Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

128 viewsSPD Airbus

SPD Airbus

Uploaded by

Emy Ann OommenThis document traces the history and strategies of Airbus from its founding in the 1970s to the present. It discusses how Airbus grew from a small startup under Bernard Lathiere in the 1970s-1980s to gaining more market share under Jean Pearson in the 1985-1998 period. By 1998 under Noel Forgeard, Airbus restructured as a company and increased its global market share to 53%. However, Airbus now faces increased competition from Boeing's new Dreamliner and economic challenges. The document performs SWOT and Porter's Five Forces analyses of Airbus and raises questions about what strategies Airbus should adopt to maintain its competitive position.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Solution Manual Global Strategy 2nd Edition PengDocument12 pagesSolution Manual Global Strategy 2nd Edition PengJessica SuryaNo ratings yet

- Consultancy Report On Organisational StrategyDocument24 pagesConsultancy Report On Organisational StrategyHorizonv4No ratings yet

- Maui and The Sun PowerPointDocument18 pagesMaui and The Sun PowerPointCarla Holtzhausen100% (1)

- FINAL Boeing Case Study (Group 4) 26042014Document29 pagesFINAL Boeing Case Study (Group 4) 26042014Amey WarudeNo ratings yet

- Case Study On Castrol India LTDDocument12 pagesCase Study On Castrol India LTDRohit0% (1)

- The Rise of AirbusDocument16 pagesThe Rise of AirbussatyaprabhuNo ratings yet

- SM Group2Document10 pagesSM Group2Arshiya SinghNo ratings yet

- Airbus - From Challenger To Leader Case StudyDocument29 pagesAirbus - From Challenger To Leader Case StudyAddie HumaizieNo ratings yet

- Ford PresentationDocument47 pagesFord PresentationSam Khan KhattakNo ratings yet

- One FordDocument47 pagesOne FordDin Aziz100% (1)

- FordDocument27 pagesFordSara MujawarNo ratings yet

- Boeing vs. AirbusDocument17 pagesBoeing vs. AirbusInez Rosario Amante50% (2)

- Business Growth and StrategyDocument28 pagesBusiness Growth and StrategyImran UmarNo ratings yet

- Lecture 2 - Five Forces Model - WebDocument8 pagesLecture 2 - Five Forces Model - WebZSNo ratings yet

- Proposal by at Kearney2Document43 pagesProposal by at Kearney2Wilson PintoNo ratings yet

- Case Study Analysis Commercial Airline Industry: Airbus & BoeingDocument17 pagesCase Study Analysis Commercial Airline Industry: Airbus & BoeingShone ThattilNo ratings yet

- Analysing The Environment Part OneDocument7 pagesAnalysing The Environment Part Onealeenz0784No ratings yet

- Umer Daraz (63848) Assignment 4Document3 pagesUmer Daraz (63848) Assignment 4Umer KhanNo ratings yet

- Strategic Management: Pavan Gadade Sachin ChavanDocument27 pagesStrategic Management: Pavan Gadade Sachin ChavanahmedrefeatNo ratings yet

- Strengths Weaknesses: Strength Weight Ratin WeightedDocument3 pagesStrengths Weaknesses: Strength Weight Ratin WeightedAsad JalalNo ratings yet

- Pestswot BCG RestDocument27 pagesPestswot BCG Restcoolman604No ratings yet

- 8 Case Notes 3MDocument20 pages8 Case Notes 3MjielahiNo ratings yet

- Boeing 7e7Document7 pagesBoeing 7e7kaye100% (2)

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Test BankDocument19 pagesStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Test Bankdammar.jealousgvg6100% (24)

- External I - SampleDocument2 pagesExternal I - SampleMohamadSammanNo ratings yet

- Airbus SM (13dec)Document21 pagesAirbus SM (13dec)Naveen VananNo ratings yet

- Case Study On Castrol India Ltd.Document12 pagesCase Study On Castrol India Ltd.Chandrakala Yadav100% (2)

- Chapter 7 External Economies of Scale and The International Location of ProductionDocument10 pagesChapter 7 External Economies of Scale and The International Location of ProductionMianda Institute100% (1)

