Professional Documents

Culture Documents

An Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIII

An Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIII

Uploaded by

Amrut KaurCopyright:

Available Formats

You might also like

- Al Shaheer CorporationDocument3 pagesAl Shaheer CorporationTaha IrfanNo ratings yet

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- Alternative Investments - A Primer For Investment ProfessionalsDocument183 pagesAlternative Investments - A Primer For Investment Professionalsmangeshvaidya100% (3)

- Capital Market OverviewDocument36 pagesCapital Market OverviewUpadhyay JiNo ratings yet

- Capital Market: Presented By: Mohit Upadhyay MBA - 2nd Year ACET, AligarhDocument25 pagesCapital Market: Presented By: Mohit Upadhyay MBA - 2nd Year ACET, AligarhRaghvendra ChaudharyNo ratings yet

- Indian Financial SystemDocument27 pagesIndian Financial SystemDurga Prasad DashNo ratings yet

- Markets. in Primary Markets, Securities Are Bought by Way of Public Issue DirectlyDocument40 pagesMarkets. in Primary Markets, Securities Are Bought by Way of Public Issue DirectlyramchandrakumbharNo ratings yet

- ProjectDocument25 pagesProjectDeana PhillipsNo ratings yet

- Capital MarketDocument20 pagesCapital MarketNikhil NemiNo ratings yet

- Basics of EquityDocument27 pagesBasics of EquityVikas Jeshnani100% (1)

- Capital Marketing: by Venkatragavan.G Mba (BT)Document28 pagesCapital Marketing: by Venkatragavan.G Mba (BT)Nilesh IsalNo ratings yet

- National Stock ExchangeDocument63 pagesNational Stock ExchangePrashantChauhanNo ratings yet

- IBE Module 6Document29 pagesIBE Module 6Prathik_Shetty_204No ratings yet

- Financial Institutions and MarketsDocument10 pagesFinancial Institutions and MarketsVikkuNo ratings yet

- Capital Market: Group MembersDocument17 pagesCapital Market: Group MembersSushil MirguleNo ratings yet

- New Issue Market: Presentation ONDocument19 pagesNew Issue Market: Presentation ONkaranj321No ratings yet

- Capital Market:: Primary Market Secondary MarketDocument63 pagesCapital Market:: Primary Market Secondary MarketvishalhiroleNo ratings yet

- Financial SystemDocument32 pagesFinancial Systemsaritasharma_sharmaNo ratings yet

- Newissuemarket 090919095525 Phpapp01Document31 pagesNewissuemarket 090919095525 Phpapp01vikramrajuNo ratings yet

- Name:-Gohil Hitesh Roll No: - 17 Subject: - Corporate Finance - I Date: - Submitted To: - Savita MissDocument14 pagesName:-Gohil Hitesh Roll No: - 17 Subject: - Corporate Finance - I Date: - Submitted To: - Savita MissHitesh GohilNo ratings yet

- Newissuemarket 090919095525 Phpapp01Document31 pagesNewissuemarket 090919095525 Phpapp01Dr-Afzal Basha HSNo ratings yet

- Wa0005.Document84 pagesWa0005.stekimeuNo ratings yet

- Financial SystemDocument32 pagesFinancial Systemneelabh1984No ratings yet

- Indian Financial Market: Rahul Kumar Department of Business AdminestrationDocument52 pagesIndian Financial Market: Rahul Kumar Department of Business AdminestrationDhruv MishraNo ratings yet

- Basic Terms of Capital MarketDocument44 pagesBasic Terms of Capital Marketdhanabalu87No ratings yet

- IPO (Initial Public Offer) : Advantages of Going PublicDocument67 pagesIPO (Initial Public Offer) : Advantages of Going PublicIsmath FatimaNo ratings yet

- Research Assignment of FmiDocument11 pagesResearch Assignment of FmiAnshita GargNo ratings yet

- Securities Law and Market Operations: Unit-IDocument21 pagesSecurities Law and Market Operations: Unit-IDerain SmilyNo ratings yet

- Indian Financial SystemDocument34 pagesIndian Financial SystemVivek SharmaNo ratings yet

- Basic of Stock MarketDocument5 pagesBasic of Stock MarketAnkit ChauhanNo ratings yet

- IFS-Primary Market - Note Prepared by Dr.R.R.YelikarDocument33 pagesIFS-Primary Market - Note Prepared by Dr.R.R.YelikarBablu JamdarNo ratings yet

- Financial Market - Capital Market - Primary MArketDocument49 pagesFinancial Market - Capital Market - Primary MArketGaurav RathaurNo ratings yet

- Capital MarketDocument58 pagesCapital MarketJasmandeep brar100% (6)

- Stock Market and Stock ExchangesDocument9 pagesStock Market and Stock ExchangesMaithreyi JntuNo ratings yet

