Prepare draft memorandum and articles of association

On receiving name availability letter from ROC, file

Eform 1- application for incorporation

Eform 18- notice of registered office

Eform 32- appointment of directors

Obtain consents from directors and requisite declaration

that they are not disqualified from being appointed as

directors under Companies Act

All formalities to be completed within 60 days of name

availability, if not apply for revalidation of the name.

ROC will approve and Corporate Identification Number

(CIN) will be generated and Certificate of Incorporation

will be issued

CIN- U17118MH1983PTC03xxxx

L12345DL1999PLCxxxxxx

15

Certificate of Incorporation

Memorandum of Association

MOA is a charter constituting the company, consisting of

six clauses namely:

Name Clause

Situation Clause

Objects Clause

Liability Clause

Capital Clause

Association Clause

Articles of Association

AOA is a document laying down the internal regulations of a

company.

17

Sources of funds

Capital

Borrowings

Share means share in the share capital of a

company and includes stock

Securities include

Shares, scrips, stocks, bonds, debentures, debenture

stock or other marketable securities of a like nature in or

of any incorporated company or other body corporate;

Derivatives

Government securities;

Such other instruments as may be declared by the Central

Government to be securities;

Rights or interest in securities.

18

Kinds of share capital

Equity

Preference

With voting

rights

With differential

rights

Cumulative

Non-

cumulative

Participating

Non-

participating

19

MODES OF ISSUE OF SHARES

20

Nature of borrowings

The borrowings may be by way of-

Debentures/ Bonds

Deposits

Loans (rupee or foreign currency), (short term or

long term)

ECB

Working capital loans

Overdraft

Commercial paper

Borrowings may be either secured or unsecured, long

term or short term, convertible and non-convertible.

Limits for Borrowings

The borrowings should not exceed the paid-

up capital of the company and its free

reserves, unless shareholders approval

obtain by special resolution in a general

meeting.

Authority to borrow

Board and shareholders resolution

Inter-Corporate Loans and

Investments

Limit for Inter-Corporate loans and

investments

Authorisation

Register

Delegation of powers by board

Exemptions

Disclosure under listing agreements and

accounting standard

Management and Administration

Board of Directors

Committee of directors Audit committee,

SIGC, Remuneration Committee,

Nomination Committee

Key Managerial Personnel

MD, Manager, WTD

CEO

CFO

Company Secretary

Directors

Maximum number of directors

Types of directors

Executive

Non- executive

Independent

Appointment of directors

First directors

Additional directors

Nominee directors

Independent directors

Compliance with Clause 49 of Listing Agreement

Retirement by rotation / Removal

Qualification and disqualifications for being a director

Duties and responsibilities of directors

Vacation of office of director

Disclosures, consents and declarations by

directors

Managerial personnel MD / WTD/

Manager

Remuneration of managerial personnel

Change in KMP

Related party transactions

26

Directors

Minimum Number of directors

Private company 2

Public company 3

Maximum

For private company- can be provided in Articles of

Association

For public company- 12 (15) directors. Company can

apply to CG to increase the number

Number of directorships 15 (20)

Meetings

Board Meetings

At least 4 meetings in a year. Gap of not more than 120

days

Quorum 1/3 of total strength or 2 directors

Video conferencing

Notice- not less than 7 days. With short notice, at least one

independent director present

Agenda

Minutes

Resolution by circulation

Chairman

Audit committee

Minimum 3 directors, majority to be

independent directors

Nomination and Remuneration Committee

Stakeholders relationship committee

Meetings of stakeholders

Annual General Meetings

Extraordinary General meetings

Creditors meetings

Court convened meetings

30

AGM (Annual general meeting)

Once a year and not more than 15 months shall elapse

between two meetings

Within 6 months of end of financial year

EGM (Extraordinary general meeting)

Quorum

Notice

Explanatory statement

Voting Rights

Equity

Preference

DVR

Voting can be by:

Show of hands

Poll

Postal ballot

Resolutions Ordinary or special

32

Accounts and Audit

Books of Accounts, financial statements-

signing, approval, inspection

Accounts should be adopted by

shareholders within 6 months of end of

financial year

Financials of subsidiary and consolidated

accounts

Directors report

Corporate Governance Report

Management Discussion and Analysis

Report as per Listing agreement

Auditors- appointment, qualification,

disqualification, removal, retirement, rights

and duties, auditors report

Persons responsible for accounts

Filing with ROC

Some important filings with ROC

Annual Return

Financial statements

Directors Report

Form 32

Form 18

Form 5

Form 2

Forms 8 and 17

Form 23B

Form 23

Form 25C

Change in promoter shareholding (new)

