Professional Documents

Culture Documents

Morning View 3feb2010 - S&P Gold

Morning View 3feb2010 - S&P Gold

Uploaded by

AndysTechnicalsCopyright:

Available Formats

You might also like

- AISL Practice Paper 2Document52 pagesAISL Practice Paper 2Brian MA100% (2)

- n2oBHJHtY Why Globalization Works 2nd New Edition 0300107773Document3 pagesn2oBHJHtY Why Globalization Works 2nd New Edition 0300107773Jom zNo ratings yet

- Me1010 3 SemDocument5 pagesMe1010 3 SemArjun OrcsNo ratings yet

- Accounts Payable ConceptsDocument3 pagesAccounts Payable ConceptsVAIBHAV PARABNo ratings yet

- Sloping Agricultural Land Technology - SALT 1Document25 pagesSloping Agricultural Land Technology - SALT 1cdwsg254100% (1)

- S&P 500 (Daily) - Sniffed Out Some Support .Document4 pagesS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsNo ratings yet

- Morning View 17 Feb 10Document10 pagesMorning View 17 Feb 10AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Morning View 28jan2010Document7 pagesMorning View 28jan2010AndysTechnicalsNo ratings yet

- Morning View 29jan2010Document5 pagesMorning View 29jan2010AndysTechnicalsNo ratings yet

- Morning View 5mar2010Document7 pagesMorning View 5mar2010AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Nov 09Document6 pagesS&P 500 Update 4 Nov 09AndysTechnicalsNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Morning View 26jan2010Document8 pagesMorning View 26jan2010AndysTechnicalsNo ratings yet

- Hacker 3 RCDocument290 pagesHacker 3 RCjennyphuong0802No ratings yet

- Morning View 23 Feb 10Document6 pagesMorning View 23 Feb 10AndysTechnicalsNo ratings yet

- Sunday Night Views 28 Feb 10Document5 pagesSunday Night Views 28 Feb 10AndysTechnicalsNo ratings yet

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- S&P Futures 3 March 10 EveningDocument2 pagesS&P Futures 3 March 10 EveningAndysTechnicalsNo ratings yet

- S&P 500 Update 16 Jan 10Document8 pagesS&P 500 Update 16 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Morning View 20jan2010Document8 pagesMorning View 20jan2010AndysTechnicalsNo ratings yet

- Sunday Evening Views 21 March 10Document6 pagesSunday Evening Views 21 March 10AndysTechnicalsNo ratings yet

- Offline Alp Set 15Document13 pagesOffline Alp Set 15Miss You kalam Education Point With Vishal guptaNo ratings yet

- BMC 15Document2 pagesBMC 15jhalakduttaNo ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- 英文黃054Document2 pages英文黃054梁海華No ratings yet

- Learning Campus: Switchyard Equipments and Tower Name and Roll No: .. Dept: . Date: .Document1 pageLearning Campus: Switchyard Equipments and Tower Name and Roll No: .. Dept: . Date: .chaubeyskcNo ratings yet

- Ee Gate 2021Document21 pagesEe Gate 2021smith polNo ratings yet

- 英文黃007Document2 pages英文黃007梁海華No ratings yet

- Answer Questions. For: ClassDocument4 pagesAnswer Questions. For: Classamali23100% (1)

- Solutions of Problem Set 4Document16 pagesSolutions of Problem Set 4yasin yttNo ratings yet

- No Test Material On This PageDocument31 pagesNo Test Material On This Pagehieutn3No ratings yet

- 97-K - PR - D Version - Sep - 10Document12 pages97-K - PR - D Version - Sep - 10sadanandghanashyammislankarNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- 97-K - RR - B Version - Sep - 9Document11 pages97-K - RR - B Version - Sep - 9sadanandghanashyammislankarNo ratings yet

- 英文黃033Document3 pages英文黃033梁海華No ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Civil Engineering MCQ'sDocument1 pageCivil Engineering MCQ'sNISHIKANTA MONDALNo ratings yet

- HW Week 1 - Part 5Document4 pagesHW Week 1 - Part 5august cobyNo ratings yet

- MR - Yasser Elsayed Mobile No: +966451482868 / +201114057545 1Document363 pagesMR - Yasser Elsayed Mobile No: +966451482868 / +201114057545 1tranquil_452889939No ratings yet

