Professional Documents

Culture Documents

Rights and Privileges of Shareholders

Rights and Privileges of Shareholders

Uploaded by

swatantra.s8872450 ratings0% found this document useful (0 votes)

46 views40 pagesThe document outlines the rights and privileges of shareholders in a corporation according to Indian law. It discusses 24 specific rights that shareholders have, including rights to inspect company documents, attend meetings, vote, receive dividends, and participate in major corporate decisions. It also summarizes the views of several committees on corporate governance and shareholder rights, noting recommendations to increase transparency, disclosure requirements, and shareholder involvement in director elections.

Original Description:

Original Title

Chapter 4

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the rights and privileges of shareholders in a corporation according to Indian law. It discusses 24 specific rights that shareholders have, including rights to inspect company documents, attend meetings, vote, receive dividends, and participate in major corporate decisions. It also summarizes the views of several committees on corporate governance and shareholder rights, noting recommendations to increase transparency, disclosure requirements, and shareholder involvement in director elections.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

46 views40 pagesRights and Privileges of Shareholders

Rights and Privileges of Shareholders

Uploaded by

swatantra.s887245The document outlines the rights and privileges of shareholders in a corporation according to Indian law. It discusses 24 specific rights that shareholders have, including rights to inspect company documents, attend meetings, vote, receive dividends, and participate in major corporate decisions. It also summarizes the views of several committees on corporate governance and shareholder rights, noting recommendations to increase transparency, disclosure requirements, and shareholder involvement in director elections.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 40

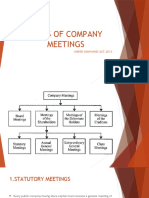

CHAPTER 4

RIGHTS AND PRIVILEGES OF

SHAREHOLDERS

OBJECTIVES

The chief purpose and objective of corporate

governance is the continued creation and

maintenance of long-term shareholder value.

While stressing the rights of shareholders as

the legitimate owners of a corporation - as

reinforced by the recommendations of

various committees - this chapter outlines

the processes and mechanism of investor

protection.

Chapter Outline

Introduction

Rights of Shareholders

Views of Various Committees on the Issue

Poor Track Record of Shareholder

Protection

Grievance Redressal Process

Introduction

Corporate governance is needed to create a

corporate culture of consciousness,

transparency and openness. It refers to a

combination of laws, rules, regulations,

procedures and voluntary practices to enable

companies maximise shareholders’ long-term

value.

Theoretical Basis - Agency Costs

The most fundamental theoretical basis of

corporate governance is agency costs.

Shareholders are the owners of joint-stock, limited

liability company, and are its principals. By virtue

of their ownership, the principals define the

objectives of the company. The management,

directly or indirectly selected by shareholders to

pursue such objectives, are the agents. While the

principals might assume that the agents will

invariably do their bidding, it is often not so.

Two broad instruments that reduce agency

costs and hence, improve corporate

governance, are

Financial and non-financial disclosures

Independent oversight of management, which

consists of two aspects - The first relates to the

role of the independent, statutory auditors and

the second aspect of independent oversight is the

board of directors of a company

Rights of Shareholders

A Shareholder of a Company

1. has a right to obtain copies of the Memorandum of

Association, Articles of Association and certain

resolutions and agreements on request on payment of

prescribed fees (Section 39);

2. has a right to have the certificate of shares held by

him within 3 months of the allotment;

Rights of Shareholders (contd.)

3. has a right to transfer his shares or other interests in

the company subject to the manner provided by the

Articles of the Company;

4. has a right to appeal to the Company Law Board if the

company refuses or fails to register the transfer of

shares;

5. has the preferential right to purchase shares on a pro-

rota basis in case of a further issue of shares by the

Company. Moreover, he/she also has the right of

renouncing all or any of the shares in favour of any

other person;

Rights of Shareholders (contd.)

