Professional Documents

Culture Documents

Foundations of Engineering Economy: Gra W Hill

Foundations of Engineering Economy: Gra W Hill

Uploaded by

Alfiano FuadiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foundations of Engineering Economy: Gra W Hill

Foundations of Engineering Economy: Gra W Hill

Uploaded by

Alfiano FuadiCopyright:

Available Formats

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I

FOUNDATIONS OF

ENGINEERING ECONOMY

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.

Foundations: Overview

1. Questions

2. Decision Making

3. Study Approach

4. Interest Rate

5. Equivalence

6. Simple and Compound Interest

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.

Foundations: Overview

7. Symbols

8. Spreadsheet Functions

9. Minimum Attractive Rate of Return

10. Cash Flows

11. Doubling Time

12. Spreadsheets

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1

Why Engineering Economy

is Important to Engineers

(and other professionals)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.1 Importance

Engineers Design

Engineers must be concerned with the

economic aspects of designs and projects

they recommend and perform (cara berpikir

yg. diikuti tindakan untuk menghasilkan

substansi/materi)

Analysis ( Fokus pd substansi yg telah

terjadi)

Design (optimalisasi rancangan secara

praktis)

Synthesis

pd 1 Authored by: Dr. Do

Blank

& Tarquin: 5th(Fokus

Edition. Ch.

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.1 Questions

Engineers must work within the realm of

economics and justification of engineering

projects

Work with limited funds (capital)

Capital is not unlimited rationed

Capital does not belong to the firm

Belongs to the Owners of the firm

Capital is not freeit has a cost

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.1 Definition

ENGINEERING ECONOMY IS INVOLVED

WITH THE FORMULATION, ESTIMATION,

AND EVALUATION OF ECONOMIC

OUTCOMES WHEN ALTERNATIVES TO

ACCOMPLISH A DEFINED PURPOSE ARE

AVAILABLE.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.1 Definition

ENGINEERING ECONOMY IS INVOLVED

WITH THE APPLICATION OF DEFINED

MATHEMATICAL RELATIONSHIPS THAT

AID IN THE COMPARISON OF

ECONOMIC ALTERNATIVES

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.1 Questions

Knowledge of Engineering Economy

will have a significant impact on you,

personally.

Make proper economic

comparisons

In your profession

Private sector

Public sector

Tarquin:

In your

personal

life by: Dr. Do

Blank &

5th Edition.

Ch. 1 Authored

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

CHAPTER I

c

M

Gra

Hill

w

Section 1.2

Role of Engineering

Economy in Decision

Making

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

10

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Role of Engineering

Economy

Remember: People make decisions

not tools

Engineering Economy is a set of tools

that aid in decision making but will

not make the decision for you

Engineering economy is based

mainly on estimates of future events

must deal with the future and risk and

uncertainty

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Role of Engineering

Economy

The parameters within an

engineering economy problem can and

will vary over time

Parameters that can vary will dictate

a numerical outcome apply and

understand

Sensitivity Analysis

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Role of Engineering

Economy

Sensitivity Analysis plays a major

role in the assessment of most, if not

all, engineering economy problems

The use of spreadsheets is now

common and students need to master

this valuable tool as an analysis aid

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Problem-Solving

Approach

1. Understand the Problem

2. Collect all relevant data/information

3. Define the feasible alternatives

4. Evaluate each alternative

5. Select the best alternative

6. Implement and monitor

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Problem-Solving

Approach

1. Understand the Problem

2. Collect all relevant data/information

3. Define the feasible alternatives

4. Evaluate each alternative

5. Select the best alternative

6. Implement and monitor

Major Role of

Engineering

Economy

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Problem-Solving

Approach

1. Understand the Problem

2. Collect all relevant data/information

3. Define the feasible alternatives

4. Evaluate each alternative

5. Select the best alternative

6. Implement and monitor

One of the more

difficult tasks

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Problem-Solving

Approach

1. Understand the Problem

2. Collect all relevant data/information

3. Define the feasible alternatives

4. Evaluate each alternative

5. Select the best alternative

6. Implement and monitor

Where the

major tools of

Engr. Economy

are applied

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Problem-Solving

Approach

1. Understand the Problem

2. Collect all relevant data/information

3. Define the feasible alternatives

4. Evaluate each alternative

5. Select the best alternative

6. Implement and monitor

Tools

Present Worth, Future

Worth

Annual Worth, Rate of

Return

Benefit/Cost, Payback,

Capitalized Cost, Value

Added

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.2 Time Value of Money

Time Value of Money

Money can make money if Invested

Centers around an interest rate

The change in the amount of money

over a given time period is called the

time value of money; by far, the most

important concept in engineering

economy

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.3

Performing and

Engineering Economy

Study

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

20

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Performing a Study

To have a problem, one must have

alternatives (two or more ways to

solve a problem)

Alternative ways to solve a problem

must first be identified

Estimate the cash flows for the

alternatives

Analyze the cash flows for each

alternative

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Alternatives

To analyze, one must have:

Concept of the time value of $$

An Interest Rate

Some measure of economic worth

Evaluate and weigh

Factor in noneconomic parameters

Select, implement, and monitor

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Needed Parameters

First cost (investment amounts)

Estimates of useful or project life

Estimated future cash flows

(revenues and expenses and salvage

values)

Interest rate

Inflation and tax effects

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Cash Flows

Estimate flows of money coming into

the firm revenues salvage values,

etc. (magnitude and timing) positive

cash flows

Estimates of investment costs,

operating costs, taxes paid negative

cash flows

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Alternatives

Each problem will have at least one

alternative DO NOTHING

May not be free and may have

future costs associated

Do not overlook this option!

