Professional Documents

Culture Documents

Cadbury

Cadbury

Uploaded by

Anonymous dGnj3bZCopyright:

Available Formats

You might also like

- Soluz 7Document9 pagesSoluz 7Angates1100% (1)

- Manual of Corporate Governance: Theory and Practice for Scholars, Executive and Non-Executive DirectorsFrom EverandManual of Corporate Governance: Theory and Practice for Scholars, Executive and Non-Executive DirectorsNo ratings yet

- ERM CharterDocument3 pagesERM ChartertitooluwaNo ratings yet

- Sample Due Diligence Checklist - 0Document4 pagesSample Due Diligence Checklist - 0andika buzzNo ratings yet

- IBM Corporation Turnaround: Case Analysis: Strategic Management IIDocument12 pagesIBM Corporation Turnaround: Case Analysis: Strategic Management IIAnonymous dGnj3bZ100% (1)

- Doji Candlestick Pattern A Simple Candlestick Trading Strategy For Consistent Profits Kindle Edition by Erik CortezDocument6 pagesDoji Candlestick Pattern A Simple Candlestick Trading Strategy For Consistent Profits Kindle Edition by Erik CortezRodrigo OliveiraNo ratings yet

- Lecture Notes of Working Capital ManagementDocument9 pagesLecture Notes of Working Capital Managementমোঃ আশিকুর রহমান শিবলু100% (1)

- Cadbury Committee ReportDocument3 pagesCadbury Committee ReportJitendra ChauhanNo ratings yet

- Slide 3 Recommendation of Cadbury CommitteeDocument13 pagesSlide 3 Recommendation of Cadbury Committeecohen.herreraNo ratings yet

- Corporate Governance RegulationDocument33 pagesCorporate Governance RegulationSaeed Agha Ahmadzai100% (1)

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- G G C G: Uide To OOD Orporate OvernanceDocument14 pagesG G C G: Uide To OOD Orporate OvernanceE W100% (1)

- Corporate GovernanceDocument17 pagesCorporate GovernanceseematanoliNo ratings yet

- A Review of Corporate Governance in Africa: Literature, Issues and ChallengesDocument35 pagesA Review of Corporate Governance in Africa: Literature, Issues and Challengestinashe chavundukatNo ratings yet

- Corporate Governance CH.1Document123 pagesCorporate Governance CH.1Mubeen WahlaNo ratings yet

- Corporate GovernanceDocument47 pagesCorporate GovernanceShivaniNo ratings yet

- Corporate GovernanceDocument16 pagesCorporate GovernanceAli DoonNo ratings yet

- Corporate Governance in VietnamDocument69 pagesCorporate Governance in Vietnamhi_monestyNo ratings yet

- Corporate Governance AssignmwntDocument6 pagesCorporate Governance Assignmwntrutendo budaiNo ratings yet

- DR Onkar Nath IDDDocument17 pagesDR Onkar Nath IDDNikhil Jain100% (1)

- Terms of Reference: Governance ReviewDocument4 pagesTerms of Reference: Governance ReviewAlbertNo ratings yet

- Corporate Governance: Principles & TheoriesDocument23 pagesCorporate Governance: Principles & Theoriesmohamed el kadyNo ratings yet

- Corporate Governance (Final)Document26 pagesCorporate Governance (Final)Kunal K PanchalNo ratings yet

- Corporate GovernanceDocument56 pagesCorporate GovernanceHimanshu Gupta100% (2)

- The King Report On Corporate GovernanceDocument8 pagesThe King Report On Corporate GovernanceEhi OkharediaNo ratings yet

- Corporate Governance ModelsDocument11 pagesCorporate Governance ModelsNajmah Siddiqua NaazNo ratings yet

- Role of Corporate Governance in Strategic ManagementDocument9 pagesRole of Corporate Governance in Strategic ManagementMahmoud WardNo ratings yet

- Corporate GovernanceDocument7 pagesCorporate GovernancePrinceSingh198No ratings yet

- Stakeholder Relationships, Social Responsibility, and Corporate GovernanceDocument30 pagesStakeholder Relationships, Social Responsibility, and Corporate GovernanceAnnie DarkNo ratings yet

