Professional Documents

Culture Documents

Negotiable Instrument Act 1881

Negotiable Instrument Act 1881

Uploaded by

mir_umaramin0 ratings0% found this document useful (0 votes)

29 views16 pagesa brief presentation on negotiable instruments act 1881 .

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenta brief presentation on negotiable instruments act 1881 .

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

29 views16 pagesNegotiable Instrument Act 1881

Negotiable Instrument Act 1881

Uploaded by

mir_umaramina brief presentation on negotiable instruments act 1881 .

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 16

Negotiable Instrument Act 1881

Umar Amin Mir

24-09-2014

Meaning and Definitions

NEGOTIABLE

INSTRUMENT

DEFINTION By Justice Willis

As one, the property in which is acquired by any one

who takes it bonafide and for value not withstanding any

defect of title.

Transferable by delivery

A written document

created in favour of some

Person.

CHARACTERISTICS

Must be in writing.

Signed by the Maker.

Involve payment of money only.

Unconditional promise.

Transferee can sue in his own name without giving name

to the debtor.

Forms of Negotiable Instruments

Payable to Order

Payable to Bearer

TYPES OF NEGOTIABLE INSTRUMENTS

Some of the negotiable instruments.

Bill of exchange

Promissory note

Cheque.

PROMISSORY NOTE SEC-4

Is an instrument in writing (not being a bank-note or

a currency note) containing an unconditional

undertaking.

Signed by the maker, to pay certain sum of money

only to or to the order of a certain person or the

bearer of the instrument.

Parties to Promissory Note

Maker Payee

CHARACTERISTICS OF PROMISSORY

NOTE

It must be in writing.

Promise to pay money only.

Promise to pay must be definite.

Must be unconditional.

Signed by the maker.

Maker and the payee must be certain

Amount be certain.

Must be properly stamped.

Other details like number, date, consideration, place etc

are generally found in the promissory note.

SPECIMEN OF A PROMISSORY

NOTE

Rs 6,000/- Pune,

2

nd

October, 2006

Three months after the date I promise to pay Mr.X of mumbai or order a

Sum of Rupees FIFTY THOUSAND FOR VALUE RECEIVED.

TO,

To

Mr. X(payee) Stamp

Address.. Signature of

.. Mr.y (Maker)

Mumbai

BILL OF EXCHANGE SEC-5

Is an instrument in writings containing an unconditional

order signed by the maker.

Three parties to a bill of exchange

-- drawer (maker)

-- drawee (acceptor)

-- payee

CHARACTERISTCS

It must be in writing

It must contain an order to pay and not request.

The order must be unconditional.

The parties to the bill of exchange i.e drawer, drawee

and payee must be certain.

Bill of exchange must be signed by the drawer and

accepted by the drawee.

The sum payable must be certain.

Bill of exchange must contain an order to pay money

only.

Bill of exchange must be stamped properly.

Bill of exchange originally drawn cannot be made

payable to bearer

SPECIMEN OF BILL OF EXCHANGE

Rs. 1,000/- Pune,

2

nd

October,2006

Three months after the date pay to Mr. Z of Nagar or order the sum of Rs.

ONE THOUSAND, for value received.

To

Mr. X (drawee) Accepted Stamp

Address.. Signature of Signature of

.. Mr. X Mr. Y (drawer)

Mumbai

Promissory note Bill of exchange

There are two parties-

maker and payee

It contains an

unconditional promise

pay

It is payable by a person

who makes it.Therefore,

no acceptance is

necessary.

The maker of the

promisssory note is

primarily liable to

payee.

There are three parties

drawer, drawee and payee

It contains an

unconditional order to

pay

It is payable by the other

person directed.

Therefore,it should be

presented to the drawee

for acceptance.

Maker of bill exchange is

secondarily and

conditionally liable to

payee. He becomes liable

only when the drawee

refuses to honour the bill.

No notice of dishonour is

necessary to the maker

Drawer stands in

immediate relation to the

drawee or acceptor and

not the payee Notice

should be given to all the

parties.

CHEQUES (Section6)

A Cheque is a negotiable instrument instructing a

financial institution to pay a specific amount of a

specific currency from a specified transactional

account held in the drawers name with that

institution.

Parties to a Cheque :

The drawer

The drawee

The payee

Essentials of a Cheque

Always drawn on a specified banker.

Always payable on demand.

It does not require acceptance.

It may be made payable to drawer himself (bearer ).

Must be dated.

Valid for 3 months.

Not required to be stamped.