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Alternatives

Goal: Define, Evaluate, Select and

Execute

Do

Nothing

The Question:

Alt. 1

Which One do

we accept?

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Mutually Exclusive

Select One and only one from a set

of feasible alternatives

Once an alternative is selected,

the remaining alternatives are

excluded at that point.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 More Alternatives

Goal: Define, Evaluate, Select and

Execute

Do

Nothing

Alt. 1

...

Alt. j

Which one do we accept?

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Default Position

If all of the proposed alternatives are

not economically desirable then

One usually defaults to the DONOTHING alternative

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Taxes

Taxes represent a significant

negative cash flow to the for-profit

firm.

A realistic economic analysis must

assess the impact of taxes.

Called and AFTER-TAX cash flow

analysis

Not considering taxes is called a

BEFORE-TAX Cash Flow analysis.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Section 1.3 Taxes

A Before-Tax cash flow analysis

(while not as accurate) is often

performed as a preliminary analysis.

A final, more complete analysis

should be performed using an AfterTax analysis

Both are valuable analysis

approaches

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.4

Interest Rate and Rate of

Return

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

32

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest Rate

INTEREST RATE - INTEREST PER

TIME UNIT

INTEREST PER TIME UNIT

INTEREST RATE

ORIGINAL AMOUNT

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest Rates and Returns

Interest can be viewed from two

perspectives:

1. Lending situation

2. Investing situation

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest (1) Lending

situation

You borrow money (renting someone

else's money)

The lender expects a return on the

money lent

The return is measured by

application of an interest rate

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest Lending Example

1.3

Example 1.3

You borrow $10,000 for one full year

Must pay back $10,700 at the end of

one year

Interest Amount (I) = $10,700 $10,000

Interest Amount = $700 for the year

Interest rate (i) = 700/$10,000 =

Blank

& Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

7%/Yr

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest Rate - Notation

For 1.3 the interest rate is..

Expressed as a per cent per year

Notation

I = the interest amount is $

i = the interest rate (%/interest

period)

N = No. of interest periods (1 for

this problem)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest Borrowing (Ex 1.3)

The interest rate (i) is 7% per year

The interest amount is $700 over one

year

The $700 represents the return to

the lender for this use of his/her funds

for one year

7% is the interest rate charged to

the borrower

7% is the return earned by the

lender

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest Example 1.4

Borrow $20,000 for 1 year at 9%

interest per year

i = 0.09 per year and N = 1 Year

Pay $20,000 + (0.09)($20,000) at

end of 1 year

Interest (I) = (0.09)($20,000) =

$1,800

Total amt. paid one year hence

$1,800

$21,800

Blank $20,000

& Tarquin: 5th+Edition.

Ch. 1=

Authored

by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest Example 1.4

Note the following

Total Amount Due one year hence is

($20,000) + 0.09($20,000)

=$20,000(1.09) = $21,800

The (1.09) factor accounts for the

repayment of the $20,000 and the interest

amount

This will be one of the important interest

factors to be seen later

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Interest (2) Investing

Perspective

Assume you invest $20,000 for one year in

a venture that will return to you, 9% per

year.

At the end of one year, you will have:

Original $20,000 back

Plus..

The 9% return on $20,000 = $1,800

We say that you earned 9%/year on the

investment! This is your RATE of RETURN on the

investment

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Inflation Effects

A social-economic occurrence in

which there is more currency

competing for constrained goods and

services

Where a countrys currency becomes

worth less over time, thus requiring

more of the currency to purchase the

same amount of goods or services in a

time period

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.4 Inflation Rate(s)

Inflation impacts:

Purchasing Power (reduces)

Operating Costs (increases)

Rate of Return on Investments

(reduces)

Specifically covered in Chapter 14

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.5

Equivalence

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

44

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 EQUIVALENCE

Example

You travel at 68 miles per hour

Equivalent to 110 kilometers per

hour

Thus:

68 mph is equivalent to 110 kph

Using two measuring scales

Miles

and

Kilometers

Blank

& Tarquin:

5th Edition.

Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 EQUIVALENCE

Is 68 equal to 110?

No, not in terms of absolute numbers

But they are equivalent in terms of

the two measuring scales

Miles

Kilometers

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 ECONOMIC EQUIVALENCE

Economic Equivalence

Two sums of money at two different

points in time can be made

economically equivalent if:

We consider an interest rate and,

No. of time periods between the

two sums

Equality in terms of Economic

Value

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 Equivalence Illustrated

Return to Example 1.4

Diagram the loan (Cash Flow

Diagram)

The $20,000

companys

perspective is shown

is

received

here

T=0

t = 1 Yr

$21,800 paid

back here

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 Equivalence Illustrated

$20,000 is

received

here

T=0

t = 1 Yr

$21,800 paid

back here

$20,000 now is economically equivalent to

$21,800 one year from now IF the interest

rate is set to equal 9%/year

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 Equivalence Illustrated

$20,000 now is not equal in

magnitude to $21,800 1 year from now

But, $20,000 now is economically

equivalent to $21,800 one year from

now if the interest rate is 9% per year.

Another way to put it is ..

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 Equivalence Illustrated

If you were told that the interest rate

is 9%....

Which is worth more?

Read over

Example 1.6

$20,000 now or

$21,800 one year from now?

The two sums are economically

equivalent but not numerically equal!

