Professional Documents

Culture Documents

History and Development of Banking Industry

History and Development of Banking Industry

Uploaded by

শামছুদ্দিন চৌধুরী দেলোয়ারCopyright:

Available Formats

You might also like

- 062323-Kyc 3B HSBCDocument27 pages062323-Kyc 3B HSBCThomas DyeNo ratings yet

- 5 Rules For Trading Supply and DemandDocument30 pages5 Rules For Trading Supply and DemandNaufal Surya100% (2)

- BDC Training MaterialDocument8 pagesBDC Training MaterialCarlos Parra RavenNo ratings yet

- Mcqs On ForexDocument62 pagesMcqs On ForexRaushan Ratnesh70% (20)

- Oracle EBS Country Specific BrazilDocument15 pagesOracle EBS Country Specific BrazilMarcelo MestiNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- SITXFIN003 Learner GuideDocument67 pagesSITXFIN003 Learner GuideZHWNo ratings yet

- Bfs2 Evolution of Banking in IndiaDocument26 pagesBfs2 Evolution of Banking in IndiaRitesh RamanNo ratings yet

- Intoduction To BankingDocument41 pagesIntoduction To BankingAbhilash ShahNo ratings yet

- FIM Banking Presentation 3Document48 pagesFIM Banking Presentation 3harshadashitoleNo ratings yet

- Evaluation of Banking Sector's Development in Bangladesh in Light of Financial ReformDocument12 pagesEvaluation of Banking Sector's Development in Bangladesh in Light of Financial Reformimrul khanNo ratings yet

- An Overview of Banking in IndiaDocument41 pagesAn Overview of Banking in IndiaVinay SudaniNo ratings yet

- Ifs PPT 101-110Document39 pagesIfs PPT 101-110Dhaval PadhiyarNo ratings yet

- The Banking Industry of Bangladesh PDFDocument12 pagesThe Banking Industry of Bangladesh PDFrased62100% (1)

- Indian Financial SystemDocument23 pagesIndian Financial SystemSujeet KhadeNo ratings yet

- 50395lecture 3 SBPDocument24 pages50395lecture 3 SBPNoman NaeemNo ratings yet

- Banking Sector in IndiaDocument29 pagesBanking Sector in Indiahahire0% (1)

- Central Banking Reserve Bank of India (RBI)Document20 pagesCentral Banking Reserve Bank of India (RBI)mayanksonucoolNo ratings yet

- IB CA 1 Shaik MasthanDocument17 pagesIB CA 1 Shaik Masthanmasthan shaikNo ratings yet

- Commercial Banking in PakistanDocument24 pagesCommercial Banking in PakistanMuhammad RadeelNo ratings yet

- Function of A, B, C, D, IdbDocument11 pagesFunction of A, B, C, D, Idbsubash rijal100% (2)

- IFS Module 2Document47 pagesIFS Module 2Dhrumi PatelNo ratings yet

- Merchant Banks Vs Commercial BanksDocument57 pagesMerchant Banks Vs Commercial BanksLeo PaulNo ratings yet

- Chapter 1 IntroductionDocument25 pagesChapter 1 IntroductiondhitalkhushiNo ratings yet

- Indian Financial System: Pravin S. Satpute Mba - Ii (Finance) Roll No. 24 Sangita Pund MBA - Ii (Finance) Roll No. 22Document23 pagesIndian Financial System: Pravin S. Satpute Mba - Ii (Finance) Roll No. 24 Sangita Pund MBA - Ii (Finance) Roll No. 22Arun KumarNo ratings yet

- Assignment: "Banking in Bangladesh"Document16 pagesAssignment: "Banking in Bangladesh"Akm Mahadi HasanNo ratings yet

- Central Bank of PakistanDocument32 pagesCentral Bank of PakistanMuhammad wali JanNo ratings yet

- Anking Ndustry IN Angladesh: 1.1 Industry BackgroundDocument31 pagesAnking Ndustry IN Angladesh: 1.1 Industry BackgroundpixytanyNo ratings yet

