Professional Documents

Culture Documents

Unit V Finance

Unit V Finance

Uploaded by

Gopal KrishnanCopyright:

Available Formats

You might also like

- Financial Decision PDFDocument72 pagesFinancial Decision PDFDimple Pankaj Desai100% (1)

- Final Report For Market Study of PicklesDocument42 pagesFinal Report For Market Study of Picklespredm88% (8)

- IB Economics - Revision Guide - Stephen Holroyd - First Edition - OSC 2004Document97 pagesIB Economics - Revision Guide - Stephen Holroyd - First Edition - OSC 2004didsleepsalot100% (1)

- Fintech - PPT 1Document37 pagesFintech - PPT 1askaashu786No ratings yet

- Commerce BankDocument31 pagesCommerce BankShakti Tandon100% (1)

- Unit-3 MIPDocument17 pagesUnit-3 MIPVeena ReddyNo ratings yet

- Financial Services: BY Rakshit Narayanan Prakhar Gupta Smriti Bhandari Mayank Singh Sayim Qureshi Swati MittalDocument14 pagesFinancial Services: BY Rakshit Narayanan Prakhar Gupta Smriti Bhandari Mayank Singh Sayim Qureshi Swati Mittalashwini_sharma_3No ratings yet

- CRM in Axis BankDocument42 pagesCRM in Axis BankMinakshi DhootNo ratings yet

- CRMDocument11 pagesCRMKapilGhanshaniNo ratings yet

- (CRM) in Axis BankDocument42 pages(CRM) in Axis Bankkrupamayekar55% (11)

- CRM in Banking Sector.Document38 pagesCRM in Banking Sector.desaikrishna24No ratings yet

- CRM in ICICIDocument7 pagesCRM in ICICIanand4444No ratings yet

- Bank MarketingDocument4 pagesBank Marketingbeena antuNo ratings yet

- 2 Ijamh 1031 NN SharmaDocument4 pages2 Ijamh 1031 NN SharmaedfwNo ratings yet

- MetrobankDocument12 pagesMetrobankAhke HiroNo ratings yet

- Strategic Marketing - Toolkit: AuthorDocument13 pagesStrategic Marketing - Toolkit: AuthorTushar GawandiNo ratings yet

- 8 Yatish Joshi 1936 Research Communication VSRDIJBMR June 2013Document4 pages8 Yatish Joshi 1936 Research Communication VSRDIJBMR June 2013Rajni TyagiNo ratings yet

- Introduction To Retail BankingDocument27 pagesIntroduction To Retail BankingMitesh Dharamwani83% (6)

- Financial Service Promotional (Strategy Icici Bank)Document51 pagesFinancial Service Promotional (Strategy Icici Bank)goodwynj100% (2)

- Global Trends and Changes in International Banking:-: 1. Focus On Next-Generation Remote Banking SolutionsDocument13 pagesGlobal Trends and Changes in International Banking:-: 1. Focus On Next-Generation Remote Banking SolutionsGayatri TolabandiNo ratings yet

- Customer Relationship Management in Banking IndustryDocument12 pagesCustomer Relationship Management in Banking IndustryAnkit BhasinNo ratings yet

- Unit 3-Marketing of Financial ServicesDocument43 pagesUnit 3-Marketing of Financial ServicesLavi VermaNo ratings yet

- Why CRM? - The Changing EnvironmentDocument7 pagesWhy CRM? - The Changing EnvironmentaaaeeeashishNo ratings yet

- MKT 666-Marketing of Financial ServicesDocument5 pagesMKT 666-Marketing of Financial ServicesmohdnizaNo ratings yet

- Marketing of Financial ServicesDocument8 pagesMarketing of Financial ServicesMohan KottuNo ratings yet

- Marketing of Banking ServicesDocument22 pagesMarketing of Banking ServicesAzeem_Rafat_40880% (1)

- CRM Presentation On Standard Charted BankDocument12 pagesCRM Presentation On Standard Charted BankPooja Gokul ShenoyNo ratings yet

- INDUSTRY: Banking Project Title: CRM in Axis BankDocument7 pagesINDUSTRY: Banking Project Title: CRM in Axis BankArup BoseNo ratings yet

- Financial Service MarketingDocument13 pagesFinancial Service MarketingrafihaiderNo ratings yet