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.5 Equivalence Illustrated

To have economic equivalence you

must specify:

Read over

Timing of the cash flows Example 1.6

An interest rate (i% per interest

period)

Number of interest periods (N)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Simple and Compound

Interest

Two types of interest calculations

Simple Interest

Compound Interest

Compound Interest is more common

worldwide and applies to most

analysis situations

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Simple and Compound

Interest

Simple Interest

Calculated on the principal amount

only

Easy (simple) to calculate

Simple Interest is:

(principal)(interest rate)(time)

$I = (P)(i)(n)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.6

Simple and Compound

Interest

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

55

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Simple and Compound

Interest

Example 1.7

Borrow $1,000 for 3 years at 5% per

year

Let P = the principal sum

i = the interest rate (5%/year)

Let N = number of years (3)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Simple and Compound

Interest

Simple Interest

DEFINITION

I = P(i)(N)

For Ex. 1.7:

I = $1,000(0.05)(3) = $150.00

Total Interest over 3 Years

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Simple and Compound

Interest

Year-by-Year Analysis: Simple

Interest

Year 1

I1 = $1,000(0.05) = $50.00

Year 2

I2 = $1,000(0.05) = $50.00

Year 3

I3 = $1,000(0.05) = $50.00

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Accrued Interest: Year 1

Accrued means owed but not yet

paid

First P=$1,00

Year:

0

1

3

I1=$50.00

$50.00 interest accrues but is not

paid

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Accrued Interest: Year 2

Year 2

P=$1,00

0

1

3

I1=$50.00

I2=$50.00

$50.00 interest accrues but is not

paid

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 End of 3 Years

$150 of interest has accrued

P=$1,00

0

1

3

I1=$50.00

I2=$50.00 I3=$50.00

The unpaid interest did

not earn interest over the

3-year period

Pay back

$1,000 + $150

of interest

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Simple Interest: Summary

In a multiperiod situation with simple

interest:

The accrued interest does not earn

interest during the succeeding time

period.

Normally, the total sum borrowed (lent)

is paid back at the end of the agreed time

period PLUS the accrued (owed but not

paid) interest.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Compound Interest

Compound Interest is much different

Compound means to stop and

compute

In this application, compounding

means to compute the interest owed

at the end of the period and then add

it to the unpaid balance of the loan

Interest then earns interest

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Compound Interest

To COMPOUND stop and compute the

associated interest and add it to the unpaid

balance.

When interest is compounded, the interest

that is accrued at the end of a given time

period is added in to form a NEW principal

balance.

That new balance then earns or is charged

interest in the succeeding time period

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Compound Interest: Ex. 1.8

Assume:

P = $1,000

i = 5% per year compounded annually

(C.A.)

N = 3 years

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Compound Interest: Cash

Flow

For compound interest, 3 years, we have:

P=$1,00

0

1

Owe at

at tt =

= 33

Owe

years:

years:

$1,000 +

+ 50.00

50.00

$1,000

+ 52.50

52.50 +

+ 55.13

55.13

+

= $1,157.63

$1,157.63

=

3

I1=$50.00

I2=$52.50

I3=$55.13

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Compound Interest:

Calculated

For the example:

P0 = +$1,000

I1 = $1,000(0.05) = $50.00

Owe P1 = $1,000 + 50 = $1,050 (but we

dont pay yet!)

New Principal sum at end of t = 1: =

$1,050.00

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Compound Interest: t = 2

Principal and end of year 1: $1,050.00

I1 = $1,050(0.05) = $52.50 (owed but not

paid)

Add to the current unpaid balance yields:

$1,050 + 52.50 = $1,102.50

New unpaid balance or New Principal

Amount

Now, go to year 3.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Compound Interest: t = 3

New Principal sum: $1,102.50

I3 = $1102.50(0.05) = $55.125 = $55.13

Add to the beginning of year principal

yields:

$1102.50 + 55.13 = $1157.63

This is the loan payoff at the end of 3

years

Note how the interest amounts were added

to form a new principal sum with interest

calculated

on5th

that

new

Blank & Tarquin:

Edition.

Ch.amount

1 Authored by: Dr. Do 6

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

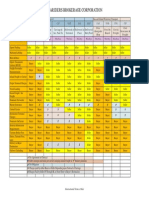

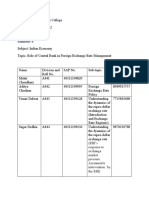

1.6 Example 1.9

Five plans are shown that will pay off a loan

of $5,000 over 5 years with interest at 8%

per year.

Plan1. Simple Interest, pay all at the end

Plan 2. Compound Interest, pay all at the

end

Plan 3. Simple interest, pay interest at end

of each year. Pay the principal at the end of

N=5

Plan 4. Compound Interest and part of the

Blank

& Tarquin:

5thyear

Edition.

Ch. 120%

Authored

by: Dr.

Do 7

principal

each

(pay

of the

Prin.

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Example 1.9: 5 Plans

Plan 5. Equal Payments of the compound

interest and principal reduction over 5 years

with end-of- year payments.

Note: The following tables will show the five

approaches. For now, do not try to

understand how all of the numbers are

determined (that will come later!). Focus on

the methods and how these tables illustrate

economic equivalence.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Plan 1: @ 8% Simple Interest

Simple Interest: Pay all at end on $5,000

Loan

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Plan 2: Compound Interest @

8%/yr

Pay all at the End of 5 Years

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Plan 3: Simple Interest Pd.