- 英文黃047Document2 pages英文黃047梁海華No ratings yet

- Screenshot 2022-11-21 at 4.18.18 PMDocument22 pagesScreenshot 2022-11-21 at 4.18.18 PMjs zimaNo ratings yet

- Imp Vector - (PART 2)Document9 pagesImp Vector - (PART 2)ankitkumarusa02No ratings yet

- e845392d8bdae3382228b13cf1d81bd3Document25 pagese845392d8bdae3382228b13cf1d81bd3DjjdjdjdNo ratings yet

- 09 Ec4t4r PDFDocument26 pages09 Ec4t4r PDFณัฐกรานต์ ไชยหาวงศ์No ratings yet

- Chapter 5Document20 pagesChapter 5Diệu ThiệnNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- Angles On para El LinesDocument19 pagesAngles On para El LinesLim LenNo ratings yet

- 해커스토익 전미정선생님 2020년 7월 적중예상문제Document7 pages해커스토익 전미정선생님 2020년 7월 적중예상문제Tae Kwan LeeNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument13 pagesCambridge International General Certificate of Secondary EducationCikgu kannaNo ratings yet

- Morning View 21jan2010Document6 pagesMorning View 21jan2010AndysTechnicalsNo ratings yet

- TransformationDocument11 pagesTransformationMuhammad DanishNo ratings yet

- M It Ya R A N Ja N: (A) (B) (A) (B)Document2 pagesM It Ya R A N Ja N: (A) (B) (A) (B)Arpit KashyapNo ratings yet

- Mht-Cet 12th Grand Test Answer KeyDocument1 pageMht-Cet 12th Grand Test Answer Keyujwalachaudhary143No ratings yet

- .Jajaangin, Agar University Admission Test-2016-17 Unit-H Set-3Document9 pages.Jajaangin, Agar University Admission Test-2016-17 Unit-H Set-3Nowshad Sarker NomanNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Sponsorship Proposal TemplateDocument6 pagesSponsorship Proposal TemplateMike100% (1)

- Bir RR 16-2011Document4 pagesBir RR 16-2011ATTY. R.A.L.C.100% (1)

- Assignment Series - 35: 1.consequence of UnemploymentDocument8 pagesAssignment Series - 35: 1.consequence of UnemploymentSURYA S SNo ratings yet

- Pitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionDocument18 pagesPitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionYA2301No ratings yet

- Morning Star Travels - Bus Booking - Bus Tickets BookingDocument2 pagesMorning Star Travels - Bus Booking - Bus Tickets Bookingnagendra reddy panyam0% (1)

- FSC STD 40 004 - V3 0 - EN Chain of Custody CertificationDocument36 pagesFSC STD 40 004 - V3 0 - EN Chain of Custody CertificationDaniel ModicaNo ratings yet

- Muhammad Khurram Khan CVDocument3 pagesMuhammad Khurram Khan CVKhurram KhanNo ratings yet

- Mining Engineering 2 ReviewerDocument22 pagesMining Engineering 2 ReviewerLara CharisseNo ratings yet

- Econ 3 Long QuizDocument1 pageEcon 3 Long QuizEarl Russell S Paulican0% (1)

- Indias Stalled RiseDocument12 pagesIndias Stalled RiseParul RajNo ratings yet

- 12 Main Reasons For Nationalisation of Banks in IndiaDocument7 pages12 Main Reasons For Nationalisation of Banks in IndiaSanjeet MohantyNo ratings yet

- List Cust Nautica Agustus 2020Document18 pagesList Cust Nautica Agustus 2020Ivan SaprialdinaNo ratings yet

- Green Coffee FOB, C F, CIF Contract: Specialty Coffee Association of AmericaDocument4 pagesGreen Coffee FOB, C F, CIF Contract: Specialty Coffee Association of AmericacoffeepathNo ratings yet

- How To Lobby at Intergovernmental MeetingsDocument194 pagesHow To Lobby at Intergovernmental MeetingsQiwei Huang100% (1)