- A Project Report On NSEDocument64 pagesA Project Report On NSEMukesh ChhotalaNo ratings yet

- INTRODUCTIONDocument26 pagesINTRODUCTION9022756315yashpatel2003No ratings yet

- Im Module2Document57 pagesIm Module2Lokesh GowdaNo ratings yet

- Unit III Capital MarketDocument27 pagesUnit III Capital MarketAbin VargheseNo ratings yet

- Investment Analysis and Portfolio Management - An OverviewDocument88 pagesInvestment Analysis and Portfolio Management - An OverviewJinal Shah100% (1)

- Q1. Discuss The Components of Money MarketDocument8 pagesQ1. Discuss The Components of Money MarketAshutosh MohantyNo ratings yet

- Secondary MarketDocument27 pagesSecondary MarketAmit BharwadNo ratings yet

- Indian Financial Markets: Class of MBADocument43 pagesIndian Financial Markets: Class of MBAaksid1No ratings yet

- Capital MarketDocument28 pagesCapital MarketVineet SinghNo ratings yet

- Primary MarketDocument15 pagesPrimary MarketKapil KumarNo ratings yet

- C CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CDocument34 pagesC CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CJayprakash MahantaNo ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet

- Financial Markets in IndiaDocument26 pagesFinancial Markets in Indiatadpelliwar_navinNo ratings yet

- New Issue Market & Secondary Markets: by Group 3Document45 pagesNew Issue Market & Secondary Markets: by Group 3Praveen VernekarNo ratings yet

- Financial MarketsDocument23 pagesFinancial Marketsमहेंद्र सिंह राजपूतNo ratings yet

- Financial Market & InstitutionsDocument7 pagesFinancial Market & InstitutionsMohammad Rakibul IslamNo ratings yet

- Financial MarketDocument15 pagesFinancial Marketrishu ashiNo ratings yet

- Securities Market The BattlefieldDocument14 pagesSecurities Market The BattlefieldJagrityTalwarNo ratings yet

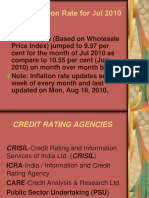

- India's Inflation Rate For Jul 2010Document21 pagesIndia's Inflation Rate For Jul 2010priyaNo ratings yet

- Financial MarketsDocument34 pagesFinancial Marketsmouli poliparthiNo ratings yet

- Meaning and Concept of Capital MarketDocument11 pagesMeaning and Concept of Capital Marketmanyasingh100% (1)

- New Issue MarketDocument31 pagesNew Issue MarketAashish AnandNo ratings yet

- Sapm PPT 1Document21 pagesSapm PPT 1Gitanjali SubbaraajNo ratings yet

- Primary MKTDocument24 pagesPrimary MKTdanbrowndaNo ratings yet

- Fs-Ii PCDocument23 pagesFs-Ii PCChandrashekhar PampannaNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Mastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesFrom EverandMastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Daily Equity Market Report - 08.09.2021Document1 pageDaily Equity Market Report - 08.09.2021Fuaad DodooNo ratings yet

- Options GreeksDocument30 pagesOptions GreeksSukumar100% (2)

- BM FI6051 WK9 Lecturer NotesDocument54 pagesBM FI6051 WK9 Lecturer NotesfmurphyNo ratings yet

- Risk Return AnalysisDocument70 pagesRisk Return Analysisvijaykumarsmec100% (7)

- Pra UAS PA 2 CBDocument3 pagesPra UAS PA 2 CBStefi Yunia SuwarlanNo ratings yet

- Stock Valuation: Dr. C. Bulent AybarDocument35 pagesStock Valuation: Dr. C. Bulent AybarkeithNo ratings yet

- MGT201 Final Term Subjective Solved With Reference 2014Document18 pagesMGT201 Final Term Subjective Solved With Reference 2014maryamNo ratings yet

- CommoditiesDocument122 pagesCommoditiesAnil TiwariNo ratings yet

- ACF Assignment Bonds - Asutosh PatraDocument11 pagesACF Assignment Bonds - Asutosh PatraAshok KumarNo ratings yet

- Chapter 3 - Forward and Futures Pricing - 2022 - SDocument63 pagesChapter 3 - Forward and Futures Pricing - 2022 - SĐức Nam TrầnNo ratings yet

- Urp GFM 01 Global Financial Markets StructureDocument61 pagesUrp GFM 01 Global Financial Markets StructureWhiny CustodioNo ratings yet

- 2326 Question - QuizDocument66 pages2326 Question - Quizidika123No ratings yet

- Media Matrix Worldwide Limited: Abridged Letter of OfferDocument1 pageMedia Matrix Worldwide Limited: Abridged Letter of OfferGauravsNo ratings yet