Annually

Principal Paid at the End (balloon Note)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Plan 4: Compound Interest

20% of Principal Paid back annually

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Plan 5: Equal Repayment

Plan

Equal Annual Payments (Part Principal and

Part Interest

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Comparisons 5 Plans

Plan 1 Simple interest = (original principal)

(0.08)

Plan 2 Compound interest = (total owed

previous year)(0.08)

Plan 3 Simple interest = (original principal)

(0.08)

Plan 4 Compound interest = (total owed

previous year)(0.08)

Plan 5 Compound interest = (total owed

previous year)(0.08)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.6 Analysis

Note that the amounts of the annual

payments are different for each repayment

schedule and that the total amounts repaid

for most plans are different, even though

each repayment plan requires exactly 5

years.

The difference in the total amounts repaid

can be explained (1) by the time value of

money, (2) by simple or compound interest,

and (3) by the partial repayment of principal

prior to year 5.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Terminology and Symbols

Specific symbols and their respective

definitions have been developed for use in

engineering economy.

Symbols tend to be standard in most

engineering economy texts world-wide.

Mastery of the symbols and their

respective meanings is most important in

understanding the subsequent material!

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Terminology and Symbols

P = value or amount of money at a time

designated as the present or time 0.

Also, P is referred to as present worth (PW),

present value (PV), net present value (NPV),

discounted cash flow (DCF), and capitalized

cost (CC); dollars

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.7

Terminology and Symbols

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

81

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Terminology and Symbols

F = value or amount of money at

some future time.

Also, F is called future worth (FW)

and future value (FV); dollars

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Terminology and Symbols

A = series of consecutive, equal,

endofperiod amounts of money.

Also, A is called the annual worth (AW)

and equivalent uniform annual worth

(EUAW); dollars per year, dollars per

month

n = number of interest periods;

years, months, days

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Terminology and Symbols

i = interest rate or rate of return

per time period; percent per year,

percent per month

t = time, stated in periods; years,

months, days, etc

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 P and F

The symbols P and F represent one-time

occurrences:

$F

Specifically:

1

n

n-1

t=n

$P

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 P and F:

It should be clear that a present

value P represents a single sum of

money at some time prior to a future

value F

This is an important basic point to

remember

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Annual Amounts

It is important to note that the

symbol A always represents a

uniform amount (i.e., the same

amount each period) that extends

through consecutive interest periods.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Annual Amounts

Cash Flow diagram for annual

amounts might look like the

following:

$

A

$

A

$

A

$

A

..

$

A

N-1

A = equal, end of period cash flow

amounts

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Interest Rate i% per period

The interest rate i is assumed to be

a compound rate, unless specifically

stated

as simple interest

The rate i is expressed in percent

per interest period; for example, 12%

per year.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.7 Terminology and Symbols

For many engineering economy

problems:

Involve the dimension of time

At least 4 of the symbols { P, F,

A, i% and n }

At least 3 of 4 are either

estimated or assumed to be known

with certainty.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.8 Computer Solutions

Use of a spreadsheet similar to

Microsofts Excel is fundamental to

the analysis of engineering economy

problems.

Appendix A of the text presents a

primer on spreadsheet use.

All engineers are expected by

training to know how to manipulate

data, macros, and the various built-in

functions common to spreadsheets.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.8 Spreadsheets

Excel supports (among many

others) six built-in functions to assist

in time value of money analysis

Master each on your own and set

up a variety of the homework

problems (on your own)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.8

Introduction to Solution by

Computer

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

93

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.8 Excels Financial Functions

To find the present value P: PV(i%,n,A,F)

To find the future value F: FV(i%,n,A,P)

To find the equal, periodic value A:

PMT(i%,n,P,F)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.8 Financial Functions Continued

To find the number of periods n:

NPER(i%,A,P,F)

To find the compound interest rate i:

RATE(n,A,P,F)

To find the compound interest rate i:

IRR(first_ cell:last_ cell)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.8 Financial Functions Continued

To find the present value P of any

series:

NPV(i%,second_cell_last cell) + first

cell

These built-in Excel functions

support a wide variety of

spreadsheet models that are useful

in engineering economy analysis.

Study Examples 1.10 and 1.11

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Minimum Attractive Rate of

Return

An investment is a commitment of funds

and resources in a project with the

expectation of earning a return over and

above the worth of the resources that were

committed.

Economic Efficiency means that the

returns should exceed the inputs.

In the for-profit enterprise, economic

efficiencies greater than 100% are

required!

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 The MARR

A firms financial managers set a

minimum interest rate that that all

accepted projects must meet or exceed.

The rate, once established by the firm is

termed the Minimum Attractive Rate of

Return (MARR).

The MARR is expressed as a percent per

year.

Numerous models exist to aid a firms

financial managers in estimating what this

rate should be in a given time period.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do 9

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.9

Minimum Attractive Rate

of Return

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

99

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 MARR Hurdle Rate

In some circles, the MARR is termed the

Hurdle Rate.

Capital (investment funds) is not free.

It costs the firm money to raise capital or

to use the owners of the firms capital.

This cost is often expresses as a % per

year.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Cost of Capital: Personal Example

Assume you want to purchase a new

computer.

Assume you have a charge card that

carries an 18% per year interest rate.

If you charge the purchase, YOUR cost of

capital is the 18% interest rate.

Very high!

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Cost to a Firm

Firms raise capital from the following

sources:

Equity using the owners funds

(retained earnings, cash on hand

belongs to the owners)

Owners expect a return on their money

and hence, there is a cost to the firm

DEBT the firm borrows from outside the

firm and pays an interest rate on the

borrowed funds

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Costing Capital

Financial models exist that will

approximate the firms weighted average

cost of capital for a given time period.