- Asi - Mid 1Document27 pagesAsi - Mid 1Naimur Rahman JoyNo ratings yet

- Group 7 - Neelabh Barua - PGFB2027Document49 pagesGroup 7 - Neelabh Barua - PGFB2027NeelabhNo ratings yet

- Unit 1Document58 pagesUnit 1mruthunjay kadakolNo ratings yet

- Institutional Financial ManagementDocument24 pagesInstitutional Financial ManagementPEDAVALLI LAKSHMANNo ratings yet

- Commercial - Banks - in - India (Just For Reading)Document18 pagesCommercial - Banks - in - India (Just For Reading)Nitya GuptaNo ratings yet

- Commercial Bank ManagementDocument38 pagesCommercial Bank ManagementAikya Gandhi100% (1)

- History of Banking in India: 1) Pre-Nationalization EraDocument7 pagesHistory of Banking in India: 1) Pre-Nationalization EraKoshyNo ratings yet

- Role of State Bank of PakistanDocument44 pagesRole of State Bank of PakistanhannanchampNo ratings yet

- Banking Aw16733487930Document281 pagesBanking Aw16733487930CJNo ratings yet

- Banking Environment and ObligationsDocument25 pagesBanking Environment and ObligationsSomesh DawaniNo ratings yet

- BanksDocument120 pagesBankskoshycjNo ratings yet

- Bankng and FinanceDocument41 pagesBankng and FinancegarvanshivijayvargiyaNo ratings yet

- Commercial BankDocument13 pagesCommercial BankVedant JhunjhunwalaNo ratings yet

- Report On Banking SectorDocument8 pagesReport On Banking SectorSaurabh Paharia100% (1)

- Role of State Bank of Pakistan in EconomicDocument20 pagesRole of State Bank of Pakistan in Economiclaiba faizNo ratings yet

- Marketing Strategies of Banks (4 Office 2007)Document63 pagesMarketing Strategies of Banks (4 Office 2007)Dev MehtaNo ratings yet

- Financial System in BD 08.10.2020 - UpdateDocument39 pagesFinancial System in BD 08.10.2020 - UpdateShamim IqbalNo ratings yet

- Intro+UCBL Background+study Part 1 PDFDocument37 pagesIntro+UCBL Background+study Part 1 PDFHumayra046100% (1)

- Indian Banking System History and StructureDocument47 pagesIndian Banking System History and StructureRahul SinghNo ratings yet

- Chapter 1 IntroductionDocument13 pagesChapter 1 IntroductiondhitalkhushiNo ratings yet

- BENI MCB Internship ReportDocument58 pagesBENI MCB Internship ReporthammadshakoorNo ratings yet

- Federal BankDocument15 pagesFederal BankRahul Vallapil100% (2)

- Manjula: Banking-Sectoral StudyDocument20 pagesManjula: Banking-Sectoral Studysantosh prasadNo ratings yet

- Banking and Insurance Session IDocument48 pagesBanking and Insurance Session IAshish ShilpkarNo ratings yet

- Banking Law and PracticeDocument8 pagesBanking Law and PracticewasoooNo ratings yet

- UNITIDocument60 pagesUNITIAmrendra KumarNo ratings yet

- Miscellaneous Important Points-1Document21 pagesMiscellaneous Important Points-1bhavishyat kumawatNo ratings yet

- Bank Negara Malaysia & Financial SystemDocument27 pagesBank Negara Malaysia & Financial SystemNatashaHaziqahNo ratings yet

- Unit 6Document107 pagesUnit 6Avinaash PraveenNo ratings yet

- FP 10 Indian Banking SectorDocument53 pagesFP 10 Indian Banking SectorMana PlanetNo ratings yet

- Commercial Banking in India: Prof.b.p.mishra XimbDocument44 pagesCommercial Banking in India: Prof.b.p.mishra Ximbrohitsomani2209No ratings yet

- Banking Services in India 583Document63 pagesBanking Services in India 583happyredroseNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- The role of banks in the regional economic development of Uzbekistan: lessons from the German experienceFrom EverandThe role of banks in the regional economic development of Uzbekistan: lessons from the German experienceNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Finding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificFrom EverandFinding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Projectoblicon BuildersDocument18 pagesProjectoblicon Builderslou017No ratings yet