- Constant Change in Environment: Primary Focus Public RelationsDocument38 pagesConstant Change in Environment: Primary Focus Public RelationsNeha BagdiNo ratings yet

- Vaishu CRM Final Project 15 FEBDocument49 pagesVaishu CRM Final Project 15 FEBVaishnavi JadhavNo ratings yet

- Ism Project: Group Members: Sabah Anis FA18-MBAP-0090 Syeda Atiqa Khursheed FA18-MBAP-0118Document18 pagesIsm Project: Group Members: Sabah Anis FA18-MBAP-0090 Syeda Atiqa Khursheed FA18-MBAP-0118sabah khanNo ratings yet

- Customer Relationship Management in Insurance Industry: Key Words:customers, CRM, Insurance, Services, TechnologyDocument7 pagesCustomer Relationship Management in Insurance Industry: Key Words:customers, CRM, Insurance, Services, TechnologyDr.K.BaranidharanNo ratings yet

- Financial ServicesDocument30 pagesFinancial Servicesmanojkumartanwar05No ratings yet

- CRM in Life Insurance: BY B.Sandeep Kumar MBA 13251042Document25 pagesCRM in Life Insurance: BY B.Sandeep Kumar MBA 13251042sandeep26bandiNo ratings yet

- Industry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaDocument12 pagesIndustry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaBhakti GuravNo ratings yet

- KPO Case Study 01Document3 pagesKPO Case Study 01rameshkoutarapuNo ratings yet

- City Bank Ltd. AuditDocument29 pagesCity Bank Ltd. AuditSameena AhmedNo ratings yet

- Assignment On Banking ProductDocument6 pagesAssignment On Banking ProductTabaraAnannyaNo ratings yet

- HSBC Case StudyDocument6 pagesHSBC Case StudySouhail AboueddihajNo ratings yet

- Serving Depositors: Optimising Branch Based BankingDocument21 pagesServing Depositors: Optimising Branch Based BankingkallasanjayNo ratings yet

- CRM in Banks - Serve Thy Customer: AbstractDocument6 pagesCRM in Banks - Serve Thy Customer: AbstractChandan VirmaniNo ratings yet

- First Direct: Branchless BankingDocument26 pagesFirst Direct: Branchless BankingNikita RunwalNo ratings yet

- CRM in InsuranceDocument18 pagesCRM in InsurancePramila ChauhanNo ratings yet

- 12-Trends in Banking and Insurance MarketingDocument50 pages12-Trends in Banking and Insurance MarketingKartik BhartiaNo ratings yet

- What Is CRM 1Document12 pagesWhat Is CRM 1Ambuj RaiNo ratings yet

- Chapter - I: 2010 Customer Relationship ManagementDocument68 pagesChapter - I: 2010 Customer Relationship ManagementShamil VazirNo ratings yet

- G7 - 35 - May Thazin-1Document3 pagesG7 - 35 - May Thazin-1mayphuu.otNo ratings yet

- CRM in Investment Banking & Financial Market (PDF) - Finance - + - Found - at PDFDocument16 pagesCRM in Investment Banking & Financial Market (PDF) - Finance - + - Found - at PDFsarferazul_haqueNo ratings yet

- CRM in Axis Bank - Stage 2 Mid-Review of The ProjectDocument7 pagesCRM in Axis Bank - Stage 2 Mid-Review of The ProjectShalini MahawarNo ratings yet

- Customer Relationship Management at Capital One (UKDocument25 pagesCustomer Relationship Management at Capital One (UKRakesh SharmaNo ratings yet

- Retail Banking Solutions: Innovation Is The Key To Competitive AdvantageDocument4 pagesRetail Banking Solutions: Innovation Is The Key To Competitive AdvantageDeepak MartinNo ratings yet

- CRM in Investment Banking & Financial Market PDFDocument15 pagesCRM in Investment Banking & Financial Market PDFrmiranda_21No ratings yet

- CRM - 1Document37 pagesCRM - 1srishti sharma.ayush1995No ratings yet

- The Emergence of CRM Practice: Customer Relationship ManagementDocument101 pagesThe Emergence of CRM Practice: Customer Relationship Managementroushanijha123No ratings yet