Once this cost is approximated, then

new projects up for funding MUST return at

least the cost of the funds used in the

project PLUS some additional percent

return.

The cost is expressed as a % per year just

like an interest rate.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Setting the MARR: Safe

Investment

First, start with a safe investment

possibility

A firm could always invest in a short-term

CD paying around 4-5%

But investors will expect more that

that!

The firm should compute its current

weighted average cost of capital (See

Chapter 10)

This cost will almost always exceed a

safe

external

investment

rate!

Blank

& Tarquin:

5th Edition.

Ch. 1 Authored

by: Dr. Do 1

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Setting the MARR continued

Assume the weighted average cost of

capital (WACC) is, say, 10.25% (for the sake

of presentation)

Certainly, the MARR must be greater than

the firms cost of capital in order to earn a

profit or return that satisfies the

owners!

Thus, some additional buffer must be

provided to account for risk and

uncertainty!

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Setting a MARR

Start with the WACC

Add a buffer percent (?? Varies from firm

to firm)

This yields an approximation to a

reasonable MARR

This becomes the Hurdle Rate that all

prospective projects should earn in order

to be considered for funding.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Graphical Presentation:

MARR

RoR - %

Acceptable range for new

projects

MARR - % +buffer

Safe

Investment,

4-5 %

WACC - % 10.25

+profit

0%

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Opportunity Forgone

Assume a firms MARR = 12%

Two projects, A and B

A costs $400,000 and presents an

estimated 13% per year.

B cost $100,000 with an estimated return

of 14.5%

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.9 Opportunity Forgone

What if the firm has a budget of, say,

$150,000?

A cannot be funded not sufficient

funds!

B is funded and earns 14.5% return or

more

A is not funded, hence the firm loses the

OPPORTUNITY to earn 13%

This often happens!

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Cash Flow Diagramming

Engineering Economy has developed a

graphical technique for presenting a

problem dealing with cash flows and their

timing.

Its called a CASH FLOW DIAGRAM

Its similar to a free-body diagram in

statics

First, some important TERMS . . . .

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.10

Cash Flows: Their

Estimation and

Diagramming

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

111

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Important TERMS

CASH INFLOWS

Money flowing INTO the firm from

outside

Revenues, Savings, Salvage Values,

etc.

CASH OUTFLOWS

Disbursements

First costs of assets, labor, salaries,

taxes paid, utilities, rents, interest, etc.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Cash Flows

For many practical engineering economy

problems the cash flows must be:

Assumed known with certainty

Estimated

A range of possible realistic values

provided

Generated from an assumed

distribution and simulated

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Net Cash Flows

A NET CASH FLOW is

Cash Inflows Cash Outflows

(for a given time period)

We normally assume that all cash

flows occur:

At the END of a given time period

End-of-Period Assumption

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 End-of-Period Assumption

END-OF-PERIOD Convention

ALL CASH

CASH FLOWS

FLOWS ARE

ARE ASSUMED

ASSUMED TO

TO OCCUR

OCCUR

ALL

AT THE

THE END

END OF

OF AN

AN INTEREST

INTEREST PERIOD

PERIOD EVEN

EVEN

AT

IF THE

THE MONEY

MONEY FLOWS

FLOWS AT

AT TIMES

TIMES WITHIN

WITHIN

IF

THE INTEREST

INTEREST PERIOD.

PERIOD.

THE

THIS IS

IS FOR

FOR SIMPLIFICATION

SIMPLIFICATION PURPOSES

PURPOSES

THIS

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 The Cash Flow Diagram:

CFD

Extremely valuable analysis tool

First step in the solution process

Graphical Representation on a time scale

Does not have to be drawn to exact

scale

But, should be neat and properly

labeled

Required on most in-class exams and

part of the grade for the problem at

hand

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Example Cash Flow

diagrams

Assume a 5-year problem

The basic time line is shown below

Now is denoted as t = 0

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Displaying Cash Flows

A sign convention is applied

Positive cash flows are normally drawn

upward from the time line

Negative cash flows are normally

drawn downward from the time line

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Sample CF Diagram

Positive CF at t = 1

Negative CFs at t = 2 &

3

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Problem Perspectives

Before solving, one must decide upon the

perspective of the problem

Most problems will present two

perspectives

Assume a borrowing situation; for

example:

Perspective 1: From the lenders view

Perspective 2: From the borrowers

view

Impact upon the sign convention

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Lending Borrowing

Example

Assume $5,000 is borrowed and payments

are $1,100 per year.

Draw the cash flow diagram for this

First, whose perspective will be used?

Lenders or the Borrowers ? ? ?

Problem will infer or you must

decide.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Lending Borrowing

From the Lenders Perspective

A = +$1,100/yr

0

-$5,000

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Lending - Borrowing

From the Borrowers Perspective

P = +$5,000

0

A = -$1,100/yr

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Example 1.17

A father wants to deposit an unknown

lumpsum amount into an investment

opportunity 2 years from now that is large

enough to withdraw $4,000 per year for

state university tuition for 5 years starting

3 years from now.

If the rate of return is estimated to be

15.5% per year, construct the cash flow

diagram.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.10 Example 1.17 CF Diagram

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.11

Rule of 72: Estimating

Doubling Time and

Interest Rate

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

126

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.11 Rule of 72 for Interest

A common question most often asked by

investors is:

How long will it take for my investment

to double in value?