- Corporate GovernanceDocument50 pagesCorporate GovernanceMooniAwanNo ratings yet

- The Influence of Corporate Governance in Risk ManagementDocument10 pagesThe Influence of Corporate Governance in Risk Managementsharukh taraNo ratings yet

- Corporate Governance of EBLDocument18 pagesCorporate Governance of EBLAhAd SAmNo ratings yet

- Risk Management & Corporate GovernanceDocument49 pagesRisk Management & Corporate GovernanceSp OngNo ratings yet

- Company Law and Business Associations IDocument186 pagesCompany Law and Business Associations ILautechPredegreeNo ratings yet

- A Practical Guide To Corporate Governance: Experiences From The Latin American Companies CircleDocument276 pagesA Practical Guide To Corporate Governance: Experiences From The Latin American Companies CircleIFC SustainabilityNo ratings yet

- Pros and Cons of Legal Process Outsourcing and The Indian SceneDocument3 pagesPros and Cons of Legal Process Outsourcing and The Indian SceneRitesh MultaniNo ratings yet

- Corruption Bibliography 2015Document307 pagesCorruption Bibliography 2015api-290917515No ratings yet

- Corporate Governance - Christine Mallin - Chapter 7 - Socially Resposible InvestmentDocument2 pagesCorporate Governance - Christine Mallin - Chapter 7 - Socially Resposible InvestmentUzzal Sarker - উজ্জ্বল সরকার100% (2)

- Corporate Social Responsibility and Corporate Governance: Role of Context in International SettingsDocument25 pagesCorporate Social Responsibility and Corporate Governance: Role of Context in International SettingswajimmyNo ratings yet

- Corporate Governance McomDocument38 pagesCorporate Governance McomNimi100% (1)

- Corporate Governance TheoriesDocument12 pagesCorporate Governance TheoriesAnonymous aT5RX0bl0% (1)

- Corporate GovernanceDocument48 pagesCorporate GovernanceMark IlanoNo ratings yet

- Corporate Governance NotesDocument65 pagesCorporate Governance NotesayyanaNo ratings yet

- Sociology of Law and Legal Profession PDFDocument21 pagesSociology of Law and Legal Profession PDFSakshiNo ratings yet

- Corporate Governance Suggested Answer June 2014Document22 pagesCorporate Governance Suggested Answer June 2014vedikaNo ratings yet

- Company-Law-Lecture Term 2 PDFDocument75 pagesCompany-Law-Lecture Term 2 PDFSam KamNo ratings yet

- Corporate Governance and Agency TheoryDocument21 pagesCorporate Governance and Agency TheoryImran KhanNo ratings yet

- 36 Theory and Practice of Corporate GovernanceDocument36 pages36 Theory and Practice of Corporate Governancem_dattaias86% (7)

- Corporate GovernanceDocument29 pagesCorporate GovernanceAmeen83% (6)

- Corporategovernance (Ashish Kaustubh)Document20 pagesCorporategovernance (Ashish Kaustubh)VikasJambhaleNo ratings yet

- Organizational Governance: Embracing Internal Audit's RoleDocument26 pagesOrganizational Governance: Embracing Internal Audit's Rolesome_one372No ratings yet

- Need of Corporate GovernanceDocument3 pagesNeed of Corporate GovernanceAmmy k100% (1)

- Stakeholders and Sustainable Corporate Governance in NigeriaDocument154 pagesStakeholders and Sustainable Corporate Governance in NigeriabastuswitaNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernanceRajesh PaulNo ratings yet

- UniTP Green Book Enhancing University Board Governance and EffectivenessDocument132 pagesUniTP Green Book Enhancing University Board Governance and EffectivenessAzam Rashid100% (1)

- Governance in The Public SectorDocument124 pagesGovernance in The Public SectorAndy Wynne100% (1)

- How The Corporate Governance Affects Organizational Strategy: Lessons From Jordan Environment.Document15 pagesHow The Corporate Governance Affects Organizational Strategy: Lessons From Jordan Environment.IOSRjournalNo ratings yet

- Case Study Operational RiskDocument27 pagesCase Study Operational RiskDikankatla SelahleNo ratings yet