Restructuring

Capital restructuring Reduction of

capital

Merger and amalgamation

Acquisition

Take over

Credit debt restructuring

Financial restructuring

Demerger

Buy back

THANK YOU

You might also like

- Ebook Business in Action 10Th Global Edition PDF Full Chapter PDFDocument67 pagesEbook Business in Action 10Th Global Edition PDF Full Chapter PDFvalerie.jepko806100% (37)

- Declaration of Political StatusDocument5 pagesDeclaration of Political StatusNadah892% (12)

- Right To Travel USA BlankDocument4 pagesRight To Travel USA BlankJames Frank Ali Bey100% (20)

- Equity Research ReportDocument41 pagesEquity Research Reportumanggg70% (10)

- Governance and ManagementDocument32 pagesGovernance and ManagementShajuShaGM100% (1)

- What Is A CorporationDocument24 pagesWhat Is A CorporationMina ButtNo ratings yet

- Companys ActDocument11 pagesCompanys ActSimp MlbbNo ratings yet

- Lecture 4 Spring 15Document54 pagesLecture 4 Spring 15salmanNo ratings yet

- Business & Corporate Law: CorporationDocument88 pagesBusiness & Corporate Law: CorporationleojeeNo ratings yet

- Business StartupDocument40 pagesBusiness StartupthanhbinhvcciNo ratings yet

- One Person CompanyDocument30 pagesOne Person CompanygurudevgaytriNo ratings yet

- Companies Act 2013Document40 pagesCompanies Act 2013SAMYUKKTHHA S (RA2252001040009)No ratings yet

- Business Entities SP 21 MBADocument21 pagesBusiness Entities SP 21 MBAMimiNo ratings yet

- The Companies Act 2013 The Companies (Amendment) Act 2017 The Companies (Amendment) Act 2020Document23 pagesThe Companies Act 2013 The Companies (Amendment) Act 2017 The Companies (Amendment) Act 2020Sana RahmanNo ratings yet

- Basic Considerations of A CorporationDocument23 pagesBasic Considerations of A CorporationArmandoNo ratings yet

- ACCOUNTING FOR CORPORATIONS-Basic ConsiderationsDocument41 pagesACCOUNTING FOR CORPORATIONS-Basic ConsiderationsMarriel Fate Cullano100% (2)

- 1-10 Business Law For PrintingDocument9 pages1-10 Business Law For PrintingKamran MirzaNo ratings yet

- Companylaw NewDocument59 pagesCompanylaw NewJaan MukherjeeNo ratings yet

- Companies Act 2013Document145 pagesCompanies Act 2013rockpd100% (1)

- The Companies (Amendment) Act, 2015: Prepared by Prof. Sandeep RaskarDocument122 pagesThe Companies (Amendment) Act, 2015: Prepared by Prof. Sandeep RaskarKiruthika nagarajanNo ratings yet

- Certificate Course For Women DirectorsDocument36 pagesCertificate Course For Women DirectorsJhilik PradhanNo ratings yet

- Past Year Question Solution: JANUARI 2013Document25 pagesPast Year Question Solution: JANUARI 2013tia87No ratings yet

- Indian Companies Act1956Document30 pagesIndian Companies Act1956Srishti MadanNo ratings yet

- Indian Companies Act1956Document51 pagesIndian Companies Act1956Ayush PurohitNo ratings yet

- The Indian Companies Act, 1956Document66 pagesThe Indian Companies Act, 1956ShamayitaNo ratings yet

- Types of Business Organisation 3 8eDocument9 pagesTypes of Business Organisation 3 8elaibahundekarNo ratings yet

- Unit-IV StudentDocument68 pagesUnit-IV StudentMonish RaniNo ratings yet

- Structural Comparison: Companies Act 1956 Companies Act 2013Document52 pagesStructural Comparison: Companies Act 1956 Companies Act 2013Sudhaker PandeyNo ratings yet

- Legal Forms of Entrepreneurial OrganizationsDocument39 pagesLegal Forms of Entrepreneurial Organizationsramya sNo ratings yet

- 8&9 14 &20 SEP18 KYC DEPOSITS Accounts Opening FormalitiesDocument19 pages8&9 14 &20 SEP18 KYC DEPOSITS Accounts Opening FormalitiesMURARI PRASADNo ratings yet