- The Changing Role of BanksDocument10 pagesThe Changing Role of BanksBharat SahniNo ratings yet

- Value Addition in SCM & Demand Chain Management: Group MembersDocument26 pagesValue Addition in SCM & Demand Chain Management: Group MembersSUMIT KHANNANo ratings yet

- Major Project ReportDocument48 pagesMajor Project Reportinderpreet kaurNo ratings yet

- Careers in FinanceDocument49 pagesCareers in FinanceManish GoyalNo ratings yet

- Customer Relationship Management: A powerful tool for attracting and retaining customersFrom EverandCustomer Relationship Management: A powerful tool for attracting and retaining customersRating: 3.5 out of 5 stars3.5/5 (3)

- How to Start a Vendor Management Consulting Business Business PlanFrom EverandHow to Start a Vendor Management Consulting Business Business PlanNo ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- A new era of Value Selling: What customers really want and how to respondFrom EverandA new era of Value Selling: What customers really want and how to respondNo ratings yet

- Yummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/2017Document3 pagesYummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/2017Gopal KrishnanNo ratings yet

- Mgtums1: Culture& BrandingDocument15 pagesMgtums1: Culture& BrandingGopal KrishnanNo ratings yet

- Unit I: Accounting For Changes Prices (Inflation Accounting)Document18 pagesUnit I: Accounting For Changes Prices (Inflation Accounting)Gopal KrishnanNo ratings yet

- Sakthi Institute of Information and Management Studies: (Feb 2011-AUQP)Document1 pageSakthi Institute of Information and Management Studies: (Feb 2011-AUQP)Gopal KrishnanNo ratings yet

- Chapter Eight: South African Policy Framework For Start-UpsDocument19 pagesChapter Eight: South African Policy Framework For Start-UpsGopal KrishnanNo ratings yet

- Week 1 Theories Concepts of EntrepreneurshipDocument21 pagesWeek 1 Theories Concepts of EntrepreneurshipGopal KrishnanNo ratings yet

- Final AccountsDocument5 pagesFinal AccountsGopal KrishnanNo ratings yet

- Introduction To Accounting: Accounting The Language of BusinessDocument34 pagesIntroduction To Accounting: Accounting The Language of BusinessGopal KrishnanNo ratings yet

- Accounting Concepts and Conventions: Unit - IDocument30 pagesAccounting Concepts and Conventions: Unit - IGopal KrishnanNo ratings yet

- Mergers & Acquisitions: How To Expand Your Business in Today's EnvironmentDocument15 pagesMergers & Acquisitions: How To Expand Your Business in Today's EnvironmentGopal KrishnanNo ratings yet

- 7 Adjustments To Final AccountsDocument11 pages7 Adjustments To Final AccountsBhavneet SachdevaNo ratings yet

- Unit II ScalingDocument57 pagesUnit II ScalingGopal KrishnanNo ratings yet

- Positioning Products and Services in The Market: Unit IvDocument16 pagesPositioning Products and Services in The Market: Unit IvGopal KrishnanNo ratings yet

- Unit I D HraDocument21 pagesUnit I D HraGopal Krishnan100% (1)

- Unit I A Introduction AccoutingDocument21 pagesUnit I A Introduction AccoutingGopal KrishnanNo ratings yet

- WSO Private Equity Guide NotesDocument2 pagesWSO Private Equity Guide NotesP Win100% (1)

- CadburyDocument16 pagesCadburyHarshit Goswami100% (1)

- Financial FormulasDocument2 pagesFinancial FormulasCoreyNo ratings yet

- Reaction Paaper No 7. - Mutual Funds As VCs - April 2022Document3 pagesReaction Paaper No 7. - Mutual Funds As VCs - April 2022Nazanin SangestaniNo ratings yet

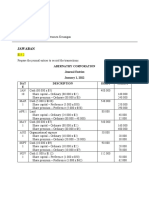

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Spatres 2 Product DevelopmentDocument5 pagesSpatres 2 Product DevelopmentSam MoralesNo ratings yet

- Digital Marketing Agency-CreativeDocument14 pagesDigital Marketing Agency-Creativesandeep DwivediNo ratings yet

- Impact of Brand On Consumer Buying BehaviorDocument4 pagesImpact of Brand On Consumer Buying BehaviorPRAVEENKUMAR MNo ratings yet

