Professional Documents

Culture Documents

Baidu (BIDU) Daily Log Scale: Bullish, Right?

Baidu (BIDU) Daily Log Scale: Bullish, Right?

Uploaded by

AndysTechnicalsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Baidu (BIDU) Daily Log Scale: Bullish, Right?

Baidu (BIDU) Daily Log Scale: Bullish, Right?

Uploaded by

AndysTechnicalsCopyright:

Available Formats

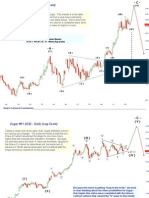

Baidu (BIDU) Daily Log Scale

- V -??

Markets ONLY peak on bullish news and fundamentals. What could

be more bullish than the news that your only competitor is leaving

the marketplace? This is the enviable position Baidu finds itself

upon Google’s withdrawal from the Chinese market. That’s really - III -

(V) (D)

bullish, right?

“5” (B)

“3”

“1”

“b” (E)

c “4”

“d” ( C ) - IV -

( III ) “2”

(A)

“5” a

“c” “e”

( IV )

“3”

b

“a”

“4”

“1”

“2”

BAIDU displayed “power” every step of the way, even during the “corrective moves.”

The Wave (IV) was an “irregular” triangle [big “b” wave”] which is more powerful than

“x” a typical contracting triangle. The Wave -IV- was a “running” triangle, where the (B)

“y”

and (D) waves are larger than the preceding (A) and (C) legs. Such triangles yield

( II ) powerful “thrusts” when completed. The important question now is whether or

not BIDU has completed a major advance yet.

-I- (I)

The Wave (II) was probably a “Double Three”

Running Correction--it ended with a triangle.

“w”

- II -

Andy’s Technical Commentary__________________________________________________________________________________________________

Baidu (BIDU) 90 Min. Log Scale ( III )

“5”

629

A “truncated” Wave (V)

coming?

BAIDU looked to have “blown-off” on the Google news, but the subsequent decline

looks more “corrective” than anything else. Therefore, one more push higher would

seem an order. Given the extremely emotional nature of the Wave (III) panic move,

some sort of “truncated” (diagonal) Wave (V) would not surprise. The next push

might look corrective and fail to better the $630 panic top.

“3”

( IV )

“4”

“1” This has the “feel” of a

triangle development.

“x”

(I) “2”

This looks like a “fifth

“5”

extension” Wave (I)

“y”

(D) “w” ( II )

“3”

“1”

“4”

“2” Based on the dramatic nature of the $629 peak on spectacularly great

“news” and the huge amount of panic buying into that level, it would

be a surprise to see $629 bettered.

407

(E)

- IV -

Andy’s Technical Commentary__________________________________________________________________________________________________

Baidu (BIDU) 90 Min. Log Scale ( III )

“5”

629

A “truncated” Wave (V)

coming?

The “alternative” count is the Wave (E) finished at 432. There is some merit to this

concept because of the way the market “thrusted” from that point--in other words, it was

the signature of triangle conclusion. If this is the count, it actually increases the

chances of a “failed” or truncated Wave (V), a move that cannot better the $629 high.

“3”

( IV )

“4”

“1” This has the “feel” of a

triangle development.

“x”

“2”

(I)

“y”

(D) “w”

( II )

432

(E)

- IV -

Andy’s Technical Commentary__________________________________________________________________________________________________

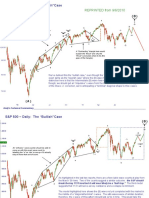

Baidu (BIDU) Daily Linear Scale

- V -??

BIDU has busted out of a channel here. R.N. Elliott described this as a “throw over,” “Throw Over?”

when a market temporarily bursts out of the channel in a final bout of volume buying.

In order for this to be considered “throw over,” it must reverse and get back under the

broken channel.

- III -

(V)

- IV -

( III )

( IV )

-I- (I) On the February 27th report, we suggested $595 as the best target for BIDU. That was

( II ) based on a Wave -IV- conclusion at $406 and Wave -V- occupying 38.2% of the entire

advance. So far the market has failed to settle above $595. If the Wave -IV- actually

concluded at $432, then the same targeting principle would yield a $637 objective for the

final fifth wave.

- II -

Andy’s Technical Commentary__________________________________________________________________________________________________

Baidu (BIDU) 90 Min. Log Scale

If one wants to remain bullish on Baidu, then it’s important to identify some critical

support points. The first level of support should be the 544-549 zone. This is the point

from which BIDU launched the panic buying phase. There should be buying at that

zone again, so a break of $544 would signal that all buying power has been exhausted

in the short term. The next big support is far lower at $465-470, the point at which the

market gapped higher and broke previous resistance. This zone should be strong

support on the first go.