6. has a right to apply to the Company Law Board for the

rectification of the register of members;

7. has the right to apply to the Court to have any

variation or abrogation to his/her rights set aside by

the Court;

8. has the right to inspect the register and the index of

members, annual returns, register of charges, and

register of investments not held by the Company in its

own name without any charge. He/she can also take

extracts from any of them;

Rights of Shareholders (contd.)

9. is entitled to receive notices of general meetings

and to attend such meetings and vote thereat

either in person or by proxy;

10. is entitled to receive a copy of the statutory

report;

11. is entitled to receive copies of the annual report

of the directors, annual accounts and auditors’

report;

Rights of Shareholders (contd.)

12. has the right to participate in appointment of auditors

and the election of directors at the annual general

meeting of the Company;

13. has a right to make an application to the Company

Law Board for calling annual general meeting if the

Company fails to call such a meeting within the

prescribed time limits;

14. can require the directors to convene an extraordinary

general meeting by presenting a proper requisition as

per the provisions of the Act and hold such a meeting

on refusal;

Rights of Shareholders (contd.)

15. can make an application to the Company Law

Board for convening an extraordinary general

meeting of the company where it is impracticable

to call such a meeting either by the directors or by

the members themselves;

16. is entitled to inspect and obtain copies of minutes

of proceedings of general meetings;

17. has a right to participate in declaration of

dividends and receive his/her dividends duly;

Rights of Shareholders (contd.)

18. has a right to demand poll;

19. has a right to apply to the Company Law Board

for investigation of the affairs of the Company.

20. has the right to remove a director before the

expiry of the term of his office;

Rights of Shareholders (contd.)

21. has a right to make an application to the Company

Law Board for relief in case of oppression and

mismanagement;

22. can make a petition to the High Court for the

winding up of the Company under certain

circumstances;

23. has a right to participate in passing of a special

resolution that the company be wound up by the

Court or voluntarily; and

24. has a right to participate in the surplus assets of the

company, if any, on its winding up.

VIEWS OF VARIOUS COMMITTEES ON

THE ISSUE

Working Group on the Companies Act

The Working Group on the Companies Act set up by

the Govt. of India has recommended many financial

as well as non-financial disclosures. These disclosures

call for greater transparency in the accounting of the

organization.

VIEWS OF VARIOUS COMMITTEES

ON THE ISSUE (contd.)

Working Group on the Companies Act

The Company should also maintain a register which

discloses interests of directors in any contract or

arrangement of the Company and the fact that such a

register is made and is open for inspection needs to

be made known to the shareholders.

Details of loans to directors should be disclosed as an

annex to the Directors' Report

CII’s Committee on Corporate

Governance

The objective of the CII was to develop and promote a

Code of Corporate Governance

This Report required listed companies to give the

following information under "Additional Shareholder's

Information“

High and low monthly averages of share prices in a

major Stock Exchange where the Company is listed for

the reporting year.

Greater detail on business segments upto 10% of

turnover, giving share in sales revenue, review of

operations, analysis of markets and future prospects.

Kumar Mangalam Birla Committee

The Committee made 25 recommendations, 19 of

them 'mandatory', that is, these were

enforceable.

This Committee made some recommendation

especially with regard to shareholders.

Recommendations Relating to

"Shareholders"

This relationship, brings in the accountability of

the boards and the management to the

shareholders of the Company.

Responsibilities of shareholders

The shareholders must, show a greater degree of

interest and involvement in the appointment of

the directors and the auditors. They should

indeed demand complete information about the

directors before approving their directorship.

Responsibilities of shareholders (contd.)

The Committee recommended, a

shareholder must be provided with the

following information:

A brief resume of the director;

Expertise in specific functional areas; and

Names of companies in which the person also holds the

directorship and the membership of committees of the

board. This is a mandatory recommendation.

The Naresh Chandra Committee

The Naresh Chandra Committee report on

'Audit and Corporate Governance' has taken

forward the recommendations of the Kumar

Mangalam Birla Committee on Corporate

Governance.