Must have a known or assumed

compound interest rate in advance

Assume a rate of 13%/year to

illustrate.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.11 Rule of 72 for Interest

The Rule of 72 states:

The approximate time for an

investment to double in value given the

compound interest rate is:

Estimated time (n) =

72/i

For i = 13%: 72/13 = 5.54 years

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.11 Rule of 72 for Interest

Likewise, one can estimate the required

interest rate for an investment to double in

value over time as:

approximate

= 72/n

Assume we want an investment to

double in, say, 3 years.

Estimate i rate would be: 72/3 = 24%

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I Section 1.12

Spreadsheet Application

Simple and Compound

Interest, and Changing Cash

Flow Estimates

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

130

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

1.12 Spreadsheet Applications

Section 1.12 introduces the concepts

associated with using a spreadsheet

program like Microsoft Excel.

To build and improve your knowledge of

modeling by using Excel, you must build

your own models and experiment with the

various functions.

You instructor will determine the extent

and depth of use of Excel for this course.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

Engineering Economy:

Application of economic factors

and criteria to evaluate

alternatives considering the time

value of money (interest and time)

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

ENGINEERING ECONOMY Fifth Edition

Blank and

Tarquin

c

M

Gra

Hill

w

CHAPTER I - Summary

Summary of Important

Points

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

133

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

Engineering Economy Study:

Involves modeling the cash flows

Computing specific measures of

economic worth

Using an interest rate(s)

Over a specified period of time

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

The concept of equivalence helps

in understanding how different sums

of money at different times are equal

in economic terms.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

Simple and Compound Interest

The differences between simple

interest (based on principal only) and

compound interest (based on principal

and interest upon interest) have been

described in formulas, tables, and

graphs.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

Compounding of Interest

The power of compounding is very

noticeable, especially over long periods

of time.

Notion of computing interest on

interest

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

The MARR

The MARR is a reasonable rate of

return established as a hurdle rate to

determine if an alternative is

economically viable.

The MARR is always higher than a

return from a safe investment.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

Attributes of Cash Flows

Difficulties with their estimation.

Difference between estimated and

actual value.

Endofyear convention for cash-flow

location.

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

Chapter Summary

Attributes of Cash Flows

Net cash flow computation.

Different perspectives in determining

the cash-flow sign convention.

Construction of a cash-flow diagram.

Introduction to spreadsheet analysis

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Do

Copyright The McGraw-Hill Companies, Inc. Permission required for reproduction or display.

End of Chapter I Lecture

Set

Blank & Tarquin: 5th Edition. Ch. 1 Authored by: Dr. Don Smith, Texas A&M University.

141

You might also like

- Economics Principles Applications and Tools Global Edition 9th Edition Osullivan Solutions ManualDocument36 pagesEconomics Principles Applications and Tools Global Edition 9th Edition Osullivan Solutions Manualfrithisomorph106100% (29)

- Engineering Economy (ES 91 Pastexams)Document23 pagesEngineering Economy (ES 91 Pastexams)Sheraflor PerezNo ratings yet

- Chapter 2 - Business Problem FramingDocument6 pagesChapter 2 - Business Problem FramingLuis Carlos PeñaNo ratings yet

- Foundations of Engineering Economy: Graw HillDocument141 pagesFoundations of Engineering Economy: Graw HillRizky RamadhanNo ratings yet

- Kuliah 1 - Blankchapter - 1-EditDocument69 pagesKuliah 1 - Blankchapter - 1-EditNastha GraceNo ratings yet

- Foundations of Foundations of Engineering Economy: Graw HillDocument142 pagesFoundations of Foundations of Engineering Economy: Graw HillPiawai Said UmbaraNo ratings yet

- Engineering Economy Chapter 5Document102 pagesEngineering Economy Chapter 5Jason Gabriel JonathanNo ratings yet

- Session V Present Worth AnalysisDocument102 pagesSession V Present Worth AnalysisNiswatin FarikaNo ratings yet

- Benefit Cost Analysis and Public Sector Economics: Session IxDocument45 pagesBenefit Cost Analysis and Public Sector Economics: Session IxDanar AdityaNo ratings yet

- The Economics of Effective ManagementDocument59 pagesThe Economics of Effective ManagementGonzales, Jeriah Denz C.No ratings yet

- Developed By: Dr. Don Smith, P.E. Department of Industrial Engineering Texas A&M University College Station, TexasDocument23 pagesDeveloped By: Dr. Don Smith, P.E. Department of Industrial Engineering Texas A&M University College Station, TexasIhab El-SayedNo ratings yet

- MGMT 701 Strategy and Competitive Advantage - Spring 2012: TH TH THDocument15 pagesMGMT 701 Strategy and Competitive Advantage - Spring 2012: TH TH THSheila EnglishNo ratings yet

- ECE 201 Unit 1 IntroductionDocument19 pagesECE 201 Unit 1 Introductionjethrocunanan04No ratings yet

- Chapter 1 Foundations of Engineering EconomyDocument13 pagesChapter 1 Foundations of Engineering EconomyHadia EmanNo ratings yet

- Chapter 1 Engineering EconomyDocument13 pagesChapter 1 Engineering EconomyKen RualloNo ratings yet

- Microeconomics Course: BY Emery Emerimana MBA-Project Management and Finance Email: Tel: 71 578 069/75 658 470Document103 pagesMicroeconomics Course: BY Emery Emerimana MBA-Project Management and Finance Email: Tel: 71 578 069/75 658 470dan dylan terimbereNo ratings yet