- Financial System of PakistanDocument3 pagesFinancial System of Pakistaniftikharchughtai83% (12)

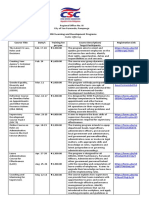

- 2022 Learning and Development Programs: Public OfferingDocument4 pages2022 Learning and Development Programs: Public OfferingFerdinand De GuzmanNo ratings yet

- Public PlacesDocument4 pagesPublic PlacesAyu Delisa PutriNo ratings yet

- Sbi Merger PDFDocument6 pagesSbi Merger PDFVijit SachdevaNo ratings yet

- The Preliminaries RevDocument5 pagesThe Preliminaries RevKid bNo ratings yet

- Agricultural DevelopmentDocument14 pagesAgricultural DevelopmentSyeda Tooba KazmiNo ratings yet

- MCB Internship Report 2010 NUMLDocument119 pagesMCB Internship Report 2010 NUMLmani151850% (2)

- AttachmentDocument49 pagesAttachmentAlhaji Mamah Sesay0% (1)

- Working Capital ManagementDocument21 pagesWorking Capital ManagementArt Virgel DensingNo ratings yet

- Report On The Expansion of Financial Inclusion in Bangladesh: A Study On ONE Bank LimitedDocument30 pagesReport On The Expansion of Financial Inclusion in Bangladesh: A Study On ONE Bank LimitedSobujNo ratings yet

- Internal Audit of Stock Brokers CCRTDocument75 pagesInternal Audit of Stock Brokers CCRTAnmol Kumar0% (1)

- STUDY PLAN Commercial Bank OperationsDocument4 pagesSTUDY PLAN Commercial Bank OperationshuzailinsyawanaNo ratings yet

- LuckyCrush Additional Terms Applicable To Female User AccountsDocument7 pagesLuckyCrush Additional Terms Applicable To Female User AccountsMónica Cazon RomeroNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument40 pagesRisk Analysis, Real Options, and Capital BudgetingANKIT AGARWALNo ratings yet

- The Hindu Editorial Vishal Sir 21 Nov 2018 PDFDocument22 pagesThe Hindu Editorial Vishal Sir 21 Nov 2018 PDFNikHil MisHraNo ratings yet

- Case Analysis Pil 1Document4 pagesCase Analysis Pil 1AAKASH SHARMANo ratings yet

- SWIFTDocument15 pagesSWIFTSubhreet KaurNo ratings yet

- Affairscloud April Week 3 PDFDocument24 pagesAffairscloud April Week 3 PDFGautam IyerNo ratings yet

- PGDSRBDocument27 pagesPGDSRBNiit AgraNo ratings yet

- Namita Mams ResumeDocument33 pagesNamita Mams Resumesachin11hahaNo ratings yet

- To Lien Doanh Cong Ty TNHH DT - XD Duyen Hai Mien Trung VNDocument1 pageTo Lien Doanh Cong Ty TNHH DT - XD Duyen Hai Mien Trung VNLinh PhuongNo ratings yet

- Online Banking Security ThesisDocument8 pagesOnline Banking Security ThesisMonique Anderson100% (2)

- Bangladesh SOUTH ASIA P161246 Livestock and Dairy Development Project Procurement PlanDocument15 pagesBangladesh SOUTH ASIA P161246 Livestock and Dairy Development Project Procurement PlanirfandogerNo ratings yet

History and Development of Banking Industry

History and Development of Banking Industry

Uploaded by

শামছুদ্দিন চৌধুরী দেলোয়ারOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

History and Development of Banking Industry

History and Development of Banking Industry

Uploaded by

শামছুদ্দিন চৌধুরী দেলোয়ারCopyright:

Available Formats

HISTORY AND DEVELOPMENT OF

BANKING SECTOR

History: Just after liberation

After liberation, all the existing banks were

nationalized to form six commercial banks.

2 Specialized Banks and 3 Foreign Banks were

also operative.