- FD ch5 PPT HullDocument37 pagesFD ch5 PPT HullBuller CatNo ratings yet

- ACFI1003 - Lecture 7 Corporations and The Share MarketDocument43 pagesACFI1003 - Lecture 7 Corporations and The Share Market王亚琪No ratings yet

- ICAI Guidance Note ESOPDocument88 pagesICAI Guidance Note ESOPKellenJaneHernandezNo ratings yet

- Pratik Tibrewala (Final Report)Document52 pagesPratik Tibrewala (Final Report)Kushal ShahNo ratings yet

- Chapter 15 - EpsDocument5 pagesChapter 15 - EpsXiena100% (1)

- A Flock of Red Flags PDFDocument10 pagesA Flock of Red Flags PDFSillyBee1205No ratings yet

- BKM 9e Commonly Used NotationDocument1 pageBKM 9e Commonly Used Notationfossils1001No ratings yet

- Stock Exchange/Merchant Bank Wise Broker ListDocument12 pagesStock Exchange/Merchant Bank Wise Broker Listmd nuruddinNo ratings yet

- CSC CH14Document8 pagesCSC CH14Xuchen ZhuNo ratings yet

- Boosting Returns - New Twists To Time-Tested Trading Techniques With Tom Gentile PDFDocument19 pagesBoosting Returns - New Twists To Time-Tested Trading Techniques With Tom Gentile PDFpreshantNo ratings yet

- IFSEDocument42 pagesIFSEvenkatNo ratings yet

- Project Report On "An Analytical Study of Gold and Gold Etf'S As An Investment Option''Document61 pagesProject Report On "An Analytical Study of Gold and Gold Etf'S As An Investment Option''abhinavreliancelife100% (2)

- Financial Derivative Instruments in Bangladesh: DefinitionDocument4 pagesFinancial Derivative Instruments in Bangladesh: DefinitionJahid AhnafNo ratings yet

- Soal 1: Jurnal Penerbitan Satu Lembar Saham BiasaDocument11 pagesSoal 1: Jurnal Penerbitan Satu Lembar Saham Biasakevin phillipsNo ratings yet

An Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIII

An Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIII

Uploaded by

Amrut KaurOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIII

An Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIII

Uploaded by

Amrut KaurCopyright:

Available Formats

An insight into Indian

Capital Market

Presented by:

Rajesh Kumar

MBA(Finance), ACS, AIII

Capital Market

A market in which individuals and institutions trade

financial securities. Organizations/institutions in the

public and private sectors also often sell securities on

the capital markets in order to raise funds. Thus, this

type of market is composed of both the primary and

secondary markets.

Capital markets are financial markets for the buying and

selling of long-term debt- or equity-backed securities.

These markets channel the wealth of savers to those

who can put it to long-term productive use, such as

companies or governments making long-term

investments.

Capital Market is where trading in financial

instruments is conducted to raise capital.

Three categories of participants:

i) Issuer of securities: Borrowers or deficit savers

who issue securities to raise funds(corporate sector,

central government).

ii) Investors: Surplus savers who deploy savings by

subscribing to these securities(include retail

investors, mutual funds).

iii) The Intermediaries: Agents who match the need of

the users and suppliers of funds.

Nature Of Capital Market

The nature of capital market is brought out by the

Following facts:

Its has two segments primary and secondary

market.

It performs trade-off function.

It deals in long-term securities.

It helps in creating liquidity.

It creates dispersion in business ownership.

It helps in capital function.

Role and Function of Capital Market

Capital Formation

Avenue Provision of Investment

Speed up Economic Growth and

Development

Mobilization of Savings

Proper Regulation of Funds

Service Provision

Continuous Availability of Funds

Factors affect the Capital Market

Economy of the Country

Money Supply

Interest Rate

Corporate Results

Global Capital Market Scenario

Foreign Funds Inflow

Strength/Weakness of the local currency

Types of capital market

There are two types of capital market:

1. Primary market

2. Secondary market

* Primary Market:

It is that market in which shares, debentures and

other securities are sold for the first time for

collecting long-term capital.

This market is concerned with new issues.

Therefore, the primary market is also called NEW

ISSUE MARKET.

Classification of Capital Marketing

CAPITAL MARKET

PRIMARY MARKET

SECONDARY

MARKET

PUBLIC

ISSUE

RIGHT

ISSUE

BONUS

ISSUE

PRIVATE

PLACEMENT

STOCK MARKET

Primary Market

In Primary Market, Securities are offered to the public for subscription, for

the purpose of raising the capital or funds.

The issue of securities in the primary market is subjected to fulfillment of a

number of pre-issue guidelines by SEBI and compliance to various provision

of the Company Act.

An unlisted issuer making a public issue i.e. (making an IPO) is required to

satisfy the following provisions:

The Issuer Company shall meet the following requirements:

(a) Net Tangible Assets of at least Rs. 3 crores in each of the preceding three

full years.