- CaterpillarTractor 1985 Spring2008 PadresDocument15 pagesCaterpillarTractor 1985 Spring2008 PadresEmie JinelsaNo ratings yet

- Techniques of Environmental ScanningDocument18 pagesTechniques of Environmental Scanningvinay sainiNo ratings yet

- Ford Motor Company, 2015: Nueva Vizcaya State UniversityDocument6 pagesFord Motor Company, 2015: Nueva Vizcaya State UniversityJoshNo ratings yet

- Operations Management: Chapter 2 - Operations Strategy in A Global EnvironmentDocument20 pagesOperations Management: Chapter 2 - Operations Strategy in A Global Environmentjomaguro1783No ratings yet

- SM2 FinA1 Grp6 BoeingDocument11 pagesSM2 FinA1 Grp6 Boeingabhi2shek2003100% (1)

- Final Airbus Finance Report - ShivaniDocument30 pagesFinal Airbus Finance Report - ShivaniShivani ShivaprasadNo ratings yet

- Ford PresentationDocument47 pagesFord PresentationDIEGONo ratings yet

- Fashion Marketing Strategies: AssignmentDocument11 pagesFashion Marketing Strategies: AssignmentShweta SinghNo ratings yet

- Haier Global in 2010Document13 pagesHaier Global in 2010nesninisNo ratings yet

- Industry Life Cycle StagesDocument7 pagesIndustry Life Cycle StagesUmar ButtNo ratings yet

- GE MatrixDocument35 pagesGE MatrixPriya SinghNo ratings yet

- Airbag Industry ReportDocument8 pagesAirbag Industry ReportSuresh Srinivasan100% (1)

- Toyota Case StudyDocument3 pagesToyota Case StudybasantsahooNo ratings yet

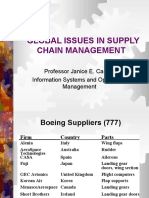

- Global Issues in Supply Chain Management: Professor Janice E. Carrillo Information Systems and Operations ManagementDocument38 pagesGlobal Issues in Supply Chain Management: Professor Janice E. Carrillo Information Systems and Operations Managementaditya_karnik_2No ratings yet

- CBM GroupDocument8 pagesCBM GroupFrances Nicole SegundoNo ratings yet

- Assignment FinalDocument7 pagesAssignment FinalelizabethNo ratings yet

- Chapter 2Document33 pagesChapter 2Sumitr NouhriaNo ratings yet

- S W O T and Porters Five ForcesDocument7 pagesS W O T and Porters Five ForcesBhoneMyint SanNo ratings yet

- Michelin CaseDocument13 pagesMichelin CaseIonut BurlusiNo ratings yet

- Strategic Management: Life-Cycle StrategiesDocument7 pagesStrategic Management: Life-Cycle StrategiesSyedAshirBukhariNo ratings yet

- Define The Problem Formulate Alternative Courses of Action Evaluate The Alternatives Choose and Recommend A Course of ActionDocument26 pagesDefine The Problem Formulate Alternative Courses of Action Evaluate The Alternatives Choose and Recommend A Course of ActionAnam ShoaibNo ratings yet

- Race World: For TheDocument17 pagesRace World: For TheSaras AgrawalNo ratings yet

- International Strategy: Pendahuluan/overviewDocument41 pagesInternational Strategy: Pendahuluan/overviewFajar ChrisNo ratings yet

- External Analysis Boeing Assignment Final 2Document7 pagesExternal Analysis Boeing Assignment Final 2Himmie Eugene LangfordNo ratings yet

- Strategy Course NotesDocument18 pagesStrategy Course Notesjosh_nsit8368No ratings yet

- Strategic ManagementDocument27 pagesStrategic ManagementSantosh ChourpagarNo ratings yet

- GilletteDocument15 pagesGilletteVarun TyagiNo ratings yet

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideFrom EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideNo ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- Beating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsFrom EverandBeating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsNo ratings yet

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- OlatheNorth DaMo Aff 01 - Washburn Rural Round 2Document25 pagesOlatheNorth DaMo Aff 01 - Washburn Rural Round 2EmronNo ratings yet

- Presentation of Engineering InformationDocument5 pagesPresentation of Engineering InformationDinesh SilvaNo ratings yet