These state-owned banks failed to perform

satisfactorily and were not enough to help

economic growth. (Siddique and Islam, 2001)

Establishment of Central Bank

Dhaka branch of the State Bank of Pakistan

was reorganized to form Bangladesh Bank (BB)

after liberation.

Established on the basis of Bangladesh Bank

Order, 1972 (P.O. No. 127 of 1972) with effect

from 16th December, 1971.

History: 1980-1990

In 1982, financial sector were reformed and

Private commercial banks were allowed to

enter in early 1980s.

2 State-owned bank were transferred to

private ownership and 1 was made public

limited company in mid 1980s.

In 1987-88, two more specialized banks were

established.

History: 1990-1995

The financial sector reform program (FSRP) was

launched under Financial Sector Adjustment Credit

(FSAC) of the World Bank in 1990

Objectives

Gradual deregulations of the interest rate structure with a

view to improving the allocative efficiency

Providing market oriented incentives for priority sector

lending

Making subsidies in the priority sectors more transparent

Adoption of appropriate monetary policy

Improvement in debt recovery environment

Strengthening of the capital markets.

History: 1996 - 2002

In order to fix the problem unveiled by FSRP, the

government formed a Banking Reform

Committee (BRC) in October 1996.

In May 1997, the government also undertook a

Commercial Bank Restructuring Project (CBRP)

funded by the World Bank.

Removal of the floor rates of deposits in 1997.

In August 1999, elimination of interest band on

agriculture and small and medium enterprises

(SMEs) loans.

History: 2003-onwards

ATM services (introduced in 2003), Debit/Credit Card

Services, Mobile Banking, and Internet Banking

Bangladesh Electronic Funds Transfer Network (BEFTN) in

2011 and National Payment Switch (NPS) in 2012

Online and real-time services

Establishment of Bangladesh Automated Clearing House

and Bangladesh Automated Cheque Processing Systems

(BACPS) in 2009

Shift from regular cheque to MICR cheques in 2010

Basel II has been successfully implemented (2010)

SME, Green banking, Mobile Financial Services and

Corporate Social Responsibility have also got a great deal of

importance

Banking Sector

Two Broad Types

1. Scheduled Banks (56 up to 2013)

2. Non-Scheduled Banks (4 up to 2013)

Scheduled Banks are classified into four

categories:

1. State Owned Commercial Banks (SOCBs)

2. Private Commercial Banks (PCBs)

3. Foreign Commercial Banks (FCBs)

4. Specialized Banks (SDBs)

Non-Scheduled Banks

Ansar VDP Unnayan Bank

Karmashangosthan Bank

Probashi Kollyan Bank

Jubilee Bank

Changes in Number of Banks

0

10

20

30

40

50

60

1980 1990 2000 2010 2012 2013

Total number of banks State-owned banks Specialized banks Private banks Foreign banks

Distribution of Branches

42%

17%

40%

1%

State-owned banks

Specialized banks

Private banks

Foreign banks

Distribution of total assets

26%

6%

62%

6%

State-owned banks

Specialized banks

Private banks

Foreign banks

Distribution of deposits

25%

5%

64%

6%

State-owned banks

Specialized banks

Private banks

Foreign banks

Profitability of different types of banks

Category ROA ROE Net Interest Income*

State-owned banks -0.6 -11.9 14.9

Specialized banks 0.1 -1.1 4.7

Private banks 0.9 10.2 114.7

Foreign banks 3.3 17.3 19.6

Total 0.6 8.2 153.8

* Figures are in Billion Taka

Source: Annual reports of Bangladesh Bank 2012-13

Contribution of different types of

banks

Category

Number

of Banks

Number of

Branches

Total

Assets*

Percentage

of Industry

Assets

Deposits*

Percentage

of Deposits

State-owned banks 4 3478 1831.9 26.0 1377.9 25.5

Specialized banks 4 1440 385.5 5.5 260.4 4.8

Private banks 30 3339 4371.5 62.2 3430.7 63.6

Foreign banks 9 65 441.8 6.3 327.0 6.1

Total 47 8322 7030.7 100 5396.0 100

* Figures are in Billion Taka

Source: Annual reports of Bangladesh Bank 2012-13

Regulation

Bank Company Act, 1991 (Amended in 2013)