(b) Distributable profits in at least three of the immediately preceding five

years.

(c) Net worth of at least Rs. 1 Crore in each of the preceding three full years.

(d) If the company has changed its name within the last one year, at least 50%

revenue for the preceding 1 year should be from the activity suggested by the

new name.

(e) The issue size does not exceed 5 times the pre issue net worth as per the

audited balance sheet of the last financial year.

MONEY MARKET: It is the market for short

term funds i.e. Up to one year maturity; or it is the

market for lending and borrowing of short term

funds.

It consists of :

Call money market: The call money market deals

in short term finance repayable on demand, with a

maturity period varying from one day to 14

days. It is done mostly by commercial banks.

Bill market: Treasury bills are instrument of

short-term borrowing by the Government of India,

issued as promissory notes under discount.

364 days bill market: The 364 day treasury bills have thus become an

important instrument of government borrowing from market and also

leading money market instrument in the sense that their yield is most

reflective of market condition. Financial institutions recognise the yield rate

on 364 days.

Certificate of Deposit(COD): It is a instrument of borrowing by

commercial for a minimum period of 3 month and a maximum of 1 year in a

multiples of 25 lakhs. The minimum value is reduced and and is presently 1

lakh. It is issue on at a discount to face value. And discount rate is freely

determined according to the market conditions.

Commercial Papers (CPs): Commercial Paper is the short term

unsecured promissory note issued by corporate and financial institutions at a

discounted value on face value. They come with fixed maturity period

ranging from 3 to 6 months. It is issued by companies with a net worth of 10

cr later reduced to 5 cr. It is issued in multiple of 25 lakhs subject to

minimum issue of 1 cr.

Repos and Reverse repos:

Repos: The rate at which the RBI lends money

to commercial banks is called repo rate, a short

term for repurchase agreement. A reduction in

the repo rate will help banks to get money at a

cheaper rate. When the repo rate increases

borrowing from RBI becomes more expensive.

Reverse repos: To sell dated government

securities through auction at fixed cut-off rate

of interest. The objective is to provide short

term avenue to bank to park their Surplus

funds when there is considerable liquidity in

money market.

Classification of Issues

ISSUES

RIGHT

PRIVATE

PLACEMENT

PUBLIC

INITIAL

PUBLIC

OFFERING

FURTHER

PUBLIC

OFFERING

FRESH

ISSUE

OFFER

FOR SALE

FRESH

ISSUE

OFFER FOR

SALE

Classification of Issue

PUBLIC ISSUE :

It involves raising of funds directly from the public and get

themselves listed on the stock exchange.

In case of new companies ,the face value of the securities is

issue at par; and

In the case of existing companies, the face value of

securities are issued at premium.

Initial public offer (IPO): When an unlisted company

makes either a fresh issue of securities or offers its existing

securities for sale or both for the first time to the public, it is

called an IPO. This paves way for listing and trading of the

issuers securities in the Stock Exchanges.

Further public offer (FPO): When an already listed

company makes either a fresh issue of securities to the

public or an offer for sale to the public, it is called a FPO.

Cont

RIGHT ISSUE:

Right issue is the method of raising additional finance from existing

members by offering securities to them on pro rata bases. The rights

offer should be kept open for a period of 60 days and should be

announced within one month of the closure of books.

BONUS ISSUE:

Companies distribute profits to existing shareholders by way of fully

paid bonus share in lieu of dividend.

These are issued in the ratio of existing shares held.

The shareholders do not have to make any additional payment for

these shares.

PRIVATE PLACEMENT:

Private Placement is an issue of shares by a company to a select

group of persons under the Section 81 of the companies act 1956. It

is a faster way for a company to raise equity capital.

Secondary Market

Secondary Market refers to a market where

securities are traded after being initially offered to

the public in the primary market and/or listed on

the stock exchange.

It is the trading avenue in which the already

existing securities are traded amongst investors.

Banks facilitate secondary market transactions by

opening direct trading and demat accounts to

individuals and companies.

Cont

The secondary market is that market in which the

buying and selling of the previously issued

securities is done.

The transactions of the secondary market are

generally done through the medium of stock

exchange.

The chief purpose of the secondary market is to

create liquidity in securities.

Secondary market comprises of Equity market

and Debt market.

Financial instruments dealt in

secondary market

Equity Shares:

An equity share is commonly referred to as an ordinary share.

It is an form of fractional ownership in which a shareholder, as

a fractional owner, undertakes the entrepreneurial risk

associated with the business venture.

Holders of the equity shares are members of the company and

have voting rights.

Right shares:

This refers to the issue of new securities to the existing

shareholders, at a ratio to those shares already held.

Bonus Shares:

These shares are issued by the companies to their shareholders

free of cost by capitalization of accumulated reserves from the

profit earned in the earlier years.