- Formation of A CompanyDocument64 pagesFormation of A CompanyLim Yew TongNo ratings yet

- NF Company IncorporationDocument29 pagesNF Company Incorporationpirater.ak.47No ratings yet

- Corporate Law Module 3.1Document28 pagesCorporate Law Module 3.1Nani MadhavNo ratings yet

- Plenary 1-Session On The Companies Act 2016 and Companies RegulationsDocument48 pagesPlenary 1-Session On The Companies Act 2016 and Companies RegulationsthanaNo ratings yet

- Company LawDocument76 pagesCompany LawtoabhishekpalNo ratings yet

- Corporate GovernanceDocument17 pagesCorporate GovernanceAshhish GangulyNo ratings yet

- Constitution, Formation of Companies and Its CategoriesDocument11 pagesConstitution, Formation of Companies and Its CategoriesMuhammad Awais IkramNo ratings yet

- Company LawDocument24 pagesCompany LawHOW BING CHENNo ratings yet

- Law PPT 1Document47 pagesLaw PPT 1Sonia SharmaNo ratings yet

- One Person Company: Aditya Sharma UG 17-11Document13 pagesOne Person Company: Aditya Sharma UG 17-11Aditya sharmaNo ratings yet

- Companies Act ModifiedDocument103 pagesCompanies Act Modifiedshrabs.karNo ratings yet

- Presented By: Group 1: Aarti Singh, Azhar Hussain, Jyoti Nawlani, Nemchand Meena, Renuka SharmaDocument39 pagesPresented By: Group 1: Aarti Singh, Azhar Hussain, Jyoti Nawlani, Nemchand Meena, Renuka SharmaAmey NayakNo ratings yet

- Company Law - NewDocument137 pagesCompany Law - NewEbinAbrNo ratings yet

- Module 1 and 2Document49 pagesModule 1 and 222bba044No ratings yet

- Commercial LawDocument36 pagesCommercial Lawramyalogi86% (7)

- Company ActDocument27 pagesCompany Actaryan28614No ratings yet

- Lecture 2.3Document16 pagesLecture 2.3daniel 2futureNo ratings yet

- Clause - 49Document18 pagesClause - 49Manish AroraNo ratings yet

- Kinds of CompanyDocument17 pagesKinds of CompanyTANIYANo ratings yet

- Chapter 3 - Establishing A BusinessDocument36 pagesChapter 3 - Establishing A BusinessmdudisinothandoNo ratings yet

- Meaning & Formaton of A Company: Legal Aspects of Business (Lab) Project Presentatation 26/02/2011 Section F / Group-1Document36 pagesMeaning & Formaton of A Company: Legal Aspects of Business (Lab) Project Presentatation 26/02/2011 Section F / Group-1sharad_bajajNo ratings yet

- Management and Administration Companies ActDocument23 pagesManagement and Administration Companies ActWahid RasoolNo ratings yet

- Provisions Relating To Corporate GovernanceDocument16 pagesProvisions Relating To Corporate GovernanceNiharika ManchalNo ratings yet

- Session 2 - Overview of Entities in The DIFCDocument58 pagesSession 2 - Overview of Entities in The DIFCZviagin & CoNo ratings yet

- Incorporating A CompanyDocument35 pagesIncorporating A CompanyXiuling Grace ZhangNo ratings yet

- RCC Bar Review 2022 NotesDocument8 pagesRCC Bar Review 2022 Notesjoymiles08No ratings yet

- Types of Co HighlightedDocument60 pagesTypes of Co Highlighteddivyakarda23No ratings yet

- Principles of Company and Group Financial Statements: ABAB113 Business Accounting Semester 1 2014/2015Document17 pagesPrinciples of Company and Group Financial Statements: ABAB113 Business Accounting Semester 1 2014/2015AmalMdIsaNo ratings yet

- Chapter 3Document50 pagesChapter 3kennedyNo ratings yet

- DirectorsDocument32 pagesDirectorsNarendra WadhwaNo ratings yet

- Introduction To Companies Act 1956Document35 pagesIntroduction To Companies Act 1956Gouri ShankarNo ratings yet

- Busi Law Ch15-1Document52 pagesBusi Law Ch15-1chuacasNo ratings yet

- Fundamentals of Business and OrganizationDocument34 pagesFundamentals of Business and OrganizationNoor M Rana100% (1)