- Corporate Governance in Private Bank in BangladeshDocument80 pagesCorporate Governance in Private Bank in BangladeshShanto SaifulNo ratings yet

- Corporate Governance Failure and Its Impact On Nat PDFDocument17 pagesCorporate Governance Failure and Its Impact On Nat PDFAdeel AmeerNo ratings yet

- Governance Risk and Business EthicsDocument440 pagesGovernance Risk and Business EthicsSadiq SagheerNo ratings yet

- Corporate Governance Short NotesDocument8 pagesCorporate Governance Short NotesVivekNo ratings yet

- ABG GMC Policy 2016-17 - Management CadreDocument10 pagesABG GMC Policy 2016-17 - Management CadreAnonymous dGnj3bZNo ratings yet

- DigvijayDocument2 pagesDigvijayAnonymous dGnj3bZNo ratings yet

- KS Test PDFDocument6 pagesKS Test PDFAnonymous dGnj3bZNo ratings yet

- Form No. 11 (New) Declaration Form: T E P F S, 1952 (P - 34 & 57) & T E P S, 1995 (P - 24)Document5 pagesForm No. 11 (New) Declaration Form: T E P F S, 1952 (P - 34 & 57) & T E P S, 1995 (P - 24)Anonymous dGnj3bZNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- The Week That FINished Vol.10Document5 pagesThe Week That FINished Vol.10Anonymous dGnj3bZNo ratings yet

- Icicidirect Stockmind Scoreboard As On 05-Feb-16 For Management Development Inst, GurgaonDocument2 pagesIcicidirect Stockmind Scoreboard As On 05-Feb-16 For Management Development Inst, GurgaonAnonymous dGnj3bZNo ratings yet

- Lecture 4 (Compatibility Mode)Document26 pagesLecture 4 (Compatibility Mode)Anonymous dGnj3bZNo ratings yet

- 7 CurvesBSpline Rev 2Document53 pages7 CurvesBSpline Rev 2Anonymous dGnj3bZNo ratings yet

- L11 Hermite Bicubic Surface PatchDocument15 pagesL11 Hermite Bicubic Surface PatchAnonymous dGnj3bZNo ratings yet

- Research - Attrition RateDocument10 pagesResearch - Attrition RateAnonymous dGnj3bZNo ratings yet

- Markov Random Field Models For Directional Field and Singularity Extraction in Fingerprint ImagesDocument10 pagesMarkov Random Field Models For Directional Field and Singularity Extraction in Fingerprint ImagesAnonymous dGnj3bZNo ratings yet

- If Section: Component QTYDocument4 pagesIf Section: Component QTYAnonymous dGnj3bZNo ratings yet

- Unit 3 Job Application Letters: ContentDocument17 pagesUnit 3 Job Application Letters: ContentanaNo ratings yet

- EI Fund Transfer Intnl TT Form V3.0Document1 pageEI Fund Transfer Intnl TT Form V3.0Tosin SimeonNo ratings yet

- Tanzim H Choudhury CVDocument2 pagesTanzim H Choudhury CVt_choudhuryNo ratings yet

- IDAYNYT Monthly and Qtrly PackagesDocument21 pagesIDAYNYT Monthly and Qtrly PackagesAtelier Tech (periyar)No ratings yet

- Rmi Salinas Report Final DraftDocument62 pagesRmi Salinas Report Final Draftksmith99No ratings yet

- Leisuwash 360Document8 pagesLeisuwash 360Julian Basilio LacanlaleNo ratings yet

- Executive Recruitment in The Me Africa Amp RussiaDocument101 pagesExecutive Recruitment in The Me Africa Amp RussiaAvik SarkarNo ratings yet

- Tender No. SH/013/2017-2019 For Supply of Cleaning Materials, Detergents and DisinfectantDocument37 pagesTender No. SH/013/2017-2019 For Supply of Cleaning Materials, Detergents and DisinfectantState House Kenya100% (4)

- Rainbow CatalougeDocument5 pagesRainbow Catalougeapi-257794235No ratings yet

- Risk Assumption Letter: Mi Service Centre Co Simran EnterprisesDocument4 pagesRisk Assumption Letter: Mi Service Centre Co Simran EnterprisesHitendra chauhanNo ratings yet