- IM C Study - DistributionDocument3 pagesIM C Study - DistributionanibuggyNo ratings yet

- Marketing Strategy Self-Assessment QuestionnaireDocument12 pagesMarketing Strategy Self-Assessment QuestionnaireAndrea ScaranoNo ratings yet

- Financial Planning Banking & Investment ManagementDocument15 pagesFinancial Planning Banking & Investment ManagementKarthik KumarNo ratings yet

- Logics of Action, Globalization, and Employment Relations Change in China, India, Malaysia, and The PhilippinesDocument57 pagesLogics of Action, Globalization, and Employment Relations Change in China, India, Malaysia, and The PhilippinesAyisha PatnaikNo ratings yet

- FM Chapter 8 PDFDocument6 pagesFM Chapter 8 PDFSuzanne AcostaNo ratings yet

- Fact-Sheet 20191230 02 Idx80 PDFDocument1 pageFact-Sheet 20191230 02 Idx80 PDFvivafatma92No ratings yet

- FINDocument26 pagesFINJadeNo ratings yet

- Is Gold A Safe Haven International EvidenceDocument38 pagesIs Gold A Safe Haven International EvidenceLuckade PoonnalimpakulNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test BankDocument25 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Test BankMalloryHartmanmkgqd100% (54)

- USANA-A Revolutionary Way To Create Wealth: #1 Distributor's Choice Ten Consecutive YearsDocument1 pageUSANA-A Revolutionary Way To Create Wealth: #1 Distributor's Choice Ten Consecutive YearsAlyNo ratings yet

- Earnings Management NotesDocument7 pagesEarnings Management NoteslciimNo ratings yet

- Answer and Explanation:: Activity Mas 2 1Document3 pagesAnswer and Explanation:: Activity Mas 2 1Mydel Avelino100% (1)

- ReceiptDocument1 pageReceiptAngela BalarbarNo ratings yet

- CadburyDocument42 pagesCadburyDeepti JainNo ratings yet

- Courses List IiDocument15 pagesCourses List IiShareef Sabi100% (1)

- TAX Final-PreboardDocument14 pagesTAX Final-PreboardMarjorie BernasNo ratings yet

- PESTLE Analysis of FMCG Retailing IndustryDocument4 pagesPESTLE Analysis of FMCG Retailing IndustryJammigumpula PriyankaNo ratings yet

- Zeus Case StudyDocument10 pagesZeus Case StudyWangJiaPeng100% (1)

- Commodity Tips and MCX TipsDocument5 pagesCommodity Tips and MCX TipsTheequicom AdvisoryNo ratings yet

Unit V Finance

Unit V Finance

Uploaded by

Gopal KrishnanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit V Finance

Unit V Finance

Uploaded by

Gopal KrishnanCopyright:

Available Formats

FINANCIAL SERVICES

UNIT V

INTRODUCTION

Financial services refer to services

provided by the finance industry.

The finance industry encompasses a

broad range of organizations that

deal with the management of

money. Among these organizations

are banks, credit card companies,

insurance companies, consumer

finance companies, stock

brokerages, investment funds and

some government sponsored

enterprises.

TYPES OF FINANCIAL SERVICES

Banking

services

Issuance of

checkbooks

Provide

personal

loans,

commercial

loans

ATMs

Foreign

exchange

services

Currency

Exchange

Foreign

Currency

Banking

Wire

transfer

Investment

services

Asset

manageme

nt

Hedge fund

manageme

nt

Insurance

Insurance

brokerage

Reinsurance

Extending CRM into multiple media means integrating the front office with

different communication channels

Factors affecting the adoption of new

financial services

IMPACT OF CRM

Benefits of Using CRM in

Banking Industry

Provide better customer balance

Increase customer revival

Discover new customers

Helps sales staff close deals faster

Making banking operation more

efficient

Simplify marketing and sales

process

Organization Without CRM

Unsatisfied Customer

Low customer retention

Low sales

In efficient Banking

Operations

Complexity

CRM Strategies Adopted in Banking Sector

One-Stop Financial Supermarket

Right service is offered to right customers

Increasing the Number of Delivery Channels to the Customers

Shifting customer access to lower cost channels can help in

bring down the operating cost

The Real Time Gross Settlement (RTGS), CBS (Core Banking

Solution)