Representation of independent directors on a

Company's board, and

The composition of the audit committee

The Naresh Chandra Committee

(contd.)

The Committee has laid down stringent

guidelines defining the relationship between

auditors and their clients.

The Committee recommended that along with its

subsidiary, associates or affiliated entities, an audit firm

should not derive more than 25 percent of its business

from a single corporate client.

The Naresh Chandra Committee (contd.)

The Committee has further recommended

Tightening of the noose around the auditors by asking

them to make an array of disclosures,

Called upon chief executive officers and chief financial

officers of all listed companies to certify their

companies’ annual accounts, besides suggesting

Setting up of quality review boards for the Institute of

Chartered Accountants of India (ICAI), the Institute

of Company Secretaries of India (ICSI) and Institute

of Cost and Works Accountants of India, (ICWA) and a

Public Oversight Board similar to the one in the United

States.

THE NARAYANA MURTHY COMMITTEE

This SEBI-appointed committee on corporate

governance, which submitted its Report on February 8,

2003, has in its own words “primarily focused on

investors and shareholders, as they are the prime

constituencies of SEBI.”

The committee recommended that in order to achieve

the objectives of corporate governance and to realise

long term shareholder value, companies should agree

that

THE NARAYANA MURTHY COMMITTEE

(contd.)

a) in case of the appointment of a new director or

reappointment of a director, the shareholders

must be provided with the following

information :

(i) A brief resume of the director;

(ii) Nature of his expertise in specific functional

areas, and

(iii) Names of companies in which the person also

holds the directorship and the membership of

committees of the board.

THE NARAYANA MURTHY COMMITTEE

(contd.)

b) Information like quarterly result, presentation made

by companies to analysts shall be put on company’s

web-site or shall be sent in such a form so as to

enable the stock exchange on which the company is

listed to put it on its own web-site.

THE NARAYANA MURTHY COMMITTEE

(contd.)

c) “a board committee under the chairmanship of a

non-executive director shall be formed to

specifically look into the redressing of shareholder

and investors complaints such as transfer of

shares, non-receipt of balance sheet, declared

dividends etc. This committee shall be designated

as ‘shareholders/Investors Grievance Committee!.

THE NARAYANA MURTHY COMMITTEE

(contd.)

d) “to expedite the process of share transfers the

board of the committee shall delegate the power

of share transfer to an officer or a committee or to

the registrar and share transfer agents. The

delegated authority shall attend to share transfer

formalities at least once in a fortnight”.

THE NARAYANA MURTHY COMMITTEE

(contd.)

Shareholders ‘Right’s and Postal Ballots

The Narayana Murthy Committee asserted

shareholders ‘rights to receive from the company

half-yearly declaration of financial performance

including summary of the significant event during

the past six months.

THE NARAYANA MURTHY COMMITTEE

(contd.)

The Committee recommended the facility of Postal

Ballot to such of those shareholders who cannot

participate in AGM of the company they have

invested in, so as to participate effectively in

corporate democracy and in the decision-making

process. Key issues that may be decided by postal

ballots could include

THE NARAYANA MURTHY COMMITTEE

(contd.)

a) Alternation in the memorandum of association;

b) Sale of whole or substantially the whole of the

undertaking;

c) Sale of substantial investments in the companies;

d) Making a further issue of shares through preferential

allotment or private placement basis;

e) Corporate restructuring;

f) Entering into a new business not germane to the

existing business of the company

g) Various rights attached to class of securities; and

h) Matters relating to change in management.

Fly-by-night operators swindle

shareholders’ money.

Since 1990, more than Rs. 60,000 crores were

collected from prospective shareholders by

several companies that did the vanishing trick.