Cont

Preference shares:

These shareholder do not have voting rights.

Owners of these shares are entitled to a fixed dividend or a

dividend calculated at a fixed rate to be paid regularly

before any dividend can be paid in respect of equity shares.

These shareholders also enjoy priority over the equity

shareholders in the payment of surplus.

Cumulative Preference Shares:

This is a type of preference shares on which dividend

accumulates if it remains unpaid.

Cumulative Convertible Preference Shares:

This is a type of preference shares on where the dividend

payable on the same accumulates, if not paid. After a

specified date, these shares will be converted into equity

capital of the company.

Derivative Market

Derivatives are synthetic instruments.

They derive value from an underlying asset

class.

Asset classes range from financial instruments

to commodities to even classes such as

weather and industrial effluents.

However the common underlying theme of

derivatives is that they are leveraged products

Derivatives are not always priced at respective

asset value (fair value).

Derivative Positions and Types of

Derivative Market Players

Naked open position taking a directional call

on the markets

Hedge against underlying asset class

Arbitrage position within an asset class

Speculators

Hedgers

Arbitrageurs

Underlying Asset Class

It is important to understand the underlying

asset class before using derivatives.

Asset classes can be classified into two broad

categories- financial which includes currencies

and commodities.

Financial asset classes can be broadly

categorised into interest rates, equities and

currencies.

Commodities range from agricultural

commodities to minerals and metals.

Financial Asset Classes

Broadly categorized into equity, interest rates and

currencies.

Equity as an asset class will include single stocks

and equity indices.

Interest rates as an asset class will include

government bonds, government bond benchmarks

and money market benchmarks.

Currencies as an asset class will include currency

pairs such as USD/INR, USD/JPY etc.

Credits as defined by corporate bonds can also be

categorized into financial assets and derivatives

on them are called credit derivatives.

Equity Derivatives

Equity derivatives can be classified into single

stock derivatives and index derivatives.

Single stock derivatives are derivatives on

specific stocks eg. Reliance.

Index derivatives are derivatives on stock

exchange indices eg- Nifty.

Hybrid derivatives on equity include

convertible shares (partly or fully).

Employee stock options are also equity

derivatives.

Interest Rate Derivatives

Interest rate derivatives have many different

types:

Derivatives on government bonds

Derivatives on bond indices/ benchmark

Derivatives on short term money market

benchmarks

Examples: Bond futures and interest rate swaps based

on benchmarks such as libor/ mibor.

Currency Derivatives

Currency derivatives are based on currency

pairs.

Currency forwards and options eg- USD/INR

forwards and options.

Currency derivatives are combined with

interest rate derivatives to offer exotics.

Exotics include principle only swaps, currency

swaps.

Derivative Exchanges

Derivative exchanges are separate from stock

exchanges.

In US CBOT and CME are the largest

exchanges for derivatives.

In UK LIFFE is the premier derivative

exchange.

In India NSE is the largest equity derivative

exchange while commodity exchanges are

NCDEX and MCX.

Hedging or Leveraging

Derivatives are viewed as a hedging

instrument.

The holder of an underlying asset can hedge

fluctuations in prices of the asset using

derivatives.

However derivatives are increasingly being

used for taking up leveraged positions in an

underlying asset.

This enables higher returns for taking on

higher risk.

Mutual Fund

Form of trust that pools the funds of a whole

lot of investors to make more money by

investing in an array of financial instruments.

Advantages of a Mutual Fund:

Professional Management

Diversification

Flexibility in choice - selection, redemption

Low costs

Transparency

Types of funds

Open ended fund

Close ended fund

Interval fund

Debt fund

Equity fund

Hybrid fund

Other funds

Commodity Market

A commodity is any good or service produced by

human labor and offered as a product for general sale

on the market .

Characteristics: Commodity is anything movable (a

good) that has following characteristics:

Fungible, i.e. the same no matter who produces it

Derivatives, i.e. involves further processing into

number of products

Economic cost, i.e. production of it involves some

cost

Classification of Commodities

Agriculture

Grains

Pulses

Edible oils/seeds

Spices etc

Base Metals

Copper

Zinc

Aluminum

Nickel

Tin

Energy

Crude oil

Heating oil

Natural gas

Furnace oil

Etc.

Bullion

Gold

Silver

Palladium

etc

Commodities

Commodity Trading Instruments

There are a variety of basic types of

instruments traded in commodity

marketplaces:

Spot contracts

Cash market contracts

Forward contracts

Futures contracts

Options

Commodity Indian Structure

FMC THE REGULATOR

COMMODITY EXCHANGE

NATIONAL

EXCHANGES

REGIONAL

EXCHANGES

NCDEX NMCE MCX NBOT

20 OTHER

REGIONAL

EXCHANGES

Reasons for Investing in Commodities

Commodity provides true diversification in financial portfolio.