- Commercial Law - Sale and Supply of Goods Detailed Module Outline 2013-2014Document34 pagesCommercial Law - Sale and Supply of Goods Detailed Module Outline 2013-2014manjeet kumarNo ratings yet

- 12 Accountancy Notes CH05 Retirement and Death of A Partner 01Document15 pages12 Accountancy Notes CH05 Retirement and Death of A Partner 01Kaustubh Urfa Amol ParanjapeNo ratings yet

- Cs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentDocument5 pagesCs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentsandeeprainaNo ratings yet

- Companies List 2011Document2 pagesCompanies List 2011Zulfadzli RidzuanNo ratings yet

- Company Profile For Banggai Indo Gemilang Luwuk - IndonesiaDocument5 pagesCompany Profile For Banggai Indo Gemilang Luwuk - IndonesiaIman BonsaiNo ratings yet

- HR, Payroll and Legal ManagerDocument3 pagesHR, Payroll and Legal ManagerSyed A H AndrabiNo ratings yet

- Feasibility Study Poring (Jica) PDFDocument278 pagesFeasibility Study Poring (Jica) PDFtnlesmanaNo ratings yet

- Small Scale Industries' PerceptionDocument14 pagesSmall Scale Industries' PerceptionBraja kumbharNo ratings yet

- International Trade - Copy For MailDocument18 pagesInternational Trade - Copy For MailIqra ZahidNo ratings yet

- Yes Bank Project ReportDocument61 pagesYes Bank Project ReportVaibhav PrasadNo ratings yet

- Card Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitDocument1 pageCard Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitNuruzzaman BiplobNo ratings yet

- PSG Institute of Technology and Applied Research, Coimbatore - 641 062 Department of Electrical and Electronics Engineering Comprehension Test - 1Document3 pagesPSG Institute of Technology and Applied Research, Coimbatore - 641 062 Department of Electrical and Electronics Engineering Comprehension Test - 1Divya VigneshbabuNo ratings yet

- English World AirportDocument69 pagesEnglish World AirportМаша СторожукNo ratings yet

Morning View 3feb2010 - S&P Gold

Morning View 3feb2010 - S&P Gold

Uploaded by

AndysTechnicalsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morning View 3feb2010 - S&P Gold

Morning View 3feb2010 - S&P Gold

Uploaded by

AndysTechnicalsCopyright:

Available Formats

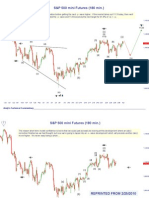

(Z) S&P 500 (60 min.) - A completed Triple Zig-Zag?

“c”

1050

The anticipated bounce rallied right into our first level of resistance hitting 1104.7 today. It would

[b] be a very classy setup to now get a pullback to 1180’s and then another rally up to 1129. In fact,

it would be a textbook type move. So, if this market behaves in a way similar to the last year, this

will probably become something much more difficult, complex and unpredictable (ha!). Bulls are

in short term control now with 1087 becoming a decent support (short term) point.

1129.25

[a]

(x)

[c]

(w) (a)?

[b] [b]

(x) 1103/1105

[c]

[b]

[a]

[a]

[a] 1087

1083 [b] (b)

[c] [b]

(y)

[a]

1071.6

[c] of (z)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 (60 min.) - A completed Triple Zig-Zag?

(Z)

“c”

1050 The sharp move up from 1071 followed by sideways consolidation is suggestive of more upside in

the very near term as the this current wave seems to have run out of some steam. The overall

move down resembles a triple zig-zag, though there are other counts (see next page). A “triple”

[b] would mean a 60-80% retracement that would bring the 1129.25 level into play. In the near term,

though, 1103/1105 remains a critical resistance area and I would expect some selling pressure

into that zone.