Though their names are posted in the web, none

of the Directors or promoters has been

prosecuted either by the Registrar of Companies

or the Securities and Exchange Board of India

who can file criminal complaints against them

under

Guide For Investors / Shareholders

(SEBI), in its guidelines to investors /

shareholders, titled “A Quick Reference Guide for

Investors” published recently makes its known

that a shareholder of a company enjoys the

following rights :

Rights of a shareholder, as an individual

To receive the share certificates on allotment or

transfer as the case may be in due time.

To receive copies of the abridged Annual Report, the

Balance Sheet and the Profit & Loss A/c and the

Auditors’ Report.

To participate and vote in General Meetings either

personally or through proxies.

To receive Dividends in due time once approved in

General Meetings

To receive corporate benefits such as rights, bonus etc.

once approved.

Rights of a shareholder, as an individual

(contd.)

To apply to Company Law Board (CLB) to call or direct the Annual

General Meeting.

To inspect the minute books of the General Meetings and to

receive copies thereof.

To proceed against the company by way of civil or criminal

proceedings.

To apply for the winding-up of the Company.

To receive the residual proceeds.

Rights of a shareholder, as an individual

(contd.)

Besides the above rights one enjoys as an individual

shareholder, one also enjoys the following rights as a

group of shareholders:

To requisition an Extra-ordinary General Meeting.

To demand a poll on any resolution.

To apply to CLB to investigate the affairs of the

company.

To apply to CLB for relief in cases of oppression and/or

mismanagement.

Rights of a shareholder, as an individual

(contd.)

As a debenture-holder, one has the right

To receive interest/redemption in due time.

To receive a copy of the trust deed on request.

To apply for winding up of the company if the

company fails to pay its debt.

To approach the Debenture trustee with your

grievance.

Shareholders’ Responsibilities

To remain informed

To be vigilant

To participate and vote in general meetings

To exercise one’s rights on one’s own, or as a

group.

Grievance Redressal (contd.)

Avenues always available to the investor to seek

redressal of his complaints are :

(i) Complaints with stock Exchange, SEBI and

Dept. of Company Affairs.

(ii). Complaints with Consumers Disputes

Redressal Forums

(iii). Suits in the Court of Law.

You might also like

- PEXAPARK - European - Ppa - Market - Outlook - 2022 - PexaparkDocument33 pagesPEXAPARK - European - Ppa - Market - Outlook - 2022 - PexaparkBORJANo ratings yet

- Ae 114 - PrelimDocument8 pagesAe 114 - PrelimMa Angelica BalatucanNo ratings yet

- 25 Comms Planning Models: For Strategic PlannersDocument27 pages25 Comms Planning Models: For Strategic PlannersOleksandr Che100% (3)

- Prepared By: Riddhi Modi (B-28) Dimple Thadhani (B-49)Document37 pagesPrepared By: Riddhi Modi (B-28) Dimple Thadhani (B-49)dimplethadhaniNo ratings yet

- Research PaperDocument16 pagesResearch PaperavinashbawaneNo ratings yet

- Corporate Governance: Indian Institute of Foreign TradeDocument14 pagesCorporate Governance: Indian Institute of Foreign TradeT_haque2No ratings yet

- Naresh Chandra Committee Report On Corporate Audit andDocument20 pagesNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNo ratings yet

- Act 2017Document5 pagesAct 2017John A. DavisNo ratings yet

- All About Powers and Duties of Shareholders Under Companies Act by Jyotsana UplavdiyaDocument6 pagesAll About Powers and Duties of Shareholders Under Companies Act by Jyotsana UplavdiyaNandita GogoiNo ratings yet

- Corporate Governance Framework in India By: Vaish Associates Advocates Vinay Vaish Hitender MehtaDocument28 pagesCorporate Governance Framework in India By: Vaish Associates Advocates Vinay Vaish Hitender Mehtaeric grimsonNo ratings yet

- FDFDJDocument4 pagesFDFDJAmit KapoorNo ratings yet

- Rights and Duties of Directors of The Company - JamaPunjiDocument5 pagesRights and Duties of Directors of The Company - JamaPunjiMUNIR HUSSAINNo ratings yet