- Savemyexams Igcse Biology Photosynthesis and Leaf Structure WorksheetDocument34 pagesSavemyexams Igcse Biology Photosynthesis and Leaf Structure WorksheetkatisspeedNo ratings yet

- Multi Inverter 4TXM6530A-SUB-1GDocument4 pagesMulti Inverter 4TXM6530A-SUB-1GOmar PiñaNo ratings yet

- Mark Elsdon - Hidden Gems Mentalism EditionDocument32 pagesMark Elsdon - Hidden Gems Mentalism EditiongauthieralNo ratings yet

- How To Become A Super Learner by Jim Kwik Workbook NSPDocument11 pagesHow To Become A Super Learner by Jim Kwik Workbook NSPmark50% (6)

- Materials Handling: in ConstructionDocument41 pagesMaterials Handling: in ConstructionSatya NaiduNo ratings yet

- US April'23 PAKET BDocument12 pagesUS April'23 PAKET BProject P2BanjaranNo ratings yet

- Project Brief - Biometrio Earth - FinalDocument3 pagesProject Brief - Biometrio Earth - FinalMarcel JonathanNo ratings yet

- Surfaces Overview: Open Nozzle - SLDPRTDocument10 pagesSurfaces Overview: Open Nozzle - SLDPRTdhaNo ratings yet

- Practice Test 2-8: Tudent EgreeDocument5 pagesPractice Test 2-8: Tudent EgreeThùy LinhNo ratings yet

- CV Updated 3-27-2020Document6 pagesCV Updated 3-27-2020api-490052612No ratings yet

- A Detailed Study On Loss Processes in Solar CellsDocument11 pagesA Detailed Study On Loss Processes in Solar CellsFernando DiasNo ratings yet

- Company Profile of Pama PersadaDocument2 pagesCompany Profile of Pama PersadairsyadjamaludinNo ratings yet

- Retail Management Final ExamDocument17 pagesRetail Management Final ExamAkhilesh JadhavNo ratings yet

- Data Protection Policy EnglishEWDocument8 pagesData Protection Policy EnglishEWAnkurNo ratings yet

- Roles and Characteristics of Problem Solving in The Mathematics Curriculum: A ReviewDocument19 pagesRoles and Characteristics of Problem Solving in The Mathematics Curriculum: A ReviewSarahNo ratings yet

- Climate DLLDocument2 pagesClimate DLLlucky may100% (1)

- COMPUTER ARCHITECTURE AND ORGANIZATION 11th Feb 2024Document4 pagesCOMPUTER ARCHITECTURE AND ORGANIZATION 11th Feb 2024Ddamulira CharlesNo ratings yet

- BCG Large-Project ManagementDocument17 pagesBCG Large-Project ManagementReyLeonNo ratings yet

- Kubernetes Deploy Mysql Spring Rest Api React Native App InstructionsDocument7 pagesKubernetes Deploy Mysql Spring Rest Api React Native App InstructionsJean Claude OnanaNo ratings yet

- Buthaina AlmamariDocument3 pagesButhaina Almamaributhin7heartNo ratings yet

- Dump Valves: DVU SeriesDocument2 pagesDump Valves: DVU SeriesalopezvillavicencioNo ratings yet

- Figure Skating Spirals in CompetitionDocument2 pagesFigure Skating Spirals in CompetitionAlexandra PurcaroiuNo ratings yet

- 3:3Document15 pages3:3Nicholas CemenenkoffNo ratings yet

- Assessing The Nature of Soil AcidityDocument8 pagesAssessing The Nature of Soil AcidityPartha DebRoyNo ratings yet

- Gallbladder Mucocele A ReviewDocument6 pagesGallbladder Mucocele A ReviewThaís ChouinNo ratings yet

- List of DictionariesDocument38 pagesList of DictionariesSaraPhoenixNo ratings yet

- Tower Crane AccidentDocument37 pagesTower Crane Accidentparawansa muisNo ratings yet

SPD Airbus

SPD Airbus

Uploaded by

Emy Ann Oommen0 ratings0% found this document useful (0 votes)