Bank Deposit Insurance Act, 2000

Bangladesh Bank Order, 1972

Company Act, 1994

Money Laundering Prevention Act,2012

Money Loan Court Act, 2003

Foreign Exchange Regulations Act, 1947

The Negotiable Instruments Act, 1881

Further guidelines

Guidelines to establish a banking company in

Bangladesh

Guidelines for Islamic banking

Prudential Regulations for Banks

Guidelines for establishment of NRB bank

Guidelines on risk based capital adequacy

Guidelines on subordinated debt

Risk Management Guidelines for Banks, 2012

Guidance notes on Prevention of Money

Laundering for Banks and others.

Circular, Notes and Orders

Bangladesh Bank and Bangladesh Securities

and Exchange Commission impose other rules

in different times.

BB issues circular and notes to regulate banks.

Bank Company Act, 1991

You might also like

- 062323-Kyc 3B HSBCDocument27 pages062323-Kyc 3B HSBCThomas DyeNo ratings yet

- 5 Rules For Trading Supply and DemandDocument30 pages5 Rules For Trading Supply and DemandNaufal Surya100% (2)

- BDC Training MaterialDocument8 pagesBDC Training MaterialCarlos Parra RavenNo ratings yet

- Mcqs On ForexDocument62 pagesMcqs On ForexRaushan Ratnesh70% (20)

- Oracle EBS Country Specific BrazilDocument15 pagesOracle EBS Country Specific BrazilMarcelo MestiNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- SITXFIN003 Learner GuideDocument67 pagesSITXFIN003 Learner GuideZHWNo ratings yet

- Bfs2 Evolution of Banking in IndiaDocument26 pagesBfs2 Evolution of Banking in IndiaRitesh RamanNo ratings yet

- Intoduction To BankingDocument41 pagesIntoduction To BankingAbhilash ShahNo ratings yet

- FIM Banking Presentation 3Document48 pagesFIM Banking Presentation 3harshadashitoleNo ratings yet

- Evaluation of Banking Sector's Development in Bangladesh in Light of Financial ReformDocument12 pagesEvaluation of Banking Sector's Development in Bangladesh in Light of Financial Reformimrul khanNo ratings yet

- An Overview of Banking in IndiaDocument41 pagesAn Overview of Banking in IndiaVinay SudaniNo ratings yet

- Ifs PPT 101-110Document39 pagesIfs PPT 101-110Dhaval PadhiyarNo ratings yet

- The Banking Industry of Bangladesh PDFDocument12 pagesThe Banking Industry of Bangladesh PDFrased62100% (1)

- Indian Financial SystemDocument23 pagesIndian Financial SystemSujeet KhadeNo ratings yet

- 50395lecture 3 SBPDocument24 pages50395lecture 3 SBPNoman NaeemNo ratings yet

- Banking Sector in IndiaDocument29 pagesBanking Sector in Indiahahire0% (1)

- Central Banking Reserve Bank of India (RBI)Document20 pagesCentral Banking Reserve Bank of India (RBI)mayanksonucoolNo ratings yet

- IB CA 1 Shaik MasthanDocument17 pagesIB CA 1 Shaik Masthanmasthan shaikNo ratings yet

- Commercial Banking in PakistanDocument24 pagesCommercial Banking in PakistanMuhammad RadeelNo ratings yet

- Function of A, B, C, D, IdbDocument11 pagesFunction of A, B, C, D, Idbsubash rijal100% (2)

- IFS Module 2Document47 pagesIFS Module 2Dhrumi PatelNo ratings yet

- Merchant Banks Vs Commercial BanksDocument57 pagesMerchant Banks Vs Commercial BanksLeo PaulNo ratings yet

- Chapter 1 IntroductionDocument25 pagesChapter 1 IntroductiondhitalkhushiNo ratings yet

- Indian Financial System: Pravin S. Satpute Mba - Ii (Finance) Roll No. 24 Sangita Pund MBA - Ii (Finance) Roll No. 22Document23 pagesIndian Financial System: Pravin S. Satpute Mba - Ii (Finance) Roll No. 24 Sangita Pund MBA - Ii (Finance) Roll No. 22Arun KumarNo ratings yet