- BR081410 An Intellectual Amit BhaduriDocument2 pagesBR081410 An Intellectual Amit BhaduriSwastee RanjanNo ratings yet

- MBA's Class of 2014: Amity UniversityDocument2 pagesMBA's Class of 2014: Amity UniversityAnuj HandaNo ratings yet

- Configuration TO Enterprise Structure (Fi) : WelcomeDocument50 pagesConfiguration TO Enterprise Structure (Fi) : WelcomemansurskNo ratings yet

- HP 12c Platinum Financial CalculatorDocument2 pagesHP 12c Platinum Financial CalculatorRodrigoOSGNo ratings yet

- Quiz Techno Group1 ECEEEMEDocument2 pagesQuiz Techno Group1 ECEEEMEJohn Mark BallesterosNo ratings yet

- Personal Information: Middleware & Java EngineerDocument5 pagesPersonal Information: Middleware & Java EngineerDonal GurningNo ratings yet

- Applying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFDocument6 pagesApplying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFdicksonhtsNo ratings yet

- BURGER KING Case Analysis Final PDFDocument26 pagesBURGER KING Case Analysis Final PDFdigantrayNo ratings yet

- CIDB Mediation RulesDocument28 pagesCIDB Mediation Rulesjiwais100% (1)

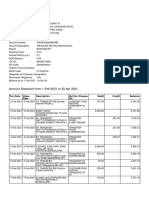

- Account Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUday AbhiNo ratings yet

- UK-US Negotions On Investment Chapter in Futrure FTADocument7 pagesUK-US Negotions On Investment Chapter in Futrure FTAbi2458No ratings yet

- Aac02 2019Document17 pagesAac02 2019Arun YadavNo ratings yet

- Asia Pacific Shopping Center Definition Standard Proposal PDFDocument18 pagesAsia Pacific Shopping Center Definition Standard Proposal PDFwitanti nur utamiNo ratings yet

- Receiving Inspection ProcedureDocument2 pagesReceiving Inspection ProcedureErwin SantosoNo ratings yet

- Part 2Document179 pagesPart 2api-253241169No ratings yet

- The Impact of Globalizationon International BusinessDocument12 pagesThe Impact of Globalizationon International Businessmoza50% (2)

- Stst3002 Op EdDocument3 pagesStst3002 Op EdEmma ChenNo ratings yet

Cadbury

Cadbury

Uploaded by

Anonymous dGnj3bZOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cadbury

Cadbury

Uploaded by

Anonymous dGnj3bZCopyright:

Available Formats

THE CADBURY REPORT ON

CORPORATE GOVERNANCE

The Cadbury Report,titled-Financial Aspects of Corporate

Governance, is a report of a board committee chaired by Adrian

Cadbury that gives out recommendations on the arrangement

of company boards and accounting systems to relieve corporate

governance risks and failures.

Thereport was published in December, 1992. The establishment of

the committee was made in May,1991 by the Financial Reporting

Council, the London Stock Exchange.

The report'srecommendations have been adopted in varying

degree by the European Union, the UnitedStates, the World Bank,

and others.

The Cadbury Committee

Sir Adrian Cadbury

Ian Butler

Jim Butler

Jonathan Charkham

Hugh Collum

Sir Ron Dearing

Andrew Likierman

Nigel Macdonald

Mike Sandland

Mark Sheldon

Sir Andrew Hugh Smith

Sir Dermot de Trafford

The Committee investigated accountability of the Board of Directors to

shareholders and to thesociety. It submitted its report and associated

"Code of Best Practices" in Dec 1992 wherein itspelt out the methods of

governance needed to achieve a balance between the essential powersof

the Board of Directors and their proper accountability

The resulting report, and associated "Code of Best Practices," published in

December 1992, wasgenerally well received. Whilst the recommendations

themselves were not mandatory, thecompanies listed on the London Stock

Exchange were required to clearly state in their accountswhether or not

the code had been followed. The companies who did not comply were

required toexplain the reasons for that.