Customer Value Management

The main thrust of CRM is to develop new products, render

value creation, gain market leadership and spread risks and

vulnerabilities besides facing competition

Utility of CRM in Banks

Campa

ign

Manag

ement

Custo

mer

Inform

ation

Consol

idation

Market

ing

Encycl

opedia

3 6 0-

degree

view

of

compa

ny

Person

alized

sales

home

page

Lead

and

Opport

unity

Manag

ement

Activit

y

Manag

ement

Contac

t

Center

Operat

ional

Ineffici

ency

Remov

al

CRM Business Model

Customer management assessment tool

Assessments bring together a range of tools and methodologies that provide a

detailed, objective, benchmarked assessment of an organizations capability to

effectively manage its customers.

Financial Services

Financial Services Institutions:

Retail, corporate, investment and private banks

Mutual funds, investment trusts

Personal and group pensions

Life and general insurance and reinsurance companies

Credit card issuers

Specialist lending companies

Stock exchanges

Leasing companies

Government saving institutions

Brokers and agents

Financial Services Environment:

A number of external forces have exerted influence on

the sector, including:

1- Socio-economic factors: play an important rule in

determining the demand for financial services. Ex.

Changes in the distribution of income and wealth

and patterns of consumption.

2- Regulatory environment: Regulations have played a

major role in shaping the behavior of suppliers and

offering increased protection to consumers. Serve to

strengthen the procedures and practices already set

in place.

Financial Services Environment:

3- Technology: Traditionally paper-based systems have

become fully automated, providing greater flexibility

and scope for expansion. Without a doubt,

technology holds the key to future long-term success

for financial institutions, from innovative distribution

channels, which are both cost efficient and effective

at delivering customer service, to customer

databases, which enable better use of target

marketing.

You might also like

- Financial Decision PDFDocument72 pagesFinancial Decision PDFDimple Pankaj Desai100% (1)

- Final Report For Market Study of PicklesDocument42 pagesFinal Report For Market Study of Picklespredm88% (8)

- IB Economics - Revision Guide - Stephen Holroyd - First Edition - OSC 2004Document97 pagesIB Economics - Revision Guide - Stephen Holroyd - First Edition - OSC 2004didsleepsalot100% (1)

- Fintech - PPT 1Document37 pagesFintech - PPT 1askaashu786No ratings yet

- Commerce BankDocument31 pagesCommerce BankShakti Tandon100% (1)

- Unit-3 MIPDocument17 pagesUnit-3 MIPVeena ReddyNo ratings yet

- Financial Services: BY Rakshit Narayanan Prakhar Gupta Smriti Bhandari Mayank Singh Sayim Qureshi Swati MittalDocument14 pagesFinancial Services: BY Rakshit Narayanan Prakhar Gupta Smriti Bhandari Mayank Singh Sayim Qureshi Swati Mittalashwini_sharma_3No ratings yet

- CRM in Axis BankDocument42 pagesCRM in Axis BankMinakshi DhootNo ratings yet

- CRMDocument11 pagesCRMKapilGhanshaniNo ratings yet

- (CRM) in Axis BankDocument42 pages(CRM) in Axis Bankkrupamayekar55% (11)

- CRM in Banking Sector.Document38 pagesCRM in Banking Sector.desaikrishna24No ratings yet

- CRM in ICICIDocument7 pagesCRM in ICICIanand4444No ratings yet

- Bank MarketingDocument4 pagesBank Marketingbeena antuNo ratings yet

- 2 Ijamh 1031 NN SharmaDocument4 pages2 Ijamh 1031 NN SharmaedfwNo ratings yet

- MetrobankDocument12 pagesMetrobankAhke HiroNo ratings yet

- Strategic Marketing - Toolkit: AuthorDocument13 pagesStrategic Marketing - Toolkit: AuthorTushar GawandiNo ratings yet

- 8 Yatish Joshi 1936 Research Communication VSRDIJBMR June 2013Document4 pages8 Yatish Joshi 1936 Research Communication VSRDIJBMR June 2013Rajni TyagiNo ratings yet

- Introduction To Retail BankingDocument27 pagesIntroduction To Retail BankingMitesh Dharamwani83% (6)