- Assignment: "Banking in Bangladesh"Document16 pagesAssignment: "Banking in Bangladesh"Akm Mahadi HasanNo ratings yet

- Central Bank of PakistanDocument32 pagesCentral Bank of PakistanMuhammad wali JanNo ratings yet

- Anking Ndustry IN Angladesh: 1.1 Industry BackgroundDocument31 pagesAnking Ndustry IN Angladesh: 1.1 Industry BackgroundpixytanyNo ratings yet

- Asi - Mid 1Document27 pagesAsi - Mid 1Naimur Rahman JoyNo ratings yet

- Group 7 - Neelabh Barua - PGFB2027Document49 pagesGroup 7 - Neelabh Barua - PGFB2027NeelabhNo ratings yet

- Unit 1Document58 pagesUnit 1mruthunjay kadakolNo ratings yet

- Institutional Financial ManagementDocument24 pagesInstitutional Financial ManagementPEDAVALLI LAKSHMANNo ratings yet

- Commercial - Banks - in - India (Just For Reading)Document18 pagesCommercial - Banks - in - India (Just For Reading)Nitya GuptaNo ratings yet

- Commercial Bank ManagementDocument38 pagesCommercial Bank ManagementAikya Gandhi100% (1)

- History of Banking in India: 1) Pre-Nationalization EraDocument7 pagesHistory of Banking in India: 1) Pre-Nationalization EraKoshyNo ratings yet

- Role of State Bank of PakistanDocument44 pagesRole of State Bank of PakistanhannanchampNo ratings yet

- Banking Aw16733487930Document281 pagesBanking Aw16733487930CJNo ratings yet

- Banking Environment and ObligationsDocument25 pagesBanking Environment and ObligationsSomesh DawaniNo ratings yet

- BanksDocument120 pagesBankskoshycjNo ratings yet

- Bankng and FinanceDocument41 pagesBankng and FinancegarvanshivijayvargiyaNo ratings yet

- Commercial BankDocument13 pagesCommercial BankVedant JhunjhunwalaNo ratings yet

- Report On Banking SectorDocument8 pagesReport On Banking SectorSaurabh Paharia100% (1)

- Role of State Bank of Pakistan in EconomicDocument20 pagesRole of State Bank of Pakistan in Economiclaiba faizNo ratings yet

- Marketing Strategies of Banks (4 Office 2007)Document63 pagesMarketing Strategies of Banks (4 Office 2007)Dev MehtaNo ratings yet

- Financial System in BD 08.10.2020 - UpdateDocument39 pagesFinancial System in BD 08.10.2020 - UpdateShamim IqbalNo ratings yet

- Intro+UCBL Background+study Part 1 PDFDocument37 pagesIntro+UCBL Background+study Part 1 PDFHumayra046100% (1)

- Indian Banking System History and StructureDocument47 pagesIndian Banking System History and StructureRahul SinghNo ratings yet

- Chapter 1 IntroductionDocument13 pagesChapter 1 IntroductiondhitalkhushiNo ratings yet

- BENI MCB Internship ReportDocument58 pagesBENI MCB Internship ReporthammadshakoorNo ratings yet

- Federal BankDocument15 pagesFederal BankRahul Vallapil100% (2)

- Manjula: Banking-Sectoral StudyDocument20 pagesManjula: Banking-Sectoral Studysantosh prasadNo ratings yet

- Banking and Insurance Session IDocument48 pagesBanking and Insurance Session IAshish ShilpkarNo ratings yet

- Banking Law and PracticeDocument8 pagesBanking Law and PracticewasoooNo ratings yet

- UNITIDocument60 pagesUNITIAmrendra KumarNo ratings yet

- Miscellaneous Important Points-1Document21 pagesMiscellaneous Important Points-1bhavishyat kumawatNo ratings yet

- Bank Negara Malaysia & Financial SystemDocument27 pagesBank Negara Malaysia & Financial SystemNatashaHaziqahNo ratings yet