- Unit 4Document18 pagesUnit 4kush mandaliaNo ratings yet

- F4 Corporate Law SolvedDocument115 pagesF4 Corporate Law SolvedKhalid MahmoodNo ratings yet

- Company JonaDocument22 pagesCompany JonaUjjwal AnandNo ratings yet

- C C C C: ! ! "" "" #$ #$ %C&%C% %C&%C%Document14 pagesC C C C: ! ! "" "" #$ #$ %C&%C% %C&%C%Azhar SayedNo ratings yet

- Book 4 InsideDocument15 pagesBook 4 InsideHamed HoseiniNo ratings yet

- Corporate ProjectDocument19 pagesCorporate ProjectPrincewillNo ratings yet

- Company Unit-2Document6 pagesCompany Unit-2thehackerdude09No ratings yet

- Role of Sebi in Corporate Governance and Finance - (Essay Example), 2973 Words GradesFixerDocument10 pagesRole of Sebi in Corporate Governance and Finance - (Essay Example), 2973 Words GradesFixerAbid ZaidiNo ratings yet

- Rights of ShareholdersDocument4 pagesRights of ShareholdersKenneth VictoriaNo ratings yet

- C P R C G N I: Onsultative Aper On Eview of Orporate Overnance Orms in NdiaDocument54 pagesC P R C G N I: Onsultative Aper On Eview of Orporate Overnance Orms in NdiaPradyoth C JohnNo ratings yet

- Statutory Requirement:: Contents of The Statutory ReportDocument3 pagesStatutory Requirement:: Contents of The Statutory ReportAhsan RazaNo ratings yet

- MeetingsDocument14 pagesMeetingsrmwsrwz2k2No ratings yet

- MS Belab 2Document7 pagesMS Belab 250 Mohit SharmaNo ratings yet

- Narayanmurthy ReportDocument17 pagesNarayanmurthy Reportmeetkamal3No ratings yet

- Code of CG China EngDocument15 pagesCode of CG China EngbilalNo ratings yet

- Rights of ShareholdersDocument10 pagesRights of ShareholdersAditi BhawsarNo ratings yet

- Stockholders' Rights and Protection of Minority Stockholders' InterestsDocument2 pagesStockholders' Rights and Protection of Minority Stockholders' InterestsButch BootsNo ratings yet

- Unit 6 Meetings ResolutionsDocument14 pagesUnit 6 Meetings ResolutionsRenNo ratings yet

- KC Audit CommitteeDocument3 pagesKC Audit CommitteeBijoyBhawanNo ratings yet

- CG - An Overview - Article - MSME ReviewDocument7 pagesCG - An Overview - Article - MSME ReviewChaitanya ShahNo ratings yet

- Company FNLDocument30 pagesCompany FNLpriyaNo ratings yet

- CGR Assignment No 2Document10 pagesCGR Assignment No 2Hamza AminNo ratings yet

- @csupdates RCD - Chapter - 1 - Dec - 22 - CS - ProfessionalDocument16 pages@csupdates RCD - Chapter - 1 - Dec - 22 - CS - ProfessionalAGHBALOUNo ratings yet

- AOA, Prospectus, MettingsDocument20 pagesAOA, Prospectus, MettingsNeha NayakNo ratings yet

- Chapter 2 - Corporate GovernanceDocument34 pagesChapter 2 - Corporate GovernancebkamithNo ratings yet

- BL 2023 SolDocument6 pagesBL 2023 SoltechworkpressNo ratings yet

- Legal FrameworkDocument48 pagesLegal FrameworkRK DeshmukhNo ratings yet

- 01 - Corporate Governance - CONCEPTUAL FRAMEWORK OF CORPORATE GOVERNANCEDocument109 pages01 - Corporate Governance - CONCEPTUAL FRAMEWORK OF CORPORATE GOVERNANCEVij88888No ratings yet