- Financial Service Promotional (Strategy Icici Bank)Document51 pagesFinancial Service Promotional (Strategy Icici Bank)goodwynj100% (2)

- Global Trends and Changes in International Banking:-: 1. Focus On Next-Generation Remote Banking SolutionsDocument13 pagesGlobal Trends and Changes in International Banking:-: 1. Focus On Next-Generation Remote Banking SolutionsGayatri TolabandiNo ratings yet

- Customer Relationship Management in Banking IndustryDocument12 pagesCustomer Relationship Management in Banking IndustryAnkit BhasinNo ratings yet

- Unit 3-Marketing of Financial ServicesDocument43 pagesUnit 3-Marketing of Financial ServicesLavi VermaNo ratings yet

- Why CRM? - The Changing EnvironmentDocument7 pagesWhy CRM? - The Changing EnvironmentaaaeeeashishNo ratings yet

- MKT 666-Marketing of Financial ServicesDocument5 pagesMKT 666-Marketing of Financial ServicesmohdnizaNo ratings yet

- Marketing of Financial ServicesDocument8 pagesMarketing of Financial ServicesMohan KottuNo ratings yet

- Marketing of Banking ServicesDocument22 pagesMarketing of Banking ServicesAzeem_Rafat_40880% (1)

- CRM Presentation On Standard Charted BankDocument12 pagesCRM Presentation On Standard Charted BankPooja Gokul ShenoyNo ratings yet

- INDUSTRY: Banking Project Title: CRM in Axis BankDocument7 pagesINDUSTRY: Banking Project Title: CRM in Axis BankArup BoseNo ratings yet

- Financial Service MarketingDocument13 pagesFinancial Service MarketingrafihaiderNo ratings yet

- Constant Change in Environment: Primary Focus Public RelationsDocument38 pagesConstant Change in Environment: Primary Focus Public RelationsNeha BagdiNo ratings yet

- Vaishu CRM Final Project 15 FEBDocument49 pagesVaishu CRM Final Project 15 FEBVaishnavi JadhavNo ratings yet

- Ism Project: Group Members: Sabah Anis FA18-MBAP-0090 Syeda Atiqa Khursheed FA18-MBAP-0118Document18 pagesIsm Project: Group Members: Sabah Anis FA18-MBAP-0090 Syeda Atiqa Khursheed FA18-MBAP-0118sabah khanNo ratings yet

- Customer Relationship Management in Insurance Industry: Key Words:customers, CRM, Insurance, Services, TechnologyDocument7 pagesCustomer Relationship Management in Insurance Industry: Key Words:customers, CRM, Insurance, Services, TechnologyDr.K.BaranidharanNo ratings yet

- Financial ServicesDocument30 pagesFinancial Servicesmanojkumartanwar05No ratings yet

- CRM in Life Insurance: BY B.Sandeep Kumar MBA 13251042Document25 pagesCRM in Life Insurance: BY B.Sandeep Kumar MBA 13251042sandeep26bandiNo ratings yet

- Industry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaDocument12 pagesIndustry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaBhakti GuravNo ratings yet

- KPO Case Study 01Document3 pagesKPO Case Study 01rameshkoutarapuNo ratings yet

- City Bank Ltd. AuditDocument29 pagesCity Bank Ltd. AuditSameena AhmedNo ratings yet

- Assignment On Banking ProductDocument6 pagesAssignment On Banking ProductTabaraAnannyaNo ratings yet

- HSBC Case StudyDocument6 pagesHSBC Case StudySouhail AboueddihajNo ratings yet

- Serving Depositors: Optimising Branch Based BankingDocument21 pagesServing Depositors: Optimising Branch Based BankingkallasanjayNo ratings yet

- CRM in Banks - Serve Thy Customer: AbstractDocument6 pagesCRM in Banks - Serve Thy Customer: AbstractChandan VirmaniNo ratings yet

- First Direct: Branchless BankingDocument26 pagesFirst Direct: Branchless BankingNikita RunwalNo ratings yet

- CRM in InsuranceDocument18 pagesCRM in InsurancePramila ChauhanNo ratings yet

- 12-Trends in Banking and Insurance MarketingDocument50 pages12-Trends in Banking and Insurance MarketingKartik BhartiaNo ratings yet