- Unit 6Document107 pagesUnit 6Avinaash PraveenNo ratings yet

- FP 10 Indian Banking SectorDocument53 pagesFP 10 Indian Banking SectorMana PlanetNo ratings yet

- Commercial Banking in India: Prof.b.p.mishra XimbDocument44 pagesCommercial Banking in India: Prof.b.p.mishra Ximbrohitsomani2209No ratings yet

- Banking Services in India 583Document63 pagesBanking Services in India 583happyredroseNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- The role of banks in the regional economic development of Uzbekistan: lessons from the German experienceFrom EverandThe role of banks in the regional economic development of Uzbekistan: lessons from the German experienceNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Finding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificFrom EverandFinding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Projectoblicon BuildersDocument18 pagesProjectoblicon Builderslou017No ratings yet

- Financial System of PakistanDocument3 pagesFinancial System of Pakistaniftikharchughtai83% (12)

- 2022 Learning and Development Programs: Public OfferingDocument4 pages2022 Learning and Development Programs: Public OfferingFerdinand De GuzmanNo ratings yet

- Public PlacesDocument4 pagesPublic PlacesAyu Delisa PutriNo ratings yet

- Sbi Merger PDFDocument6 pagesSbi Merger PDFVijit SachdevaNo ratings yet

- The Preliminaries RevDocument5 pagesThe Preliminaries RevKid bNo ratings yet

- Agricultural DevelopmentDocument14 pagesAgricultural DevelopmentSyeda Tooba KazmiNo ratings yet

- MCB Internship Report 2010 NUMLDocument119 pagesMCB Internship Report 2010 NUMLmani151850% (2)

- AttachmentDocument49 pagesAttachmentAlhaji Mamah Sesay0% (1)

- Working Capital ManagementDocument21 pagesWorking Capital ManagementArt Virgel DensingNo ratings yet

- Report On The Expansion of Financial Inclusion in Bangladesh: A Study On ONE Bank LimitedDocument30 pagesReport On The Expansion of Financial Inclusion in Bangladesh: A Study On ONE Bank LimitedSobujNo ratings yet

- Internal Audit of Stock Brokers CCRTDocument75 pagesInternal Audit of Stock Brokers CCRTAnmol Kumar0% (1)

- STUDY PLAN Commercial Bank OperationsDocument4 pagesSTUDY PLAN Commercial Bank OperationshuzailinsyawanaNo ratings yet

- LuckyCrush Additional Terms Applicable To Female User AccountsDocument7 pagesLuckyCrush Additional Terms Applicable To Female User AccountsMónica Cazon RomeroNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument40 pagesRisk Analysis, Real Options, and Capital BudgetingANKIT AGARWALNo ratings yet

- The Hindu Editorial Vishal Sir 21 Nov 2018 PDFDocument22 pagesThe Hindu Editorial Vishal Sir 21 Nov 2018 PDFNikHil MisHraNo ratings yet

- Case Analysis Pil 1Document4 pagesCase Analysis Pil 1AAKASH SHARMANo ratings yet

- SWIFTDocument15 pagesSWIFTSubhreet KaurNo ratings yet

- Affairscloud April Week 3 PDFDocument24 pagesAffairscloud April Week 3 PDFGautam IyerNo ratings yet

- PGDSRBDocument27 pagesPGDSRBNiit AgraNo ratings yet

- Namita Mams ResumeDocument33 pagesNamita Mams Resumesachin11hahaNo ratings yet

- To Lien Doanh Cong Ty TNHH DT - XD Duyen Hai Mien Trung VNDocument1 pageTo Lien Doanh Cong Ty TNHH DT - XD Duyen Hai Mien Trung VNLinh PhuongNo ratings yet

- Online Banking Security ThesisDocument8 pagesOnline Banking Security ThesisMonique Anderson100% (2)

- Bangladesh SOUTH ASIA P161246 Livestock and Dairy Development Project Procurement PlanDocument15 pagesBangladesh SOUTH ASIA P161246 Livestock and Dairy Development Project Procurement PlanirfandogerNo ratings yet