128 views16 pagesThis document traces the history and strategies of Airbus from its founding in the 1970s to the present. It discusses how Airbus grew from a small startup under Bernard Lathiere in the 1970s-1980s to gaining more market share under Jean Pearson in the 1985-1998 period. By 1998 under Noel Forgeard, Airbus restructured as a company and increased its global market share to 53%. However, Airbus now faces increased competition from Boeing's new Dreamliner and economic challenges. The document performs SWOT and Porter's Five Forces analyses of Airbus and raises questions about what strategies Airbus should adopt to maintain its competitive position.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document traces the history and strategies of Airbus from its founding in the 1970s to the present. It discusses how Airbus grew from a small startup under Bernard Lathiere in the 1970s-1980s to gaining more market share under Jean Pearson in the 1985-1998 period. By 1998 under Noel Forgeard, Airbus restructured as a company and increased its global market share to 53%. However, Airbus now faces increased competition from Boeing's new Dreamliner and economic challenges. The document performs SWOT and Porter's Five Forces analyses of Airbus and raises questions about what strategies Airbus should adopt to maintain its competitive position.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

128 views16 pagesSPD Airbus

SPD Airbus

Uploaded by

Emy Ann OommenThis document traces the history and strategies of Airbus from its founding in the 1970s to the present. It discusses how Airbus grew from a small startup under Bernard Lathiere in the 1970s-1980s to gaining more market share under Jean Pearson in the 1985-1998 period. By 1998 under Noel Forgeard, Airbus restructured as a company and increased its global market share to 53%. However, Airbus now faces increased competition from Boeing's new Dreamliner and economic challenges. The document performs SWOT and Porter's Five Forces analyses of Airbus and raises questions about what strategies Airbus should adopt to maintain its competitive position.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 16

Introduction

A journey from Infancy to Growth to Maturity

Historical Journey

Problems of 1970s

Strategies of Bernard Lathiere (1975 1985)

Strategies of Jean Pearson (1985 1998)

Strategies of Noel Forgeard (1998 2005)

Current Problems

Commercial Aircraft Industry

Enormous risks

1980s four companies (Boeing, McDonnell Douglas,

Airbus and Lockheed)

1990s Duopoly (Boeing and Airbus)

High Development costs (at least 300 to 400 planes)

Complex technology

Material innovations

Need of Government support

Deregulation (allowing smaller short distance

aircrafts)

Problems of 1970s

After WWII

Coming together of Governments

Development of A300

Decline of Sales (Total no of planes ordered for 4 years

20)

Establishing Consortium

France's

Aerospatiale

48% Germany's

Deutsche Airbus

48%

Spain's CASA

5%

Airbus in BCG Matrix - 1970

Cash Cows Dogs

Stars Question

Marks

Industry

Growth

Rate

Relative Market

Share

HIGH

LOW

LOW

Airbus

Infancy Bernard Lathiere (1975 1985)

Low Sales (only 1 in 1975)

Lathieres winning Strategy 3 Pillars

Family of Planes

Technological Leadership and Decentralized Production

Global Sales Strategy

Downside of Lathieres Strategies

Airbus in BCG Matrix - 1985

Cash Cows Dogs

Stars Question mark

Industry

Growth

Rate

Relative Market

Share

HIGH

LOW

LOW

Airbus

Growth Jean Pierson (1985 1998)

Internal Measures

Product Development

Cost Cutting (Lean Manufacturing)

External Measures

Sales Strategy (American Rivalry)

Subsidies (Bilateral agreement with Boeing)

37% Market Share

Airbus in BCG Matrix - 1998

Cash Cows Dogs

Stars Question mark

Industry

Growth

Rate

Relative Market

Share

HIGH

LOW

LOW

Airbus

Maturity Noel Forgeard (1998 2005)

Restructuring Airbus Ownership

Consortium to Company

Diversification in defense products

Globalization (Supply Chain)

Marketing Strategies (53% Market Share)

Favourable Financial Performance

France's

Aerospatiale

48%

Germany's

Deutsche Airbus

48%

Spain's CASA

4%

British Aerospace

20%

Airbus in BCG Matrix - 1998

Cash Cows Dogs

Stars Question mark

Industry

Growth

Rate

Relative Market

Share

HIGH

LOW

LOW

Airbus

Porters Five Forces Analysis

No close Substitutes

No supplier pressure

Competition

1. Boeings B-787 Dreamliner

2. Boeings case with the WTO

on Government Loans

Buyers power

Deregulation in market

Reduced demand for

Jumbo carriers

No new entrants

SWOT Analysis

Strengths

Technology Leadership

Lean Manufacturing (Global Supply Chain)

Ownership of company

Diverse products

Strategic Alliances

Strong Marketing support

Weakness

Lack of adaptability to changing environment (failure of

A350)

SWOT Analysis (Contd.)