Commodity act as hedge against risks involved in business.

Rising income will ensure Inflation which in turn will ensure bull market

in commodities.

Explosion of population and shrinking agricultural land would leave

commodity scarce.

Returns chasing funds & investors (traders, investor &HNI) will make it

vibrant.

Consumption / Spending in infrastructure / GDP growth will lead to

depletion of metals.

Secular bull market in commodities is likely to continue.

Stock Exchange

Stock Exchange denotes a place where

stocks, shares and other securities are

bought and sold. In other words, a stock

exchange is any organization or a group

of persons which constitutes, maintains

or provides a market place or facilities

for bringing together purchasers and sellers

of securities.

Stock Exchanges

In India

Bombay

Stock

Exchange

(BSE)

National

Stock

Exchange

(NSE)

Regional

Stock

Exchanges

STOCK

EXCHANGES

IN INDIA

Functions of Stock Exchange

Motivates individual to save and invest funds.

A safe and productive channels for investment

of savings.

Provides liquidity to the savings of the

investors, by developing a secondary capital

market.

Meeting the large capital needs of organized

industry, trade and business.

Legal Framework

Securities

Contract

(Regulation)

Act, 1956

Listing

Agreements

All the Rules &

Regulations

The

Depositories

Act, 1996

Securities

And Exchange

Board of

India Act,

1992

Companies Act,

1956

Legal

Framework

Securities Contracts (Regulation) Act, 1956

It provides for direct and indirect control

of virtually all aspects of securities trading

and the running of stock exchanges and aims

to prevent undesirable transactions in

securities. It gives SEBI regulatory

jurisdiction over

(a) stock exchanges through a process of

recognition and continued supervisions.

(b) contracts in securities.

(c) listing of securities on stock exchange.

Objectives of Securities Contracts

(Regulation) Act, 1956

To provide for the regulation of stock exchanges.

To provide for the regulation of transactions in securities.

To prevent undesirable speculations in securities.

To regulate the buying and selling of securities outside the

limits of stock exchanges.

To provide for ancillary matters.

Important SEBI Regulations

SEBI ( ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS)

Regulations, 2009

SEBI ( ISSUE AND LISTING OF DEBT SECURITIES) Regulations,

2008.

SEBI ( PROHIBITION OF INSIDER TRADING ) Regulations, 1992

SEBI ( MERCHANT BANKERS ) Regulations, 1992

SEBI ( UNDERWRITERS ) Regulations, 1993

SEBI ( REGISTRARS TO AN ISSUE AND SHARE TRANSFER

AGENTS ) Regulations, 1993

SEBI ( BANKERS TO AN ISSUE ) Regulations, 1994

SEBI ( SUBSTANTIAL ACQUISITION OF SHARES AND

TAKEOVERS ) Regulations 1997 (Takeover Code)

SEBI ( PROHIBITION OF FRADULENT AND UNFAIR TRADE

PRACTICES RELATING TO SECURITIES MARKET ) Regulations,

2003

Thank you

You might also like

- Al Shaheer CorporationDocument3 pagesAl Shaheer CorporationTaha IrfanNo ratings yet

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- Alternative Investments - A Primer For Investment ProfessionalsDocument183 pagesAlternative Investments - A Primer For Investment Professionalsmangeshvaidya100% (3)

- Capital Market OverviewDocument36 pagesCapital Market OverviewUpadhyay JiNo ratings yet

- Capital Market: Presented By: Mohit Upadhyay MBA - 2nd Year ACET, AligarhDocument25 pagesCapital Market: Presented By: Mohit Upadhyay MBA - 2nd Year ACET, AligarhRaghvendra ChaudharyNo ratings yet

- Indian Financial SystemDocument27 pagesIndian Financial SystemDurga Prasad DashNo ratings yet

- Markets. in Primary Markets, Securities Are Bought by Way of Public Issue DirectlyDocument40 pagesMarkets. in Primary Markets, Securities Are Bought by Way of Public Issue DirectlyramchandrakumbharNo ratings yet

- ProjectDocument25 pagesProjectDeana PhillipsNo ratings yet

- Capital MarketDocument20 pagesCapital MarketNikhil NemiNo ratings yet

- Basics of EquityDocument27 pagesBasics of EquityVikas Jeshnani100% (1)

- Capital Marketing: by Venkatragavan.G Mba (BT)Document28 pagesCapital Marketing: by Venkatragavan.G Mba (BT)Nilesh IsalNo ratings yet

- National Stock ExchangeDocument63 pagesNational Stock ExchangePrashantChauhanNo ratings yet

- IBE Module 6Document29 pagesIBE Module 6Prathik_Shetty_204No ratings yet

- Financial Institutions and MarketsDocument10 pagesFinancial Institutions and MarketsVikkuNo ratings yet