1129.25

[a]

(x)

[c]

(w)

[b] (x)

1103/1105

[c]

[b]

[a]

[a]

[a]

1083 [b]

[c] [b]

(y)

[a]

Reprinted from 2/2/2010

1071.6

[c]

(z)

Andy’s Technical Commentary__________________________________________________________________________________________________

Gold Futures ~ Feb (Daily)

Gold has decisively taken out our first level of resistance at $1,104 and is now vigorously testing our next

level at $1,119. The candlesticks and wave structure (next page) off the lows are impressive looking for

sure. The latest Commitment of Traders showed a decent amount of long liquidation in the yellow metal,

so some sort of bounce shouldn’t surprise. This three day hop looks like the beginning of a bigger or more

prolonged bear market rally. My guess is it becomes a “five wave” impulsive c-wave, but a large triangle

from the “a” wave conclusion wouldn’t be shocking. I would be neutral on Gold right here with a bias to buy

the next dip as a short term trading opportunity.

-1-?

1119

-2-?

“a” b

Andy’s Technical Commentary__________________________________________________________________________________________________

Gold Futures ~ Feb (60 min.) -1-

(5)?

1124.9

(3)?

(1)? [4?]

(2)?

This is an impressive looking wave off the lows. It has the “look” of a completed five

wave advance. In this position, and with this duration, there’s a high probability this is

only the first leg up of a larger advance. If this is the first wave up, then 1095 should not

be violated while 1100 would present a decent buying opportunity. Gold bulls would

love to see a choppy and shallow correction down from 1124.9

alt:b

Andy’s Technical Commentary__________________________________________________________________________________________________

Gold Futures ~ Feb (Daily)

Not much has changed with Gold since the last look on 1/22/10. This market does not look

“healthy” longer term. The best case for gold bulls is that the market might be at the lower end

of a congestion zone of some kind, and there might be some kind of “last gasp” rally back to

the 1150’s. Other than that, this is a picture of a market that “has fallen and can’t get back up.”

1104 and 1119 look like first and second levels of resistance for this week. Breaks of those

levels should cause short term Gold bears some anxiety.

“x”

1119

1104

b

“w”

Reprinted from 2/1/2010

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any kind. This report is technical

commentary only. The author is NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s interpretation of technical analysis. The

author may or may not trade in the markets discussed. The author may hold positions opposite of

what may by inferred by this report. The information contained in this commentary is taken from

sources the author believes to be reliable, but it is not guaranteed by the author as to the accuracy

or completeness thereof and is sent to you for information purposes only. Commodity trading

involves risk and is not for everyone.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading:

Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or options contracts, you should

consider your financial experience, goals and financial resources, and know how much you can

afford to lose above and beyond your initial payment to a broker. You should understand commodity

futures and options contracts and your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk

disclosure documents your broker is required to give you.

You might also like

- AISL Practice Paper 2Document52 pagesAISL Practice Paper 2Brian MA100% (2)

- n2oBHJHtY Why Globalization Works 2nd New Edition 0300107773Document3 pagesn2oBHJHtY Why Globalization Works 2nd New Edition 0300107773Jom zNo ratings yet

- Me1010 3 SemDocument5 pagesMe1010 3 SemArjun OrcsNo ratings yet

- Accounts Payable ConceptsDocument3 pagesAccounts Payable ConceptsVAIBHAV PARABNo ratings yet

- Sloping Agricultural Land Technology - SALT 1Document25 pagesSloping Agricultural Land Technology - SALT 1cdwsg254100% (1)

- S&P 500 (Daily) - Sniffed Out Some Support .Document4 pagesS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsNo ratings yet

- Morning View 17 Feb 10Document10 pagesMorning View 17 Feb 10AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Morning View 28jan2010Document7 pagesMorning View 28jan2010AndysTechnicalsNo ratings yet

- Morning View 29jan2010Document5 pagesMorning View 29jan2010AndysTechnicalsNo ratings yet

- Morning View 5mar2010Document7 pagesMorning View 5mar2010AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Nov 09Document6 pagesS&P 500 Update 4 Nov 09AndysTechnicalsNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Morning View 26jan2010Document8 pagesMorning View 26jan2010AndysTechnicalsNo ratings yet

- Hacker 3 RCDocument290 pagesHacker 3 RCjennyphuong0802No ratings yet

- Morning View 23 Feb 10Document6 pagesMorning View 23 Feb 10AndysTechnicalsNo ratings yet

- Sunday Night Views 28 Feb 10Document5 pagesSunday Night Views 28 Feb 10AndysTechnicalsNo ratings yet