The Cadbury Code of Best Practices had 19 recommendations. Being a

pioneering report onCorporate Governance, it would be in order to make a

brief reference to them. Therecommendations are in the nature of

guidelines relating to the Board of Directors, Non-executiveDirectors,

Executive Directors and those on Reporting & Control

Origin of the Report

The need arose for the Committee's creation was an increasing lack of

investor confidence in thehonesty and accountability of listed companies,

occasioned in particular by the sudden financialcollapses of two big

companies, Wallpaper group Coloroll and Asil Nadir's Polly

Peck Consortium: neither of these sudden failures was at all foreshadowed

in their apparently healthypublished accounts.Even as the Committee was

getting down to business, two more further scandals shook thefinancial

world: the collapse of the Bank of Credit and Commerce International and

exposure of its widespread criminal practices; and the posthumous

discovery of Robert Maxwell'sappropriation of 440m from his companies'

pension funds as the Maxwell Group filed forbankruptcy in 1992. The

shockwaves from these two incidents only increased the sense of urgency

behind the Committee's work and ensured that all eyes would be on its

eventual report

Recommendations

The Board should meet regularly, retain full and effective control over the company andmonitor

the executive management.

There should be a clearly accepted division of responsibilities at the head of a company,which will

ensure balance of power and authority, such that no individual has unfetteredpowers of decision.

In companies where the Chairman is also the Chief Executive, it isessential that there should be a

strong and independent element on the Board, with arecognized senior member.

The Board should include non-executive Directors of sufficient caliber and number for their views

to carry significant weight in the Boards decisions.

The Board should have a formal schedule of matters specifically reserved to it for decisions to

ensure that the direction and control of the company is firmly in its hands.

There should be an agreed procedure for Directors in the furtherance of their duties totake

independent professional advice if necessary, at the companys expense.

All Directors should have access to the advice and services of the Company Secretary,who is

responsible to the Board for ensuring that Board procedures are followed and thatapplicable rules

and regulations are complied with. Any question of the removal of Company Secretary should be

a matter for the Board as a whole

You might also like

- Soluz 7Document9 pagesSoluz 7Angates1100% (1)

- Manual of Corporate Governance: Theory and Practice for Scholars, Executive and Non-Executive DirectorsFrom EverandManual of Corporate Governance: Theory and Practice for Scholars, Executive and Non-Executive DirectorsNo ratings yet

- ERM CharterDocument3 pagesERM ChartertitooluwaNo ratings yet

- Sample Due Diligence Checklist - 0Document4 pagesSample Due Diligence Checklist - 0andika buzzNo ratings yet

- IBM Corporation Turnaround: Case Analysis: Strategic Management IIDocument12 pagesIBM Corporation Turnaround: Case Analysis: Strategic Management IIAnonymous dGnj3bZ100% (1)

- Doji Candlestick Pattern A Simple Candlestick Trading Strategy For Consistent Profits Kindle Edition by Erik CortezDocument6 pagesDoji Candlestick Pattern A Simple Candlestick Trading Strategy For Consistent Profits Kindle Edition by Erik CortezRodrigo OliveiraNo ratings yet

- Lecture Notes of Working Capital ManagementDocument9 pagesLecture Notes of Working Capital Managementমোঃ আশিকুর রহমান শিবলু100% (1)

- Cadbury Committee ReportDocument3 pagesCadbury Committee ReportJitendra ChauhanNo ratings yet

- Slide 3 Recommendation of Cadbury CommitteeDocument13 pagesSlide 3 Recommendation of Cadbury Committeecohen.herreraNo ratings yet

- Corporate Governance RegulationDocument33 pagesCorporate Governance RegulationSaeed Agha Ahmadzai100% (1)

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- G G C G: Uide To OOD Orporate OvernanceDocument14 pagesG G C G: Uide To OOD Orporate OvernanceE W100% (1)

- Corporate GovernanceDocument17 pagesCorporate GovernanceseematanoliNo ratings yet

- A Review of Corporate Governance in Africa: Literature, Issues and ChallengesDocument35 pagesA Review of Corporate Governance in Africa: Literature, Issues and Challengestinashe chavundukatNo ratings yet

- Corporate Governance CH.1Document123 pagesCorporate Governance CH.1Mubeen WahlaNo ratings yet