- Managerial Economics: Applications, Strategy, and Tactics, 12 EditionDocument16 pagesManagerial Economics: Applications, Strategy, and Tactics, 12 Editionsamer abou saadNo ratings yet

- Economics and The Market: Powerpoint Slides T/A Principles of Macroeconomics by Bernanke, Olekalns and FrankDocument46 pagesEconomics and The Market: Powerpoint Slides T/A Principles of Macroeconomics by Bernanke, Olekalns and FranksnowiieeNo ratings yet

- Entrepreneurship Week 2Document9 pagesEntrepreneurship Week 2ruel rinconadaNo ratings yet

- Shell TestDocument23 pagesShell TestLawNo ratings yet

- SixSigma-Case Study AnswersDocument14 pagesSixSigma-Case Study AnswersPrasun MajumderNo ratings yet

- Engineering Economics Engineering Economics: Elliott Parker, Ph.D. Elliott Parker, PH.DDocument18 pagesEngineering Economics Engineering Economics: Elliott Parker, Ph.D. Elliott Parker, PH.DNasser ShelilNo ratings yet

- Chapter 11Document48 pagesChapter 11Sarah MoonNo ratings yet

- Abm A - Riego Kierstin Kyle - Sas - Entrepreneurship - Lesson2 - Week-3-6Document16 pagesAbm A - Riego Kierstin Kyle - Sas - Entrepreneurship - Lesson2 - Week-3-6Kierstin Kyle RiegoNo ratings yet

- PresentationDocument21 pagesPresentationZayda LaugoNo ratings yet

- Benefit Cost Analysis and Public Sector Economics: Graw HillDocument22 pagesBenefit Cost Analysis and Public Sector Economics: Graw HillsalmanshahidkhanNo ratings yet

- Managerial EconomicsDocument16 pagesManagerial EconomicsIzwan YusofNo ratings yet

- Economics For Managers: Mcguigan, Moyer, & HarrisDocument18 pagesEconomics For Managers: Mcguigan, Moyer, & Harrisconnie-lee06No ratings yet

- Edited 2Document10 pagesEdited 2RODEL DESABILLENo ratings yet

- IBIG 04 08 Natural Resources Questions Answers PDFDocument34 pagesIBIG 04 08 Natural Resources Questions Answers PDFEmanuil SirakovNo ratings yet

- Corporate-Level Strategy:: Creating Value Through DiversificationDocument9 pagesCorporate-Level Strategy:: Creating Value Through DiversificationAyShaRafiQueNo ratings yet

- In A Turnaround or Transformation Situation, Making Adjustments To The Business Model Is More Important Than Managing The People IssuesDocument6 pagesIn A Turnaround or Transformation Situation, Making Adjustments To The Business Model Is More Important Than Managing The People IssuesgreffenstetteNo ratings yet

- G1 Engineering EconomicsDocument21 pagesG1 Engineering EconomicsMerlund Rey ZamoraNo ratings yet

- Entrepreneurship M3Document5 pagesEntrepreneurship M3Milah BaraNo ratings yet

- Lesson 1&2 ENTREPDocument31 pagesLesson 1&2 ENTREPRomeo Duque Lobaton Jr.No ratings yet

- Economics For Managers: Mcguigan, Moyer, & HarrisDocument18 pagesEconomics For Managers: Mcguigan, Moyer, & HarrisfizalazuanNo ratings yet

- Lecture 7-Critical Milestone 2 and Scale-UpDocument34 pagesLecture 7-Critical Milestone 2 and Scale-UpRAPELANG MORAPEDINo ratings yet

- UC11-Develop Business ParcticeDocument76 pagesUC11-Develop Business ParcticemulugetaNo ratings yet

- Questionnaire Note January 2007Document31 pagesQuestionnaire Note January 2007Jorge Cerdeira e SousaNo ratings yet

- Project Manager Inc. Real Estate DevelopmentDocument13 pagesProject Manager Inc. Real Estate DevelopmentinventionjournalsNo ratings yet

- Week 01 - Lecture 1Document14 pagesWeek 01 - Lecture 1khizerhayat7272No ratings yet

- Strategic Management Concepts and Cases 1st Edition Dyer Solutions ManualDocument25 pagesStrategic Management Concepts and Cases 1st Edition Dyer Solutions ManualKaylaVasquezjoqfn100% (45)

- Managing For Opportunity: 7 Sources of InnovationDocument7 pagesManaging For Opportunity: 7 Sources of InnovationĐào Thu ThủyNo ratings yet

- Ch.3 Identification of BODocument17 pagesCh.3 Identification of BORitik MishraNo ratings yet

- Lecture 1 - Updated Cost Management & Engineering Economy-2020Document37 pagesLecture 1 - Updated Cost Management & Engineering Economy-2020Abdul WaheedNo ratings yet

- Unit - 1 - Part - BDocument43 pagesUnit - 1 - Part - BUmar Badamasi IbrahimNo ratings yet

- Microeconomics Canadian 15th Edition Mcconnell Solutions ManualDocument35 pagesMicroeconomics Canadian 15th Edition Mcconnell Solutions Manualmespriseringdovelc70s100% (37)

- Dwnload Full Microeconomics Canadian 15th Edition Mcconnell Solutions Manual PDFDocument35 pagesDwnload Full Microeconomics Canadian 15th Edition Mcconnell Solutions Manual PDFconjectxanthinev76r100% (18)

- Entrepreneurship - Lesson 2Document26 pagesEntrepreneurship - Lesson 2Joyce Lynel LapitanNo ratings yet