544-549

465-470

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Fa - End TermDocument21 pagesFa - End Termmadhurialamuri100% (3)

- GolfGamez Agung - Alan - ToshiDocument2 pagesGolfGamez Agung - Alan - ToshiWidyawan Widarto 闘志No ratings yet

- Pivot Chord MapDocument1 pagePivot Chord MapSebastián Bustos Ponce75% (4)

- Baidu (BIDU) Daily Linear ScaleDocument6 pagesBaidu (BIDU) Daily Linear ScaleAndysTechnicals100% (1)

- Market Commentary 1may11Document12 pagesMarket Commentary 1may11AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- Sugar Dec 11 2009Document6 pagesSugar Dec 11 2009AndysTechnicalsNo ratings yet

- Sugar Jan 1 2010Document9 pagesSugar Jan 1 2010AndysTechnicalsNo ratings yet

- SP500 Update 2 Jan 11Document9 pagesSP500 Update 2 Jan 11AndysTechnicalsNo ratings yet

- Elliott Wave PrincipleDocument8 pagesElliott Wave PrinciplebacreatheNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Morning View 23 Feb 10Document6 pagesMorning View 23 Feb 10AndysTechnicalsNo ratings yet

- 210 - 64 S O P - PunjabiDocument8 pages210 - 64 S O P - PunjabiDivNo ratings yet

- S&P 500 Update 4 Nov 09Document6 pagesS&P 500 Update 4 Nov 09AndysTechnicalsNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Urdu Guess Paper 10thDocument35 pagesUrdu Guess Paper 10thLuqman ahmadNo ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- Sunday Evening Views 21 March 10Document6 pagesSunday Evening Views 21 March 10AndysTechnicalsNo ratings yet

- CC-111 HindiDocument2 pagesCC-111 Hindiwehoxak452No ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Accountancy 1Document36 pagesAccountancy 1Krishna PatelNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Class 9 QuesAtion Paper Final New Syllabus 2017 2018 9Document8 pagesClass 9 QuesAtion Paper Final New Syllabus 2017 2018 9Aditi KumariNo ratings yet

- ICSE Class 10 Mathematics Answer Key 2023 (1) - WatermarkDocument3 pagesICSE Class 10 Mathematics Answer Key 2023 (1) - WatermarkSubhajit BakshiNo ratings yet

- Punjab Examination Commission 2019 5th Class Urdu Part A Objective Model PaperDocument4 pagesPunjab Examination Commission 2019 5th Class Urdu Part A Objective Model PaperTayyabah Shah100% (2)

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- Hindi Set-A PDFDocument14 pagesHindi Set-A PDFdaisyNo ratings yet

- Fgunh: ' (A) (B) (C) (D)Document14 pagesFgunh: ' (A) (B) (C) (D)daisyNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Science Youtube TEST PDFDocument3 pagesScience Youtube TEST PDFmaghashtagsNo ratings yet

- Circle.: Midterm Test ADocument4 pagesCircle.: Midterm Test ALeo Dodi TesadoNo ratings yet

- ( (EC-I) 111 Hindi)Document4 pages( (EC-I) 111 Hindi)wehoxak452No ratings yet

- 15 Appendix BDocument13 pages15 Appendix BNITIN PANDEYNo ratings yet

- Seas Math Class ViDocument4 pagesSeas Math Class ViAvika SinghNo ratings yet

- 10th Physics Chapter10Document5 pages10th Physics Chapter10Mohammad AshfaqNo ratings yet

- Villupuram Driver Not - No.115 2024 TamilDocument15 pagesVillupuram Driver Not - No.115 2024 TamilSelva KumarNo ratings yet

- Gold Report 20 Dec 2009Document9 pagesGold Report 20 Dec 2009AndysTechnicalsNo ratings yet

- The Nilgiris-Cleanliness Worker-Not - No.160-2024-TamilDocument18 pagesThe Nilgiris-Cleanliness Worker-Not - No.160-2024-Tamilkayalpatnam kingsNo ratings yet

- Daily Test - 78 Hindi PDFDocument2 pagesDaily Test - 78 Hindi PDFankitkumar80843781No ratings yet

- Phys Chapter1Document2 pagesPhys Chapter1Muhammad SaleemNo ratings yet

- 51 International Chemistry Olympiad 2019 UK Round One Student Answer BookDocument12 pages51 International Chemistry Olympiad 2019 UK Round One Student Answer BookJackieWilsonNo ratings yet

- Paper English Class 7: (Answers)Document1 pagePaper English Class 7: (Answers)Nouman HameedNo ratings yet

- ( (EC-I) 102 Psychology) (Hindi Version)Document2 pages( (EC-I) 102 Psychology) (Hindi Version)wehoxak452No ratings yet

- Science Test-42: An Institute of Railway, SSC & ITI-TradeDocument2 pagesScience Test-42: An Institute of Railway, SSC & ITI-TradePAWAN ROYNo ratings yet

- AM 2002-Numerical Analysis MCQ Answer SheetDocument1 pageAM 2002-Numerical Analysis MCQ Answer SheetDilruk GallageNo ratings yet