- Corporate GovernanceDocument47 pagesCorporate GovernanceShivaniNo ratings yet

- Corporate GovernanceDocument16 pagesCorporate GovernanceAli DoonNo ratings yet

- Corporate Governance in VietnamDocument69 pagesCorporate Governance in Vietnamhi_monestyNo ratings yet

- Corporate Governance AssignmwntDocument6 pagesCorporate Governance Assignmwntrutendo budaiNo ratings yet

- DR Onkar Nath IDDDocument17 pagesDR Onkar Nath IDDNikhil Jain100% (1)

- Terms of Reference: Governance ReviewDocument4 pagesTerms of Reference: Governance ReviewAlbertNo ratings yet

- Corporate Governance: Principles & TheoriesDocument23 pagesCorporate Governance: Principles & Theoriesmohamed el kadyNo ratings yet

- Corporate Governance (Final)Document26 pagesCorporate Governance (Final)Kunal K PanchalNo ratings yet

- Corporate GovernanceDocument56 pagesCorporate GovernanceHimanshu Gupta100% (2)

- The King Report On Corporate GovernanceDocument8 pagesThe King Report On Corporate GovernanceEhi OkharediaNo ratings yet

- Corporate Governance ModelsDocument11 pagesCorporate Governance ModelsNajmah Siddiqua NaazNo ratings yet

- Role of Corporate Governance in Strategic ManagementDocument9 pagesRole of Corporate Governance in Strategic ManagementMahmoud WardNo ratings yet

- Corporate GovernanceDocument7 pagesCorporate GovernancePrinceSingh198No ratings yet

- Stakeholder Relationships, Social Responsibility, and Corporate GovernanceDocument30 pagesStakeholder Relationships, Social Responsibility, and Corporate GovernanceAnnie DarkNo ratings yet

- Corporate GovernanceDocument50 pagesCorporate GovernanceMooniAwanNo ratings yet

- The Influence of Corporate Governance in Risk ManagementDocument10 pagesThe Influence of Corporate Governance in Risk Managementsharukh taraNo ratings yet

- Corporate Governance of EBLDocument18 pagesCorporate Governance of EBLAhAd SAmNo ratings yet

- Risk Management & Corporate GovernanceDocument49 pagesRisk Management & Corporate GovernanceSp OngNo ratings yet

- Company Law and Business Associations IDocument186 pagesCompany Law and Business Associations ILautechPredegreeNo ratings yet

- A Practical Guide To Corporate Governance: Experiences From The Latin American Companies CircleDocument276 pagesA Practical Guide To Corporate Governance: Experiences From The Latin American Companies CircleIFC SustainabilityNo ratings yet

- Pros and Cons of Legal Process Outsourcing and The Indian SceneDocument3 pagesPros and Cons of Legal Process Outsourcing and The Indian SceneRitesh MultaniNo ratings yet

- Corruption Bibliography 2015Document307 pagesCorruption Bibliography 2015api-290917515No ratings yet

- Corporate Governance - Christine Mallin - Chapter 7 - Socially Resposible InvestmentDocument2 pagesCorporate Governance - Christine Mallin - Chapter 7 - Socially Resposible InvestmentUzzal Sarker - উজ্জ্বল সরকার100% (2)

- Corporate Social Responsibility and Corporate Governance: Role of Context in International SettingsDocument25 pagesCorporate Social Responsibility and Corporate Governance: Role of Context in International SettingswajimmyNo ratings yet

- Corporate Governance McomDocument38 pagesCorporate Governance McomNimi100% (1)

- Corporate Governance TheoriesDocument12 pagesCorporate Governance TheoriesAnonymous aT5RX0bl0% (1)

- Corporate GovernanceDocument48 pagesCorporate GovernanceMark IlanoNo ratings yet

- Corporate Governance NotesDocument65 pagesCorporate Governance NotesayyanaNo ratings yet

- Sociology of Law and Legal Profession PDFDocument21 pagesSociology of Law and Legal Profession PDFSakshiNo ratings yet

- Corporate Governance Suggested Answer June 2014Document22 pagesCorporate Governance Suggested Answer June 2014vedikaNo ratings yet