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- S&P Futures 3 March 10 EveningDocument2 pagesS&P Futures 3 March 10 EveningAndysTechnicalsNo ratings yet

- S&P 500 Update 16 Jan 10Document8 pagesS&P 500 Update 16 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Morning View 20jan2010Document8 pagesMorning View 20jan2010AndysTechnicalsNo ratings yet

- Sunday Evening Views 21 March 10Document6 pagesSunday Evening Views 21 March 10AndysTechnicalsNo ratings yet

- Offline Alp Set 15Document13 pagesOffline Alp Set 15Miss You kalam Education Point With Vishal guptaNo ratings yet

- BMC 15Document2 pagesBMC 15jhalakduttaNo ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- 英文黃054Document2 pages英文黃054梁海華No ratings yet

- Learning Campus: Switchyard Equipments and Tower Name and Roll No: .. Dept: . Date: .Document1 pageLearning Campus: Switchyard Equipments and Tower Name and Roll No: .. Dept: . Date: .chaubeyskcNo ratings yet

- Ee Gate 2021Document21 pagesEe Gate 2021smith polNo ratings yet

- 英文黃007Document2 pages英文黃007梁海華No ratings yet

- Answer Questions. For: ClassDocument4 pagesAnswer Questions. For: Classamali23100% (1)

- Solutions of Problem Set 4Document16 pagesSolutions of Problem Set 4yasin yttNo ratings yet

- No Test Material On This PageDocument31 pagesNo Test Material On This Pagehieutn3No ratings yet

- 97-K - PR - D Version - Sep - 10Document12 pages97-K - PR - D Version - Sep - 10sadanandghanashyammislankarNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- 97-K - RR - B Version - Sep - 9Document11 pages97-K - RR - B Version - Sep - 9sadanandghanashyammislankarNo ratings yet

- 英文黃033Document3 pages英文黃033梁海華No ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Civil Engineering MCQ'sDocument1 pageCivil Engineering MCQ'sNISHIKANTA MONDALNo ratings yet

- HW Week 1 - Part 5Document4 pagesHW Week 1 - Part 5august cobyNo ratings yet

- MR - Yasser Elsayed Mobile No: +966451482868 / +201114057545 1Document363 pagesMR - Yasser Elsayed Mobile No: +966451482868 / +201114057545 1tranquil_452889939No ratings yet

- 英文黃047Document2 pages英文黃047梁海華No ratings yet

- Screenshot 2022-11-21 at 4.18.18 PMDocument22 pagesScreenshot 2022-11-21 at 4.18.18 PMjs zimaNo ratings yet

- Imp Vector - (PART 2)Document9 pagesImp Vector - (PART 2)ankitkumarusa02No ratings yet

- e845392d8bdae3382228b13cf1d81bd3Document25 pagese845392d8bdae3382228b13cf1d81bd3DjjdjdjdNo ratings yet

- 09 Ec4t4r PDFDocument26 pages09 Ec4t4r PDFณัฐกรานต์ ไชยหาวงศ์No ratings yet

- Chapter 5Document20 pagesChapter 5Diệu ThiệnNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- Angles On para El LinesDocument19 pagesAngles On para El LinesLim LenNo ratings yet

- 해커스토익 전미정선생님 2020년 7월 적중예상문제Document7 pages해커스토익 전미정선생님 2020년 7월 적중예상문제Tae Kwan LeeNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument13 pagesCambridge International General Certificate of Secondary EducationCikgu kannaNo ratings yet

- Morning View 21jan2010Document6 pagesMorning View 21jan2010AndysTechnicalsNo ratings yet

- TransformationDocument11 pagesTransformationMuhammad DanishNo ratings yet

- M It Ya R A N Ja N: (A) (B) (A) (B)Document2 pagesM It Ya R A N Ja N: (A) (B) (A) (B)Arpit KashyapNo ratings yet

- Mht-Cet 12th Grand Test Answer KeyDocument1 pageMht-Cet 12th Grand Test Answer Keyujwalachaudhary143No ratings yet

- .Jajaangin, Agar University Admission Test-2016-17 Unit-H Set-3Document9 pages.Jajaangin, Agar University Admission Test-2016-17 Unit-H Set-3Nowshad Sarker NomanNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Sponsorship Proposal TemplateDocument6 pagesSponsorship Proposal TemplateMike100% (1)