- Capital Market: Group MembersDocument17 pagesCapital Market: Group MembersSushil MirguleNo ratings yet

- New Issue Market: Presentation ONDocument19 pagesNew Issue Market: Presentation ONkaranj321No ratings yet

- Capital Market:: Primary Market Secondary MarketDocument63 pagesCapital Market:: Primary Market Secondary MarketvishalhiroleNo ratings yet

- Financial SystemDocument32 pagesFinancial Systemsaritasharma_sharmaNo ratings yet

- Newissuemarket 090919095525 Phpapp01Document31 pagesNewissuemarket 090919095525 Phpapp01vikramrajuNo ratings yet

- Name:-Gohil Hitesh Roll No: - 17 Subject: - Corporate Finance - I Date: - Submitted To: - Savita MissDocument14 pagesName:-Gohil Hitesh Roll No: - 17 Subject: - Corporate Finance - I Date: - Submitted To: - Savita MissHitesh GohilNo ratings yet

- Newissuemarket 090919095525 Phpapp01Document31 pagesNewissuemarket 090919095525 Phpapp01Dr-Afzal Basha HSNo ratings yet

- Wa0005.Document84 pagesWa0005.stekimeuNo ratings yet

- Financial SystemDocument32 pagesFinancial Systemneelabh1984No ratings yet

- Indian Financial Market: Rahul Kumar Department of Business AdminestrationDocument52 pagesIndian Financial Market: Rahul Kumar Department of Business AdminestrationDhruv MishraNo ratings yet

- Basic Terms of Capital MarketDocument44 pagesBasic Terms of Capital Marketdhanabalu87No ratings yet

- IPO (Initial Public Offer) : Advantages of Going PublicDocument67 pagesIPO (Initial Public Offer) : Advantages of Going PublicIsmath FatimaNo ratings yet

- Research Assignment of FmiDocument11 pagesResearch Assignment of FmiAnshita GargNo ratings yet

- Securities Law and Market Operations: Unit-IDocument21 pagesSecurities Law and Market Operations: Unit-IDerain SmilyNo ratings yet

- Indian Financial SystemDocument34 pagesIndian Financial SystemVivek SharmaNo ratings yet

- Basic of Stock MarketDocument5 pagesBasic of Stock MarketAnkit ChauhanNo ratings yet

- IFS-Primary Market - Note Prepared by Dr.R.R.YelikarDocument33 pagesIFS-Primary Market - Note Prepared by Dr.R.R.YelikarBablu JamdarNo ratings yet

- Financial Market - Capital Market - Primary MArketDocument49 pagesFinancial Market - Capital Market - Primary MArketGaurav RathaurNo ratings yet

- Capital MarketDocument58 pagesCapital MarketJasmandeep brar100% (6)

- Stock Market and Stock ExchangesDocument9 pagesStock Market and Stock ExchangesMaithreyi JntuNo ratings yet

- A Project Report On NSEDocument64 pagesA Project Report On NSEMukesh ChhotalaNo ratings yet

- INTRODUCTIONDocument26 pagesINTRODUCTION9022756315yashpatel2003No ratings yet

- Im Module2Document57 pagesIm Module2Lokesh GowdaNo ratings yet

- Unit III Capital MarketDocument27 pagesUnit III Capital MarketAbin VargheseNo ratings yet

- Investment Analysis and Portfolio Management - An OverviewDocument88 pagesInvestment Analysis and Portfolio Management - An OverviewJinal Shah100% (1)

- Q1. Discuss The Components of Money MarketDocument8 pagesQ1. Discuss The Components of Money MarketAshutosh MohantyNo ratings yet

- Secondary MarketDocument27 pagesSecondary MarketAmit BharwadNo ratings yet

- Indian Financial Markets: Class of MBADocument43 pagesIndian Financial Markets: Class of MBAaksid1No ratings yet

- Capital MarketDocument28 pagesCapital MarketVineet SinghNo ratings yet

- Primary MarketDocument15 pagesPrimary MarketKapil KumarNo ratings yet

- C CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CDocument34 pagesC CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CJayprakash MahantaNo ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet

- Financial Markets in IndiaDocument26 pagesFinancial Markets in Indiatadpelliwar_navinNo ratings yet

- New Issue Market & Secondary Markets: by Group 3Document45 pagesNew Issue Market & Secondary Markets: by Group 3Praveen VernekarNo ratings yet

- Financial MarketsDocument23 pagesFinancial Marketsमहेंद्र सिंह राजपूतNo ratings yet

- Financial Market & InstitutionsDocument7 pagesFinancial Market & InstitutionsMohammad Rakibul IslamNo ratings yet

- Financial MarketDocument15 pagesFinancial Marketrishu ashiNo ratings yet

- Securities Market The BattlefieldDocument14 pagesSecurities Market The BattlefieldJagrityTalwarNo ratings yet