- Company-Law-Lecture Term 2 PDFDocument75 pagesCompany-Law-Lecture Term 2 PDFSam KamNo ratings yet

- Corporate Governance and Agency TheoryDocument21 pagesCorporate Governance and Agency TheoryImran KhanNo ratings yet

- 36 Theory and Practice of Corporate GovernanceDocument36 pages36 Theory and Practice of Corporate Governancem_dattaias86% (7)

- Corporate GovernanceDocument29 pagesCorporate GovernanceAmeen83% (6)

- Corporategovernance (Ashish Kaustubh)Document20 pagesCorporategovernance (Ashish Kaustubh)VikasJambhaleNo ratings yet

- Organizational Governance: Embracing Internal Audit's RoleDocument26 pagesOrganizational Governance: Embracing Internal Audit's Rolesome_one372No ratings yet

- Need of Corporate GovernanceDocument3 pagesNeed of Corporate GovernanceAmmy k100% (1)

- Stakeholders and Sustainable Corporate Governance in NigeriaDocument154 pagesStakeholders and Sustainable Corporate Governance in NigeriabastuswitaNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernanceRajesh PaulNo ratings yet

- UniTP Green Book Enhancing University Board Governance and EffectivenessDocument132 pagesUniTP Green Book Enhancing University Board Governance and EffectivenessAzam Rashid100% (1)

- Governance in The Public SectorDocument124 pagesGovernance in The Public SectorAndy Wynne100% (1)

- How The Corporate Governance Affects Organizational Strategy: Lessons From Jordan Environment.Document15 pagesHow The Corporate Governance Affects Organizational Strategy: Lessons From Jordan Environment.IOSRjournalNo ratings yet

- Case Study Operational RiskDocument27 pagesCase Study Operational RiskDikankatla SelahleNo ratings yet

- Corporate Governance in Private Bank in BangladeshDocument80 pagesCorporate Governance in Private Bank in BangladeshShanto SaifulNo ratings yet

- Corporate Governance Failure and Its Impact On Nat PDFDocument17 pagesCorporate Governance Failure and Its Impact On Nat PDFAdeel AmeerNo ratings yet

- Governance Risk and Business EthicsDocument440 pagesGovernance Risk and Business EthicsSadiq SagheerNo ratings yet

- Corporate Governance Short NotesDocument8 pagesCorporate Governance Short NotesVivekNo ratings yet

- ABG GMC Policy 2016-17 - Management CadreDocument10 pagesABG GMC Policy 2016-17 - Management CadreAnonymous dGnj3bZNo ratings yet

- DigvijayDocument2 pagesDigvijayAnonymous dGnj3bZNo ratings yet

- KS Test PDFDocument6 pagesKS Test PDFAnonymous dGnj3bZNo ratings yet

- Form No. 11 (New) Declaration Form: T E P F S, 1952 (P - 34 & 57) & T E P S, 1995 (P - 24)Document5 pagesForm No. 11 (New) Declaration Form: T E P F S, 1952 (P - 34 & 57) & T E P S, 1995 (P - 24)Anonymous dGnj3bZNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- The Week That FINished Vol.10Document5 pagesThe Week That FINished Vol.10Anonymous dGnj3bZNo ratings yet

- Icicidirect Stockmind Scoreboard As On 05-Feb-16 For Management Development Inst, GurgaonDocument2 pagesIcicidirect Stockmind Scoreboard As On 05-Feb-16 For Management Development Inst, GurgaonAnonymous dGnj3bZNo ratings yet

- Lecture 4 (Compatibility Mode)Document26 pagesLecture 4 (Compatibility Mode)Anonymous dGnj3bZNo ratings yet

- 7 CurvesBSpline Rev 2Document53 pages7 CurvesBSpline Rev 2Anonymous dGnj3bZNo ratings yet

- L11 Hermite Bicubic Surface PatchDocument15 pagesL11 Hermite Bicubic Surface PatchAnonymous dGnj3bZNo ratings yet

- Research - Attrition RateDocument10 pagesResearch - Attrition RateAnonymous dGnj3bZNo ratings yet