- What Is CRM 1Document12 pagesWhat Is CRM 1Ambuj RaiNo ratings yet

- Chapter - I: 2010 Customer Relationship ManagementDocument68 pagesChapter - I: 2010 Customer Relationship ManagementShamil VazirNo ratings yet

- G7 - 35 - May Thazin-1Document3 pagesG7 - 35 - May Thazin-1mayphuu.otNo ratings yet

- CRM in Investment Banking & Financial Market (PDF) - Finance - + - Found - at PDFDocument16 pagesCRM in Investment Banking & Financial Market (PDF) - Finance - + - Found - at PDFsarferazul_haqueNo ratings yet

- CRM in Axis Bank - Stage 2 Mid-Review of The ProjectDocument7 pagesCRM in Axis Bank - Stage 2 Mid-Review of The ProjectShalini MahawarNo ratings yet

- Customer Relationship Management at Capital One (UKDocument25 pagesCustomer Relationship Management at Capital One (UKRakesh SharmaNo ratings yet

- Retail Banking Solutions: Innovation Is The Key To Competitive AdvantageDocument4 pagesRetail Banking Solutions: Innovation Is The Key To Competitive AdvantageDeepak MartinNo ratings yet

- CRM in Investment Banking & Financial Market PDFDocument15 pagesCRM in Investment Banking & Financial Market PDFrmiranda_21No ratings yet

- CRM - 1Document37 pagesCRM - 1srishti sharma.ayush1995No ratings yet

- The Emergence of CRM Practice: Customer Relationship ManagementDocument101 pagesThe Emergence of CRM Practice: Customer Relationship Managementroushanijha123No ratings yet

- The Changing Role of BanksDocument10 pagesThe Changing Role of BanksBharat SahniNo ratings yet

- Value Addition in SCM & Demand Chain Management: Group MembersDocument26 pagesValue Addition in SCM & Demand Chain Management: Group MembersSUMIT KHANNANo ratings yet

- Major Project ReportDocument48 pagesMajor Project Reportinderpreet kaurNo ratings yet

- Careers in FinanceDocument49 pagesCareers in FinanceManish GoyalNo ratings yet

- Customer Relationship Management: A powerful tool for attracting and retaining customersFrom EverandCustomer Relationship Management: A powerful tool for attracting and retaining customersRating: 3.5 out of 5 stars3.5/5 (3)

- How to Start a Vendor Management Consulting Business Business PlanFrom EverandHow to Start a Vendor Management Consulting Business Business PlanNo ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- A new era of Value Selling: What customers really want and how to respondFrom EverandA new era of Value Selling: What customers really want and how to respondNo ratings yet

- Yummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/2017Document3 pagesYummy Ice-Cream!!!!: Offer!!!OFFER!!! FROM 21/12/2017 TILL 27/12/2017Gopal KrishnanNo ratings yet

- Mgtums1: Culture& BrandingDocument15 pagesMgtums1: Culture& BrandingGopal KrishnanNo ratings yet

- Unit I: Accounting For Changes Prices (Inflation Accounting)Document18 pagesUnit I: Accounting For Changes Prices (Inflation Accounting)Gopal KrishnanNo ratings yet

- Sakthi Institute of Information and Management Studies: (Feb 2011-AUQP)Document1 pageSakthi Institute of Information and Management Studies: (Feb 2011-AUQP)Gopal KrishnanNo ratings yet

- Chapter Eight: South African Policy Framework For Start-UpsDocument19 pagesChapter Eight: South African Policy Framework For Start-UpsGopal KrishnanNo ratings yet

- Week 1 Theories Concepts of EntrepreneurshipDocument21 pagesWeek 1 Theories Concepts of EntrepreneurshipGopal KrishnanNo ratings yet

- Final AccountsDocument5 pagesFinal AccountsGopal KrishnanNo ratings yet

- Introduction To Accounting: Accounting The Language of BusinessDocument34 pagesIntroduction To Accounting: Accounting The Language of BusinessGopal KrishnanNo ratings yet

- Accounting Concepts and Conventions: Unit - IDocument30 pagesAccounting Concepts and Conventions: Unit - IGopal KrishnanNo ratings yet