- India's Inflation Rate For Jul 2010Document21 pagesIndia's Inflation Rate For Jul 2010priyaNo ratings yet

- Financial MarketsDocument34 pagesFinancial Marketsmouli poliparthiNo ratings yet

- Meaning and Concept of Capital MarketDocument11 pagesMeaning and Concept of Capital Marketmanyasingh100% (1)

- New Issue MarketDocument31 pagesNew Issue MarketAashish AnandNo ratings yet

- Sapm PPT 1Document21 pagesSapm PPT 1Gitanjali SubbaraajNo ratings yet

- Primary MKTDocument24 pagesPrimary MKTdanbrowndaNo ratings yet

- Fs-Ii PCDocument23 pagesFs-Ii PCChandrashekhar PampannaNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Mastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesFrom EverandMastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Daily Equity Market Report - 08.09.2021Document1 pageDaily Equity Market Report - 08.09.2021Fuaad DodooNo ratings yet

- Options GreeksDocument30 pagesOptions GreeksSukumar100% (2)

- BM FI6051 WK9 Lecturer NotesDocument54 pagesBM FI6051 WK9 Lecturer NotesfmurphyNo ratings yet

- Risk Return AnalysisDocument70 pagesRisk Return Analysisvijaykumarsmec100% (7)

- Pra UAS PA 2 CBDocument3 pagesPra UAS PA 2 CBStefi Yunia SuwarlanNo ratings yet

- Stock Valuation: Dr. C. Bulent AybarDocument35 pagesStock Valuation: Dr. C. Bulent AybarkeithNo ratings yet

- MGT201 Final Term Subjective Solved With Reference 2014Document18 pagesMGT201 Final Term Subjective Solved With Reference 2014maryamNo ratings yet

- CommoditiesDocument122 pagesCommoditiesAnil TiwariNo ratings yet

- ACF Assignment Bonds - Asutosh PatraDocument11 pagesACF Assignment Bonds - Asutosh PatraAshok KumarNo ratings yet

- Chapter 3 - Forward and Futures Pricing - 2022 - SDocument63 pagesChapter 3 - Forward and Futures Pricing - 2022 - SĐức Nam TrầnNo ratings yet

- Urp GFM 01 Global Financial Markets StructureDocument61 pagesUrp GFM 01 Global Financial Markets StructureWhiny CustodioNo ratings yet

- 2326 Question - QuizDocument66 pages2326 Question - Quizidika123No ratings yet

- Media Matrix Worldwide Limited: Abridged Letter of OfferDocument1 pageMedia Matrix Worldwide Limited: Abridged Letter of OfferGauravsNo ratings yet

- FD ch5 PPT HullDocument37 pagesFD ch5 PPT HullBuller CatNo ratings yet

- ACFI1003 - Lecture 7 Corporations and The Share MarketDocument43 pagesACFI1003 - Lecture 7 Corporations and The Share Market王亚琪No ratings yet

- ICAI Guidance Note ESOPDocument88 pagesICAI Guidance Note ESOPKellenJaneHernandezNo ratings yet

- Pratik Tibrewala (Final Report)Document52 pagesPratik Tibrewala (Final Report)Kushal ShahNo ratings yet

- Chapter 15 - EpsDocument5 pagesChapter 15 - EpsXiena100% (1)

- A Flock of Red Flags PDFDocument10 pagesA Flock of Red Flags PDFSillyBee1205No ratings yet

- BKM 9e Commonly Used NotationDocument1 pageBKM 9e Commonly Used Notationfossils1001No ratings yet

- Stock Exchange/Merchant Bank Wise Broker ListDocument12 pagesStock Exchange/Merchant Bank Wise Broker Listmd nuruddinNo ratings yet

- CSC CH14Document8 pagesCSC CH14Xuchen ZhuNo ratings yet

- Boosting Returns - New Twists To Time-Tested Trading Techniques With Tom Gentile PDFDocument19 pagesBoosting Returns - New Twists To Time-Tested Trading Techniques With Tom Gentile PDFpreshantNo ratings yet

- IFSEDocument42 pagesIFSEvenkatNo ratings yet

- Project Report On "An Analytical Study of Gold and Gold Etf'S As An Investment Option''Document61 pagesProject Report On "An Analytical Study of Gold and Gold Etf'S As An Investment Option''abhinavreliancelife100% (2)

- Financial Derivative Instruments in Bangladesh: DefinitionDocument4 pagesFinancial Derivative Instruments in Bangladesh: DefinitionJahid AhnafNo ratings yet

- Soal 1: Jurnal Penerbitan Satu Lembar Saham BiasaDocument11 pagesSoal 1: Jurnal Penerbitan Satu Lembar Saham Biasakevin phillipsNo ratings yet