- Markov Random Field Models For Directional Field and Singularity Extraction in Fingerprint ImagesDocument10 pagesMarkov Random Field Models For Directional Field and Singularity Extraction in Fingerprint ImagesAnonymous dGnj3bZNo ratings yet

- If Section: Component QTYDocument4 pagesIf Section: Component QTYAnonymous dGnj3bZNo ratings yet

- Unit 3 Job Application Letters: ContentDocument17 pagesUnit 3 Job Application Letters: ContentanaNo ratings yet

- EI Fund Transfer Intnl TT Form V3.0Document1 pageEI Fund Transfer Intnl TT Form V3.0Tosin SimeonNo ratings yet

- Tanzim H Choudhury CVDocument2 pagesTanzim H Choudhury CVt_choudhuryNo ratings yet

- IDAYNYT Monthly and Qtrly PackagesDocument21 pagesIDAYNYT Monthly and Qtrly PackagesAtelier Tech (periyar)No ratings yet

- Rmi Salinas Report Final DraftDocument62 pagesRmi Salinas Report Final Draftksmith99No ratings yet

- Leisuwash 360Document8 pagesLeisuwash 360Julian Basilio LacanlaleNo ratings yet

- Executive Recruitment in The Me Africa Amp RussiaDocument101 pagesExecutive Recruitment in The Me Africa Amp RussiaAvik SarkarNo ratings yet

- Tender No. SH/013/2017-2019 For Supply of Cleaning Materials, Detergents and DisinfectantDocument37 pagesTender No. SH/013/2017-2019 For Supply of Cleaning Materials, Detergents and DisinfectantState House Kenya100% (4)

- Rainbow CatalougeDocument5 pagesRainbow Catalougeapi-257794235No ratings yet

- Risk Assumption Letter: Mi Service Centre Co Simran EnterprisesDocument4 pagesRisk Assumption Letter: Mi Service Centre Co Simran EnterprisesHitendra chauhanNo ratings yet

- BR081410 An Intellectual Amit BhaduriDocument2 pagesBR081410 An Intellectual Amit BhaduriSwastee RanjanNo ratings yet

- MBA's Class of 2014: Amity UniversityDocument2 pagesMBA's Class of 2014: Amity UniversityAnuj HandaNo ratings yet

- Configuration TO Enterprise Structure (Fi) : WelcomeDocument50 pagesConfiguration TO Enterprise Structure (Fi) : WelcomemansurskNo ratings yet

- HP 12c Platinum Financial CalculatorDocument2 pagesHP 12c Platinum Financial CalculatorRodrigoOSGNo ratings yet

- Quiz Techno Group1 ECEEEMEDocument2 pagesQuiz Techno Group1 ECEEEMEJohn Mark BallesterosNo ratings yet

- Personal Information: Middleware & Java EngineerDocument5 pagesPersonal Information: Middleware & Java EngineerDonal GurningNo ratings yet

- Applying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFDocument6 pagesApplying Innovation Resistance Theory To Understand User Acceptance of Online Shopping PDFdicksonhtsNo ratings yet

- BURGER KING Case Analysis Final PDFDocument26 pagesBURGER KING Case Analysis Final PDFdigantrayNo ratings yet

- CIDB Mediation RulesDocument28 pagesCIDB Mediation Rulesjiwais100% (1)

- Account Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUday AbhiNo ratings yet

- UK-US Negotions On Investment Chapter in Futrure FTADocument7 pagesUK-US Negotions On Investment Chapter in Futrure FTAbi2458No ratings yet

- Aac02 2019Document17 pagesAac02 2019Arun YadavNo ratings yet

- Asia Pacific Shopping Center Definition Standard Proposal PDFDocument18 pagesAsia Pacific Shopping Center Definition Standard Proposal PDFwitanti nur utamiNo ratings yet

- Receiving Inspection ProcedureDocument2 pagesReceiving Inspection ProcedureErwin SantosoNo ratings yet

- Part 2Document179 pagesPart 2api-253241169No ratings yet

- The Impact of Globalizationon International BusinessDocument12 pagesThe Impact of Globalizationon International Businessmoza50% (2)

- Stst3002 Op EdDocument3 pagesStst3002 Op EdEmma ChenNo ratings yet