Opportunities

Low cost mid sized planes segment

Threats

Stiff competition from Boeing (B787 Dreamliner)

Political Lobbying by Boeing (case in WTO and Airbus

Accord in US Govt)

High development cost

Decline in the value of Dollar

Decline in demand for Jumbo Carriers

Increase in Fuel Prices

Recession and decline in use of air travel

Decline in Competitive edge in Airbus

Questions to be answered

Should Airbus implement its past CEOs strategy in

order to increase its competitive position?

Should some earlier policies and strategies be revised

and modified?

Should new strategies be formed to tackle this

downturn and Boeings competition to stay in Star

position? If yes, what are they?

Thank You!!

You might also like

- Solution Manual Global Strategy 2nd Edition PengDocument12 pagesSolution Manual Global Strategy 2nd Edition PengJessica SuryaNo ratings yet

- Consultancy Report On Organisational StrategyDocument24 pagesConsultancy Report On Organisational StrategyHorizonv4No ratings yet

- Maui and The Sun PowerPointDocument18 pagesMaui and The Sun PowerPointCarla Holtzhausen100% (1)

- FINAL Boeing Case Study (Group 4) 26042014Document29 pagesFINAL Boeing Case Study (Group 4) 26042014Amey WarudeNo ratings yet

- Case Study On Castrol India LTDDocument12 pagesCase Study On Castrol India LTDRohit0% (1)

- The Rise of AirbusDocument16 pagesThe Rise of AirbussatyaprabhuNo ratings yet

- SM Group2Document10 pagesSM Group2Arshiya SinghNo ratings yet

- Airbus - From Challenger To Leader Case StudyDocument29 pagesAirbus - From Challenger To Leader Case StudyAddie HumaizieNo ratings yet

- Ford PresentationDocument47 pagesFord PresentationSam Khan KhattakNo ratings yet

- One FordDocument47 pagesOne FordDin Aziz100% (1)

- FordDocument27 pagesFordSara MujawarNo ratings yet

- Boeing vs. AirbusDocument17 pagesBoeing vs. AirbusInez Rosario Amante50% (2)

- Business Growth and StrategyDocument28 pagesBusiness Growth and StrategyImran UmarNo ratings yet

- Lecture 2 - Five Forces Model - WebDocument8 pagesLecture 2 - Five Forces Model - WebZSNo ratings yet

- Proposal by at Kearney2Document43 pagesProposal by at Kearney2Wilson PintoNo ratings yet

- Case Study Analysis Commercial Airline Industry: Airbus & BoeingDocument17 pagesCase Study Analysis Commercial Airline Industry: Airbus & BoeingShone ThattilNo ratings yet

- Analysing The Environment Part OneDocument7 pagesAnalysing The Environment Part Onealeenz0784No ratings yet

- Umer Daraz (63848) Assignment 4Document3 pagesUmer Daraz (63848) Assignment 4Umer KhanNo ratings yet

- Strategic Management: Pavan Gadade Sachin ChavanDocument27 pagesStrategic Management: Pavan Gadade Sachin ChavanahmedrefeatNo ratings yet

- Strengths Weaknesses: Strength Weight Ratin WeightedDocument3 pagesStrengths Weaknesses: Strength Weight Ratin WeightedAsad JalalNo ratings yet

- Pestswot BCG RestDocument27 pagesPestswot BCG Restcoolman604No ratings yet

- 8 Case Notes 3MDocument20 pages8 Case Notes 3MjielahiNo ratings yet

- Boeing 7e7Document7 pagesBoeing 7e7kaye100% (2)

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Test BankDocument19 pagesStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Test Bankdammar.jealousgvg6100% (24)

- External I - SampleDocument2 pagesExternal I - SampleMohamadSammanNo ratings yet