- Unit 7Document32 pagesUnit 7Radhika SinghaniaNo ratings yet

- Corporate Governance-2Document25 pagesCorporate Governance-2Sachin PrakashNo ratings yet

- Mod 2 CGDocument16 pagesMod 2 CGNeha MakeoversNo ratings yet

- Kumar Mangalam Birla CommitteeDocument24 pagesKumar Mangalam Birla CommitteeParas Gupta100% (1)

- Shareholder ActivismDocument16 pagesShareholder ActivismSiddhant SodhiaNo ratings yet

- Board Committees and Its Roles and Responsibilities: Presented by Rahul S IPEDocument20 pagesBoard Committees and Its Roles and Responsibilities: Presented by Rahul S IPESmriti ShahNo ratings yet

- Clause 49 - Listing AgreementDocument36 pagesClause 49 - Listing AgreementMadhuram Sharma100% (1)

- Chapter 2Document16 pagesChapter 2Sakhawat HossainNo ratings yet

- Final Report 7Document14 pagesFinal Report 7Rukhsar FatimaNo ratings yet

- Auditing&Assurance LL (Lesson2)Document13 pagesAuditing&Assurance LL (Lesson2)BRIAN KORIRNo ratings yet

- Taxguru - In-Audit Committee - Section 177 Companies Act 2013 Amp RulesDocument3 pagesTaxguru - In-Audit Committee - Section 177 Companies Act 2013 Amp Rulesasmitamittal1998No ratings yet

- Company ActDocument92 pagesCompany ActSunny ProjectNo ratings yet

- Code On Corporate GovernanceDocument63 pagesCode On Corporate GovernanceVishwas JorwalNo ratings yet

- Company Meetings NavinDocument12 pagesCompany Meetings NavinNavin SureshNo ratings yet

- SHORT NOTES - Powers of Chairman, Audit Comm, SEBIDocument5 pagesSHORT NOTES - Powers of Chairman, Audit Comm, SEBIsimuleguminternshipsNo ratings yet

- Lms SFM CGDocument10 pagesLms SFM CGKanishka ChhabriaNo ratings yet

- Landmarks in CGDocument13 pagesLandmarks in CGAishwaryaNo ratings yet

- Class 5 Company MeetingsDocument31 pagesClass 5 Company MeetingsSwati Sucharita DasNo ratings yet

- Corporate GovernanceDocument72 pagesCorporate GovernanceNiket RaikangorNo ratings yet

- CG AnalysisDocument5 pagesCG AnalysisCHETHAN KUMAR N 17BBLB012No ratings yet

- Charter of The Board of Directors PT Kalbe Farma TBKDocument9 pagesCharter of The Board of Directors PT Kalbe Farma TBKoryzafathoni24No ratings yet

- Corporation Accounting - IntroductionDocument7 pagesCorporation Accounting - IntroductionErica Calzada50% (2)

- Corporate Governance and Other StakeholdersDocument44 pagesCorporate Governance and Other Stakeholdersswatantra.s8872450% (1)

- Chapter 4: Board of Directors Roles and ResponsibilitiesDocument21 pagesChapter 4: Board of Directors Roles and Responsibilitiesswatantra.s887245No ratings yet

- Assignment On Budget 2010-11Document8 pagesAssignment On Budget 2010-11swatantra.s887245No ratings yet

- Commodities MKT ModuleDocument154 pagesCommodities MKT ModulecasachinNo ratings yet

- Investment in Equity Securities - Problem 16-5 and 16-7Document4 pagesInvestment in Equity Securities - Problem 16-5 and 16-7Jessie Dela CruzNo ratings yet

- Solved Depreciation Information For Buckingham LTD Is Given in Be9 4 UsingDocument1 pageSolved Depreciation Information For Buckingham LTD Is Given in Be9 4 UsingAnbu jaromiaNo ratings yet

- Porter's Framework of Competitive Strategies (Generic Strategies)Document14 pagesPorter's Framework of Competitive Strategies (Generic Strategies)Adil Bin Khalid100% (1)