- Entrepreneurship Mod2 Recognize A Potential MarketDocument14 pagesEntrepreneurship Mod2 Recognize A Potential MarketEver BrandinoNo ratings yet

- Financial Economics ModuleDocument166 pagesFinancial Economics ModuleKeith P. KatsandeNo ratings yet

- MO CH 2Document10 pagesMO CH 2IceTea Wulan ArumitaNo ratings yet

- Business Plan Business Reality Starting and Managing Your Own Business in Canada 3rd Edition Skinner Test BankDocument16 pagesBusiness Plan Business Reality Starting and Managing Your Own Business in Canada 3rd Edition Skinner Test Bankveneratedemesnew1klx100% (12)

- Chapter 1Document25 pagesChapter 1xffbdgngfNo ratings yet

- Managerial Economics: Applications, Strategy, and Tactics, 12 EditionDocument24 pagesManagerial Economics: Applications, Strategy, and Tactics, 12 EditionWilliam DC RiveraNo ratings yet

- Hweco515Document6 pagesHweco515Kunal KinsuNo ratings yet

- Fraser SM Ch01Document4 pagesFraser SM Ch01Mike ArthursNo ratings yet

- Lecture 3Document22 pagesLecture 3zohaib akhtarNo ratings yet

- Industrial Megaprojects: Concepts, Strategies, and Practices for SuccessFrom EverandIndustrial Megaprojects: Concepts, Strategies, and Practices for SuccessRating: 3 out of 5 stars3/5 (3)

- ArmeniaDocument12 pagesArmeniaHamed PiriNo ratings yet

- Department of Labor: 2nd Injury FundDocument140 pagesDepartment of Labor: 2nd Injury FundUSA_DepartmentOfLabor100% (1)

- Form GST ITC 04 NewDocument2 pagesForm GST ITC 04 NewAjay DayalNo ratings yet

- AFAR Backflush CostingDocument2 pagesAFAR Backflush CostingJaybie John Palco EralinoNo ratings yet

- Algeria (ALG) Algiers-Houari Boumediene Airport: 1. LandingDocument4 pagesAlgeria (ALG) Algiers-Houari Boumediene Airport: 1. LandingGemy232No ratings yet

- CLSS Declaration - RevisedDocument3 pagesCLSS Declaration - RevisedIndudhar Jha100% (1)

- N. Mixture, CombinationDocument2 pagesN. Mixture, CombinationYareniNo ratings yet

- Ibm 530Document6 pagesIbm 530Muhamad NasirNo ratings yet

- Mandvi Ibibo Tax InvoiceDocument2 pagesMandvi Ibibo Tax InvoiceSumit PatelNo ratings yet

- Scribd Paid Access End User License AgreementDocument7 pagesScribd Paid Access End User License Agreementrad rumNo ratings yet

- CIBP Projects and Working Groups PDFDocument37 pagesCIBP Projects and Working Groups PDFCIBPNo ratings yet

- Air Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionDocument3 pagesAir Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionJenny ThuNo ratings yet

- Breed InauguralDocument3 pagesBreed InauguralJeff ElderNo ratings yet

- Affidavit of WaiverDocument1 pageAffidavit of Waivergelbert palomarNo ratings yet

- Marketing Strategy of Maruti Suzuki - Deepankti SenDocument93 pagesMarketing Strategy of Maruti Suzuki - Deepankti SenTahir HussainNo ratings yet

- Research Proposal PDFDocument10 pagesResearch Proposal PDFhanoseNo ratings yet

- Be Tutorial 3 - StuDocument18 pagesBe Tutorial 3 - StuGia LinhNo ratings yet

- Incoterms 2011Document1 pageIncoterms 2011barath1986No ratings yet

- Exercise of Chapter 67Document3 pagesExercise of Chapter 67Jean TanNo ratings yet

- B.O 2033 DGC Aee - II Data Sor 2014Document3 pagesB.O 2033 DGC Aee - II Data Sor 2014nisajamesNo ratings yet

- Panagariya-2005-The World EconomyDocument23 pagesPanagariya-2005-The World EconomyLucasNo ratings yet

- Acca Presentation 3Document23 pagesAcca Presentation 3Nearchos A. IoannouNo ratings yet

- Thank You!!! For Using WWW - Freecharge.in: Tax InvoiceDocument1 pageThank You!!! For Using WWW - Freecharge.in: Tax InvoiceChintamani VeerrajuNo ratings yet

- Chapter 8 Measures of Economic ActivityDocument14 pagesChapter 8 Measures of Economic Activity刘文雨杰No ratings yet

- Chapter 26 Web Chapter: The ISLM Model: Economics of Money, Banking, and Fin. Markets, 10e (Mishkin)Document23 pagesChapter 26 Web Chapter: The ISLM Model: Economics of Money, Banking, and Fin. Markets, 10e (Mishkin)Ahmad Tawfiq DarabsehNo ratings yet

- Chapter I GlobalizationDocument87 pagesChapter I GlobalizationJanenina BoholstNo ratings yet

- 18 06 08 Primark-2Document2 pages18 06 08 Primark-2Sachin RailhanNo ratings yet

- Tybcom - A - Group No. - 5Document10 pagesTybcom - A - Group No. - 5Mnimi SalesNo ratings yet

- Full Report SipDocument72 pagesFull Report SipAnubhav SonyNo ratings yet

- The US ECONOMYDocument2 pagesThe US ECONOMYVALERIA PATRICIA MURILLO MENDIETANo ratings yet