- Airbus SM (13dec)Document21 pagesAirbus SM (13dec)Naveen VananNo ratings yet

- Case Study On Castrol India Ltd.Document12 pagesCase Study On Castrol India Ltd.Chandrakala Yadav100% (2)

- Chapter 7 External Economies of Scale and The International Location of ProductionDocument10 pagesChapter 7 External Economies of Scale and The International Location of ProductionMianda Institute100% (1)

- CaterpillarTractor 1985 Spring2008 PadresDocument15 pagesCaterpillarTractor 1985 Spring2008 PadresEmie JinelsaNo ratings yet

- Techniques of Environmental ScanningDocument18 pagesTechniques of Environmental Scanningvinay sainiNo ratings yet

- Ford Motor Company, 2015: Nueva Vizcaya State UniversityDocument6 pagesFord Motor Company, 2015: Nueva Vizcaya State UniversityJoshNo ratings yet

- Operations Management: Chapter 2 - Operations Strategy in A Global EnvironmentDocument20 pagesOperations Management: Chapter 2 - Operations Strategy in A Global Environmentjomaguro1783No ratings yet

- SM2 FinA1 Grp6 BoeingDocument11 pagesSM2 FinA1 Grp6 Boeingabhi2shek2003100% (1)

- Final Airbus Finance Report - ShivaniDocument30 pagesFinal Airbus Finance Report - ShivaniShivani ShivaprasadNo ratings yet

- Ford PresentationDocument47 pagesFord PresentationDIEGONo ratings yet

- Fashion Marketing Strategies: AssignmentDocument11 pagesFashion Marketing Strategies: AssignmentShweta SinghNo ratings yet

- Haier Global in 2010Document13 pagesHaier Global in 2010nesninisNo ratings yet

- Industry Life Cycle StagesDocument7 pagesIndustry Life Cycle StagesUmar ButtNo ratings yet

- GE MatrixDocument35 pagesGE MatrixPriya SinghNo ratings yet

- Airbag Industry ReportDocument8 pagesAirbag Industry ReportSuresh Srinivasan100% (1)

- Toyota Case StudyDocument3 pagesToyota Case StudybasantsahooNo ratings yet

- Global Issues in Supply Chain Management: Professor Janice E. Carrillo Information Systems and Operations ManagementDocument38 pagesGlobal Issues in Supply Chain Management: Professor Janice E. Carrillo Information Systems and Operations Managementaditya_karnik_2No ratings yet

- CBM GroupDocument8 pagesCBM GroupFrances Nicole SegundoNo ratings yet

- Assignment FinalDocument7 pagesAssignment FinalelizabethNo ratings yet

- Chapter 2Document33 pagesChapter 2Sumitr NouhriaNo ratings yet

- S W O T and Porters Five ForcesDocument7 pagesS W O T and Porters Five ForcesBhoneMyint SanNo ratings yet

- Michelin CaseDocument13 pagesMichelin CaseIonut BurlusiNo ratings yet

- Strategic Management: Life-Cycle StrategiesDocument7 pagesStrategic Management: Life-Cycle StrategiesSyedAshirBukhariNo ratings yet

- Define The Problem Formulate Alternative Courses of Action Evaluate The Alternatives Choose and Recommend A Course of ActionDocument26 pagesDefine The Problem Formulate Alternative Courses of Action Evaluate The Alternatives Choose and Recommend A Course of ActionAnam ShoaibNo ratings yet

- Race World: For TheDocument17 pagesRace World: For TheSaras AgrawalNo ratings yet

- International Strategy: Pendahuluan/overviewDocument41 pagesInternational Strategy: Pendahuluan/overviewFajar ChrisNo ratings yet

- External Analysis Boeing Assignment Final 2Document7 pagesExternal Analysis Boeing Assignment Final 2Himmie Eugene LangfordNo ratings yet

- Strategy Course NotesDocument18 pagesStrategy Course Notesjosh_nsit8368No ratings yet

- Strategic ManagementDocument27 pagesStrategic ManagementSantosh ChourpagarNo ratings yet

- GilletteDocument15 pagesGilletteVarun TyagiNo ratings yet

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideFrom EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideNo ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- Beating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsFrom EverandBeating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsNo ratings yet