- @ Reading Comprehension Workshop On Technical Terms On Supply and Technical Terms On Supply and DemandDocument5 pages@ Reading Comprehension Workshop On Technical Terms On Supply and Technical Terms On Supply and Demandrafael santosNo ratings yet

- Chapter 6 - Global Information Systems and Market ResearchDocument27 pagesChapter 6 - Global Information Systems and Market Researchaqiilah subrotoNo ratings yet

- Case Study WilkersonDocument2 pagesCase Study WilkersonHIMANSHU AGRAWALNo ratings yet

- 5 - Sales and Service Cloud DatasheetDocument2 pages5 - Sales and Service Cloud Datasheetitsme.mahe263No ratings yet

- Infiniti BenefitsDocument11 pagesInfiniti Benefitssu maiyahNo ratings yet

- Week11 CH5 SeminarAssignmentDocument10 pagesWeek11 CH5 SeminarAssignmentbhattfenil29No ratings yet

- Cambridge International General Certificate of Secondary EducationDocument4 pagesCambridge International General Certificate of Secondary EducationSalman BashirNo ratings yet

- Urban Governance - An Overview - ScienceDirect TopicsDocument21 pagesUrban Governance - An Overview - ScienceDirect Topicsraj niraliNo ratings yet

- Internship ReportDocument38 pagesInternship ReportManasvi DoshiNo ratings yet

- Term Loan/Project Appraisal A Presentation: by A K Mishra IifbDocument69 pagesTerm Loan/Project Appraisal A Presentation: by A K Mishra Iifbmithilesh tabhaneNo ratings yet

- Swot Analysis of CompaniesDocument22 pagesSwot Analysis of CompaniesSnow SnowNo ratings yet

- Solutions of Cash Flow Statement QuestionsDocument7 pagesSolutions of Cash Flow Statement QuestionsSuvana YasminNo ratings yet

- Shubham PIDocument1 pageShubham PIVarsha JiNo ratings yet

- Excise Superintendent, Bhabua KaimurDocument1 pageExcise Superintendent, Bhabua KaimurBittu SinghNo ratings yet

- Siddu PDFDocument2 pagesSiddu PDFNikhil MohaneNo ratings yet

- Unit Test 7A Basic LevelDocument3 pagesUnit Test 7A Basic LevelВалентин БивалінNo ratings yet

- 1 s2.0 S0278431913000170 MainDocument8 pages1 s2.0 S0278431913000170 MainBirce BogaNo ratings yet

- Project On Consumer Behavior "Clear Shampoo": Course: MKT344 Instructor: Mahafuz Mannan, Lecturer, Department ofDocument23 pagesProject On Consumer Behavior "Clear Shampoo": Course: MKT344 Instructor: Mahafuz Mannan, Lecturer, Department ofAuroraNo ratings yet

- Final BBA Internship Report Guidlines KMCDocument36 pagesFinal BBA Internship Report Guidlines KMCDeepak JoshiNo ratings yet

- AOM 2023-002 Cash in Bank - Javier (Reviewed)Document3 pagesAOM 2023-002 Cash in Bank - Javier (Reviewed)Ken BocsNo ratings yet

- Improve Business Practice LO 5 & 6Document35 pagesImprove Business Practice LO 5 & 6John YohansNo ratings yet

- Leadershipand The Art of DiscretionDocument6 pagesLeadershipand The Art of DiscretionJovanie BeñolaNo ratings yet

- Assessment Two - Group CaseDocument8 pagesAssessment Two - Group CaseDalyaNo ratings yet

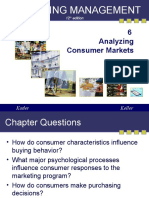

- Marketing Management: 6 Analyzing Consumer MarketsDocument40 pagesMarketing Management: 6 Analyzing Consumer Marketsvineet vermaNo ratings yet