Types of crossing

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- McDonalds Service AnalysisDocument13 pagesMcDonalds Service AnalysisIsha Kembhavi92% (12)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

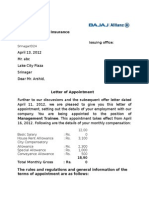

- Appointment Letter Format For Bajaj AllianzDocument4 pagesAppointment Letter Format For Bajaj Allianzmir_umaramin100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pirates of The Silicon Valley Management LessonsDocument8 pagesPirates of The Silicon Valley Management Lessonsmir_umaramin100% (1)

- Anta Sports Annual Report 2015Document132 pagesAnta Sports Annual Report 2015Billy Lee100% (1)

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocument7 pagesFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- Final Amul ReportDocument39 pagesFinal Amul ReportTeena Varma36% (11)

- MetlifeDocument6 pagesMetlifemir_umaraminNo ratings yet

- Aircel Limited 1 2 3 4 5: Idea Cellular Vodafone Bharti Airtel LTD Telewings CommunicationsDocument1 pageAircel Limited 1 2 3 4 5: Idea Cellular Vodafone Bharti Airtel LTD Telewings Communicationsmir_umaraminNo ratings yet

- Working Capital FinanceDocument69 pagesWorking Capital Financemir_umaramin100% (1)

- Illusions PpsDocument15 pagesIllusions Ppsmir_umaraminNo ratings yet

- World Diamond Mark On IDEX OnlineDocument4 pagesWorld Diamond Mark On IDEX OnlinethemarcusNo ratings yet

- Concept NoteDocument3 pagesConcept NoteSakshi PriyaNo ratings yet

- Msci Indonesia Esg Leaders Index Usd GrossDocument3 pagesMsci Indonesia Esg Leaders Index Usd GrossputraNo ratings yet

- P12+ +receivablesDocument21 pagesP12+ +receivablesJoyce Merrylyn CreusNo ratings yet

- Internship Report On Shakarganj Sugar Mill by SYED AHMAD MUSTAFADocument21 pagesInternship Report On Shakarganj Sugar Mill by SYED AHMAD MUSTAFAAhmad Mustafa100% (3)

- SAP Standard Reports Accounts Payable NewDocument17 pagesSAP Standard Reports Accounts Payable NewDavidNo ratings yet

- TIẾN ĐỘ THE ALPHA - THE 9 STELLARS - Trang Tính1Document2 pagesTIẾN ĐỘ THE ALPHA - THE 9 STELLARS - Trang Tính1Đỗ Hoàng TháiNo ratings yet

- Module 4 - Commodities Derivatives TradingDocument71 pagesModule 4 - Commodities Derivatives TradingLMT indiaNo ratings yet

- IBFT - Member Bank Account Number FormatDocument1 pageIBFT - Member Bank Account Number FormatSyed Shah Jehan GillaniNo ratings yet

- Project Feasibility Study For The Establishment of Footwear and Other AccessoriesDocument12 pagesProject Feasibility Study For The Establishment of Footwear and Other Accessoriesregata4No ratings yet

- Mondo TV InformeDocument12 pagesMondo TV InformeAntonio Perez CastilloNo ratings yet

- Asia Pacific Licensure ExaminationDocument12 pagesAsia Pacific Licensure ExaminationTGiF TravelNo ratings yet

- CHAPTER 1 Financial Reporting-ShareDocument3 pagesCHAPTER 1 Financial Reporting-ShareCahyo PriyatnoNo ratings yet

- 6 Dividend Icai PDFDocument27 pages6 Dividend Icai PDFsuksesNo ratings yet

- Management Accounting II: Assignment PresentationDocument6 pagesManagement Accounting II: Assignment PresentationPui YanNo ratings yet

- 49 CIR V Glenshaw GlassDocument2 pages49 CIR V Glenshaw GlassMiguel AlonzoNo ratings yet

- Pre Board: Subject - Social Science Maximum Marks: 80 Class - X Time: 3 HoursDocument3 pagesPre Board: Subject - Social Science Maximum Marks: 80 Class - X Time: 3 HoursAnivesh MudgalNo ratings yet

- Internship ReportDocument38 pagesInternship ReportSaran Khaliq0% (1)

- Monetary Policy InstrumentsDocument2 pagesMonetary Policy InstrumentsCharlene Lyra SaacNo ratings yet

- Ias 33 - EpsDocument26 pagesIas 33 - Epsnissiem10% (1)

- CHAPTER 1 IntroductionDocument22 pagesCHAPTER 1 IntroductionCarissa May Maloloy-on100% (1)

- Plastic Carry BagsDocument8 pagesPlastic Carry BagsRavi PrakashNo ratings yet

- Contract of Employment For The Position of Seasonal Cabin CrewDocument11 pagesContract of Employment For The Position of Seasonal Cabin CrewnienkegroenendijkNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020MaayaBimbamNo ratings yet

- Practicing The Pie ChartDocument8 pagesPracticing The Pie ChartPhan Phương ThuýNo ratings yet

- Mattels Case StudyDocument27 pagesMattels Case StudyRashid AliNo ratings yet