- Bir RR 16-2011Document4 pagesBir RR 16-2011ATTY. R.A.L.C.100% (1)

- Assignment Series - 35: 1.consequence of UnemploymentDocument8 pagesAssignment Series - 35: 1.consequence of UnemploymentSURYA S SNo ratings yet

- Pitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionDocument18 pagesPitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionYA2301No ratings yet

- Morning Star Travels - Bus Booking - Bus Tickets BookingDocument2 pagesMorning Star Travels - Bus Booking - Bus Tickets Bookingnagendra reddy panyam0% (1)

- FSC STD 40 004 - V3 0 - EN Chain of Custody CertificationDocument36 pagesFSC STD 40 004 - V3 0 - EN Chain of Custody CertificationDaniel ModicaNo ratings yet

- Muhammad Khurram Khan CVDocument3 pagesMuhammad Khurram Khan CVKhurram KhanNo ratings yet

- Mining Engineering 2 ReviewerDocument22 pagesMining Engineering 2 ReviewerLara CharisseNo ratings yet

- Econ 3 Long QuizDocument1 pageEcon 3 Long QuizEarl Russell S Paulican0% (1)

- Indias Stalled RiseDocument12 pagesIndias Stalled RiseParul RajNo ratings yet

- 12 Main Reasons For Nationalisation of Banks in IndiaDocument7 pages12 Main Reasons For Nationalisation of Banks in IndiaSanjeet MohantyNo ratings yet

- List Cust Nautica Agustus 2020Document18 pagesList Cust Nautica Agustus 2020Ivan SaprialdinaNo ratings yet

- Green Coffee FOB, C F, CIF Contract: Specialty Coffee Association of AmericaDocument4 pagesGreen Coffee FOB, C F, CIF Contract: Specialty Coffee Association of AmericacoffeepathNo ratings yet

- How To Lobby at Intergovernmental MeetingsDocument194 pagesHow To Lobby at Intergovernmental MeetingsQiwei Huang100% (1)

- Commercial Law - Sale and Supply of Goods Detailed Module Outline 2013-2014Document34 pagesCommercial Law - Sale and Supply of Goods Detailed Module Outline 2013-2014manjeet kumarNo ratings yet

- 12 Accountancy Notes CH05 Retirement and Death of A Partner 01Document15 pages12 Accountancy Notes CH05 Retirement and Death of A Partner 01Kaustubh Urfa Amol ParanjapeNo ratings yet

- Cs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentDocument5 pagesCs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentsandeeprainaNo ratings yet

- Companies List 2011Document2 pagesCompanies List 2011Zulfadzli RidzuanNo ratings yet

- Company Profile For Banggai Indo Gemilang Luwuk - IndonesiaDocument5 pagesCompany Profile For Banggai Indo Gemilang Luwuk - IndonesiaIman BonsaiNo ratings yet

- HR, Payroll and Legal ManagerDocument3 pagesHR, Payroll and Legal ManagerSyed A H AndrabiNo ratings yet

- Feasibility Study Poring (Jica) PDFDocument278 pagesFeasibility Study Poring (Jica) PDFtnlesmanaNo ratings yet

- Small Scale Industries' PerceptionDocument14 pagesSmall Scale Industries' PerceptionBraja kumbharNo ratings yet

- International Trade - Copy For MailDocument18 pagesInternational Trade - Copy For MailIqra ZahidNo ratings yet

- Yes Bank Project ReportDocument61 pagesYes Bank Project ReportVaibhav PrasadNo ratings yet

- Card Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitDocument1 pageCard Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitNuruzzaman BiplobNo ratings yet

- PSG Institute of Technology and Applied Research, Coimbatore - 641 062 Department of Electrical and Electronics Engineering Comprehension Test - 1Document3 pagesPSG Institute of Technology and Applied Research, Coimbatore - 641 062 Department of Electrical and Electronics Engineering Comprehension Test - 1Divya VigneshbabuNo ratings yet

- English World AirportDocument69 pagesEnglish World AirportМаша СторожукNo ratings yet