- Equity Research Fundamental and Technical Analysis and Its Impact On Stock PricesDocument82 pagesEquity Research Fundamental and Technical Analysis and Its Impact On Stock PricesNeel ModyNo ratings yet

- Bata IndiaDocument13 pagesBata IndiaNeel ModyNo ratings yet

- Balaji WafersDocument49 pagesBalaji WafersNeel ModyNo ratings yet

- Balaji WafersDocument49 pagesBalaji WafersNeel ModyNo ratings yet

- Leyson v. Office of The Ombudsman, G.R. No. 134990, April 27, 2000Document3 pagesLeyson v. Office of The Ombudsman, G.R. No. 134990, April 27, 2000heyy rommelNo ratings yet

- Chapter - Three: Business & Business EntitiesDocument18 pagesChapter - Three: Business & Business Entitiesbelay abebeNo ratings yet

- Revised Corporation CodeDocument18 pagesRevised Corporation CodeClarisse GonzalesNo ratings yet

- The Anti Dummy LawDocument6 pagesThe Anti Dummy LawEmaleth LasherNo ratings yet

- Solution Manual For Macroeconomics 7th Edition R Glenn Hubbard Anthony Patrick ObrienDocument25 pagesSolution Manual For Macroeconomics 7th Edition R Glenn Hubbard Anthony Patrick ObrienRalphLaneifrteNo ratings yet

- Retention AgreementDocument10 pagesRetention AgreementJosh MarshallNo ratings yet

- Weems Lawsuit Vs Association of Related ChurchesDocument42 pagesWeems Lawsuit Vs Association of Related ChurchesActionNewsJaxNo ratings yet

- Donina Halley vs. Printwell Inc.Document2 pagesDonina Halley vs. Printwell Inc.JermaeDelosSantosNo ratings yet

- Review Questions & Answers Macro All ChaptersDocument84 pagesReview Questions & Answers Macro All ChaptersHarjinder Pal Singh67% (3)

- Application Form V2019 1Document2 pagesApplication Form V2019 1Feili Hr&AdminNo ratings yet

- Essential Features of PartnershipsDocument2 pagesEssential Features of PartnershipsYenelyn Apistar Cambarijan100% (1)

- Financial Management Part I Quiz - 1 Name: - ScoreDocument3 pagesFinancial Management Part I Quiz - 1 Name: - Scorejeric rotasNo ratings yet

- Topical Outline Gen - Banking Law Absin EscabarteDocument28 pagesTopical Outline Gen - Banking Law Absin EscabarteJM EnguitoNo ratings yet

- SUCCESSION LAW Case DigestsDocument11 pagesSUCCESSION LAW Case Digestsione salveronNo ratings yet

- Corporations Law - Research Assessment PDFDocument12 pagesCorporations Law - Research Assessment PDFHarjit Singh MahindrooNo ratings yet

- Evangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957Document3 pagesEvangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957Marianne Hope VillasNo ratings yet

- CORP Case DigestsDocument12 pagesCORP Case DigestsFrances Lipnica PabilaneNo ratings yet

- Palacio Vs Fely Transportation (1962)Document6 pagesPalacio Vs Fely Transportation (1962)Joshua DulceNo ratings yet

- Corporation Midterm Exam 502 (2017)Document5 pagesCorporation Midterm Exam 502 (2017)Meg MagtibayNo ratings yet

- MWA Supplemental Report PDFDocument6 pagesMWA Supplemental Report PDFSoMa2022No ratings yet

- PDF Fundamental Accounting 7Th Edition David Flynn Ebook Full ChapterDocument53 pagesPDF Fundamental Accounting 7Th Edition David Flynn Ebook Full Chaptermuriel.bernier781100% (3)

- Corporation Law Digest Atty. RanadaDocument85 pagesCorporation Law Digest Atty. RanadaFederico Dipay Jr.100% (1)

- NPC Vs City of CabanatuanDocument2 pagesNPC Vs City of Cabanatuan8111 aaa 1118100% (1)

- Corporation Law DigestsDocument18 pagesCorporation Law DigestsDonnNo ratings yet

- Palting v. San Jose Petroleum Inc., 18 SCRA 924 (1966)Document31 pagesPalting v. San Jose Petroleum Inc., 18 SCRA 924 (1966)inno KalNo ratings yet

- Classes of CorporationDocument4 pagesClasses of CorporationDessa CaballeroNo ratings yet