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- OlatheNorth DaMo Aff 01 - Washburn Rural Round 2Document25 pagesOlatheNorth DaMo Aff 01 - Washburn Rural Round 2EmronNo ratings yet

- Presentation of Engineering InformationDocument5 pagesPresentation of Engineering InformationDinesh SilvaNo ratings yet

- Savemyexams Igcse Biology Photosynthesis and Leaf Structure WorksheetDocument34 pagesSavemyexams Igcse Biology Photosynthesis and Leaf Structure WorksheetkatisspeedNo ratings yet

- Multi Inverter 4TXM6530A-SUB-1GDocument4 pagesMulti Inverter 4TXM6530A-SUB-1GOmar PiñaNo ratings yet

- Mark Elsdon - Hidden Gems Mentalism EditionDocument32 pagesMark Elsdon - Hidden Gems Mentalism EditiongauthieralNo ratings yet

- How To Become A Super Learner by Jim Kwik Workbook NSPDocument11 pagesHow To Become A Super Learner by Jim Kwik Workbook NSPmark50% (6)

- Materials Handling: in ConstructionDocument41 pagesMaterials Handling: in ConstructionSatya NaiduNo ratings yet

- US April'23 PAKET BDocument12 pagesUS April'23 PAKET BProject P2BanjaranNo ratings yet

- Project Brief - Biometrio Earth - FinalDocument3 pagesProject Brief - Biometrio Earth - FinalMarcel JonathanNo ratings yet

- Surfaces Overview: Open Nozzle - SLDPRTDocument10 pagesSurfaces Overview: Open Nozzle - SLDPRTdhaNo ratings yet

- Practice Test 2-8: Tudent EgreeDocument5 pagesPractice Test 2-8: Tudent EgreeThùy LinhNo ratings yet

- CV Updated 3-27-2020Document6 pagesCV Updated 3-27-2020api-490052612No ratings yet

- A Detailed Study On Loss Processes in Solar CellsDocument11 pagesA Detailed Study On Loss Processes in Solar CellsFernando DiasNo ratings yet

- Company Profile of Pama PersadaDocument2 pagesCompany Profile of Pama PersadairsyadjamaludinNo ratings yet

- Retail Management Final ExamDocument17 pagesRetail Management Final ExamAkhilesh JadhavNo ratings yet

- Data Protection Policy EnglishEWDocument8 pagesData Protection Policy EnglishEWAnkurNo ratings yet

- Roles and Characteristics of Problem Solving in The Mathematics Curriculum: A ReviewDocument19 pagesRoles and Characteristics of Problem Solving in The Mathematics Curriculum: A ReviewSarahNo ratings yet

- Climate DLLDocument2 pagesClimate DLLlucky may100% (1)

- COMPUTER ARCHITECTURE AND ORGANIZATION 11th Feb 2024Document4 pagesCOMPUTER ARCHITECTURE AND ORGANIZATION 11th Feb 2024Ddamulira CharlesNo ratings yet

- BCG Large-Project ManagementDocument17 pagesBCG Large-Project ManagementReyLeonNo ratings yet

- Kubernetes Deploy Mysql Spring Rest Api React Native App InstructionsDocument7 pagesKubernetes Deploy Mysql Spring Rest Api React Native App InstructionsJean Claude OnanaNo ratings yet

- Buthaina AlmamariDocument3 pagesButhaina Almamaributhin7heartNo ratings yet

- Dump Valves: DVU SeriesDocument2 pagesDump Valves: DVU SeriesalopezvillavicencioNo ratings yet

- Figure Skating Spirals in CompetitionDocument2 pagesFigure Skating Spirals in CompetitionAlexandra PurcaroiuNo ratings yet

- 3:3Document15 pages3:3Nicholas CemenenkoffNo ratings yet

- Assessing The Nature of Soil AcidityDocument8 pagesAssessing The Nature of Soil AcidityPartha DebRoyNo ratings yet

- Gallbladder Mucocele A ReviewDocument6 pagesGallbladder Mucocele A ReviewThaís ChouinNo ratings yet

- List of DictionariesDocument38 pagesList of DictionariesSaraPhoenixNo ratings yet

- Tower Crane AccidentDocument37 pagesTower Crane Accidentparawansa muisNo ratings yet