- Socialogyr 9Document1 pageSocialogyr 9M Usama AnsaryNo ratings yet

- Batch 53 TBMT 07 (MCQ)Document14 pagesBatch 53 TBMT 07 (MCQ)sr samieNo ratings yet

- June 2015 p1Document10 pagesJune 2015 p1Ritavia NewellNo ratings yet

- Gemh 1 AnDocument17 pagesGemh 1 AnDhananjayareddyThanakantiNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- EnggGraphics MSDocument8 pagesEnggGraphics MSNafeesNo ratings yet

- Class 9 QuesAtion Paper Final New Syllabus 2017 2018 8Document8 pagesClass 9 QuesAtion Paper Final New Syllabus 2017 2018 8Aditi KumariNo ratings yet

- Unit 2 - Ability - Grade 5Document10 pagesUnit 2 - Ability - Grade 5RoopaNo ratings yet

- Question Paper Pattern 5 Module CourseDocument2 pagesQuestion Paper Pattern 5 Module Coursehaashir374No ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- EC-II-103 HindiDocument2 pagesEC-II-103 Hindiwehoxak452No ratings yet

- CH - No.1 (1st Half)Document3 pagesCH - No.1 (1st Half)AISHA BIBINo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- 9th Bio 1 (Waqar Younis)Document2 pages9th Bio 1 (Waqar Younis)waseem abbasNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Bachelor Thesis Investment BankingDocument6 pagesBachelor Thesis Investment Bankingafknoaabc100% (2)

- Questions CH 10Document4 pagesQuestions CH 10Maria DevinaNo ratings yet

- Learning Resource 8 Lesson 1Document7 pagesLearning Resource 8 Lesson 1Vianca Marella SamonteNo ratings yet

- SPS Commerce IncDocument6 pagesSPS Commerce IncRishi SinghNo ratings yet

- Improving Corporate NegotiationsDocument44 pagesImproving Corporate NegotiationsVanja KrunicNo ratings yet

- Law On SalesDocument35 pagesLaw On SalesHAKUNA MATATANo ratings yet

- Derivative Instruments and Hedging ActivitiesDocument620 pagesDerivative Instruments and Hedging Activitiesw_fib100% (1)

- ECO4108Z Futures, Options, DerivativesDocument4 pagesECO4108Z Futures, Options, DerivativesnondweNo ratings yet

- ESOPDocument8 pagesESOPKiran GvNo ratings yet

- (PDF) The Options Playbook, Expanded 2nd Edition: Featuring 40 Strategies For Bulls, Bears, Rookies, All-Stars and Everyone in Between. Full OnlineDocument1 page(PDF) The Options Playbook, Expanded 2nd Edition: Featuring 40 Strategies For Bulls, Bears, Rookies, All-Stars and Everyone in Between. Full OnlinePeper12345No ratings yet

- Black ScholeDocument11 pagesBlack ScholetraderescortNo ratings yet

- Decma 2019Document331 pagesDecma 2019IMaths PowaiNo ratings yet

- Lufthansa Case StudyDocument8 pagesLufthansa Case StudyTrisha860% (1)

- Chapter 8Document24 pagesChapter 8Cynthia AdiantiNo ratings yet

- Implied Volatility - Financial Analysts JournalDocument14 pagesImplied Volatility - Financial Analysts JournalRaymon PrakashNo ratings yet

- COMSATS University Islamabad, Lahore Campus: Terminal - Semester Spring 2020Document8 pagesCOMSATS University Islamabad, Lahore Campus: Terminal - Semester Spring 2020Be Like ComsianNo ratings yet

- Pas 32Document15 pagesPas 32Cheska GalvezNo ratings yet

- Financial Management Assignment 2Document24 pagesFinancial Management Assignment 2Rohan AhujaNo ratings yet

- Fixed Income Markets - Term-V - Prof. Vivek RajvanshiDocument5 pagesFixed Income Markets - Term-V - Prof. Vivek RajvanshiAcademic Management SystemNo ratings yet

- AFM ForexExp QsDocument6 pagesAFM ForexExp QsJessica Marilyn VazNo ratings yet

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocument8 pagesChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanNo ratings yet

- Fin622 QuizDocument59 pagesFin622 Quizwqas_akramNo ratings yet

- TBchap 010Document90 pagesTBchap 010DemianNo ratings yet

- CFA Level III MCQ Mocks Relevancy For 2014Document2 pagesCFA Level III MCQ Mocks Relevancy For 2014Ad QasimNo ratings yet

- Economy 25 - DPPDocument4 pagesEconomy 25 - DPPmikasha977No ratings yet

- Parcel Delivery The Future of Last Mile PDFDocument32 pagesParcel Delivery The Future of Last Mile PDFAkshit AggarwalNo ratings yet

- Module Learning BL 4Document54 pagesModule Learning BL 4Joyce Ann CortezNo ratings yet

- CBBC or Turbo Warrants - Knowing The ProductDocument5 pagesCBBC or Turbo Warrants - Knowing The ProductJasvinder JosenNo ratings yet