- Mergers & Acquisitions: How To Expand Your Business in Today's EnvironmentDocument15 pagesMergers & Acquisitions: How To Expand Your Business in Today's EnvironmentGopal KrishnanNo ratings yet

- 7 Adjustments To Final AccountsDocument11 pages7 Adjustments To Final AccountsBhavneet SachdevaNo ratings yet

- Unit II ScalingDocument57 pagesUnit II ScalingGopal KrishnanNo ratings yet

- Positioning Products and Services in The Market: Unit IvDocument16 pagesPositioning Products and Services in The Market: Unit IvGopal KrishnanNo ratings yet

- Unit I D HraDocument21 pagesUnit I D HraGopal Krishnan100% (1)

- Unit I A Introduction AccoutingDocument21 pagesUnit I A Introduction AccoutingGopal KrishnanNo ratings yet

- WSO Private Equity Guide NotesDocument2 pagesWSO Private Equity Guide NotesP Win100% (1)

- CadburyDocument16 pagesCadburyHarshit Goswami100% (1)

- Financial FormulasDocument2 pagesFinancial FormulasCoreyNo ratings yet

- Reaction Paaper No 7. - Mutual Funds As VCs - April 2022Document3 pagesReaction Paaper No 7. - Mutual Funds As VCs - April 2022Nazanin SangestaniNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Spatres 2 Product DevelopmentDocument5 pagesSpatres 2 Product DevelopmentSam MoralesNo ratings yet

- Digital Marketing Agency-CreativeDocument14 pagesDigital Marketing Agency-Creativesandeep DwivediNo ratings yet

- Impact of Brand On Consumer Buying BehaviorDocument4 pagesImpact of Brand On Consumer Buying BehaviorPRAVEENKUMAR MNo ratings yet

- IM C Study - DistributionDocument3 pagesIM C Study - DistributionanibuggyNo ratings yet

- Marketing Strategy Self-Assessment QuestionnaireDocument12 pagesMarketing Strategy Self-Assessment QuestionnaireAndrea ScaranoNo ratings yet

- Financial Planning Banking & Investment ManagementDocument15 pagesFinancial Planning Banking & Investment ManagementKarthik KumarNo ratings yet

- Logics of Action, Globalization, and Employment Relations Change in China, India, Malaysia, and The PhilippinesDocument57 pagesLogics of Action, Globalization, and Employment Relations Change in China, India, Malaysia, and The PhilippinesAyisha PatnaikNo ratings yet

- FM Chapter 8 PDFDocument6 pagesFM Chapter 8 PDFSuzanne AcostaNo ratings yet

- Fact-Sheet 20191230 02 Idx80 PDFDocument1 pageFact-Sheet 20191230 02 Idx80 PDFvivafatma92No ratings yet

- FINDocument26 pagesFINJadeNo ratings yet

- Is Gold A Safe Haven International EvidenceDocument38 pagesIs Gold A Safe Haven International EvidenceLuckade PoonnalimpakulNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test BankDocument25 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Test BankMalloryHartmanmkgqd100% (54)

- USANA-A Revolutionary Way To Create Wealth: #1 Distributor's Choice Ten Consecutive YearsDocument1 pageUSANA-A Revolutionary Way To Create Wealth: #1 Distributor's Choice Ten Consecutive YearsAlyNo ratings yet

- Earnings Management NotesDocument7 pagesEarnings Management NoteslciimNo ratings yet

- Answer and Explanation:: Activity Mas 2 1Document3 pagesAnswer and Explanation:: Activity Mas 2 1Mydel Avelino100% (1)

- ReceiptDocument1 pageReceiptAngela BalarbarNo ratings yet

- CadburyDocument42 pagesCadburyDeepti JainNo ratings yet

- Courses List IiDocument15 pagesCourses List IiShareef Sabi100% (1)

- TAX Final-PreboardDocument14 pagesTAX Final-PreboardMarjorie BernasNo ratings yet

- PESTLE Analysis of FMCG Retailing IndustryDocument4 pagesPESTLE Analysis of FMCG Retailing IndustryJammigumpula PriyankaNo ratings yet

- Zeus Case StudyDocument10 pagesZeus Case StudyWangJiaPeng100% (1)

- Commodity Tips and MCX TipsDocument5 pagesCommodity Tips and MCX TipsTheequicom AdvisoryNo ratings yet